Blog > 10 creative Ideas for your Title- and End-Slides in Presentations

10 creative Ideas for your Title- and End-Slides in Presentations

11.13.19 • #powerpointtips #presentation.

Of all the slides in a PowerPoint presentation, the ones that are without a doubt the most important ones are the first and the last one. It makes perfect sense – the title slide sets the general tone. Make it boring and you’ll loose your audience’s attention within the first few minutes. If you’re making it exciting and innovative on the other hand, you’re taking a big step towards giving an amazing presentation and having an engaged audience. It is very similar with the final slide. It will be the one that people are going to remember most, the one that is supposed to make people leave the room thinking ‘Wow! What a great presentation!’ A bad ending could even mess up what would otherwise be a good performance overall (just think of a good TV show with a bad ending…).

The most common mistakes for title and final slides

If you asked 100 people what belongs on your PowerPoint’s title slide, the majority would answer ‘The title, maybe a subtitle, the presenter’s name and company, the date’. That kind of title slide is alright, but you usually say all of these things in the beginning of a presentation anyway. Also, it is very likely that most of your attendees know these things – they usually signed up for it after all. So what’s the point in listing all of that information on your title slide, when you could also use it for making a stunning first impression? Not only the title slide is commonly designed in an uncreative and conventional way. Too often, you can see PowerPoint presentations ending with the ‘Any Questions?’ or even worse – the ‘Thank you for your attention’ slide. ‘Thank you for your attention’ is a set phrase that has been said so many times it can’t possibly be delivered in an authentic way anymore. Therefore, it’s better to think of something else for your grand final. Finding an unconventional ending that suits your presentation style makes you seem much more charismatic and authentic than using an empty phrase.

1. An inspiring quote

An inspiring quote on your slide is a perfect way to both start and finish your presentation. Well, it does not have to be inspiring. It could be any quote that is somehow connected to your presented topic. Just have fun looking through books and the internet to find interesting quotes that you want your audience to hear. Good pages to look at for inspiration are goodreads and brainyquotes.com .

2. A blank slide

This might seem strange to some people, but a blank slide can be really powerful if you want to have your audience’s full attention. You can use the advantage of blank slides by incorporating them at the beginning, in the end or even in between your regular slides. You can either use a blank slide of your regular template (so there will still be some design elements on it) or go all in and make the slide completely black (or white).

3. A call to action

If the goal of your presentation is to really make your audience act in some kind of way, there is no better way to start – or better yet end your presentation than with a call to action. This can be literally anything from little trivial things like “Drink enough water during the presentation so your brain stays intact!” – which will lighten up the mood – to more serious calls like “Help reducing waste by recycling whenever possible!”.

4. A question

Usually, it is the audience that asks questions after a presentation. However, you can also turn that around and ask your attendees instead. However, it’s important to ask a question that can be answered easily and individually – the best questions involve previous experiences and personal opinions (asking about facts or questions that are hard to understand can often lead to silence and no one wanting to answer).

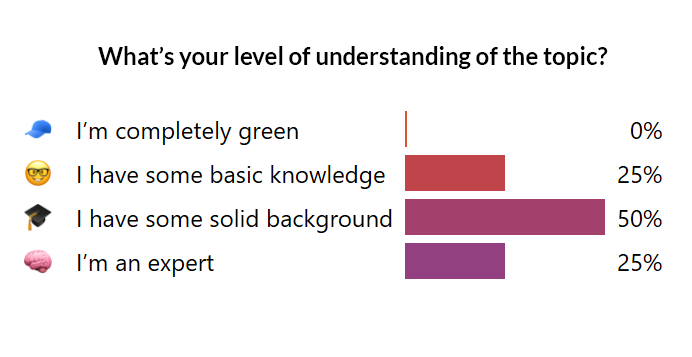

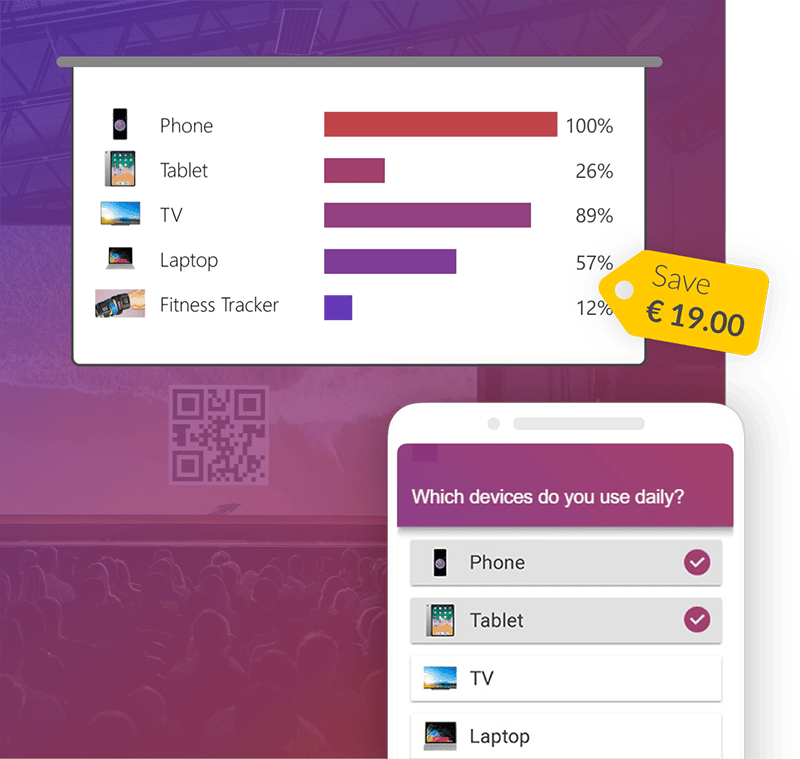

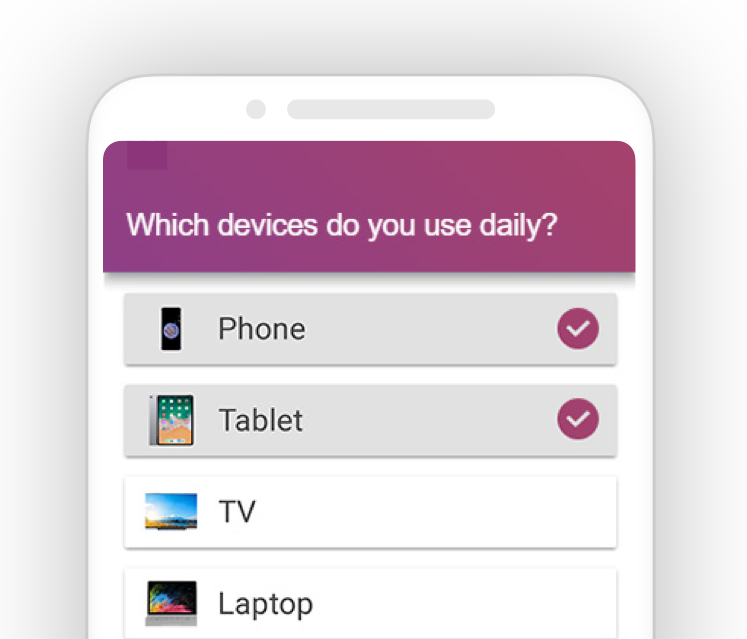

5. An interactive poll

Nothing engages the audience like a live poll. Conduct one right at the beginning to get everybody envolved, and/or wait until the end to get your audience’s opinion on something. Icebreaker polls are the perfect way to start, as they lighten the mood. You can easily create polls for free with interactive software tools such as SlideLizard .

6. A funny picture, meme, or quote

I’m pretty sure that every student nowadays has that teacher that just tries a little too hard to be cool by throwing in a meme on literally every single slide. That may be a bit too much. But just a little comedy at the beginning or in the end can make you seem very charismatic and entertaining and catch the attention of your listeners. Open (or close) with a joke, a funny picture or a quote – whichever you feel comfortable with. It is usually best if it has something to do with the topic you’re presenting.

7. An interesting fact

Catch the audience’s attention by putting an interesting fact concerning the topic on one of your slides – ideally at the beginning, but maybe also in the end (to keep up the audience’s interest even after the presentation is done).

8. The title, but with a twist

If you feel like you need to put the presentations name/topic on the front slide, but still want that little creative twist, just change the title slightly. According to what I’m proposing, rather dull presentation titles like e.g. “Marine Biology – An Introduction to Organisms in the sea” can be transformed to “Marine Biology – Diving Deep” (or something less cheesy if you prefer). Make it either funny or over-the-top spectacular and catch the audience’s attention!

9. A bold statement, opinion, or piece of information

This is probably the best way to capture your audience from the beginning on. Start with a radical, crazy opinion or statement and then get your attendees hooked by telling them that during the presentation, they will learn why you’re right. It could be anything, really, as long as it goes well with your presented topic – from the statement “Everybody has the time to read 5 books a month” to “Going to college is a waste of time” or “The human species is not the most intelligent on earth” – Take whatever crazy, unpopular theory or opinion you have, throw it out there and (very important!) explain why you’re right. You’ll have your audience’s attention for sure and might even change some of their opinions about certain things.

10. No title and end slide at all

Yes, that’s a possibility as well. If you absolutely can’t think of any creative or otherwise good way to start and end your presentation – even after reading the tips mentioned above – then simply don’t. That’s right - no title and end slide at all. You can pull that of by simply introducing yourself in the beginning, then getting right into the topic (which makes a good impression, long introductions are usually rather tedious) and when you’re at your last slide just saying a simple ‘Goodbye, thank you and feel free to ask questions’.

Related articles

About the author.

Pia Lehner-Mittermaier

Pia works in Marketing as a graphic designer and writer at SlideLizard. She uses her vivid imagination and creativity to produce good content.

Get 1 Month for free!

Do you want to make your presentations more interactive.

With SlideLizard you can engage your audience with live polls, questions and feedback . Directly within your PowerPoint Presentation. Learn more

Top blog articles More posts

6 Tips to turn your boring slides into stunning presentations

Microsoft Copilot: A Comprehensive Review of the AI tool

Get started with Live Polls, Q&A and slides

for your PowerPoint Presentations

The big SlideLizard presentation glossary

Visual communication.

If there are used images or videos for communication, it is visual communication. Visual Communication is almost used everywhere like on television, posts on social media (Instagram, Facebook), advertisement.

.ppt file extension

A .ppt file is a presentation which was made with PowerPoint, that includes different slides with texts, images and transition effects.

Virtual Event

Virtual events take place entirely online. They are very convenient as anyone may join from wherever they are via a smartphone or computer.

Recall Questions

With recall questions, you have to remember something or something has to be recalled. Example: A teacher asks his students a question so that they remember the material from the last lesson.

Be the first to know!

The latest SlideLizard news, articles, and resources, sent straight to your inbox.

- or follow us on -

We use cookies to personalize content and analyze traffic to our website. You can choose to accept only cookies that are necessary for the website to function or to also allow tracking cookies. For more information, please see our privacy policy .

Cookie Settings

Necessary cookies are required for the proper functioning of the website. These cookies ensure basic functionalities and security features of the website.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information about the number of visitors, etc.

