Fashion Market Research: Specifics, Challenges, and Tips

- by Alice Ananian

- May 2, 2024

In the fashion industry, being on top of trends and consumer preferences is the key between launching a hit product and facing an inventory full of unsold merch. Market research is the compass that guides fashion entrepreneurs, retail analysts, and marketing professionals in the right direction, helping them to stay ahead of the game.

Understanding the specifics of fashion market research, overcoming industry-specific challenges, and utilizing the right tools and resources are essential for any player in the fashion industry who wants to thrive. This comprehensive guide equips you with the knowledge and techniques necessary to excel in fashion market research.

Market Research for the Fashion Industry

Market research within the fashion industry is not merely about spotting trends; it’s about understanding the complex web of factors that influence buying decisions. From cultural shifts to economic indicators, a multitude of elements influence what we wear and why. Brands that translate this data into innovative products and marketing strategies are the ones that capture market share.

The fashion industry, notorious for its rapid shifts and turnovers, demands a heightened emphasis on timeliness and accuracy in market research. What was “in” last season might be long-forgotten by the time the next collection hits the shelves. Therefore, the methodology and tools must be as dynamic and trend-responsive as the industry itself.

Fashion market research typically encompasses four key components:

Consumer Behavior and Trends

Studying consumer behavior involves collecting data on shopping habits, brand loyalty, and demographics. To predict upcoming trends, fashion researchers need to be one step ahead, analyzing emerging micro-trends that reflect a changing social landscape.

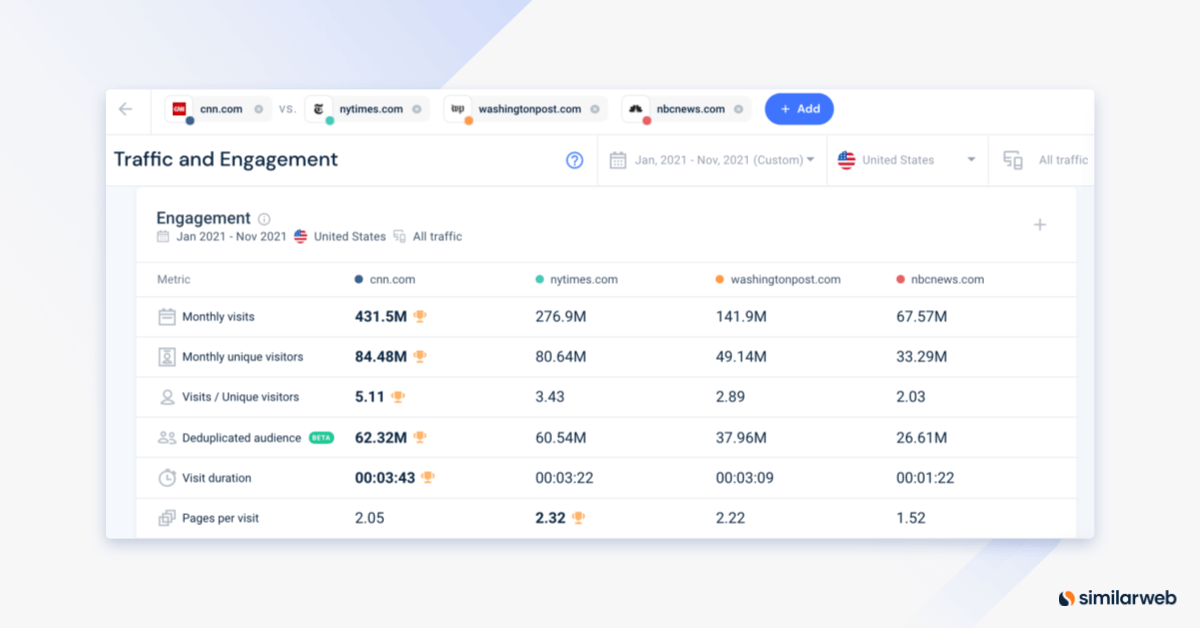

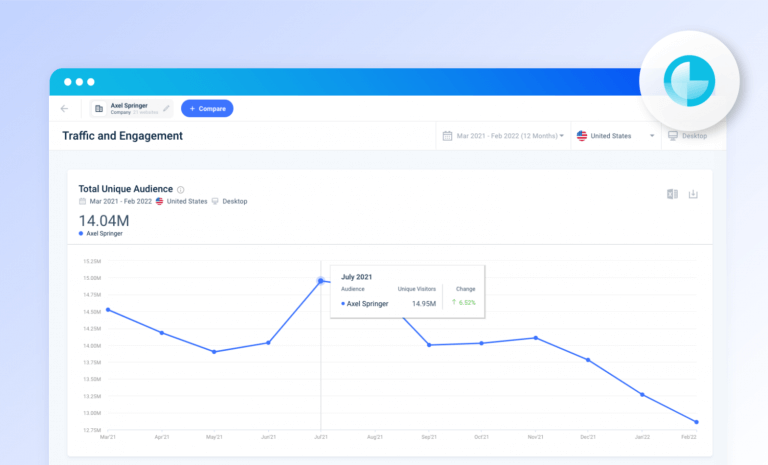

Competitive Analysis

Understanding your competitors is crucial in the saturated fashion market. This includes identifying key players, benchmarking performance, and keeping an eye on their moves in terms of products, pricing, and promotions.

Product Research and Development

Researching products involves exploring concepts, materials, and designs that resonate with consumers. Feedback loops from surveys, focus groups, and prototype testing can be invaluable in refining products prior to launch.

Marketing and Branding

Effective marketing and branding research involves evaluating the impact of advertisements, the effectiveness of branding statements, and the resonance of the brand’s image with the intended audience.

How to do Fashion Market Research [Step-by-Step Guide]

Fashion is a dynamic industry fueled by trends and consumer preferences. Conducting thorough market research is crucial for any fashion business, from established brands to aspiring designers. Here’s a step-by-step guide to navigate the process:

Step 1: Define Your Objectives

What do you want to learn? Are you trying to validate a new product idea, understand your target audience better, or analyze competitor strategies?

Clearly defined goals will guide your research methods and ensure you gather relevant information.

Example: A handbag designer wants to launch a line of eco-friendly totes. Their research objective might be to understand consumer preferences for sustainable materials in handbags and their willingness to pay a premium.

Step 2: Find the Right Sources and Tools

There are two main types of research sources: primary and secondary.

Primary Research: Data you collect directly from your target audience. This can involve:

