Paul Graham on How to Be an Angel Investor

Yesterday, we featured a famous speech by Charlie Munger, one of the world’s most savvy and successful investors. Let’s stick to the investing theme for this weekend and seek advice from another world-famous investor today, Paul Graham.

As you may remember, we’ve already featured several Paul Graham essays in previous issues, but we haven’t heard from him yet, at least not explicitly, on the topic that he arguably knows more about than almost anyone else on the planet: angel investing.

Today’s nugget is a classic of the genre, and a must-read not only for budding angel investors, but also for founders and anyone else who is interested in technology startups.

Read on to learn why you shouldn’t worry too much about deal terms, how to pick winners, what makes for a great founder, and how to attract a strong deal flow!

Sign up for free to receive your daily nuggets in your email inbox

© 2024 Rivuspurus

- Start your Journey

- Accelerate your Progress

- Raise Capital

- Get Incorporated

- Get Started

Paul Graham Predicting New Opportunities in Angel Investment

In his essay published last month, Startup Investing Trends , Paul Graham (that’s this Paul Graham , Y Combinator co-founder) says “one of the biggest unexploited opportunities in startup investing right now is angel-sized investments made quickly.” Here’s the full quote:

I think one of the biggest unexploited opportunities in startup investing right now is angel-sized investments made quickly. Few investors understand the cost that raising money from them imposes on startups. When the company consists only of the founders, everything grinds to a halt during fundraising, which can easily take 6 weeks. The current high cost of fundraising means there is room for low-cost investors to undercut the rest. And in this context, low-cost means deciding quickly. If there were a reputable investor who invested $100k on good terms and promised to decide yes or no within 24 hours, they’d get access to almost all the best deals, because every good startup would approach them first.

That’s an interesting thought, but I wonder: Can anybody do any kind of due diligence in 24 hours? And wouldn’t the access to “almost all the best deals” be drowned in the noise of all the worst, bad, and not-so-bad deals too?

Graham does address this. He adds:

It would be up to them to pick, because every bad startup would approach them first too, but at least they’d see everything.

At the very least, it’s an interesting thought.

Graham goes on to predict a change in the patterns of success in startups, which will result in more opportunities for early stage investment, and more opportunity for new investors.

Mostly because of the increasing number of early failures, the startup business of the future won’t simply be the same shape, scaled up. What used to be an obelisk will become a pyramid. It will be a little wider at the top, but a lot wider at the bottom.

What does that mean for investors? One thing it means is that there will be more opportunities for investors at the earliest stage, because that’s where the volume of our imaginary solid is growing fastest. Imagine the obelisk of investors that corresponds to the obelisk of startups. As it widens out into a pyramid to match the startup pyramid, all the contents are adhering to the top, leaving a vacuum at the bottom.

That opportunity for investors mostly means an opportunity for new investors, because the degree of risk an existing investor or firm is comfortable taking is one of the hardest things for them to change. Different types of investors are adapted to different degrees of risk, but each has its specific degree of risk deeply imprinted on it, not just in the procedures they follow but in the personalities of the people who work there.

Paul Graham does essays, not blog posts. Whether you’re a startup founder, angel investor, or just interested in the topic, this most recent essay makes very interesting reading. To prove that point, I end with this quote:

The empirical evidence on that is already clear: investors make more money as founders’ bitches than their bosses. Though somewhat humiliating, this is actually good news for investors, because it takes less time to serve founders than to micromanage them.

Gust Launch can set your startup right so its investment ready.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.

Ready to launch your startup?

We have everything you need to build a successful, high-growth company—the right way.

" * " indicates required fields

My projects

Transcription

How to Be an Angel Investor

Sep 16, 2023 · 16:03

Description

All Paul Graham essay's, brought to life in audio format. This is a third party project, independent from Paul Graham, and produced by Wondercraft AI.

Angel Investing 101: What it is and How to Get Started

May 14, 2021

Angel Investing defined: A basic guide to help individual investors understand this new opportunity.

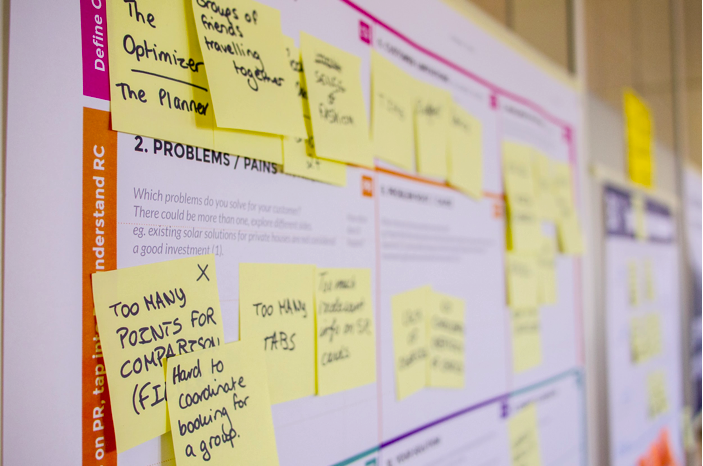

Angel investing is all about spotting potential in teams and companies.

Photo by Daria Nepriakhina on Unsplash

If you invested $US 10,000 in Facebook’s seed round in 2004, your money would have grown to over $US 250 million today. The same goes for many other companies, where a seed investment could yield a 100 fold return or more.

You hear all these stories about investors getting in early on startups that blow up, but how does all of this work? In recent years, loosening government regulations and new investing platforms have made angel investing more accessible than ever.