- Skip to primary navigation

- Skip to main content

- Skip to footer

Laura M. Foley Design

Cheat Death by PowerPoint!

How to create an effective title slide in PowerPoint

April 10, 2013 by Laura Foley 5 Comments

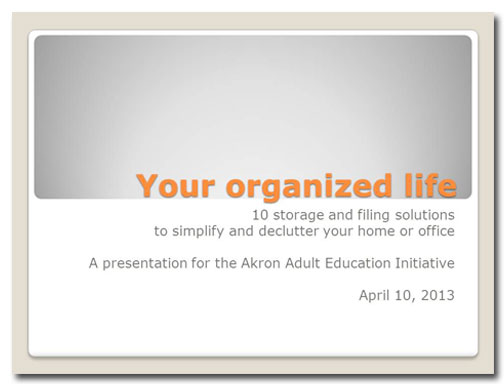

Presenters often overlook a valuable opportunity to connect with their audience: their title slides.

Think about it. Your title slide is up there on the screen while you wait for the audience to arrive and find their seats. It might be onscreen while you’re being introduced by your host. Your title slides can be very effective billboards for you, but only if you design them well.

The most important elements of a title slide

Since title slides are usually on display for a while before a presentation, you want to make sure that they’re doing a good job of marketing you, your topic, and your company. Always include the following elements on your title slides:

- Title of presentation, with a subtitle if the presentation’s title is unclear

- Contact information (email address, Twitter account, website, etc.)

- Company logo

Providing this information on the title slide tells the audience what they’re about to hear, who’s responsible for the presentation, and how to get in touch with you if they need to.

Simple title slides

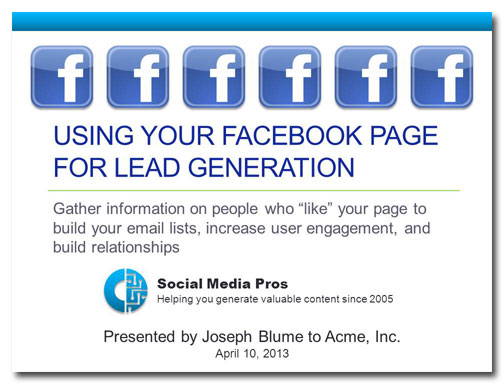

Let’s look at a typical title slide for a corporate presentation:

- There is too much text on the slide and it’s all competing for our attention.

- The abundance of Facebook logos distract viewers from the logo of the presenter’s company.

- That subtitle looks more like a paragraph.

- You don’t have to point out the organization to which your audience belongs. The audience already knows what company they work for.

- You also don’t have to tell them what day it is.

Here’s how I would redesign this slide while remaining true to the template:

- The multiple Facebook logos have been replaced by an image that appears to be on a computer screen. Because I chose the typographic Facebook logo, it doesn’t compete with the presenter’s company logo.

- The presenter’s name appears to be a window on a computer screen, and his email address and Twitter name have been provided.

- The company logo is now on the top of the slide, giving it the most importance.

- The subtitle has been shortened from 19 words to four.

Animated title slides

Sometimes your subject matter will lend itself to a more interesting approach to your title slides. Animating a title slide can be a great way to provide contact information, to invite people to subscribe to your blog or newsletter, or to introduce opportunities for audience participation. The animation reveals information a little at a time, creating anticipation and interest.

We begin with a plain, unimaginative title slide:

Wake me when it’s over

ZZ ZZZZ ZZ ZZ ZZ … snork! Wha…what? I’m awake, I’m awake. I wasn’t sleeping!

The title and subtitle are fine, but, again, the remaining text doesn’t tell the audience something they don’t already know. And the layout is totally boring.

Now you’re talking!

Click on the video link below to see how the animations play on this title slide. I’ve sped up the animation for this demo, but if this slide were actually being used in a presentation I’d wait a couple of minutes between animations.

Presenting this information in the form of sticky notes is a good idea for this particular subject because they are used to organize thoughts and messages. They are often overused, being pasted on top of one another until their original purpose of organization is lost. Take a look at the image below, which is what the audience would see after the animations have played out.

This slide tells the audience who the presenter is, provides a personalized greeting, and includes four calls to action, including an opportunity for an audience member to win a prize. This last bit will keep people interested and engaged in the presentation, because everybody likes getting something for nothing!

What are of your ideas for creating more interesting, informative title slides?

- [email protected]

- (800) 834-7700

- Customer Portal

- Case Studies

- Training Workshops

- Food Manufacturing

- Food Distribution

- Discrete Manufacturing

- Job Shops & Made-To-Order Manufacturing

- Wholesale Distribution

- Business Central On Premise

- Business Central SaaS

- Microsoft Dynamics NAV

- Our Third Party App Partners

- BC / NAV Tune-Up

- Business Central Release Waves

- Microsoft Power Platform

- Microsoft 365 Business Plans

- Microsoft Teams

- Team's Calling Plan

- Customer Voice Surveys

- Business Central Implementations

- NAV Upgrades

- NAV Re-Implementation

- Press & News

- Upcoming Events & Webinars

- On-Demand Webinars

- Conferences

- BC Release Waves

Using Captions and Subtitles in PowerPoint

Posted By Tim Britton | Thursday, August 6, 2020

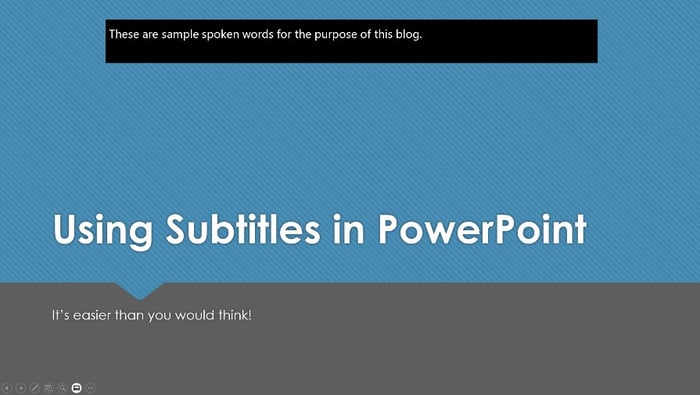

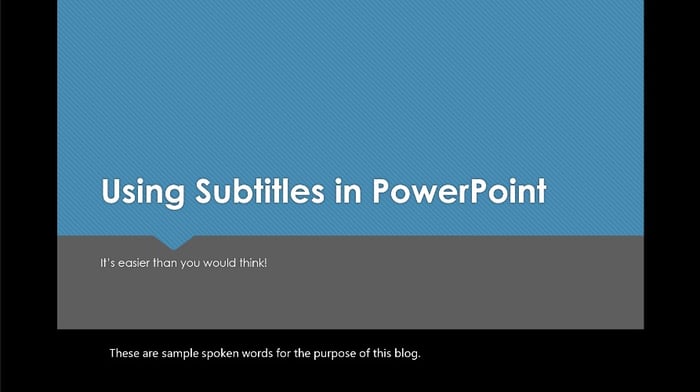

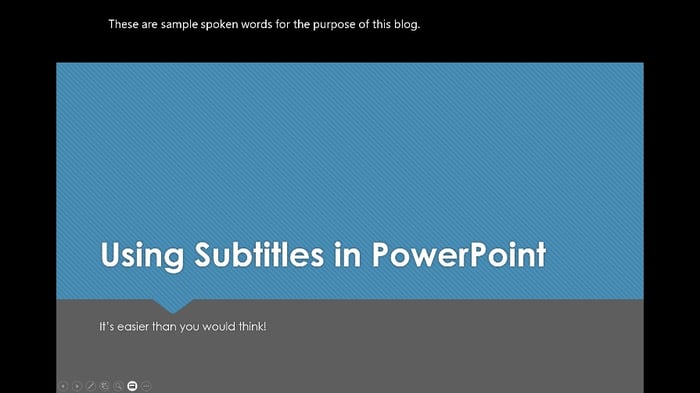

In today's blog, we are going to talk about how to use subtitles in PowerPoint. This useful feature helps ensure your audiences understand what is being said and is a great accessibility option.

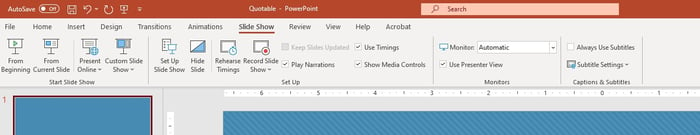

To get started, open a presentation and select Slide Show from the main navigation ribbon.

At the far right, you will see a sub-menu called Captions and Subtitles . Go ahead and check the option to Always Use Subtitles, which turns on captions for your slide show. Captions and subtitles use Microsoft speech recognition services to provide you with real-time closed captioning for your presentation.

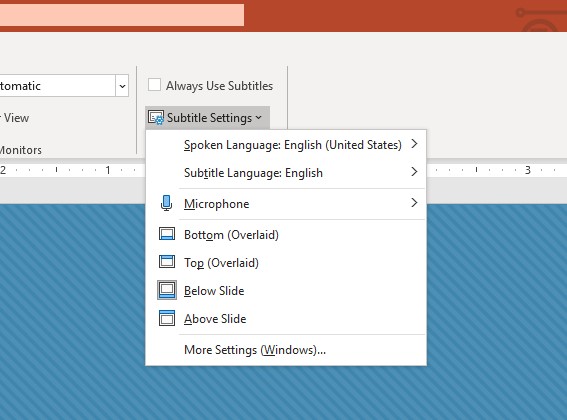

Adjusting Your Subtitles/Captions with Subtitle Settings

Under the Subtitle Settings menu, you will find a series of options to customize your subtitle experience. Let's take a closer look at each of these options in order.

- The first option you will see in your menu is the Spoken Language . You will want to choose the language that you are going to be speaking when you give the presentation. In most cases, you should not need to change this, but it's good to know the option is there in case you do.

- The second option is the Subtitle Language . This shows what language your dialogue will appear in. Microsoft Speech technology will convert your spoken words to the selected language in real-time. I have been very impressed with the overall quality of this AI. In my testing, this feature has worked accurately with every word I say.

- Continuing down the list, the next option is Microphone Settings . It is critical that you select the microphone you are going to be using as the output. Otherwise, this feature may not work as expected.

The next set of options relate specifically to the way your subtitles are formatted in the actual presentation. Below I have screenshots of how each of those captioning options looks when viewed in presentation mode.

Bottom Overlaid

Top Overlaid

Below Slide

Above Slide

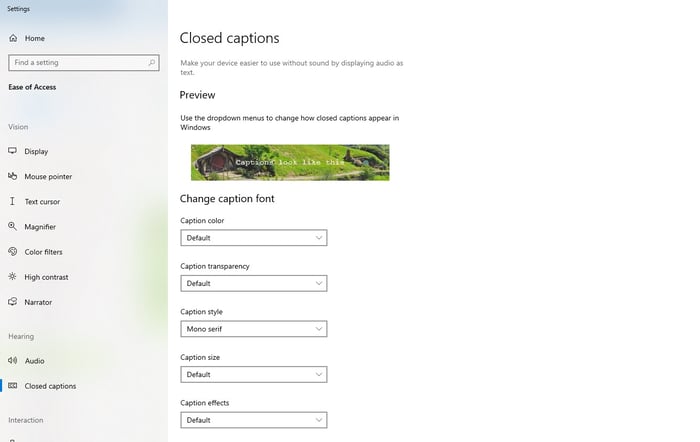

More Settings for Captions/Subtitles in Windows 10

The last option in the Captions and Subtitles Menu is More Settings , which sends you to your computer’s settings to optimize the appearance of your text. I will show you what options you have in Windows 10.

