Mobile Money Transfer Agency Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Financial Services

Are you about starting a money transfer agency? If YES, here is a complete sample money transfer agency business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting a money transfer agency . We also took it further by analyzing and drafting a sample money transfer agency marketing plan template backed up by actionable guerrilla marketing ideas for money transfer agencies. So let’s proceed to the business planning section.

Have you ever dreamt of becoming your own boss? Did you per chance study Banking and Finance, Accountancy or any related course and are finding it difficult to get your ideal job? You don’t need to worry because your dream of becoming your own boss and still work as a professional can be fulfilled.

One of the business opportunities that you can leverage on is to start a money transfer agency business. Although you would need ample experience with good track record to be able to attract well – paying clients, but that does not stop you from still making headway in this line of business.

The truth is that the business has pretty low entry capital and you can start the business from your home, shared offices space or from a kiosk with one or two staff members.

You can be sure that your services would always be in demand by people who want to send money to other parts of the world especially migrants who want to send money back home. If you are interested in starting a money transfer agency, then you should be ready to conduct thorough feasibility studies and market survey before committing your money and other resources to it.

Aside from a thorough and detailed feasibility studies and market survey, one of the important documents that will aid the success of the business is a good and workable business plan. Below is a sample money transfer business plan template that can help you to successfully write your own.

A Sample Mobile Money Transfer Agency Business Plan Template

1. industry overview.

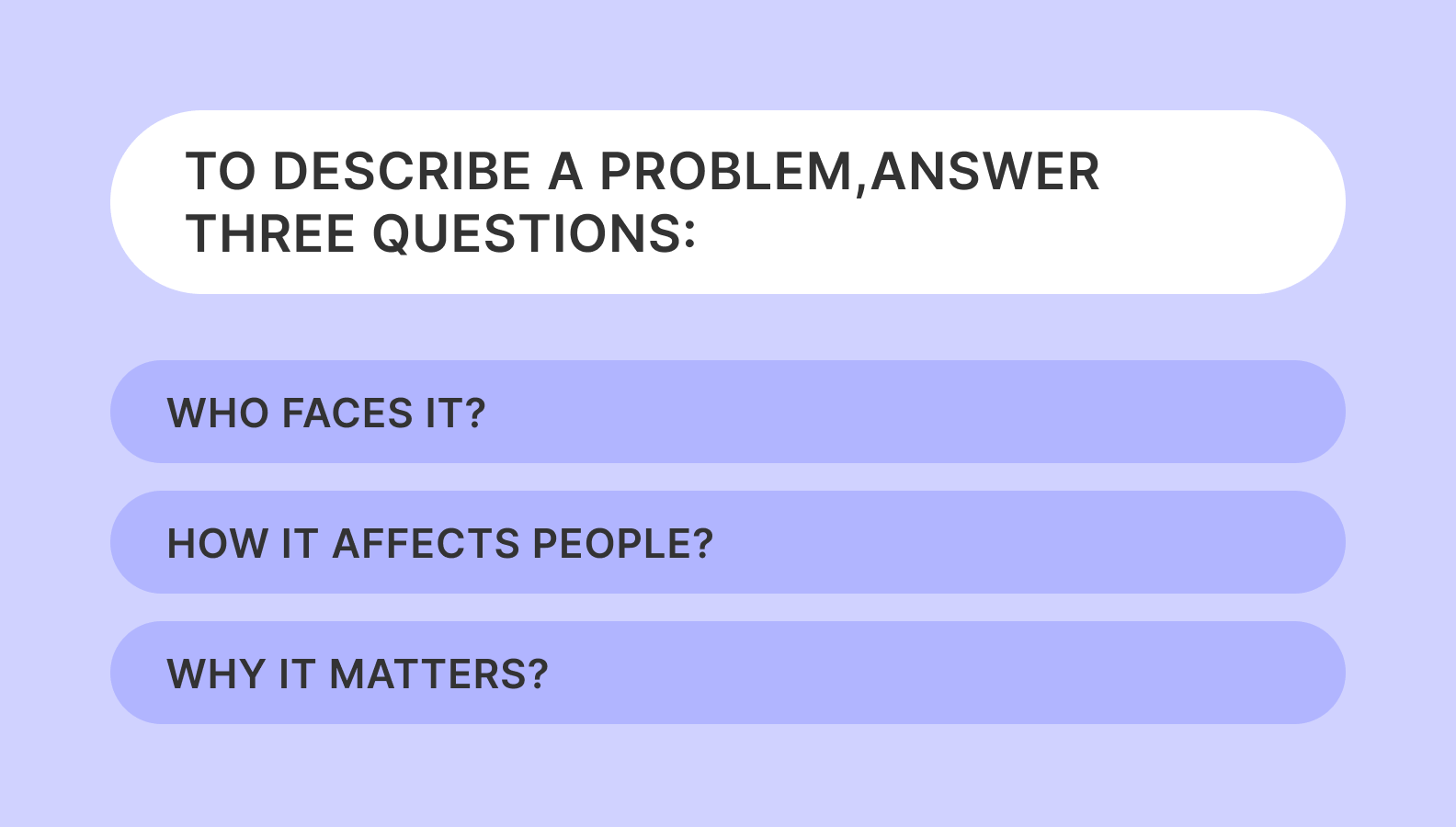

The money transfer industry comprises of firms that act as third-party agents that facilitate money transfers and payments among parties in different locations. Please note that this industry does not include organizations that are involved in bank wire services and card-based services.

Research conducted by IBISWorld shows that the Money Transfer Agencies industry has recorded robust growth over the past five years.

This growth is largely due to the increasing globalization and rising mobility of labor. Industry revenue is closely linked to the number of overseas workers employed in the united states, with many sending money back to their respective countries to support their families.

The resilience of the US economy relative to other developed economies and its skill shortages make the US an attractive place for overseas workers to seek employment. As a result, industry revenue is expected to increase at an annualized 7.2 percent over the five years through 2017-18, to $299.9 million. Industry revenue is anticipated to grow by 3.7 percent.

The Money Transfer industry is indeed a thriving industry and pretty much active in all parts of the world and the industry is responsible for employing several people.

The Money Transfer industry is in the growth phase of its life cycle. Industry value added, which measures an industry’s contribution to the overall economy, is forecast to grow at an annualized 4.5 percent over the 10 years through 2022-23.

This represents an outperformance compared with real GDP, which is projected to grow at an annualized 2.5 percent over the same period. This outperformance is a key characteristic of an industry in the growth phase of its economic life cycle. Increasing labor mobility and globalization will underpin demand for money transfer services over the next five years.

Any aspiring entrepreneur or investor that is considering starting this type of business whether on a small scale or in a large scale should ensure that he or she conducts thorough market survey and feasibility studies so as to get it right.

The truth is that, this type of business does pretty well when it is strategically positioned. Places like campus, school board / districts, passport office, immigration centers, licensing offices and migrant communities are ideal for this type of business.

Over and above, the money transfer business is profitable and it is open for any aspiring entrepreneur to come into the industry; you can choose to start on a small scale in one or two public facilities and operate on a local and national level. If you have the capital and business exposure, then you can choose to start on a large scale with several outlets in key cities.

