The Brand Hopper

All Brand Stories At One Place

Case Study: Dove’s “Real Beauty” Brand Campaign

Case Study: Dove’s “Real Beauty” Brand Campaign 6 min read

In the world of skincare, Unilever’s Dove has not only solidified its position with products promising moisture and softness but has also reshaped the beauty industry through its groundbreaking “Real Beauty” campaign, launched in 2004 . This article delves into the multifaceted facets of Dove’s campaign, exploring its inception, objectives, social impact, marketing mix analysis, key elements, pros and cons, and the profound long-term implications it has had on the brand and the beauty industry as a whole.

A Revolutionary Approach to Beauty Standards

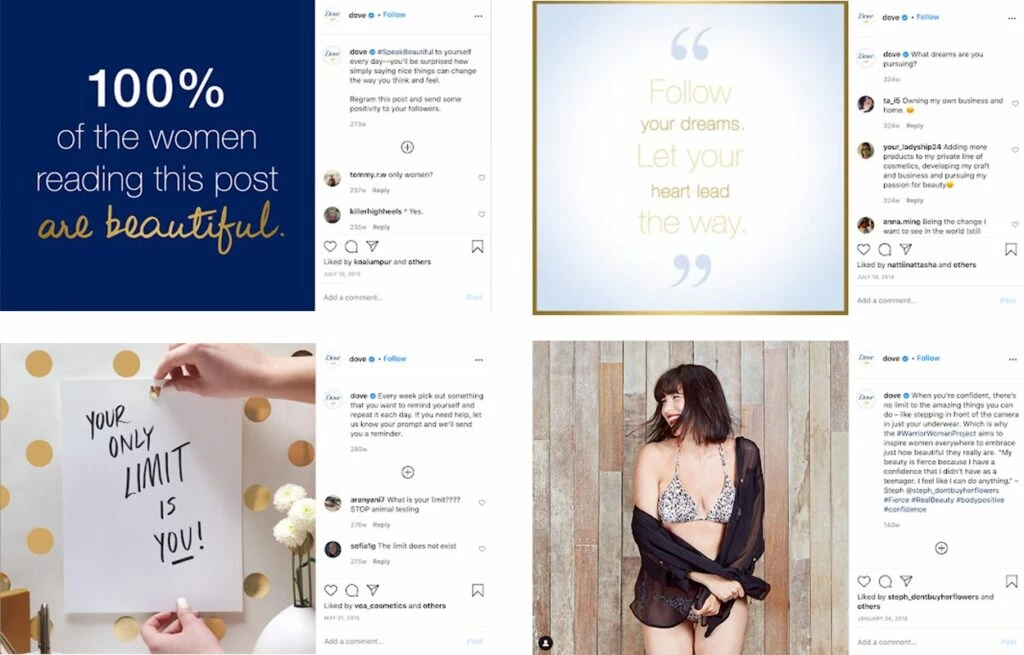

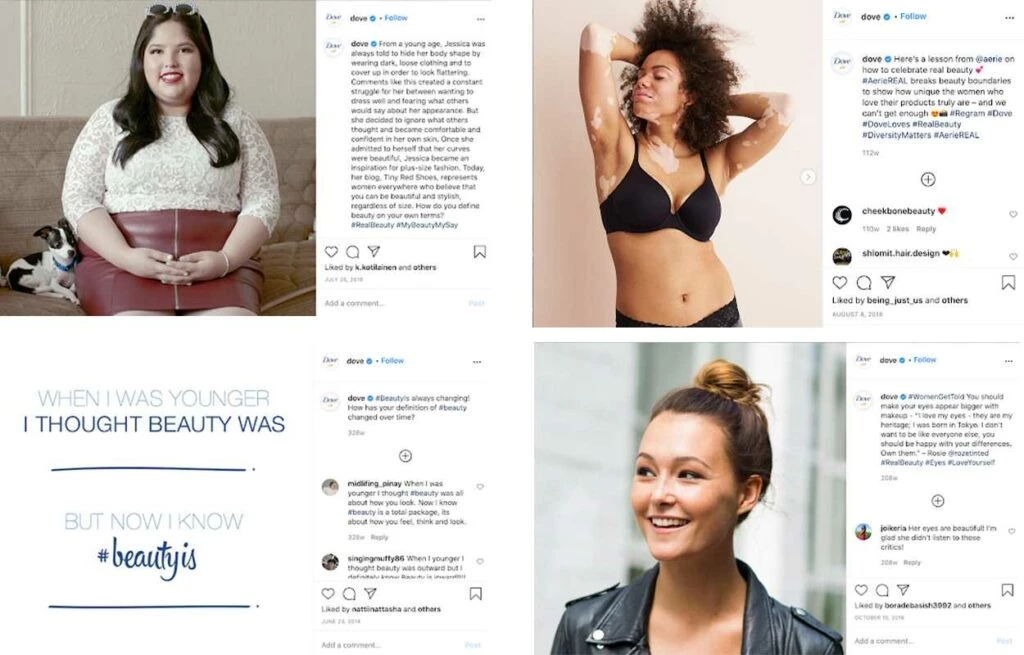

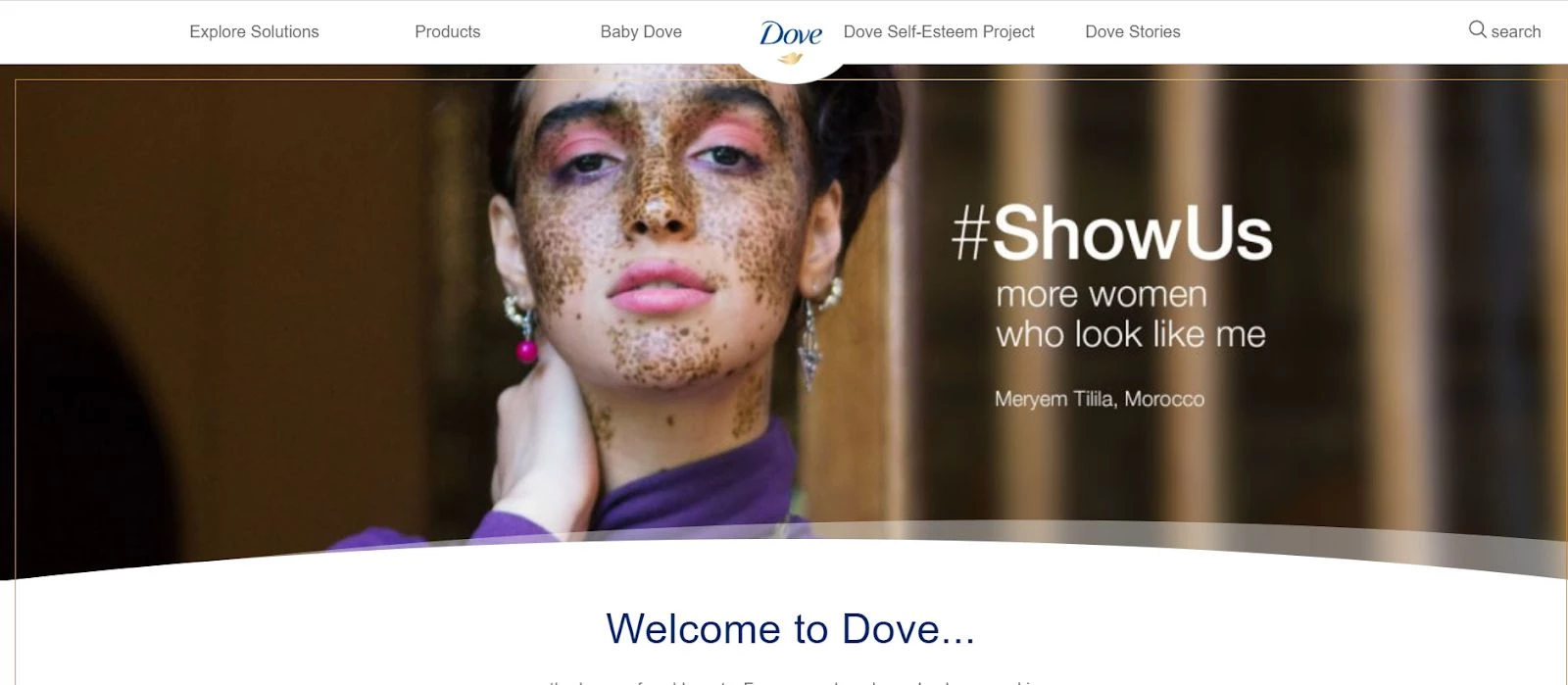

Dove’s “Real Beauty” campaign embarked on a revolutionary journey by challenging and redefining the prevailing beauty standards. Departing from the conventional models seen in beauty ads, Dove opted for authenticity, featuring real women of diverse body types, ages, and ethnicities. This bold move aimed not only to celebrate the natural beauty of women but also to inspire a global conversation on self-image and societal perceptions of beauty.

The Objectives: Beyond Skin Deep

The campaign’s objectives were multifaceted. Firstly, Dove sought to broaden the narrow beauty standards dictated by media and society, offering a more inclusive definition of beauty. Secondly, it aimed to stimulate a global conversation, urging people to reconsider their perceptions of beauty. Lastly, Dove sought to boost women’s self-esteem by featuring diverse women, fostering a positive self-image.

Impacting Society: Beyond Beauty Products

The social impact goals were evident from the outset – Dove aimed to change the narrative around beauty, inspiring women worldwide to embrace their unique beauty. Furthermore, the campaign sought to influence other brands and the advertising industry to adopt a more inclusive and realistic portrayal of women.

Analyzing the Marketing Mix

Dove’s “Real Beauty” campaign serves as a stellar example of a well-executed marketing mix, strategically incorporating the four Ps – Product, Price, Place, and Promotion.

- Product : Beyond skincare, Dove sold an idea – a new definition of beauty that was inclusive and diverse.

- Price : The brand maintained its value-based pricing strategy, reinforcing the message that real beauty is not a luxury but a right accessible to every woman.