The settings menu for Closed Captioning in Windows 10 is broken into 3 parts. They are:

Change Caption Font

- Change Caption Background

- Dim Window Content

Here are quick summaries of your options in all three categories

- Caption Color: Change the font color of your subtitles

- Caption Transparency: Set varying degrees of opacity to your font

- Caption Style : Change to a different font

- Caption Size: Change the overall size of the text

- Caption Effects: Some additional effects for you to choose from, most notably adding a drop shadow

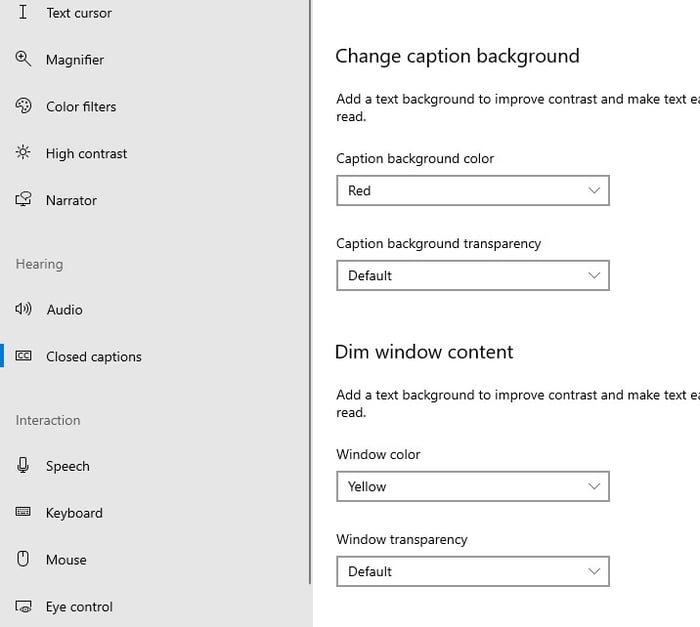

Change Caption Background and Dim Window Transparency

These menus allow you to change the color and transparency of both the window and the text background for your captions.

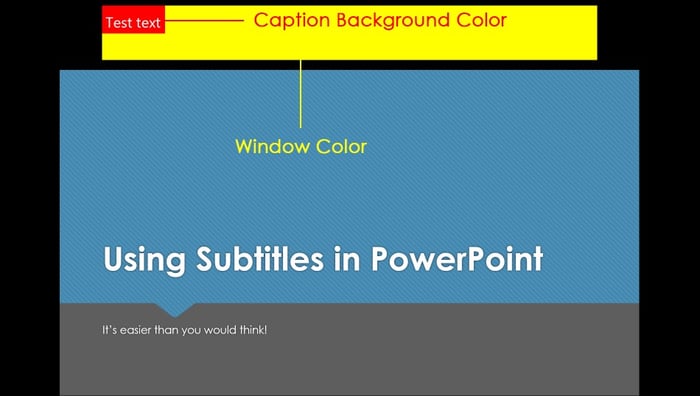

To give you a helpful visual of what that means I took a screenshot where I selected red for the caption background color and yellow for the window color.

I hope this overview has given you a good grasp of how to leverage this nifty feature when giving presentations.

If you have any questions or suggestions for another PowerPoint blog topic please feel to reach out via email [email protected] . You can also check out these other entries in my ongoing series of PowerPoint tutorials.

Related Posts

The Right Tool to Support Your Migration to The Cloud

Microsoft's New Commerce Experience (NCE) Explained

5 Reasons You Should Move to Windows 365

View All Events

Contact Info

Innovia Headquarters: 1062 Oak Forest Dr. Suite 300 Onalaska, WI 54650

Phone: 800.834.7700

Innovia is a multiple-award-winning Microsoft Dynamics NAV and Business Central consulting firm known for delivering innovative Microsoft ERP systems while providing exceptional client-focused service.

One Time Code

< Go back to Login

Forgot Password

Please enter your registered email ID. You will receive an email message with instructions on how to reset your password.

How To Create A Captivating Title Slide For A Presentation

Are you looking for a way to ditch the boring title slide and hook your audience from the start? This blog will teach you all you need to know to nail your first impression. We’ll break down the key ingredients for a captivating PowerPoint title slide, right from must-have elements to the art of titling with PowerPoint. Plus, you’ll get a step-by-step guide on how to create a title slide that will set the stage for a killer presentation.

When designing your PowerPoint presentation, there is no doubt that the most crucial slide is the one at the beginning of your presentation. A well-designed title slide can amp up your presentation game and instantly grab your audience’s attention.

What Is A Title Slide?

As the name suggests, a title slide is the first slide of a PowerPoint presentation. Usually, a title slide’s content is the presentation’s title and subtitles.

What Is The Purpose Of A Title Slide?

A title slide for a presentation has to be interesting to stand out, and one has to be very cautious while making a title slide. If you make it dull, you will lose your audience’s attention within minutes. An excellent first slide is not only a reflection of professionalism but also a great way of triggering that much-needed initial interest.

What Should Be Included In The Title Slide?

A title slide contains:

- the title of the presentation.

- a preface of a presentation, at times.

- author’s name.

- a background relevant to the topic of the presentation, at times.

- the branding of the company

How To Create A Title Slide For Presentation

Based on the device or platform you’re using PowerPoint on, you can pick from three different methods to create a presentation title slide in PowerPoint.

Method 1: Choosing A Template From The PowerPoint Library For Creating A Title Slide

Step 1: To create a title slide, open the PowerPoint presentation application and click on ‘New.’

Step 2: You will find many PowerPoint templates; double-click on the template you like and click on ‘Create.’

Step 3: The template you chose will appear. Now, the template will already have a title slide design.

Step 4: Click on the title and edit it according to your needs.

Step 5: Select the title and edit its font style, color, thickness, etc. You can customize the title, keeping in mind the background color or image of the slide.

Step 6: You can play around with the title slide’s image by cropping or adjusting it to meet your presentation style requirement.

Step 7: If you don’t like the background image, you can even delete it and adjust it according to your liking by clicking on the ‘Design’ tab and then on ‘Formate Background.’

Step 8: Tip: A plain title slide looks boring; therefore, add animations by clicking on ‘Animations’ on the file menu bar. Select the title and choose any animation.

And voila! Your title slide is ready. Make sure to play around with more tools and options to find out more features you can do to make it more attractive and presentable.

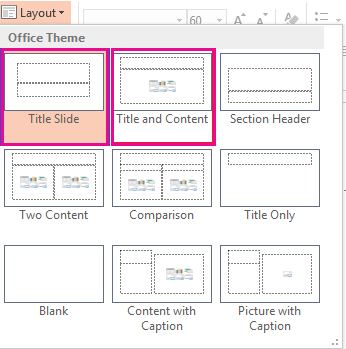

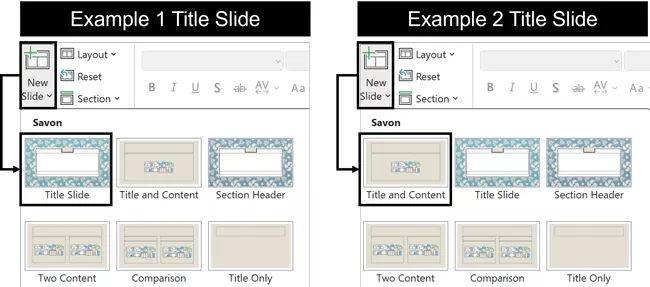

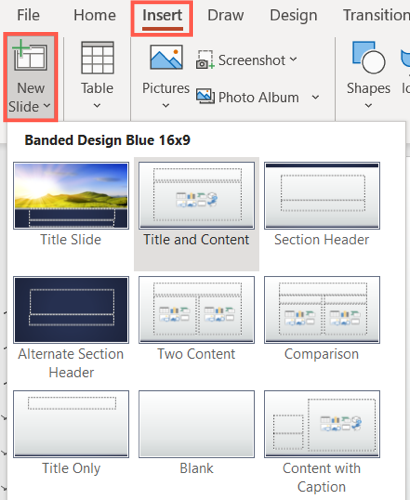

Method 2: Create A Title Slide Design Using The ‘Layout’ Option

Step 1: Open a blank presentation in your PowerPoint application and select the slide you wish to convert to a title slide.

Step 2: Click Home > Layout. Select Title Slide for a standalone title page or select Title and Content for a slide that contains a title and a full slide text box.

Step 3: Select the Click to add title text box. Enter your title for that slide.

As the previous method shows, you can similarly play around with Powerpoint animations, fonts, and colors to make it more aesthetic.

Method 3: Create A Title Slide Using Slideuplift’s PowerPoint Add-In

Slideuplift provides a plethora of templates that can assist you in making a title slide. These templates are accessible through their PowerPoint Plugin.

Follow the steps given below to make a title slide using Slideuplift PowerPoint Add-In.

Step 1: Open the slide which you want to edit.

Step 2: Go to ‘Insert,’ then click on ‘Get Add-Ins.’

Step 3: In the search bar, type ‘Slideuplift’ and click on Search.

Step 4: Click on the ‘Add’ button next to SlideUpLift, then click on ‘Continue.’

And you are done! Just type cover slides on the search console and get various PowerPoint title slides for your presentation. You can choose the one you like and make edits.

How To Title A Slide In PowerPoint

Writing a catchy title is very important. A catchy title triggers the viewers’ interest and shows that you have made some effort to make the presentation.

A title also sets the tone for a presentation; for instance, a business presentation title slide and a title slide for informal events will have a formal tone and a casual or neutral tone.

The following tips can help you write catchy presentation titles.

- Make it easy to understand.

- The title should be directly related to the presentation.

- Add an element of emotion to the title (keep it neutral during formal meetings and try to add humor if the occasion allows)

- Match other elements of the title slide, like background image, font, etc, with the title.

- Keep it concise and to the point.

Having a beautiful and functional PowerPoint title page is very important if you want to catch the attention of the viewer. A bland title page is not only boring but also shows your lack of effort, which can be a deal breaker. At the same time, keep the presentation cover page minimalistic, and only use animations and effects that add value and look interesting.

Creating the perfect title slide sure does take a lot of time and effort. We at SlideUpLift have curated a collection of PowerPoint title slides that can be used as a starting point for your presentation. These PowerPoint title slide ideas are 100% customizable and can be used on both PowerPoint and Google Slides.

It’s time to buckle up for your next presentation now that you know how to create an interesting title slide.

What Is A Good Title For A Presentation?

A good presentation title is short (under 15 words). It teases the benefit for the audience, which is what they’ll learn. Use a question, surprising fact, or statement that intrigues the audience.

How Do You Title A Presentation Slide?

