CBSE Class 12 Case Studies In Business Studies – Financial Management

FINANCIAL MANAGEMENT Financial Management: Definition Financial Management is concerned with optimal procurement as well as usage of finance.

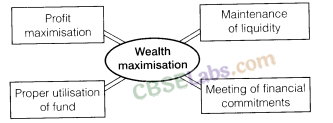

Objective The prime objective of financial management is to maximise shareholder’s wealth by maximising the market price of a company’s shares.

Financial Decisions Involved in Financial Management

- Investment Decision

- Financing Decision

- Dividend Decision

Role of Financial Management

- To determine the capital requirements of business, both long-term and short-term.

- To determine the capital structure of the company and determine the sources from where required capital will be raised keeping in view the risk and return matrix.

- To decide about the allocation of funds into profitable avenues, keeping in view their safety as well.

- To decide about the appropriation of profits.

- To ensure efficient management of cash in order to ensure both liquidity and profitability.

- To exercise overall financial controls in order to promote safety, profitability and conservation of funds.

INVESTMENT DECISION

- It seeks to determine as to how the firm’s funds are invested in different assets

- It helps to evaluate new investment proposals and select the best option on the basis of associated risk and return.

- Investment decision can be long-term or short-term.

- A long-term investment decision is also called a Capital Budgeting decision.

Types of Investment Decision

- It refers to the amount of capital required to meet day- to-day running of business.

- It relates to decisions about cash, inventory and receivables.

- It affects both liquidity and profitability of business.

- It refers to the amount of capital required for investment in fixed assets or long term projects which will yield return and influence the earning capacity of business over a period of time.

- It affects the amount of assets, competitiveness and profitability of business.

- The expected cash flows from the proposed project should be carefully analysed.

- The expected rate of return should be carefully studied in terms of risk associated from the proposed project.

- Different types of ratio analysis should be done to evaluate the feasibility of the proposed project as compared to similar projects in the same industry.

FINANCING DECISION Financing Decision: Definition Financing decision relates to determining the amount of finance to be raised from different sources of finance.This decision determines the overall cost of capital and the financial risk of the enterprise. Types of Sources of Raising Finance

- Equity shares

- Preference shares

- Retained earnings

- Loan from bank or financial institutions

- Public deposit

Considerations Involved in the Issue of Debt

- Interest on borrowed funds has to be paid regardless of whether or not a business has made a profit. Likewise, borrowed funds have to be repaid ata fixed time.

- There is some amount of financial risk in debt financing.

- The cost of debt is less than equity as the degree of risk assumed by the investors is less and the amount of interest paid by the company is tax deductible.

Factors Affecting Financing Decision

- The source of finance which involves the least cost should be chosen.

- The risk involved in raising debt capital is higher than equity.

- The sources involving high flotation cost require special consideration.

- If the cash flow position of a business is good, it should opt for debt else equity.

- If the fixed operating cost ofa business is low, it should opt for debt else equity.

- The issue of equity capital dilutes the control of existing shareholders over business whereas financing through debt does not lead to any such effect

- If there is boom in capital market it is easy for the company to raise equity capital, else it may opt for debt.

Considerations Involved in the Issue of Equity

- Shareholders do not expect any commitment regarding the payment of returns or repayment of capital.

- The floatation cost on raising equity capital is high.

- The shareholders expect higher returns in return for assuming higher risks.

DIVIDEND DECISION Dividend Decision relates to disposal of profit by deciding the proportion of profit which is to be distributed among shareholders and the proportion of profit which is to be retained in the business for meeting the investment requirements.

Factors Affecting Dividend Decision

- If the earnings of the company are high, dividends are paid at a higher rate.

- If the earnings of a company are stable, it is likely to pay higher dividends.

- A company is more likely to maintain a stable dividend rate over a period of time,unless there is a significant change in its earnings.

- A company planning to pursue a growth opportunity is likely to pay lower dividends. The dividends are paid in cash, therefore if the cash flow of the company is good, it is likely to pay higher dividends.

- If the shareholders prefer regular income in form of dividends, the company is likely to maintain a dividend payout rate.

- If the tax rate is high, the company is likely to pay less dividend.

- If a company wants positive reactions at stock market, It Is likely to pay higher dividends.

- A large company can access funds easily from capital market as per its requirements, therefore, it is likely to retain lesser profits and is likely to pay higher dividends.

- The legal constraint should be considered at the time of dividend payment by a company.

- The contractual constraints may also affect the dividend payment by a company.

FINANCIAL PLANNING Financial Planning: Definition The process of estimating the funds requirement of a business and specifying the sources of funds is called financial planning. It basically involves preparation of a financial blueprint of an organisation’s future operations.

Twin Objectives of Financial Planning

- To ensure availability of funds as per the requirements of business.

- To see that the enterprise does not raise resources needlessly.

Importance of Financial Planning

- It ensures smooth running of a business enterprise by ensuring availability of funds at the right time.

- It helps in anticipating future requirements of funds and evading business shocks and surprises.

- It facilitates co-ordination among various departments of an enterprise, like marketing and production functions, through well-defined policies and procedures.

- It increases the efficiency of operations by curbing wastage of funds, duplication of efforts, and gaps in planning. .

- It helps to establish a link between the present and the future.

- It provides a continuous link between investment and financing decisions.

- It facilitates easy performance as evaluation standards are set in clear, specific and measurable terms.

CAPITAL STRUCTURE Capital Structure: Definition It refers to the mix between owners and borrowed funds.

Financial Risk: Definition It refers to a situation when a company is unable to meet its fixed financial charges like payment of interest on debt capital.

Trading on Equity: Definition It refers to the increase in the earnings per share by employing the sources of finance carrying fixed financial charges like debentures (interest is paid at a fixed rate) or preference shares (dividend is paid at fixed rate).

Financial Leverage: Definition The proportion of debt in the overall capital is called financial leverage. It is computed as D/E or D/D+E, where D is the Debt and E is the Equity.

FIXED CAPITAL Fixed Capital: Definition It refers to investment in long-term assets.

Importance of Management of Fixed Capital

- It affects the growth and profitability of busmess m future.

- It involves huge investment outlay in terms of investment in land, building, machinery etc.

- Its influences the overall level of business risk of the organisation.

- If these decisions are reversed they may lead to major losses.

WORKING CAPITAL Working Capital: Definition The funds needed to meet the day-today operations of the business is called working capital.

Factors Affecting the Choice of Capital Structure

| 1. | Cash flow position | If the cash flow position is good the business may use debt. | If the cash flow position is poor the business may use equity. |

| 2. | Interest coverage ratio | If the interest coverage ratio is high the business may use debt. | If the interest coverage ratio low the business may use equity. |

| 3. | Debt service coverage ratio | If the debt service coverage ratio is high the business may use debt. | If the debt service coverage ratio is low the business may use equity. |

| 4. | Return on investment | If the return on investment is high the business may use debt. | If the return on investment is low the business may use equity. |

| 5. | Cost of debt | If the cost of debt is low the business may use debt. | If the cost of debt is high the business may use equity. |

| 6. | Cost of equity | The company may use debt up to a certain limit so that shareholders do not expect higher returns on equity. | Shareholders expect higher returns when the company uses debt beyond a point due to increase in the financial risk, so the cost of equity increases. |

| 7. | Tax rate | If the tax rate is high the business may use debt. | If the tax rate is low the business may use equity. |

| 8. | Floatation costs | The floatation cost is lesser on using debt | The floatation cost is higher on using equity. |

| 9. | Financial risk consideration | If the financial risk is low the business may use debt. | If the financial risk is high the business may use equity. |

| 10. | Flexibility | Too much use of debt reduces flexibility to raise more debt. | If the business doesn’t want to restrict its flexibility, it may issue equity. |

| 11. | Control | Issue of debt doesn’t affect control of existing shareholders. | Issue of equity dilutes the control of the existing shareholders. |

| 12. | Stock market conditions | If there is recession in the stock market, the business may issue debt capital. | If there is boom in the stock market, the business may issue equity. |