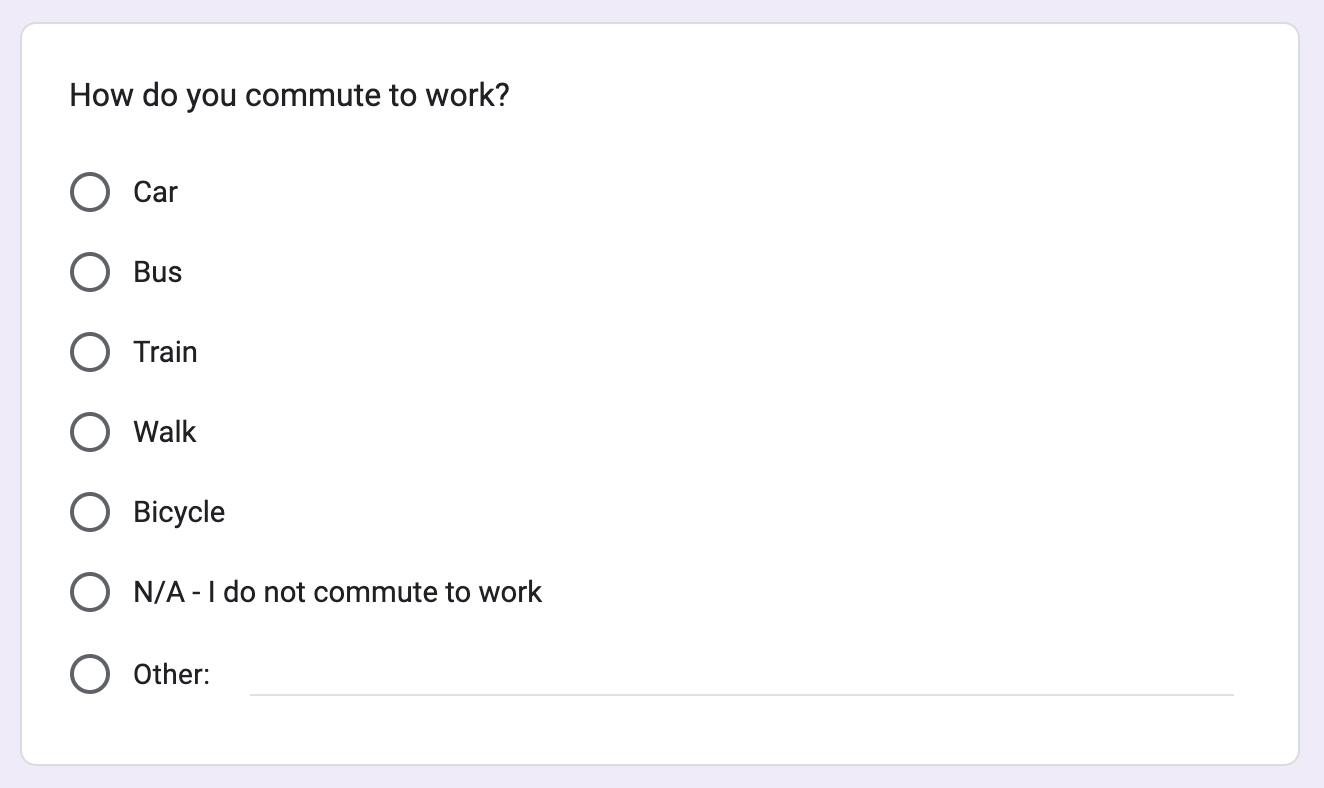

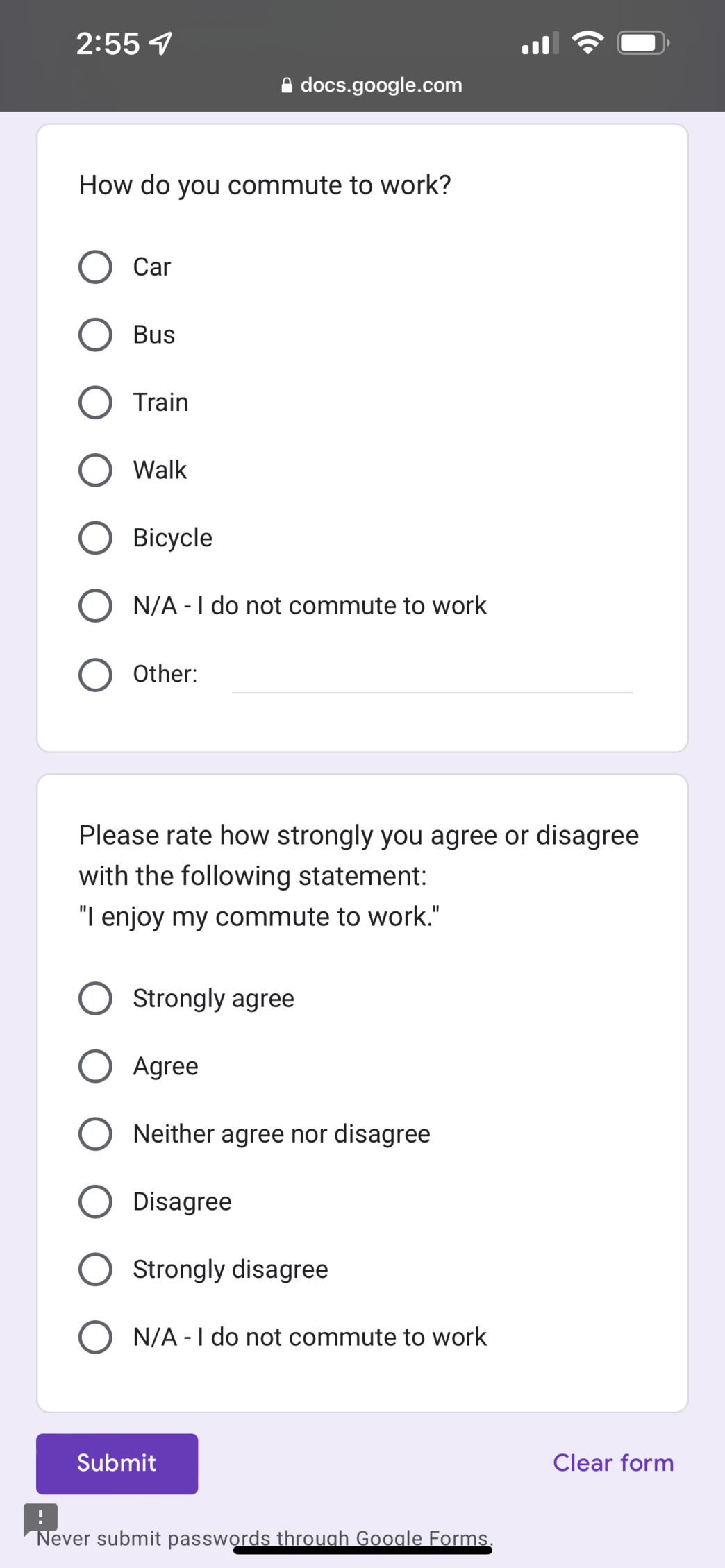

Surveys: Online questionnaires to gather a large pool of data on demographics, preferences, and buying habits. (e.g., Google Forms , SurveyMonkey )

Focus Groups: In-depth discussions with a smaller group to gain qualitative insights into attitudes and motivations.

Interviews: One-on-one conversations for detailed feedback from potential customers.

Pre-launching: This is a goldmine for market research in the fashion industry. By creating a landing page with your concept and gauging customer response, you gain real-time insights into demand, iterate on your design based on feedback, and avoid investing heavily in an idea that might flop. This direct interaction with potential customers makes pre-launching a powerful primary research tool.

Secondary Research: Existing data collected by others. Look for:

Industry Reports: Market research firms publish reports on fashion trends, consumer spending, and market size.

Here’s where to look:

- Euromonitor International : Provides comprehensive reports on various fashion segments like apparel, footwear, and accessories, with a global perspective.

- LWD (Leather Working Group) : Focuses on the leather industry, offering reports on sustainability practices, sourcing trends, and market analysis.

- Nielsen : Offers reports on consumer spending habits and demographics, including insights relevant to the fashion industry.

Fashion Publications: Trade publications and online fashion magazines often feature trend forecasts and consumer analysis.

- The Business of Fashion (BoF) : Publishes insightful reports on various fashion industry topics, including market analysis, trend forecasts, and business strategies.

- Vogue Business : Offers in-depth reports on luxury fashion trends, consumer preferences, and the business landscape within the high-end segment.

- WWD (Women’s Wear Daily) : Provides regular reports on fashion trends, retail analysis, and industry news, often with a focus on the US market.

Step 3: Analyze Your Insights

Once you have collected data, it’s time to make sense of it. Analyze survey responses and identify trends in demographics, preferences, and buying habits.

Look for common themes emerging from focus groups and interviews. Summarize key takeaways from industry reports and publications.

Step 4: Develop Buyer Personas

Use your research findings to create detailed profiles of your ideal customers. These buyer personas should include:

- Demographics (age, gender, income)

- Lifestyle and interests

- Fashion preferences and needs

- Shopping habits and preferred channels

Example: Based on your research, you discover a significant demand for eco-friendly totes among millennial women who prioritize sustainability and ethical manufacturing. This informs your buyer persona.

Pro tip: Make sure to leverage the power of online communities like those on Reddit . Use platforms like this to examine your target audiences threads and not what topics they discuss.

Step 5: Understand Your Competitors

Start by identifying your main competitors in the market and conduct a thorough analysis of their products, pricing strategies, marketing channels, and brand image. Understand the strengths and weaknesses of their offerings and how they position themselves in the industry.

Next, scrutinize the market to identify any gaps or unmet needs that your competitors are overlooking. This is your opportunity to carve out a niche for your brand. Think about what unique value proposition your brand can offer to fill these gaps and differentiate itself from the competition. Consider how your products or services can solve problems or meet needs that are currently being neglected.

By focusing on these areas, you can develop a strategic approach that leverages your brand’s unique strengths, setting you apart in a crowded marketplace and positioning you for success

Pro tip: To circumvent all the hassle of a detailed competitor analysis use tools such as the AI Market Research Assistant by Prelaunch.com. This tool allows you to analyze thousands of reviews and feedback to discover top customer praises and complaints simply by entering your competitor’s links.

Step 6: Summarize Your Findings and Take Action

Create a clear and concise report summarizing your research findings.

Use this information to make informed decisions about product development, marketing strategies, and pricing.

Step 7: Keep Checking In

Fashion trends and consumer preferences are constantly evolving. Monitor industry publications, conduct surveys periodically, and stay updated on competitor strategies.

Here’s a list of major fashion industry publications:

- Harper’s Bazaar

- WWD (Women’s Wear Daily)

- The Business of Fashion (BoF)

- Another Man (menswear)

- GQ (Gentlemen’s Quarterly) (menswear)

- Numéro (considered more avant-garde than mainstream publications)

By following these steps and continuously refining your research, you can gain valuable insights that will give your fashion business a competitive edge.

Tools and Resources for Fashion Market Research

Fashion market research equips you with valuable customer insights to design successful clothing lines, marketing campaigns, and pricing strategies. Here’s a breakdown of tools and resources categorized by primary and secondary research methods:

Primary Research

SurveyMonkey and Google Forms : Create online surveys to gather a large pool of data on demographics, preferences, and buying habits from your target audience. These tools offer user-friendly interfaces for designing questionnaires, distributing them electronically, and analyzing the collected data.

UserTesting : Conduct remote usability testing to see how potential customers interact with your clothing line prototypes or website. This online platform allows you to recruit participants, moderate testing sessions, and gain valuable insights into user experience.

Focus Group Discussion Platforms: Platforms like Lookback and User Interviews enable you to conduct online focus groups where you can moderate discussions with a smaller group to gain qualitative insights into attitudes and motivations.

Pro tip: Instead of scattering around to compile a combination of different primary research sources, get all your data in one place with Prelaunch.com . The idea validation platform lets you quickly create a landing page and share it with your friends and wider community to start generating first-hand feedback on your latest apparel concept.