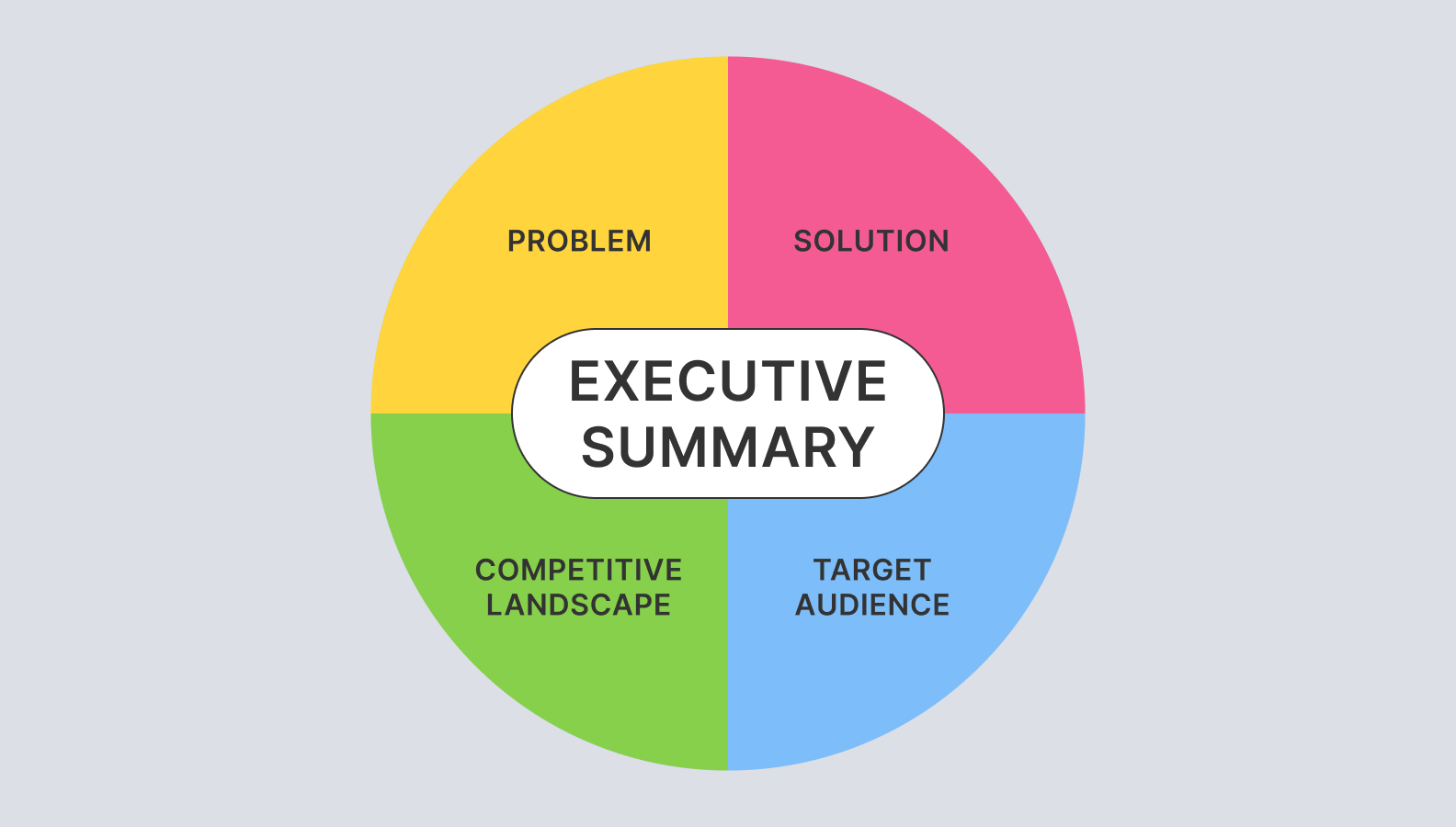

2. Executive Summary

Swiftness© Money Transfer Agency, Inc. is a registered and licensed international money transfer agency. We have been able to secure all the required documentation and a standard office facility that is highly suitable for the kind of business we are into.

Our head office is situated in Los Angeles – California and we hope to sometime in the nearest future have branches scattered all across major cities in the United States of America.

Swiftness© Money Transfer Agency, Inc. will be involved in all aspect of money transfer, we will act as third-party agents that facilitate money transfers and payments among parties in different locations. Our business goal is to become one of the leading money transfer agencies in Los Angeles – California and we will make sure that every service we handle compete favorably with the best in the industry in terms of time.

We are aware that there are several money transfer agencies all around Los Angeles – California which is why we spent time and resources to conduct a thorough feasibility studies and market survey so as to position our business in strategic locations in Los Angeles – California.

Much more than prompt money transfer, our customer care is going to be second to none in the whole of Los Angeles – California. We know that our customers are the reason why we are in business which is why we will go the extra mile to get them satisfied when they patronize our services.

At Swiftness© Money Transfer Agency, Inc. our client’s best interest come first, and everything we do will be guided by our values and professional ethics. We will ensure that we hold ourselves accountable to the highest standards by delivering excellent jobs and also meeting our client’s needs precisely and completely.

Swiftness© Money Transfer Agency, Inc. is a family business that is owned and managed by Jude Adamson and his immediate family members.

Jude Adamson is a graduate of Business Administration and has extensive experience working with one of the leading global money transfer agencies in the United States of America. He will bring his experience and expertise to help grow Swiftness© Money Transfer Agency, Inc.

3. Our Products and Services

Swiftness© Money Transfer Agency, Inc. is in the industry for the purpose of making profits and we will ensure we position our business to favorably compete for the available market in the industry. We are going to do all that is permitted by the laws in the United States of America to achieve our business goals.

Here are some of our service offerings;

- In-store money transfers operations

- Retail money transfer

- Online money transfer

4. Our Mission and Vision Statement

- Our vision is to build a money transfer agency that will have active presence all over the United States of America and the globe.

- Our mission is to establish a standard money transfer agency that will make available a wide range of services in the money transfer industry at affordable prices to residents of Los Angeles – California, and other locations in the United States of America where we intend operating from.

Our Business Structure

Our intention of starting a money transfer agency is to build a standard business with active presence in major cities in the United States of America and the globe. We will ensure that we put the right structures in place that will support the kind of growth that we have in mind while setting up the business.

In putting in place a good business structure, we will ensure that we hire only people that are qualified, honest, customer centric and are ready to work to help us build a prosperous business that will benefit all the stake holders.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of ten years or more. In view of that, we have decided to hire qualified and competent hands to occupy the following positions;

- Chief Executive Officer (Owner)

- Admin and Human Resources Manager

Sales and Marketing Manager

Money Transfer Agents

- Client Services Executive

5. Job Roles and Responsibilities

Chief Executive Officer – CEO:

- Intensifies management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, appraising job results and developing incentives

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Accountable for fixing prices and signing business deals

- Responsible for providing direction for the business

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Reports to the board

Admin and HR Manager

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

- Manages external research and coordinates all the internal sources of information to retain the organizations’ best customers and attract new ones

- Models demographic information and analyze the volumes of transactional data generated by customer purchases

- Identifies, prioritizes, and reaches out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts; participates in the structuring and financing of the business

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps to increase sales and growth for the company

- Handle in-store money transfer operations

- Handle retail money transfer

- Handle online money transfer

- Responsible for operating IT systems for the organization

- In charge of planning for and negotiating technical difficulties

- Responsible for monitoring exchange rates

- In charge of negotiating service charges.

- Responsible for dealing with the effects of network congestion.

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the organization

- Serves as internal auditor for the organization

Client Service Executive

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Assist in helping clients track their transfer and provide helpful information as required

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the human resources and admin manager in an effective and timely manner

- Consistently stays abreast of any new information on the organizations’ products, promotional campaigns etc. to ensure accurate and helpful information are supplied to clients when they make enquiries.

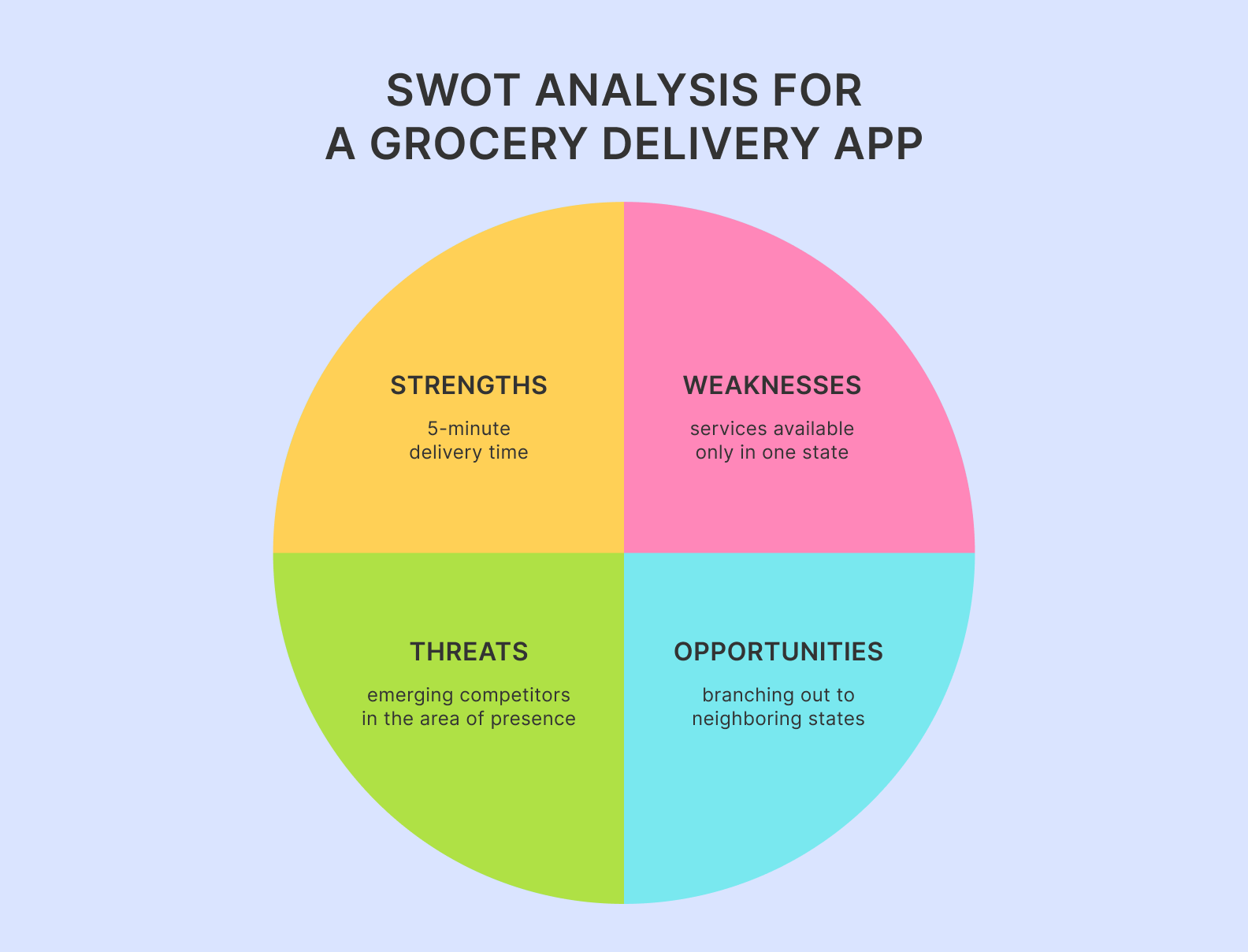

6. SWOT Analysis

Our intention of starting our money transfer business in Los Angeles – California is to test run the business for a period of 3 to 6 months to know if we will invest more money, expand the business and then open transfer centers all around key cities in the United States.