Basics of Startup Investing

Angel investing gives individuals the opportunity to fund very early-stage startups that are not yet ready to raise venture money. Typically, angel investments and seed rounds raise between $US 500,000 and $US 2,000,000 from a few people. You can invest either as an individual or join an angel group (the Angel Capital Association has a great list here ).

The amount that is invested can be highly variable, based upon the investor’s and the startup’s needs.

VC Fundraising Journey ( University Lab Partners)

I n return for the investment, angels are given an early stake in a company. These shares can increase in value exponentially in future funding rounds, if the company becomes successful.

Traditionally, angel investors needed to be “accredited investors” (see SEC definition here ), meaning that they have over $US 1,000,000 in investable assets or have an annual income over $US 200,000. However, under Title III of The Jobs Act, even if you don’t meet these requirements, you can now invest through a new breed of crowdfunding platforms.

Making Money through Angel Investing

While your company may grow in value over time, you, as an investor, can only make money through a “liquidity event” that allows investors and founders to cash out some or all of their shares. There are 2 main ways angels can make money:

- IPO (initial public offering) : when a company is formally listed on a public exchange.

- Acquisitions : when a startup is acquired by a larger company, resulting in a payout to the startup investors.

When making investment decisions, keep these potential exit opportunities in mind.

Important Investing Terms to Know

- SAFE vs. Convertible Notes — A SAFE, which stands for “simple agreement for future equity,” was coined by Y Combinator. It is a warrant to enable investment in the first round. On the other hand, a Convertible Note is a form of debt that can convert to equity at a certain funding/valuation milestone. SAFEs are generally considered to be more founder-friendly than convertible notes.

- Priced rounds — Startups can also give the investor shares of the company in return for funding. There are usually two stock classes, common and preferred. The common stock usually goes to the founders. The preferred shares typically go to investors and usually come with perks, like getting paid back first when there is an exit

- Carry — Venture capitalists usually take a percentage of the payout profits in the form of a “carry.” For example, VCs lead the research, due diligence, logistics, and the investment in a startup. In return, they are typically compensated 20% of the profits (in addition to management fees). This vehicle is usually employed by those with considerable financial experience.

See more VC terms here .

Angel Investing Strategies

In his essays, the famous investor, Paul Graham, advises readers to not get hung up on the nuances of a deal — “When angels make a lot of money from a deal, it’s not because they invested at a valuation of $1.5 million instead of $3 million. It’s because the company was really successful.” Regardless of how much you invested in Snapchat a decade ago, you made incredible returns on your investment.

With that being said, how do you pick a great company?

Good market — Marc Andreesen famously said:

“When a great team meets a lousy market, market wins.

When a lousy team meets a great market, market wins.

When a great team meets a great market, something special happens. ”

Essentially, market need is one of the biggest factors in startup success . If there is no widespread need for a product or service, even the best team will not be able to launch a successful startup. As a result, even seasoned entrepreneurs can raise billions in capital on an idea, but misjudge the prevailing market. The inevitable loss is painful for the investors (remember Quibi from early 2020?).

In fact, lack of product-market fit is the leading cause for all startup failures.

- Personal fit: Make sure that you invest in technologies that you already understand or can put time into understanding. With today’s pitch decks, buzz words are thrown around left and right. Having a real understanding of a startup’s core technology is essential to making a good investment decision. Also, angel investing isn’t just about picking the right companies. As an angel investor, you are often able to support these startups beyond just capital. Think about how you can personally bring value to the company.

- Exit opportunities: This was touched upon above, but think about how you can cash in on your investment. Is the startup a clear acquisition target for a larger company? Does the company have the potential to go public?

- Great team: Finally, the team also plays a crucial role in a startup’s success. As the saying goes, it’s not just the idea that counts, but the execution of that idea. Good things to look for in a team are diverse skill sets, strong technical background in the topic, previous entrepreneurial experience, and a boundless passion for the company.

As we mentioned in our blog on diversification, the majority of startups fail. However, when investing in startups, the magnitude of the outcome is more important than the frequency of your wins (please see our previous blog, Investing is Simple, Not Easy ).

A general guideline in startup investing is that a small portion of investments will make up the majority of returns. As such, it is important to look for companies with the potential to become huge.

With early-stage startups, there is also much less information available about their finances and operations. This makes proper due diligence extremely important.

Other reasons to angel invest

Besides the possibility of getting in early on the next billion dollar company, angel investing gives investors the opportunity to work with passionate entrepreneurs, solving important issues. Since you get to work with the company in its youth, you can play a significant role in mentoring the startup and helping it grow.

- INNOVATION FESTIVAL

- Capital One

11-12-2012 WORK LIFE

The Aha! Moments That Made Paul Graham’s Y Combinator Possible

When it comes to funding startups, Y Combinator is an incubation machine. And behind it all are founder Paul Graham’s unique insights about what constitutes true innovation.

BY Robert Greene 10 minute read

In the summer of 1995, Paul Graham heard a story on the radio promoting the endless possibilities of online commerce, which at the time hardly existed. The promotion came from Netscape, which was trying to drum up interest in its business on the eve of its IPO. The story sounded so promising, yet so vague. At the time, Graham was at a bit of a crossroads. After graduating from Harvard with a PhD in computer science, he had fallen into a pattern: he would find some part-time consulting job in the software business; then, with enough money saved, he would quit the job and devote his time to his real love–art and painting–until the money ran out, and then he would scramble for another job. Now 30 years old, he was getting tired of the pattern, and he hated consulting. The prospect of making a lot of money quickly by developing something for the Internet suddenly seemed very appealing.