Based on which device or platform you’re using PowerPoint on, you can title a presentation slide using:

- The accessibility ribbon

- The layout option

- The outline view

Can I Add a Title To Multiple Slides At Once?

Although there isn’t a way to add the same title to multiple slides, you can use these workarounds to add a title slide to all your slides at once:

- Go to Slide > Edit theme. Add your title as word art to the theme. This way, it will show up on every slide in that presentation.

- You could also try creating your first slide and duplicating it to create the remaining slides. This way, you’ll skip typing in the title each time.

What Do You Say In The Title Slide Of A Presentation?

Your title slide PowerPoint should include a short, catchy title (benefit-focused!), your name for credibility (optional), and maybe the date/location for handouts (skip it on the slide itself).

Where Is The Layout Of The Title Slide Present In Powerpoint?

The layout of the title slide is present under the ‘home’ tab. You can change the title slide’s layout with the help of this tool.

Table Of Content

Related presentations.

Title Slides Collection

Cover Slides Colection

Animated Presentation Templates

Related posts from the same category.

15 May, 2023 | SlideUpLift

How To Add Slide Numbers To PowerPoint

Adding slide numbers to PowerPoint presentations is an important aspect of creating effective presentations. Slide numbers not only help you organize your presentation but also allow your audience to follow

16 May, 2023 | SlideUpLift

How To Move A Slide In PowerPoint

PowerPoint is an excellent presentation software that helps you create eye-catching yet informative slideshows. Whether you are making a business presentation or a school project, knowing how to move a

22 May, 2023 | SlideUpLift

How to Add a New Slide in PowerPoint

PowerPoint is a powerful tool that allows users to create engaging and dynamic slideshows for various purposes. Adding new slides to a PowerPoint presentation is a fundamental skill that is

3 May, 2024 | SlideUpLift

How To Delete A Slide In PowerPoint? [1-Minute Guide]

Whether you are giving a presentation at work, school, or to friends and family, ensuring it is polished and professional is crucial. Figuring out how to delete a slide in

How To Copy And Paste a Slide In PowerPoint

When making presentations, you can save time and effort by simply copying and pasting a slide into PowerPoint. The duplicate slide option in PowerPoint is useful to eliminate the two-step

31 May, 2023 | SlideUpLift

How to Hide And Unhide A Slide In PowerPoint

If you've ever used PowerPoint to create a presentation, you are aware that one of the reasons for its popularity is the program's extensive selection of options. There will inevitably

7 Dec, 2022 | SlideUpLift

How To Create Neumorphic PowerPoint Presentation To Dazzle Your Audience?

Neumorphic designs are a relatively recent design style that was first used in the User Interface design of gadgets in the previous decade. The perfect and straightforward design is unexpectedly

25 Jan, 2018 | SlideUpLift

PowerPoint Hack: How To Create Sections In PowerPoint And How To Zoom In PowerPoint

This PowerPoint tutorial is about How To Create Sections In PowerPoint. Imagine that you are about to begin your business presentation to a room full of clients, and you remember

26 Sep, 2022 | SlideUpLift

Learn How To Create A PowerPoint Template To Build Engaging Presentations

If you use PowerPoint often to make professional presentations, you probably have realized that PowerPoint Library doesn’t have sufficient PowerPoint templates available for all types of presentation needs. As it

26 Mar, 2024 | SlideUpLift

How To Create An Org Chart In PowerPoint?

Have you ever needed help explaining the intricacies of your company or project's structure to an investor, management, or employees? Whatever the case, creating an org chart can be a

Related Tags And Categories

Forgot Password?

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

- Customer stories

- Microsoft 365

Present more inclusively with Live Captions and Subtitles in PowerPoint

- The Microsoft 365 Marketing Team

- Microsoft Stream

Live presentations can be thought-provoking, inspirational, and powerful. A great presentation can inspire us to think about something in an entirely different way or bring a group together around a common idea or project. But not everyone experiences presentations in the same way. We may speak a different language from the presenter, or be a native speaker in another language, and some of us are deaf and hard of hearing. So, what if speakers could make their presentations better understood by everyone in the room? Now they can with Live Captions and Subtitles in PowerPoint .

In honor of the United Nations International Day of Persons with Disabilities , we’re announcing this new feature—powered by artificial intelligence (AI)—which provides captions and subtitles for presentations in real-time. Live Captions and Subtitles in PowerPoint supports the deaf and hard of hearing community by giving them the ability to read what is being spoken in real-time. In addition, captions and subtitles can be displayed in the same language or in a different one, allowing non-native speakers to get a translation of a presentation. At launch, Live Captions and Subtitles will support 12 spoken languages and display on-screen captions or subtitles in one of 60+ languages.

Live Captions and Subtitles in PowerPoint brings:

- The power of AI to presenters, so they can convey simple and complex information across subjects and topics.

- Speech recognition that automatically adapts based on the presented content for more accurate recognition of names and specialized terminology.

- The ability for presenters to easily customize the size, position, and appearance of subtitles. Customizations may vary by platform.

- A peace of mind with security and compliance knowing that the feature meets many industry standards for compliance certifications.

The feature joins other accessible features in Office 365, like automatic suggestions for alt-text in Word and PowerPoint , expanded availability of automatic closed captions and searchable transcripts for videos in Microsoft Stream , enhancements to the Office 365 Accessibility Checker , and more.

Here’s what one of our customers had to say:

“We are constantly looking for new ways of ensuring that the Government of Canada sets the highest possible standards as an accessible and inclusive workplace. We welcome such positive advances in technology, like this feature, that allows everyone, and notably those with disabilities, to better communicate ideas. They help break down barriers and lead to greater inclusiveness to the benefit of individuals and society as a whole.” —Yazmine Laroche, deputy minister responsible for Public Service Accessibility

Live Captions and Subtitles in PowerPoint will begin rolling out in late January 2019 and will be available for Office 365 subscribers worldwide for PowerPoint on Windows 10, PowerPoint for Mac, and PowerPoint Online.

Related Posts

From empowering frontline workers to accessibility improvements—here’s what’s new in Microsoft 365

Reduce the load on frontline workers with the right management technology

3 ways technology can help rebuild your frontline workforce

3 ways to support frontline workers in a hybrid world

Unsupported browser

This site was designed for modern browsers and tested with Internet Explorer version 10 and later.

It may not look or work correctly on your browser.

- Presentations

How to Make a Great PowerPoint Title Cover Slide Quickly (+ Video)

Want to avoid creating another boring presentation? Well-designed presentations make a great first impression. A PowerPoint title slide sets the stage for your subsequent slides!

Your PowerPoint title slide is critical for a successful slide deck.

Half the battle is building excitement with a PowerPoint title page. Invest extra time to add design polish to your cover slide PowerPoint design. Build a bold PowerPoint title slide that shows your audience that you're excited to share!

In this tutorial, I'll show you how to build a PowerPoint title page. You'll see intro slide examples that spark success. Attention is everything, and presentation title pages help you get and keep it. It's quick, easy, and key to success in 2024!

Learn How to Make Great Presentations Today: Grab our FREE eBook!

Before we take a closer look at PowerPoint cover slides, let's look at another great resource. We've got a helpful complement to this tutorial. Download our FREE eBook: The Complete Guide to Making Great Presentations . Grab it now before you read on .

How to Quickly Make Great PowerPoint Presentation Title Cover Slides (Video)

If you're making a PowerPoint title slide for your presentation, you need it to look good. Learn how to make a visually appealing PowerPoint title page quickly in the video below:

To learn even more about cover slides for PowerPoint, study the rest of the tutorial. You'll see real world examples of PowerPoint title pages. These presentation title page designs are tried-and-true options for great design.

Jump to instructions for the type of PowerPoint cover slide you're interested in:

- The Logo Slide

- The Big Question Slide

- The Introductory Slide

- The Roadmap Slide

- The Team Slide

- The Quote Slide

- The Challenge Slide

The Seven PowerPoint Cover Slides to Build

There's no limit to the directions that you can take your PowerPoint title slide. You can let your creativity run wild as you build title page in PPT designs.

But it's hard to disagree that the first slide is going to set the stage for the rest of your presentation. So, it's essential that your presentation gets off to a strong start. But what direction should you go with your presentation title page so that you grab and keep audience attention?

In this tutorial, you'll learn to build seven types of PowerPoint title slides. Here are the intro slide examples that I tend to think about when designing my PowerPoint title pages:

- The Logo Slide. Focus on the branding and brand image of your group with this PowerPoint title page! Start off by putting your logo and tagline front and center.

- The Big Question Slide. Most presentations work to inform. But it's also fun to flip the script and ask a question of your audience. It kickstarts the conversation.

- The Introductory Slide. This slide focuses on showcasing your credentials and background to establish authority.

- The Roadmap Slide. Chart the course for your presentation ahead by giving a sneak preview of the topics you'll cover.

- The Team Slide. Does your presentation focus on a group's effort? It's a great idea to start your presentation by showcasing all the minds behind the project.

- The Quote Slide. Sharing an inspirational or motivational quote is a fun way to engage your audience.

- The Challenge Slide. Many presentations strive to help solve problems. Set the stage by highlighting the big challenge immediately.

In this tutorial, we're going to build an example of each of these PowerPoint cover slides. We'll use pre-built templates to create impactful slide designs with ease. Let's dive in!

How to Make PowerPoint Title Slides

We're going to use an impressive template called the BePro PowerPoint Business template. This is one of the top PowerPoint templates for Envato Elements subscribers.

BePro has a litany of cover slide PowerPoint designs that you can use to create the perfect PowerPoint title page! It also includes several color schemes to make it easy to reuse on multiple presentation title pages.

Explore the BePro Template

Envato Elements includes over 25,000 premium PowerPoint themes! You have countless title page in PPT options. With these, you can build amazing intro slide examples of your own. Start with this collection for more great ideas:

Now, you can learn about each of the seven types of title slides:

1. The Logo Slide

The Logo Slide focuses on your brand image and showcasing the logo of your company. Branding takes center stage with this title page in PPT concept. It's ideal to use a logo slide to show your branding on the PowerPoint title page when you're building brand awareness.

A good starting point for this slide is slide design three that's built into the BePro template. It's perfect for just adding a logo and background image. In the example below, I dropped in the logo on the slide. I also took the same logo and faded it into the background image placeholder.

Make sure too that your version of the logo slide stays with the branding message. Adjust the colors of shapes and text to match the overall color scheme of your business. Presentation title pages should always fit with your overall brand style.

Building a logo slide as your title slide doesn't have to be complicated. A well-made logo slide shows your branding quickly. An alternate option for this slide is slide design 4, a simple slide with a dark color scheme. Just add your logo to that slide to create contrast.

2. The Big Question Slide

Your audience may be expecting you to impart knowledge on them. But you can flip the script by asking a question up front.

The "Big Question Slide" doesn't take much time to design. It helps you free up time that you can spend thinking about the rest of your content.

When you're writing a presentation, there should always be a goal or big idea. In the example below, I used the minimalist slide design 4 to ask a question of the audience. Over the course of the presentation, I'll answer this question for the audience.

If you aren't answering a question or sharing an idea, it might be time to re-think the content.

