Capital Work in Progress (CWIP)

- What is Capital Work in Progress?

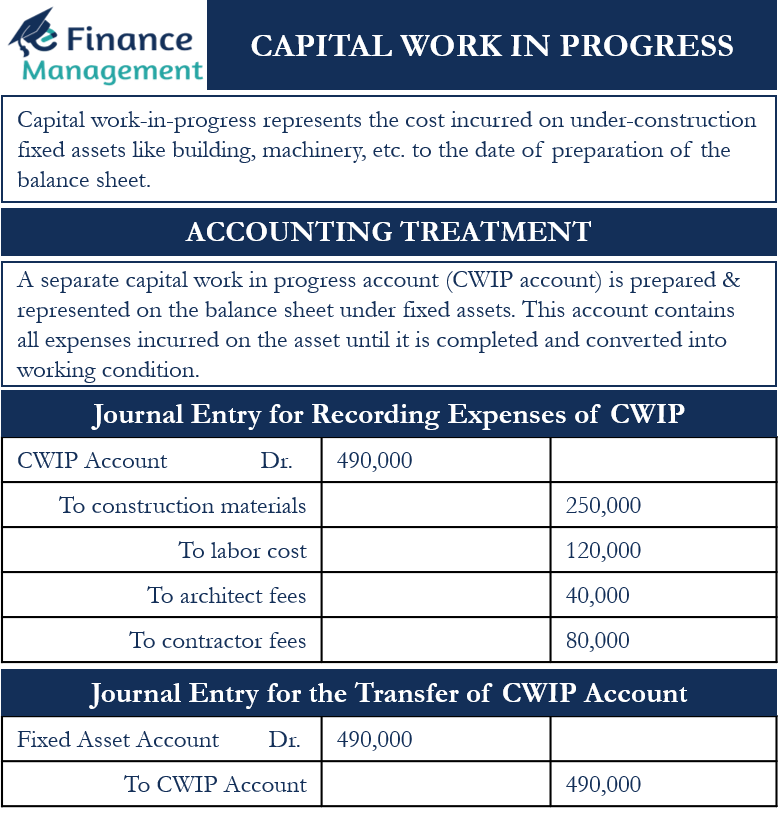

Capital work-in-progress or CWIP is one of the most important components of the non-current assets of an entity. Capital work-in-progress represents the cost incurred on under-construction fixed assets like building, machinery, etc. to the date of preparation of the balance sheet. The cost that is incurred on these assets cannot be recognized as fixed assets because they are not operational. CWIP can also be explained as the work that is not yet completed but has already been paid for.

The concept of CWIP is most relevant for organizations with under-construction immovable assets, like buildings or plants & machinery, because they take more extended periods for construction. Therefore, all costs incurred on assets under construction are recorded as CWIP and transferred to the “fixed assets account” once completed and ready for use.

Accounting Treatment of CWIP

Example of accounting treatment.

The capital work-in-progress requires proper accounting treatment for accurate presentation on the balance sheet. The entity prepares a separate “capital work in progress account” and represents it on the balance sheet under fixed assets. All the costs incurred on an under-construction asset up to the date of the balance sheet are transferred to that account.

A capital work-in-progress account (CWIP Account) contains all expenses incurred on the asset until it is completed and converted into working condition. All these expenses incurred will become part of the cost of that asset. Once the asset is completed and ready to use, the balance is transferred to the fixed assets account and the CWIP account is removed from the balance sheet.

Also Read: Work in Progress – Meaning, Importance, Accounting And More

Let’s assume that a company is constructing a building for its new office. The company prepares its balance sheet at the end of each financial year, that is, 31 st March. As of 31 st March, the building is still under construction. The following are the costs that company has incurred on the building as of 31 st March:

- Construction material = $250,000

- Labour cost = $120,000

- Architect fees = $40,000

- Contractor fees = $80,000

The total payment made for the construction of the building is $490,000. The CWIP Account will be debited by $490,000 against the cost incurred on the building. The journal entry for the same would be:

| CWIP Account Dr. | 490,000 | |

| To construction materials | 250,000 | |

| To labor cost | 120,000 | |

| To architect fees | 40,000 | |

| To contractor fees | 80,000 |

After the completion of construction, we credit the CWIP account and debit the fixed assets account. Therefore, removing the CWIP account from the balance sheet, and transferring its balance to the fixed assets account. The journal entry for the transfer of the CWIP account will be:

| Fixed Assets account Dr. | 490,000 | |

| To CWIP account | 490,000 |

RELATED POSTS

- Types of Working Capital – Gross and Net, Temporary and Permanent

- Capital Expenditure

- Capital Expenditure Accounting

- Capital Employed Calculator

- Accrued Expense – Meaning, Accounting Treatment And More

- Days Working Capital (DWC)

Sanjay Bulaki Borad

MBA-Finance, CMA, CS, Insolvency Professional, B'Com

Sanjay Borad, Founder of eFinanceManagement, is a Management Consultant with 7 years of MNC experience and 11 years in Consultancy. He caters to clients with turnovers from 200 Million to 12,000 Million, including listed entities, and has vast industry experience in over 20 sectors. Additionally, he serves as a visiting faculty for Finance and Costing in MBA Colleges and CA, CMA Coaching Classes.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the newsletter!

How Does Work in Progress Affect the Balance Sheet?

For a manufacturing company, work in progress is created when items are part-way through the production process. WIP usually consists of three elements -- raw materials, direct labor and applied overhead. Depending on the manufacturing process, the stores may have issued all or part of the raw materials required for the production run and additional labor may be required to make the goods ready for sale. Service businesses, such as accounting or legal practices, use WIP to track hours billed to a client but not yet invoiced.

A manufacturing company has three separate categories of inventory on its balance sheet. Raw materials are stores that have not yet been issued to the production facility, work in progress represents products in a partially finished state and finished goods are items that are ready for sale. WIP and finished goods both represent accumulated raw materials, direct labor and applied overheads but only finished goods are directly reflected in the cost of goods sold.

Advertisement

Article continues below this ad

More For You

How to calculate beginning inventory & conversion costs, reporting work in process inventory with fifo, how to report prior period adjustments in a cash flow statement, how inventory adjustments affect income statements, what merchandising accounts will appear in the post closing trial balance, raw materials.

The value of raw materials at the end of the accounting period is calculated by adding the cost of raw materials purchased to the raw materials valuation at the beginning of the period, and deducting the cost of raw materials transferred to work in progress. For example, opening inventory at January 1st was $10,000, the company purchased raw materials of $50,000 during the year and $45,000 of materials were issued from stores to work in progress. The closing inventory is therefore $10,000 plus $50,000 minus $45,000, or $15,000, and this would usually be confirmed by a physical inventory audit.

Work in Progress

All raw materials are transferred to the work WIP account as they are issued from stores. In addition, direct labor costs are transferred from the wages account to the WIP account as hours are accumulated. Factory overhead, consisting of indirect materials and labor, utilities, depreciation and other non-direct expenses, is also posted to the WIP account. The total of raw materials, direct labor and factory overhead represents the total manufacturing costs for the period. The value of goods still in progress at the end of the period is deducted from the total costs, and the balance is transferred to the finished goods account as the cost of goods manufactured.

Cost of Goods Sold

The cost of goods sold is calculated by adding the cost of goods manufactured to the opening finished goods inventory and deducting the closing finished goods inventory. Gross profit is arrived at by deducting the cost of goods sold from total sales revenue. The value of closing inventory directly impacts the gross -- and ultimately net -- profit; a higher inventory valuation is associated with a greater profit. The WIP valuation therefore affects the current assets section of the balance sheet and the retained earnings.