We are quite aware that there are several money transfer agencies in the United States and even in the same locations where we intend locating ours, which is why we are following the due process of establishing a business.

We know that if a proper SWOT analysis is conducted for our business, we will be able to position our business to maximize our strength, leverage on the opportunities that will be available to us, mitigate our risks and be equipped to confront our threats.

Swiftness© Money Transfer Agency, Inc. employed the services of an expert HR and Business Analyst with bias in startups to help us conduct a thorough SWOT analysis and to help us create a Business model that will help us achieve our business goals and objectives. This is the summary of the SWOT analysis that was conducted for Swiftness© Money Transfer Agency, Inc.;

The strategic locations we intend positioning our business, the business model we will be operating on, ease of transfer, wide range of services and our excellent customer service culture will definitely count as a strong strength for Swiftness© Money Transfer Agency, Inc.

So also we have a team that can go all the way to give our clients value for their money; a team that are trained and equipped to pay attention to details and swiftly and safely transfer money both locally, nationally and internationally.

A major weakness that may count against us is the fact that we are a new money transfer agency and we don’t have the financial capacity to compete with multi – million dollar money transfer agencies in this industry.

- Opportunities:

Rising globalization and labor mobility continues to benefit the industry’s revenue performance and online operators have benefited from their lower cost base and the rise of online transfers. The fact that people and businesses are always sending money from one location to another provides us with unlimited opportunities.

We have been able to conduct thorough feasibility studies and market survey and we know what our potential clients will be looking for when they patronize our services; we are well positioned to take on the opportunities that will come our way.

Just like any other business, one of the major threats that we are likely going to face is economic downturn. It is a fact that economic downturn affects purchasing / spending power; in essence, if the economy is under stress, people will find it difficult to transfer money.

Another threat that may likely confront us is the arrival of a new money transfer agency in same location where ours is located. unfavorable government policies and technology can also pose a threat to businesses such as ours.

7. MARKET ANALYSIS

- Market Trends

Rising globalization and labor mobility continues to benefit industry’s revenue performance and online operators have benefited from their lower cost base and the rise of online transfers.

Although the fact that the industry is divided in the two categories makes it easier for aspiring entrepreneurs to choose to start on a small scale by servicing local communities and small to medium scale businesses or to start big by offering all the services.

A common trend in this industry is that money transfer agencies usually position their offices close to colleges and migrant communities. This is so because statistics shows that international students and of course working class migrants/expatriates are known to be top on the list when it comes to transferring monies from the United States to other countries of the world.

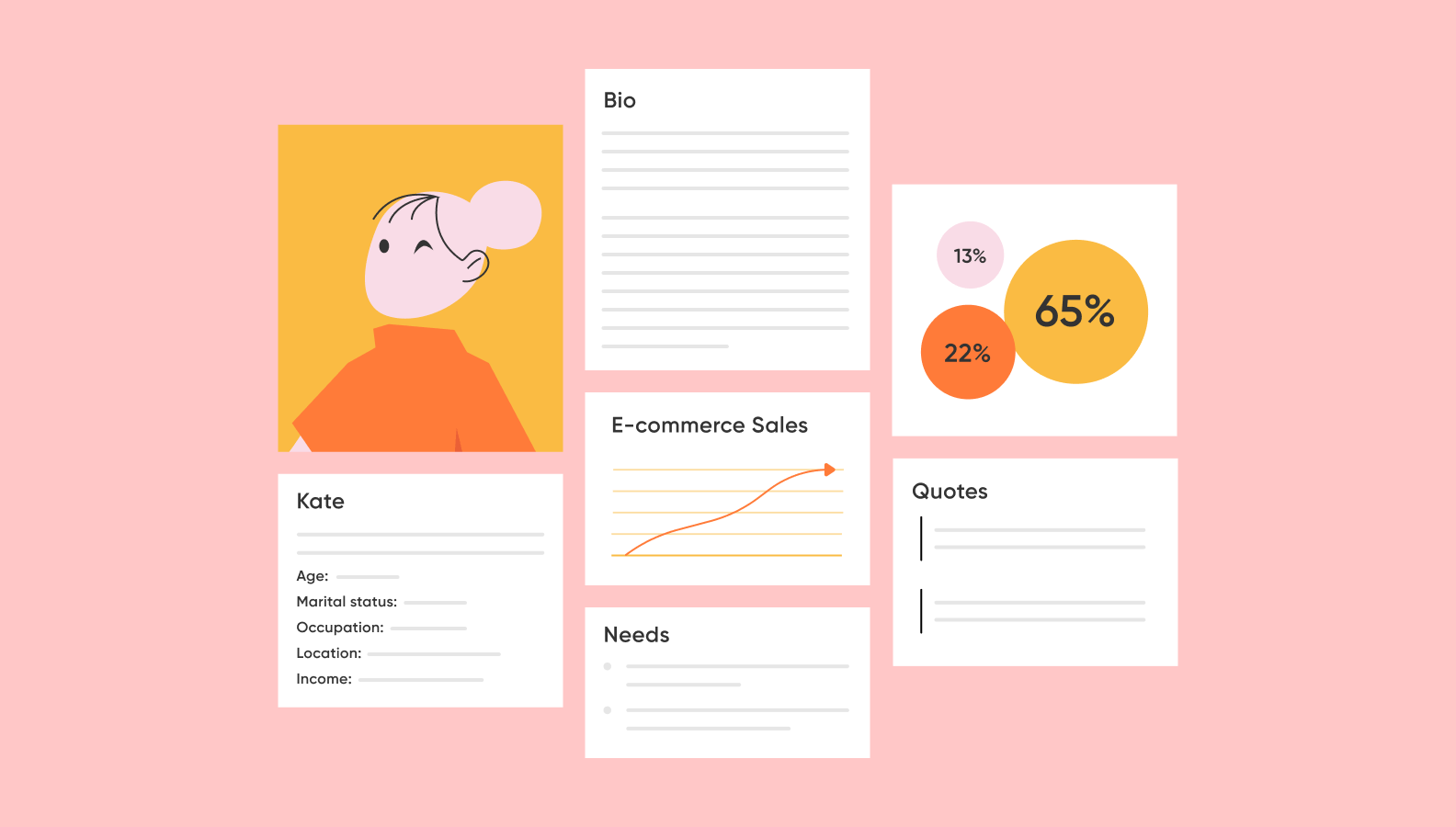

8. Our Target Market

The target market for those who need the services of money transfer businesses are all encompassing. In view of that, we have positioned our transfer centers in strategic locations to service residents and businesses in Los Angeles – California and other towns in key cities in the United States of America. We are in the money transfer industry to attract the following clients;

- Expatriates

- Business men and women

- Small scale businesses

- Clearing and forwarding agents

- Corporate Executives

Our competitive advantage

The competitions that exist in the industry is stiff because anyone that has the finance and business expertise can decide to start this type of business howbeit on a small scale servicing a city or more. Although, the money transfer industry requires some form of trainings and expertise, but that does not in any way stop any serious minded entrepreneur from starting the business and still make good profit out of it.

The business model we will be operating on, having a good reputation, proximity to key markets, unlimited access to the latest available and most efficient technology and techniques, ease of money transfer, wide range of services and our excellent customer service culture will definitely count as a competitive advantage for Swiftness© Money Transfer Agency, Inc.

So also, we have a team that can go give our clients value for their money; a team that is trained and equipped to pay attention to details and deliver parcels on time both locally, nationally and internationally.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Swiftness© Money Transfer Agency, Inc. is established with the aim of maximizing profits in the money transfer industry and we are going to ensure that we do all it takes to offer our services and products to a wide range of customers. Swiftness© Money Transfer Agency, Inc. will generate income by offering the following services;

10. Sales Forecast

One thing is certain; there would always be individuals, businesses or corporate organizations in Los Angeles – California and in the United States of America who would always need the services of money transfer agencies.