Secondary Research

Industry Reports: Market research firms like Euromonitor International , LWD (Leather Working Group) , and Nielsen publish comprehensive reports on fashion trends, consumer spending, and market size. These reports provide valuable data-driven insights into the industry landscape. Fashion Publications: Stay updated on current trends and consumer analysis through trade publications like Women’s Wear Daily (WWD) and online fashion magazines like The Business of Fashion (BoF) and Vogue Business .

Social Media Listening Tools: Brandwatch and Sprout Social are social media listening tools that allow you to track brand mentions, analyze online conversations, and understand consumer sentiment about fashion trends and brands.

E-commerce Trend Reports: Platforms like Etsy and Trendalytics offer trend reports based on their sales data, giving you insights into what’s popular with online shoppers.

Additional Resources:

Fashion Trend Forecasting Services: WGSN and NellyRodi are fashion trend forecasting services that offer insights into upcoming trends, color palettes, and materials. Subscription fees apply, but these services can be invaluable for staying ahead of the curve.

By leveraging this comprehensive toolkit, you can conduct thorough market research that empowers you to make informed decisions and achieve success in the ever-evolving fashion industry.

Case Study [Start-up brand]: Reformation – Sustainable Style Takes Root

Brand: Reformation

Challenge: Reformation, a sustainable fashion brand launched in 2009, aimed to disrupt the industry with eco-friendly clothing but needed to validate their concept and target market.

Market Research Strategy: Reformation utilized a combination of online and offline methods:

- Social Media Engagement: Reformation actively engaged with their target audience on social media platforms like Instagram, conducting polls and surveys to understand their preferences for sustainable clothing.

- Trend Analysis: The company closely monitored fashion trend reports and social media conversations to identify styles and silhouettes in high demand.

- Customer Reviews: Reformation analyzed customer reviews of their existing products to understand what resonated with their audience and identify areas for improvement.

Key Insights: The research revealed a strong consumer interest in sustainable fashion, particularly among millennials and Gen Z. They identified a demand for trendy yet timeless pieces made with eco-friendly materials.

Action Taken:

- Focused on using recycled and sustainable materials like organic cotton and Tencel.

- Developed a core collection of versatile pieces that aligned with current trends but offered longevity.

- Utilized social media to showcase their commitment to sustainability and connect with environmentally conscious consumers.

Results: Reformation’s market research ensured their products catered directly to their target audience’s desires. Their focus on sustainability and trendy styles propelled their growth, establishing them as a leader in the sustainable fashion movement.

These case studies illustrate how established and start-up brands can leverage market research to gain valuable customer insights, adapt their offerings, and achieve success in the dynamic fashion industry.

Overcoming Challenges in Fashion Industry

The fast-paced and ever-evolving nature of the fashion industry presents unique challenges for market researchers. Here are some common roadblocks and how to navigate them:

Fickle Consumer Tastes: Trends shift quickly, making it difficult to predict what will be popular next season.

Social Media Influence: Viral trends and influencer marketing can significantly impact buying decisions, adding a layer of complexity.

Data Saturation & Inaccuracy: Consumers may not accurately report their preferences or be swayed by marketing messages in surveys.

Reaching Target Audiences: Identifying and engaging with specific demographics across diverse online and offline channels can be tricky.

Fast Response Times: Fashion cycles are short, requiring research to be agile and deliver insights quickly.

Embrace Trend Forecasting: Utilize trend forecasting services and analyze historical data to identify emerging trends with long-term potential.

Monitor Social Media Conversations: Track social media buzz, analyze influencer endorsements, and engage with online communities to understand real-time trends.

Employ Qualitative Research Methods: Conduct focus groups or in-depth interviews to gain deeper insights into consumer motivations and purchase decisions.

This is easier said than done. So a more realistic alternative is to set up a landing page on using the Prelaunch concept validaiton tool to start gaining real insights into purchase intent, as well as what could be improved.

(e.g. You might offer a garment in certain colors and not others. Based on feedback that is conveniently complied into a single Dashboard you’ll be able to learn what iteration is most popular with your target audience, who they are both demographically/psychographically and and even the optimal price point to set.)

Utilize Diverse Research Methods: Combine quantitative surveys with qualitative methods like focus groups to get a more holistic picture of consumer preferences.

Partner with Social Listening Platforms: Track brand mentions, sentiment analysis, and competitor activity to gain real-time market intelligence.

Rapid Prototyping & A/B Testing: Create low-fidelity prototypes of designs or marketing campaigns and conduct A/B testing to gather quick feedback and iterate quickly.

Market research is the backbone of success in the fashion industry. By meticulously studying consumer behavior, keeping a finger on the pulse of trends, and analyzing the strategies of competitors, fashion professionals can craft a robust business model. Utilizing the right tools, case studies, and overcoming challenges, your path to informed decision-making is set.

In a realm where yesterday’s fad is tomorrow’s old news, thorough market research ensures you’re always on the cusp of what’s next in fashion. It’s the secret to crafting not just great products, but legacies.

What is fashion market research?

Fashion market research is the systematic gathering, recording, and analysis of data that pertains to the market’s preferences, economic indicators, and various other factors that contribute to the behavior of fashion consumers. This research helps brands and retailers understand what products to create, how to promote them, and at what price point.

Who should be conducting fashion market research?

Anyone involved in the lifecycle of a fashion product should be involved in market research to some degree. This includes designers, manufacturers, retailers, marketers, and any other professionals with a vested interest in the success of a product in the market.

What types of market research are most appropriate for the fashion industry?

A mix of qualitative and quantitative research methods are most appropriate for the fashion industry. This includes surveys, focus groups, trend analysis, and consumer panel studies, among others. These methods help capture both broad market trends and individual consumer preferences.

Alice Ananian

Alice has over 8 years experience as a strong communicator and creative thinker. She enjoys helping companies refine their branding, deepen their values, and reach their intended audiences through language.

Related Articles

9 Proven Methods to Collect Customer Feedback for Businesses

- by Angel Poghosyan

- January 31, 2024

Things to Learn from These Shark Tank Failures

- by Arman Khachikyan

- February 29, 2024

68 market research questions to ask (and how to ask them)

Example market research questions, market research questions to ask customers, market research questions for product development, market research questions for brand tracking, pricing survey questions for market research, how to write your own market research questions.

No two market research projects are alike, but happily there are some tried-and-tested questions you can use for inspiration to get the consumer insights you’re looking for.

It’s all about asking questions that are most relevant to the goals of your research. Every so often the best questions are actually quite straightforward, like asking consumers where they do their grocery shopping.

If you’re creating a customer profile, you’ll ask different questions than when you’re running creative testing with your target audience, or getting insights on key consumer trends in your market.

The right market research questions are the ones that will lead you to actionable insights, and give you a competitive advantage in your target market.

Let’s kick this off and get straight into some questions, shall we?

Where do we even begin with this?! There are so many types of research and we’ll get into which questions work for each below, but here are some classic example market research questions to get you started.

These particular questions are good for surveys that you might run when you’re running some essential consumer profiling research.

- Which of these products have you purchased in the last 3 months?

- Which of the following types of >INSERT YOUR PRODUCT/SERVICE CATEGORY< do you buy at least once a month?

- Approximately, how much would you say you spend on >INSERT YOUR PRODUCT/SERVICE CATEGORY< per month?

- What is stopping you from buying more of >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- When was the last time you tried a new >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Please rank the following on how important or unimportant they are when deciding which >INSERT PRODUCT CATEGORY< to buy?

- Which of these brands are you aware of?

- Which of these brands have you purchased from in the last 3 months?

- How do you prefer to shop for >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Why do you prefer to shop online?

- Why do you prefer to shop in-store?

- Thinking about the following, how often do you use/listen/watch each of these media?

- Where do you go to keep up to date with the news?

- Which social media platforms do you use daily?

- What mobile phone do you currently own?

Surely you want to talk to your current customers to understand why they buy from you and what they think about your products?

Correct! But your consumer research should definitely not end with current customers!

Here’s why you should think about broadening your research to include other groups and different market research methods :

- Current customers: This is a must! Running research to your current customers will help you understand how you can make your product or service better. These are the people who’ve spent their hard-earned cash on your products so they have a unique perspective on what kind of value you offer. In addition, understanding why your existing customer base chose your brand over others can help you create messaging that resonates with people who are still on the fence.

- Previous customers: People who used to buy your products but don’t anymore can give you valuable insight into areas you might need to improve. Perhaps your brand perception has shifted making some customers buy elsewhere, or maybe your competitors offer customers better value for money than you currently do. These are the kinds of areas you can learn about by running research to previous customers.

- Non-customers: You should also ask people who haven’t bought your products why they haven’t. That way you’ll learn what you need to improve to bring new customers in. You should ideally ask the same kinds of questions, so that you can learn about what product features you need to work on but also things like the messaging you should be putting out there to win people over.

Here are some questions that are perfect for competitive market analysis research. Some of these questions might sound similar to some from our previous section on consumer profiling—that’s because there’s often some crossover between these types of research. Consumer profiling often refers to a more general type of research that covers similar ground to market analysis. If you’re wondering how to calculate market size , questions like these would be a great starting point.