3. The Introductory Slide

There's nothing wrong with getting a bit personal in your presentation. Set the stage by building your authority and expertise, and the audience will trust and follow you through the presentation.

BePro has many slide designs that work well for this, but I opted for slide 25. It's a clean and straightforward slide design. It's easy to add points that explain your expertise to the audience.

As you can see above, I also added a stock photo as the background image. Envato Elements features a ton of stock images as part of the subscription. They're ideal for sourcing a stock image for your presentation.

In my example slide, I grabbed a great photo and faded it into the background. It's a great reminder that Elements is a total solution for building presentations—not just for the PowerPoint templates.

4. The Roadmap Slide

The roadmap style slide is used to tell the story of where your presentation is headed. I've sat through many presentations that seemed to wander through the agenda and would've benefitted from a roadmap slide.

When you build a roadmap, you show the audience the direction that you'll take them on over the course of the presentation.

Slide design 41 might take a bit of customization, but I do think that it's the perfect choice for showcasing your roadmap for the presentation. Just update each of the four placeholder boxes with a key section of your presentation to architect the roadmap of your big speech.

5. The Team Slide

This type of slide is the perfect intro to showcasing a project that was a total team effort. If you're going to spend your presentation sharing how you built a big app, product, or project, it's only right that you share the credit with your team.

Slide 22 in BePro is the perfect choice to build a team slide of your own. It's tailor-made to drop in images and descriptions of your team members and see it come to life.

In my example below, I put a vital member of the project team in each of the image placeholders. Giving a brief background or description of their contribution to the project is a great way to set the stage.

I think the Team Slide approach is perfect when multiple speakers are involved. Some of my favorite presentations are when several different presenters will each take a part of the presentation. If this is the style of your presentation, use a team slide that introduces everyone's role and contributions.

6. The Quote Slide

Starting off with a quote is a great way to build a PowerPoint cover slide. Share a signature quote and you can inspire and engage with your audience! Quotes provide motivation and inspiration. They can be key to helping you convey your message.

Let’s use slide #9 in the BePro template. Over on the left, you’ll see a text placeholder. Here, you can quickly keyboard in a quote to share with your audience. Optionally, up at the top, you can add a title. Using this layout as your title slide makes for a fun and inspiring opener.

As you can see, it’s easy to add a quote to your cover slide PowerPoint design. This is a good way if you’re motivating your audience to take action. Sharing the inspiring words of others helps you inspire confidence and drive your audiences to act on your message.

7. The Challenge Slide

In PowerPoint, you’re often sharing the solution to a problem. Don’t waste time - address things head-on right away! To do that, consider PPT title slide examples that outline a challenge. After all, if you’re proposing solutions, you first must define the challenge.

Above, I’ve used slide #6 to create a challenge slide. Once again, the process is quick and easy. Simply swap out the placeholder content with your own words and numbers. When you use layouts like this, there will be no confusion on the part of your audience. You can clearly show the challenge that must be accepted.

5 Quick PowerPoint Title Cover Slide Design Tips for 2024

We've looked at how to make a great PowerPoint cover slide. Soon, you can begin building amazing slides on your own.

Still need inspiration? These tips can serve as PPT title slide ideas. Let's check out five quick design tips that are sure to help you out:

Bold style is essential on your PowerPoint cover page. Remember, you've got one goal: capturing audience attention . Sharp, eye-catching design does exactly that on cover slide PowerPoint designs.

Premium templates built by creatives provide unmatched designs. They even help inspire you to do your very best work. I think of templates as a top source for PPT title slide ideas. And they're incredibly easy to customize, making you look like a PPT expert.

2. Create Your Own Layouts

PPT decks are really frameworks for your message. Inside the app, you've got the flexibility to customize every slide layout. That's never more important than on the first page of PPT presentations.

By adjusting layouts, you can show exactly what you want, where you want. It's the best way to create a memorable and unique PowerPoint cover page.

Ready to implement PPT title slide ideas of your own? Tweaking layouts helps you do just that. Learn how to customize PPT layouts with our quick tutorial:

3. Embrace Minimalism

Minimalism. It's a popular design aesthetic, and for good reason. It adds style without being overpowering or distracting. That's perfect for a PowerPoint cover page.

Try to build a cover showing only the essentials. These could be things like an image, the presentation title, a date, and your name. Be careful to avoid adding clutter: it's a quick way to lose your audience.

4. Add Kinetic Typography

You might not think of animated text. But it's actually a great way to grab attention and lock in audience focus on your title page in PPT. Thanks to PowerPoint, you can add these animations (called kinetic typography) easily.

Kinetic typography brings subtle, stylish text animation to any slide. It's ideal for the first page of PPT presentation layouts in need of a bit more energy.

Learn how to use kinetic typography in just 60 seconds here. It's yet another source of inspiration for PPT title slide ideas:

.jpg)

5. Use Industry-Specific PowerPoint Cover Slides

First impressions are key in a title page in PPT, and you'll make one with your PowerPoint cover page. So why use generic layouts if you can find something specifically suited to your needs?

My favorite PPT title slide ideas are situation specific. That means choosing PowerPoint title slides that match your purpose. Check out Pizzarena , for example. The designs are targeted at a pizza restaurant. That's far from the norm, but it will instantly resonate with your audience with eye-catching intro slide examples.

This might mean choosing a premium template built for your industry. Or, you might add your brand's colors, logos, and more. Either way, being specific and tailoring your cover slide to your needs is sure to impress.

5 Top PowerPoint Title Cover Slide Templates (For 2024 Presentations)

Premium templates from Envato Elements include stunning PowerPoint cover page designs. And remember, they're a top source for intro slide examples. Let's check out five of the very best PowerPoint templates with built-in PPT title slide examples:

1. VERA PowerPoint Template

Bold colors abound in this visually stunning PPT deck. With 55 unique slides, you're sure to find the perfect PowerPoint cover page. Also, inside is a custom icon set that's easy to work with. This title page in PowerPoint template is perfect for almost any project.

2. STYLE - Multipurpose PowerPoint Template V50

Style: it's in the name of this template, and for good reason . This is a perfect example of a sleek, minimalist PowerPoint cover page. Customize it in seconds, and with 4,000 slides to choose from, your options are almost unlimited. You're sure to find outstanding options for title page in PowerPoint designs!

3. IPSUM - PowerPoint

IPSUM offers a key part of a successful PowerPoint cover page. That's creative flexibility. Over 50 layouts are built into the pack. You can use those pre-built designs as PPT title slide examples! You'll also see custom infographics, icons, and more. Each slide element is completely editable.

4. Livy PowerPoint

Searching for a timeless, retro inspired PPT cover page? Livy has you covered. With 50 slides and resizable graphics, it's easy to adapt to your project needs. The included gallery slide makes for a perfect mosaic cover layout. It's yet another great example with PowerPoint title slide examples.

5. Conference PowerPoint Presentation Template

Last but not least is Conference, a modern PowerPoint cover page deck. Choose between multiple color themes and quickly add in your content. Plus, slides are pre-animated, saving you precious time as you build a title page in PowerPoint! Each slide is in full HD, helping them look great on large screens.

More Top PowerPoint Templates

PowerPoint templates give you a tremendous advantage when creating a presentation. Many of them even give you pre-built title page in PowerPoint designs. You've already seen options for PowerPoint cover pages in this tutorial, but these just scratch the surface.

Check out more of the top templates below. Many of these templates give you even more options for PowerPoint title slide examples:

Learn More About How to Use PowerPoint

PowerPoint is a fantastic app because it's easy to learn. But it also has many advanced features that you can use to build beautiful slides. The title slide designs and the template we used to build them are a great example of how easy it can be.

Still want to learn more about PowerPoint? One of the best resources for learning the app is our article, Ultimate Guide to the Best PPT . That guide and the tutorials below will help you build competence and present confidently.

.jpg)

The Top Source for the Best PowerPoint Cover Slide Templates (With Unlimited Downloads)

As we've shown, the title page of your PowerPoint presentation sets the tone. But you need to make sure that the rest of your presentation looks good too.

The best way to build a presentation is to use pre-built templates from Envato Elements. Elements has a massive library of PowerPoint presentation designs you can use. Each template has starter slides that you can just drop your own content into! The PowerPoint cover slides we feature are the fastest way to design.

Find PowerPoint Templates

The best part of Elements? It's an all-you-can-download creative buffet. With a single subscription, you've got access to all that Elements offers. It includes thousands of PowerPoint designs plus millions of total creative assets. That includes:

- stock photos

- so much more!

With Elements, finding the perfect assets is easier than ever. Use the tool to find PowerPoint title slide examples, and so much more with a bit of AI-assisted help. Elements now includes a powerful AI search tool ! With it, you can simply describe your own project needs.

With this prompt, Elements will deliver a curated list of assets from the vast library! It's an amazing way to save time and find the perfect content for your title page in PowerPoint. Join Elements and try it today!

Make Great Presentations ( Free PDF eBook Download )

We also have the perfect complement to this PowerPoint tutorial. It walks you through the complete presentation process. Learn how to write your presentation, design it like a pro, and prepare it to present powerfully.

Download our new eBook: The Complete Guide to Making Great Presentations . It's available for free with a subscription to the Tuts+ Business Newsletter.

Start Using PowerPoint Cover Pages Today

In this tutorial, you saw some of the best options for PowerPoint cover pages inside of premium templates. These files set the tone with the help of the first page of PPT presentations, presented perfectly. Choose one of these templates and get started now.

When you use these PPT title slide examples, you’re sure to wow your audience. You’ll kick off every presentation with a strong start! You’ll capture attention and keep everyone engaged. Try it today!

Editorial Note: This tutorial was originally published in August of 2019. It's been revised to make it current, accurate, and up to date by our staff—with special help from Andrew Childress .

Home Blog PowerPoint Tutorials How to Add Title Slides in PowerPoint

How to Add Title Slides in PowerPoint

Before you can begin showcasing your work or open up a topic for discussion before your audience, you can start with the title slide! Since a title slide template is the first impression of your slide deck , it is essential that you pay special attention to it.

What is a Title Slide?

A title slide contains the slide title, introduces the topic, and often includes other relevant details, such as the name of the presenter and the organization they are representing. The title slide is an important part of the presentation and is often good for marketing your ideas beforehand using creatively crafted layouts.

Slide Vs. Title Slide Layout

A title slide contains the title in a presentation deck. The layout of such a slide can contain a title, subtitle, and other relevant information. The title slide also often includes particular branding, such as the company’s logo or/and tagline.

Slide layout refers to not only the cover or title slide and other types. The layouts used in a presentation can differ according to the needs of the presentation. For example, other than the title slide, a presentation might have a picture layout, chart layout, dashboard layout, etc. The title slide will be the introductory slide of the presentation containing the presentation title .

How to Add Titles to Slides in Microsoft PowerPoint

If you’re making a presentation from scratch rather than using a PowerPoint template , you will notice that a title slide is added by default when you start a new PowerPoint presentation. You can also add it via Home -> New Slide .

When making a title slide, you can also seek help from PowerPoint Designer, which provides suggestions based on the content of your slide, such as the text and layout of the slide you are using. To view suggestions regarding adding a slide title, click Designer from the Home tab and click on a design from the right sidebar to change your PowerPoint design.

