- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

Principled Research. Insightful Analysis. Engaged Experts.

Trending topics, where does kamala harris stand on taxes.

- Trump’s Tax and Tariff Ideas: Details & Analysis

- 2026 Tax Calculator: How the TCJA’s Expiration Will Affect You

Latest Work

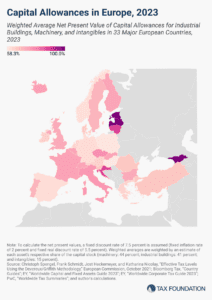

Capital Allowances in Europe, 2024

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

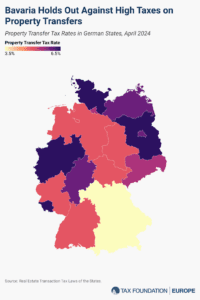

Real Estate Transaction Tax Rates in German States

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

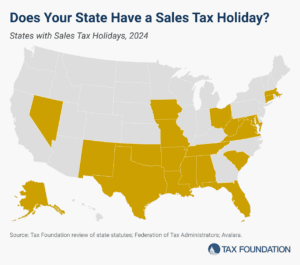

Sales Tax Holidays by State, 2024

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

State Sales Tax Breadth and Reliance, Fiscal Year 2022

An ideal sales tax is imposed on all final consumption, both goods and services, but excludes intermediate transactions to avoid tax pyramiding.

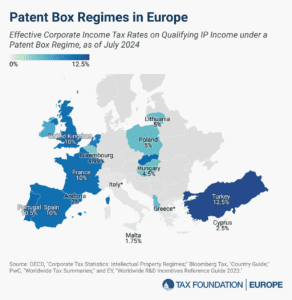

Patent Box Regimes in Europe, 2024

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

Puerto Rican Competitiveness and Pillar Two

Puerto Rico, a US territory with a limited ability to set its own tax policies, will be the first part of the US to be substantially affected by Pillar Two, the global tax agreement that seeks to establish a 15 percent minimum tax rate on corporate income.

State and Local Sales Tax Rates, Midyear 2024

Tax subsidies for r&d expenditures in europe, 2024, the impact of high inflation on tax revenues across europe, sources of personal income, tax year 2021, tariff tracker: tracking the economic impact of the trump-biden tariffs, the high cost of wealth taxes, latest blog posts, exempting social security benefits from income tax is unsound and fiscally irresponsible.

How Are Olympians and Attendees Taxed?

Good policy leads to more tax cuts for west virginia, current challenges in vaping markets, space race and the cost of industrial policy, frustrated with tipping no tax on tips could make it worse.

See All Recent Posts

Popular Data

We are the world’s leading nonpartisan tax policy nonprofit.

The Tax Foundation is the nation’s leading nonpartisan tax policy 501(c)(3) nonprofit. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Our vision is a world where the tax code doesn’t stand in the way of success. Every day, our team of trusted experts strives towards that vision by remaining principled, insightful, and engaged and by advancing the principles of sound tax policy : simplicity, neutrality, transparency, and stability.

Learn More About Tax Foundation

We have the experts you need to understand how tax policy works.

Daniel Bunn

Jared Walczak

William McBride

Garrett Watson

Katherine Loughead

Cecilia Perez Weigel

See All Experts and Request a Speaker

Featured Work

2024 State Business Tax Climate Index

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

International Tax Competitiveness Index 2023

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

2023 European Tax Policy Scorecard

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

Options for Navigating the 2025 Tax Cuts and Jobs Act Expirations

How to rein in the national debt, eight state tax reforms for mobility and modernization, risks to the u.s. tax base from pillar two, details and analysis of a tax reform plan for growth and opportunity, how taxing consumption would improve long-term opportunity and well-being for families and children.

TaxEDU is designed to advance tax policy education, discussion, and understanding in classrooms, living rooms, and government chambers. It combines the best aspects of cutting-edge and traditional education to elevate the debate, enable deeper understanding, and achieve principled policy.

TaxEDU gives teachers the tools to make students better citizens, taxpayers a vocabulary to see through the rhetoric, lawmakers crash courses to write smarter laws, and videos and podcasts for anyone who wants to boost their tax knowledge on the go.

Understand the terms of the debate with our comprehensive glossary, including over 100 tax terms and concepts.

Our animated explainer videos are designed for the classroom, social media, and anyone looking to boost their tax knowledge on the go.

Educational Resources

Our primers, case studies, and lesson plans form a comprehensive crash course ready for the classroom.

The Deduction, a Tax Foundation podcast, is your guide to the complicated world of tax and economics.

Learn about the principles of sound tax policy—simplicity, transparency, neutrality, and stability—which should serve as touchstones for policymakers and taxpayers everywhere.

Legislative Courses

Our Tax Foundation University and State Tax Policy Boot Camp lecture series are designed to educate tomorrow's leaders on the principles of sound tax policy.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS - Taxpayer compliance and burden research

More in our agency.