He called up his old programming partner from Harvard, Robert Morris, and interested him in the idea of collaborating on their own startup, even though Graham had no clue where they would start or what they would develop; eventually, they decided they would try to write software that would enable a business to generate an online store. Once they were clear about the concept, they had to confront a very large obstacle in their way. In those days, for a program to be popular enough it would have to be written for Windows. As consummate hackers, they loathed everything about Windows and had never bothered to learn how to develop applications for it. They preferred to write in Lisp and have the program run on Unix, the open-source operating system.

They decided to postpone the inevitable and wrote the program for Unix anyway. To translate this later into Windows would be easy, but as they contemplated doing this, they realized the terrible consequences it would lead to–once the program was launched in Windows, they would have to deal with users and perfect the program based on their feedback. This would mean they would be forced to think and program in Windows for months, perhaps years. This was too awful a prospect, and they seriously considered giving up.

One morning Graham woke up with the idea that they might be able to control the software on the server by clicking on links. He suddenly sat bolt upright, as he realized what these words could mean–the possibility of creating a program to set up an online store that would run on the web server itself. People would download and use it through Netscape, clicking various links on the web page to set it up. This would mean he and Morris would bypass the usual route of writing a program that users would download to their desktop. It would cut out the need ever to have to dabble in Windows. There was nothing out there like this, and yet it seemed like such an obvious solution. In a state of excitement he explained his epiphany to Morris, and they agreed to give it a try. Within a few days they finished the first version, and it functioned beautifully. Clearly, the concept of a web application would work.

Over the next few weeks they refined the software, and found their own angel investor who put up an initial $10,000 for a 10 percent share in the business. In the beginning, it was quite hard to interest merchants in the concept. Their application server provider was the very first Internet-run program for starting a business, at the very frontier of online commerce. Slowly, however, it began to take off.

As it panned out, the novelty of their idea, which Graham and Morris had come upon largely because of their distaste for Windows, proved to have all kinds of unforeseen advantages. Working directly on the Internet, they could generate a continuous stream of new releases of the software and test them right away. They could interact directly with consumers, getting instant feedback on their program and improving it in days rather than the months it could take with desktop software. With no experience running a business, they did not think to hire salespeople to do the pitching; instead, they made the phone calls to potential clients themselves. But as they were the de facto salespeople, they were also the first to hear complaints or suggestions from consumers, and this gave them a real feel for the program’s weaknesses and how to improve it. Because it was so unique and came out of left field, they had no competitors to worry about; nobody could steal the idea because they were the only ones who were insane enough to attempt it.

Naturally, they made several mistakes along the way, but the idea was too strong to fail (though Graham notes the company came close several times anyway ); and in 1998 they sold their company, named Viaweb, to Yahoo! for $50 million.

Explore Topics

- Paul Graham

- Y Combinator

- Tech Say goodbye to static user interfaces

- Tech Telegram CEO Durov says the messaging app will tackle criticism of how it moderates content

- Tech The White House calls on Amazon and Google to help defeat online censors in these countries

- News New York law now mandates that major retail stores add ‘panic buttons’ for workers

- News 2,000 employees to lose jobs as LL Flooring, formerly Lumber Liquidators, ceases operations

- News Seven & i rejects Couche-Tard’s $38.5 billion takeover bid

- Design UNESCO says ‘selfie-tourism’ is destroying the world’s best landmarks

- Design Everyone hates the new Capri Sun bottles—and that’s actually good for the brand

- Design Jony Ive’s LoveFrom reinvents the button with Moncler

- Work Life How to start assuming the best in people

- Work Life The growing movement to help workers achieve digital balance

- Work Life 6 myth-busting facts about entrepreneurship and poverty

- ₹ 10 Lakh,1" data-value="Loan ₹ 10 Lakh">Loan ₹ 10 Lakh

- Games & Puzzles

- Entertainment

- Latest News

- Kolkata rape case live updates

- Web Stories

- Mumbai News

- Bengaluru News

- Daily Digest

Top 10 quotes from Paul Graham's viral essay for all bosses: 'Founder mode vs manager mode'

Investor paul graham challenged conventional b-school wisdom as he spoke about the “founder mode” in his widely-discussed essay. .

Investor Paul Graham recently published an essay titled "Founder Mode" that has been widely discussed by the start-up ecosystem in Silicon Valley as well as India. The 59-year-old co-founder of accelerator Y Combinator, calls all leaders to run their companies in the "founder mode" instead of the "manager mode". The latter, which is conventional B-school wisdom, said founders must switch to manager mode if they wanted to scale up their companies. The leaders, according to this school of thought, would not get into the smaller details and would rather prefer to delegate.

Here are top 10 quotes from Paul Graham's “Founder Mode” essay :

- “In effect there are two different ways to run a company: founder mode and manager mode.”

- “Till now most people even in Silicon Valley have implicitly assumed that scaling a startup meant switching to manager mode.”

- “There are as far as I know no books specifically about founder mode. Business schools don't know it exists. All we have so far are the experiments of individual founders who've been figuring it out for themselves.”

- “The way managers are taught to run companies seems to be like modular design in the sense that you treat subtrees of the org chart as black boxes.”

- “Hire good people and give them room to do their jobs. Sounds great when it's described that way, doesn't it? Except in practice, judging from the report of founder after founder, what this often turns out to mean is: hire professional fakers and let them drive the company into the ground.”

- “Founders feel like they're being gaslit from both sides — by the people telling them they have to run their companies like managers, and by the people working for them when they do.”

- VCs who haven't been founders themselves don't know how founders should run companies, and C-level execs, as a class, include some of the most skillful liars in the world.

- “Whatever founder mode consists of, it's pretty clear that it's going to break the principle that the CEO should engage with the company only via his or her direct reports.”