13. Regulatory framework: The business will choose the option where it can easily fulfill the norms of the concerned regulator like a bank or SEBI. 14. Capital structure of other companies: The business must know what the industry norms are, whether they are following them or deviating from them and adequate justification must be there.

| 1. | Nature of Business | Manufacturing | Trading |

| 2. | Scale of Operations | Large | Small |

| 3. | Choice of Technique | Capital Intensive | Labour Intensive |

| 4. | Frequency of Technology Upgradation | High | Low |

| 5. | Diversification Plans | Yes | No |

| 6. | Availability of Financial Alternatives | No | Yes |

| 7. | Growth Prospects | High | Low |

| 8. | Level of Collaboration | Low | High |

Factors Affecting the Working Capital Requirements of a Business Enterprise

| 1. | Nature of Business | Manufacturing | Trading |

| 2. | Scale of Operations | Large | Small |

| 3. | Business Cycle | Boom | Recession |

| 4. | Seasonal Factors | On Season | Off Season |

| 5. | Production Cycle | Longer | Shorter |

| 6. | Credit Allowed | Liberal/Yes | Strict/Nil |

| 7. | Credit Availed | No | Yes |

| 8. | Operating Efficiency | Low | High |

| 9. | Availability of Raw Material | Difficult | Easy |

| 10. | Growth Prospects | High | Low |

| 11. | Level of Competition | High | Low |

| 12. | Inflation | High | Low |

LATEST CBSE QUESTIONS

Question 1. What is meant by ‘financial management’ ? (CBSE, Delhi 2017) Answer: Financial Management is concerned with optimal procurement as well as usage of finance.

Question 2. Somnath Ltd. is engaged in the business of export of garments. In the past, the performance of the company had been upto the expectations. In line with the latest technology, the company decided to upgrade its machinery. For this, the Finance Manager, Dalmia estimated the amount of funds required and the timings. This will help the company in linking the investment and the financing decisions on a continuous basis. Dalmia therefore, began with the preparation of a sales forecast for the next four years. Fie also collected the relevant data about the profit estimates in the coming years. By doing this, he wanted to be sure about the availability of funds from the internal sources of the business. For the remaining funds he is trying to find out alternative sources from outside. (CBSE, Delhi 2017) Identify the financial concept discussed in the above para. Also state the objectives to be achieved by the use of financial concept, so identified. Answer: Financial planning is the financial concept discussed in the above paragraph. The process of estimating the fund requirements of a business and specifying the sources of funds is called financial planning. It relates to the preparation of a financial blueprint of an organisation’s future operations. The objectives to be achieved by the use of financial concept are stated below:

- To ensure availability of funds whenever required which involves estimation of the funds required, the time at which these funds are to be made available and the sources of these funds.

- To see that the firm does not raise resources unnecessarily as excess funding is almost as bad as inadequate funding. Financial planning ensures that enough funds are available at right time.

Question 3. Explain briefly any four factors which affect the choice of capital structure of a company. (CBSE, Delhi 2017) Answer: The four factors which affect the choice of capital structure of a company are described below:

- Risk: Financial risk refers to a situation when a company is unable to meet its fixed financial charges. Financial risk of the company increases with the higher use of debt. This is because issue of debt involves fixed commitment in terms of payment of interest and repayment of capital.

- Flexibility: Too much dependence on debt reduces the firm’s ability to raise debt during unexpected situations. Therefore, it should maintain flexibility by not using debt to its full potential.

- Interest Coverage ratio (ICR): The interest coverage ratio refers to the number of times earnings before interest and taxes of a company covers the interest obligation. This may be calculated as follows: ICR = EBIT/Interest. If the ratio is higher, lower is the risk of company failing to meet its interest payment obligations hence debt may be issued or vice versa. But besides interest payment related repayment obligations should also be considered.

- Cash flow position: The issue of debt involves a fixed commitment in the form of payment of interest and repayment of capital. Therefore if the cash flow position of the company is weak it cannot meet the fixed obligations involved in issue of debt it is likely to issue equity or vice versa.

Question 4. Explain briefly any four factors that affect the working capital requirement of a company. (CBSE, Delhi 2017) Answer: The four factors that affect the working capital requirements of a company are explained below:

- Credit availed: In case the suppliers from whom the firm procures the raw material needed for production or finished goods follow a liberal credit policy, the business can be operated on minimum working capital or vice versa.

- Credit allowed: The credit terms may vary from firm to firm. However, if the level of competition is high or credit worthiness of its clients is good the firm is likely to follow a liberal credit policy and grant credit to its clients it results in higher amount of debtors, increasing the requirement of working capital or vice versa.

- Scale of operations: The amount of working capital required by a business varies directly in proportion to its scale of business. For organisations which operate on a higher scale of operation, the quantum of inventory, debtors required is generally high. Such organisations, therefore, require large amount of working capital as compared to the organisations which operate on a lower scale.

- Growth prospects: The business firms who wish to take advantage of a forthcoming business opportunity or plan to expand its operations will require higher amount of working capital so that is able to meet higher production and sales target whenever required or vice versa .

Question 5. Explain briefly any four factors that affect the fixed capital requirements of a company. (CBSE, Delhi 2017) Answer: The four factors that affect the fixed capital requirements of a company are explained below:

- Nature of business: The kind of activities a business is engaged in has an important bearing on its fixed capital requirements. On one hand a trading concern does not require to purchase plant and machinery etc. and needs lower investment in fixed assets. Whereas on the other hand a manufacturing organisation is likely to invest heavily in fixed assets like land, building, machinery and needs more fixed capital.

- Scale of operations: The amount of fixed capital required by a business varies directly in proportion to its scale of businessA larger organisation operating at a higher scale needs bigger plant, more space etc. and therefore, requires higher investment in fixed assets when compared with the small organisation.

- Diversification: If a business enterprise plans to diversify into new product lines, its requirement of fixed capital will increase as compared to an organisation which does not have any such plans.

- Growth prospects: If a business enterprise plans to expand its current business operations in the anticipation of higher demand, its requirement of fixed capital will be more as compared to an organisation which doesn’t plan to persue any such plans.

Question 6. What is meant by ‘Capital Structure’ ? (CBSE, OD 2017) Answer: Capital structure refers to the mix between owned funds and borrowed funds.

Question 7. Ramnath Ltd. is dealing in import of organic food items in bulk. The company sells the items in smaller quantities in attractive packages. Performance of the company has been up to the expectations in the past. Keeping up with the latest packaging technology, the company decided to upgrade its machinery. For this, the Finance Manager of the company, Mr. Vikrant Dhull, estimated the amount of funds required and the timings. This will help the company in linking the investment and the financing decisions on a continuous basis. Therefore, Mr. Vikrant Dhull began with the preparation of a sales forecast for the next four years. He also collected the relevant data about the profit estimates in the coming years. By doing this, he wanted to be sure about the availability of funds from the internal sources. For the remaining funds he is trying to find out alternative sources. Identify the financial concept discussed in the above paragraph. Also, state any two points of importance of the financial concept, so identified. (CBSE, OD 2017) Answer:

- Financial planning is the financial concept discussed in the above paragraph. The process of estimating the fund requirements of a business and specifying the sources of funds is called financial planning. It relates to the preparation of a financial blueprint of an organisation’s future operations.

- It helps in anticipating future requirements of a funds and evading business shocks and surprises .