- IRS organization

- A closer look

- Financial and budget reports

- Products and publications

- Individual tax statistics

- Business tax statistics

- Charitable and exempt organization statistics

- Estate, gift and trust statistics

- IRS Data Book

- IRS operations and budget

- Taxpayer research and IRS data

- About Statistics of Income (SOI)

- Do business with the IRS

- Criminal Investigation

- Whistleblower Office

- Freedom of Information Act

- Privacy policy

- Civil rights

- Vulnerability disclosure policy

This section contains research papers, publications, and other documents dealing with taxpayer compliance and burden research. You can learn about the tax gap, specific compliance analysis issues, and studies of the causes of compliance behavior, and the drivers of tax compliance burden. Below are links to the topics within this section, as well as some examples of what you can find within each topic.

The tax gap is the difference between true tax liability for a given tax year and the amount that is paid on time. It is comprised of the nonfiling gap, the underreporting gap, and the underpayment gap.

This section contains:

- IRS reports and presentations on the size of the tax gap for various tax years

- Related charts and tables

- Reports on reducing the tax gap

Compliance analysis

This section contains a wide variety of papers related to taxpayer compliance, including:

- Overviews of National Research Program (NRP) data

- Analyses of NRP data

- Estimates of noncompliance other than the tax gap

Understanding taxpayer compliance behavior

While the tax gap reflects the extent of taxpayer noncompliance, it is also important to understand why taxpayers are compliant or noncompliant. This section contains papers that seek to provide insights into taxpayer behavior through:

- Econometric analyses

- Lab experiments

- Field or natural experiments

- Other modeling

- Taxpayer burden research

eJournal of Tax Research

The eJournal of Tax Research is a peer reviewed journal published twice a year by the School of Accounting, Auditing and Taxation. It’s ranked A by the Australian Business Deans Council and attracts contributions from researchers and academics who are international leaders in their fields.

With its strong focus on the interdisciplinary nature of taxation, it provides a platform for the taxation research community, practitioners and policy makers to stay abreast of important new research and tax related issues.

We welcome new submissions of unpublished work on a wide range of tax topics.

Read the current issue and access past issues of the eJournal of Tax Research.

Guide to submissions

New submission of original contributions on any topic of tax interest is welcomed, and should be sent through ScholarOne . Submission of a manuscript is taken to imply that it is an unpublished work and has not already been submitted for publication elsewhere.

- Submission of contributions is free of charge and should be sent through ScholarOne .

- Submission of a paper is taken to be an understanding by the author(s) that the paper is original, unpublished and that it has not already been submitted for publication elsewhere. Articles will not normally be published if they are minor variations of existing analyses, or of interest to a very small audience, or if they are purely descriptive.

- All submissions must be typed in English, double spaced with wide margin. Manuscripts should include in the cover page: the title of the paper, name(s) and institutional affiliation(s) of author(s), email address of the corresponding author, an abstract of no more than 100 words, a list of key words of the article and, if appropriate, acknowledgments of no more than 80 words.

- The editors will give preference to succinctly written manuscripts. The abstract, introduction and conclusion should be written for the non-specialist. Lengthy mathematical derivations, if any, should be located in appendices.

- Authors are encouraged to view past issues of the journal for a guide to style before writing and submitting their papers. Manuscripts which require extensive editorial work to comply with the eJournal requirements will be returned to authors for modification.

- Author may use either of the following two citation styles: the Australian Guide to Legal Citation (AGLC 4) or the Harvard style. If the Harvard style is used, all materials cited in the main text should be listed at the end of the manuscript under the title References. All references should be typed double-spaced and appear in alphabetical order of author names. Relevant examples are given below:

Books Sandford, Cedric, Michael Godwin and Peter Hartwick (1989), Administrative and Compliance Costs of Taxation, Fiscal Publications, Bath Sandford, C (ed.) (1995), Taxation Compliance Costs: Measurement and Policy, Fiscal Publications, Bath

Journal articles Carney, T. and G. Ramia (2002), "Mutuality, Mead & McClure: More 'Big M's for the Unemployed?", Australian Journal of Social Issues, 37(3): 277-300. Hite, Peggy and Michael Roberts (1991), "An Experimental Investigation of Taxpayer Judgments on Rate Structure in the Individual Income Tax System", Journal of the American Taxation Association, 13(2): 47-63

Chapter from a book Baxter, J. (1998), "Moving Towards Equality? Questions of Change and Equality in Household Work Patterns" in M. Gatens and A. Mackinon (eds), Gender and Institutions: Welfare, Work and Citizenship, Cambridge University Press, Cambridge, pp. 19-37

Working papers, Conference papers, etc. Beer, G. (1996), "An Examination of the Impact of the Family Tax Initiative", National Centre for Social and Economic Modelling (NATSEM) Policy Paper No. 3, University of Canberra, Canberra. Gerbing, Monica (1988), "An Empirical Study of Taxpayer Perceptions of Fairness", Paper presented at the American Accounting Association Annual Meeting, Orlando, Florida

Government reports, Public addresses, etc. Cass, B. (1986), "Income Support for Families with Children", Social Security Review Issues Paper No. 1, AGPS, Canberra. Howard, J. (2003), Address to the Australian American Association Luncheon, Melbourne, 2 September, available at http://www.pm.gov.au/

- Prior to publication, authors will be asked to sign a document to (i) grant the School of Accounting, Auditing and Taxation the absolute and exclusive worldwide copyright of their papers published in the journal, (ii) warrant that they have the right to assign copyright, (iii) warrant that their papers have not been published anywhere else in the world, (iv) warrant their papers do not infringe the rights of any third party, (v) warrant that their papers do not contain material which is deliberately false, defamatory or unlawful, and (vi) agree to indemnify the School of Accounting, Auditing and Taxation against any losses, damages and costs incurred as a result of any breach by them of any of these obligations or warranties.