We are well positioned to take on the available market in Los Angeles – California and we are quite optimistic that we will meet our set target of generating enough income from the first six months of operation and grow the business and our clientele base.

We have been able to examine the money transfer agencies industry, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. Below are the sales projections for Swiftness© Money Transfer Agency, Inc., it is based on the location of our business and the wide range of services that we will be offering;

- First Fiscal Year: $240,000

- Second Fiscal Year: $450,000

- Third Fiscal Year: $750,000

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and natural disasters within the period stated above. There won’t be any major competitor offering same services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

Before choosing a location for our business, we conducted a thorough market survey and feasibility studies in order for us to penetrate the available market and become the preferred choice for businesses and residents of Los Angeles – California.

We have detailed information and data that we were able to utilize to structure our business to attract the number of customers we want to attract per time.

We hired experts who have good understanding of the money transfer agency industry to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market in Los Angeles – California.

In summary, Swiftness© Money Transfer Agency, Inc. will adopt the following sales and marketing approach to win customers over;

- Introduce our business by sending introductory letters alongside our brochure to corporate organizations, households and key stakeholders in Los Angeles and other cities in California.

- Print handbills about our business and its locations

- Advertise on the internet on blogs and forums, and also on social media like Twitter, Facebook, LinkedIn to get our message across.

- Create a basic website for our business so as to give our business an online presence (list the locations of our transfer centers)

- Directly market our business

- Join local business center associations for industry trends and tips

- Provide discount days for our customers

- Advertise our business in community based newspapers, local TV and radio stations

- List our business on yellow pages’ ads (local directories)

- Encourage the use of Word of mouth marketing (referrals)

11. Publicity and Advertising Strategy

Despite the fact that our office facility and transfer centers will be well located, we will still go ahead to intensify publicity for the business. We are going to explore all available means to promote our business.

Swiftness© Money Transfer Agency, Inc. has a long term plan of opening our transfer centers in various locations in key cities all around the United States of America which is why we will deliberately build our brand to be well accepted in Los Angeles – California before venturing out.

As a matter of fact, our publicity and advertising strategy is not solely for winning customers over but to effectively communicate our brand. Here are the platforms we intend leveraging on to promote and advertise Swiftness© Money Transfer Agency, Inc.;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms

- Sponsor relevant community programs

- Leverage on the internet and social media platforms like; Instagram, Facebook, twitter, et al to promote our brand

- Install our billboards in strategic locations all around Los Angeles – California

- Distribute our fliers and handbills in target areas

- Position our Flexi Banners at strategic positions in the location where our money transfer centers are located.

- Ensure that all our workers wear our branded shirts and all our delivery vehicles are well branded with our company’s logo.

12. Our Pricing Strategy

At Swiftness© Money Transfer Agency, Inc. we will keep the prices of our money transfer service charges below the average market rate for all of our customers by keeping our overhead low and by collecting payment in advance from corporate organizations who would hire our services. In addition, we will also offer special discounted rates to all our customers at regular intervals.

- Payment Options

The payment policy adopted by Swiftness© Money Transfer Agency, Inc. is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America.

Here are the payment options that Swiftness© Money Transfer Agency, Inc. will make available to her clients;

- Payment via bank transfer

- Payment with cash

- Payment via online bank transfer

- Payment via check

- Payment via Point of Sale Machines (POS Machine)

- Payment via bank draft

- Payment via mobile money

In view of the above, we have chosen banking platforms that will enable our clients make payment for our services without any stress on their part.

13. Startup Expenditure (Budget)

When it comes to starting a money transfer agency, the major areas that you should look towards spending the bulk of your cash is in the renting or leasing of well – located facilities. Aside from that, you are not expected to spend much except for paying of your employees and the purchase of supplies. These are the key areas where we will spend our startup capital;

- The total fee for registering the Business in the United States – $750.

- Legal expenses for obtaining licenses and permits as well as the accounting services (software, P.O.S machines and other software) – $1,300.

- Marketing promotion expenses for the grand opening of the business in the amount of $3,500 and as well as flyer printing (2,000 flyers at $0.04 per copy) for the total amount of $3,580.

- The cost for hiring Business Consultant – $2,500.

- The amount needed for the purchase of insurance policy cover (general liability, workers’ compensation and property casualty) coverage at a total premium – $2,400.

- The cost for payment of rent for 12 months at $1.76 per square feet in the total amount of $35,600.

- The cost for the facility and remodeling – $10,000.

- Other start-up expenses including stationery ( $500 ) and phone and utility deposits ( $2,500 ).

- Operational cost for the first 3 months (salaries of employees, payments of bills et al) – $100,000

- The cost for store equipment (cash register, security, ventilation, signage) – $13,750

- The cost of purchase and installation of CCTVs and car tracker devices – $10,000

- The cost for the purchase of furniture and gadgets for the office (computers, internet device, photocopy machine, computers, fax machine, phone box, printing machines, laminating machines and scanning machine, TVs, Sound System, tables and chairs et al) – $20,000

- The cost of launching a website – $600

- Miscellaneous – $10,000

We would need an estimate of $150,000 to successfully set up our money transfer agency in Los Angeles – California.

Generating Startup Capital for Swiftness© Money Transfer Agency, Inc.

No matter how fantastic your business idea might be, if you don’t have the required money to finance the business, the business might not become a reality. Finance is a very important factor when it comes to starting a money transfer agency.

Swiftness© Money Transfer Agency, Inc. is a family business that is solely owned and financed by Jude Adamson and his immediate family members. They do not intend to welcome any external business partners which is why he has decided to restrict the sourcing of the startup capital to 3 major sources.

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from the bank

N.B: We have been able to generate about $50,000 ( Personal savings $30,000 and soft loan from family members $20,000 ) and we are at the final stages of obtaining a loan facility of $100,000 from our bank. All the papers and documents have been signed and submitted, the loan has been approved and any moment from now our account will be credited with the amount.

14. Sustainability and Expansion Strategy

The future of a business lies in the number of loyal customers that they have, the capacity and competence of their employees, their investment strategy and the business structure. If all of these factors are missing from a business, then it won’t be too long before the business close shop.

One of our major goals of starting Swiftness© Money Transfer Agency, Inc. is to build a business that will survive off its own cash flow without injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to offer our money transfer services a little bit cheaper than what is obtainable in the market and also to ensure timely and safe deliveries. We are well prepared to survive on lower profit margin for a while.

Swiftness© Money Transfer Agency, Inc. will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check : Completed

- Business Registration: Completed

- Opening of Corporate Bank Accounts: Completed

- Securing standard photo booths: In Progress

- Opening Mobile Money Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Leasing of facility for positioning and remodeling the facility: In Progress

- Conducting Feasibility Studies: Completed

- Generating capital from family members: Completed

- Applications for Loan from the bank: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: In Progress

- Recruitment of employees: In Progress

- Purchase of furniture, racks, shelves, computers, electronic appliances, office appliances and CCTV: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business both online and around the community: In Progress

- Health and Safety and Fire Safety Arrangement (License): Secured

- Establishing business relationship with third party services providers – banks, technology companies and other financial institutions et al: In Progress

Related Posts:

- Tax Preparation Business Plan [Sample Template]

- Check Cashing Business Plan [Sample Template]

- Private Equity Firm Business Plan [Sample Template]

- ATM Business Plan [Sample Template]

- Credit Card Processing Business Plan [Sample Template]

E-Book Download – 2024 GUIDE: Building a high-performing mobile money business strategy

Key Takeaways:

- Learn the truth behind the buzz: what does it really take to launch a successful mobile money business?

- Go inside a mobile money company five years after deployment, using numbers based on real-world metrics to understand their rollout strategy.

- Gain a fly-over perspective on what’s working and what isn’t in the mobile money regulatory environment.

- Look ahead at where the next mobile money opportunities may lie.

Please fill out the form to download.