- Future Accountant: Closing Stock (at Work-in-Progress Stage) in Process Account

- Principles of Accounting: Financial Statement Issues That Are Unique to Manufacturers

Isobel Phillips has been writing technical documentation, marketing and educational resources since 1980. She also writes on personal development for the website UnleashYourGrowth. Phillips is a qualified accountant, has lectured in accounting, math, English and information technology and holds a Bachelor of Arts honors degree in English from the University of Leeds.

- Canada (English)

- Canada (Français)

- Europe & Middle East

- Deutschland (Deutsch)

- France (Français)

- United Arab Emirates (English)

- United Kingdom (English)

- Asia Pacific

- Australia (English)

- Singapore (English)

- Preconstruction

- Financial Management

Risk Management

Take Your Knowledge to the Next Level

Choose from our library of free certification courses—start earning CE credits today.

Work in Progress (WIP) Accounting: What Is It and Why Is It Important?

Last Updated Jun 18, 2024

Work in progress (WIP) accounting is a method of accounting tailored specifically to construction that tracks costs and revenues throughout the lifecycle of construction projects. Rather than waiting for project completion, WIP accounting involves recording the direct labor, materials, subcontracting costs and allocated overhead associated with construction work as it is performed.

The WIP (work in progress) report — often referred to as the WIP schedule — serves as a fundamental financial document that offers an overview of the costs incurred and the revenues earned for a project during a specific period, providing a detailed snapshot of ongoing work against the budget.

The WIP schedule acts as a thread that weaves together two critical components in construction: financial data and project milestones. In this article, we delve into the intricacies of WIP reports, exploring their components, utilization, and the crucial role of WIP accounting in construction project management.

Table of contents

Understanding the Components of a Work in Progress (WIP) Report

While WIP accounting lays the foundation for financial transparency in construction , WIP reports offer a dynamic, real-time view of a project's financial pulse.

To navigate the complexities of construction accounting effectively, it's essential to understand the various components that make up a WIP report. In this section, we delve into the key elements that make up a WIP report, providing a detailed overview of each component's role and significance.

- Completion percentage: This percentage indicates the extent to which the project has been completed as of the reporting date. It is often calculated using the percentage of completion method based on actual costs incurred relative to estimated total costs.

- Actual costs: Represent the cumulative expenses incurred on the project up to the reporting date. These costs encompass direct costs (e.g., materials, labor, subcontractor expenses) and indirect costs (e.g., overhead, equipment, administration).

- Earned revenue: Reflects the cumulative amount of revenue that the project has earned based on the work completed. This is a key component for revenue recognition.

- Gross profit: Determined by subtracting the actual costs from the earned revenue. It offers insight into the project's financial performance.

- Actual billings: Represent the total amount billed to the client for work completed up to the reporting date, including progress billings and retainage .

- Over- and underbilling: Highlights any variances between actual billings and earned revenue.

The contract overview section sets the stage by outlining the contract's foundational details, while the actual job totals offer real-time insights into the project's progress and financial health. By gaining a deeper understanding of these components, project managers, accountant staff, and stakeholders can monitor project financial performance, make informed decisions and ensure fiscal accuracy.

Stay updated on what’s happening in construction.

Subscribe to Blueprint, Procore’s free construction newsletter, to get content from industry experts delivered straight to your inbox.

Why is the WIP Report Important?

To navigate the intricacies of construction contracts , revenue recognition, and cost management effectively, the WIP report emerges as a cornerstone in construction management and accounting.

Ensures Financial Accuracy

WIP reports play a crucial role in maintaining financial accuracy within the construction industry. They provide a systematic approach to tracking project-related revenue and costs, ensuring that financial statements accurately reflect the true financial position of each project and the firm as a whole.

Effective Revenue Recognition

One of the primary benefits of WIP reports is their alignment with the percentage of completion method for revenue recognition . By tracking earned revenue based on project progress, companies can recognize revenue as work is completed, offering a more accurate representation of their financial performance.

Cost Management and Control

WIP reports offer insights into actual project costs, enabling effective cost management and control. By monitoring spending and identifying cost overruns early on, construction companies can take corrective actions to keep projects within budget. This is especially important in construction given the unpredictable nature of cost fluctuations in the industry and their potential to trigger ripple effects throughout a project,

Billing Accuracy and Contractual Compliance

Accurate billings are essential in the construction industry. WIP reports help ensure that when invoicing clients, billings align with the work completed, reducing the risk of billing disputes and ensuring compliance with contractual obligations.

Overbilling and Underbilling

Over- and underbilling identify disparities between the actual billings and the earned revenue.

Overbilling is when a contractor invoices for labor and materials outlined in a contract before the corresponding work has been fully executed. Underbilling , on the other hand, occurs when the invoiced amount to date is lower than the earned revenue. These situations can occur for a variety of reasons including changes in project scope, unexpected delays, or discrepancies between progress and billing.

Billing accuracy is essential for upholding financial integrity, nurturing client trust, and managing cash flow efficiently. Overbilling has the potential to undermine client trust and trigger disputes, potentially jeopardizing long-term relationships. Conversely, underbilling can impact cash flow and the ability to meet financial commitments. While overbilling can accelerate cash inflows, underbilling can delay receipt of payment. Adhering to accurate billing practices can help to maintain effective cash flow throughout the project lifecycle.

Learn more – Construction Cash Flow Projection: A Deep Dive into Financial Forecasting

Project Monitoring, Issue Identification and Informed Decision-Making

WIP reports serve as a valuable project monitoring tool, providing snapshots of project progress. They help project managers and stakeholders identify potential issues, delays, or bottlenecks that may require attention and facilitate proactive problem-solving.

WIP reports empower project managers and executives to make informed decisions about resource allocation, project prioritization, and strategic planning. Accurate financial data supports better decision-making at both the project and organizational level. By capturing both financial nuances and operational dynamics, WIP reports play a crucial role in steering projects towards successful completion and achieving the company’s larger strategic financial goals.

By regularly assessing and reporting on the financial status of construction projects, WIP reports enable proactive risk management . They help identify potential risks such as cost overruns, schedule delays, or scope changes that could impact a project's profitability. In essence, WIP reports act as early warning systems, allowing construction professionals to anticipate and address risks before they escalate into larger issues.

Transparency and Accountability

WIP reports enhance transparency by providing clear breakdowns of project finances, including costs, billings, and revenue. This transparency benefits internal stakeholders and external parties such as auditors, banks, insurance companies, and investors. It plays a pivotal role in reinforcing financial accountability within construction firms, ensuring that financial operations are transparent and easily comprehensible to all stakeholders.

Learn more : How to Prepare for & Manage a Construction Audit

The WIP schedule helps construction professionals keep projects on track, make informed decisions, and uphold financial integrity.

Common Mistakes in WIP Accounting

In the complex realm of construction accounting, the WIP report plays a pivotal role in project financial management, offering insights into project progress and financial health. However, avoiding common mistakes is essential to ensure the accuracy and reliability of these reports.

Incomplete or Inaccurate Data Entry

Failing to consistently and accurately record all project-related costs, billings, and progress can lead to incomplete and inaccurate WIP reports. This can distort financial statements and make it challenging to assess the true financial health of a project. When critical decisions and future actions are based on data that lacks precision and reliability, it can lead to misinformed choices that negatively impact future project outcomes. The importance of meticulous and accurate record-keeping in WIP accounting cannot be overstated, as it forms the foundation upon which sound financial and project decisions are made.