- “So founder mode will be more complicated than manager mode. But it will also work better. We already know that from the examples of individual founders groping their way toward it.”

- “Look at what founders have achieved already, and yet they've achieved this against a headwind of bad advice. Imagine what they'll do once we can tell them how to run their companies like Steve Jobs instead of John Sculley.”

- Silicon Valley

- Terms of use

- Privacy policy

- Weather Today

- HT Newsletters

- Subscription

- Print Ad Rates

- Code of Ethics

- India vs Sri Lanka

- Live Cricket Score

- Cricket Teams

- Cricket Players

- ICC Rankings

- Cricket Schedule

- Shreyas Iyer

- Harshit Rana

- Kusal Mendis

- Ravi Bishnoi

- Rinku Singh

- Riyan Parag

- Washington Sundar

- Avishka Fernando

- Charith Asalanka

- Dasun Shanaka

- Khaleel Ahmed

- Pathum Nissanka

- Other Cities

- Income Tax Calculator

- Petrol Prices

- Reliance AGM 2024 Live

- Diesel Prices

- Silver Rate

- Relationships

- Art and Culture

- Taylor Swift: A Primer

- Telugu Cinema

- Tamil Cinema

- Board Exams

- Exam Results

- Admission News

- Employment News

- Competitive Exams

- BBA Colleges

- Engineering Colleges

- Medical Colleges

- BCA Colleges

- Medical Exams

- Engineering Exams

- Love Horoscope

- Annual Horoscope

- Festival Calendar

- Compatibility Calculator

- Career Horoscope

- Manifestation

- The Economist Articles

- Lok Sabha States

- Lok Sabha Parties

- Lok Sabha Candidates

- Explainer Video

- On The Record

- Vikram Chandra Daily Wrap

- Entertainment Photos

- Lifestyle Photos

- News Photos

- Olympics 2024

- Olympics Medal Tally

- Other Sports

- EPL 2023-24

- ISL 2023-24

- Asian Games 2023

- Public Health

- Economic Policy

- International Affairs

- Climate Change

- Gender Equality

- future tech

- HT Friday Finance

- Explore Hindustan Times

- Privacy Policy

- Terms of Use

- Subscription - Terms of Use

Being a Good Investor

edition e1.0.2

You’re reading an excerpt of Angel Investing: Start to Finish , a book by Joe Wallin and Pete Baltaxe. It is the most comprehensive practical and legal guide available, written to help investors and entrepreneurs avoid making expensive mistakes. Purchase the book to support the authors and the ad-free Holloway reading experience. You get instant digital access, commentary and future updates, and a high-quality PDF download.

If everyone is motivated, the deal is priced attractively, and there are few if any red flags, getting through this process can take as little as four to six weeks. Unfortunately, this process can often drag on for several months or more, in which case it becomes a big time and energy drain for the entrepreneur who is trying to build a company.

important It behooves angels to move as quickly as is prudent to get the deal done if they want to maintain the momentum of the company they are investing in. As an angel, be respectful of the lead investor’s time, and be responsive to their inquiries and requests, as they have taken on the extra work and responsibility for no additional gain.

Paul Graham, in his essay “ How To Be an Angel Investor ,” writes that being a “good” investor is defined by the following traits:

Decide quickly whether you want to dig in on a deal.

After you have done your diligence, be decisive about whether you are going to invest. Stringing entrepreneurs along while you are waiting for their company to make progress is bad for them and will not lead to your getting deals referred to you.

Don’t get too aggressive on deal terms, as there is plenty of room for a win-win if the company is successful.

Be helpful where you can, whether or not you invest.

What to Watch Out For

Non-disclosure agreements.

Sometimes a company will ask you early on to sign a nondisclosure agreement .

A nondisclosure agreement (or confidentiality agreement or NDA) is an agreement in which you agree to keep a company’s confidential information confidential. In the broader business world, companies consider almost all their information confidential unless it is publicly available on their website, for example, or has been made public through press releases or financial filings. The startup world is a more specialized context, in which the investors will need to know a lot about a company before they consider investing, and will likely be pitching to groups of potential investors and sharing key details of the business in the process.

Paul Graham Essays: Readalouds and Discussions with Amara Ventures

This is Amara Ventures' reading of Paul Graham's essays. At Amara, we rever Paul Graham and we strongly believe that his essays are a must-read for everyone in the world of tech and beyond. This podcast is divided into TWO segments. The first segment is a verbatim reading of a particular essay and the second segment is a discussion with a guest who helps us connect the core ideas of essay with the contemporary world of startups in India and the valley by sharing insightful stories and anecdotes. Visit www.amaraventres.co to know more.

Ep 4.2: Vivek Joshi discussing Good and Bad Procrastination by Paul Graham

Can procrastination be good? If yes, when? Can you afford to forget the 'small stuff' because you are focused on the bigger things? But then doesn't God lie in the details? This and much more is discussed in this fantastic discussion with Vivek Joshi on the ever-green essay by Paul Graham. Vivek Joshi is a seasoned entrepreneur and an avid investor who is interested in startups, stock markets and social change. You can reach Vivek on Twitter at https://twitter.com/startupfundas.