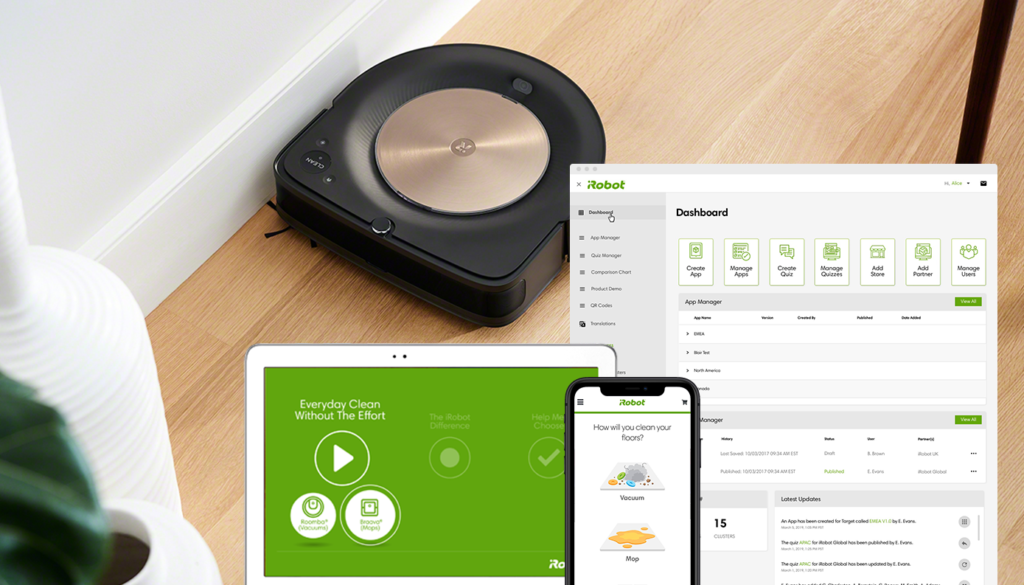

- Place : Widely available globally, Dove’s products reached a broad audience. The digital presence further expanded its global reach, making it a conversation transcending borders.

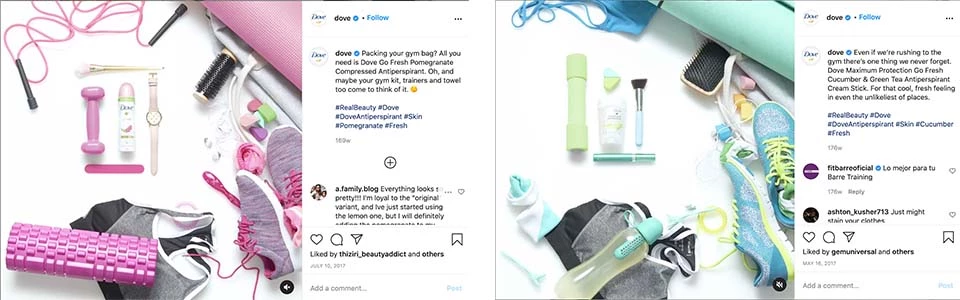

- Promotion : The campaign leveraged unconventional strategies, featuring real women across various mediums, from TV commercials to digital platforms.

Key Elements of Authenticity

The campaign’s authenticity lay in its use of diverse models and the introduction of the “inner goddess” concept. By showcasing real women of different ages, sizes, and ethnicities, Dove aimed to boost self-esteem and change the narrative around beauty.

Navigating Pros and Cons

While the campaign successfully shifted beauty ideals towards inclusivity, it faced criticism for inconsistencies, particularly concerning Unilever’s ownership of brands with contradictory messages. Instances of racial insensitivity in certain ads also sparked public outcry. Despite these challenges, the campaign significantly impacted the beauty industry and resonated positively with consumers.

https://www.youtube.com/watch?v=XpaOjMXyJGk

Results and Outcome of the Campaign

Dove’s “Real Beauty” campaign was not only a triumph in challenging traditional beauty standards but also an exceptional success in terms of its financial impact and long-lasting resonance. The results can be analyzed based on the information provided:

Free Media Exposure:

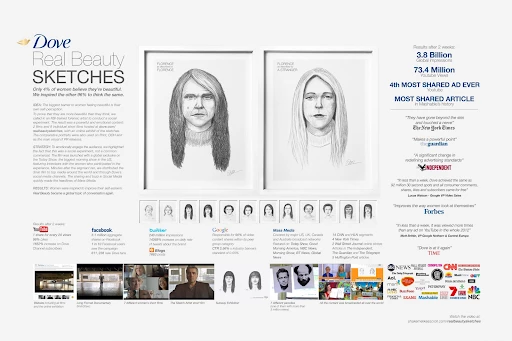

The campaign generated remarkable buzz, resulting in free media exposure worth 30 times Dove’s initial spend . This indicates the campaign’s extraordinary reach and effectiveness in capturing public attention.

Website Engagement:

The campaign’s website drew a substantial 1.5 million visitors . This high level of engagement suggests that people were actively seeking more information about the campaign, indicating a strong public interest and involvement.

Viral Videos:

Dove strategically released a series of viral videos that resonated with viewers. These videos aimed to showcase the self-critical nature of women regarding their appearance while highlighting their true beauty. The viral nature of these videos amplified the campaign’s impact and facilitated widespread conversation.

Inclusive Advertising:

Dove’s decision to feature women of all shapes and sizes in their underwear, with the tagline “ Tested on real curves ,” was a pivotal move . It challenged the conventional use of runway models in beauty advertisements and celebrated the diversity of everyday women. This approach resonated positively with the target audience, fostering a sense of representation and inclusivity.

Financial Impact:

The most tangible result of the campaign’s success was reflected in Dove’s finances. The company experienced a remarkable 10% increase in revenues within a single year. This substantial growth indicates not only a positive response from consumers but also the campaign’s effectiveness in driving sales.

Long-Term Sustainability:

The campaign’s enduring success is noteworthy, considering it is still running nearly 20 years later. This longevity underscores its sustained impact on Dove’s brand image and continued relevance in addressing societal perceptions of beauty.

Inspiring a Movement

The revolutionary impact of Dove’s campaign transcends the beauty industry. It has inspired other brands across various sectors, from lingerie with Aerie’s #AerieREAL campaign to cosmetics with CoverGirl’s #IAmWhatIMakeUp initiative. Even sports apparel, as seen in Nike’s ‘Better For It’ campaign, has embraced inclusivity, inspired by Dove’s groundbreaking initiative.

Conclusion: A Lasting Legacy

Dove’s Real Beauty campaign has left a lasting legacy in the marketing world, not only for its strategic approach but also for the profound impact it had on societal perceptions of beauty. The campaign’s success can be attributed to several key factors that set it apart from traditional marketing strategies.

Emotional Connection:

Dove’s ability to tap into people’s emotions played a pivotal role in the campaign’s success. By addressing a sensitive and prevalent issue – women’s self-image – Dove created a deep emotional connection with its audience. The campaign resonated with the insecurities many women face, fostering a sense of empathy and understanding.

Empowerment Over Exploitation:

Unlike some marketing campaigns that leverage fear, shame, or the desire to conform to societal standards, Dove chose a path of empowerment. The brand celebrated women for who they were at that moment, rejecting unrealistic beauty standards perpetuated by the media. This approach not only differentiated Dove from its competitors but also contributed to building a positive brand image.

Everyday Product Focus:

The decision to center the campaign around everyday products, such as soap and body wash, showcased Dove’s commitment to promoting realistic beauty standards in everyday life. This strategic choice allowed consumers to actively participate in promoting a new paradigm while purchasing products they regularly use. This broad appeal significantly contributed to the widespread success of the campaign.

Affordability and Accessibility:

Dove’s commitment to offering affordable and accessible products further amplified the impact of the Real Beauty campaign. By keeping prices reasonable and ensuring widespread availability in stores like Target, Walmart, and convenience stores, Dove made it easy for a diverse range of consumers to support the cause. This inclusivity ensured that the success of the campaign wasn’t limited to a specific demographic with higher purchasing power.

In conclusion, Dove’s Real Beauty campaign stands as a testament to the power of authenticity, empathy, and social responsibility in marketing. By addressing a societal issue with sensitivity and promoting positive change, Dove not only garnered customer loyalty but also contributed to a broader conversation about inclusivity and self-acceptance. The campaign’s impact transcended the realm of marketing, leaving a lasting legacy and setting a benchmark for brands aspiring to make a meaningful difference in society through their advertising efforts.

Also Read: Dissected: Snickers “You’re Not You When You’re Hungry” Campaign

To read more content like this, subscribe to our newsletter

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

A Case Study on Levi’s “501 Blues” Brand Campaign

A Case Study on Cadbury’s Gorilla Brand Campaign

A Case Study on Airbnb’s Belong Anywhere Campaign

Terms and Conditions

Fenty Beauty Marketing Strategy 2024: A Case Study

Fenty Beauty, created by Rihanna in 2017, revolutionized the beauty industry with its groundbreaking marketing strategy. Focusing on inclusivity and authenticity, Fenty Beauty challenged traditional beauty standards and became a trailblazer in the industry. In this case study, we will delve into Fenty Beauty’s marketing strategy, uncovering its key tactics and analyzing the impact it has had on the beauty industry.

Key Takeaways:

- Fenty Beauty launched with 40 shades of foundation, offering the widest range of tones at the time.

- The brand’s revenue growth has been impressive, with $300 million in 2020, $400 million in 2021, and $500 million in 2022.

- Fenty Beauty expanded its market presence, entering the Middle Eastern, European, and Asian markets.

- The brand has a strong online following, with 2.6 million TikTok followers and 908,000 YouTube subscribers.

- Fenty Beauty’s award-winning AI app for foundation color matching enhances the customer experience.

Fenty Beauty made waves in the beauty industry with its inclusive approach, offering a wide range of foundation shades to cater to diverse skin tones. This commitment to representation and diversity resonated with consumers, leading to rapid success. In fact, the brand achieved an astonishing $100 million in sales within its first month of launch, solidifying its position as a game-changer.

Within just two months of its debut, Fenty Beauty was featured in Time Magazine’s list of greatest inventions, alongside iconic names like Tesla and the iPhone X. The term “Fenty effect” was coined to describe the profound impact of the brand’s foundation shades, providing options for individuals with various skin tones.