- First name * Required

- Last name * Required

- Email address * Required

- Company name

- Country * Required Please Select Country Andorra United Arab Emirates Afghanistan Antigua and Barbuda Anguilla Albania Armenia Angola Antarctica Argentina Austria Australia Aruba Aland Islands Azerbaijan Bosnia and Herzegovina Barbados Bangladesh Belgium Burkina Faso Bulgaria Bahrain Burundi Benin Saint Barthélemy Bermuda Brunei Darussalam Bolivia, Plurinational State of Bonaire, Sint Eustatius and Saba Brazil Bahamas Bhutan Bouvet Island Botswana Belarus Belize Canada Cocos (Keeling) Islands Congo, the Democratic Republic of the Central African Republic Congo Switzerland Cote d’Ivoire Cook Islands Chile Cameroon China Colombia Costa Rica Cuba Cape Verde Curaçao Christmas Island Cyprus Czech Republic Germany Djibouti Denmark Dominica Dominican Republic Algeria Ecuador Estonia Egypt Western Sahara Eritrea Spain Ethiopia Finland Fiji Falkland Islands (Malvinas) Faroe Islands France Gabon United Kingdom Grenada Georgia French Guiana Guernsey Ghana Gibraltar Greenland Gambia Guinea Guadeloupe Equatorial Guinea Greece South Georgia and the South Sandwich Islands Guatemala Guinea-Bissau Guyana Heard Island and McDonald Islands Honduras Croatia Haiti Hungary Indonesia Ireland Israel Isle of Man India British Indian Ocean Territory Iraq Iran, Islamic Republic of Iceland Italy Jersey Jamaica Jordan Japan Kenya Kyrgyzstan Cambodia Kiribati Comoros Saint Kitts and Nevis Korea, Democratic People’s Republic of Korea, Republic of Kuwait Cayman Islands Kazakhstan Lao People’s Democratic Republic Lebanon Saint Lucia Liechtenstein Sri Lanka Liberia Lesotho Lithuania Luxembourg Latvia Libyan Arab Jamahiriya Morocco Monaco Moldova, Republic of Montenegro Saint Martin (French part) Madagascar Macedonia, the former Yugoslav Republic of Mali Myanmar Mongolia Macao Martinique Mauritania Montserrat Malta Mauritius Maldives Malawi Mexico Malaysia Mozambique Namibia New Caledonia Niger Norfolk Island Nigeria Nicaragua Netherlands Norway Nepal Nauru Niue New Zealand Oman Panama Peru French Polynesia Papua New Guinea Philippines Pakistan Poland Saint Pierre and Miquelon Pitcairn Palestine Portugal Paraguay Qatar Reunion Romania Serbia Russian Federation Rwanda Saudi Arabia Solomon Islands Seychelles Sudan Sweden Singapore Saint Helena, Ascension and Tristan da Cunha Slovenia Svalbard and Jan Mayen Slovakia Sierra Leone San Marino Senegal Somalia Suriname South Sudan Sao Tome and Principe El Salvador Sint Maarten (Dutch part) Syrian Arab Republic Swaziland Turks and Caicos Islands Chad French Southern Territories Togo Thailand Tajikistan Tokelau Timor-Leste Turkmenistan Tunisia Tonga Turkey Trinidad and Tobago Tuvalu Taiwan Tanzania, United Republic of Ukraine Uganda United States Uruguay Uzbekistan Holy See (Vatican City State) Saint Vincent and the Grenadines Venezuela, Bolivarian Republic of Virgin Islands, British Vietnam Vanuatu Wallis and Futuna Samoa Yemen Mayotte South Africa Zambia Zimbabwe

- Job Level * Required Please Select Job Level C-suite Executive Management (VP/Director) Mid-level management Consultant Other

- Department * Required Please Select Department Mobile Money Airtime top-up Financial Services Other

- Function * Required Please Select Function Marketing Executive Management or business Product/IT Procurement/finance Analyst/media Other

- Market Segment * Required Please Select Market Segment Mobile operator Fintech operator Mobile money supplier Partner Systems integrator Other

- Email This field is for validation purposes and should be left unchanged.

- Stay Informed * Required

- Website Design & Development Services

- Startup Branding

- Paid Marketing

- Organic Marketing

- Market Research

- Business Plans

- Pitch Decks

- Financial Forecast

- Industry Market Research Reports

- Social Media & Website Guides

- Case Studies

- Services Marketing Website Design & Development Services Startup Branding Paid Marketing Organic Marketing Consulting Market Research Business Plans Pitch Decks Financial Forecast

- About Resources Articles Templates Industry Market Research Reports Social Media & Website Guides Case Studies Team

Mobile Money Transfer Business Plan Template

Explore Options to Get a Business Plan.

Are you interested in starting your own Mobile Money Transfer Business?

Introduction

Global market size, target market, business model, competitive landscape, legal and regulatory requirements, financing options, marketing and sales strategies, operations and logistics, human resources & management.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Mobile Business Ideas to Make Money on Wheels Discover mobile business ideas for the modern age and learn how to leverage flexibility and innovation for on-the-go profits.

By Dan Bova Aug 7, 2023

In today's fast-paced, technology-driven world, the entrepreneurial landscape is evolving at an unprecedented pace. Innovation is at an all-time high, driven by advanced technology, consumer behavior changes and market dynamics that consistently challenge traditional business models.

This shift is characterized by the increasing dominance of service-oriented businesses, the integration of technology in all aspects of operations and the rise of entrepreneurship as a viable career choice for many. Furthermore, the advent of digital transformation has made it easier for businesses to reach out to consumers and vice versa, thus leading to more dynamic interaction and transaction models.

Amidst this transformation, one particular trend has caught the eye of many entrepreneurs and investors — mobile businesses. These enterprises are not tied to a specific location, and instead bring their services or products directly to the consumer.

The concept isn't an entirely new creation; think of food trucks or traveling salesmen. However, the modern interpretation of mobile businesses has expanded to include a wide array of sectors and services, all leveraging the power of modern technology and digital connectivity.

Related: Thriving in a Rapidly Changing Business Landscape with Innovation and Agility | Entrepreneur

Why is the popularity of mobile businesses skyrocketing?

The rise of mobile businesses is no accident. Various benefits make them attractive for entrepreneurs, contributing to their growing popularity. Here are some reasons why mobile businesses are currently enjoying the spotlight:

Flexibility

At the core of mobile businesses is their inherent flexibility, which allows them to maneuver swiftly and adjust to evolving market conditions .

Unlike traditional businesses tied to a specific location, mobile businesses can move directly to where their customers are. This ability to "go where the customer is" greatly reduces dependence on foot traffic and physical location, providing an edge in today's consumer-centric market.

Furthermore, the mobility of these businesses enables them to respond promptly to changing market needs, customer preferences and emerging trends. Whether it's moving to a new location to tap into a different demographic or adapting services based on real-time feedback, the flexibility of mobile businesses is a key factor driving their popularity.

Lower startup costs

Another compelling factor is the cost-efficiency of mobile businesses.

Starting a traditional brick-and-mortar business often requires a substantial investment upfront, including rent for premises, renovation costs, utility bills and property maintenance expenses. In contrast, mobile businesses, whether they operate from a food truck or via a smartphone, typically have significantly lower startup costs.

The absence of expenses related to physical premises allows entrepreneurs to channel more resources into improving their products or services and enhancing customer experience. This makes mobile businesses an accessible entry point for aspiring entrepreneurs or those with limited capital.

Related: How to Track Your Startup Costs and Save Money | Entrepreneur

Digital connectivity

The digital revolution has undoubtedly paved the way for the growth of mobile businesses. The ubiquity of high-speed internet and the proliferation of smart devices have changed the way businesses interact with their customers.

In today's digital age, businesses are no longer confined by geographical limitations. They can reach global customers with just a few clicks, provide real-time updates via social media and offer personalized online shopping experiences.

Online platforms, social media and digital marketing are all significant elements in a mobile business's toolkit. They enable mobile entrepreneurs to engage with, attract and serve customers in ways that were unimaginable a decade ago.

These tools also facilitate seamless transactions, customer relationship management and data-driven decision-making, making it easier for businesses to grow and succeed in the digital sphere.

Related: 5 Ways Small Business Owners Can Embrace Rapid Digital Change to Get Closer to Their Customers | Entrepreneur

What mobile business ideas stand out in the modern age?

There is no shortage of ideas when it comes to opening a mobile business. Here are just a few examples of the best mobile business ideas of the modern age:

Mobile food and beverage enterprises

There's no denying that mobile food businesses have surged in popularity over the past decade.

Whether it's a gourmet food truck offering locally-sourced delicacies, a mobile coffee shop brewing artisanal blends or an ice cream van bringing joy to local neighborhoods, mobile food and beverage businesses provide a flexible, cost-effective alternative to traditional brick-and-mortar establishments.

The mobility of mobile food businesses allows them to cater to different locations and events, creating a diverse customer base. Furthermore, these ventures often draw attention with their unique branding and innovative menu offerings.

Related: Why Food Truck Businesses Are Revving Up | Entrepreneur

Mobile retail shops on-the-move

The idea of a "store on wheels" has reinvented retail in many ways.

Mobile retail shops offer a unique shopping experience, bringing products directly to consumers. From fashion and accessories to books and homewares, these stores can pop up anywhere – festivals, street fairs, corporate events or busy urban areas.

This business model reduces overhead costs associated with a physical store and allows for more dynamic customer interaction. Additionally, the novelty of shopping in a mobile retail store can attract clientele.

Health and wellness services on wheels

The health and wellness industry is another area where mobile businesses are making a significant impact. On-the-go health and wellness services, such as mobile medical clinics, mobile spa services or even a traveling fitness coach, are increasingly sought after.

These services can provide valuable care in underserved areas or offer clients a convenient, personalized experience. They can also partner with businesses to offer on-site services, creating an additional stream of clientele.