Inconsistent Reporting Periods

Using inconsistent reporting periods, such as irregular intervals for generating WIP reports, can make it difficult to track progress and trends accurately. Consistent and regular reporting intervals are crucial to analyze the project data effectively and derive actionable insights.

Furthermore, when WIP reports are not synchronized with the project's billing cycles or accounting periods, it can lead to confusion and misinterpretation of the project's performance and financial health. When reporting periods are standardized, it becomes easier to spot anomalies, identify patterns, and diagnose potential issues early on.

Failure to Update Estimates

If the original cost estimates for a project are not updated to reflect changes in scope, costs, or schedules, the WIP report may not accurately represent the project's financial status. This is particularly true when change orders arise, as they often have significant impact on project finances. Updating estimates is critical to conduct precise revenue recognition and ensure that the WIP report provides an accurate reflection of the project's evolving financial landscape.

Not Addressing Overbilling or Underbilling

Neglecting to address overbilling or underbilling situations can have a substantial impact on the accurate portrayal of a project's financial standing. These discrepancies have the potential to distort the financial picture of a project, making it difficult to gauge its true financial health. When overbilling or underbilling situations are allowed to persist unchecked, they can lead to skewed financial data, which in turn can affect decision-making processes. To maintain financial accuracy and integrity, it is imperative that overbilling and underbilling issues are promptly identified, thoroughly investigated, and rectified. This ensures that billings align accurately with earned revenue to provide a clearer and more realistic representation of the project's financial position.

Misinterpreting Percentage of Completion (POC)

Misapplying the percentage of completion method can lead to errors in revenue recognition. Construction companies that use the POC method in their WIP reporting must ensure that their practices align with the Financial Accounting Standards Board (FASB) standards and guidelines. This includes accurately tracking costs, estimating project completion percentages, and recognizing revenue in accordance with FASB principles. Failure to adhere to FASB standards can result in financial reporting discrepancies and potential compliance issues.

Lack of Detailed Notes

A WIP report lacking detailed explanatory notes may fall short in providing a clear understanding of the project's financial trajectory. Without a record of the assumptions used for cost and revenue projections, the methodologies applied for progress measurement, leaves stakeholders with an incomplete understanding. Similarly, not capturing adjustments in project scope or shifts in accounting practices can obscure the report’s reliability and lead to misunderstandings about the project's actual status and expected outcomes.

Case Study: Effective Use of the WIP Accounting in Construction

Let’s explore a case study that exemplifies the interconnection between WIP accounting practices and the utilization of a WIP schedule in construction.

Concrete Crew, a concrete subcontractor, implements WIP accounting as an integral component of their financial management system. The firm generates a WIP schedule monthly, which aligns with their payment application cycle, a practice that reflects industry-standard WIP accounting principles.

Using WIP accounting standards, Concrete Crew meticulously records and tracks the direct costs of materials, labor, and overhead attributable to their projects, Job A and Job B. They recognize these costs as they are incurred, consistent with the accrual basis of accounting, which is also fundamental to WIP accounting. This approach allows for matching the revenue earned with the expenses incurred during the same period, providing a more accurate picture of project profitability.

Concrete Crew’s WIP schedule offers a detailed view of project-specific financials, reporting on the status of their construction contracts (Job A and Job B) and the percentage of completion.

Job A: As per the WIP report, Job A has a revised budget of $100 and a revised contract amount of $150. With a job-to-date (JTD) cost of $80 and a completion percentage of 80%, the earned revenue is $120. However, billing to date is only $75, resulting in an underbilling of $45. This discrepancy indicates that, while the work has been nearly completed, the billing has lagged. The schedule notes a forthcoming change order, which stalls further billing until November, affecting cash flow management. The inability to bill until then can strain the company's liquidity, emphasizing the need to navigate through this period without compromising the firm’s financial stability.

Job B: Similar to Job A, Job B also shows a revised budget and contract amount of $100 and $150. The job is also 80% complete, with an earned revenue of $120. The billed amount to date is $125, indicating an overbilling of $5. In the WIP report, Concrete Crew notes that the project is on hold until Spring 2024, and the billing status will remain as is for the time being.

Concrete Crew's application of WIP accounting, reflected in their monthly WIP schedule, serves as a vital instrument for fiscal oversight and strategic financial planning. It helps the firm to identify and adjust to underbilling and overbilling situations, thereby securing cash flow and preserving client relationships.

For Job A, the impending change order necessitates a careful reassessment of the project budget and timeline. For Job B, managing the overbilling requires communication and transparency with the client to ensure that when the project restarts, the financial reconciliation aligns with the client's expectations and the contract stipulations.

This example underscores the importance of an effective and accurate WIP schedule in providing transparency, fostering client trust, and ensuring the financial agility of construction firms. It also highlights the significance of proactive financial management in dealing with the ebbs and flows of project lifecycles, ultimately ensuring that companies maintain a steady cash flow, adhere to contractual obligations, and sustain long-term client relationships.

Was this article helpful?

Thank you for your submission., scroll less, learn more about construction..

Subscribe to The Blueprint, Procore’s construction newsletter, to get content from industry experts delivered straight to your inbox.

By clicking this button, you agree to our Privacy Notice and Terms of Service .

You’re signed up to receive The Blueprint newsletter from Procore. You can unsubscribe at any time.

Categories:

Construction Accounting

Kelsie Keleher

Kelsie is a Senior Strategic Product Consultant for general contractors at Procore; working closely with civil and infrastructure clients. Kelsie holds a Masters of Business Administration (MBA) and has close to a decade of experience in construction accounting and finance.

Taylor Riso

54 articles

Taylor Riso is a marketing professional with more than 10 years of experience in the construction industry. Skilled in content development and marketing strategies, she leverages her diverse experience to help professionals in the built environment. She currently resides in Portland, Oregon.

Explore more helpful resources

.css-c249p1::before{width:100%;height:100%;display:block;position:absolute;top:0px;left:0px;z-index:0;content:'';cursor:inherit;} What are Committed Costs in Construction Accounting?

In construction projects, managing finances can be a challenging task — but understanding committed costs can simplify the process. Committed costs refer to expenses that are guaranteed through formal agreements,...

Understanding Construction Financial Statements

For construction firms, effectively managing financial statements is an important building block for success. These documents play a key role in tracking performance, maintaining financial health and securing future projects....

Construction Progress Billing: Keeping the Cash Flowing

Rome wasn’t built in a day, and neither are skyscrapers and bridges. Construction projects take time, and because of that, they require significant upfront costs for labor, materials and equipment....

Cost Management in Construction: 4 Key Challenges

The financial stability of construction firms often hinges on their ability to effectively manage costs, a key factor in keeping projects within budget and securing profitability. The process of cost...

The Role of Work in Progress Adjustment in Financial Statements

Explore the significance of WIP adjustments in financial reporting and how they ensure accurate representation of a company's fiscal health.

Financial statements are critical tools for stakeholders to assess the health of a company. Among the various elements that constitute these financial reports, Work in Progress (WIP) adjustments stand out as a pivotal aspect, particularly for businesses involved in manufacturing or long-term projects. These adjustments ensure that reported assets and earnings accurately reflect the ongoing operations within a reporting period.

The importance of WIP adjustments extends beyond mere accounting compliance; it affects how investors perceive the value and performance of a company. Accurate WIP figures can influence investment decisions, credit ratings, and even the strategic direction of the business itself.