One of the key factors contributing to Fenty Beauty’s success is its customer-centric marketing strategy . The brand prioritizes personalized interactions with consumers and adopts a colloquial tone on social media, fostering a sense of authenticity and relatability. Additionally, Fenty Beauty’s campaigns showcase models of diverse backgrounds, including different skin tones, ethnicities, body types, disabilities, hijabs, and LGBTQ+ identities, setting new standards for inclusivity and representation.

The brand’s emphasis on diversity has not only set a benchmark in the beauty industry but has also influenced other brands to prioritize inclusivity, particularly among Generation Z consumers. Fenty Beauty’s marketing strategy goes beyond traditional advertising, leveraging the power of word-of-mouth marketing and the celebrity backing of Rihanna herself.

With its global product reach spanning 137 countries, Fenty Beauty has successfully captured the attention of beauty enthusiasts worldwide. Social media has played a significant role in the brand’s marketing efforts , with 2.6 million TikTok followers and 908,000 YouTube subscribers. The brand’s engagement rate is ranked 6th worldwide, showcasing the strong connection it has established with its audience.

Fenty Beauty’s marketing strategy highlights the power of authenticity, inclusivity, and customer-centric approaches in the beauty industry. By disrupting traditional norms and setting new standards, Rihanna’s cosmetics brand has created a lasting impact that extends far beyond its innovative products.

The Shifting Landscape of the 2010s

In the 2010s, the beauty industry witnessed a significant transformation fueled by changing societal norms and values. As the rising Gen Z generation began shaping marketing expectations and values, beauty brands were compelled to adapt their advertising tactics to stay relevant.

Gen Z, known as the most diverse generation in history, has driven the shift towards inclusivity and authenticity in marketing. Inclusive Marketing 2.0 goes beyond basic diversity and emphasizes authentic representation, diverse voices, purpose-driven initiatives, and inclusive language.

Recognizing the importance of catering to Gen Z’s values and expectations, brands like Nike, Dove, Ben & Jerry’s, and Fenty Beauty have successfully embraced inclusive marketing practices through strategic initiatives led by Gen Z strategy agencies. It has become essential for brands not only to offer a wide range of products but also to take a stand on social and environmental issues to create a positive impact.

Fenty Beauty, founded by renowned artist Rihanna, revolutionized the beauty industry by introducing a diverse range of foundation shades to cater to all skin tones. The brand’s commitment to inclusivity garnered widespread acclaim and commercial success, earning $27 million in media value within just one month of its launch.

Rihanna’s Fenty Beauty has emerged as a frontrunner in the cosmetics industry, projected to surpass competitors like Kylie Cosmetics and KKW with its annual revenue. The brand’s largest consumer groups include African-American, Hispanic, and Asian shoppers, highlighting its appeal to diverse audiences.

Notably, Fenty Beauty consumers are highly loyal and invest an average of $471 annually on makeup, surpassing spending by consumers of other well-known brands like Kat Von D, KKW, and Kylie Cosmetics.

Rihanna’s influence as an A-level artist extends beyond cosmetics. She commands substantial advances for clothing and footwear lines and receives a percentage cut of gross sales. Her overall N-Score for marketability outperforms the music industry average, and her fans are more likely to make purchases related to her brand compared to other celebrities.

The rise of artists as influential figures has been observed in the industry, with retail now being referred to as “the new media.” Major labels are expanding their brand partnership teams and placing a greater emphasis on fashion collaborations to secure strategic deals with artists.

In conclusion, the beauty industry underwent a significant shift in the 2010s, driven by the rise of Gen Z and their values of inclusivity and authenticity. Fenty Beauty’s marketing strategy exemplified these trends, disrupting the market with its diverse product range and strong brand messaging. As the industry continues to evolve, staying attuned to marketing trends will be crucial for brands looking to connect with this influential generation.

Fenty Beauty’s Marketing Strategy Revealed

Fenty Beauty revolutionized the beauty industry with its groundbreaking marketing strategy, centered around inclusivity, authenticity, and social media engagement. By leveraging digital marketing and social media campaigns, Fenty Beauty set new industry standards and captured the attention and loyalty of millions of consumers worldwide.

From its inception, Fenty Beauty prioritized inclusivity, launching with an unprecedented 40 foundation shades, catering to diverse skin tones and undertones. This move challenged the status quo and established Fenty Beauty as a brand committed to diversity and representation. With the expansion of its foundation range to 50 shades, Fenty Beauty addressed a significant gap in the market, ensuring that every individual could find their perfect match.

Fenty Beauty recognized the power of social media in connecting with its target audience . The brand’s strong social media presence, with over 10 million followers, allowed for enhanced consumer engagement and popularity. Fenty Beauty’s Instagram, Twitter, and YouTube platforms became hubs of creativity, showcasing diverse models, behind-the-scenes content, beauty tutorials, and product insights.

Through its marketing campaigns, Fenty Beauty emphasized authenticity and real-life representation. The brand’s commitment to showcasing a diverse range of models, predominantly Black, Asian, and minority ethnic (BAME) individuals, resonated with consumers from ethnic minorities who had previously felt underrepresented in the beauty industry.

Fenty Beauty positioned itself as an accessible luxury brand, offering high-quality products at a competitive price point. Priced at $35, the brand’s foundation provided a more affordable option compared to competitors like Estée Lauder, whose foundation costs $42. This pricing strategy allowed Fenty Beauty to appeal to a wide audience, further expanding its customer base.

Fenty Beauty’s marketing approach focused on “showing, not telling.” By prioritizing authentic storytelling rooted in culture and emotionally resonant with consumers, the brand created a genuine connection. This approach earned the loyalty of consumers who felt seen and represented by Fenty Beauty’s campaigns.

| Fenty Highlights | Statistics |

|---|---|

| Biggest beauty brand launch in YouTube history | First-year revenue of $100 million |

| Simultaneous launch in 17 countries, prepared to ship to 137 countries | Over 500 global leaders involved in operational execution |

| Market reactions: photos of lines outside stores, selfies on social media, and website crashing | Generated buzz and exceeded sales expectations |

| Raised brand awareness through | Successful partnerships with vloggers and influencers on YouTube |

The success of Fenty Beauty’s marketing strategy can be attributed to its commitment to diversity, authentic storytelling, and social media engagement. By challenging industry norms and capturing the hearts of consumers, Fenty Beauty set a new standard for inclusivity in the beauty industry and paved the way for positive change.

Innovative Product Launch and Authenticity

Fenty Beauty made waves in the beauty industry with its groundbreaking product launches that challenged industry norms. One of the brand’s standout features was its foundation line, which offered an impressive range of 40 shades. This broad spectrum of shades catered to all skin tones and undertones, setting a new benchmark for inclusivity in the industry. By going above and beyond the industry standard of around 33 shades, Fenty Beauty positioned itself as a brand that valued diversity and aimed to be inclusive for everyone.

But it wasn’t just the extensive shade range that made Fenty Beauty’s product launches unique. The brand’s commitment to authenticity played a pivotal role in shaping its marketing strategy. Fenty Beauty’s advertising campaigns featured models from diverse backgrounds, showcasing real-life representation and resonating with consumers who yearned to see themselves reflected in beauty advertisements. This authenticity not only set Fenty Beauty apart from its competitors but also inspired a cultural shift within the beauty industry.

To further enhance its authenticity and connect with its target audience, Fenty Beauty leveraged social media platforms. Rihanna, the founder of Fenty Beauty, boasts an impressive following of 57 million on Instagram alone. Her personal brand and influence played a significant role in raising awareness for Fenty Beauty. By aligning her powerful social media presence with the brand’s target audience, Fenty Beauty was able to tap into a vast pool of potential customers and create a buzz around its product launches.

In addition to Rihanna’s Instagram, Fenty Beauty utilized platforms like YouTube to provide product development insights, beauty tutorials, and collaborations with influencers. With nearly 800,000 subscribers on its YouTube channel, Fenty Beauty was able to connect authentically with its audience, sharing valuable content and building a loyal community.

The success of Fenty Beauty’s product launches and its commitment to authenticity influenced the beauty industry as a whole. Competitors were compelled to expand their shade ranges and embrace diversity in marketing, a phenomenon now known as the “Fenty Effect.” This industry-wide change signifies the powerful impact that Fenty Beauty has had and continues to have on the beauty industry.

The Fenty Effect and Industry-Wide Change

The launch of Fenty Beauty in 2017 caused waves throughout the cosmetics industry, revolutionizing brand positioning and setting new marketing trends. Fenty Beauty’s groundbreaking approach to inclusivity and diversity not only propelled the brand to remarkable success but also triggered a significant shift in the entire beauty landscape.

With a staggering $72 million in sales generated within just one month of its launch, Fenty Beauty quickly cemented its position as a game-changer in the industry. The brand’s annual revenue skyrocketed to an impressive $582 million, outperforming competitors and taking the market by storm.

Emphasizing the importance of representation, Fenty Beauty’s 40-shade foundation was met with high consumer demand. Despite consistent restocks, darker shades consistently sold out, showcasing the brand’s ability to effectively cater to a wide variety of skin tones. Fenty Beauty’s commitment to inclusivity did not go unnoticed, leading to other beauty brands expanding their shade ranges in response to what became known as the “Fenty Effect”.

Time magazine recognized Fenty Beauty as one of the “Inventions of the Year” for its broad shade range and use of diverse models in marketing campaigns. This accolade solidified the brand’s influence and status in the industry, further fueling the demand for inclusive beauty products.

The impact of the “Fenty Effect” prompted other beauty brands to reevaluate their marketing strategies and product offerings. The industry standard for foundation shades shifted from a limited range to a minimum of 40 shades, as brands realized the importance of catering to diverse consumer needs.

In response to Fenty Beauty’s success, beauty brands began extending their shade ranges, with some launching 50, 60, or even 100 foundation shades. Achieving a wide range of foundation shades became a priority, with a focus on maintaining the quality of the formulation to ensure customer satisfaction.

The influence of Fenty Beauty goes beyond the cosmetics industry. Rihanna, the mastermind behind the brand, leveraged its success to expand her fashion empire. Under various Fenty brand names, she launched skincare, lingerie, and luxury fashion lines, capitalizing on the brand’s global recognition and popularity.