Question 8. When is financial leverage favourable? (CBSE, Sample Paper 2017) Answer: Financial leverage affects the profitability of a business and it is said to be favourable when return on investment ( ROI) is higher than cost of Debt.

Question 9. “A business that doesn’t grow dies”, says Mr. Shah, the owner of Shah Marble Ltd. with glorious 36 months of its grand success having a capital base of RS.80 crores. Within a short span of time, the company could generate cash flow which not only covered fixed cash payment obligations but also create sufficient buffer. The company is on the growth path and a new breed of consumers is eager to buy the Italian marble sold by Shah Marble Ltd. To meet the increasing demand, Mr. Shah decided to expand his business by acquiring a mine. This required an investment of RS.120 crores. To seek advice in this matter, he called his financial advisor Mr. Seth who advised him about the judicious mix of equity (40%) and Debt (60%). Mr. Seth also suggested him to take loan from a financial institution as the cost of raising funds from financial institutions is low. Though this will increase the financial risk but will also raise the return to equity shareholders. He also apprised him that issue of debt will not dilute the control of equity shareholders. At the same time, the interest on loan is a tax deductible expense for computation of tax liability. After due deliberations with Mr. Seth, Mr. Shah decided to raise funds from a financial institution.

- Identify and explain the concept of Financial Management as advised by Mr. Seth in the above situation.

- State the four factors affecting the concept as identified in part (1) above which have been discussed between Mr. Shah and Mr. Seth. (CBSE,Sample Paper 2017)

- Capital structure is the concept of Financial Management as advised by Mr. Seth in the above situation. Capital structure refers to the mix between owners funds and borrowed funds.

- Cashflow position: The issue of debt capital involves a fixed burden on the company in the form of payment of interest and repayment of capital. Therefore if the cash flow position of a company is good it may issue debt else equity to raise the required amount of capital.

- Risk Consideration: Financial risk refers to a situation when a company is unable to meet its fixed financial charges. Financial risk of the company increases with the higher use of debt. This is because issue of debt involves fixed commitment in terms of payment of interest and repayment of capital.

- Tax rate: Considering the fact that amount of interest paid is a deductible expense, cost of debt is affected by the tax rate. If for example a firm is borrowing @ 10% and the tax rate is 30%, the after tax cost of debt is only 7%. Therefore, when the tax rate is higher it makes debt relatively cheaper and increases its attraction vis-a-vis equity.

- Control: The issue of debentures doesn’t affect the control of the equity shareholders over the business as the debenture holders do not have the right to participate in the management of the business.

Question 10. Shalini, after acquiring a degree in Hotel Management and Business Administration, took over her family food processing company of manufacturing pickles, jams and squashes. The business had been established by her great grandmother and was doing reasonably well. However, the fixed operating costs of the business were high and the cash flow position was weak. She wanted to undertake modernisation of the existing business to introduce the latest manufacturing processes and diversify into the market of chocolates and candies. She was very enthusiastic and approached a finance consultant, who told her that approximately ? 50 lakh would be required for undertaking the modernisation and expansion programme. He also informed her that the stock market was going through a bullish phase.

- Keeping the above considerations in mind, name the source of finance Shalini should not choose for financing the modernisation and expansion of her food processing business. Give one reason in support of your answer.

- Explain any two other factors, apart from those stated in the above situation, which Shalini should keep in mind while taking this decision. (CBSE, Sample Paper 2016)

- Shalini should not choose debt capital for financing the modernisation and expansion of her food processing business because the fixed operating cost of the company is high. It cannot take the additional burden of fixed commitments in terms of payment of interest and repayment of capital by issuing debt.

Question 11. Radhika and Vani who are young fashion designers, left their job vyith a famous fashion designer chain to set-up a company ‘Fashionate Pvt. Ltd.’ They decided to run a boutique during the day and coaching classes for the entrance examination of National Institute of Fashion Designing in the evening. For the coaching centre, they hired the first floor of a nearby building. Their major expense was the money spent on photocopying of notes for their students. They thought of buying a photocopier knowing fully that their scale of operations was not sufficient to make full use of photocopier. In the basement of the building of Fashionate Pvt. Ltd, Praveen and Ramesh were carrying on a printing and stationery business in the name of ‘Neo Prints Pvt. Ltd.’ Radhika approached Praveen with the proposal to buy a photocopier jointly which could be used by both of them without making separate investment. Praveen agreed to this. Identify the factor affecting the fixed capital requirements of Fashionate Pvt. Ltd. (CBSE, Delhi 2016) Answer: The factor affecting the fixed capital requirement of Fashionable Pvt. Ltd. is the level of collaboration. This kind of arrangement of using the resources jointly helps to reduce the fixed capital requirements of the business firms.

Question 12. Kay Ltd. is a company manufacturing textiles. It has a share capital of ? 60 lakhs. In the previous year, its earning per share was ? 0.50. For diversification, the company requires an additional capital of ? 40 lakhs. The company raised funds by issuing 10% debentures for the same. During the year, the company earned a profit of ? 8 lakhs on the capital employed. It paid tax @ 40%.

- State whether the shareholders gained or lost, in respect of earning per share on diversification. Show your calculations clearly.

- Also state any three factors that favour the issue of debentures by the company as part of its capital structure. (CBSE, OD 2016)

OR Vivo Ltd. is a company manufacturing textiles. It has a share capital of Rs. 60 lakhs. The earning per share in the previous year was Rs. 0.50. For diversification, the company requires an additional capital of Rs. 40 lakhs. The company raised funds by issuing 10% debentures for the same. During the current year, the company earned a profit of Rs. 8 lakhs on the capital employed. It paid tax @ 40%.

- State whether the shareholders gained a lost, in respect of earning per share on diversification. Show your calculations clearly.

- Also, state any three factors that favour the issue of debentures by the company as part of its capital structure. (CBSE, Delhi 2016)

| Equity shares | 60,00,000 | 60,00,000 |

| 10 % Debentures | NIL | 40,00,000 |

| Total Capital | 60,00,000 | 1,00,00,000 |

| EBIT | — | 8,00,000 |

| Less: Interest | — | – (4,00,000) |

| EBT | — | 4,00,000 |

| Less: Tax @ 40% | — | – (1,60,000) |

| EAT | *3,00,000 | 2,40,000 |

| No. of shares of Rs. 10 each | 6,00,000 | 6,00,000 |

| EPS | 0.50 | 2,40,000/6,00,000 = 0.40 |

- Tax deductibility: Debt is considered to be a relatively cheaper source of finance as the amount of interest paid on debt is treated as a tax deductible expense.

- Flotation cost: The money spent by the company on raising capital through debentures is less than that spent on equity.

Question 13. Rizul Bhattacharya, after leaving his job, wanted to start a Private Limited Company with his son. His son was keen that the company may start manufacturing mobile-phones with some unique features. Rizul Bhattacharya felt that mobile phones are prone to quick obsolescence and a heavy fixed capital investment would be required regularly in this business. Therefore, he convinced his son to start a furniture business. Identify the factor affecting fixed capital requirements which made Rizul Bhattacharya choose the furniture business over mobile phones. (CBSE, OD 2016) Answer: The factor affecting the fixed capital requirements which made Rizul Bhattacharya choose the furniture business over mobile phones is technological upgradation.

Question 14. Tata International Ltd. earned a net profit of Rs. 50 crores. Ankit, the finance manager of Tata International Ltd. wants to decide how to appropriate these profits. Discuss any five factors which will help him in taking this decision. (CBSE, Sample Paper, 2015) Answer: The five factors which will help Ankit, in taking the dividend decision are described below:

- Earnings: Since the dividends are paid out of current and past earnings, there is a direct relationship between the amount of earnings of the company and the rate at which it declares dividend. If the earnings of the company are high, it may declare a higher dividend or vice-versa.