- How often do you usually purchase >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Why do you buy >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- What types of >INSERT YOUR PRODUCT/SERVICE CATEGORY< do you buy?

- How often do you buy the following types of >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Where do you buy your >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Where do you find out about >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Which of these brands have your purchased in the last 12 months?

- How would you feel if you could no longer buy >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- How important or unimportant do you find the following topics? (e.g. sustainability, diversity and inclusion, ethical supply chain)

- What could be improved about the products you currently use?

By involving consumers in the product development process, you can make sure that your products are designed to meet—and ideally exceed—their needs.

Product market research can be done at several points in the product development process, by asking potential customers in your target market questions about existing products (yours or competitors’), prototypes, or just your own early-stage product ideas.

You can dive into the customer experience, specific product features or simply find out if the product quality matches the value proposition you’re putting out there.

Sometimes you even get a surprising answer to the question: how does our product or service help people?

You might learn from the survey responses that customers are using your product in a different way than you intended, opening you up to new target markets and different product types in the future.

Asking these questions also allows you to get feedback on your designs, so that you can make necessary changes before the product is released. Here’s some inspiration for when you’re conducting product market research.

There are different types of new product development research. A key type is Jobs to be done research. This research digs into the practical reasons people buy products—the jobs they need to get done with a specific product. You use these insights to help you create products that will genuinely help consumers, and that they’ll ultimately want to buy.

- How many times have you carried out [INSERT ACTIVITY] in the last 12 months?

- How much time would you typically spend on this [INSERT ACTIVITY]?

- How important or unimportant is carrying out this [INSERT ACTIVITY]?

- How satisfied or unsatisfied do you feel when carrying out this [INSERT ACTIVITY]?

- What is the best thing about carrying out [INSERT ACTIVITY]?

- How does carrying out [INSERT ACTIVITY] make you feel? Please select all that apply

- What particular problems or challenges do you run into while carrying out [INSERT ACTIVITY]?

When you’re cooking up your brand’s next product, you’ll want to go through a concept testing phase. This is where you ask consumers what they think about your idea and find out whether it’s likely to be a success. Here are some of the questions you could ask in your concept testing research.

- To what extent do you like or dislike this idea/product? [ATTACH IMAGE]

- What do you like about this idea/product?

- What do you dislike about this idea/product?

- Is easy to use

- Sounds tasty

- Is good quality

- Is Innovative

- Is different from others

- Purchase this product

- Replace the product I currently own with this

- What other products this idea/product reminds you of? Please provide as much detail as possible including the product name.

- What feature(s), if any, do you feel are missing from this product?

- How would you improve this idea/product? Be as descriptive as possible!

- What issues do you solve through the use of this product?

- When can you see yourself using this product? Please select all that apply.

- The price for this product is $25.00 per item. How likely or unlikely would you be to buy this product at this price?

Get inspired with NPD survey templates

Our in-house research experts have created New Product Development (NPD) survey templates to give you the perfect starting point for your product research!

Does the perspective of new customers change over time? How do you compare to other brands, and how do you become the preferred brand in your market and increase that market share?

Brand perception and brand awareness are super important metrics to track. These insights can be used to improve customer experience and satisfaction on a higher level than just product: the relationship you have with your customers.

This research can also help you understand how to reach the holy grail of branding: turning loyal customers into brand ambassadors.

You should also remember to ask marketing research questions about your brand to existing and potential customers.

Existing customers might have a different view after having interacted with your team and products, and you can use that to manage the expectations of your target customers down the line. And potential customers can help you understand what’s holding them back from joining your customer base.

Top tip: it’s completely fine (and super beneficial!) to run brand tracking into your competitors’ brands as well as your own. Replicating research for different brands will give you a tailored benchmark for your category and position.

Here are some key questions to ask in your brand tracking research.

- Which of the following, if any, have you purchased in the past 12 months?

- Thinking about >INSERT YOUR CATEGORY<, what brands, if any, are you aware of? Please type in all that you can think of.

- Which of these brands of facial wipes, if any, are you aware of?

- Which of these facial wipe brands, if any, have you ever purchased?

- Which of these facial wipe brands, if any, would you consider purchasing in the next 6 months?

- e.g. Innovative

- Easy to use

- Traditional

- We’d now like to ask you some specific questions about >INSERT YOUR BRAND<.

- When did you last use >INSERT YOUR BRAND<?

- What do you like most about >INSERT YOUR BRAND<?

- What do you like least about >INSERT YOUR BRAND<?

- How likely would you be to recommend >INSERT YOUR BRAND< to a friend, family or colleague?

- Why did you give that score? Include as much detail as possible

- In newspapers/magazines

- On Instagram

- On Facebook

- On the radio

- Through friends/family/colleagues

- When did you last use >INSERT MAIN COMPETITOR BRAND<?

- How likely would you be to recommend >INSERT MAIN COMPETITOR BRAND< to a friend, family or colleague?

Kick off your brand tracking with templates

Track your brand to spot—and act on!—how your brand’s perception and awareness affects how people buy. Our survey templates give you the ideal starting point!

When it comes to pricing your product, there’s no need to wing it—a pricing survey can give you the insights you need to arrive at the perfect price point.

By asking customers questions about their willingness to pay for your product, you can get a realistic sense of what price point will be most attractive to them and, not unimportant, why.

Top tip: good pricing research can be tough to get right. Asking how much people would theoretically be willing to pay for a product is very different from them actually choosing it in a shop, on a shelf next to competitors’ products, and with a whole load of other economic context that you can’t possibly test for. Price testing is useful, but should sometimes be taken with a pinch of salt.

Here are some questions you could use in your pricing research.

- Which of the following product categories have you bought in the last 12 months?

- How often do you currently purchase >INSERT YOUR CATEGORY<?

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be so expensive that you would not consider buying it? (Too expensive)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be starting to get expensive, so that it is not out of the question, but you have to give some thought to buying it? (e.g. Expensive)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be a bargain—a great buy for the money? (e.g. cheap)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

- How much do you currently pay for >INSERT PRODUCT CATEGORY<? Please type in below

- Thinking about this product, please rank the following aspects based on how much value they add, where 1 = adds the most value 10 = adds the least value.

- Thinking about the product category as a whole, please rank the following brands in order of value, where 1 is the most expensive and 10 is the least.

Formulating market research questions can be tricky. On the one hand, you want to be specific enough that you can get tangible, useful answers. But on the other hand, you don’t want to ask questions that are so difficult or unclear that respondents will get frustrated and give up halfway through.

Think about what answers you need and what actions you are hoping to take based on those answers.

We’ll help you get started with a list of steps to take when formulating your own market research questions, and putting them together in a survey that makes sense.

1. Define your research goals and link them to actions you can take

Before you can write great market research questions, you need to know what you want to learn from your research.

What are your goals? What do you want to find out? Once you have a clear understanding of your goals, you can start brainstorming questions that will help you achieve them.

2. Know your target market and the language they use

Who are you conducting market research for? It’s important to know your audience before you start writing questions, as this will help you determine the best way to phrase them.

For example, if you’re conducting market research for a new product aimed at teenagers, you’ll want to use different language than if you were conducting research for a new financial planning service aimed at retirees.

3. Keep it simple, and break things into smaller pieces

Don’t make your questions too complicated. Stick to simple, straightforward questions that can be easily understood by your target audience.

The more complex your questions are, the more likely it is that respondents will get confused and provide inaccurate answers.

If you feel a question is too difficult, see if you can break it up into smaller pieces and add follow-up questions on top.

And don’t ever load two questions into one! This falls into Consumer Research 101, but it’s amazing how often it happens. Instead of ‘What’s your favorite chocolate bar, and why?’ ask two questions: ‘What’s your favorite chocolate bar?’ and ‘Why is this your favorite chocolate bar?’

4. Be super specific

Make sure your questions are specific enough to get the information you need. Vague questions will only lead to vague answers.

For example, instead of asking ‘What do you think of this product?’, ask ‘What did you think of the taste of this product?’ or ‘What did you think of the packaging of this product?’.

5. Avoid leading questions

Leading questions are those that suggest a particular answer or course of action. For example, instead of asking ‘Do you like our new product?’, which suggests that the respondent should like the product, try asking ‘What are your thoughts on this product?

This question is neutral and allows the respondent to answer freely without feeling pressured in any particular direction. It’s also brand-neutral: people answering this question will have no idea who’s asking, and their opinion won’t be biased as a result.

6. Make sure your question is clear

It’s important that your question is clear and concise so that respondents understand exactly what they’re being asked. If there is any ambiguity in your question, respondents may interpret it in different ways and provide inaccurate answers.

Always test your questions on a few people before sending them to a larger group to make sure they understand what they’re being asked.

7. Avoid loaded words

Loaded words are those with positive or negative connotations that could influence the way respondents answer the question. For example, instead of asking ‘Do you love this product?’, which has a positive connotation, try asking ‘What are your thoughts on this product?’

This question is neutral and allows the respondent to answer freely without feeling pressured in any particular direction

8. Make sure the question is answerable

Before you include a question in your market research survey, make sure it’s actually answerable. There’s no point in asking a question if there’s no way for respondents to answer it properly. If a question isn’t answerable, either revise the question or remove it from your survey altogether.