Ep 4.1 Read aloud of 'Good and Bad Procrastination' by Paul Graham

Good and Bad Procrastination is a fantastic essay by Paul Graham written in 2005. Long before Tim Urban's TED talk - Inside the mind of a master Procrastinator came out, this is one essay that spoke of how procrastination plays a huge role in one's life. Contrary to the common wisdom of staying organized and keeping a tab on the To-Do list, the essay makes a case for forgetting 'small stuff' if you can put your brain to better use. Harping on the difference between creativity and productivity, the essay is a must-hear for everyone. The essay reading is done by Minal Desai of Amara Ventures, an angel investment firm in India. To know more about them visit www.amaraventures.co

Ep 3.2: Vivek Khare discussing Do Things That don't Scale to Investors by Paul Graham

Startups must have a DNA that lets them scale faster than a normal business. But what does that DNA comprise of? To understand that we have Vivek Khare ex-Naukri and a stellar investor (zomato, Vastra, Nivesh, etc) who shares many of his personal stories about founders' hustle Hear Vivek Khare answer this and much more in this enticing discussion with Minal Desai of Amara Ventures. You can connect with Vivek on Twitter @Vivekstartupguy and know more about Amara Ventures at www.amaraventures.co

Ep 3.1: Read-aloud of 'Do Things That Don't Scale' by Paul Graham

Written in 2013, Do Things that Don't Scale remains one of the topmost essays ever written by our beloved Paul Graham. It talks of how startup in its initial days must do things that seem impossible to scale but are extremely valuable to be done in the early days. Drawing from examples of Airbnb and Stripe, Paul makes a compelling case for founders to focus on the user and simply do whatever it takes to delight them. The essay reading is done by Minal Desai of Amara Ventures, an angel investment firm in India. To know more about them visit www.amaraventures.co

Ep 2.2: Sanjay Mehta discussing A Hacker's Guide to Investors by Paul Graham

The Indian startup ecosystem is growing at a frantic pace. And Sanjay Mehta of 100x is one of the handful of people who are shaping it. But what is it to raise money and approach investors in today's day and age? How much time does it take to raise money? What do investors look for in startups? Hear Sanjay Mehta answer this and much more in this enticing discussion with Minal Desai of Amara Ventures. You can connect with Sanjay on Twitter @mehtasanjay and know more about Amara Ventures at www.amaraventures.co

Ep 2.1: Readaloud of A Hacker's Guide to Investors by Paul Graham

Written in 2007, this is mecca of guides to investors by none other than our beloved Paul Graham. The expansive essays lists down 23 things a founder should keep in mind when approaching investors. The timeless advice shared by Paul is as relevant today as it was then and if you are a founder starting out to raise funds, this is a MUST hear essay. The essay reading is done by Minal Desai of Amara Ventures, an angel investment firm in India. To know more about them visit www.amaraventures.co

Ep 1.2 - Discussion of PaulG's Four Quadrants of Conformism with Mohit Satyanand

To discuss a multi-faceted essay like Four Quadrants of Conformism, we have the most versatile guest- Mohit Satyanand with us. Mohit is an investor par excellence and is a keen observer of society. The conversation begins with the essay and meanders its way through history, politics and startups. Know more about Mohit follow him on twitter @mohitsatyanand.

Ep 1.1 - Readaloud of Four Quadrants of Conformism by Paul Graham

Written in July 2020, Four quadrants of conformism is a stupendous essay that needs to be heard more than once. It talks of how every society has four different types of people from independent-minded highly conventional ones and why protecting the independent-minded ones should be the aim of society and what is the cost of not doing so

Ratings & Reviews

Information.

- Creator Amara Ventures

- Years Active 2K

- Rating Clean

- Copyright © Amara Ventures

You Might Also Like

Updated Weekly

Updated Daily

Updated Semiweekly

To listen to explicit episodes, sign in.

Stay up to date with this show

Sign in or sign up to follow shows, save episodes, and get the latest updates.

Africa, Middle East, and India

- Brunei Darussalam

- Burkina Faso

- Côte d’Ivoire

- Congo, The Democratic Republic Of The

- Guinea-Bissau

- Niger (English)

- Congo, Republic of

- Saudi Arabia

- Sierra Leone

- South Africa

- Tanzania, United Republic Of

- Turkmenistan

- United Arab Emirates

Asia Pacific

- Indonesia (English)

- Lao People's Democratic Republic

- Malaysia (English)

- Micronesia, Federated States of

- New Zealand

- Papua New Guinea

- Philippines

- Solomon Islands

- Bosnia and Herzegovina

- France (Français)

- Deutschland

- Luxembourg (English)

- Moldova, Republic Of

- North Macedonia

- Portugal (Português)

- Türkiye (English)

- United Kingdom

Latin America and the Caribbean

- Antigua and Barbuda

- Argentina (Español)

- Bolivia (Español)

- Virgin Islands, British

- Cayman Islands

- Chile (Español)

- Colombia (Español)

- Costa Rica (Español)

- República Dominicana

- Ecuador (Español)

- El Salvador (Español)

- Guatemala (Español)

- Honduras (Español)

- Nicaragua (Español)

- Paraguay (Español)

- St. Kitts and Nevis

- Saint Lucia

- St. Vincent and The Grenadines

- Trinidad and Tobago

- Turks and Caicos

- Uruguay (English)

- Venezuela (Español)

The United States and Canada

- Canada (English)

- Canada (Français)

- United States

- Estados Unidos (Español México)

- الولايات المتحدة

- États-Unis (Français France)

- Estados Unidos (Português Brasil)

- 美國 (繁體中文台灣)

- For Investors

- For Founders

- Education Center

- Recommended Resources

Paul Graham essays

- Black Swan Farming

- A Unified Theory of VC Suckage

- Why Smart People Have Bad Ideas

- The Venture Capital Squeeze

- How to Fund a Startup

- A New Venture Animal

- The Future of Startup Funding

- High Resolution Fundraising

- The New Funding Landscape

- What We Look for in Founders

- Subject: Airbnb

- The FundersClub Blog (Guides, Research, Interviews, and more)

- Josh Kopelman posts

- Fred Wilson posts

- Understanding Startup Investments

- VC 101: The Angel Investor's Guide to Startup Investing

- Exploring the Tech Startup Space

A Revival in Moscow: Billy Graham’s Legacy in Eurasia 3.13.2018

Rev. Billy Graham Preaching in Moscow, Russia

The life of the Reverend Billy Graham -- one of the world’s most inspiring pillars of Christian faith -- has moved us at Mission Eurasia to reflect with immense gratitude on his rich life of service to God’s Kingdom and the ways in which his ministry and ours intersected by God’s grace over the years.