- Cash flow position: Since the dividends are paid in cash, if the cash flow position of the company is good it may declare higher dividend or vice-versa.

- Access to capital market: If the company enjoys an easy access to capital market because of its credit worthiness. It does not feel the need to depend entirely on retained earnings to meet its financial needs. Hence, it may declare higher dividend or vice-versa.

- Growth prospects: If the company has any forthcoming investment opportunities, it may like to retain profits to finance its expansion projects. This is because retained profits is considered to be the cheapest source of finance as it doesn’t involve any explicit costs. Hence, it may declare lower dividend or vice-versa.

- Preferences of the shareholders: The companies paying stable dividends are always preferred by small investors primarily if they want regular income in the form of ‘stable returns’ from their investments. Large shareholders may be willing to forgo their present dividend in pursuit of higher profits in future. Therefore, the preferences of the shareholders must be taken into consideration.

Question 15. ‘Abhishek Ltd’ is manufacturing cotton clothes. It has been consistently earning good profits for many years. This year too, it has been able to generate enough profits. There is availability of enough cash in the company and good prospects for growth in future. It is a well managed organisation and believes in quality, equal employment opportunities and good remuneration practices. It has many shareholders who prefer to receive a regular income from their investments. It has taken a loan of Rs. 50 lakhs from ICICI Bank and is bound by certain restrictions on the payment of dividend according to the terms of the loan agreement. The above discussion about the company leads to various factors which decide how much of the profits should be retained and how much has to be distributed by the company. Quoting the lines from the above discussion, identify and explain any four such factors. (CBSE, 2015) Answer: The five factors which Ankit has to consider before taking dividend decisions are:

- Growth Opportunities: Financial needs of a firm are directly related to the investment opportunities available to it. If a firm has abundant profitable investment opportunities, it will adopt a policy of distributing lower dividends. It would like to retain a large part of its earnings because it can reinvest them at a higher rate.

- Stability of Dividends: Investors always prefer a stable dividend policy. They expect to get a fixed amount as dividends which should increase gradually over the years.

- Legal Restrictions: A firm’s dividend policy has to be formulated within the legal provisions and restrictions of the Indian Companies Act.

- Restrictions in Loan Agreements: Lenders, mostly financial institutions, put certain restrictions on the payment of dividends to safeguard their interests.

- Liquidity: The cash position is a significant factor in determining the size of dividends. Higher the cash and overall liquidity position of a firm, higher will be its ability to pay dividends.

Question 16. Amit is running an ‘advertising agency’ and earning a lot by providing this service to big industries State whether the working capital requirement of the firm will be ‘less’ or ‘more’. Give reason in support of your anser. (CBSE, Sample Paper 2014-15) Answer: The working capital requirements of Amit will be relatively less as he is running an advertising agency, wherein there is no need to maintain inventory.

Question 17. Yogesh, a businessman, is engaged in the purchase and sale of ice-creams. Identify his working capital requirements by giving reasons to support your answer. Now, he is keen to start his own ice-cream factory. Explain any two factors that will affect his fixed capital requirements. (CBSE, OD 2012) Answer:

- The working capital requirements of Yogesh will be less as he is engaged in trading business.

- Level of collaboration: If Yogesh gets an opportunity to set up his factory in collaboration with another enterprise, his fixed capital requirements will reduce considerably else his fixed capital requirements will be more.

- Financial alternatives available: If Yogesh is able to get the place to start the factory and machinery on lease, his fixed capital requirements will reduce considerably. Whereas if he decides to purchase them, his fixed capital requirements will be more.

Question 18. Amar is doing his transport business in Delhi. His buses are generally used for tourists going to Jaipur and Agra. Identify the working capital requirements of Amar. Give reasons to support your answer. Further, Amar wants to expand and diversify his transport business. Explain any two factors that will affect his fixed capital requirements. (CBSE, OD, 2012) Answer:

- The working capital requirements of Amar will be relatively less as he is engaged in prtividing transport services wherein there is no need to maintain inventory.

- Diversification: If a business enterprise plans to diversify into new product lines, its requirement of fixed capital will increase.

- Growth prospects: If a business enterprise plans to expand its current business operations in the anticipation of higher demand, consequently, more fixed capital will be needed by it.

Question 19. Manish is engaged in the business of manufacturing garments. Generally, he used to sell his garments in Delhi. Identify the working capital requirements of Manish giving reason in support of your answer. Further, Manish wants to expand and diversify his garments business. Explain any two factors that will affect his fixed capital requirements. (CBSE, Delhi 2012) Answer:

- The working capital requirements of Manish will be relatively more as he is engaged in the business of manufacturing garments. This is because the length of production cycle is longer i.e. it takes time to convert raw material into finished goods.

- Scale of Operations: The amount of fixed capital required by a business enterprise is directly proportionate to its scale of operations. Therefore, if Manish plans to do business on a large scale, his fixed capital requirements will be more or vice versa.

- Technological Upgradation: If Manish plans to use machines of latest technology in manufacturing garments, his fixed capital requirements will be more as replacement of obsolete machines will require huge financial outlay.

Question 20. Harish is engaged in the warehousing business and his warehouses are generally used by businessmen to store fruits. Identify the working capital requirements of Harish giving reasons in support of your answer. Further, Harish wants to expand and diversify his warehousing business. Explain any two factors that will affect his fixed capital requirements. (CBSE, Delhi 2012) Answer:

- The working capital requirements of Harish will be relatively less as he is engaged in providing warehousing services wherein there is no need to maintain inventory.

- Scale of Operations: The amount of fixed capital required by a business enterprise is directly proportionate to its scale of operations. Therefore, if Harish plans to do business on a large scale his fixed capital requirements will be more or vice versa.

ADDITIONAL QUESTIONS

Question 1. Arun is a successful businessman in the paper industry. During his recent visit to his friend’s place in Mysore, he was fascinated by the exclusive variety of incense sticks available there. His friend tells him that Mysore region is known as a pioneer in the activity of Agarbathi manufacturing because it has a natural reserve of forest products especially Sandalwood to provide for the base material used in production. Moreover, the suppliers of other types of raw material needed for production follow a liberal credit policy and the time required to manufacture incense sticks is relatively less. Considering the various factors, Arun decides to venture into this line of business by setting up a manufacturing unit in Mysore. In context of the above case:

- Identify and explain the type of financial decision taken by Arun.

- Identify the three factors mentioned in the paragraph which are likely to affect the working capital requirements of his business.

- Investment decision has been taken by Arun. Investment decision seeks to determine as to how the firm’s funds are invested in different assets. It helps to evaluate new investment proposals and select the best option on the basis of associated risk and return. Investment decision can be long term or short-term. A long-term investment decision is also called a Capital Budgeting decision

- Availability of raw material: As there is easy availability of Sandalwood which is used as the base material for production, the working capital requirements of his business will be less as there is no need to stock the raw materials.

- Production cycle: The production cycle is shorter and less time is required to manu¬facture incense sticks. Thus, the working capital requirements of his business will be low.

- Credit availed: Due to the fact that the suppliers of other types of raw material needed for production follow a liberal credit policy, the business can be operated on minimum working capital.

Question 2. ‘Adwitiya’ is a company enjoying market leadership in the food brands segment. It’s portfolio includes three categories in the Foods business namely Snack Foods, Juices and Confectionery. Keeping in line with the growing demand for packaged food it now plans to introduce Ready- To-Eat Foods. Therefore, the company has planned to undertake investments of nearly Rs. 450 crores for its new line of business. As per the current financial report, the interest coverage ratio of the company and return on investment is higher. Moreover, the corporate tax rate is high. In context of the above case:

- As a financial manager of the company, which source of finance will you opt for debt or equity, to raise the required amount of capital? Explain by giving any two suitable reasons in support of. your answer.