As a result of Fenty Beauty’s groundbreaking approach and industry-wide impact, the beauty industry underwent significant changes in representation and product diversity. The brand’s commitment to inclusivity not only transformed the marketing strategies of other cosmetic companies but also empowered consumers by providing them with a broader range of options that catered to their individual needs.

With the Fenty Effect paving the way, the beauty industry continues to evolve, with brands now striving to create more inclusive and representative products for consumers around the world.

| Statistics | Details |

|---|---|

| Fenty Beauty’s Initial Revenue | US$72 million in the first month (five times more than its closest peer competitor) |

| Fenty Beauty’s First-Year Revenue | US$570 million |

| Fenty Beauty’s Global Presence | Available in over 30 countries worldwide |

| Fenty Beauty’s Partnership with Sephora | Instrumental in its success, leveraging Sephora’s extensive distribution network |

Leveraging Social Media and Entertainment

Fenty Beauty’s social media campaigns and influencer partnerships have been instrumental in establishing its strong presence and loyal community. With over 10 million followers on Instagram and 641,000 followers on Twitter, the brand has successfully leveraged social media to engage with its audience and build a passionate following.

One of the key strategies employed by Fenty Beauty is the use of branded hashtags like #Fentyface and #Fentybeauty, which have generated 145,000 and 4.5 million posts respectively. These hashtags encourage users to share their Fenty Beauty experiences and create user-generated content, fostering a sense of community and inclusivity.

Fenty Beauty’s social media content showcases a wide diversity of products, featuring multiple skin tones and body types. This inclusive approach, reflected in the brand’s initial launch of 40 foundation shades (later expanded to 50), embraces the beauty of individuality and resonates with users seeking representation in the beauty industry.

The brand also utilizes the hashtag #fentybeautyuniversity to provide tutorials and beauty tips, catering specifically to college students. This targeted approach allows Fenty Beauty to connect with its target audience on a deeper level and establish itself as a go-to beauty resource among young consumers.

Collaboration is another key element of Fenty Beauty’s marketing strategy. By partnering with sister brands like Savage Fenty and Fenty Skin, the brand extends its visibility and engagement, tapping into diverse consumer segments and cross-promoting its products.

In addition to its strategic use of social media, Fenty Beauty’s witty, fun, and trendy personality resonates with its audience, creating a friendly and relatable brand image. This aligns with the preference of 83% of people for friendly brand interactions and helps foster a strong emotional connection with consumers. The brand effectively uses pop culture references and internet slang in its social media communication, further enhancing its relatability and establishing itself as a trendsetter in the beauty industry.

| Fenty Beauty | Colour Pop |

|---|---|

| 689,000 likes on Facebook | 1.9 million likes on Facebook |

| 9.5 million followers on Instagram | Around 9.3 million followers on Instagram |

| 599,000 followers on Twitter | 1.2 million followers on Twitter |

Fenty Beauty’s social media prowess and community-building approach have given it a competitive advantage in the beauty industry. The brand’s commitment to inclusivity and its ability to connect with its audience on a personal level have positioned it as an irreplaceable part of the lives of its users. By constantly innovating and engaging its community, Fenty Beauty continues to dominate social media and drive industry-wide change.

Affordable Luxury and Future Prospects

Fenty Beauty’s brand positioning as an accessible luxury beauty brand has been a key factor in its success. By offering high-quality products at an affordable price point, Fenty has tapped into a consumer desire for both luxury and inclusivity. This unique brand positioning has allowed Fenty Beauty to stand out in the highly competitive cosmetics industry.

As the cosmetics industry continues to evolve, marketing trends indicate a growing demand for inclusive and diverse beauty products. Fenty Beauty’s commitment to inclusivity, evident in its expansive foundation shade range and representation of individuals with albinism, has resonated strongly with consumers. The brand’s dedication to diversity has not only set it apart from its competitors but has also earned it a loyal and devoted customer base.

In addition to its inclusive product range, Fenty Beauty has successfully leveraged social media influencers to enhance its brand visibility. Collaborating with influential figures who align with the brand’s values and aesthetics, Fenty has been able to reach a wider audience and generate higher engagement. With an impressive following of over 10 million users on Instagram, Fenty Beauty has effectively built a community of engaged and loyal fans.

Fenty Beauty’s ability to capitalize on marketing trends and adapt to changing consumer preferences has positioned the brand for future success. By expanding into skincare and fragrance lines, Fenty Beauty has demonstrated its commitment to providing a comprehensive beauty experience. Additionally, the brand’s partnership with luxury conglomerate LVMH has further propelled its growth and global presence.

Furthermore, Fenty Beauty’s commitment to sustainability and eco-friendly practices has further strengthened its brand positioning. The brand’s phased approach to phasing out eco-unfriendly packaging showcases its dedication to environmental responsibility, appealing to consumers who prioritize sustainability.

Looking ahead, Fenty Beauty’s affordable luxury brand positioning and commitment to inclusivity positions it as a frontrunner in the cosmetics industry. By staying attuned to marketing trends and consistently delivering innovative, high-quality products, Fenty Beauty is well-equipped to navigate the ever-changing beauty landscape and maintain its success.

Filling a Gap

Fenty Beauty’s brand positioning in the cosmetics industry was solidified by its commitment to inclusivity and addressing a significant gap in the market. Upon its launch in 2017, Fenty Beauty released the ProFiltr foundation with an impressive range of 40 shades, the most extensive offering at the time. This bold move immediately garnered attention and set the brand apart from competitors.

Recognizing the lack of diversity in the beauty industry, Fenty Beauty aimed to provide options for people of all skin tones and undertones. By offering a wide range of foundation shades, the brand ensured that customers with different skin tones could find a perfect match for their complexion. This inclusive approach resonated with consumers who felt overlooked by other brands and propelled Fenty Beauty to the forefront of the industry.

With a strong focus on diversity and inclusiveness, Fenty Beauty revolutionized the cosmetics industry and influenced marketing trends. The brand’s commitment to representing and catering to various body types and skin tones set a new standard for inclusivity in product representation and marketing campaigns. Other brands, such as Revlon and Dior, recognized the success of Fenty Beauty and have since made efforts to catch up in terms of diversity and inclusiveness.

The market response to Fenty Beauty’s inclusive approach was overwhelmingly positive. The brand’s foundation shades, along with other products, received praise from fans, bloggers, and celebrities alike. Rihanna leveraged her brand recognition and involvement of influencers and fans to prove the high quality of Fenty Beauty products.

By filling this gap in the industry and positioning itself as a brand that caters to all individuals, Fenty Beauty not only achieved financial success but also became a true game-changer in the cosmetics industry.

| Inclusivity Initiative | Impact |

|---|---|

| Release of 40 foundation shades | Fenty Beauty’s ProFiltr foundation had the most shade variety at the time of launch. |

| Positive reviews and customer feedback | Customers praised Fenty Beauty’s commitment to diversity and inclusivity on social media. |

| Influencer and fan involvement | Rihanna’s brand recognition and partnership with influencers lent credibility to the brand’s positioning. |

| Inspiring industry-wide change | Other brands have since made efforts to replicate Fenty Beauty’s inclusive approach. |

Using Influencers

Fenty Beauty’s marketing strategy extends beyond its groundbreaking product offerings. The brand has successfully tapped into the power of influencer partnerships to amplify its reach and connect with a wider audience. By collaborating with influencers who align with its brand values, Fenty Beauty has been able to position itself as a leader in the beauty industry.

One notable example of Fenty Beauty’s influencer campaigns is the Eaze Drop’lit All-Over Glow Enhancer campaign in 2023. This campaign featured both influencers and everyday users applying the product on Instagram, showcasing its versatility and generating excitement among consumers. By leveraging the influence of these individuals, Fenty Beauty was able to create buzz and generate positive word-of-mouth.

The brand also embraced the world of gaming and collaborated with Roblox for the Fenty Beauty + Skin Experience in mid-2023. This interactive virtual experience aimed to engage a younger audience and promote key products like the Fenty Skin Melt Awf Jelly Oil Makeup-Melting Cleanser. By partnering with Roblox and utilizing influencers within the gaming community, Fenty Beauty was able to reach a new demographic and expand its customer base.

In addition to these larger campaigns, Fenty Beauty has also successfully collaborated with individual influencers to showcase its products and drive engagement. For instance, the brand partnered with TikTok influencer Meredith Duxbury, whose video featuring Fenty Beauty garnered an impressive 3.4 million views. These collaborations not only showcase the effectiveness of influencer marketing but also align with Fenty Beauty’s emphasis on diversity and inclusivity.

Fenty Beauty’s use of influencers extends beyond social media platforms as well. Collaborations with celebrities like actor Daniel Kaluuya further highlight the brand’s commitment to inclusivity. Kaluuya promoting Fenty Beauty’s Pro Filt’R Foundation in shades #480 and #490 not only showcased the range of shades available but also reinforced the brand’s mission of “Beauty for Everyone.”

With a robust presence on social media platforms, Fenty Beauty has harnessed the power of influencer partnerships to enhance its marketing strategy. The brand has over 12.7 million followers on Instagram, 2.6 million on TikTok, and 906K on YouTube, among other significant social media followings. These partnerships have contributed to Fenty Beauty’s success and have played a crucial role in its growth as a leading celebrity cosmetics brand.

By collaborating with influencers and utilizing their platforms, Fenty Beauty has been able to directly engage with its target audience and build credibility. These partnerships not only showcase the brand’s products but also align with its focus on diversity, inclusivity, and engagement with diverse audiences. Through influencer marketing, Fenty Beauty continues to stay at the forefront of the beauty industry and build a loyal customer base.

Fenty Beauty’s Key Marketing Strategy Tactics

Fenty Beauty, with its innovative marketing strategies and diverse range of products, has positioned itself as a leading brand in the cosmetics industry. By effectively utilizing digital marketing, social media campaigns, and influencer partnerships, Fenty Beauty has successfully captured the attention and loyalty of consumers worldwide.

Inclusivity and Celebrity Endorsement

A key aspect of Fenty Beauty’s marketing strategy is its commitment to inclusivity. The brand’s foundation range, comprising an impressive 50 shades, caters to a diverse range of skin tones and undertones. This emphasis on diversity has resonated with consumers, fostering a sense of representation and inclusion.