Mission Eurasia’s president, Sergey Rakhuba, remembers first meeting Billy Graham in 1987, during the height of the Soviet Union, at a dinner for evangelical pastors in Russia. Sergey shares the memory of this inspiring meeting with Rev. Graham in Moscow and the impact it had on Sergey’s future ministry and the ministry of Mission Eurasia:

“For pastors who had to faithfully lead their churches under the pressures and challenges of the Soviet regime, this dinner with Rev. Graham in Moscow was an encouraging and faith-building night in the midst of a fearful and uncertain time,” says Sergey. It foreshadowed the growing gospel movement that would spread across Eurasia when the Soviet Union fell a few years later . . .

Billy Graham meeting with evangelical pastors and leaders in Moscow, Russia in 1987

“My closest colleague, Dr. Michael Cherenkov (Mission Eurasia’s executive director of field ministries), was also impacted forever by an encounter with Billy Graham in Russia. In 1992, a year after the fall of the Soviet Union, Michael remembers traveling as a young man and brand-new Christian from faraway Donetsk, Ukraine to the Red Square in Moscow in order to hear the great Rev. Graham preach to a crowd of thousands. Michael called this an ‘unbelievable miracle,’ writing, ‘In the center of Moscow, not far from the Kremlin, the most famous evangelist in history preached the gospel to thousands, and everyone who wished could freely obtain a formerly forbidden Bible. A revival had started, which promised reformation and renewal .

A Moscow crowd gathers to see Billy Graham preach in 1992

“Inspired and captivated by what he had seen and heard that day, Michael returned to his village in Ukraine under the influence of Billy Graham’s message. Feeling the promptings of God’s call and seeing a colossal need for the gospel in post-Soviet society, Michael made a decision. He would be a preacher, an evangelist, and a catalyst for reformation and renewal in the post-Soviet sphere. And so Michael began working with Mission Eurasia (then Russian Ministries) to continue this gospel movement across Eurasia, where it blossoms and flourishes to this day as we train and equip thousands of young Christian leaders for strategic ministry.

“Like Michael and myself, many of the men and women who heard Rev. Graham preach in Russia on that miraculous day in 1992 went on to be trained as church-planters and evangelists, working with Mission Eurasia and other ministries to plant churches, serve the lost, train new Christian leaders, and deliver God’s Word and the message of Jesus to a broken and hurting post-Soviet world."

The incredible legacy of Billy Graham is still being felt in the heart of Eurasia today and in the hearts of those who serve with Mission Eurasia. We grieve his passing from this world, but we rejoice that Rev. Graham is united with his beloved Savior and hope for the day when we, too, will be united with our Savior and every tear will be wiped away.

- Angel Match /

- Investors /

- Investors by location /

Venture Capital Investor & Angel Investor in Moscow

We've compiled thousands of venture capitalists, angel investors, venture funds, private equity investors, and angel groups filtered by industries, and investment stages. please take a look at the moscow investors below, along with some of their data, such as locations where they focus investing, markets in which they have investment focuses, and type of investors data., this is the internet's largest database of the moscow investors. you can try using angel match for free below. premium data & filtering are redacted until you subscribe..

| , | , , | |||||

| , , | , , | |||||

| , | ||||||

| , , | , , | , , | ||||

| , | , , | |||||

| , | , , | , , | ||||

| , | , , | |||||

| , | , , | |||||

| , | , , | |||||

| , | , | , , |

FAQ & Useful Tips

Our users often ask us questions about who are angel investors, how to get connected with them and how to secure funding from them. That's why, we've created a little section below where you can find some of the most frequently asked questions and answers to them about angel investors. We hope that these useful tips will help you get connected with relevant investors, secure funding, and also get the most out of your fundraising journey.

Q: Are angel investors easy to find in Moscow?

A: Well, yes, angel investors are pretty easy to find now. Gone are the days when you needed to search high and low for them. We have a huge database of investors looking for opportunities to invest in Moscow. Also, there are now a variety of websites, networks, and organizations that can help connect potential investors with businesses. These include venture capital firms, angel investor networks, and private equity firms. You can read our in depth blog post to learn more about the different ways you can find an angel investor in Moscow

Q: How long does it take to get funding from an angel investor in Moscow?

A: It all depends on the amount of effort you put into your search, the type of investor you are looking for, the amount of capital you need to raise, and the size and location of your business. Generally speaking, it can take anywhere from four weeks to six months to secure funding from an angel investor. Finding an investor can be difficult, so we have prepared a guide for you on finding an investor for free.

Q: How much funds should I ask an angel investor to invest?

A: The amount of funding you should ask an angel investor will depend on the size of your company and its growth potential. As per my research, most startups ask angel investors to invest anywhere between $100,000 to $1 million in a startup, and in exchange, they receive a small percentage of the company's equity. There are a lot of things angel investors look for in a startup, and we have explained everything in this separate guide of ours.

Q: How much do angel investors usually invest?

A: This totally depends on the angel investor, the company and its stage, and most importantly, the risk involved. But on average, most angel investors invest anywhere between $25,000 to $100,000. To attract angel investors, you need a fantastic business model, a solid team, and growth potential. We've also prepared a guide on how to attract angel investors.