Related: 4 Reasons Why You Should Enter the Health and Wellness Industry Now | Entrepreneur

On-the-go pet care ventures

As pet ownership continues to rise , so does the demand for pet care services. Mobile pet care ventures can range from on-the-go grooming and veterinary services to mobile pet daycare or dog walking services.

By coming to the pet's home environment, these businesses can provide less stressful and more convenient services for both pets and their owners.

Mobile educational and tutoring services

In the age of remote learning , mobile educational services have become increasingly relevant.

Whether providing tutoring in various subjects, teaching musical instruments, or offering language classes, mobile education businesses can deliver personalized, one-on-one instruction tailored to the learner's pace.

Moreover, by using digital tools, these services can be offered both in-person and virtually, further expanding their reach.

Related: Examples of Educational Business Ideas | Entrepreneur

Tech and repair services at your doorstep

As we become more dependent on technology, on-demand tech support and repair services become increasingly valuable. A mobile tech repair business can offer services ranging from smartphone and computer repairs to home network setup and troubleshooting.

Such businesses provide a convenient solution to clients, saving them the trouble of disconnecting their devices and hauling them to a repair shop.

Related: Beyond the Food Truck: 10 Unique Mobile Businesses | Entrepreneur

How do you launch a successful mobile business?

Starting a successful mobile business involves a blend of strategic planning, compliance with regulations and effective marketing. Here's how to set your mobile venture on the path to success.

Develop an effective mobile business plan

A well-crafted business plan serves as a roadmap for your mobile business. It should outline your business concept, target market, competition analysis, operational plan, financial projections and marketing strategies.

Research your industry thoroughly and identify the unique selling proposition of your mobile business. Develop a solid financial model, including startup costs, operational expenses and revenue projections. Your business plan should also incorporate growth strategies, highlighting how you plan to expand and scale your business over time.

Related: How to Prepare and Write the Perfect Business Plan for Your Company | Entrepreneur

Consider regulatory aspects for mobile businesses

Mobile businesses, like their brick-and-mortar counterparts, need to comply with various regulatory requirements.

These might include obtaining necessary permits and licenses, complying with health and safety regulations (especially for food and health-related businesses) and ensuring you meet zoning laws for operating in different locations.

Make sure you understand the specific regulations in your industry and locale to avoid potential legal issues.

Create a marketing strategy for your mobile business

Effectively marketing your mobile business is crucial to attracting customers. Leverage the power of social media, create a compelling website and use online marketing tools to reach your target audience.

Local SEO is particularly vital for mobile businesses as it helps local customers find you. Offering promotions and discounts can attract initial clientele and engaging with customers online can help you build a strong brand reputation.

Related: 9 Tips to Successfully Market Your Business | Entrepreneur

How can you overcome the unique challenges that come with a mobile business?

Like any business venture, mobile businesses come with their unique set of challenges.

For instance, the nomadic nature of mobile businesses can make it hard to establish a steady customer base. Unpredictable weather conditions can also impact operations. However, these challenges can be tackled with the right strategies.

Building a loyal customer base can be achieved by consistently offering high-quality products or services and maintaining a strong online presence. Regularly updating your locations and hours on social media can help customers find you. As for weather conditions, having a backup plan for bad weather days, like offering home deliveries or focusing on online sales, can be beneficial.

Related: 5 Ways to Grow Your Customer Base Organically | Entrepreneur

Finding a winning business idea

In conclusion, the mobile business trend has become a powerful entrepreneurial path, offering the flexibility and potential for creative business ideas.

With strategic planning, compliance, effective marketing and resilience in overcoming challenges, you can successfully ride the wave of this trend. As technology advances and consumer behaviors shift, the future for mobile businesses looks promising and full of exciting opportunities.

The ideas above are only scratching the surface for potential mobile business ideas. By using your imagination, you just might create the next billion-dollar industry.

If you're interested in learning more about how to start a business, then check out some of the additional information available at Entrepreneur today.

Entrepreneur Staff

VP of Special Projects

Dan Bova is the VP of Special Projects at Entrepreneur.com. He previously worked at Jimmy Kimmel Live, Maxim, and Spy magazine. His latest books for kids include This Day in History , Car and Driver's Trivia Zone , Road & Track Crew's Big & Fast Cars , The Big Little Book of Awesome Stuff , and Wendell the Werewolf .

Read his humor column This Should Be Fun if you want to feel better about yourself.

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Exclusive: Kevin O'Leary Is Launching a New Agency With the Founder of Shazam — Here's Why He Says It's a Game Changer

- Lock Younger Generations Want to Retire By 60. Their Strategy Is a Win-Win for Everyone.

- These Are the AI Skills You Should Learn Right Now, According to the World's Youngest Self-Made Billionaire

- Lock I Worked at Google for 14 Years — Here's What I Had to Unlearn When I Started My Own Company

- Lock New Research Reveals How Much Money Most Side Hustles Make in 1 Month — and the Number Might Surprise You

- Celebrities Are Collaborating on Iconic Meals With Popular Fast-Food Chains — Did Your Favorite Make the Cut?

Most Popular Red Arrow

Trump said harris used ai to fake crowd size. here's why that claim was debunked..

What's real in the age of AI and deepfakes?

How to Find the Right Programmers: A Brief Guideline for Startup Founders

For startup founders under a plethora of challenges like timing, investors and changing market demand, it is extremely hard to hire programmers who can deliver.

Building Your Business With Limited Resources? Here's the Mindset You Need to Succeed.

"Do what you can, with what you have, where you are."

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Cash App Will Pay $15 Million to Settle a Class Action Lawsuit — Here's How to Claim Up to $2500

Eligible users have until November 18 to claim a part of the cash.

Disney World Is Adding New Attractions and Themed Lands in a Massive Expansion — Here's What to Expect

The company announced its plans during its annual fan convention D23 in California.

Successfully copied link

Small Business Trends

67 mobile business ideas for modern on-the-go entrepreneurs.

What Are Mobile Businesses?

Here’s a word from Zay Wonder about ‘Mobile Business Ideas For 2023 That Can Make You $8k/month or More!’ He’s a regular guy but has entrepreneurial savvy, which you can see in several of his great mobile business ideas.

The Mobile Retail Business Industry Today

Why people should consider becoming mobile business owners, mobile business vs. brick-and-mortar: a comparative overview.

| Feature/Criteria | Mobile Business | Brick-and-Mortar Business |

|---|---|---|

| Startup Costs | Generally lower due to no fixed location and smaller inventory. | Typically higher due to rent/lease and infrastructure. |

| Location Flexibility | Can relocate based on demand and opportunity. | Fixed location; cannot easily relocate. |

| Operational Overheads | Lower; mainly vehicle maintenance and fuel. | Higher; includes rent, utilities, maintenance, etc. |

| Customer Reach | Broad; can reach various demographics and locations. | Limited to those nearby or willing to travel. |

| Operational Hours | Flexible; can adjust based on events or demand. | Typically fixed, may require consistent staffing. |

| Visibility | Dynamic; vehicle can serve as advertising. | Static; relies on storefront and traditional marketing. |

| Inventory | Limited space often leads to smaller inventory. | Larger space allows for more stock and variety. |

| Customer Experience | Unique and often personalized. | Standardized and consistent. |

| Regulatory Considerations | Mobile licenses, permits for various locations. | Typically fixed licenses and permits. |

| Expansion | Can add more vehicles or service areas. | Physical expansion or opening new stores. |

| Natural Disasters/Risks | Mobility allows for movement away from high-risk areas. | Fixed; potential loss due to disasters. |

Our Methodology for Picking the Best Mobile Business Ideas

Assessing market demand and trends (rating: 9/10).

Our first step was evaluating the market demand for mobile services or products. We focused on ideas that cater to current consumer needs and preferences, ensuring a viable market presence.

Cost Effectiveness and Initial Investment (Rating: 8/10)

Flexibility and lifestyle compatibility (rating: 8/10), unique value proposition (rating: 7/10).

To stand out in the mobile business sector, having a unique selling point is crucial. We looked for ideas that offer something distinct from traditional brick-and-mortar businesses and other mobile competitors.

Scalability and Expansion Potential (Rating: 7/10)

Skill and passion alignment (rating: 8/10), regulatory compliance and logistics (rating: 7/10), best mobile business ideas, 1. mobile catering business.

Mobile Catering Business Caterers often find themselves at weddings, birthdays, or corporate events. To launch a mobile catering service, secure a reliable vehicle, stock up on delicious food items, and invest in quality serving equipment. Tailor your menu based on event types to stand out.

2. Mobile Salon

3. mobile pet grooming business, 4. mobile car wash, 5. mobile bike services.

Cycling enthusiasts often need tune-ups or repairs. Provide valuable, on-site bike maintenance or restoration services. By meeting cyclists in their homes, you eliminate the need for them to transport bulky bikes to a shop.

6. Food Truck Business

7. mobile cleaning services, 8. photography business, more ideas for starting a mobile business, 9. ice cream truck.