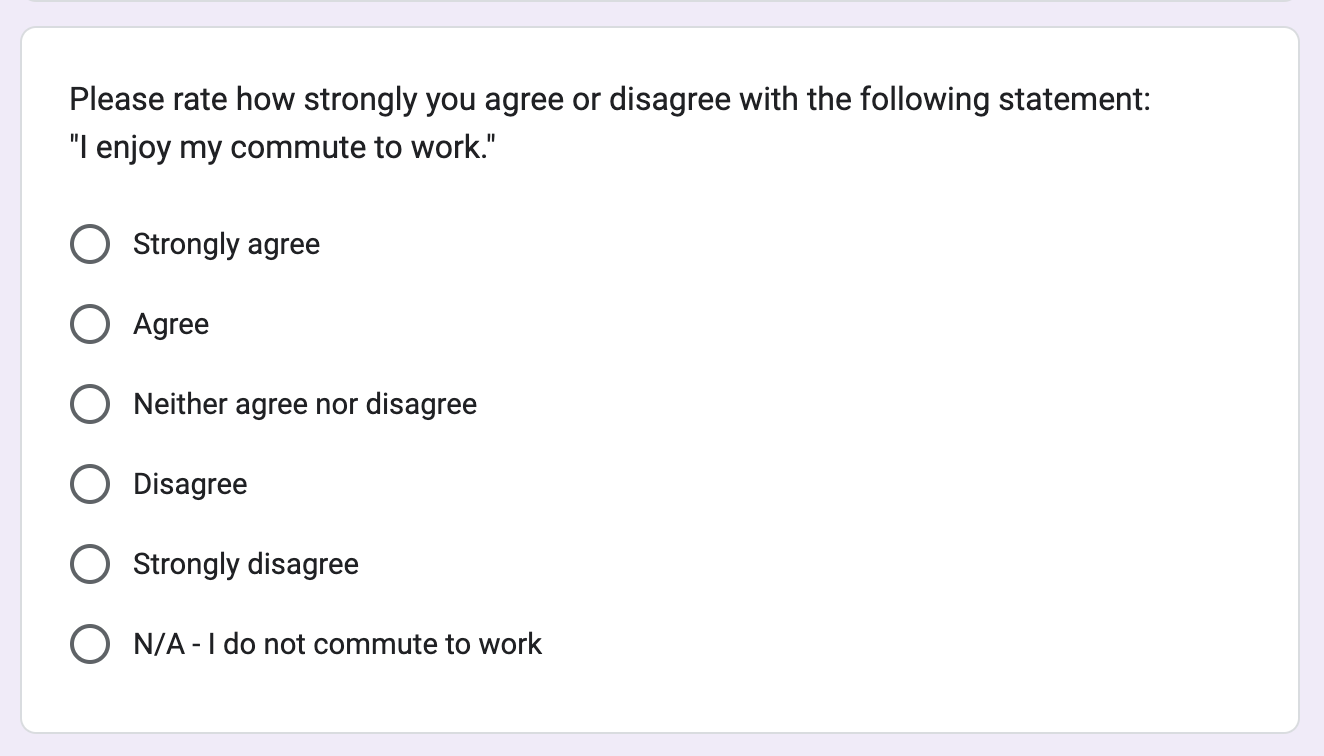

9. Use an appropriate question type

When designing your market research survey, be sure to use an appropriate question type for each question you include. Using the wrong question type can lead to inaccurate or unusable results, so it’s important to choose wisely. Some common question types used in market research surveys include multiple choice, rating scale, and open-ended questions.

10. Pay attention to question order

The order of the questions in your survey can also impact the results you get from your research. In general, it’s best to start with more general questions and then move on to more specific ones later on in the survey. This will help ensure that respondents are properly warmed up and able to provide detailed answers by the time they reach the end of the survey.

Make smart decisions with the reliable insights

To make sure you make smart decisions that have real impact on your business, get consumer insights you can rely on. Here’s our rundown of the top market research tools.

Survey questions for market research are designed to collect information about a target market or audience. They can be used to gather data about consumer preferences, opinions, and behavior. Some common types of market research survey questions include demographic questions, behavioral questions and attitudinal questions.

There are many different types of market research questions that companies can use to gather information about consumer preferences and buying habits. They can be divided into different categories, like a competitive analysis, customer satisfaction or market trends, after which you can make them more specific and turn them into survey questions. These are some of the things your research questions can help you answer: – What is the target market for our product? – Who is our competition? – What do consumers think of our product? – How often do consumers purchase our product? – What is the typical customer profile for our product? – What motivates consumers to purchase our product?

When conducting market research, surveys are an invaluable tool for gathering insights about your target audience. But how do you write a market research questionnaire that will get you the information you need? First, determine the purpose of your survey and who your target respondents are. This will help you to write questions that are relevant and targeted. Next, craft clear and concise questions that can be easily understood. Be sure to avoid ambiguity, leading questions and loaded language. Finally, pilot your survey with a small group of people to make sure that it is effective. With these tips in mind, you can write a market research survey that will help you to gather the crucial insights you need.

Elliot Barnard

Customer Research Lead

Elliot joined Attest in 2019 and has dedicated his career to working with brands carrying out market research. At Attest Elliot takes a leading role in the Customer Research Team, to support customers as they uncover insights and new areas for growth.

Related articles

5 beverage branding ideas (with examples you can learn from), survey vs questionnaire: what’s the difference and which should you use, what does inflation mean for brands, consumer profiling, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

20 Market Research Questions To Ask In Your Customer Survey

The primary reason you conduct any customer survey with market research questions is to make effective decisions that grow your business by selling more to both existing customers, as well as by acquiring new customers by increasing the effectiveness of your product/service to suit their needs better. But when you take even a closer look, we’re making these decisions because the main objective is to become the obvious choice for that ideal customer. For that to happen and to reach market research goals, you need to ask:

What are Market Research Questions?

Market research questions is a questionnaire that is answered by customers or potential consumers, to understand their perception and opinion on a given subject, typically pertaining to product or service feasibility, understanding consumer needs and interests, and pricing concepts.

LEARN ABOUT: Dealership Marketing Strategies & Tips

For example: A customer survey on market research of an existing product line that focuses on the usefulness of specific features in a product line. Based on the feedback received from this survey, a business can now decide which features to invest and enhance/improve, and which features to relatively defocus/discontinue. This market research , therefore, enables a business to efficiently allocate resources based on real, data-oriented insights from their own customers.

LEARN ABOUT: Test Market Demand

A similar set of market research questions can also be sent to potential consumers of a product, to understand market absorption capability.

LEARN ABOUT: Consumer Surveys

What Market Research Questions should I ask in my Customer Survey?

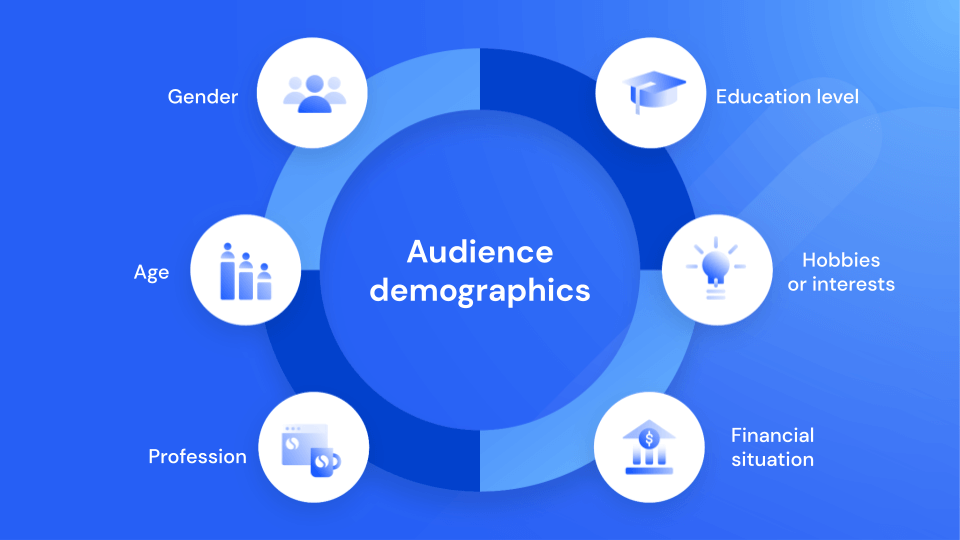

- Who is our ideal customer? These are typically demographic market research questions such as gender survey questions , education level, income level or location. You can expand these questions to find out your customer’s occupation or if your ideal customer is a parent, pet owner. Don’t skimp on demographics or psychographics . If anything, get really creative with them. You might consider conducting a survey with nothing but profiling questions that include where your customers shop, or where they prefer to eat. It’s critical to know as much as possible about your ideal customer so that you can begin focusing your marketing decisions around their preferences.

- What do they struggle with? Another root set of data that market researchers are searching for within their ideal customer is “what they struggle with.” What are the 5 to 7 frustrations that they are dealing with when it comes to interacting with our product or service? Suppose you are a golf accessories company and you ask your ideal customer what frustrates them about their golfing experience. In that case, you might get responses such as “expensive golf clubs getting wet during a rainstorm.” If you get enough of those responses, you may consider developing a golf accessory that protects golf clubs in the rain.