How to Create an Effective Title Slide?

Merely adding a slide title isn’t enough to create a title slide that can help get the message across to the audience at the very start of the presentation. Below are some examples of title slides in PowerPoint that can help you design effective title slides. You might also be interested in our article about how to start a presentation .

Title Slide that Provides Basic Information

The most common method for making a title slide is to use text that can easily explain the presentation context. If you are making a presentation for an interactive discussion, this can be mentioned in the title slide. Similarly, a slide deck to guide discussion for a one-on-one meeting can mention the context of the meeting.

Title Slide that Visually Represents the Topic

A title slide can visually represent the topic. For example, the title slide shown below clearly elaborates on the topic under discussion, i.e., the digital divide. Such a title slide can help effectively deliver a message visually, even before the presenter elaborates on the topic.

Title Slide that Invokes Curiosity

Sometimes, making an ambiguous title slide is best to cause curiosity. This technique is often used to keep the audience interested and guess the presentation’s context. The technique can also be useful when aiming to persuade an audience during a presentation.

Related: See our article about the Zeigarnik Effect for presentations.

Zooming Title Slide

Zooming slides have been the hallmark of presentation platforms like Prezi. Some PowerPoint templates also come with a similar effect for title slides that can effectively add extensive information within the title slide to elaborate various details using a zooming UI. In such a case, the screen zooms to the area you click in slideshow mode to help you elaborate on the information before moving on to the next bit of detail.

Quiz Title Slide

If you run a quiz competition using PowerPoint or need to start your presentation with a burning question, using a quick title slide might be a good idea! Using quiz PowerPoint templates like the one below you can create a multiple-choice question as your title slide using quiz PowerPoint templates like the one below.

Final Words

A title slide is more important than many people might think. While many presenters skip through it in a rush, a title slide can be a good starting point to set the tone for the discussion ahead. Spending time making a title slide that can convey a message to the audience or cause curiosity can help make the presentation all the more interesting—enabling the presenter to positively influence the audience’s mood at the very start of the presentation.

Like this article? Please share

Design, Presentation Tips Filed under PowerPoint Tutorials

Related Articles

Filed under Google Slides Tutorials • August 6th, 2024

How to Use Google Slides Strikethrough Text

Customize your presentation slides by using Google Slides strikethrough and add a factor of humor, emphasize, or track changes in a truly visual method.

Filed under Presentation Ideas • July 17th, 2024

How to Convert a Text Document into a Presentation with AI

One of the biggest challenges for presenters is to summarize content from lengthy reports, academic papers, or any other kind of written media in an informative and concise way. Rather than losing countless hours going over and over the same text, we can speed up the process thanks to the virtues of artificial intelligence. In […]

Filed under Google Slides Tutorials • July 16th, 2024

How to Make a Google Slides Presentation Look Good

Polish your presentation slides with these 10 tips by design professionals. Learn how to make Google Slides look good now!

Leave a Reply

How to easily make an AWESOME first slide in PowerPoint?

By: Author Shrot Katewa

A good first impression can have a lasting impact. Thus, having a good design for your first slide is important. We’ve seen that people often simply put the title of the presentation as a first slide. I personally dislike this the most. It just shows that the person creating the presentation was simply not interested in it (even though that may not necessarily be true).

Thus, knowing how to create a good first slide is as important if not more as knowing how to create the rest of the presentation. The best part is – you can easily create an awesome first slide for your presentation in minutes in a few quick and easy steps. Obviously, if you have the time at hand, you can easily spend an hour or two making that perfect first slide! In this post, we take a look at how to easily create a first slide with a few examples of actual designs that we have created for our clients.

1. What is the first slide of a PPT presentation called?

The first slide of a presentation is called a “Title slide” or a “Cover slide” . This slide often contains the title of the presentation and hence the name title slide. It is also often referred to as the “Opening slide” of the presentation. The title slide is often the slide that is displayed on the screen before you start your presentation. Thus, it is important to have a title slide that not only looks good but also shares relevant information about your presentation.

2. What content should be included on the first slide of the PPT presentation?

A title slide or the cover slide does not need too much content. The purpose of the title slide is really to give an indication of what the presentation is all about. Thus, an ideal title slide should contain nothing more than –

- Presentation title

- Date of the presentation

- Presenter’s name and designation

It is not necessary to have all the above three pieces of information on a cover slide. Do keep in mind that not all cover slides are the same and what content is displayed on the cover slide can be organisation specific. An organisation may have a preference or a fixed structure for the content that needs to be put on a cover slide. This may vary from the above structure.

3. How to easily design a beautiful first slide in minutes?

As I mentioned earlier, having a good first slide can have a lasting positive impact on your audience. Thus, it is important to create a good design for your first slide. There are several ways you can design the cover slide. Let’s look at some of the easiest ways you can create a beautiful cover slide –

Method 1 – Using PowerPoint’s “Design Ideas” functionality (for beginners)

I must admit, PowerPoint’s “Design Ideas” functionality has great potential. In fact, we at OwlScape were planning on creating a similar plugin for PowerPoint users before Microsoft introduced this feature. This functionality is not just great for beginners, but also at least a must try for intermediate level users too. Designers from OwlScape also at least check out the functionality every once in a while especially when we hit a creative bloq.

It is really easy to work with. In just a couple of clicks and a few minutes, you can make your title slide look completely different –

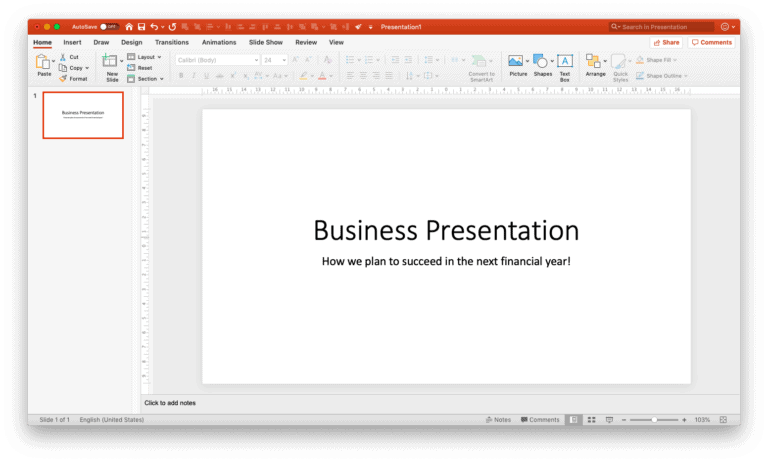

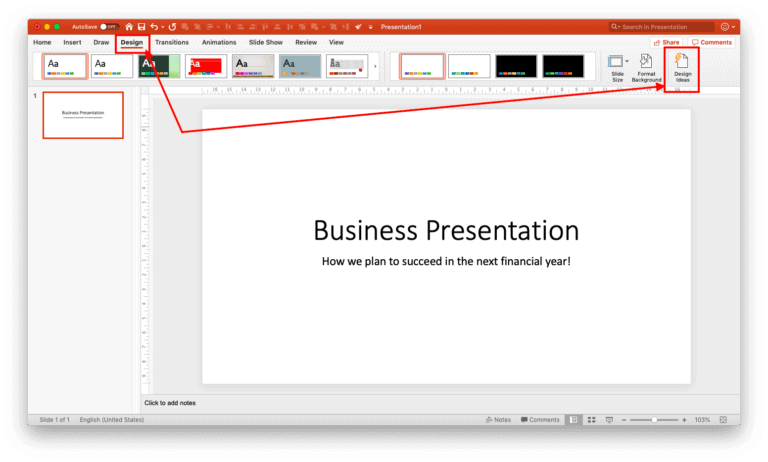

To do this, all you need to do is put some text on your cover slide and use the “Design Ideas” functionality of PowerPoint. For example, you can write the title and subtitle of your presentation.

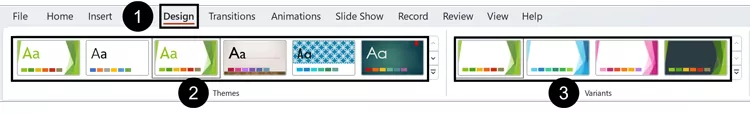

Next, click on the “Design” tab on your Menu bar. On the ribbon under the design tab, look for “Design Ideas” feature. It is normally on the far right of the screen on the ribbon. Click on it, and wait for a bit.

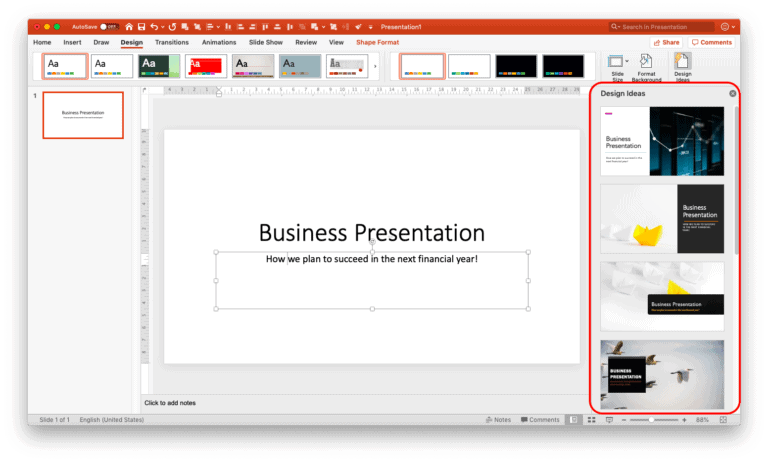

In a few seconds, PowerPoint will automatically throw a few ways in which you can design your title slide. You can choose the design you like, and repeat the process to get more results.

If you are unable to see any design ideas or you get an error, you could close the error result by clicking on the close button marked with “X” next to Design Ideas. Then, try clicking in any of the text box on the slide and click on “Design Ideas” again. A few attempts will surely give you some interesting results.

There are a few drawbacks though. These are as follows –

- The results are not consistent . If you happen to delete the slide and try to recreate using the exact same process, the result may be different. This can be both good and bad 🙂

- Editing the design of the suggested slide may not be easy for beginners – when you need to make some changes to the chosen design option, it doesn’t happen directly. You will need to work with the master slides in order to make the design changes. This may seem daunting especially if you are a beginner.

- Sometimes, it just doesn’t work – Even though you may have created a slide using the same content before, sometimes when you try to recreate using the same content, it may simply fail to showcase any ideas. In such an event, we would advise you to click on the text box or an image on your slide and try again by clicking on the Design Ideas option.

- Available for Office 2016 onwards – If you are a PowerPoint user using an older version of Microsoft Office, you may not be able to easily access this functionality. Having the latest PowerPoint version can be of great help!