- Despite assigning copyright to the School of Accounting, Auditing and Taxation, authors retain the right to re-use their published papers in future collections of their own work without fee. Acknowledgments of prior publications in the eJournal of Tax Research and of the School of Accounting, Auditing and Taxation (as the copyright holder) are the only requirements in such cases.

- The authors may make photocopies of, or distribute through any media, their published papers for their own teaching and research purposes provided that the eJournal of Tax Research and the School of Accounting, Auditing and Taxation are clearly stated on each copy made of the paper.

- The author's consent will be sought before the School of Accounting, Auditing and Taxation grants permission to any third party to use his/her paper in any academic or commercial exploitation. The permission is assumed to be given if the School of Accounting, Auditing and Taxation does not hear from the author within thirty days of writing to his/her last known email address.

- When an article is Crown copyright, the School of Accounting, Auditing and Taxation must be informed as soon as the article is accepted for publication so that the appropriate arrangement can be made with the relevant office.

Editorial board

- Associate Professor Youngdeok Lim, School of Accounting, Auditing and Taxation, UNSW Business School, UNSW Sydney

- Scientia Associate Professor Yan Xu, School of Accounting, Auditing and Taxation, UNSW Business School, UNSW Sydney

For enquiries about the journal and submissions of papers please email the production editor: [email protected].

Editorial guidance is provided by an international panel of eminent tax academics and professionals:

- Professor Robin Boadway, Department of Economics, Queen’s University

- Professor Cynthia Coleman, Faculty of Law, University of Sydney

- Professor Graeme Cooper, Faculty of Law, University of Sydney

- Professor Robert Deutsch, School of Accounting, Auditing and Taxation, UNSW Sydney

- Emeritus Professor Chris Evans, School of Accounting, Auditing and Taxation, UNSW Sydney

- Emeritus Professor Judith Freedman, Faculty of Law, Oxford University

- Professor Malcolm Gammie, Chambers of Lord Grabiner QC, London

- Professor Jennie Granger, School of Accounting, Auditing and Taxation, UNSW Sydney

- Professor John Hasseldine, Paul College of Business and Economics, University of New Hampshire

- Professor Helen Hodgson, Curtin Law School, Curtin University of Technology

- Professor Jeyapalan Kasipillai, School of Business, Monash University Sunway Campus

- Professor Rick Krever, University of Western Australia Law School

- Professor Lisa Marriott, School of Business and Government, Victoria University of Wellington

- Professor Charles McLure Jr., Hoover Institution, Stanford University

- Emeritus Professor Fiona Martin, School of Accounting, Auditing and Taxation, UNSW Sydney

- Professor Dale Pinto, Curtin Business School, Curtin University

- Professor John Prebble, Faculty of Law, Victoria University of Wellington

- Professor Adrian Sawyer, Department of Accounting and Information Systems, University of Canterbury

- Professor Joel Slemrod, University of Michigan Business School

- Professor Natalie Stoianoff, Faculty of Law, University of Technology Sydney

- Professor Jeffrey Waincymer, Faculty of Law, Monash University

- Emeritus Professor Neil Warren, School of Accounting, Auditing and Taxation, UNSW Sydney

- Professor Robin Woellner, UNSW Business School, UNSW Sydney

In this section

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- PRACTICE & PROCEDURES

Practical highlights of recent tax research

- Individual Income Taxation

- Personal Financial Planning

- Tax Planning

- Practice Management & Professional Standards

- Client communications

- IRS Practice & Procedure

- Collections, Liens & Levies

- Employee Benefits

EXECUTIVE | |

Perhaps more than ever, recent years demonstrate the increasing importance of taxation for both businesses and individuals. This article distills research published in tax and accounting journals of interest to tax practitioners. The first study presents evidence on the importance of training for tax professionals in dealing with contentious client interactions. The next three studies provide insights on taxpayer responses to tax incentives and government efforts to increase tax compliance and awareness. A final study examines how companies adjust their tax planning decisions in response to those of their competitors. Collectively, these studies have been published in The Journal of the American Taxation Association , National Tax Journal ,and Journal of Accounting and Economics.