Distinct from the traditional food truck, ice cream trucks embody nostalgia and joy. They remain constantly on the move, engaging communities at every turn, bringing delightful cold treats to neighborhoods and parks, changing locations to maximize reach.

10. Clothing Boutique

11. mobile billboard, 12. mobile mechanic, 13. personal trainer.

Craft a niche as a traveling fitness mentor. Collaborate with clients in their homes, serene local parks, or even community gyms. Tailor exercise regimes to individual needs, ensuring each session feels personalized and effective.

14. IT Services

15. farmers market vendor, 16. mobile coffee shop, 17. party bus.

Transform occasions into memorable journeys. Cater to weddings, proms, or corporate retreats with a fleet of luxury buses. Equipped to hold numerous guests, these vehicles should ensure comfort, safety, and a touch of extravagance.

18. Independent Bookstore

19. thrift store, 20. home organizer, 21. junk removal.

Post-construction debris, old furniture, or accumulated clutter often overwhelm homeowners. Junk removal businesses come to the rescue, clearing up spaces, responsibly disposing of waste, or even recycling. They ensure homes and commercial spaces regain their original luster.

22. Drone Photography Business

23. tour guide, 24. errand services, 25. tutoring.

Education doesn’t always need a classroom setting. Offer personalized sessions at students’ homes, assisting with tricky subjects or providing guidance for standardized test preparations. By being mobile, tutors can tailor teaching styles to individual learning environments.

26. Handyman Services

27. event planner, 28. landscape designer, 29. home chef.

A gourmet experience doesn’t always need a restaurant. As a mobile chef, you can curate customized menus for families or intimate gatherings, cooking in clients’ kitchens. This approach ensures fresh preparation, personalized dishes, and a memorable culinary experience.

30. Wardrobe Consultant

31. event entertainer, 32. florist, 33. pet sitting.

Pet sitters offer peace of mind to traveling animal owners. By caring for pets in their familiar environments, stress is minimized. Whether it’s playful dogs or tranquil fish, pet sitters ensure all creatures receive care, attention, and love in their owners’ absence.

34. Smart Home Installations

35. business consultant, 36. in-home care, 37. travel blogging.

Chronicle wanderlust adventures through a blog, sharing insights and experiences. Monetizing can arise from ads, brand partnerships, or building a following that values genuine travel advice and stories.

38. Yoga Instructor

39. pop-up events, 40. mobile photo booth, 41. mobile phone repairs.

Phones, essential in our daily lives, often suffer mishaps. Offer on-the-spot repairs, addressing issues from shattered screens to malfunctioning buttons, ensuring customers stay connected.

42. Laundry Service

43. airport shuttle service, 44. corporate transportation service, 45. employee training service, 46. courier, 47. locksmith.

Lock predicaments are common yet stressful. Mobile locksmiths offer relief, whether it’s crafting new home keys or unlocking stranded cars, always ready for emergency calls.

48. Food Delivery

49. recycling service, 50. compost collection, 51. tool rental business, 52. pool cleaning service, 53. painting service, 54. window tinting, 55. massage therapy, 56. dog walking, 57. personal shopper, 58. party rental provider, 59. holiday decor service, 60. landscaping service.

The beauty of a well-maintained yard is undeniable. Offer comprehensive landscaping services to those passionate about their outdoor spaces. This includes meticulous lawn care, strategic weed control, and decorative mulching, ensuring gardens radiate throughout warmer months.

61. Paint and Sip Parties

62. home inspector, 64. power washing service, 65. windshield replacement service.

A cracked windshield poses both aesthetic and safety concerns. Offer customers swift, on-location windshield replacement, ensuring they’re back on the road with a clear view, without the hassle of visiting a workshop.

66. Disc Jockey

67. home services provider, which business is best for mobile, places to meet your customers.

Selecting strategic locations to engage with your customers is vital for the success of your mobile business. These locations should align with your target audience’s preferences and routines. Consider setting up at popular community events, local markets, office complexes, or near recreational areas. High foot traffic areas, such as festivals downtown districts, shopping centers, and college campuses, can also be lucrative spots to connect with potential customers. A lot of customers like to relax at home, so think about bringing services like lawn care to them.

What Are the Advantages of Mobile Businesses?

How to start a mobile business in 6 easy steps.

2. Set Your Budget Even though mobile businesses boast lower overhead costs, you’ll still need to budget for various expenses. Startup costs may include purchasing or outfitting a vehicle, registering your business, designing a website or app, and obtaining necessary licenses and permits. Ongoing expenses encompass vehicle and inventory insurance, small business insurance, staff wages, fuel, parking, and more.

6. Hire Your Team and Start Selling With your vehicle customized, permits obtained, and inventory ready, it’s time to build your team and launch your business. Whether you’re starting small or expanding rapidly, hiring motivated team members and hosting a grand opening can create a buzz and kick off your selling journey.

Summary of Steps

| Steps to Start a Mobile Business | Description |

|---|---|

| 1. Develop Your Business Plan | Create a detailed business plan encompassing your company's mission, market analysis, product details, marketing strategies, and financial projections. A comprehensive plan is crucial for attracting investors and guiding your business towards success. |

| 2. Set Your Budget | Although mobile businesses come with lower overhead costs, you must budget for startup expenses like vehicle purchase or outfitting, business registration, website/app development, licenses, and permits. Ongoing costs include vehicle and inventory insurance, staff wages, fuel, and parking. |

| 3. Pick and Register Your Business Name | Choose a business name that resonates with your target audience and aligns with your market analysis. Ensure the name's availability as a domain and on social media. Once chosen, register your business with the state for official branding. |

| 4. Purchase Your Vehicle | Select the right vehicle to transport your products or services. Options include buying a pre-owned vehicle and customizing it, leasing an outfitted vehicle for a trial, or investing in a new custom vehicle tailored to your needs. |

| 5. Acquire the Necessary Licenses | Obtain licenses and permits for legal operation. Depending on your location and industry, this may include state and local business licenses, seller's permits, fire certificates, health department permits, and industry-specific licenses. |

| 6. Hire Your Team and Start Selling | Build a motivated team and launch your business with customized vehicles, permits, and stocked inventory. Whether starting small or expanding, hosting a grand opening can create excitement and initiate sales efforts. |

Ways to Build Repeat Business

Mobile Money

Explore the world of mobile money and how it revolutionizes how people access and manage their finances.

What is Mobile Money?

Mobile money is a transformative financial service enabling individuals to conduct various financial transactions conveniently through mobile phones. Originating from regions with limited traditional banking infrastructure, mobile money platforms empower users to store, transfer, and manage funds securely, fostering financial inclusion on a global scale.

The term "mobile money" encompasses a range of digital financial services accessible through mobile devices, offering solutions such as money transfers, bill payments, airtime top-ups, and even microloans. It represents a paradigm shift in how people interact with money, transcending geographical barriers and bridging the gap between the banked and unbanked populations.

Mobile Money Utilities

With mobile money, users can:

Store funds securely in a digital wallet linked to their mobile phone number.

Transfer money to family, friends, or businesses domestically and internationally with ease and affordability.

Receive payments for goods and services, including salaries and remittances, directly into their mobile wallets.

Access credit and microfinance services to meet short-term financial needs.

Pay bills, purchase goods, and top up mobile airtime credits without the need for physical cash.

Why Should Businesses Embrace Mobile Money?

Embracing mobile money as a payment method offers numerous advantages for businesses, including:

Expanding customer reach : Mobile money usage is widespread in regions with limited access to traditional banking services, opening up new markets and customer segments for businesses.

Enhancing convenience and accessibility : Mobile money enables seamless and instant transactions, catering to the growing demand for digital payment solutions in an increasingly connected world.

Strengthening financial inclusion : Businesses foster financial inclusion and economic empowerment by accepting mobile payments, particularly in underserved communities.

EBANX & Mobile Money

Incorporating mobile money into your payment strategy through EBANX can revolutionize your business operations and unlock growth opportunities in emerging markets.

You may also like

Brazil Payment Market

Understand how Brazil has been standing out in the global market and what is the ranking of the 4 most used payment methods in the country!

Mexican Payment Market

This guide will teach you how to design an effective checkout process for cross-border payments, with a specialized focus on the trending emerging markets.

Checkout Process Design

EBANX Solution for OTAs

EBANX is the payment partner helping global Online Travel Agencies simplify financial flows for suppliers and consumers in Africa and Latin America

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Best Business Cell Phone Plans

Best Business Cell Phone Plans Of 2024

Updated: Mar 17, 2024, 11:08am

Business cell phone plans are an important consideration for any team. LinkedIn reports that 57% of sales professionals saw an increase in calls to customers in 2020. Ensuring that all of your staff can pick up the phone no matter where they are can make a huge difference in your overall sales.