One thing to note is that the “Design Ideas” option can be used not just for the cover slide, but also for other slides. However, I would advise resisting the temptation of using it for every single slide. 🙂

Method 2 – Using shapes to create an interesting cover slide (for intermediate users)

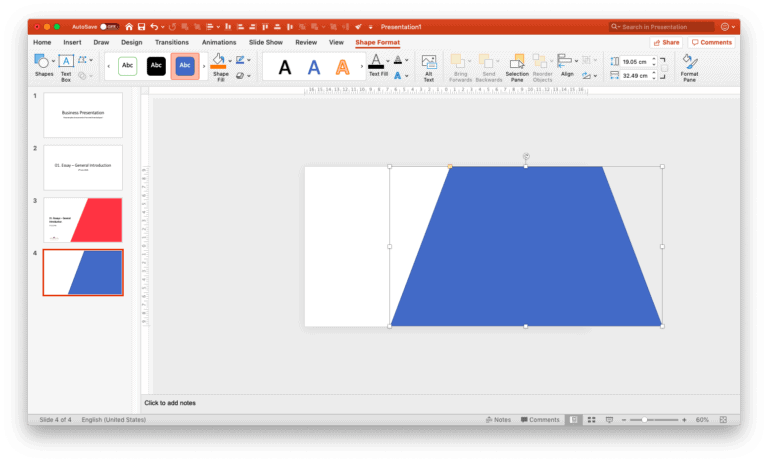

One other way of having an interesting cover slide is by using the shapes in PowerPoint. Let’s look at the following example –

If you look at the above example carefully, you’ll notice that we’ve only added a shape to the already existing title and the subtitle in the “After” slide. Simply adding a shape, a logo and aligning the text can alter the look of the slide drastically.

There are many ways you can add a shape to the slide. My favourite method is to add a horizontal or a vertical “Trapezoid/ trapezium” (a quadrilateral shape with one pair of parallel sides). A trapezoid shape allows me to have enough space to write the title of the slide and some more content.

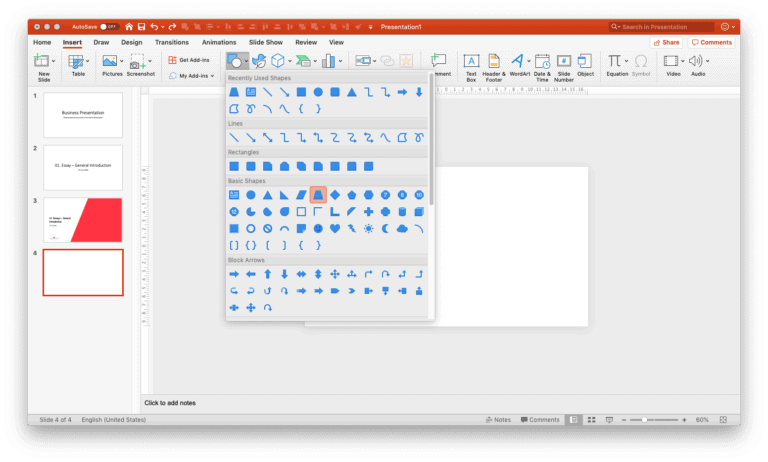

To create this shape, you can follow the below steps –

On the menu bar, click on “Insert” and then click on “Shapes”. Under the basic shapes option, select the trapezium shape. Next, create the shape on your slide.

Make sure that the size of the trapezium is good enough to cover about ⅔ parts of the slide. Also ensure that the parallel sides of the trapezium touch the top and bottom part of the slide. Now all you need to do is add the title and subtitle, along with the logo to create your cover slide.

Similarly, you can also use the trapezium vertically. You can also use various types of shapes on your cover slide. The possibilities are literally endless!

Method 3 – Using shapes with images to create an awesome cover slide! (for advanced users)

If you are still not satisfied with your cover slide, there are several other ways you can make it look even more impressive. The easiest way to take it to the next level is to use images in combination with the shapes.

Let’s look at a few examples –

Combination cover slide design example – 1

In the above design, a shape has been created in the background using a freeform tool. Next, two appropriate images have been identified and put in front of the shape. All this has been kept predominantly to the right side of the slide allowing space to write the title, subtitle and the other relevant information on the left.

Combination cover slide design example – 2

In this example, we’ve used one corner of curved rectangle shape to create an interesting design. Two copies of the same shape have been considered. The one below is filled with a colour and tilted at a slight angle. The one above has an image inserted in the shape.

Combination cover slide design example – 3

In the above example, a combination of several shapes and images are used to create a visually pleasing design. Obviously, this may not be something that a beginner can create right of the bat. But the reason we put this design as an example is because barring the design skills (knowing what shape to include and where), creating this slide is not as advanced as you might think. This slide has been created by only using shapes and image elements along with the logo and text. The purpose of using this as an example was to showcase the endless possibilities on how a seemingly complex cover slide can be made by merely using basic shapes and images.

4. How to find images for the first slide of your presentation?

Whether you are using a combination of images and shapes or simply using an image on your title slide, it is important to identify a good image that resembles the topic of your presentation. Consider the following example –

If you’ve been following along, I’m sure you would have noticed by now that the above title slide has been created using a combination of images and shapes. Again, the design can be easily created using shapes and image elements. However, part of the reason that makes this slide look good and relevant to the presentation is the choice of image. Since the presentation is for a corporate organisation, choosing an image that resembles a corporate environment would be relevant.

Take a moment to scroll up and notice the other cover slide examples that I shared above.

The cover slide example 1 was designed for a presentation on education. Thus, choosing an image that represents education effectively communicates to the audience that the presentation is something to do with education even without the word “education” in the title or the subtitle or anywhere on the slide (Don’t resist, go ahead and have a look at the slide again! 🙂 )

Likewise, example 3 uses a mobile device in the title slide giving an indication that the product being talked about in the presentation is likely going to be an app.

Thus, choosing an appropriate image is important as it subtly communicates the message to the audience.

Finding the images for your presentation can take some time. You can use Google to see a few references on what type of images can be used. Avoid the temptation of using Google images directly on your presentation as this can violate copyright laws. We wrote a detailed post on where to find and how to use images for your presentation (link – https://owlscape.in/can-i-use-google-images-for-my-presentation/ ). Be sure to check it out!

I’m sure by now you’ve noticed a few different ways you can create a good title slide for your presentation. I hope this post helps you to think out of the box while creating the title slide of your next presentation. I also hope that going forward you will surely give enough focus on creating an impressive first slide even if you only have a few minutes.

If you’re struggling while creating your next title slide or your presentation, simply drop us an email on [email protected]

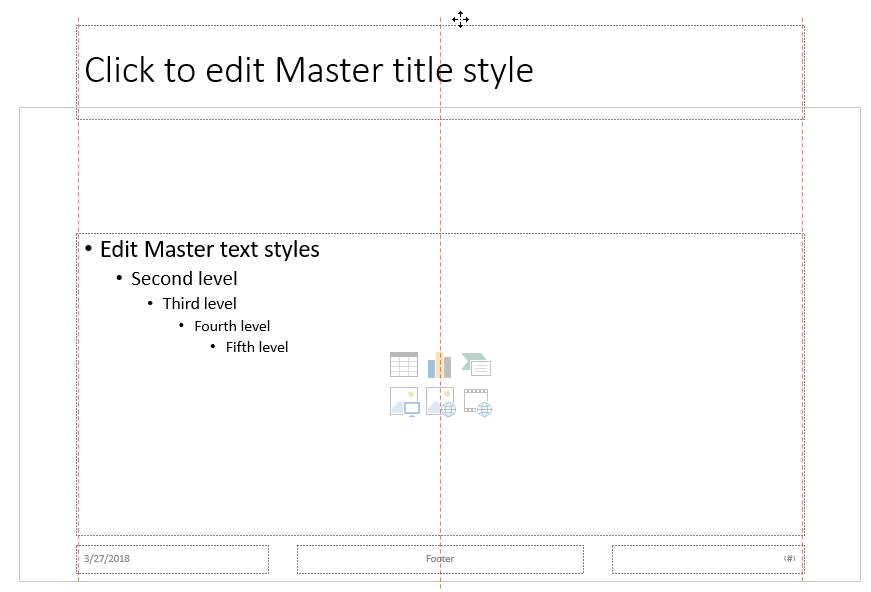

Title a slide

There are multiple ways to add titles to your slides in PowerPoint. Use the Layout option to create a standalone title slide or to add a title to a slide that contains other text. You can also use the Outline view or the Accessibility ribbon to create and update the titles of your slides.

Select a heading below to open it and see the detailed instructions.

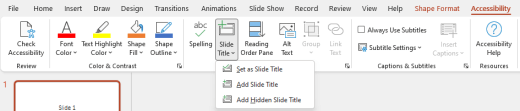

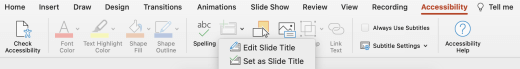

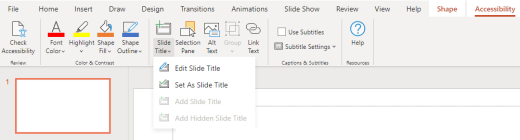

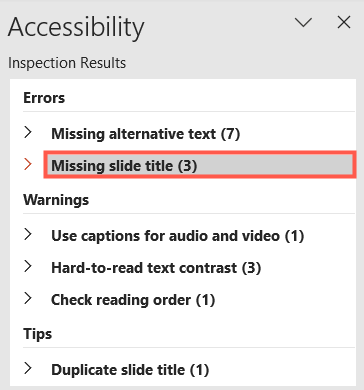

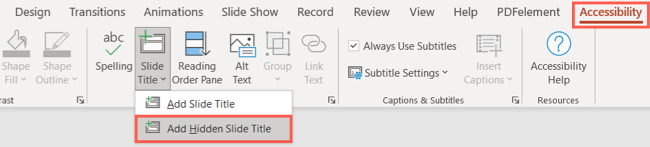

Use the Accessibility ribbon to title a slide

You can use the Accessibility ribbon to add or edit slide titles and to make sure your slides are accessible to everyone.

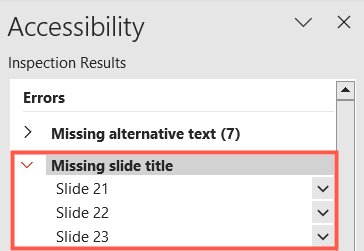

Select Review > Check Accessibility . The Accessibility ribbon is displayed, and the Accessibility pane opens to the right of the selected slide.

Select one of the following options:

Note: The available options depend on whether a title placeholder exists or not, and what type of element is selected on the slide.

To move the cursor to the title placeholder, select Edit Slide Title .

To add a title placeholder to the slide and move the cursor to the placeholder, select Add Slide Title .

To add an off-slide title placeholder and move the cursor to the placeholder, select Add Hidden Slide Title . Because the title is positioned off-slide, it will be invisible during a slide show, but the title is available to help users navigate or select the slide.

If there is no title placeholder on the slide, to let the Accessibility Checker select the text box or shape that seems most like a title, select Set as Slide Title . This makes the selected object your slide title. If there is another text box or shape you want to use as the title, select the object, and then choose this option. Only objects with text that aren't in groups can be made into a title.

Selecting the Slide Title button without expanding the dropdown menu does the following:

If an object that can be set as the title is selected on the slide, that object is set as the slide title ( Set as Slide Title ).

If there is a title, but no object is selected, the cursor moves to the title placeholder ( Edit Slide Title ).