A recent study in The Journal of the American Taxation Association examines the relationship between tax professionals and their clients when a disagreement occurs due to a controversial tax position. 1 In contrast to the frequently researched subject of auditor - client relationships, tax professional - client interactions are seldom examined. Phase one of the two - phase study surveyed public accounting professionals to gather information about the types of contentious client situations that occur, the persuasion tactics used, and the relationship status between tax professional and client after resolution of the issue. Based on information gathered in phase one, the authors created a second survey to analyze details about the nature of contentious interactions, persuasion tactics used, negotiation training received, and recommendations from survey respondents.

Authors Donna Bobek, Derek Dalton, Amy Hageman, and Robin Radtke sent 5,200 emails to a list of South Carolina CPAs for phase one and 4,260 emails from the same list for the follow - up survey. The 140 respondents averaged over 25 years of experience, with the majority serving as partner or equivalent, and were employed by a variety of firm types and sizes.

Survey results show that the most challenging interactions occurred when a client demanded an overly aggressive position to reduce taxes. Professionals with less experience, and concerned about client retention, felt the most pressure. While most respondents indicated the need for training in the areas of negotiation, persuasion, and interpersonal skills, only 10% of professionals in the study had such a program in their firm.

The authors of the research, titled "An Experiential Investigation of Tax Professionals' Contentious Interactions With Clients," conclude with several recommendations. Firms need to develop formal training and mentoring relationships. Professionals should be clear in their communications with clients and should maintain detailed documentation of contentious conversations. The survey revealed that the most effective tactic to persuade a contentious client is to express concerns over penalty exposure. The authors suggest that less - experienced professionals should seek advice from those with more experience. Finally, the study showed the value of remaining objective and composed throughout all client interactions.

Individual retirement accounts (IRAs) play an important role for U.S. retirement savings. One - third of U.S. households (over 40 million) owned at least one IRA in 2018, and the total asset value of these IRAs was approximately $9.5 trillion, or about 33% of total U.S. retirement assets. Traditional IRAs defer taxation on contributions and gains until funds are withdrawn. To prevent taxpayers from living off of other income and never taking taxable withdrawals, the required minimum distribution (RMD) rules force account holders to begin withdrawing a minimum amount each year, beginning the year after which they reach age 72 (age 70½ if born before July 1, 1949). These distributions are taxed as ordinary income.

The RMD amount varies each year and is based on the IRA account balance and the taxpayer's age. The RMD is about 3.9% of the IRA account balance at age 72 and gradually increases to about 8.8% at age 90. Taxpayers must take RMDs from each IRA account owned, as well as from certain other retirement plans (e.g., 401(k) plans). Penalties for not taking RMDs are substantial — a 50% penalty tax on the undistributed required amount, in addition to the regular income tax that is due.

While tax - deferred IRA accounts are an effective tool to incentivize taxpayers to save for retirement, policymakers must weigh this benefit against the cost of forgone government tax revenues — approximately $17.8 billion in fiscal year 2018. The RMD rules are designed, in part, to ensure the government begins collecting its tax revenues sooner rather than later. But do the RMD rules actually cause taxpayers to withdraw more than they otherwise would? It is important for policymakers to understand how the RMD rules affect taxpayers so they can adjust the rules and help incentivize the desired behavior.

Authors Jacob Mortenson, Heidi Schramm, and Andrew Whitten used administrative tax data collected by the IRS, consisting of 1.8 million IRA holders from 2000 to 2013. They found that the RMD rules are strongly binding. 2 For every age group above 70½ years, distributions are concentrated at the RMD amount. This suggests that a significant portion of taxpayers are withdrawing only the amount required to avoid the penalty and would prefer to withdraw less. Overall, the authors estimate that about 50% of individuals would prefer to withdraw less than their RMD and that this percentage increases with age. For example, the authors estimate that between 60% to 70% of the oldest taxpayers (ages 85-100) would prefer to withdraw less. The authors also found that people tend to close their IRA accounts when they turn 70½ and the RMD rules begin, especially when their account balance is small. This suggests that some IRA holders view the hassle of complying with the RMD rules as outweighing any benefits from their IRA's tax deferral.

Last, the authors examined the effects of a 2009 temporary suspension of the RMD rules, passed by Congress in response to the financial crisis and depressed asset values. Interestingly, they found that about 26% of individuals made a withdrawal in 2009 that closely approximated what their RMD would have otherwise been, even though no distribution was required, and only 35% of those who took RMDs in 2008 suspended them for 2009. The authors discuss that this possibly occurred for several reasons. Taxpayers could have been inattentive to the temporary suspension, thought it was too much trouble to change the RMD for one year, or may have believed the RMD amounts provided reasonable guidance on withdrawals. The study's results on the 2009 temporary suspension are especially informative and timely given that the Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L. 116 - 136 , waived taxpayer RMDs for 2020 in response to the coronavirus pandemic.