Rihanna, a global icon and the founder of Fenty Beauty, serves as the ultimate celebrity endorsement for the brand. Her involvement not only lends credibility but also reinforces the brand’s mission of “Beauty for Everyone.” Rihanna’s personal touch and genuine passion for the brand have played a significant role in establishing Fenty Beauty as a celebrity cosmetics powerhouse.

Social Media Engagement and Visual Storytelling

Fenty Beauty’s digital marketing efforts have focused on leveraging the power of social media platforms. The brand has built a strong presence on Instagram, Twitter, YouTube, and TikTok, engaging with followers through interactive content and captivating visuals.

The brand’s social media campaigns have showcased influencers and everyday users, highlighting the versatility and impact of Fenty Beauty products. The “Eaze Drop’lit All-Over Glow Enhancer” campaign in 2023, for example, featured influencers and individuals from diverse backgrounds, promoting an inclusive and relatable image of the brand.

Fenty Beauty has also mastered the art of visual storytelling, using impactful imagery and captivating videos to convey the brand’s values and product benefits. Collaborations with prominent publications like Harper’s Bazaar for skincare routine videos and engagement with BootsUK for the #FentyFace campaign have further amplified the brand’s message.

Influencer Partnerships and Global Reach

Recognizing the power of influencer marketing, Fenty Beauty has strategically partnered with a diverse range of influencers to extend its reach and connect with target audiences. Collaborations with influencers like Meredith Duxbury on TikTok and the brand’s ambassador program featuring stars like Madison Beer, Kane Lim, and Nikita Kering have significantly contributed to Fenty Beauty’s global resonance.

By partnering with major retailers like Sephora, Ulta, Kohl’s, and Boots in the UK, Fenty Beauty has ensured broad accessibility to its products. These partnerships have facilitated the brand’s expansion into new markets and increased its visibility among potential consumers.

| Partnerships and Collaborations | Results |

|---|---|

| Collaboration with Harper’s Bazaar for skincare routine video | 1.71 million views |

| Collaboration with influencer Meredith Duxbury on TikTok | 3.4 million views |

| Influencer ambassador program with stars like Madison Beer, Kane Lim, Madison Bailey, and Nikita Kering | Increased global reach and resonance |

| Partnerships with major retailers like Sephora, Ulta, Kohl’s, and Boots | Expanded market accessibility |

Through these key marketing strategy tactics, Fenty Beauty has cemented its position as a trailblazer in the cosmetics industry. By embracing inclusivity, leveraging social media platforms, and forging strategic partnerships, the brand has successfully built a loyal fan base and achieved remarkable financial success.

The Benefits of Fenty Beauty’s Social Media Strategy

Fenty Beauty’s social media campaigns and digital marketing have played a pivotal role in the brand’s success. By harnessing the power of social media platforms, Fenty Beauty has been able to connect with a wide audience, build a strong brand presence, and drive sales. Through strategic and innovative social media tactics, the brand has redefined beauty standards, fostered inclusivity, and cultivated a loyal community of beauty enthusiasts.

One of the key benefits of Fenty Beauty’s social media strategy is its ability to reach and engage with its target audience. By utilizing platforms such as Instagram, Twitter, and YouTube, Fenty Beauty has been able to showcase its diverse range of products and celebrate inclusivity. Through visually appealing and relatable content, the brand has effectively captured the attention of beauty enthusiasts of all skin tones and backgrounds.

Fenty Beauty’s social media campaigns have also created a sense of community among its followers. By encouraging user-generated content, such as makeup tutorials, product reviews, and before-and-after photos, the brand has empowered its customers to become brand ambassadors. This has not only strengthened the bond between Fenty Beauty and its customers but has also provided authentic testimonials and real user experiences that build trust and credibility.

Furthermore, Fenty Beauty’s digital marketing strategy has helped the brand increase its brand awareness and drive customer engagement. By leveraging social media influencers, collaborating with celebrities, and partnering with industry experts, Fenty Beauty has been able to expand its reach and tap into new markets. These partnerships have not only generated buzz and excitement but also provided valuable insights into the preferences and desires of the target audience.

The success of Fenty Beauty’s social media campaigns is evident in the brand’s impressive sales figures. In its first year of operation, Fenty Beauty generated 500 million euros in sales, and within its first 40 days on the market, it made $100 million in sales. These numbers are a testament to the brand’s ability to leverage social media to drive business growth and establish itself as a force to be reckoned with in the beauty industry.

| Benefits of Fenty Beauty’s Social Media Strategy |

|---|

| Reach and engage with target audience |

| Build a sense of community and foster brand loyalty |

| Drive brand awareness and customer engagement |

| Generate authentic testimonials and user-generated content |

| Expand reach and tap into new markets through partnerships |

Fenty Beauty’s marketing strategy has disrupted the cosmetics industry and set a new standard for inclusivity and authenticity. By launching with a groundbreaking range of 40 foundation shades, the brand challenged traditional beauty standards and inspired others to follow suit. Leveraging Rihanna’s online presence, Fenty Beauty engaged directly with consumers, fostering stronger brand-customer relationships.

With a global reach of 137 countries, Fenty Beauty showcases its commitment to inclusivity on a global scale. The brand’s emphasis on authenticity and real-life representation in its advertising campaigns has enhanced relatability and attracted a diverse audience. By challenging conventional norms, Fenty Beauty not only drove sales but also revolutionized the beauty industry.

Through collaborations with individuals of various skin types and tones, Fenty Beauty has fostered a stronger sense of community and customer loyalty. The brand’s commitment to diversity representation in corporate culture and products has advocated for inclusivity across different demographics. With a direct-to-consumer approach and strategic use of social media platforms, Fenty Beauty has gained greater control of the customer experience and higher profit margins.

As Fenty Beauty continues to prioritize innovation and partnerships with influential figures, its marketing strategy will remain at the forefront of the cosmetics industry. By embracing inclusivity as a core value and advocating for social change, Fenty Beauty has not only contributed to empowering individuals but has also created a cultural resonance that sets it apart from other brands. With a genuine commitment to making a difference, Fenty Beauty has proven that inclusivity and authenticity are not just marketing trends but powerful tools for success.

What makes Fenty Beauty’s marketing strategy unique?

How did fenty beauty disrupt the beauty industry, how did fenty beauty leverage social media in its marketing strategy, what impact did fenty beauty have on the beauty industry as a whole, how did fenty beauty position itself as an accessible luxury brand, what gap did fenty beauty fill in the beauty industry, how did fenty beauty utilize influencer partnerships, what were the key marketing strategy tactics used by fenty beauty, how did fenty beauty’s social media strategy benefit the brand, what is the future outlook for fenty beauty, related posts:.

- The Role of Marketing Mix in Business Success

- Ben and Jerry’s Marketing Strategy 2024: A Case Study

- Strategies for Successful Cross Channel Marketing

- Effective Product Positioning in Marketing

Nina Sheridan is a seasoned author at Latterly.org, a blog renowned for its insightful exploration of the increasingly interconnected worlds of business, technology, and lifestyle. With a keen eye for the dynamic interplay between these sectors, Nina brings a wealth of knowledge and experience to her writing. Her expertise lies in dissecting complex topics and presenting them in an accessible, engaging manner that resonates with a diverse audience.

Nike Marketing Strategy 2024: A Case Study

Mamee marketing strategy 2024: a case study.

Breaking Barriers: Fenty Beauty's Marketing Strategy Case Study

Fenty Beauty, the brainchild of global superstar Rihanna, stormed the beauty industry in 2017, revolutionizing the way cosmetics are marketed and sold. With its approach to inclusivity and nonconformity, Fenty Beauty disrupted the status quo, challenging traditional beauty standards and setting a new benchmark for other brands to follow. Fenty Beauty's launch in 2017 marked a watershed moment for the beauty world, as it showcased a groundbreaking foundation line with an unprecedented 40 shades catering to a diverse range of skin tones.

Rihanna's involvement and passion for inclusivity propelled Fenty Beauty to become more than just a cosmetics brand ; it became a symbol of empowerment for individuals of all backgrounds. By daring to go against the grain, Fenty Beauty proved that a luxury brand can simultaneously embrace both edginess and sophistication, challenging the conventional notion of exclusivity. As we delve into the depths of Fenty Beauty's marketing brilliance, we will uncover the strategies that catapulted it to stardom and explore the ripple effect it created, inspiring other beauty brands to embrace diversity and embrace change, but first, let’s get to know its history.

The Shifting Landscape of the 2010s

Before delving into Fenty Beauty's strategy, let's set the stage with a glimpse into the macroeconomic and cultural trends of the 2010s. The past decade in America witnessed significant social change, marked by movements for inclusivity and individual freedoms. As more Americans deviated from traditional norms, social conversations around race, gender, and sexual identity took center stage, paving the way for brands to embrace diversity and authenticity. In this evolving landscape, Fenty Beauty's emphasis on inclusivity and nonconformity resonated deeply, aligning perfectly with the societal shift towards acceptance and diversity.

Fenty Beauty's Marketing Strategy Revealed

Fenty Beauty's Chief Marketing Officer attributed the brand's success to three key strategies: exclude no one, let values inform the process, and show, don't tell. From the very beginning, Rihanna's vision for Fenty Beauty was crystal clear - to cater to everyone, irrespective of skin tone or ethnicity. In a market dominated by a limited range of shades, Fenty Beauty launched 40 foundation shades, emphasizing inclusivity in a way no other brand had done before.

To achieve its vision of inclusivity, Fenty Beauty made a bold move by releasing 40 foundation shades right from its debut, shattering the industry's norms. Rihanna's dedication to catering to all skin tones and undertones was evident, and the well-crafted nuance of each shade became a testament to the brand's commitment to representation. In addition to its diverse shade range, Fenty Beauty also chose to let its values inform the entire process of brand creation . The brand was sincere in its acceptance of all people and embraced diversity both in its product offerings and its marketing campaigns . Rihanna's track record of advocating for social issues further reinforced the brand's authenticity and message. Rather than relying on conventional marketing tactics , Fenty Beauty opted to show, not tell. The brand used Rihanna's strong online presence and social media platforms to convey its luxurious image, emphasizing the importance of authenticity and real interactions with consumers. Through YouTube tutorials, social media campaigns, and behind-the-scenes glimpses, Fenty Beauty engaged its audience and created a sense of community.