If there is no title and no object is selected, a title placeholder is added and the cursor moves to the placeholder ( Add Slide Title ).

Type or edit the slide title.

Tip: To review your presentation for missing or duplicate slide titles, run the Accessibility Checker, and then check the Accessibility pane to find them.

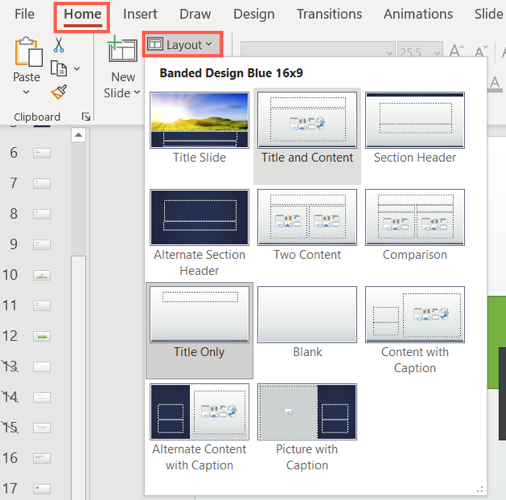

Use the Layout option to title a slide

You can name or rename a slide by using a slide layout that has a title placeholder .

Select the slide whose layout you will change so that it can have a title.

Click Home > Layout .

Select Title Slide for a standalone title page or select Title and Content for a slide that contains a title and a full slide text box. Many other layout options include titles, too. Pick the one that’s best suited for your presentation.

Select the Click to add title text box. Enter your title for that slide.

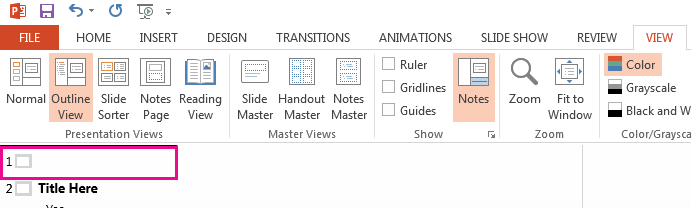

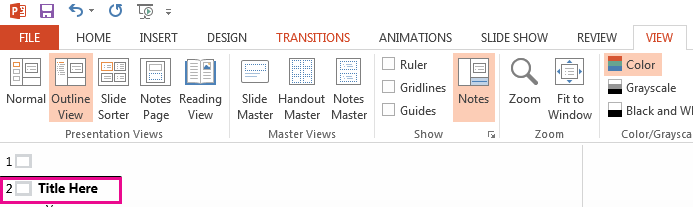

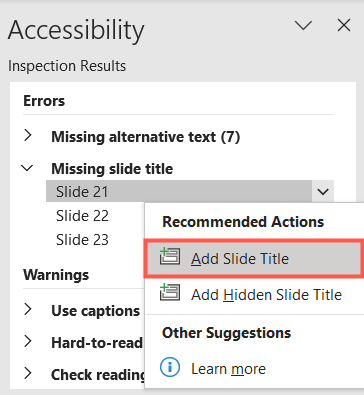

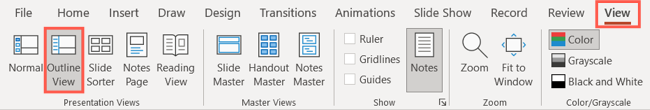

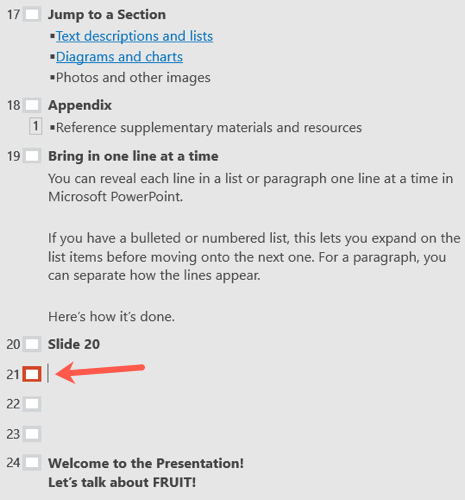

Use Outline view to title a slide

You can also create a slide title in Outline view. This view also shows the titles for any other slides in your presentation.

Click View > Outline View .

A slide without a title will have no text to the right of the slide number.

If your slide already has a title, it appears next to the slide number.

Click to the right of the slide number.

Type your new title here, or update an existing slide title. Your text will appear on the slide as you enter it.

Tip: You can use Outline view as your notes when you give a presentation.

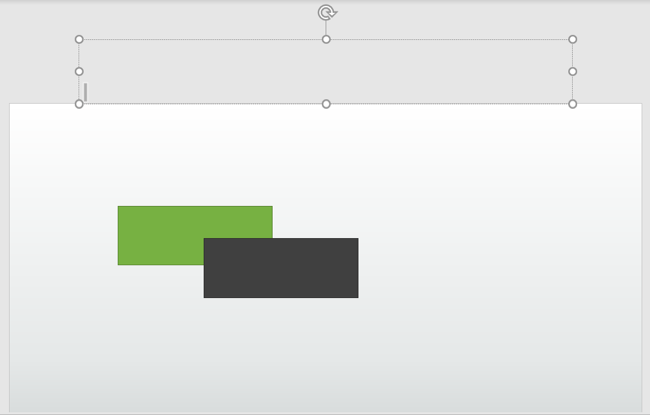

Put a title on a slide, but make the title invisible

You can position a title off the slide. That way, the slide has a title for accessibility or sorting reasons, but you save space on the slide for other content.

On the View tab, select Zoom and then lower the zoom percentage to about 50% so that the margins outside the slide are visible.

Type a title in the Title placeholder box.

Drag the Title placeholder upward or downward and then drop it outside the slide boundary.

You can confirm that the title will be invisible during a slide show by selecting Slide Show > From Current Slide .

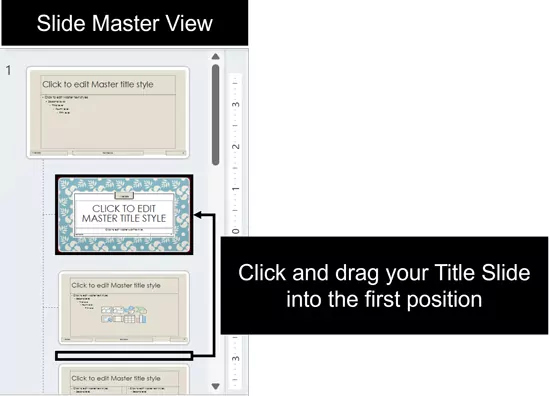

Systematically hide slide titles

If you want all or many of your slide titles to be hidden, use Slide Master view to achieve it. Duplicate the slide layout for which you want to have hidden titles. Then on the duplicate layout, move the title placeholder off-slide. Then apply the new layout to the appropriate slides.

For example:

On the View tab of the ribbon, in the Master Views group, select Slide Master .

In the slide thumbnail pane on the left side of the PowerPoint window, right-click a slide layout (such as Title and Content Layout ) that you want to alter and choose Duplicate Layout .

Select the duplicated layout.

Select the title placeholder, drag it upward, and drop it outside the boundary of the visible slide.

If PowerPoint doesn't allow you to drag the placeholder that far, use View > Zoom to make the slide surface area appear smaller so that there is adequate room to move the placeholder fully off-slide.

Close Master view and return to Normal view.

Select a slide whose title you want to hide. Right-click it, and apply the "hidden-title" slide layout that you just created.

The title moves to an off-slide position, but it still exists. You can see the title of the slide by switching to Outline view.

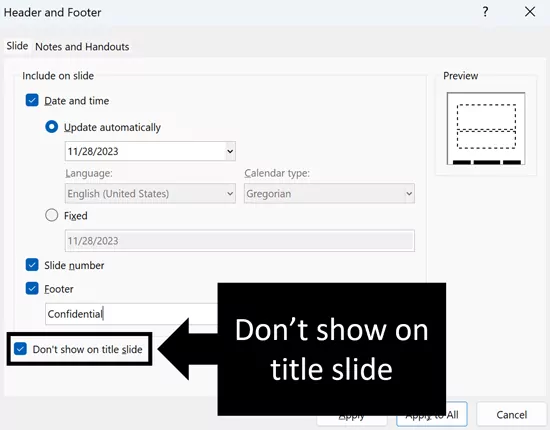

Put the same title on every slide

If you want the same title on every slide, you may be thinking of what PowerPoint calls a footer . For instructions on putting footers on your slides, see Insert or change footers in PowerPoint slides .

Why slide titles are important

Having slide titles is valuable for:

Accessibility A visually impaired person that uses a screen reader relies on the slide titles to know which slide is which.

Helping various PowerPoint features work correctly Design Ideas, Apply Layout, and Reset Slide work better on slides that have titles. Insert Hyperlink, Insert Zoom, and custom shows all refer to slides by their titles.

PowerPoint expert Geetesh Bajaj has an article on his site about Hiding Slide Titles in PowerPoint .

You can name or rename a slide by using a slide layout that has a title placeholder

Tip: You can use Outline view as your notes when you give a presentation.

In the slide thumbnail pane on the left side of the PowerPoint window, right-click a slide layout (such as Title and Content Layout ) that you want to alter, and choose Duplicate Layout .

If there is no title placeholder on the slide, to let the Accessibility Checker select the text box or shape that seems most like a title, select Set as Slide Title . This makes the selected object your slide title. If there is another text box or shape you want to use as the title, select that object, and then choose Set as Slide Title . Only objects with text that aren't in groups can be made into a title.

If there is no title placeholder on the slide, to let the Accessibility Checker select the text box or shape that seems most like a title, select Set As Slide Title . This makes the selected object your slide title. If there is another text box or shape you want to use as the title, select that object, and then choose Set As Slide Title . Only objects with text that aren't in groups can be made into a title.

If an object that can be set as the title is selected on the slide, that object is set as the slide title ( Set As Slide Title ).

You can confirm that the title will be invisible during a slide show by selecting Slide Show > From Current Slide .

Need more help?

Want more options.

Explore subscription benefits, browse training courses, learn how to secure your device, and more.

Microsoft 365 subscription benefits

Microsoft 365 training

Microsoft security

Accessibility center

Communities help you ask and answer questions, give feedback, and hear from experts with rich knowledge.

Ask the Microsoft Community

Microsoft Tech Community

Windows Insiders

Microsoft 365 Insiders

Was this information helpful?

Thank you for your feedback.

Byte Bite Bit

What is a Subtitle in PowerPoint: Key Uses and Best Practices

Picture this: You’re in the middle of an engaging PowerPoint presentation, and you want to ensure everyone understands your speech perfectly. That’s where subtitles come into play. Subtitles in PowerPoint are real-time captions that appear on your slides, translating your spoken words into text. This can be a game-changer for making your presentations more accessible and engaging.

Using subtitles in PowerPoint can enhance your presentation by reaching a wider audience, including non-native speakers and people with hearing impairments. By integrating this feature, you can break language barriers and make your talk more inclusive. I remember a time when I used this feature during an international conference. It was a hit, ensuring that all attendees, regardless of their native language, could follow along seamlessly.