A field experiment conducted with the Colorado Department of Revenue (DOR) investigated the wording on delinquent income tax notices to see if specific variations could affect tax collections. The over - 90 ,000 households analyzed in the study owed more than $85 million in state income tax. Typically, only 34% of taxpayers receiving delinquency notices made full payment by the deadline. Researchers Taylor Cranor, Jacob Goldin, Tatiana Homonoff, and Lindsay Moore conducted the study to examine the change in compliance based on modifications to one sentence in the standard tax delinquency notice. 3

Four tax notice versions were sent randomly to delinquent taxpayers. One version provided greater details about late - payment penalties, stating the specific interest rate and highlighting that the penalty would increase for each month not paid until the "statutory maximum is reached." A second letter discussed penalties, including an incentive to make payment to avoid the interest rate doubling after 30 days. The third delinquency notice stated the interest rate effective for 30 days and included an appeal to social norms, stating that 90% of Colorado taxpayers pay their taxes on time. Finally, the control version, sent by the DOR in prior years, stated that the delinquent taxes included interest and penalties according to state law but indicated nothing specific about further penalties.

Results showed that the notice containing detailed wording about increasing penalties improved compliance by 4.1% compared with the control notice, as measured by the fraction of taxpayers creating a payment plan or making a full payment before the statutory deadline. The notice reminding taxpayers of increasing penalties that omitted specific details other than the avoidance of future interest increases improved compliance by approximately 2%. Finally, the notice appealing to social norms resulted in the same compliance rate as the control/standard notification. The compliance rates across notices were similar at low (under $95), medium ($95 to $433), or high (over $433) balances of tax due. The authors suggest that emphasizing delinquency penalties through relatively minor wording changes could result in increased collection and a reduced need for more extensive tax collection actions.

Numerous tax policies are put in place to help low - income households; however, these policies are only effective in achieving their goals if they are used as intended to benefit qualifying taxpayers. The earned income tax credit (EITC), established in 1975, is a refundable tax credit meant to subsidize low - income working families. The credit amount depends on a household's income, filing status, and number of qualifying children. The credit rises with earned income until it reaches a maximum level and then begins to phase out at higher income levels. For 2019, the maximum credit ranged from $529 for a single taxpayer with no qualifying children, to $6,557 for a married couple with three or more children. The maximum income at which married taxpayers with three or more children could claim an EITC was $55,950, although the credit is quite small ($6) at this income level. In 2016, over 27 million households claimed the EITC; about 20% of all U.S. taxpayers. However, data shows that 20% of eligible households (about 5 million) do not take advantage of the credit.

In an effort to increase taxpayer EITC claims, seven states and one city implemented a variety of laws requiring employers to inform their employees about the EITC, either through mailings, annual notifications, or posted notices in the workplace. Using IRS data from 2000-2014, authors Taylor Cranor, Jacob Goldin, and Sara Kotb examined the effectiveness of the government - mandated taxpayer notifications. 4

Results reveal that while approximately 5 million qualifying U.S. households do not take the credit, a minimal increase (0.3%) occurred in states or jurisdictions that provided notification compared with states that did not notify employees. The study suggests several reasons for the ineffectiveness, including taxpayers who do not use tax software for filing, taxpayers who do not file a return and thus are unaware of the refundable nature of the credit, a failure to read or understand the notifications, and noncompliance by employers. The authors recommend that notifications should focus on the EITC's benefits rather than laws, encourage taxpayers to use tax preparation software, and educate taxpayers about the EITC for childless taxpayers.

Evidence shows that corporate decisions on research and development (R&D), advertising, and capital expenditures are influenced by management's expectations of how their peers will behave. For example, if a firm's competitors are investing in R&D, then firm management may choose to increase or decrease R&D to a comparable level. In this instance, the firm is strategically reacting to its competitors' behavior. Authors Christopher Armstrong, Stephen Glaeser, and John Kepler examined whether strategic behavior also occurs when firms make tax planning decisions. 5 Specifically, does a firm's management adjust its own tax planning decisions in response to their competitors' tax planning decisions?

To examine whether firms exhibit strategic behavior in tax planning decisions, the authors examined two different tax settings and attempted to isolate corporations' strategic reactions to the tax planning choices of their competitors. The first setting is the reduction in corporate tax rates in Ireland, where tax rates decreased from 32% to 12.5% between 1998-2003. The second setting is the staggered adoption by different states of tax policies designed to limit interstate income shifting to Delaware, a state that does not tax income earned from intangible assets.

In both the Irish and Delaware settings, the authors found that a firm's tax planning decisions appear to be influenced by the choices of their competitors. In the Irish setting, firms not directly benefiting from the tax rate decreases made other tax planning choices that lowered their tax liabilities. This suggests that these firms strategically responded to their competitors by changing their own tax planning decisions. Conversely, firms not negatively impacted by the limits on shifting income to Delaware responded by making choices that increased their state taxes. The authors attribute these reactions to firms not wanting to appear more aggressive than their competitors, since this could bring unwanted attention from tax agencies and other stakeholders. The study also found that firms adjust their own tax planning as they learn from the tax planning decisions of their industry competitors.

Overall, the research suggests that policymakers should consider both direct and indirect effects of policy choices on firms' tax planning behavior to avoid underestimating the potential effect on a government's tax revenues.