- What does your ideal customer really WANT? No matter how you phrase the market research questions (and there are countless creative formats) all we really want to know is what our customer will actually purchase as a solution. What is it that they WANT? Of course, they’re NOT going to say that they want something that doesn’t exist yet — in the 1960’s the average person would NOT have known that they wanted a microwave. They wanted hot food fast. One good way to get at these wants is to give your respondents some examples of product offerings and combinations and see how they rate them.

- What sets you apart from your competition? Competitive analysis and bench-marking are critical if you want to increase the profitability of your product and build your brand. An effective way to measure or identify differentiators or competitive advantage is to ask Customer Satisfaction questions . The key to asking these market research questions is getting the attributes right. For example “How important is it that your tires have a run-flat safety feature?” instead of asking “How important is it that your car has tires.”For example, A survey can be conducted by either Apple or Samsung to find out how satisfied are the customers with their products and what are the other features that the consumer prefers from the competitive brand. Using such data a company can incorporate features based on the demand and can also benchmark their features that the customers prefer. A Apple vs Samsung Survey Questions template can help to achieve the data required to compare their products with the competition and strategize accordingly .

- What benefits do your customers perceive? Because we all choose and purchase based on emotion — it’s important to understand specifically what emotional benefits our customers receive from our products and services. The more we connect with our customers on an emotional level and provide that benefit — the more likely they are to choose us. This is an ideal place to use matrix questions that rate the degree to which customers agree or disagree with a variety of “benefit” statements. Here is an example “I can count on Service X to pull me out of a bind.”

- Who is currently buying from us? A very important research metric to track is the “who” is currently buying a product or a service from you. Deriving a pattern from the current purchasing population, helps you target and market to a similar potential demographic. This also is an ideal place to use demographic questions extensively but it also helps if other factors like geographical metrics are tracked. You don’t want to be ignoring your existing customer base and also be smart and agile in attracting new business to your brand.

- Why are other people not buying from us? While it is imperative to know who is your potential customer or map your existing customer base, you need to find out who is not buying from you. This information is essential to understand if there are shortcomings in a product or service and at what milestone customers drop out of the purchasing process . This also helps to identify the way your business is conducted, if additional training is required to make a sale or if your product or service lacks in quality. Understanding why people are not buying from you also helps monitor if there is something fundamentally wrong with what you are offering to the masses.

- Who can buy from us in the future? It is a known fact that is about 10x more expensive to create a new customer rather than to maintain the one you currently have. That, however, is no reason not to aim for new business. It is therefore important to have a clear picture of your potential future business. Targeting potential customers, is a mix of customer demographics that have purchased from you in the past and a mix of demographics you advertise and market to. It is therefore important to have a well-rounded product or solution. For example, since your barbecue sauces and rubs are famous and widely used in the midwest does not mean they cannot be bought in the southern states.

- Why do people buy from you? What value or need does it fulfill? Customers only buy from you because of a perceived value . This value is either what you depict to potential customers or repeat customers have been privy to the value of your product or service. Customers also make a purchase because of the trust they have either in the product or service or the brand or sometimes even certain individuals. It is therefore important that you understand the value of your brand and stick to the morals and ethics of delivering high quality to ensure that the perceived and actual brand quotient is very high. The other reason why customers purchase from you is if their need is fulfilled by what you have on offer. This could either be a direct or an indirect need.

- What would make you a perfect brand? No brand can be perfect! But you can surely be close to perfect. What this means is everything about your product or service is easy to use, intuitive, is value for money, scalable and ancillary support is impeccable. All of this is obviously immaterial if the product does not solve a real problem or make life easier for the customer. Having a very high customer oriented focus gives your brand a positive ring and becomes increasingly the go-to brand. You can use a simple Net Promoter Score question to understand how referrable is your brand and who are the promoters and detractors of your brand.

- What single aspect about your brand makes it stand out and makes clients trust you? People buy from you or transact with you mostly when there is a high trust factor. Very rarely is the purchasing decision purely based on need or ease of access. To identify and build on that one factor that makes you a preferred buying choice over your competitors is very important. You can map preferred aspects of your brand to age, sex, geographical location , financial limitations etc. because each of those factors can appeal to your brand differently. It is important that you identify and fortify those aspects of your business. Your brand can also be preferred because of other factors like personnel, customer service , ethos and perception amongst peers, consumers and the society alike. Abercrombie & Fitch was a respected brand but lost a lot of market share and goodwill due to CEO’s words in one isolated incident. It takes lots of work and time to build trust but takes none to lose all of it!

- What is the best way to communicate with the kind of people you are trying to reach out to? What’s caused the downfall for a lot of brands is the inability to reach out to target customers despite their product or service being impeccable. Not knowing how to reach your target audience or potential customer makes all your hardwork go down the drain. For example, if a new life saving drug is making its way to the market, but medical professionals and doctors don’t know about it or how to administer it and its benefits, about 20 years of work goes down the drain. You need to identify the right channels and avenues to reach out to the people that will consume your product or service.

- What do customers make of your product and/or service line? There are a few brands that have one product or service and that rakes in the customers and money for them because of the nature of the product or service. But most brands aren’t this way! They would need to branch out into multiple products or services or very often, a mix of both. It is, therefore important to understand the value of your products and/or services. It is imperative to know if they solve a problem a customer has or make life easier for the customer or any other such reason. This helps in consolidating the customer base.

- What improvements could be made to your products or services to have a wider reach? A product or a service has never achieved the maximum number of customers it can get. There always is someone who could use your product or service; maybe not in the form that it currently is but there is scope to scale. This makes it so much more important to collect periodic feedback on what additions your current customer base would like to see in your brand and what can bring in new customers from your competitors. Chipping away at deadwood features and making increased usability tweaks increases the adoption and use of your product and service. For example, a retail store wants to promote the use of its self-service checkout systems. However, a lot of customers still are not opting for the system. There can be many reasons to why the customer is choosing not to use the system, like complex operation, no readability, or even slow speed of the system. To understand the reason, a Usability survey for self-service checkouts can be conducted. This will enable the store to gather first-hand information from the customers and make improvements in the system accordingly.

Learn More: User Interface Survey Template

- What is the right price to charge? Pricing a product or service is one of the most important aspects of your business. Pricing right can decide the revenue, brand perception, profitability and adoption of the product or service. Pricing too slow has a negative connotation and may increase in bringing in lower revenue. Pricing high gives the feeling of being elite and then the profitability and revenue hinge on the factors of per unit adoption rather than a very high adoption. Pricing just right is a myth – what someone finds cheap, someone else could find expensive. Where someone finds your product or service value for money, others may find it exorbitant. Hence, it is important to collect extensive feedback from your existing and potential customers about what they think is an ideal price to play. It is also important to conduct due diligence on competitors to map how they price versus the service and product features they provide. These factors will help you come close to an “ideal price” to charge.

- What is the vision for the brand? A vision for a brand dictates the level the brand aspires to be and wants to scale up to be. Apple is now a preferred phone because the vision was to be an experience, not a device. The device is the means to ensuring that vision. They wanted to make the ecosystem so robust that any device you use, that familiarity and ease of use is standardized but also stonewall easy. Despite being expensive and facing ridicule during early days due to the ecosystem being different, they are now a one trillion behemoth, more than the GDP of some countries, due to having a vision for the brand.

- What is the way to ensure you reach that vision? A vision is easy to have but tough to follow through on. This is because your vision may see many roadblocks and may not be the current flavor of the market, but it is the right thing to stick with it. Innovate in your product and service lines by taking into consideration what your customers want and need and items they themselves don’t know that they need. Despite enduring hardships, if you stick to your vision, it is easier to use that as a launchpad for being an immaculate and preferred brand.

- What should the brand branch out into to avoid stagnation or imitation? While launching a product or service, it’s essential to understand where your competitors stand on the same product type or service line. How soon can they catch up to you and imitate your service or product? On the other hand, stagnation brings the ultimate demise of a brand, product, or service line. With little innovation and competitors saturating the market by imitating your product or service line, you’ll soon see your customer base dwindle. To ensure your customers don’t drop out, the key question to ask is, “What next?”. The best way to innovate or bundle your product or service is to understand what your customers struggle with and what value they are looking for. For example, Sony is known for its PlayStations, but competitors like Xbox don’t take long to catch up to their new products. How Sony does manage to stay ahead of the market is by constantly branching into new products and services.

- What bundled service or product you can offer in conjunction with yours? Good partnerships are hard to come by, strategic ones are even harder. This question tackles two of your problems, how to offer something new to your customers and how to reduce competitors in market. Your bundled service or product though has to make sense to the use, should complement your brand and cannot be an operational and logistical nightmare for your brand which then makes it counter-productive. Facebook’s acquisition of Instagram to consolidate on social images and short content rich video, is a strategic initiative to increase customer base as well as reduce competition at the same time. The key to building strong brand partnerships is to ensure your vision and product values align. Summing up, offering a bundled service or product in partnership will not only retain the existing customer base but also attract and increase new customers.

No matter why you are conducting a survey, you’ll find these 20 research questions at the core of “WHY” you want to know. Remember, your respondents will read or spend time with absolutely ANYTHING as long as they are at the center. Be sure to keep these 20 questions in mind when creating your survey and everyone involved will save time, aggravation and money. You can use single ease questions . A single-ease question is a straightforward query that elicits a concise and uncomplicated response.