- Why are the shareholder’s of the company like to gain from the issue of debt by the company?

- Interest coverage ratio: The interest coverage ratio of the company is high so it can easily meet its fixed commitment of payment of interest and repayment of capital.

- Tax rate: The tax rate is high which makes debt relatively cheaper as the amount of interest paid on debt is treated as a tax deductible expense.

- The shareholders of the company are likely to gain from the issue 6f debt by the company because the return on investment is higher. It helpS a company to take advantage of trading on equity to increase the earnings per share.

Question 3. Computer Tech Ltd.,is one of the leading information technology outsourcing services providers in India. The company provides business consultancy and outsourcing services to its clients. Over the past five years the company has been paying dividends at high rate to its shareholders. However, this year, although the earnings of the company are high, its liquidity position is not so good. Moreover, the company plans to undertake new ventures in order to expand its business. In context of the above case: .

- Give any three reasons because of which you think Computer Tech Ltd. has been paying dividends at high rate to its shareholders over the past five years.

- Comment upon the likely dividend policy of the company this year by stating any two reasons in support of your answer.

- Earnings: The earnings of the company have been high. Since the dividends are paid out of current and past earnings, there is a direct relationship between the amount of earnings of the company and the rate at which it declares dividend .

- Cashflow position: The cash flow position of the company must have been good as in order to pay high dividends, more cash is required.

- Access to capital market: Because of its credit worthiness, the company enjoyed an easy access to capital market. Therefore, it did not feel the need to depend entirely on retained earnings to meet its financial needs. Hence, it declared higher dividends in past.

- The cash flow position of the company is not good and dividends are paid in cash.

- The company may like to retain profits to finance its expansion projects. Retained profits do not involve any explicit cost and are considered to be the cheapest source of finance.

Question 4. Bhuvan inherited a very large area of agricultural land in Haryana after the death of his grandfather. He plans to sell this piece of land and use the money to set up a small scale paper factory to manufacture all kinds of stationary items from recycled paper. Being an amateur in business, he decides to consult his friend Subhash who works in a financial consultancy firm. Subhash helps him to prepare a blue print of his future business operations on the basis of sales forecast in next five years. Based on these estimates, he helps Bhuvan to assess the fixed and working capital requirements of business. In context of the above case:

- Identify the type of financial service that Subhash has offered to Bhuvan.

- Briefly state any four points highlighting the importance of the type of financial service identified in part (1).

- Financial planning is the type of financial service that Subhash has offered to Bhuvan.

- It helps in anticipating future requirements of a funds and evading business shocks and surprises.

- It facilitates co-ordination among various departments of an enterprise like marketing and production functions, through well-defined policies and procedures.

- It increases the efficiency of operations by curbing wastage of funds, duplication of efforts, and gaps in planning.

Question 5. ‘Madhur Milan’ is a popular online matrimonial portal. It seeks to provide personalized match making service. The company has 80 offices in India, and is now planning to open offices in Singapore, Dubai and Canada to cater to its customers beyond the country. The company has decided to opt for the sources of equity capital to raise the required amount of capital. In context of the above case:

- Identify and explain the type of risk which increases with the higher use of debt.

- Explain briefly any four factors because of which you think the company has decided to opt for equity capital.

- Financial risk of the company increases with the higher use of debt. This is because issue of debt involves fixed commitment in terms of payment of interest and repayment of capital. Financial risk refers to a situation when a company is unable to meet its fixed financial charges.

- Capital market conditions: The state of capital market is bullish, so people are likely to invest more in equity.

- Fixed operating cost: The fixed operating cost of company is high so it cannot take the further burden fixed commitment in terms of payment of interest and repayment of capital by issuing debt.

- Cashflow position: The cash flow position of the company is weak so it cannot meet the fixed obligations involved in issue of debt.

- Risk: The proportion of debt in its capital structure is already high so it cannot issue further debt, thereby endangering the solvency of the company.

Question 6. Wooden Peripheral Pvt. Ltd. is counted among the top furniture companies in Delhi. It is known for offering innovative designs and high quality furniture at affordable prices. The company deals in a wide product range of home and office furniture through its eight showrooms in Delhi. The company is now planning to open five new showrooms each in Mumbai and Bangalore. In Bangalore it intends to take the space for the showrooms on lease whereas for opening showrooms in Mumbai, it has collaborated with a popular home furnishing brand, ‘Creations.’

- Identify the factors mentioned in the paragraph which are likely to affect the fixed capital requirements of the business for opening new showrooms both in Bangalore and Mumbai separately,

- “With an increase in the investment in fixed assets, there is a commensurate increase in the working capital requirement.” Explain the statement with reference to the case above.

- The fixed capital requirements of Wooden Peripheral Pvt. Ltd. for opening new showrooms in Bangalore will be relatively less as its taking space on lease, so only rentals have to be paid. Similarly, its fixed capital requirement for opening showrooms in Mumbai will be reduced as its going to share the costs with another company through collaboration.

- It’s true that,” With an increase in the investment in fixed assets, there is a commen¬surate increase in the working capital requirement.” Like in the above case, Wooden Peripheral Pvt. Ltd. is planning to invest in new showrooms. Consequently, its requirement of working capital will increase as it will need more money to stock goods, pay electricity bills and salaries to staff. Also, it intends to take the space for the showrooms in Mumbai on lease so it will have to pay rentals.

Question 7. ‘Apparels’ is India’s second largest manufacturer of branded Lifestyle apparel. The company now plans to diversify into personal care segment by launching perfumes, hair care and skin are products. Moreover, it is planning to open ten exclusive retail outlets in various cities across the country in next two years. In context of the above case:

- Identify the two factors affecting the fixed capital needs of the company by quoting lines from the paragraph.

- Why is the management of fixed capital considered to be an important for a business?

- It affects the growth and profitability of business in future.

- It influences the overall level of business risk of the organisation.

- If these decisions are reversed, they may lead to major losses.

Question 8. After persuing a course in event management, Kajal and her brother Kamal promoted an event management company under the name Khushi Entertainment Private Limited. They strive together as dedicated and dynamic professionals managing different kinds of formal and informal events across all major cities in India and abroad. They design the event idea and co-ordinate the different aspects of the event to make it a grand success. As a policy, they take fifty percent of the payment as advance from the client before the start of an event and receive the balance charges after the successful completion of the event. In context of the above case:

- Comment upon the working capital needs of the company keeping in mind its nature of business.

- Identify the other factor mentioned in the paragraph which is likely to affect the working capital requirement of their business.

- The working capital requirements of Khushi Entertainment Private Limited will be relatively less as they are engaged in providing event management services, wherein there is no need to maintain inventory

- The other factor mentioned in the paragraph which is likely to affect the working capital requirement of their business is ‘Credit availed.’ Since as a policy, they take fifty percent of the payment as advance from the client before the start of an event, their requirement of working capital is reduced.

Question 9. Storage Solution Ltd. is a large warehousing network company operating. through a chain of warehouses at 40 different locations across India. The company now intends to undertake computerisation of its owned ware houses as it seeks to provide better value added and cost effective solutions for scientific storage and preservation services to the market participants dealing in agricultural products including farmers, traders, etc. In context of the above case:

- How is the decision to undertake computerisation of owned warehouses likely to affect the fixed capital requirements of its business?

- Name any two sources that company may use to finance the implementation of this plan.

- The decision to undertake computerisation of owned warehouses will increase the fixed capital requirements of its business both in present and future as after sometime, the technology being used will become obsolete and need upgradation.

- The company may use retained earnings and take loans from financial institutions to implement this plan.