1 Bobek, Dalton, Hageman, and Radtke, "An Experiential Investigation of Tax Professionals' Contentious Interactions With Clients," 41 - 2 The Journal of the American Taxation Association 1 (Fall 2019).

2 Mortenson, Schramm, and Whitten, "The Effects of Required Minimum Distribution Rules on Withdrawals From Traditional IRAs," 72 - 3 National Tax Journal 507 (September 2019).

3 Cranor, Goldin, Homonoff, and Moore, "Communicating Tax Penalties to Delinquent Taxpayers: Evidence From a Field Experiment," 73 - 2 National Tax Journal 331 (June 2020).

4 Cranor, Goldin, and Kotb, "Does Informing Employees About Tax Benefits Increase Take - Up ? Evidence From EITC Notification Laws," 72 - 2 National Tax Journal 397 (June 2019).

5 Armstrong, Glaeser, and Kepler, "Strategic Reactions in Corporate Tax Planning," 68 - 1 Journal of Accounting and Economics (August 2019).

| |

| , CPA, M.Tax, is a professor of accounting in the Baker School of Business at The Citadel in Charleston, S.C. , CPA, Ph.D., is a professor of accounting in the Neeley School of Business at Texas Christian University in Fort Worth, Texas. For more information about this article, contact .

|

Recapture considerations for Inflation Reduction Act credits

Electing the unicap historic absorption ratio under the modified simplified production method, revisiting firpta and return-of-capital distributions, partners’ basis on the liquidation of an insolvent partnership, the bba’s ‘ceases-to-exist’ rule in partnership termination transactions.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

EMPLOYEE BENEFITS & PENSIONS

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On May 2, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Whether you are a die-hard fan or part of a sports brand, you will need sports marketing at some point. The most challenging aspect of sports marketing is securing and activating sponsorships, building relationships with customers, and getting brand approvals.

Human civilization cannot continue to develop without environmental sustainability. A legal provision that protects the environment is called an “environmental law.” An academic study of environmental law provides a better understanding.

Nurses provide daily clinical care based on evidence-based practice. They improve patient health outcomes by using evidence-based practice nursing. Take a look at why you should consider a career as an EBP nurse to contribute to the healthcare industry.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

A Systems View Across Time and Space

- Open access

- Published: 16 February 2021

Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers

- Erstu Tarko Kassa ORCID: orcid.org/0000-0002-8199-4910 1

Journal of Innovation and Entrepreneurship volume 10 , Article number: 8 ( 2021 ) Cite this article

73k Accesses

20 Citations

6 Altmetric

Metrics details

The main purpose of this paper is to investigate factors that influence taxpayers to engage in tax evasion. The researcher used descriptive and explanatory research design and followed a quantitative research approach. To undertake this study, primary and secondary data has been utilized. From the target population of 4979, by using a stratified and simple random sampling technique, 370 respondents were selected. To verify the data quality, the exploratory factor analysis (EFA) was conducted for each variable measurements. After factor analysis has been done, the data were analyzed by using Pearson correlation and multiple regression analysis. The finding of the study revealed that the relationship between the study independent variables with the dependent variable was positive and statistically significant. The regression analysis also indicates that tax fairness, tax knowledge, and moral obligation significantly influence taxpayers to engage in tax evasion, and the remaining moral obligation and subjective norms were not statistically significant to influence taxpayers to engage in tax evasion.

Introduction

In developed and developing countries, business owners, government workers, service providers, and other organizations are forced by the government to pay a tax for a long period in human being history, and no one can escape from the tax of the country. To support this, there is an interesting statement mentioned by Benjamin Franklin “nothing is certain except death and taxes”. This statement confirmed that every citizen should be subjected to the law of tax, and they are obliged to pay the tax from their income. To build large dams, to construct transportation infrastructures, and to provide quality social services for the community, collecting a tax from citizens plays a significant role for the governments (Saxunova and Szarkova, 2018 ).

Tax is the benchmark and turning point of the country’s overall development and changing the livelihoods and enhancing per capital income of the individuals. The gross domestic product of the developed countries and average revenue ratio were 35% in the year 2005, whereas in developing countries the share was 15% and in third world countries also not more than 12% (Mughal, 2012 ).

In the developing world, countries have no system to collect a sufficient amount of tax from their taxpayers. The expected amount of revenue cannot be enhanced due to different reasons. Among the reasons tax operation of the system may not be smooth, tax evasion and lack of awareness creation for the taxpayers are common in the developing world, and citizens are not committed to paying the expected amount of tax for their countries (Fagbemi et al., 2010 ). In today’s world, this remains very much the same as persons now pay taxes to their governments. As the world has evolved, tax compliance has taken a back seat with tax avoidance and tax evasion being at the forefront of the taxpayer’s main objective. Tax avoidance is the use of legal means to reduce one’s tax liability while tax evasion is the use of illegal means to reduce that tax liability (Alleyne & Harris, 2017 ). Tax evasion is a danger to the community; the countries and international organizations have been making an effort to fight undesirable phenomena related to taxation, the tax evasion, or tax fraud (Saxunova and Szarkova, 2018 ).