By combining these three strategies, Fenty Beauty successfully redefined the beauty industry's standards and set a new benchmark for inclusivity and nonconformity. The brand's impact extended far beyond cosmetics, sparking a global movement known as the "Fenty Effect," which challenged other beauty brands to follow suit and embrace diversity in their offerings. Fenty Beauty's approach to marketing will undoubtedly be remembered as a groundbreaking moment in the history of the beauty industry.

Innovative Product Launch and Authenticity

Choosing to launch with a foundation, a rather safe product such as a lip kit, in the cosmetics industry, Fenty Beauty's bold move paid off immensely. The brand's foundation range catered not only to different skin tones but also to various undertones, catering to the diverse needs of consumers. Fenty Beauty's marketing campaign highlighted authenticity and real-life representation, using models of all races, sizes, and backgrounds. This sincerity struck a chord with consumers, earning the brand's admiration and loyalty.

Fenty Beauty's decision to launch with a foundation was a calculated risk that set it apart from traditional beauty brands. By focusing on creating a diverse range of foundation shades that matched various undertones, the brand demonstrated a genuine commitment to inclusivity and representation.

In contrast to the polished and airbrushed images commonly associated with beauty advertisements, Fenty Beauty opted for authenticity and real-life representation. The brand's choice to feature models of different races, sizes, and backgrounds in its marketing campaigns resonated with consumers, making them feel seen and valued.

This emphasis on authenticity and inclusivity not only earned Fenty Beauty a dedicated following but also inspired a cultural shift within the beauty industry. The brand's approach showed that beauty should be about embracing individuality and celebrating diversity, ultimately paving the way for other brands to follow suit.

The Fenty Effect and Industry-Wide Change

The impact of Fenty Beauty's launch was so significant that it sparked what is now known as the "Fenty Effect." Other beauty brands were compelled to follow suit, expanding their shade ranges and promoting inclusivity in their marketing . The brand's commitment to diversity set a new standard for the industry, challenging conventional norms and making beauty accessible to all. This industry-wide change signalled a shift towards greater inclusivity and representation, breaking away from the conventional beauty standards that had been upheld for decades. Fenty Beauty's commitment to diversity not only transformed its brand but also set a new benchmark for beauty companies worldwide, inspiring a more inclusive and accepting beauty landscape.

Leveraging Social Media and Entertainment

Fenty Beauty's social media strategy played a pivotal role in its success. Rihanna's strong online presence, combined with creative product launches and engaging tutorials, garnered immense consumer interaction and boosted the brand's popularity . The brand leveraged social media to stay connected with consumers and to showcase the diversity and versatility of its products. Fenty Beauty's 10M social media presence allowed the brand to connect with consumers on a personal level and showcase the versatility of its products. Rihanna's active engagement on social media, along with the brand's innovative product launches and tutorials, created a captivating online experience that resonated with consumers and fueled the brand's popularity. By leveraging social media as a platform for creativity, interaction, and trendiness, Fenty Beauty solidified its position as a market-driving brand in the beauty industry.

Affordable Luxury and Future Prospects

Fenty Beauty positioned itself as an accessible luxury brand, offering high-quality products at a price point that appealed to a broad audience. This unique blend of luxury and inclusivity ensured that consumers felt special and valued when using Fenty Beauty products. The brand's continued success in the future will depend on how it maintains its luxury image while expanding its distribution channels and product offerings.

Fenty Beauty's ability to strike the balance between luxury and accessibility allowed it to capture a wide consumer base and solidify its position as a game-changer in the beauty industry. By maintaining a reputation for high-quality products and genuine inclusivity, the brand established a loyal customer following that continues to support its growth. As Fenty Beauty looks ahead, its prospects will depend on its capacity to adapt to evolving consumer trends, expand its global reach, and innovate in ways that uphold its commitment to diversity and authenticity. With Rihanna's visionary leadership and the brand's already proven track record, the world eagerly anticipates what groundbreaking strides Fenty Beauty will make next in the beauty sphere.

Fenty Beauty's commitment to affordable luxury went beyond makeup, as the brand ventured into new product categories, including skincare and fragrance lines. Building on the success of its makeup range, Fenty Beauty launched a series of innovative skincare products designed to cater to a diverse range of skin types and concerns. From cleansers and moisturizers to serums and masks, the brand's skincare line emphasized the importance of self-care and empowerment through a personalized beauty routine.

Moreover, Fenty Beauty made an impactful entry into the fragrance market by introducing a fragrance that embraced the brand's values of individuality. The fragrance showcased a variety of scent undertones that were breaking away from the traditional scene. By doing so, Fenty Beauty once again challenged norms and demonstrated its dedication to promoting a more inclusive and authentic beauty experience.

The expansion into skincare and fragrance not only broadened the brand's product offerings but also allowed Fenty Beauty to reach an even wider audience. By maintaining the ethos of accessible luxury, the brand continued to provide high-quality products that consumers could incorporate into their everyday lives. Fenty Beauty's foray into skincare and fragrance exemplified its adaptability and foresight, setting the stage for further growth and prosperity in the ever-evolving beauty market.

Celebrity and Influencer Endorsement

Fenty Beauty leveraged the power of celebrity endorsements to create buzz and attract attention. Rihanna's involvement in the brand and her genuine passion for inclusivity resonated with consumers and added credibility to Fenty Beauty's mission. Fenty Beauty collaborated with beauty influencers and makeup artists to showcase its products and create buzz among their dedicated followers with Youtube review videos, and Tiktok tutorials featuring Fenty products. These influencers demonstrated the versatility and effectiveness of Fenty Beauty products through tutorials and reviews, further solidifying the brand's reputation.

The strategic use of celebrity endorsements and influencer collaborations allowed Fenty Beauty to tap into a vast audience of loyal fans and beauty enthusiasts. Rihanna's iconic status and authentic connection to the brand elevated Fenty Beauty's appeal, drawing in consumers who admired her artistic vision and commitment to diversity. By partnering with influential makeup artists and beauty gurus, Fenty Beauty expanded its reach to niche communities and gained credibility through word-of-mouth marketing .

The brand's choice to collaborate with influencers who shared its values of inclusivity and self-expression ensured that the message resonated with their audiences authentically. Fenty Beauty's products became a part of viral makeup challenges, trends, and online conversations, further solidifying the brand's position as a leader in the beauty industry. Through celebrity and influencer partnerships, Fenty Beauty was not only able to drive immediate sales but also cultivate a community of advocates who continue to champion the brand's values and products.

Global Expansion

Fenty Beauty strategically expanded its reach by shipping products to 137 countries worldwide. The global expansion of Fenty Beauty allowed the brand to break geographical barriers and tap into diverse markets with unique beauty needs. By shipping products to 137 countries, Fenty Beauty demonstrated its commitment to serving a global audience and catering to the beauty aspirations of people from various cultural backgrounds. This expansion not only bolstered the brand's revenue streams but also contributed to its cultural influence, solidifying its status as a trailblazer in the cosmetics industry on a worldwide scale. As Fenty Beauty continues to embrace diversity and accessibility, its global presence is poised to shape the beauty landscape for years to come.

Collaborations with Retailers

Fenty Beauty partnered with major retailers like Sephora and Ulta Beauty, leveraging their existing customer base and in-store presence to increase brand visibility and accessibility.

The strategic collaborations with retailers like Sephora and Ulta Beauty proved instrumental in Fenty Beauty's rapid ascent in the beauty market. By aligning with established and reputable beauty retailers, Fenty Beauty gained access to a vast network of brick-and-mortar stores, expanding its physical presence and making its products readily available to a broader audience. These partnerships not only boosted sales but also helped Fenty Beauty foster lasting relationships with consumers through personalized in-store experiences and expert beauty consultations.

Influential Awards and Recognition

The brand's products received critical acclaim and won several prestigious beauty awards, further boosting its reputation and credibility within the industry. Fenty Beauty's innovative products garnered widespread recognition and appreciation from beauty experts and influencers alike. The brand's Pro Filt'r Soft Matte Longwear Foundation, in particular, received accolades for its extensive shade range and flawless finish. These influential awards solidified Fenty Beauty's position as a frontrunner in the cosmetics industry and demonstrated its commitment to excellence and quality. The recognition also provided valuable marketing opportunities, allowing the brand to showcase its award-winning products and gain even more traction in the competitive beauty market.

Fenty Beauty's marketing strategy will go down in history as a masterclass in inclusivity and nonconformity. By daring to break the beauty industry's mould and setting new standards, the brand has made a lasting impact on the cosmetics industry. As consumers increasingly demand authentic representation and diversity, Fenty Beauty's groundbreaking approach will continue to shape the future of beauty marketing and inspire other brands to embrace inclusivity wholeheartedly.

Updated on November 2nd, 2023

Fenty Beauty's introduction of an AI-powered shade finder for foundation marks a significant and innovative update to their website , perfectly aligning with their brand ethos of inclusivity and diversity. They have revolutionized the way clients find their ideal base by utilizing state-of-the-art AI technologies. The brand's innovative use of AI, which also enhances the brand's customers ' experiences, highlights Fenty Beauty's commitment to the cutting edge of beauty technology. This app-only feature demonstrates their familiarity with the needs of today's mobile consumers and their ability to combine the digital and real worlds. Fenty Beauty has simplified the process by having clients simply scan a QR code with their mobile devices. This is a smart marketing initiative that not only demonstrates their commitment to serving customers of all skin tones but also sets them apart as an innovative company that values its customers highly. Through this initiative, Fenty Beauty continues to reaffirm its position as a leader in the beauty business, making cosmetics buying more personalized, efficient, and pleasant for consumers worldwide.

Please fill out the form below if you have any advertising and partnership inquiries.

Consultation & Audit

Privacy policy.