If you want phone calls on the go, you have several options at your disposal. For one, you could go with a business-centric plan from one of the major United States wireless carriers. Alternatively, you could use one of the leading voice-over-internet-protocol (VoIP) platforms and stay connected via a mobile app. Forbes Advisor ranked the best mobile options on the market to help you figure out which is best for your brand.

- Best VoIP Service

- Best Free VoIP Phone Service

- Best VoIP Cell Phone Service

- Best Conference Calling Services

- Best Call Center Software

The Best 5 Business Cell Phone Plans of 2024

Why you can trust forbes advisor small business.

RingCentral

Verizon Wireless

Google voice, at&t wireless, forbes advisor ratings, methodology, considerations for choosing the best business cell phone plan, frequently asked questions (faqs), next up in business.

Featured Partners

$20 per user, per month (paid annually)

On RingCentral's Website

Starts at $10 per user, per month

On Zoom's Website

$18.95 per user, per month

On Nextiva's Website

- RingCentral: Best VoIP business mobile plan

- Verizon Wireless: Best traditional wireless carrier

- Google Voice: Best mobile solution for sole proprietors and freelancers

- AT&T Wireless: Best for mobile security

- T-Mobile: Best for novel features

The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey.

We reviewed the leading mobile phone providers in the market using a detailed system to determine the five best cell phone services for small businesses. Pricing was an essential consideration when putting together our list as were the features that each provider offered. We also took into consideration real users’ experiences with the cell phone providers to come up with our final rankings. All ratings are determined solely by our editorial team.

Best Overall Business Cell Phone Plan

Starting price

$24.99 per user, per month

Free hardware available

International coverage

RingCentral is a far cry from your traditional business cell phone plan. It does not offer a wireless network or devices for your team. Instead, this VoIP service offers a monthly (or annual) subscription to software you can use from a computer, tablet or smartphone via an app. In most cases, subscribing to RingCentral and having your team log in to the app via their accounts is a lot more affordable than going with one of the big wireless carriers. Therefore, it is our top overall pick for business cell phone plans.

Regardless of which plan you choose, all versions of RingCentral come standard with the following:

- Unlimited calls within the United States and Canada

- Unlimited business short message service (SMS)

- Team member messaging

- Voicemail to text

- Document sharing

- Toll-free numbers

Service plan costs vary depending on how many people you employ. Pricing for two to 20 users on an annual basis is as follows:

- Essentials: $24.99 per user, per month with unlimited domestic calling, SMS, document sharing and voicemail-to-text functionality

- Standard: $27.99 per user, per month with unlimited fax, video calling for up to 100 people, the ability to adopt a number in more than 100 countries and more

- Premium: $39.99 per user, per month with automatic call recording, third-party software integrations and more

- Ultimate: $54.99 per user, per month with advanced status reports, alerts and unlimited online file storage

RingCentral’s plans offer features that aren’t available through larger carriers. The fact that RingCentral offers toll-free numbers is helpful in commanding a more professional business presence, and features like video calling and faxing are nice bonuses. RingCentral also has an intuitive, modern interface that closely resembles your smartphone’s default phone and texting apps. Once it is installed, you can think of the app as a business phone that lives in your personal phone.

The only downside with RingCentral as a business cell phone plan is it requires a fair amount of trust. On one end, you will need to consider whether or not you can count on your team members to keep company information secure if the app is installed on their personal devices. Additionally, your staff may not feel comfortable with having their work phone installed onto their smartphones.

While the lines between work and home continue to blur, thanks in large part to apps like Slack and Zoom, you might want to evaluate your company culture before moving forward. It’s also worth noting that all of RingCentral’s features can be used on a PC or Mac.

Learn more: Read our full RingCentral review .

Who should use it:

RingCentral’s pricing and features make it a good fit for businesses of every size.

- Free 15-day trial

- Very affordable monthly plans

- Able to customize service by business size and industry

- Available across multiple devices

- Possible to video conference with up to 200 people

- Must upgrade for 24/7 customer support and, even then, it apparently leaves a lot to be desired

- Plans get inexplicably more expensive for sole proprietors

- Can only rent phones with multi-year contracts

Best for Traditional Plans and VoIP Features

Plans as low as $30 per month, per line

Verizon is one of the largest carriers in operation, with coverage and services spanning from coast to coast and beyond. The company makes our list as it provides solid cell phone plans for small and large businesses alike. You can choose from one of several subscription options according to what works best for your company.

Flexible Business Wireless Plans

The Flexible Business Wireless Plan offers unlimited domestic talk and text, unlimited international messaging and a mobile hot spot. It also comes with a shareable data pool for your phones, tablets and other devices. You can even gain access to corporate email services.

What makes this plan “flexible” is that you get to choose the amount of data you want to add to your smartphone, tablet or both. The pricing plans vary according to the amount of data you need for your device. Use a handy calculator to determine how much smartphone or tablet data you’ll need to get an idea of your expected monthly price.

Business Unlimited Plans

These Verizon business phone subscriptions provide companies with unlimited talk, text and data through three tier levels: Start. 2.0, Plus 2.0 and Pro 2.0:

- Business Unlimited Start 5G: As low as $30 per month when you add five or more lines. Includes unlimited talk, text and data; 5G nationwide/4G LTE and call filter

- Business Unlimited Plus 5G: As low as $40 per month with five or more lines; it includes everything in Start plus 5G Ultra Wideband, 100 GB Premium network access and an unlimited mobile hotspot. The tier also offers Business Mobile Secure, which protects your smartphones against potential security threats.

- Business Unlimited Pro 5G: As low as $45 per month when you buy five or more lines; offers unlimited Premium Network Access and a 50% discount on Business Unlimited Pro tablet plans

The monthly plan price fluctuates according to the number of smartphone lines you buy. Although Verizon offers generous price discounts with each tier, smaller businesses might find the pricing plans a bit expensive, even excessive if they don’t need five or more lines.

Verizon lets you bring your own device (BYOD) to the service and even offers discount deals for doing so. However, not every device is compatible, and the brand recommends confirming compatibility before making the switch. Verizon often offers free phones or generous credit, between $200 and $1,000, toward purchasing a new phone.

Like many service providers, Verizon tends to automate customer support to the point where some customers struggle to speak with an actual human. Because it can be hard to talk to anyone, customers often find Verizon’s customer service somewhat lacking. To make up for this, Verizon offers a feature in which an agent will call you when one is available if you don’t feel like waiting on hold.

Verizon represents a more traditional phone plan structure, one with its service easily accessible across the country and via different locations worldwide. As such, even pricing and customer service issues are but minor deterrents. You’re still getting a big carrier plan with coverage in most of the United States and a wide range of service plans and devices to suit your needs.

Verizon works well for small to large businesses with a healthy budget.

Learn more:

Read our full Verizon Wireless review .

- Nationwide coverage

- Offers mobile VPN with certain plans

- Data, calls and texting available to use while in Canada and Mexico

- Ability to mix and match plans

- Could be overkill for smaller organizations

- Plans can get expensive

Best for Sole Proprietors and Freelancers

Plans starting at $10 per month, per user

Google Voice is an ideal choice for those who need an extra business phone number but might not be able to afford a complex and pricey service plan. Google Voice is a popular virtual phone service that offers call forwarding, voice and text messaging and voicemail options. Best of all, there is a version of the system that is entirely free to use as long as you have a Google Account.

Google Voice is popular for offering an impressive set of functionality in its free tier. As long as you have a personal Google Account, you can adopt a local number with nearly any area code in the United States. You can make unlimited domestic calls and texts across the U.S. and Canada from your phone or computer.

Because Google Voice is a free service, it can be especially useful to a small, cash-strapped business that wants to be able to make and receive calls without committing to pricier service plans offered by AT&T or T-Mobile. Though an existing number is required, once you link it to Google Voice, you’re able to communicate using virtually any device. If your business needs more than what the freeware offers, you can sign up for one of Google Voice’s subscription plans:

- Business Starter: $10 per user, per month; recommended for entrepreneurs or small businesses with 10 people or less

- Business Standard: $20 per user, per month; works for businesses of any size

- Business Premier: $30 per user, per month; aimed at larger, international companies

Once you upgrade, you can enjoy features such as unlimited domestic calling and text, voicemail transcripts, a “do not disturb” feature linked to your Google Calendar working hours, use and activity reports and 24-hour technical support. Upgrade to Standard or Premier for additional perks, including desk-phone compatibility, auto attendants and eDiscovery for calls, text messages and voicemail.

Overall, Google Voice offers businesses several benefits at either no cost or through very affordable service plans. Even if there are downsides, with the amount of free features, Google Voice is a beneficial service.

Learn more: Read our full Google Voice review .

Google Voice works best for organizations, small and large, that want a business cell phone plan that streamlines their contacts across multiple devices.

- Free version available

- 14-day trial for paid features

- Highly scalable, with service options for businesses of every size and budget

- Get a local number

- Unlimited calling and SMS

- Need an existing phone number to forward calls

- Must have internet/Wi-Fi connection to use

Best for Mobile Security

$30 per line, per month