Tax evasion may brings a devastating loss for the country's GDP at the micro level, and it became a debatable and a special concern for tax collector authorities (Aumeerun et al., 2016 ). The participants in tax evasion activity critized by different individuals and groups by considering the loss that brings to the country economy (Alleyne & Harris, 2017 ).

According to Dalu et al., ( 2012 ) state that in the Zimbabwe tax system there are identical devils tax evasion and tax avoidance that create a problem for the government to collect a tax from taxpayers. Like Zimbabwe, many nations have faced challenges to cover the annual budget and to construct different infrastructures due to the budget deficit created by tax evasion (Alleyne & Harris, 2017 ; Turner, 2010 ).

Scholars especially economists agreed that tax evasion may be considered a technical problem that exists in the tax collection system, whereas psychologists believed that tax evasion is a social problem for the countries (Terzić, 2017 ).

Tax evasion practices are more worsen in developing countries than when we compare against the developed countries. Tax evasion is like a pandemic for the countries because they are unable to control it. Therefore, governments were negatively affected by tax evasion to improve the life standard of its citizens and to allocate a budget for public expenditure, and it became a disease for the country’s economy and estimated to cost 20% of income tax revenue (Ameyaw et al., 2015 ; degl’Innocenti & Rablen, 2019 ; Palil et al., 2016 ).

Several factors may lead taxpayers to engage in tax evasion. Among the factors, tax knowledge, tax morale, tax system, tax fairness, compliance cost, attitudes toward the behavior, subjective norms, perceived behavioral control, and moral obligation are major factors (Alleyne & Harris, 2017 ; Rantelangi & Majid, 2018 ). Other factors have also a significant effect on taxpayers to engage in tax evasion practice such as capital intensity, leverage, fiscal loss, compensation, profitability, contextual tax awareness, interest rate, inflation, average tax rate, gender, and ethical tax awareness on tax evasion (Annan et al., 2014 ; AlAdham et al., 2016 ; Putra et al., 2018 ).

According to Woldia City Administration Revenue Office annual report ( 2019/2020 ) from July 1, 2019, to June 30, 2020, 232,757,512 birr was planned to be collected from taxpayers; however, the office was able to collect only 198,537,785.25 birr; however, the remaining 34,219,726.75 birr have not been collected by the office from the taxpayers. The reason behind this was there might be some factors that lead to taxpayers not to pay the annual tax from their annual income. Based on the review of the previous studies and by diagnosing the tax collection system in the city administration, the researcher identified the gaps. The first gap that motivated the researcher to undertake this study is that the prior studies did not address the factors that influence the tax collection system of Ethiopia, specifically, there is no research result that was able to show which factors influence taxpayers to engage in tax evasion in the Woldia city administration. The other gap is the previous study focused on the demographic, economic, social, and other factors. However, this study mainly focused on the behavioral and other factors that lead taxpayers to engage in tax evasion.

To indicate the benefit of this study, the study specifies on which critical factors the authority will focus on to enhance annual revenue and to aware tax payers of the devastating impact of tax evasion. Moreover, the paper may bring new insights on tax evasion influential non-economic factors that the researchers may give more emphasis on the upcoming researches. This paper will also contribute innovative ways to know the reasons why tax payers engage in tax evasion and inform the authority at which factors they will struggle to reduce their influence and to enhance revenue. The study can be an evidence that the tax authority should launch innovative techniques to control tax evasion practices. Moreover, applying fair tax system in the collectors’ side, the enterprises become innovative and will expand their business.

To sum up, in this study, the researcher examined which factor (tax knowledge, tax fairness, subjective norms, moral obligation, and attitude towards the behavior) influences taxpayers to engage in tax evasion activities. Based on the above discussion, the objective of the study is to examine factors that influence taxpayers to engage in tax evasion in Woldia city administration.

Literature review

Tax and tax evasion.

Tax is charged by the government to the business, governmental organization, and individual without any return forwarded from the authority. Tax can be categorized as direct tax which is collected from the profit of the companies and the incomes of individuals, and the other category of tax is an indirect tax collected from consumers’ payment (James and Nobes, 1999 ).

Tax evasion is a word explaining individuals, groups, and companies rejecting the expected amount of payment for the authority. It is a criminal offense on the view of law (Nangih & Dick, 2018 ). The overall procedure of tax collection faced different challenges especially tax evasion the most important one. Tax evasion is done intentionally by taxpayers by avoiding and hiding different documents that become evidence for the tax collection authorities. It is simply an illegal act to pay the true amount of the tax (Aumeerun et al., 2016 ; Storm, 2013 ). Tax evasion is a crime that is able to distort the overall economic, political, and social system of the country. The economic aspect of tax evasion affects fair distribution of wealth for the citizens. The social aspect also creates different social groups motivated by tax evasion discouraged by these individuals due to unfair competition (AlAdham et al., 2016 ). Tax evasion is a mal-activity that reduces the amount of tax paid by the payers. Perhaps the taxpayers who engaged in evasion activity may be supported by the legislative of the country (Kim, 2008 ; Putra et al., 2018 ; Allingham & Sandmo, 1972 ). According to Al Baaj et al. ( 2018 ) argument, there are two types of tax evasions. The first one is the legal evasion or tax avoidance which is supported by the legislation of the countries and the right is given for the taxpayer, but it is not constitutional (Gallemore & Labro, 2015 ; Zucman, 2014 ).