- Browse All Articles

- Newsletter Sign-Up

No results found in Working Knowledge

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

🏆 Ranking #1 in AI Tools – Submit Your Tool Today! 🚀

From Start-up to Sensation: Unraveling the Success Story of SUGAR Cosmetics

- Published Date : Thursday July 27, 2023

- Last Updated November 11, 2023

Suraj Shrivastava

Chief Link Building Strategist

The Indian personal care industry has a total market size of US$12 billion (as per 2023 reports) , with increased opportunities due to the emergence of e-commerce platforms and D2C models. Previously, the Indian beauty sphere consisted of a few global giants like Maybelline, Revlon, Lakme, and Mac, to name a few.

Now the scenario has turned gradually, with local brands coming to the forefront and dominating the market with innovation and tactics. Sugar Cosmetics is a great example of a homegrown brand that has scaled from almost nothing to a Rs 300 crore business.

Humble beginnings

The history of Sugar Cosmetics starts in 2012, with Vineeta Singh and Kaushik Mukherjee founding a new company from scratch. They were classmates at IIM Ahmedabad. Their main goal was to provide cosmetics to the masses at an affordable price with no compromise in quality.

So they quit their jobs, gathered some capital, and finally started selling cosmetics at a few local boutiques, from which they got a great response through word-of-mouth publicity.

Sugar Cosmetics went from a modest operation to a functioning company in less than a year. Now that their goods were being sold in shops across the nation, Vineeta Singh and Kaushik Mukherjee even had famous people as fans who loved their products and endorsed them to the masses.

Meet the fantastic founders!

Vineeta singh.

Vineeta Singh is an entrepreneur and the CEO and cofounder of Sugar Cosmetics. She was born in 1983 in Anand, near Ahmedabad, to a medical practitioner mother and a biophysicist father.

As a young girl, she wanted to be a doctor and study at AIIMS, a highly reputed-medical college in India. Soon after her birth, they shifted to Delhi, where Vineeta did her schooling at the famous Delhi Public School, RK Puram.

During her school days, she was very much an all-rounder with a passion for badminton and running, always managing to be in the top 1% of scorers in her school.

Later, for her undergraduate studies, she went to IIT Madras to pursue a BTech In electrical engineering and further did an MBA from IIM Ahmedabad, which was the opposite of her childhood dream of being a doctor.

After her studies, she got a job offer of Rs 1 crore, which she rejected to start her heroic entrepreneurial journey, and the rest is history.

Then she came into the limelight when she got featured as a shark in the reprised Indian version of Shark Tank. People loved her for her clarity and analytical skills. She is also an active feminist and promotes female-owned businesses.

Kaushik Mukherjee

Kaushik was born on June 17, 1983, in a middle-class Bengali family in Kolkata, and attended Don Bosco School.

Later, he studied Electrical Engineering at Birla Institute of Technology and Sciences (BITS) Pilani before pursuing his MBA at the Indian Institute of Management (IIM) Ahmedabad, where he was named Best All-Rounder of his batch.

This is where he met Vineeta Singh, with whom he later collaborated to launch Sugar. They finally tied the knot in 2011.

He participated in sports such as swimming and football while studying for his MBA. He also sang, drummed, and played the sitar in the university’s music club. He was also a member of the IIMA’s Finance Club.

Mission and vision

Sugar Cosmetics’ mission statement says, “We believe in every interpretation of beauty. Bold to subdued, quirky to crazy, every day to glam goddess!

We aim to celebrate every aspect of you, no matter what your style is. So, go ahead and pick your faves.” says the official site of Sugar Cosmetics .

Sugar Cosmetics strives to achieve high-quality standards at affordable prices for the masses. They have established a great D2C business model with great capture in the retail segments of the beauty industry.

Sugar’s business model

Sugar operates on a direct-to-consumer (D2C) business model. The business employs an omnichannel strategy to market its goods, which entails selling them on various E-Commerce sites like Nykaa, Amazon, Flipkart, Myntra, etc. Its sales in India and abroad form a big part of its revenue share.

A hybrid online-offline business model is used by Sugar Cosmetics, which has more than 10,000 sales outlets spread across more than 130 locations in 28 states.

After the pandemic, the company has been focusing on developing business strategies that can strengthen the client-brand relationship even further. Their revised business model includes cost-cutting, social media marketing, team restructuring, and e-commerce dominance.

Magnetic marketing: Sugar’s best-kept secrets

Sugar Cosmetic believes in the optimal use of marketing and also dedicates a large chunk of its annual budget to this facet of the business. Without that, they wouldn’t have experienced the massive success they already have!

Here, we are going to discuss the marketing strategies they put into action, which led them to boost their customer base and skyrocket their sales.

1. Affordable range

It provides consumers with comparable effective prices as compared to the beauty giants Lakme and Maybelline. As the products were priced with the middle-class population in mind, the company heavily endorses make-up products at affordable prices.

2. Astounding packaging

Even though the company’s products are reasonably priced, there are no efforts left in the packaging sector. The products come in attractive packaging with high-quality content and a cult following among the youth.

3. Optimal use of internet marketing

- Sugar Cosmetics also made an effort to market their goods through the Internet. Instagram and YouTube have produced the best results for them out of all the digital platforms!

- They also promote their products through Social Media influencers. They collaborate with a famous content creator who targets their audience and captures a mass audience at cheaper prices as compared to conventional marketing strategies.

- Last but not least, they will also continue to rely on BTL activities for their marketing. Organizing trade shows, telemarketing their products, sending direct mail to the targeted audience, and focusing on search engine marketing are all producing positive results.

The rise and rise of Sugar Cosmetics

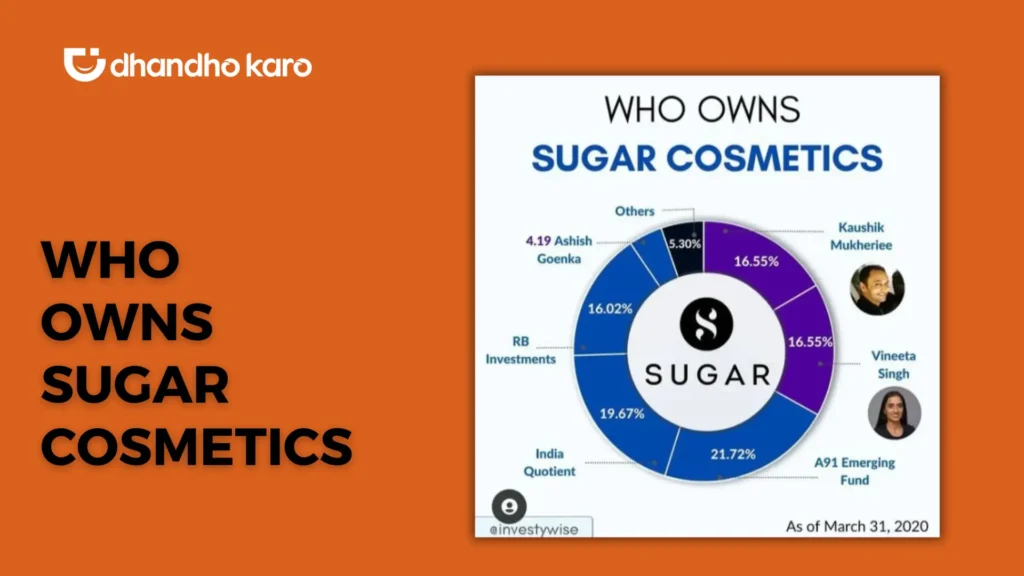

Over the course of six rounds, Sugar Cosmetics has raised a total of $87.5 million in funding. Their most recent funding came from an angel round on September 3, 2022. Nine investors are funding Sugar Cosmetics.

The most recent investors are A91 Partners and Ranveer Singh. On January 13, 2022, ENN Beauty was purchased by Sugar Cosmetics.

As of today, Sugar Cosmetics Net Worth is Rs 300 crore .