Definition of Work in Progress (WIP)

Work in Progress, commonly abbreviated as WIP, refers to the inventory account that tracks the costs associated with unfinished goods in the production process. These goods are neither raw materials nor finished products; instead, they are in a transitional state, absorbing both direct and indirect costs as they move through various stages of completion. WIP is a line item found under the current assets section of a company’s balance sheet, representing the investment in products that are expected to be converted into finished goods and, eventually, sold.

The valuation of WIP is a nuanced process, as it encompasses a range of costs. Direct costs include raw materials and labor directly involved in the creation of the product, while indirect costs might cover overhead such as factory utilities or depreciation of equipment. The complexity of accurately assessing these costs is compounded by the need to allocate them appropriately over the course of the production cycle.

WIP Accounting Methods

The approach to accounting for Work in Progress inventory is not uniform and can vary depending on the industry and the complexity of the production process. One common method is the job costing system, which is typically used when products are customized or produced in distinct batches. Under this system, costs are tracked for each job individually, allowing for precise allocation of materials, labor, and overhead to each project. This method is particularly useful for companies that handle a variety of projects with different production requirements and timelines.

Another prevalent method is process costing, which is suitable for industries where goods are produced in a continuous process, such as chemicals or textiles. Here, costs are accumulated over a set period and then allocated evenly across all units produced during that time. This method simplifies the accounting process for large volumes of similar or identical products, providing a consistent approach to valuing WIP inventory.

The Process of WIP Adjustment

Adjusting Work in Progress inventory is a systematic process that ensures the value of WIP reported on financial statements is both accurate and reflective of the actual state of production. This process is essential for maintaining the integrity of financial reporting and providing stakeholders with a clear picture of a company’s operational efficiency.

Need for Adjustment

Adjustments to WIP are necessary for several reasons. Production processes can be lengthy, and costs may fluctuate during the period. Materials prices might change, labor rates can vary, and overhead costs could shift due to a multitude of factors. Additionally, errors in accounting entries, changes in project scope, or production inefficiencies may also necessitate adjustments. Without these periodic recalibrations, WIP values could be misstated, leading to inaccurate cost of goods sold (COGS) calculations and gross margin analysis. This could distort a company’s profitability and financial position, misleading stakeholders and potentially affecting the company’s market value.

Steps in WIP Adjustments

The adjustment process typically begins with a physical inventory count to verify the quantity of WIP. This is followed by a review of the costs assigned to each WIP item, ensuring they are in line with the current cost environment. Any discrepancies between the physical count and the recorded amounts, or between actual and standard costs, must be investigated and corrected. The next step involves updating the WIP records to reflect any changes in the production process, such as the completion of certain stages or the consumption of materials. Finally, the adjusted WIP values are used to update the general ledger, which in turn affects the balance sheet and income statement.

Recording in Accounting Systems

Once the adjustments are calculated, they must be recorded in the company’s accounting system. This involves making journal entries that reflect the increase or decrease in WIP value. An increase in WIP, indicating more costs have been incurred, would be recorded as a debit to the WIP account and a corresponding credit to various accounts such as raw materials, labor, or overhead. Conversely, a decrease in WIP, suggesting that costs have been overstated or that WIP has been transferred to finished goods, would be recorded as a credit to the WIP account and a debit to the appropriate expense or asset accounts. These entries are crucial for ensuring that the financial statements are up-to-date and accurately represent the company’s current financial status.

Factors Influencing WIP Adjustments

The valuation of Work in Progress inventory is subject to a variety of factors that can necessitate adjustments. One such factor is the production cycle length. Longer production cycles can lead to greater variability in costs and a higher likelihood of changes that require adjustments. For instance, a construction project spanning several years will likely encounter fluctuations in material costs and labor wages, necessitating periodic recalibration of the WIP values.

Technological advancements also play a role in influencing WIP adjustments. The introduction of new machinery or software can lead to more efficient production processes, altering the cost structure associated with WIP. As companies invest in technology to improve productivity, the initial costs may increase WIP values, but over time, the enhanced efficiency can reduce the cost per unit, thus affecting the WIP valuation.

Market dynamics, such as supply chain disruptions or changes in demand, can impact the costs associated with WIP. A sudden increase in the cost of raw materials due to supply shortages, or a change in consumer demand affecting production volumes, can both lead to significant adjustments in WIP valuation to maintain accuracy in financial reporting.

Impact on Financial Ratios

The adjustments made to Work in Progress inventory have a direct and significant effect on financial ratios, which are key indicators of a company’s financial health and operational efficiency. For instance, an increase in WIP, without a corresponding rise in sales, can lead to a higher inventory turnover ratio, suggesting that the company may be accumulating inventory faster than it can sell it. This could signal potential inefficiencies in production or issues with market demand.

Conversely, if WIP adjustments lead to a decrease in inventory value, this could improve the perceived efficiency of the company, as reflected by a lower days in inventory ratio. However, it’s important to consider the context of such adjustments. A decrease due to improved production efficiency is favorable, whereas a decrease due to overstatement of costs in prior periods may indicate issues with inventory management or accounting practices.

The gross profit margin is another ratio that can be influenced by WIP adjustments. If WIP is undervalued due to not capturing all relevant costs, the cost of goods sold will be understated, and the gross profit margin will appear artificially high. This could mislead stakeholders into overestimating the company’s profitability. Accurate WIP adjustments ensure that the gross profit margin reflects the true cost of production, providing a reliable measure for stakeholders to assess the company’s performance.

Essential Functions of a Merchandiser Accountant

Fund accounting principles for financial professionals, you may also be interested in..., differentiating office expenses vs. supplies for budgeting, accounting for subsidiaries: types, reporting, and tax implications, effective cip accounting for modern construction projects, current portion of long-term debt demystified for financial pros.

- Understanding Work-In-Progress (WIP) When Analyzing Financial Statements

Featured in:

For someone with very little to no background in accounting or financial matters, making business decisions based on the results of reviewing and analyzing financial statements and other financial reports can be quite intimidating. In fact, that is the reason why you hear about a lot of company executives leaving the job in the hands of staff members who they think have the right qualifications and knowledge.

For example, they’ll have their accountants do the reviewing – more formally, it is referred to as “financial statements analysis” – and then have them interpret the results and make recommendations in layman’s terms. In short, in business language that they can understand.

That’s all well and good, but don’t you think it would be better if you knew a little more about the basics of financial statements analysis? It doesn’t mean that you should know the often too intricate processes and methodologies of analyzing financial statements, but only to get the basic idea or the gist of things.

To a certain extent, this will let you keep a handle on most things, maintaining a degree of awareness about how the business is really performing, instead of simply and blindly going along with what your accountants tell you. That way, you will also feel more confident in your decisions. Plus, it also minimizes the risks of you being swindled by those who advise you on these matters, and surely you want to make sure of that, don’t you?

Granted, financial statements analysis is not something that can be easily learned. There are simply too many factors to consider and a lot of elements at play. One of the elements that often give rise to confusions in the review of financial statements is the Inventory account.

It’s certainly not much of a problem in a merchandising concern where, often, there is only one type of inventory maintained. It becomes a bit complicated in a manufacturing concern, because there are several inventories to consider, mainly depending on the stages of completion, including Finished Goods Inventory and Work-in-Progress.

The confusion is definitely going to be greater if we also consider the Raw Materials Inventory and other inventories of indirect supplies and materials used in the production process.

But don’t worry. We don’t want to overwhelm you with too much information all at once, so we’ll take things one at a time. By the end of this discussion, you will understand Work-in-Progress in the context of financial statements analysis.

WHAT IS WORK-IN-PROGRESS?