Q: What is the best way to find an angel investor?

A: The best way to find an angel investor is by using different resources and networks. Networking with like-minded people, attending events, and using social media are great ways to find potential investors. You can also use online platforms and crowdfunding websites like AngelList, EquityNet, and Crowdfunder to find angel investors. We've also written a comprehensive guide on the best to find angel investors that will help you get started.

Q: How do I get connected with an angel investor in Moscow

A: It's a fact that attracting angel investors in Moscow requires a lot of research, networking, and effort. You must identify potential angel investors interested in funding your business, reach out to them, and build strong relationships. You can use websites and networks like AngelList, EquityNet, and Crowdfunder to find potential investors. Check out our guide on how to get angel investors for more detailed information on the process.

Q: How many angel investors are in Moscow

A: The exact number of angel investors in Moscow is hard to pinpoint. According to the Center of Venture Research of the University of New Hampshire, the total number of angel investors in the US is 334,680 as of 2020.

Q: Where can I find angel investors in Moscow

A: There are a lot of ways to find angel investors in Moscow. You can start by exploring online investor directories like AngelList and EquityNet. They provide comprehensive lists of all the accredited investors in the area. You can also attend local investment events and networking meetups. These are great places to meet angel investors and learn more about their investing criteria. Check out this list of the best angel investor networks in Moscow for more information.

Q: Who are called angel investors?

A: Angel Investors are high net worth individuals who invest their own money in early-stage companies. They usually invest in exchange for an equity stake and may provide additional assistance such as mentoring and advice. They are also known as angel investors, private investors, or seed investors. Here's what you need to know about angel investors.

Q: What is the characteristic of an angel investor?

A: Angel investors are usually high net worth individuals who provide much more than just money – they also offer advice and mentorship to entrepreneurs. They often have extensive business experience, contacts, and networks that they can leverage to help the businesses they invest in succeed. Check out the ten things they look for in startup evaluation.

Q: What are the advantages of angels investors?

A: The benefits angels investors provide are just invaluable. They provide not only capital but also mentorship, advice, and access to networks. They implement what is known as 'smart money, meaning that their investment comes with experience and expertise that can benefit the startup. For more information on the advantages of angel investors, read this blog post.

Q: Who can be an angel investor?

A: An angel investor can be anyone with the capital and the willingness to invest in early-stage businesses. They should be willing to take risks, have a passion for startups, and be in it for the long haul. They usually have prior business experience, but this is not a requirement. We have a comprehensive guide if you want to know more about angel investors .

Q: Are angel investors entrepreneurs?

A: Well, that's not really true. Angels Investors are not entrepreneurs, although they do have a lot in common with them. Angel investors provide capital to startups and entrepreneurs in exchange for a stake in the business. If you want to know more about angel investors, check out this guide . It outlines everything you need to know about them.

Q: Who is the most famous angel investor?

A: There are a lot of famous angel investors, but one of the most notable is Marc Andreessen. He is an American entrepreneur, venture capitalist, and software engineer. He co-founded Netscape, the first popular web browser, and has invested in startups since the late 1990s. Want to know more about the famous angel investors out there? Check out this list of the top 8 angel investors of all time.

Q: How do angel investors work?

A: Angel Investors usually invest in early-stage businesses, such as startups and small companies. They provide capital in exchange for an equity stake in the business and offer additional assistance, such as mentoring and advice. If the startup becomes a success, they get a good return on their investment. Find out more about how angel investors work with this guide.

Q: How do I contact angel investors?

A: Angel investors can be difficult to contact, but there are a few ways you can reach out to them. You can join an angel investor network or attend conferences and trade shows to meet angel investors in person. You can also research angel investor directories to find their contact information. Email, however, is the most common way to contact them. Want more details? Check out this guide.

Q: Who is an eligible angel investor?

A: An eligible angel investor is someone who has a net worth of at least $1 million and an annual income of at least $200,000. Check out our in depth guide to find out more about angel investors.

Q: How do I ask angel investors for money?

A: The first thing you should do is ensure you have a well-researched and solid business plan outlining your goals, strategies, and financial projections. You should also prepare an elevator pitch to explain your business idea in just a few sentences. When contacting angel investors, ensure you are professional, confident, and clear about your goals. Find out more about how to ask angel investors for money in this guide.

Q: How many angel investors are in the United States?

A: It's no surprise that the United States is home to a large number of angel investors. According to my research, more than 360,000 active angel investors are in the United States. These investors are spread out across the country, but many reside in major cities such as San Francisco, New York City, and Los Angeles. We have a list of the best angel investors in 2022 that will surely blow your mind.

Q: What is the best website for angel investors?

A: Undoubtedly, there are uncountable websites for angel investors, but none can match the quality and versatility of AngelList. AngelList is a platform that connects entrepreneurs with investors, and it has over 300,000 active angel investors from around the world. Want to know more about AngelList? Have a look at this guide for more information.

Q: How do I find an approach to angel investors?

- Create a professional business plan

- Develop an elevator pitch

- Research angel investors and contact them directly

- Attend conferences and events

- Network with other entrepreneurs

- Leverage social media

Angel Match is the easiest way to research investors for your startup so you can spend less time Googling and more time raising.

IMAGES

VIDEO

COMMENTS

In the long term it's to your advantage to be good. The other component of being a good angel investor is simply to be a good person. Angel investing is not a business where you make money by screwing people over. Startups create wealth, and creating wealth is not a zero sum game. No one has to lose for you to win.