Question 10. Visions Ltd. is a renowned multiplex operator in India. Presently, it owns 234 screens in 45 properties at 20 locations in the country. Considering the fact that the there is a growing trend among the people to spend more of their disposable income on entertainment, two years back the company had decided to add more screens to its existing set up and increase facilities to enhance leisure, food chains etc. It had then floated an initial public offer of equity shares in order to raise the desired capital. The issue was fully subscribed and paid. Over the years, the sales and profits of the company have increased tremendously and it has been declaring higher dividend and the market price of its shares has increased manifolds. In context of the above case:

- Name the different kinds of financial decisions taken by the company by quoting lines from the paragraph.

- Do you think the financial management team of the company has been able to achieve its prime objective? Why or why not? Give a reason in support of your answer.

- Investment decision: “Two years back the company had decided to add more screens to its existing set up and increase facilities to enhance leisure, food chains etc.”

- Financing decision: “It had then floated an initial public offer of equity shares in order to raise the desired capital.”

- Dividend decision: “Over the years, the sales and profits of the company have increased tremendously and it has been declaring higher dividend.”

- Yes, the financial management team of the company has been able to achieve its prime objective i.e. wealth maximisation of the shareholders by maximising the market price of the shares of the company.

Question 11. After completing his education in travel and tourism, Arjun started Travel Angels Pvt. Ltd. along with his twin brother Bheem. Their company seeks to provide travel solutions to its clients like ticket booking for airways, railways and road ways, hotel booking, insurance etc. Although the business is doing well both of them have realised that they are not good in managing finance, and feel confused and frustrated sometimes due to financial crises that may suddenly arise. In order to avoid such situations in the future, they hire Nakul and Sehdev as financial managers, who have done a degree certification course in financial management. In context of the above

- Give the meaning of financial management.

- Outline the role of Nakul and Sehdev as the financial management team of the Travel Angels Pvt. Ltd. by giving any four suitable points.

- Financial Management is concerned with optimal procurement as well as usage of finance.

- To determine the capital requirements of business both long-term and short term.

- To exercise overall financial control in order to promote s’afety, profitability and conservation of funds.

Question 12. Wireworks Ltd. is a company manufacturing different kinds of wires. Despite fierce competition in the industry, it has been able to maintain stability in its earnings and as a policy, uses 30% of its profits to distribute dividends. The small investors are very happy with the company as it has been declaring high and stable dividend over past five years. In context of the above case:

- State any one reason because of which the company has been able to declare high dividend by quoting line from the paragraph.

- Why do you think small investors are happy with the company for declaring stable dividend?

- Stability in earnings: The company has been able to declare high dividend because its earnings are stable. “Despite fierce competition in the industry, it has been able to maintain stability in its earnings.”

- The small investors are happy with the company for declaring stable dividend as they enjoy a regular income on their investment.

Question 13. Manoj is a renowned businessman involved in export business of leather goods. As a responsible citizen, he chooses to use jute bags for packaging instead of plastic bags. Moreover, on the advice of his friends, he decides to use jute for manufacturing aesthetic handicrafts, keeping in view the growing demand for natural goods. In order to implement his plan, after conducting a feasibility study, he decides to set up a separate manufacturing unit for producing varied jute products. In context of the above case:

- Identify the type of investment decision taken by Manoj by deciding to set up a separate manufacturing unit for producing jute products.

- State any two factors that he is likely to consider while taking this decision

- Capital budgeting decision has been taken by Manoj.

- Cash inflows: The expected cash inflows from the proposed projects should be carefully analysed and the project indicating higher cash inflows should be selected.

- Rate of return: The expected rate of return should be carefully studied in terms of risk associated from the proposed project. If two projects are likely to offer the same rate of return, the project involving lesser risk should be selected.

Question 14. Khoobsurat Pvt. Ltd. is the largest hair salon chain in the Delhi, with over a franchise of 200 salons. The company is now planning to set up a manufacturing unit in Faribadad for production of various kinds of beauty products under its own brand name. In context of the above case:

- Comment upon the fixed capital needs of the company.

- How will the requirement of fixed capital of the company change when it implements its plan to set up a manufacturing unit?

- The fixed capital needs of the company are low as its salons have been promoted in the form of franchises.

- The requirement of fixed capital of the company will increase when it implements its plan to set up a manufacturing unit because it will have to make investments in buying land, building, machinery etc.

Question 15. Well-being Ltd. is a company engaged in production of organic foods. Presently, it sells its products through indirect channels of distribution. But, considering the sudden surge in the demand for organic products, the company is now inclined to start its online portal for direct marketing. The financial managers of the company are planning to use debt in order to take advantage of trading on equity. In order to finance its expansion plans, it is planning to ‘ raise a debt capital of Rs. 40 lakhs through a loan @ 10% from an industrial bank. The present capital base of the company comprises of Rs. 9 lakh equity shares of Rs. 10 each. The rate of tax is 30%. In the context of the above case:

- What are the two conditions necessary for taking advantage of trading on equity?

- Assuming the expected rate of return on investment to be same as it was for the current year i.e. 15% , do you think the financial managers will be able to meet their goal. Show your workings clearly.

- The rate of return on investment should be more than the rate of interest.

- The amount of interest paid should be tax deductible.

| | | |

| Equity shares | 90,00,000 | 90,00,000 |

| 10 % Debentures | NIL | 40,00,000 |

| Total Capital | 90,00,000 | 1,30,00,000 |

| EBIT | 13,50,000 | 19,50,000 |

| Less: Interest | — | – (4,00,000) |

| EBT | 13,50,000 | 15,50,000 |

| Less: Tax @ 30% | – (4,05,000) | – (4,65,000) |

| EAT | 9,45,000 | 10,85,000 |

| No. of shares of Rs. 10 each | 9,00,000 | 9,00,000 |

| EPS | 9,45,000/9,00,000 = 1.05 | 10,85,000/9,00,000 = 1.21 |

Yes, the financial managers will be able to meet their goal as the projected EPS, with the issue of debt, is higher than the present EPS.

Case Studies in Business Studies Business Studies Case Studies Business Studies Commerce

GRASIM Pivot Point Calculator

CBSE NCERT Solutions

NCERT and CBSE Solutions for free

Case Study Chapter 9 Financial Management

Please refer to Chapter 9 Financial Management Case Study Questions with answers provided below. We have provided Case Study Questions for Class 12 Business Studies for all chapters as per CBSE, NCERT and KVS examination guidelines. These case based questions are expected to come in your exams this year. Please practise these case study based Class 12 Business Studies Questions and answers to get more marks in examinations.

Case Study Questions Chapter 9 Financial Management

Read the source given below and answer the following questions : Financial management is concerned with efficient acquisition and allocation of funds. In other words, financial management is concerned with flow of funds and involves decisions related to procurement of funds, investment of funds in long term and short term assets and distribution of earnings to owners. In simple words we can say Financial Management refers to “Efficient acquisition of finance, efficient utilisation of finance and efficient distribution and disposal of surplus for smooth working of company.”

Questions :

Question. Efficient disposal of surplus, indicates which financial decisions ? (a) Financial decision (b) Investment decision (c) Dividend decision (d) None of the above

Question. Every organisation considers Financial management department as (a) Life blood of an organisation (b) Not very important department (c) Controlling department (d) None of the above

Question. ‘Efficient acquisition’ of finance is related to which financial decision ? (a) Financial decision (b) Investment decision (c) Dividend decision (d) None of the above

Question. “Efficient utilisation of finance”, indicates which financial decision ? (a) Financial decision (b) Investment decision (c) Dividend decision (d) None of the above

Read the source given below and answer the following questions : After completing the course of Hotel Management, Rahul plans to start his own Hotel, he plans to hire a team of experts to give his guests a unique and unforgettable experience. Keeping in mind their budgets. Before starting the business he visited his home town to take blessings of his father. His father told him that success of business depends on how well finance is invested in assets and operations and how timely and economically finances are arranged from outside or from with in the business. He guided him that he should always spend time in identifying different available sources of finance and comparing them in terms of their costs and associated risks. The returns from investment should always exceed the cost of investment.