Work-in-Progress, or WIP, is a component of the Inventory account, which is reflected in the Asset section of the Balance Sheet (or the Statement of Financial Position). You may have seen other companies use the account title “Work-in-Process”. They’re the same thing.

WIP is clearly different from the other types of inventory for manufacturing concerns. Raw Materials Inventory includes the direct materials that are still in their unaltered form, prior to being placed into production; WIP includes the materials that have been subjected to processing, regardless of the degree or extent. Finished Goods Inventory, on the other hand, includes those that have been completed, after undergoing the entire production process, and are now ready for sale; WIP are still unfinished and certainly not yet ready to be sold.

Production Cost (or Manufacturing Cost) refers to the total costs put into the production or manufacturing process in order to complete products that have been partially worked on or completed. It includes all the costs that have been incurred at various stages of the production process, and has three elements:

- Raw materials , or the materials directly used in the production process

- Direct labor , or the wages of worker or staff directly involved in the production process

- Allocated overhead (e.g. indirect materials, indirect labor, and other overhead expenses, such as utilities and depreciation directly traceable to the production process)

At the end of the reporting period, the amount corresponding to the cost of goods that have been placed into process, but are not yet completed, is the ending inventory of the WIP. This is the figure that will be included in the Inventory account presented in the Balance Sheet.

But you have to be careful here. In financial statements analysis, the WIP may also refer to the portion of the total Production Costs that was actually used in the production process. Instead of an asset account, it will form part of the cost of goods manufactured, which will appear in the Income Statement. The formula to arrive at that figure is:

| WIP Inventory, beginning balance | XXX | |

| Add: Costs put into process | ||

| Raw Materials Used | XX | |

| Direct Labor | XX | |

| Factory Overhead | XX | |

| Total Production Cost | XXX | |

| Less: WIP Inventory, ending balance | ||

| WIP Used |

Confused yet? You’d understand this better if we go over the production process for a bit.

WHERE DOES WIP FIT IN THE PRODUCTION PROCESS?

Depending on the product being manufactured and the business processes and practices of the company, the production process may be simple and straightforward, or it may be complex and composed of more than a few stages or phases. At every stage of the production process, costs will be added, and these costs will be accumulated in the WIP.

Once the raw materials and even the indirect materials have been placed into the production process, they cease to be raw materials and become WIP. However, since they have not yet fully gone through the entire production process and remain unfinished, they still aren’t classified as Finished Goods.

You can then say that the WIP is indicative of the flow of manufacturing costs from one production stage to the succeeding stages.

Now how does WIP figure into the process of analyzing financial statements? We’ll get to that soon. But first, we have to establish what businesses should aim for with regards to WIP.

WHAT SHOULD BUSINESSES AIM FOR WITH RESPECT TO WIP?

As much as possible, retail and merchandising businesses want to have a reasonable balance in their Inventory accounts. Not too large, but not completely zero, either. This same goal applies to WIP, which directly relates to the production process of the company.

Manufacturing companies are more concerned with keeping its production at optimal levels. Production management that aims to keep things at such optimal levels means that the firm should put effort in minimizing its WIP.

Why is that? Shouldn’t you aim for a higher amount to appear in the Balance Sheet? Not necessarily, considering that the accounts and components have varying implications.

The main reason why you should keep your WIP at minimal levels is to keep the associated costs low. You see, WIP, or any inventory for that matter, requires storage and warehousing. While awaiting completion, they will take up floor space in your warehouse, and will also require the use of various utilities to “preserve” them until such time that they can be processed further for completion. Your warehouse will utilize electricity, and you may have to spend on manpower costs to maintain them and even keep them secure.

What if you don’t store them and, instead, keep them in the assembly line? Well, that is even worse, because it means that you have WIP in queue, and it is holding up the flow of work in the production process. The likely effects are backlogs and slow production rates, which can result to bigger problems when you are unable to meet a high demand from customers.

Further, this means that the cost is tied up in the inventory account. You won’t be able to invest those funds or use them for other business purposes while they are still tied up in WIP. If you have a high WIP, there is a large amount that you won’t be able to invest until they have been completed and sold.

You’re going to understand this well when we go into analyzing the financial statements.

WIP IN HORIZONTAL ANALYSIS

Horizontal analysis, which you may also know as trend analysis , involves comparing financial statement data over a series of reporting periods, with the intention to see the trend or pattern of financial information on operations of a business from period to period. The main concern is to note the increases or decreases, if any. The comparison may spark greater interest if there are obvious discrepancies or differences, prompting management and investors to look deeper into the operations, for the reason or cause of said differences.

In the horizontal analysis of the Balance Sheet, the balances of the different accounts under the three categories – Assets, Liabilities and Stockholders’ (or Owners’, depending on the form of business) – are compared with that of the balances of previous years to recognize trends and spot any irregularities.

As we have already established earlier, WIP forms part of Inventories account, which is under the Current Asset heading in the Asset section. In some cases, the comparison will be made using the total figures of each period for Inventories , but it would be more accurate to compare the respective balances of the various components of the Inventories account.

What can you tell if you employ horizontal analysis on WIP?

- An increase in the ending WIP inventory from period to period may indicate

- that there is an increase in the demand for the company’s products, if Sales levels also show an upward trend;

- that the company is manufacturing more or faster than it can actually sell, if Sales levels are decreasing or remain relatively stable/constant; and

- that the production process may be experiencing a slowdown and cannot complete products fast enough to meet deadlines, resulting to excess WIP inventory, if Sales levels show a downward trend.

- A decrease in the ending WIP inventory from period to period may indicate

- that the company is not manufacturing enough products, or the production process is not fast enough to manufacture products, that will meet the demand; and

- a weakening in the demand for the company’s products, prompting management to revisit its production processes and marketing programs.

WIP IN VERTICAL ANALYSIS

If Horizontal Analysis involves the evaluation of a series of financial statements for more than one reporting period, Vertical Analysis focuses on the financial statement of a company for a single period. In this method, each line item of the financial statement is treated as a percentage of the whole.

The purpose of this type of analysis is to determine the proportion of account balances. If it turns out that there is an abnormal disparity between the proportion of Current Assets and Non-Current Assets to the Total Assets, this is bound to prompt management to reassess how it utilizes its resources in its operations. You are likely to use this method when you’re comparing the financial data and performance of different companies, regardless of the difference in their sizes.

For example, in the Balance Sheet , each line item is taken as a percentage of the Total Assets. Meanwhile, in the Income Statement , each expenditure and cost line item is taken as a percentage of the Total Sales.

As an illustration, here’s an excerpt of the Inventories section of two different-sized companies in the same industry. Company A

| Amount (in USD) | Amount (in USD) | |

| Raw Materials | 12,000 (4.3%) | 170,000 (9.1%) |

| Work in Process | 26,000 (9.4%) | 240,000 (12.9%) |

| Finished Goods | 11,000 (4.0%) | 260,000 (14.0%) |

| Total Inventories | 49,000 (17.8%) | 670,000 (36.2%) |

| Total Assets | 275,000 (100%) | 1,850,000 (100%) |

The above data, combined with results of analysis of the other line items and the various factors that may affect them, will give you more information on which company is performing better financially.

This will provide a clearer and more accurate picture, rather than simply relying on the bottom figures (Total Assets, Total Sales, and Net Income).

WIP IN FINANCIAL RATIO ANALYSIS

Although horizontal and vertical analysis methods are used often, there is no doubt that the most prefer to employ financial ratios in analyzing financial statement data. The preference is because these ratios easier and quicker to use, and they are applicable even when you are analyzing financial statement data over time, or among businesses within the same industry.