LEARN ABOUT: Marketing Insight

Beyond these 20 market research questions, here are 350+ Market Research Templates for you to use completely free!

MORE LIKE THIS

Jotform vs SurveyMonkey: Which Is Best in 2024

Aug 15, 2024

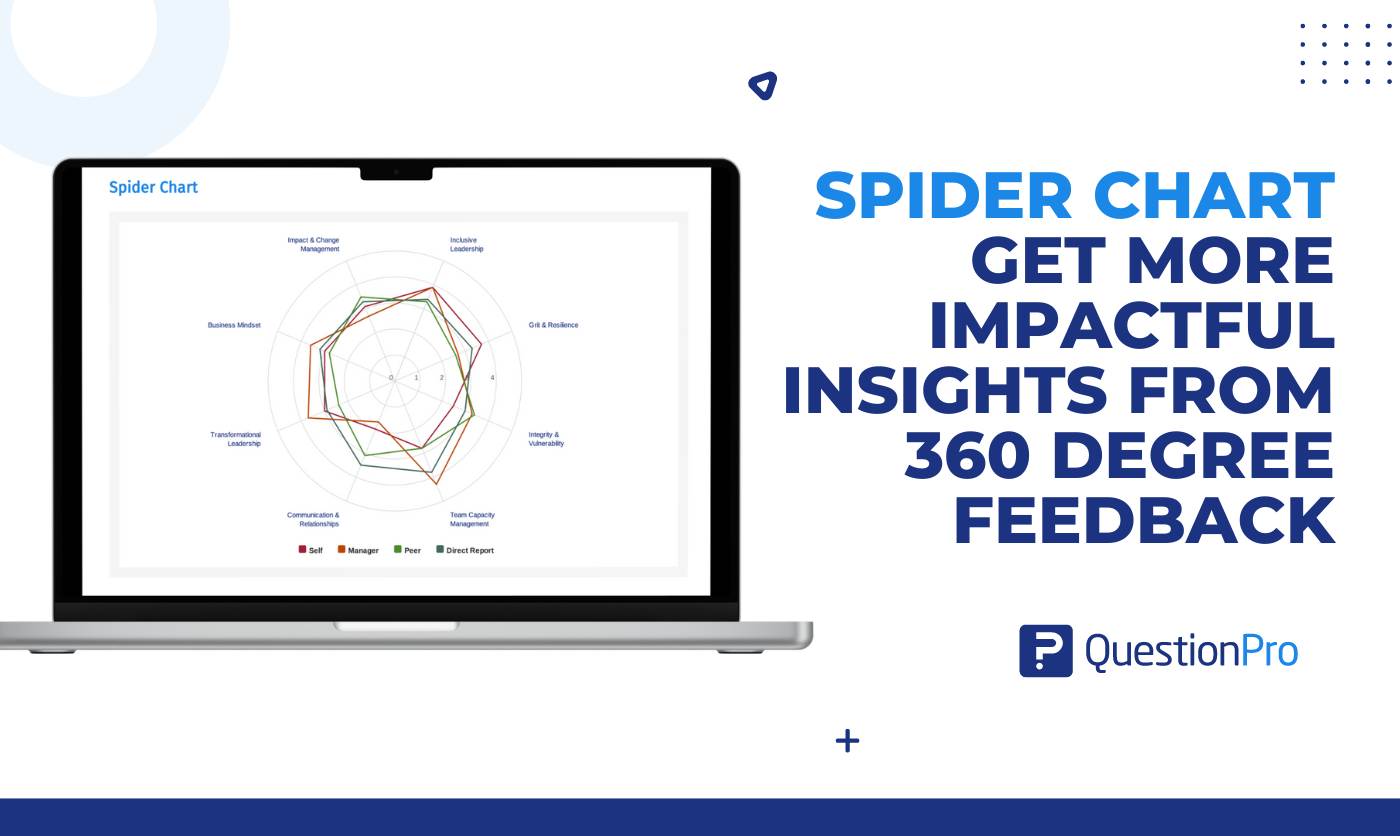

360 Degree Feedback Spider Chart is Back!

Aug 14, 2024

Jotform vs Wufoo: Comparison of Features and Prices

Aug 13, 2024

Product or Service: Which is More Important? — Tuesday CX Thoughts

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

- How it works

Pricing plans

Build your survey, our network, market research.

Become a better researcher. Read guides on how to measure what is important for your business

Pollfish Blog

Read our latest research studies and company announcements

Pollfish School

Guides regarding Pollfish features and how to use them

Survey Guides

Comprehensive guides on research

Insights that shape iconic brands.

Get high-end data quality..

Brands are more than goods and clothes— they’re how consumers express their identity. You need to connect with them on a deeper level to remain at the forefront of their shopping preferences.

Pollfish data shapes everything from strategy to brand awareness to testing products before launch. Use our real consumer insights to create a brand your consumers covet and remember.

Trusted by leading brands

Get real data - fast..

Pollfish is the only research partner trusted to deliver fast results from an audience of over 500+ million real consumers across 120K+ app partners. We provide the real-time insights you need to inform strategies that win new business and drive better campaigns.

Let's find your solution.

- Brand Managers

- Product Professionals

- Shopper Marketing Teams

- Brand Strategists

- Project Managers

- Content Strategists

- Social Media Managers

Brand Awareness

Brand health, product testing, attitude & usage, package testing.

- Content Creation

Naming Tests

You need more than your existing research

An internal panel is great for plenty of reasons. However, they are typically made up of your cheerleaders and your haters, rather than your average customer. And last years spreadsheets can’t be trusted to predict next year’s trends.

Pollfish is a natural complement to qualitative research, offering a cost-effective, quantitative perspective from a broad audience of existing and prospective customers—even your competitor’s customers— to give you a holistic view of your entire market potential.

Be more than a brand, be a lifestyle.

Learn what your customers care about and whether your brand resonates with their values. We’ll help you keep a pulse on how your brand measures up while you build your legacy.

One thing all leading brands have in common: customers know them when they see them. Find out if your branding efforts are paying off from logos to language.

Are you trendy or tone-deaf? Pollfish surveys are the perfect way learn how current and potential customers perceive your brand and help identify gaps in your intended messaging.

Stay ahead of a changing market by examining market size, brand penetration, general category satisfaction, pain points and more.

Put your money where your opportunities are.

Don’t launch something that nobody wants. Any personal style choice—from outerwear to underwear—can be tested against a real audience prior to launch to ensure the right mix of look, feel, function and fit.

Does your new product fit the look and feel users expect from your brand? Does the colorway work for your top influencers? Get near-real-time feedback on new product images before they hit store shelves.

Make sure your packaging—both physical and digital—are conveying the luxury experience your customers are paying for by broadly surveying potential targets.

Test potential names for your new product line against a real audience to find the one that elicits the emotions and associations you want anchored to your brand.

Flaunt what you got.

Survey your target audience to identify better ways to reach them with the type of content they love. Craft a message that resonates to keep your brand top-of-mind with your most valuable customers.

Don’t just “post and pray.” Image testing helps you identify which assets catch your customers eye—and which will be lost in the noise.

PR coverage comes to brands who stand out—whether its backing a cause or a campaign catastrophe. Take control of your brand’s story by pitching original insights that editors can’t resist.

Social Media Updates

Find out how to engage your customers with the right content. From style advice to special offers—make sure your social presence is adding value to your repeat customers.

Have we convinced you to get real?

Get your own audience insights, let's get real.

Create an Account or contact us

- Pollfish School

- Market Research

- Survey Guides

- Get started

The Most Insightful Market Research Questions You Can Ask

With great customer expectations in today’s ever-growing digital world, market research has become exceedingly important. It should be at the forefront of every business’s strategy. Even if you feel as though you’ve nailed your target market down to a tee, there will always remain work to be done on the market research front.

That’s because market trends sway, as do the opinions and desires of your customer base. That means when you least expect it, even your most loyal customers will turn to your competitors, sometimes for good. But you can still stay in the know about what your customers want and think by running a sturdy market research plan.

As part of any solid market research endeavor, you’ll need an apt set of questions to help answer the most pressing needs and opinions of your customers. You’ll also need sets of questions that pertain to your needs as well; this is especially crucial to understanding your customers’ minds about your product or service.

Let’s explore four sets of insightful market research questions.

Questions Based on Pain Points

These questions are thematically based on the difficulties customers may have undergone, are currently experiencing, or may run into in the future. In regards to the latter, these types of questions are great in that they are wired to prevent the pain points from occurring in the first place.

Here are some examples of market research questions on customer experience (CX) and customer journey points of friction.

What is the most difficult aspect of [action related to your product]?

What bothers you the most about ?

What issues do you typically run into on our website?

How can we better support your needs when shopping for…?

What frustrates you the most about ?

Questions Based on Goals

Goals-based questions help answer what your customers want, in that they inquire specifically about what it is customers are looking for and what they hope to gain from a product or service. These questions do not necessarily have to zero in a particular product/service — although some of them should. Rather, they can focus on improving specific tasks/actions related to your field. This will not only help you understand how your customers feel about your market but will allow you to innovate more and faster.