Question. State the decision of financial management which assures the returns from investment should always exceed the cost of investment. (a) Investment decision (b) Financing decision (c) Dividend decision (d) None of the above

Question. Which decision helped him in identifying different available sources of finance and comparing them in terms of cost and risk. (a) Investment decision (b) Financing decision (c) Dividend decision (d) None of the above

Question. Identify the concept discussed above which has direct bearing on the financial health of a business. (a) Financial Management (b) Financial Planning (c) Business objective (d) None of the above

Question. State the key objective of concept identified in above para. (a) Profit maximisation (b) Wealth maximisation (c) Sales maximisation (d) None of the above

Read the source given below and answer the following questions : ‘ Sarah Ltd.’ is a company manufacturing cotton yarn. It has been consistently earning good profits for many years. This year too, it has been able to generate enough profits. There is availability of enough cash in the company and good prospects for growth in future. It is a well-managed organisation and believes in quality, equal employment opportunities and good remuneration practices. It has many shareholders who prefer to receive a regular income from their investments. It has taken a loan of `40 lakhs from IDBI and is bound by certain restrictions on the payment of dividend according to the terms of loan agreement.

Question. Company is able to generate enough profit, so it should give how much dividend to share holders ? (a) More (b) Less (c) Moderate (d) None of the above

Question. “They have many shareholders, who prefer to receive a regular income from their investment.” This indicates the company should pay : (a) less dividend (b) more dividend (c) moderate dividend (d) none of the above

Question. IDBI restricted the company regarding payment of dividend. This is related to which factor of dividend decision? (a) Legal Restrictions (b) Stock market reaction (c) Access to capital market (d) Contractual constraint

Question. The above para is indicating which decision ? (a) Investment decision (b) Financing decision (c) Dividend decision (d) None of the above

Read the source given below and answer the following questions : Mr. A. Bose is running a successful business. Mr. Bose is the owner of R. K. Cement Ltd. Mr. Bose decided to expand his business by acquiring a Steel Factory. This required an investment of Rs. 60 crores. To seek advice in this matter, he called his financial advisor Mr. T. Ghosh who advised him about the judicious mix of equity (40%) and Debt (60%). Employ more of cheaper debt may enhance the EPS. Mr. Ghosh also suggested him to take loan from a financial institution as the cost of raising funds from financial institutions is low. Though this will increase the financial risk but will also raise the return to equity shareholders. He also apprised him that issue of debt will not dilute the control of equity shareholders. At the same time, the interest on loan is a tax deductible expense for computation of tax liability. After due deliberations with Mr. Ghosh, Mr. Bose decided to raise funds from a financial institution.

Question. In the above case Mr. Ghosh suggested to raised more fund from debt. Higher debtequity ratio results in: (a) Lower financial risk (b) Higher degree of operating risk (c) Higher degree of financial risk (d) Higher Earning of profit.

Question. Employ more of cheaper debt may enhance the EPS. Such practice is called: (a) Equity Trading (b) Financial Leverage (c) Investment Decision (d) Trading on Equity

Question. “Mr. T. Ghosh who advised him about the judicious mix of equity (40%) and Debt (60%)” The proportion of debt in the overall capital is called___________. (a) Working Capital (b) Financial Leverage (c) Total Assets (d) None of these

Question. Identify the concept of Financial Management as advised by Mr. Ghosh in the above situation. (a) Capital Budgeting (b) Capital Structure (c) Dividend Decision (d) Working Capital Decision

Read the source given below and answer the following questions : Sunrises Ltd. dealing in ready made garments, is planning to expand its business operations in order to cater to international market. For this purpose the company needs additional Rs. 80,00,000 for replacing machines with modern machinery of higher production capacity. It involves committing the finance on a long term basis. These decisions are very crucial for any business since they affect its earning capacity in the long run. The company wishes to raise the required funds by issuing debentures. The debt can be issued at an estimated cost of 10%. The EBIT for the previous year of the company was Rs. 8,00,000 and total capital investment was Rs. 1,00,00,000. Instead of issuing 10% Debenture the Company can issue Equity Shares for raising the fund. The financial manager of the company would normally opt for a source which is the cheapest.

Question. A decision for raising fund of Rs. 80,00,000 either from 10% Debenture or Equity Shares is a: (a) Financing decision (b) Dividend decision (c) Investment decision (d) None of the above

Question. What is the other name of long term decision ? (a) Capital Budgeting (b) Gross working capital (c) Financial management (d) Working Capital

Question. The financing decisions are affected by various factors. Which one of the following factor is discussed in the above case? (a) Cash Flow Position of the Company (b) Cost (c) Amount of Earnings (d) Taxation Policy

Question. A decision for replacing machines with modern machinery of higher production capacity is a: (a) Financing decision (b) Working capital decision (c) Investment decision (d) None of the above

Read the source given below and answer the following questions : ‘Monisha Consumer Goods’ is a leading consumer goods chain with a network of 46 stores primarily across Mumbai, Delhi and Pune. It was started by Monisha Gupta in 1987. It has a large market share in Mumbai, Delhi and Pune. Looking for an opportunity to expand, it has decided to open a new branch in Kerala. It has decide on what new resources it will invest in so that it is able to earn the highest possible return for investors. Once the company believes that it will be able to generate higher revenues and profits, it also has to decide on how this project will get funded. The finance manager, Atul was told to have an optimal capital structure by striking a balance between various sources of getting the project funded so as to increase shareholders’ wealth. Atul, after assessing the cash flow position of the company, evaluated the cost of different sources of finance and compared the risk associated with each source as well as the cost of raising funds.

Question. State the two financial decisions discussed in the above situation.

(i) Investment decision/ Capital budgeting decision/ Long term Investment decision (ii) Financing decision

Read the source given below and answer the following questions : Sudha is an enterprising business woman who has been running a poultry farm for the past ten years. She has saved ` 4,00,000 from her business. She shared with her family her desire to utilise this money to expand her business. Her family members gave her different suggestions like buying new machinery to replace the existing one, acquiring altogether new equipments with latest technology, opening a new branch of the poultry farm in another city and so on. Since these decisions are crucial for her business, involve a huge amount of money and are irreversible except at a huge cost, Sudha wants to analyse all aspects of the decisions, before taking any final decision.

Question. Identify and explain the financial decision to be taken by Sudha.

Investment decision/Capital budgeting decision Investment/Capital budgeting decision involves deciding about how the funds are invested in different assets so that they are able to earn the highest possible return for their investors

Question. Also, explain the briefly the factors that will affect this decision

Factors that affect capital budeting decision are: (a) Cash flows of the project (b) Rate of return of the project (c) Investment criteria

Read the source given below and answer the following questions : Rizul Bhattacharya after leaving his job wanted to start a Private Limited Company with his son. His son was keen that the company may start manufacturing of Mobile-phones with some unique features. Rizul Bhattacharya felt that the mobile-phones are prone to quick obsolescence and a heavy fixed capital investment would be required regularly in this business. Therefore he convinced his son to start a furniture business.

Question. Identify the factor affecting fixed capital requirements which made Rizul Bhattacharya to choose furniture business over mobile-phones.

Technology upgradation

Read the source given below and answer the following questions : ‘Sarah Ltd.’ is a company manufacturing cotton yarn. It has been consistently earning good profits for many years. This year too, it has been able to generate enough profits. There is availability of enough cash in the company and good prospects for growth in future. It is a well managed organisation and believes in quality, equal employment opportunities and good remuneration practices. It has many shareholders who prefer to receive a regular income from their investments. It has taken a loan of ` 40 lakhs from IDBI and is bound by certain restrictions on the payment of dividend according to the terms of loan agreement. The above discussion about the company leads to various factors which decide how much of the profits should be retained and how much has to be distributed by the company.