Financial ratios are also more specific. If you want to know something about a company’s financial state, such as its liquidity or profitability, all you have to do is use the appropriate financial ratios.

And yes, WIP also figures greatly when you use financial ratio analysis. Let’s go over some of the most salient points.

Current Ratio

Current Ratio is a prime ratio used to measure a company’s liquidity, or its ability to quickly convert its assets into cash when it is in the middle of a financial crisis, and still continue its operations.

This ratio shows the relationship between your current assets and current liabilities. Do not forget that your WIP ending inventory balance is a component of your current assets. It is computed using the formula below.

How it works: Obviously, you’d want a high Current Ratio, such as 3:1 or 4:1, since this means you won’t have any trouble turning your current assets – even your WIP – into cash whenever you run into financial difficulties. This means you have more Accounts Receivables that you can collect on and Finished Goods Inventory that you can sell. You probably even have short-term marketable securities that you can quickly sell to raise some cash.

Of course, this is not conclusive when it comes to inventories, which are not entirely liquid. The WIP, for example, cannot be sold immediately precisely because they are NOT yet completed and therefore they are NOT yet ready for sale. Unless, of course, the nature of the product allows it to be salable even when it is partially completed. For example, a manufacturer of electronics products may sell its partially completed units in its WIP to another company with similar manufacturing operations. That could work.

That’s why you shouldn’t take the Current Ratio at face value alone. You still have to dig deeper into the components. What if Inventories, particularly the generally-unsellable WIP, make up a very large part of Current Assets? Then it could mean that your company is not as liquid as you thought.

Working Capital

Working Capital serves as an indicator of your ability to meet your current obligations as they fall due. These current obligations include those that are usually incurred in the normal operations of the business, such as electricity bills and other utilities, salaries and wages, and payments on short-term loans.

Working Capital = Current Assets – Current Liabilities

How it works: You’d definitely want to have a higher amount of working capital, since this means that you are in a better position to make your payments on time, as they fall due. With respect to WIP, Working Capital will tell you about the WIP Days, or the average number of days that you can afford to keep units or jobs in progress before they are completed and delivered to customers.

WIP Days = Total Current WIP Used / Total Production Cost x No. of Days

To illustrate, let us say that, for the year, the total Production Costs add up to $3,000,000. Currently, the total WIP used amounts to $1,300,000, and you operate for 360 days in a year. By applying the formula above, the WIP Days is equal to 156 days.

What does this mean? This means that units or jobs should be in progress for an average of 156 days. If you go beyond that, you might not be able to sell the finished goods because the customers looked elsewhere for another source. Therefore, you have to make sure the production process goes on smoothly, and that you are not taking more jobs or orders than you can take on.

Inventory Turnover

Inventory Turnover, or inventory turns, will show you how effective you are at managing your inventory levels. Take a look at the formula below.

You might be wondering how WIP comes into play in this, since Inventory Turnover actually refers to the Finished Goods Inventory, and how it fares in comparison to your sales level during a specific period.

Let me walk you through it. In the formula above, you have to get two figures. The Cost of Goods Sold (COGS) and the Average Inventories. The Average Inventories is easy enough, since you only have to take the average between the beginning and ending balances of the Finished Goods Inventory.

It’s the COGS part that you have to pay closer attention to. COGS, by the way, is the equivalent of Cost of Sales in a retail business, referring to the cost of goods or products that were actually sold during the period.

| Finished Goods Inventory, beginning balance | XXX |

| Add: Cost of Goods Manufactured | XXX |

| Total Cost of Goods Available for Sale | |

| Deduct: Finished Goods Inventory, ending balance | (XXX) |

| Cost of Goods Sold (COGS) |

Still don’t see where WIP comes in? Be patient. In the computation, you have to have a separate computation to get your Cost of Goods Manufactured, which basically refers to the production costs that apply to the products that have been completed during the reporting period.

| WIP Inventory, beginning balance | XXX | |

| Add: | ||

| Raw or Direct Materials | XX | |

| Direct Labor | XX | |

| Allocated/Assigned Overhead | XX | |

| Total Manufacturing Costs | XXX | |

| Deduct: WIP Inventory, ending balance | ||

| Cost of Goods Manufactured |

There you go.

How it works: This ratio will tell you about your inventory management and sales performance. Generally, a high WIP used means a high Cost of Goods Manufactured, which will also increase your Cost of Goods Sold. Usually, this also means a high Inventory Turnover Ratio, which is preferred, since it may indicate strong sales performance. It may also be an indicator that you are not holding any excess inventory and incurring related inventory costs unnecessarily.

If you take a look at the Balance Sheet and the Income Statement, there is no doubt that you will find more areas where WIP – be it the Inventory account or the WIP used or incurred during the period – will have an impact. In fact, it is safe to say that WIP has an effect on the net income or overall profitability of the company.

WRAPPING IT UP…

Through the analysis of financial statements, you will be able to see how important it is to also include the WIP in your inventory management and control policies and activities. After all, it is a critical component of the production process, and every movement will have an effect on your financial statements.

Comments are closed.

Related posts

Ultimate Guide to Testing Mobile Applications

Mobile applications are everywhere and most businesses seem to be developing one these days. But …

Management by Walking Around (MBWA) – The Essential Guide

We live in a world where communication is easier than ever, yet face-to-face conversations …

What is a Reduction in Force and How Does it Work?

This is one of the terms that strikes fear in the hearts of a great deal of employees. When a …

408,000 + job opportunities

Not yet a member? Sign Up

join cleverism

Find your dream job. Get on promotion fasstrack and increase tour lifetime salary.

Post your jobs & get access to millions of ambitious, well-educated talents that are going the extra mile.

First name*

Company name*

Company Website*

E-mail (work)*

Login or Register

Password reset instructions will be sent to your E-mail.

How do you account for a project under construction?

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Read more →

Author: Harold Averkamp, CPA, MBA

Accounting for a Project Under Construction

If a company is constructing a major project such as a building, assembly line, etc., the amounts spent on the project will be debited to a long-term asset account categorized as Construction Work-in-Progress .

Construction Work-in-Progress is often reported as the last line within the balance sheet classification Property, Plant and Equipment .

There is no depreciation of the accumulated costs until the project is completed and the asset is placed into service.

When the completed asset is placed into service, the project’s accumulated costs will be removed from the Construction Work-in-Progress account and will be debited to the appropriate plant asset account.

Related Questions

- What is Construction Work-in-Progress?

- Is there a difference between work-in-process and work-in-progress?

- What is the difference between an adjunct account and a contra account?

- Why does the internal rate of return equate to a net present value of zero?

- Is there a difference between the accounts Purchases and Inventory?

- Why and how do you adjust the inventory account in the periodic method?