2. Valuation and turnover

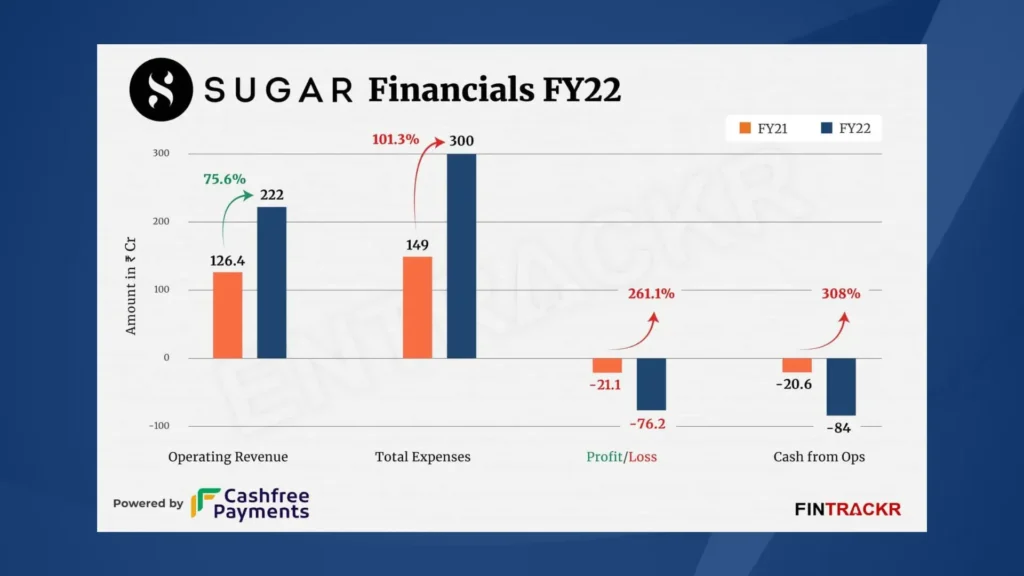

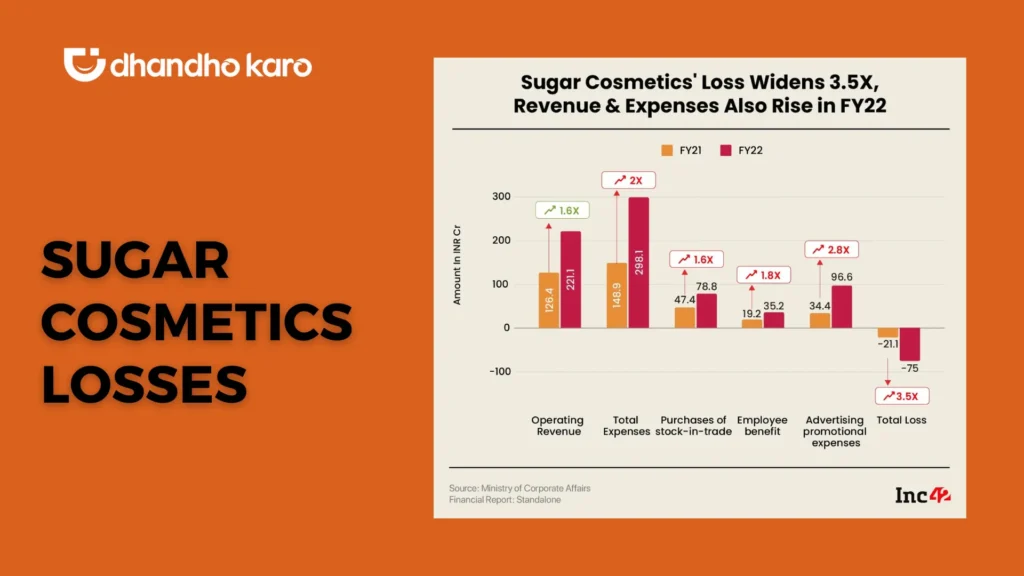

According to the most recent reports, it is valued at $500 million (4,133 crore rupees). And if we talk about the turnover, In FY22, Sugar Cosmetics generated total operating revenue of INR 210.9 crore from India, as against INR 117.6 crore in FY21. With a projected 70% growth rate by 2024 , Sugar Cosmetics is ready to become the second-largest brand in the color cosmetics category.

Despite an increase in sales, Vellvette Lifestyle-owned Sugar Cosmetics reported a widening of its loss to INR 75 crore in the financial year 2021-2022 (FY22) from INR 21.1 crore in the previous fiscal year.

Although its operating revenue from the sale of its cosmetic and beauty products increased by almost 75% to INR 221.1 crore in FY22, the startup still reported a 255% YoY increase in its loss. The figure stood at INR 126.4 crore in FY21.

The startup, which has a $500 million market cap, is growing in the US, Russia, and West Asia with the goal of going global soon. According to Sugar Cosmetics CEO Vineeta Singh, the company needs perfect timing to enter the IPO stage, where it can attempt to become the most well-known brand in the market while also experiencing the fastest profit growth.

Naturally, the market places a high value on profitability, and Sugar wants to clear that hurdle over the course of the upcoming year.

SWOT analysis

- High-end materials that are designed in state-of-the-art facilities.

- Online as well as offline.

- Easy application

- Large target audience

- Brand awareness amongst youth

- less recognition internationally

- Mediocre promotional campaigns on social media platforms

- No big celebrity endorsements

- Relatively low budget as compared to global brands

Opportunity

- Able to change its products with shifts in trends.

- Launch a wider range of products

- Increase presence in the marketplace with digital and influencer marketing

Threats

- The competitors have more capital to invest in marketing campaigns

- Owing to changes in trends, many products get outdated

- Many competitors launch the same product at even more competitive prices

Staying ahead in the game

Sugar faces fierce competition with the other established cosmetics brands in the country; to name a few, we have Nykaa, Myglamm, Lotus, Purple, Mamaearth, Lakme, Maybelline, etc.

To create a space in the industry, one has to find a gap in the market and bridge the gap for the audience. Luckily, Sugar Cosmetics has been very successful in doing so, By various strategies listed below:

1. Bridging the gap

Sugar Cosmetics charted the prices of all red lipsticks available on the market using the least common denominator—red lipstick. They discovered that there were no competitors in the Rs 599–Rs 699 price range.

They consequently made the decision to join that band. Even though investors did not find it exciting at the time because they believed it to be a niche market, the brand stuck with it.

“That is one of the benefits of developing consumer brands in India. “Today’s niche is tomorrow’s mass market,” Mukherjee observed. This way, they were able to capture large audiences by playing in the rare air.

2. Accessibility to the masses

With affordable pricing and premium quality, Sugar Cosmetics adds value to thousands of lives every day, is light on their pockets, and offers a variety of products. It is often observed that sugar strives to make their products accessible to the economic majority of the population in India, that is, the middle class.

3. Making gizmos its best friends

Sugar’s owned media generates 4 billion views per year. The company was very careful to avoid promoting bottom-of-the-funnel messaging on top-funnel platforms. The brand took Social Media influencers into the spotlight and used the right approach to build a loud voice for the brand.

Its digital footprint has helped it scale the business, by constantly trying new strategies and reflecting on previous failures to grow even stronger with increased revenues.

4. Going omnichannel

The brand adopted a step-by-step strategy. D2C was the beginning, followed by availability on partner portals and other e-commerce sites, and finally shop-in-shops. Launching its exclusive brand outlets and kiosks came next. There are currently more than 114 Clients and kiosks for the brand. The company has also entered the high streets. Their future plan now is to get into travel retail.

5. Devotion towards feedbacks

Actions speak louder than words, and when it came to sugar, words—in the form of customer reviews—spoke about what they wanted and got it done by the brand, leading to its rise in the Indian market.

On marketplaces and e-commerce websites, Mukherjee has made it a habit to read reviews of the products his business sells. The feedback from customers has provided Sugar with a wealth of insightful information that it has used to enhance and diversify its product line.

The insight even allowed Sugar to create some innovative products, including matte eyeliners and foundation sticks.

“You’re never really ready… And you’re never really ready. But as long as you’re willing to put your heart into something, and feel strongly about it – at least you’ll have the calming peace of knowing that you tried,” – Says Mukherjee.

Vineeta and Kaushik’s 11-year journey started in 2012. They were full of doubts, insecurities, and fears, but they never gave up, and today we all know the brand by its faces and embrace the long yet beautiful journey of Sugar Cosmetics.

Suraj Shrivastava at ForgeFusion shares simple, effective ways to grow your business using SEO, content marketing, and AI, learned from helping over 50 companies. When he's not working, he loves teaching others or watching documentaries.

About The Author

Share this article

Case Study: Fenty Beauty

Lyndal | Founder (ide)ate Studio

Organisation: Fenty Beauty

For decades, the beauty industry held a narrow vision of who deserved to be represented on its shelves. Foundation shades catered primarily to lighter skin tones, leaving a vast majority of consumers feeling excluded. Rihanna’s Fenty Beauty, launched in 2017, shattered this paradigm with a revolutionary approach to inclusivity.

The Problem

Before Fenty Beauty, the foundation struggle was real. People of colour, particularly those with darker complexions, faced a constant battle to find a foundation that matched their skin tone. Existing brands offered limited shade ranges, often with undertones that didn’t complement a variety of complexions. This lack of representation wasn’t just frustrating, it sent a clear message: you weren’t part of the beauty conversation.

Rihanna (yep, that Rhianna), recognised this gap in the market and the need for inclusivity.

Inspired by her own experiences, she envisioned Fenty Beauty “so that women everywhere would be included.” The brand launched with a record-breaking 40 foundation shades, catering to a wide spectrum of skin tones and undertones. But Fenty Beauty went beyond just the number of shades. Formulas were developed for all skin types, ensuring a flawless finish for everyone.

Fenty Beauty’s impact transcended sales figures. With an annual revenue of $582 million and a valuation of $2.8 billion, it quickly became a top beauty brand.

But the true victory was the message it sent: beauty is for everyone. Women of all backgrounds finally saw themselves reflected in the beauty world, a feeling of empowerment that resonated deeply.

‘The Fenty effect’ is a term now used to describe the knockon effect in forcing the wider industry to develop inclusive ranges too.

Why Fenty Beauty Worked: Rethinking the Target Audience

Fenty Beauty’s success stemmed from a fundamental shift in perspective. Traditionally, the beauty industry focused on a “dominant” customer — typically a white, youthful-looking woman. But Fenty Beauty looked beyond this limited view.

Here’s how they did it:

- Thinking Beyond Dominant Groups: A Total Addressable Market (TAM) analysis typically considers factors like age, income, and location. Fenty Beauty went a step further, acknowledging the importance of ethnicity, gender expression, physical ability, and body size in shaping consumer needs and desires. This broader perspective allowed them to develop products that catered to a much larger and previously underserved market.

- Decentering Dominant Groups: Fenty Beauty’s marketing and design choices reflected a conscious effort to move away from centring whiteness as the default standard. Their campaigns featured a diverse range of models, and the brand actively partnered with underrepresented communities. This authenticity resonated with consumers who finally felt seen and valued.

Key Takeaways

Fenty Beauty serves as a powerful case study in the power of inclusive innovation. By prioritising representation and understanding the needs of diverse consumers, brands can unlock a wider market and establish genuine customer loyalty.

Here are some key takeaways for businesses looking to follow Fenty Beauty’s lead:

- Conduct a TAM Analysis with inclusivity in mind: Expand your analysis to consider factors that impact feelings of inclusion and spending habits beyond your traditional demographics.

- Co-create with Underrepresented Communities: Engage with diverse groups during the product development process. This ensures solutions that are effective and resonate with those they aim to serve.

- Avoid Stereotypes : Don’t make assumptions about what inclusivity means to different demographics. Actively seek out feedback and perspectives to ensure your approach is authentic and respectful.

By following these steps, brands can move beyond performative inclusivity and create products and experiences that truly celebrate the beauty in all its diverse forms. The beauty industry may have been slow to catch on, but Rihanna’s Fenty Beauty has shown the world the power of inclusivity — a revolution that extends far beyond the world of makeup.

View & download summary in .png format below

Did you find this helpful or interesting? Consider sharing & tagging us on Instagram at @ideate_studio or on LinkedIn at (ide)ate Studio .

Would you like some help running a needs analysis on your current design processes? You can find us at https://www.ideatestudio.io/

- TikTok creators say beauty industry still has an inclusivity problem after popular makeup company generates backlash , NBC News

- Rihanna’s Fenty Beauty Is The World’s Biggest Celebrity Beauty Brand , Essence

Written by Lyndal | Founder (ide)ate Studio