Question. Quoting the lines from the above discussion identify and explain any four such factors.

Factors affecting dividend decision: (i) Stability of earnings – ‘It has been consistently earning good profits for many years’. (ii) Cash Flow position – ‘There is availability of enough cash in the company’. (iii) Growth Prospects – ‘Good prospects for growth in the future.’ (iv) Shareholders’ preference – ‘It has many shareholders who prefer to receive regular income from their investments.’ (v) Contractual constraints – ‘It has taken a loan of ` 40 Lakhs from IDBI and … agreement.’

Related Posts

Case Study Questions Chapter 3 Reconstitution Of A Partnership Firm – Admission Of A Partner

Alcohols, phenols and ethers class 12 chemistry important questions.

Case Study Chapter 9 Recent Developments in Indian Politics

- New QB365-SLMS

- 12th Standard Materials

- 11th Standard Materials

- 10th Standard Materials

- 9th Standard Materials

- 8th Standard Materials

- 7th Standard Materials

- 6th Standard Materials

- 12th Standard CBSE Materials

- 11th Standard CBSE Materials

- 10th Standard CBSE Materials

- 9th Standard CBSE Materials

- 8th Standard CBSE Materials

- 7th Standard CBSE Materials

- 6th Standard CBSE Materials

- Tamilnadu Stateboard

- Scholarship Exams

- Scholarships

Class 12th Business Studies - Financial Management Case Study Questions and Answers 2022 - 2023

By QB365 on 08 Sep, 2022

QB365 provides a detailed and simple solution for every Possible Case Study Questions in Class 12 Business Studies Subject - Financial Management, CBSE. It will help Students to get more practice questions, Students can Practice these question papers in addition to score best marks.

QB365 - Question Bank Software

Financial management case study questions with answer key.

12th Standard CBSE

Final Semester - June 2015

Business Studies

Mr. A. Bose is running a successful business. Mr. Bose is the owner of R. K. Cement Ltd. Mr. Bose decided to expand his business by acquiring a Steel Factory. This required an investment of Rs. 60 crores. To seek advice in this matter, he called his financial advisor Mr. T. Ghosh who advised him about the judicious mix of equity (40%) and Debt (60%). Employ more of cheaper debt may enhance the EPS. Mr. Ghosh also suggested him to take loan from a financial institution as the cost of raising funds from financial institutions is low. Though this will increase the financial risk but will also raise the return to equity shareholders. He also apprised him that issue of debt will not dilute the control of equity shareholders. At the same time, the interest on loan is a tax deductible expense for computation of tax liability. After due deliberations with Mr. Ghosh, Mr. Bose decided to raise funds from a financial institution. 1. Identify the concept of Financial Management as advised by Mr. Ghosh in the above situation.

2. In the above case Mr. Ghosh suggested to raised more fund from debt. Higher debt-equity ratio results in:

3. “Mr. T. Ghosh who advised him about the judicious mix of equity (40%) and Debt (60%)” The proportion of debt in the overall capital is called___________.

4. Employ more of cheaper debt may enhance the EPS. Such practice is called:

Sunrises Ltd. dealing in readymade garments, is planning to expand its business operations in order to cater to international market. For this purpose the company needs additional Rs.80,00,000 for replacing machines with modern machinery of higher production capacity. It involves committing the finance on a long term basis. These decisions are very crucial for any business since they affect its earning capacity in the long run. The company wishes to raise the required funds by issuing debentures. The debt can be issued at an estimated cost of 10%. The EBIT for the previous year of the company was Rs. 8,00,000 and total capital investment was Rs. 1,00,00,000. Instead of issuing 10% Debenture the Company can issue Equity Shares for raising the fund. The financial manager of the company would normally opt for a source which is the cheapest. 1. What is the other name of long term decision?

2. A decision for replacing machines with modern machinery of higher production capacity is a:

3. A decision for raising fund of Rs. 80,00,000 either from 10% Debenture or Equity Shares is a:

4. The financing decisions are affected by various factors. Which one of the following factor is discussed in the above case? Choose the correct option.

*****************************************

Financial management case study questions with answer key answer keys.

1. (b) Capital Structure 2. (c) Higher degree of financial risk 3. (b) Financial Leverage 4. (d) Trading on Equity

1. (a) Capital Budgeting 2. (c) Investment decision 3. (a) Financing decision 4. (b) Cost

Related 12th Standard CBSE Business Studies Materials

12th standard cbse syllabus & materials, cbse 12th physics wave optics chapter case study question with answers, cbse 12th physics ray optics and optical instruments chapter case study question with answers, cbse 12th physics nuclei chapter case study question with answers, cbse 12th physics moving charges and magnetism chapter case study question with answers, cbse 12th physics electromagnetic induction chapter case study question with answers, cbse 12th physics atoms chapter case study question with answers, 12th physics alternating current chapter case study question with answers cbse, 12th maths vector algebra chapter case study question with answers cbse, 12th maths three dimensional geometry chapter case study question with answers cbse, 12th maths probability chapter case study question with answers cbse, 12th maths linear programming chapter case study question with answers cbse, 12th maths differential equations chapter case study question with answers cbse, 12th maths continuity and differentiability chapter case study question with answers cbse, 12th maths application of integrals chapter case study question with answers cbse, 12th chemistry the d and f block elements chapter case study question with answers cbse.

Class VI to XII

Tn state board / cbse, 3000+ q&a's per subject, score high marks.

12th Standard CBSE Study Materials

12th Standard CBSE Subjects

- CBSE Class 12 NCERT Solutions

NCERT Solutions for Class 12 Business Studies Chapter 9 Financial Management, Download PDF

ncert solutions for class 12 business studies chapter 9 financial management : students can find attached ncert solutions for cbse class 12 business studies part 2, chapter 9, financial management. a pdf download link has been attached below for the free download of complete ncert solutions..

NCERT Solutions Class 12 Business Studies: This article hands out complete NCERT Solutions for Class 12 Financial Management. Students can be carefree while referring to these NCERT Solutions since they have been prepared as per the latest CBSE Syllabus 2023-2024 and updated CBSE Curriculum. NCERT Solutions for class 12 Business Studies Chapter 9 all exercise pdf download link has been attached below for your reference.

NCERT Solutions for Class 12 Business Studies Chapter 9 is important for students to practice since they are the most important part of your Board Examinations. Almost 80% of the entire CBSE Board Exam Question Paper is based on NCERT exercises. Thus, students must practice these solutions daily in order to score well in Board Examinations. Along with this, NCERT’s in-text exercises must also be referred to. Test your Understanding, Do It Yourself also helps in increasing your textual knowledge and would assist you in scoring high marks in CBSE Board Examinations.

CBSE Class 12 Business Studies Syllabus 2023-2024

CBSE Class 12 Business Studies Sample Paper 2023-2024

Highlights of NCERT Solutions for Class 12 Business Studies Chapter 9 – Financial Management

- NCERT Solutions for Class 12 Financial Management are based on CBSE Class 12 Business Studies Chapter 9, Financial Management.

- These NCERT Solutions are important from the CBSE Business Studies Board Exam's point of view

- The solutions have been divided into three segments: Very Short Answer Questions, Short Answer Questions, Long Answer Questions

Key Features of NCERT Solutions for Class 12 Business Studies Chapter 9 – Financial Management

- NCERT Solutions for Class 12 Business Studies Chapter 9, Financial Management are based on the updated and revised CBSE Syllabus 2024