Related In-Depth Explanations

- Accounting Principles

- Balance Sheet

- Depreciation

Advance Your Accounting and Bookkeeping Career

- Perform better at your job

- Get hired for a new position

- Understand your small business

- Pass your accounting class

Earn Our Certificates of Achievement

- Debits and Credits

- Adjusting Entries

- Financial Statements

- Income Statement

- Cash Flow Statement

- Working Capital and Liquidity

- Financial Ratios

- Bank Reconciliation

- Accounts Receivable and Bad Debts Expense

- Payroll Accounting

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

About the Author

Read 2,651 Testimonials

- 01. Accounting Basics 0%

- 02. Debits and Credits 0%

- 03. Chart of Accounts 0%

- 04. Bookkeeping 0%

- 05. Accounting Equation 0%

- 06. Accounting Principles 0%

- 07. Financial Accounting 0%

- 08. Adjusting Entries 0%

- 09. Financial Statements 0%

- 10. Balance Sheet 0%

- 11. Working Capital and Liquidity 0%

- 12. Income Statement 0%

- 13. Cash Flow Statement 0%

- 14. Financial Ratios 0%

- 15. Bank Reconciliation 0%

- 16. Accounts Receivable and Bad Debts Expense 0%

- 17. Accounts Payable 0%

- 18. Inventory and Cost of Goods Sold 0%

- 19. Depreciation 0%

- 20. Payroll Accounting 0%

- 21. Bonds Payable 0%

- 22. Stockholders' Equity 0%

- 23. Present Value of a Single Amount 0%

- 24. Present Value of an Ordinary Annuity 0%

- 25. Future Value of a Single Amount 0%

- 26. Nonprofit Accounting 0%

- 27. Break-even Point 0%

- 28. Improving Profits 0%

- 29. Evaluating Business Investments 0%

- 30. Manufacturing Overhead 0%

- 31. Nonmanufacturing Overhead 0%

- 32. Activity Based Costing 0%

- 33. Standard Costing 0%

- Explanations

- Practice Quizzes

- Word Scrambles

- Video Training

- Visual Tutorials

- Quick Tests

- Cheat Sheets

- Business Forms

- Printable PDFs

- Certificates

Get A Free Accounting Quote!

Construction in Progress Accounting (CIP) Basics

Construction in progress accounting , also known as construction work in progress accounting , is a specialized accounting method used in the construction industry to track and manage the costs and financial aspects of construction projects . In this article, we will provide an overview of the basics of construction in progress accounting and its importance in effective construction financial management.

Construction work in progress accounting involves the proper recording and tracking of construction costs, including materials, labor, and overhead expenses. By accurately monitoring these costs, construction companies can make informed decisions, control project budgets, ensure profitability, and track progress efficiently.

Understanding construction in progress accounting is essential for construction professionals, including project managers, accountants, and financial executives. Whether you are involved in construction accounting , construction project management, or construction financial management, having a solid foundation in construction-in-progress accounting principles is crucial for success.

In this article, we will explore various aspects of construction in progress accounting, including the role of Construction in Progress (CIP) in company balance sheets, distinguishing between fixed assets and construction in progress, principles of construction cost tracking in CIP accounting, and the importance of accurate financial reports in construction.

Additionally, we will discuss construction in progress accounting procedures and protocols, the accounting process from project inception to completion, the impact of accurate billing and revenue recognition in construction projects, and the role of construction accounting software in CIP tracking and streamlining construction financial management.

By gaining a comprehensive understanding of construction in progress accounting, construction professionals can effectively manage project costs, foster financial transparency, and make informed business decisions. Join us on this journey as we navigate the intricacies of construction in progress accounting and learn key strategies for success in construction financial management.

Understanding Construction in Progress Accounting

In the construction industry, effectively managing and tracking project costs is vital for the financial management of any construction job. Construction in progress accounting, also known as construction work-in-progress accounting, provides a specialized method to monitor and control these costs. In this section, we will explore the concept of construction in progress accounting, focusing on the role of Construction in Progress (CIP) accounts in company balance sheets and the distinction between fixed assets and construction in progress.

The Role of CIP in Company Balance Sheets

Construction in Progress (CIP) accounts play a crucial role in maintaining financial transparency in company balance sheets. These accounts represent the ongoing construction projects that the company is currently working on. By tracking and recording costs associated with each CIP account, companies can accurately assess their construction project expenses and allocate resources effectively.

In the balance sheet, CIP accounts are typically classified as current assets or non-current assets, depending on the expected time of completion. This classification ensures that the value of ongoing construction projects is recognized, providing a comprehensive overview of the company’s financial position.

Distinguishing Between Fixed Assets and Construction in Progress

It is crucial to understand the distinction between fixed assets and construction in progress for accurate accounting and financial reporting. Fixed assets are tangible assets that a company owns and uses in its operations, such as land, buildings, and equipment. On the other hand, construction in progress refers to the costs incurred during the construction phase of a project before its completion.

While fixed assets are fully completed and ready for use, construction in progress represents the ongoing work and costs associated with a project that is not yet completed. Properly distinguishing between these two categories ensures that the company’s financial statements reflect the accurate values of each asset type.

To summarize, understanding the role of CIP in company balance sheets and distinguishing between fixed assets and construction in progress is essential for accurate accounting and financial management in the construction industry. In the next section, we will explore the principles of construction cost tracking in CIP accounting.

Principles of Construction Cost Tracking in CIP Accounting

Effective construction cost tracking is a crucial aspect of construction in progress (CIP) accounting, which is essential for accurate debit and credit management. By accurately monitoring and managing costs, construction companies can achieve better cost control, improve project management, and make informed financial decisions. In this section, we will explore the principles and best practices for tracking construction costs in construction work in progress accounting, highlighting the importance of cost control, accurate record-keeping, and the ability to track progress.

1. Cost Control: Cost control is essential for managing construction projects within budget. By diligently tracking costs, construction companies can identify potential cost overruns and take timely corrective measures, enhancing construction management. This includes closely monitoring expenses, comparing actual costs to the estimated budget, and implementing measures to control cost variations.

2. Accurate Record-Keeping: Accurate record-keeping is critical for effective construction cost tracking in CIP accounting. It involves maintaining detailed records of all construction-related expenses, including labor, materials, equipment, subcontractor costs, and indirect costs. Proper documentation ensures transparency, facilitates auditing and provides a reliable basis for financial reporting.

3. Integration with Project Management: Construction cost tracking should be integrated with project management processes. This allows project managers to monitor costs in real time, identify cost deviations, and take proactive measures to keep the project on track. By aligning cost tracking with project schedules and milestones, construction companies can optimize resource allocation and mitigate risks associated with cost overruns.

4. Regular Reporting and Analysis: Regular reporting and analysis of construction costs are essential for effective CIP accounting. Construction companies should generate periodic cost reports that provide an overview of project expenses, budget variances, and cost trends. This enables stakeholders to assess project performance, make data-driven decisions, and implement necessary adjustments to ensure financial success.

5. Utilization of Construction Accounting Software: Construction cost tracking can be significantly enhanced by leveraging construction accounting software. These software solutions streamline the tracking process, automate data entry, and provide real-time visibility into project costs. Construction companies can benefit from features such as budget tracking, cost allocation, invoice management, and financial forecasting.

Successful construction cost tracking in CIP accounting requires a combination of diligent cost control, accurate record-keeping, integration with project management, regular reporting, and the adoption of construction accounting software. By following these principles and best practices, construction companies can improve their financial management, enhance project profitability, and ensure the successful completion of construction projects.

The Importance of Accurate Financial Reports in Construction

Accurate financial reporting is of utmost importance in the construction industry. It plays a critical role in ensuring financial transparency and enabling construction companies to make informed business decisions. By providing precise and reliable financial data, accurate financial reports facilitate effective construction financial management and contribute to the overall success of construction projects.

Fostering Financial Transparency with CIP Accounts

One of the key tools in achieving financial transparency in construction is the use of Construction in Progress (CIP) accounts. CIP accounts allow construction companies to track and record the costs incurred during the construction process. By properly maintaining and updating these accounts, companies can ensure that all relevant expenses are accurately captured and reported.

Through the use of CIP accounts, construction companies can provide stakeholders with a clear and comprehensive view of the financial status of construction projects, classifying them as a specific type of account in financial statements. This transparency not only enhances stakeholder trust but also enables better decision-making in terms of project budgeting, resource allocation, and risk management.