How to Convince Investors. Y Combinator. August 2013. When people hurt themselves lifting heavy things, it's usually because they try to lift with their back. The right way to lift heavy things is to let your legs do the work. Inexperienced founders make the same mistake when trying to convince investors. They try to convince with their pitch.

How to Be an Angel Investor: Why TV Lost: Can You Buy a Silicon Valley? Maybe. What I've Learned from Hacker News: Startups in 13 Sentences: Keep Your Identity Small : After Credentials: Could VC be a Casualty of the Recession? The High-Res Society: The Other Half of "Artists Ship" Why to Start a Startup in a Bad Economy: A Fundraising Survival ...

Yesterday, we featured a famous speech by Charlie Munger, one of the world's most savvy and successful investors. Let's stick to the investing theme for this weekend and seek advice from another world-famous investor today, Paul Graham. As you may remember, we've already featured several Paul Graham essays in previous issues, but we haven't heard from him yet, at least not explicitly ...

In his essay published last month, Startup Investing Trends, Paul Graham (that's this Paul Graham, Y Combinator co-founder) says "one of the biggest unexploited opportunities in startup investing right now is angel-sized investments made quickly."Here's the full quote: I think one of the biggest unexploited opportunities in startup investing right now is angel-sized investments made ...

Listen to How to Be an Angel Investor on wondercraft.ai. All Paul Graham essay's, brought to life in audio format. This is a third party project, independent from Paul Graham, and produced by Wondercraft AI.

Angel Investing Strategies. In his essays, the famous investor, Paul Graham, advises readers to not get hung up on the nuances of a deal — "When angels make a lot of money from a deal, it's not because they invested at a valuation of $1.5 million instead of $3 million. It's because the company was really successful."

Most angel investors had some related experience before they began investing, and they tended to start out on a small scale to get their feet wet. Graham had no such business experience.

Paul Graham wrote about the founder mode on his blog. Here are top 10 quotes from Paul Graham's "Founder Mode" essay : "In effect there are two different ways to run a company: founder mode ...

As an angel, be respectful of the lead investor's time, and be responsive to their inquiries and requests, as they have taken on the extra work and responsibility for no additional gain. Paul Graham, in his essay "How To Be an Angel Investor," writes that being a "good" investor is defined by the following traits:

This is Amara Ventures' reading of Paul Graham's essays. At Amara, we rever Paul Graham and we strongly believe that his essays are a must-read for everyone in the world of tech and beyond. ... The essay reading is done by Minal Desai of Amara Ventures, an angel investment firm in India. To know more about them visit www.amaraventures.co. 27 ...

Maybe someone has a lawyer friend. Maybe the angel pays for his lawyer to represent both sides. (Make sure if you take the latter route that the lawyer is representing you rather than merely advising you, or his only duty is to the investor.) An angel investing $200k would probably expect a seat on the board of directors.

Marginal niche — Graham and YC see a lot of startups that target a small, obscure niche in the hope of avoiding competition. Yet, (1) if you make something really good, you will end up having ...

Our data operations team has logged over 3.5 million hours researching, organizing, and integrating the information you need most. Information on investments, active portfolio, exits, fund performance, dry powder, team and co-investors for Paul Graham. Use the PitchBook Platform to explore the full profile.

Investor Paul Graham set the startup world buzzing again on Sunday with his thoughts on "founder mode"--and three days later, founders, investors and other business leaders are still talking about it.

Paul Graham essays A. Black Swan Farming; A Unified Theory of VC Suckage; Why Smart People Have Bad Ideas; The Venture Capital Squeeze; How to Fund a Startup ... VC 101: The Angel Investor's Guide to Startup Investing; Exploring the Tech Startup Space; Join FundersClub for Free Investors What We Do ...

The Hacker's Guide to Investors. April 2007. (This essay is derived from a keynote talk at the 2007 ASES Summit at Stanford.) The world of investors is a foreign one to most hackers—partly because investors are so unlike hackers, and partly because they tend to operate in secret. I've been dealing with this world for many years, both as a ...

Essays by Paul Graham: You need three things: formidable founders, a promising market, and some evidence of success so far. About. ... But angel investors like big successes too.) How do you seem like you'll be one of the big successes? You need three things: formidable founders, a promising market, and (usually) some evidence of success so far

David Oliver Sacks (born May 25, 1972) [1] is a South African-American [2] entrepreneur, author, and investor in internet technology firms. He is a general partner of Craft Ventures, a venture capital fund he co-founded in late 2017. Additionally, he is a co-host of the All In podcast, alongside Chamath Palihapitiya, Jason Calacanis and David Friedberg. [3] ...

By Jim Forest. Billy Graham died yesterday, 99 years old. His passing triggered memories of time spent with him in Russia in 1988, when we were both guests of the Russian Orthodox Church during the celebrations of the 1000-year anniversary of the baptism of Rus'. "I had many letters from people in the U.S. who were praying in support of the ...

A revival had started, which promised reformation and renewal. A Moscow crowd gathers to see Billy Graham preach in 1992. "Inspired and captivated by what he had seen and heard that day, Michael returned to his village in Ukraine under the influence of Billy Graham's message. Feeling the promptings of God's call and seeing a colossal need ...

A: The exact number of angel investors in Moscow is hard to pinpoint. According to the Center of Venture Research of the University of New Hampshire, the total number of angel investors in the US is 334,680 as of 2020. A: There are a lot of ways to find angel investors in Moscow.

Most startups that raise money do it more than once. A typical trajectory might be (1) to get started with a few tens of thousands from something like Y Combinator or individual angels, then (2) raise a few hundred thousand to a few million to build the company, and then (3) once the company is clearly succeeding, raise one or more later rounds ...