Here you’ll find some examples of market research questions on customer goals.

What do you look for in a ?

What do you think can do to improve its usefulness?

What can do to help improve your overall user experience?

What aspects would you like to see in new ?

What do you hope to gain when taking on [problem or goal within a market]?

Questions Based on Pricing

Pricing has always been (and will remain to be) a major part of the buying equation. Even customers in the luxury sector care about prices to some extent. No one wants to be ripped off; even businesses aim to save money. For example, in 2020, 69% of companies are expected to decrease ad spending.

Thus, it is ideal to have reasonably priced goods or services. But you won’t know what is considered a reasonable price until you conduct a questionnaire on your target market. Referring to general internet research alone will not suffice for this.

Here are a few examples of market research questions to ask about pricing.

What is a reasonable price range for ?

Are there any conditions in which you’d be willing to buy at a higher range?

What do you think is the ideal price for ?

How would you rate the prices within [industry, niche, or specific market]?

Is [price point] too high, low, or a fair ask for ?

Questions Based On Psychographic Traits

Psychographic questions help reveal the psychological characteristics within your target market, or your entire pool of respondents. This type of approach to market research questions involves the feelings, interests, and attitudes your customer base holds.

It allows brands to understand their customers at a more intimate level, specifically, their views on any topic. You can tailor these to focus on your product/service or the desired act of making purchases.

Here are a few examples of questions based on psychographic traits.

Which of the following is most important to you?

How do you like to spend your free time?

If you had more time, which of the following would you do?

If you had more time, what would you spend more money on?

How do you favor making purchases?

What interests you?

What draws you to one brand over another in the [niche, industry, space, etc.]?

A Reminder on Market Research Questions

All four of the question types covered in this article are critical to tap into the brains of your current and potential customers. What’s more empowering about these kinds of questions is that they can help you expand your target market and appeal to a much wider audience. They can inform both your marketing strategies, your content, and the innovation of your product/service itself.

But you must remember, these in-depth questions do NOT cover demographics. Instead, these questions are for those who already passed the screening question portion of the survey.

Screening questions, which determine the eligibility of a respondent to partake in a survey, answer demographic questions about the responders. While they are incredibly necessary to understand who your respondents are, they do not necessarily allow you to conclude your customers’ behaviors, needs, and attitudes (although a few of them might).

A strong survey should combine both sets of questions for a comprehensive market research assemblage.

If you’re looking for more great resources on using surveys to meet your business and marketing goals, check out the Pollfish Resource Center, or reach out to our 24/7 customer experience team for guidance and support.

Frequently asked questions

What is market research.

Market research is an important aspect of business strategy that focuses on gathering information about the target market.

How are surveys used in market research?

Surveys can be used to gather first-hand information while conducting market research. Surveys are an example of primary research and are tailored to gather information specific to your business.

What is the purpose of goals-based questions in a market research survey?

Goals-based questions help you understand what your customers want from a certain product or service. This type of question will help you understand your customers’ wants and needs better so you can create or improve a product to meet their needs.

What are psychographic questions?

Psychographic questions help a researcher understand consumers’ feelings, values, interests, and lifestyle choices. Understanding the psychographic traits of an audience can help a company market to them more effectively.

What are screening questions?

Screening questions are conducted before a survey is distributed. They help researchers identify the eligibility of individuals to take part in the survey. Typically, screening questions focus on demographics and the relationship to a company’s products or services.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

Do you want to create free survey about:

Fashion Survey Questionnaire?

Or maybe something else?

or use this template:

Fashion Survey Questionnaire

Explore the latest fashion trends and consumer preferences through the Fashion Survey Questionnaire under 'User Experience'. Share your feedback today!

Would you like to work on this survey?

Startquestion is a free survey platform which allows you to create, send and analyse survey results.

Exploring Fashion Trends Through a Unique Survey Questionnaire

Fashion Survey Questionnaire is a comprehensive set of questions designed to delve into the preferences, habits, and opinions of individuals regarding the fashion industry. This survey, categorised under 'User Experience', aims to gather valuable insights from participants about their shopping behaviours, style preferences, and attitudes towards sustainability in fashion. With questions ranging from frequency of shopping to favorite fashion trends and designer choices, the survey provides a holistic view of how individuals interact with the world of fashion. By exploring topics such as preferred clothing materials, accessory choices, and sources of fashion inspiration, the questionnaire aims to capture the diverse perspectives and tastes within the fashion landscape. Through this survey, participants can reflect on their personal style, shopping habits, and perceptions of the latest fashion trends, offering valuable feedback for brands and designers looking to better understand their target audience. Whether you're a fashion enthusiast or simply curious about the ever-evolving world of style, the Fashion Survey Questionnaire invites you to share your thoughts and experiences in the exciting realm of fashion.

63 Insightful Market Research Questions to Ask in 2023

Better understand your target customer with these must-ask questions.

Understanding your target market, and how they respond to your product, is the key to successful promotional campaigns. Even if you feel like you understand your market perfectly, markets do change over time. Your customers’ opinions, needs, and wants will change along with current trends in society, politics, pop culture, and other influences. Asking the right market research questions can help you stay on top of your changing market.

The market research questions below will help you understand your market’s most pressing concerns , along with potential pain points.

Market research questions to understand customer demographics and psychology

Aside from basic demographic questions, like age, gender, income, and location, you can create a more specific customer profile. Ask these questions to get to know your customers better:

- How do you primarily spend your time?

- In which industry do you work?

- What kind of hobbies do you regularly participate in?

- What are your main interests?

- If money or time were not an issue, what do you prefer to spend money on?

- What draws you to one brand over another?

- How do you choose between brands and products?

- Who makes the primary purchasing decisions in your household?

- How many people do you shop for on a regular basis?

- What’s your preferred method of shopping? Why?

- What makes you decide to avoid a brand in the future?

- How do you feel about available products in [your product category]?

- How often do you shop for [your product category]?

- How much do you spend on [product category] on a monthly basis?

- How do you use [product type] in your everyday life?

Market research questions for new products

If you’re gathering information to create or launch new products, these questions can provide valuable insight:

- What do you look for when purchasing [new product or service]?

- What is the most important feature for a [product type]?

- How does [product type] make your life easier?

- How often do you use [product type]?

- Describe how you use [product type].

- How much would you prefer to spend on a similar product or service?

- What features would encourage you to pay more for a product or service?

- Are there any features in [similar product or service] that you wouldn’t use?

- Do you feel [competing products] are priced fairly?

- What would convince you to try a new product or service in this category?

Market research questions for pain points

Understanding how your customers are responding to your current offerings, whether product, service, advertising, or customer service, can help you understand where your business can improve. Ask these questions to learn more:

- When was the last time you purchased from [company]?

- Describe your experience with your last purchase.

- Where did we succeed in meeting your expectations?

- Where did we fail in meeting your expectations?

- What would make your experience with [product] better?

- Are there any features you don’t use?

- What would your ideal product or service include?

- Have you ever talked to our customer service team?

- Describe your reason for needing customer service assistance.

- Describe your experience with our customer service team.

- Was your issue resolved?

- How quickly was your issue resolved?

- Were you satisfied with the outcome?

- What would have made the experience better?

- What’s the most difficult part of using our products or services?

- Do you use our website? How do you use it?

- Have you experienced any problems contacting us for assistance? What were they?

- Have you experienced any problems on our website? What were they?

Market research questions for pricing and placement

Understanding how your product pricing and placement compare to those of your competitors can be helpful. Use these questions to refine your pricing and promotional strategies:

- How much do you currently pay for [product type]?

- Do you think our product is priced fairly?

- Have you found [product or service] for less? Did you purchase it? Why or why not?

- What is a reasonable price range for [product or service]?

- What is the ideal price for [product or service]?

- Is [price point] too low or too high for a similar product/service?

- Have you seen our products in stores before?

- Where have you seen our products mentioned/placed/advertised?

- Where would you like to see our products or services mentioned/placed/advertised?

Market research questions for advertising and brand awareness

Advertising, marketing, and branding create an image in your customers’ minds. While brand awareness is its own market research niche, these questions will help you understand how customers perceive your brand and advertising campaigns:

- Are you familiar with our brand?

- How did you find our brand/company?

- Have you ever seen any reviews of our brand/product/company? How did they influence your purchase?

- Have you ever seen advertisements for our brand/product/company? How did they influence your opinion of us?

- Who do you think our target customer is?

- When you think of our brand, how do you feel?

- Does our advertising and branding accurately reflect your experience with our company?

- What should potential customers know about our products and services?

- What do you think our brand/company stands for?

- Have you ever followed any of our social media channels? Which ones? How do you feel about our social media presence?

Ask the insightful questions with Voiceform

When it’s time to ask the market research questions that will get you the insight you desire, Voiceform will make the process simple. Our feature-rich, innovative multimedia survey platform empowers companies to get the answers they need. From voice and video functions to AI transcription and analysis , this powerful survey platform can help you create, launch and distribute multiple survey types. Learn more about our products today by scheduling a demonstration.

We make collecting, sharing and analyzing data a breeze

Get started for free. Get instant access to Voiceform features that get you amazing data in minutes.

- (855) 776-7763

All Products

BIGContacts CRM

Survey Maker

ProProfs.com

- Get Started Free