Challenges Faced Without Proper Construction Work-In-Progress Accounting

Without proper construction work-in-progress accounting, construction companies may encounter various challenges that can have a significant impact on their financial management. These challenges include:

- Inaccurate financial reporting: Without accurate construction work-in-progress accounting, companies may struggle to provide precise financial reports, leading to a lack of transparency and potential misinterpretation of project costs.

- Difficulty in project cost tracking: In the absence of construction work-in-progress accounting, tracking and managing project costs become challenging. This can result in cost overruns, budgeting issues, and difficulties in assessing project profitability.

- Limited visibility into project financials can often limit the ability to track accounts payable and record construction-in-progress efficiently. Construction work-in-progress accounting provides visibility into the financial health of individual projects. Without it, companies may lack insights into project-specific financials, hindering efficient resource allocation and decision-making.

To overcome these challenges, construction companies must prioritize the implementation of proper construction work-in-progress accounting practices. This includes employing robust financial management systems, ensuring accurate cost-tracking mechanisms, and maintaining transparency through regular and accurate financial reporting.

Construction in Progress Accounting Procedures and Protocols

This section provides detailed insights into the procedures and protocols involved in construction in progress accounting. It covers the accurate recording of construction costs and expenditures using different methods such as job costing and cost classification. Additionally, it explores the process of transferring the costs from the construction in progress account to fixed asset accounts to ensure proper asset recognition and depreciation.

Recording Construction Costs and Expenditures

Accurately recording construction costs and expenditures is essential for effective construction in progress accounting. The following methods can be used:

- Job Costing: This method involves tracking costs on a per-job basis. It allows for the identification of direct and indirect costs associated with each construction project, enabling more precise cost allocation and analysis.

- Cost Classification: Construction costs can be classified into various categories such as labor, materials, equipment, and overhead. By categorizing costs, construction companies can better monitor and control their expenses.

The Process of Transferring CIP to Fixed Asset Accounts

When a construction project is completed, the costs recorded in the construction in progress account need to be transferred to fixed asset accounts for proper asset recognition and depreciation. The transfer process involves the following steps:

- Verification: Confirm that the construction project is completed and all costs have been accurately recorded in the construction in progress account, a critical step before the asset can be depreciated as a long-term asset.

- Adjustment: Make any necessary adjustments to ensure that the costs transferred to fixed asset accounts reflect the current value of the assets.

- Transfer: Transfer the costs from the construction work in progress account to the appropriate fixed asset accounts, such as new buildings, land, or plant and equipment.

- Depreciation: Once the costs are transferred, calculate and apply depreciation to the fixed assets based on their estimated useful lives.

| Construction in Progress Accounting Procedures and Protocols |

|---|

| 1. Recording Construction Costs and Expenditures |

| 1.1 Job Costing |

| 1.2 Cost Classification |

| 2. The Process of Transferring CIP to Fixed Asset Accounts |

| 2.1 Verification |

| 2.2 Adjustment |

| 2.3 Transfer |

| 2.4 Depreciation |

Construction in Progress Accounting: From Inception to Completion

Construction in progress accounting plays a crucial role in tracking and managing construction costs throughout the entire construction project lifecycle. In this section, we will explore the various stages of construction in progress accounting, from project inception to completion. We will discuss the CIP accounting process and highlight the impact of CIP accounts on financial reporting.

1. Project Inception

During the project inception stage, construction costs are estimated and budgeted, ensuring that all expenses are accurately accounted for in the construction-in-progress account. This involves identifying the scope of work, analyzing project requirements, and determining the financial resources needed to complete the project successfully. CIP accounts are established to track and monitor the initial costs incurred during this stage.

2. Design and Planning

In the design and planning stage, construction professionals create detailed construction plans and blueprints for a new building. Cost estimates are refined based on the finalized project specifications. CIP accounts continue to accumulate costs related to design and planning activities, including architectural and engineering fees.

3. Procurement and Pre-construction

During procurement and pre-construction, materials, equipment, and subcontractor services are acquired. CIP accounts capture the costs associated with purchasing construction materials, obtaining necessary permits, and performing site preparation work.

4. Construction Execution

The construction execution stage is where the actual construction work takes place. CIP accounts track direct and indirect costs incurred during this stage, such as labor expenses, equipment rentals, and project management fees. Ongoing cost monitoring and control are essential to ensure projects stay within budget, leveraging accounts payable tracking to manage cash flow.

5. Project Completion

Once the construction work is completed, the costs accumulated in the CIP accounts are transferred to fixed asset accounts. This ensures that the costs are properly recognized, and the fixed assets are appropriately valued on the company’s balance sheet. Proper asset recognition is crucial for determining asset depreciation and financial reporting accuracy.

The construction in progress accounting process covers the entire construction project lifecycle, from inception to completion. CIP accounts play a vital role in tracking and managing construction costs at each stage, providing valuable insights into project financials. By effectively utilizing CIP accounting, construction companies can ensure accurate financial reporting, better cost control, and informed decision-making.

| Project Stage | CIP Accounting Process |

|---|---|

| Project Inception | Establish CIP accounts to track initial costs. |

| Design and Planning | Accumulate costs related to design and planning activities for costs of construction. |

| Procurement and Pre-construction | Track costs associated with acquiring materials, equipment, and subcontractor services. |

| Construction Execution | Monitor and control direct and indirect costs incurred during construction. |

| Project Completion | Transfer costs to fixed asset accounts for proper asset recognition. |

Impact of Accurate Billing and Revenue Recognition in Construction Projects

Accurate billing and revenue recognition play a vital role in the financial management of construction projects. In this section, we will explore the significance of accurate billing and revenue recognition and their impact on project profitability and financial reporting.

Understanding Over- and Underbilling in Construction Accounting

Overbilling and underbilling are common challenges in construction accounting that can negatively affect project finances. Overbilling refers to charging more than the actual work completed, while underbilling occurs when the amount billed is less than the work performed.

Overbilling can result in strained client relationships, disputes, or even legal issues. It can also lead to cash flow problems for contractors if clients delay payment due to billing discrepancies. On the other hand, underbilling can impact project cash flow and profitability, as expenses may exceed the revenue generated.

To avoid overbilling and underbilling, construction companies need robust billing processes and systems in place. Accurate estimation of work completed, diligent record-keeping, and regular reconciliations are crucial to ensure billing reflects the actual progress of the project.

Navigating Revenue Recognition Methods: Percentage of Completion

Revenue recognition is the process of recording and reporting revenue in financial statements. In construction accounting, the percentage of completion (POC) method is widely used to recognize revenue throughout the project’s duration.

The POC method recognizes revenue based on the proportion of work completed to the total project scope. It provides a more accurate reflection of project profitability compared to other methods, such as the completed contract method (which recognizes revenue only upon project completion).

Under the POC method, revenue is recognized as work progresses and can be calculated by multiplying the total estimated revenue by the percentage of completion. This approach ensures that revenue is matched with the corresponding expenses and provides a more realistic view of the financial performance of a construction project.

Comparison of Revenue Recognition Methods

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Percentage of Completion | Recognizes revenue based on work completed | Provides timely revenue recognition Matches revenue with related expenses Provides a more accurate view of project profitability | Requires reliable estimates of project completion Requires diligent tracking of project progress |

| Completed Contract | Recognizes revenue only upon project completion | Simple and straightforward method Revenue recognition aligned with project completion | Does not provide real-time revenue recognition Can distort financial statements in long-term projects May delay revenue recognition for extended periods |

Construction Accounting Software Solutions for CIP Tracking