Theoretical reviews on factors affecting tax evasion

The illegal activity done by taxpayers has many determinants that lead them to engage in tax evasion. Among the factors that trigger taxpayers who participate in this activity are the economic factors. Under the economic factors, business sanctions, business stagnation, and the amount of tax burden are considered as influential factors. On the other hand, legal factors, social factors, demographic factors, mental factors, and moral factors are the most important factors (Saxunova and Szarkova, 2018 ). Many factors determine the taxpayers’ interest to engage in tax evasion. Among the factors, the following are considered under this review.

The factors that able to influence taxpayers to engage in tax evasion are moral obligation . It is a principle and a duty of taxpayers by paying a reasonable amount of tax for the tax authorities without the enforcement of others. It is an intrinsic motivation of payers paying the tax (Sadjiarto et al., 2020 ). When taxpayers have low tax morals, they will become negligent to pay their allotted tax, and they will engage in tax evasion (Alm & Torgler, 2006 ; Frey & Oberholzer-Gee, 1997 ; Torgler et al., 2008 ). According to Feld and Frey ( 2007 ), when tax officials are responsible and provide respect in their duties toward taxpayers, tax morale or the honesty of taxpayers will increase. Tax morals may be affected by a demographic and another factor like income level, marital status, and religion (Rantelangi & Majid, 2018 ). It is the determinant behavior of tax payers whether they participate or not. Tax morals can affect positively taxpayers to engage in tax evasion (Nangih & Dick, 2018 ; Terzić, 2017 ). It is known that taxes levied by the concerned authority are ethical. As cited by Ozili ( 2020 ), McGee ( 2006 ) argues that there are three basic views on the ethics and moral of tax evasion. The first view is tax evasion is unethical and should not be practice by any payer, the second argument deals that the state is illegal and has no moral authority to take anything from anyone, and the last argument is tax evasion can be ethical under some conditions and unethical under other situations; therefore, the decision to evade tax is an ethical dilemma which considers several factors (Robert, 2012 ). Therefore, the discussion leads to the following hypothesis:

H 1 . Moral obligation has a negative influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is tax fairness . Tax fairness is a non-economic factor that determines the tax collection of the country (Alkhatib et al., 2019 ). It is known that the tax collection procedures, principles, and implementation must be fair. Unethical behavior may happen due to the unfairness of the tax collection process. The fairness of tax may influence payers positively to pay the tax. When the tax rate is not reasonable and fair, the payers will regret to engage in the tax evasion practices and they will inform authorities their annual income without denying the exact amount. Considering the ability of paying or acceptable tax rates helps to maintain the fairness of the taxation system (Rantelangi & Majid, 2018 ). The governments choose to levy in what amounts and on whom will pay a high tax rate (Thu, 2017 ). The tax rate is a factor that induces taxpayers to pay less amount from their income. The rate of tax should be fair and reasonable for the payers (Ozili, 2020 ). As cited by Gandhi et al. ( 1995 ) the Allingham and Sandmo’s model, Allingham and Sandmo ( 1972 ) shows that the tax rate on payment can be positive, zero, or negative, which implies that an increase in the tax rate may cause the tax payment to increase, remain the same, or decrease. The theoretical literature could not evidence the claim that an increase in the tax rate will lead to an increase in tax evasion (Gandhi et al., 1995 ). The fairness of tax is controversial and argumentative because there may not happen a similar amount of tax for all payers (Abera, 2019 ). Thus, based on this ground the study hypothesis would be:

H 2 . Tax fairness has a positive influence on taxpayers to engage in tax evasion.

Tax knowledge is vital for taxpayers to know the cause and effect brought to them to engage in tax evasion. If tax payers are well informed about tax evasion, their participation in tax evasion would be infrequent; the reverse is true for a taxpayer who is not well informed. Tax-related information should give more emphasis to enhance the knowledge of taxpayers and experts of the authority (Poudel, 2017 ). Tax knowledge is a means to enhance the revenue of the country from the side of tax payers (Sadjiarto et al., 2020 ). If the authorities cascade different training for taxpayers about tax evasion and other tax-related issues, taxpayers become reluctant to engage in tax evasion (Rantelangi & Majid, 2018 ). Tax knowledge is a determinant factor for the taxpayer to engage and retain from the tax evasion activities (Abera, 2019 ). When taxpayers are undertaking their routine tasks without tax knowledge, they may involve in certain risks that expose them to engage in tax evasion (Thu, 2017 ). Thus, the discussion leads to the following hypothesis:

H 3 . Tax knowledge has a negative influence on taxpayers engaged in tax evasion.

The stakeholders, government experts, families, individuals, groups, and peers influence taxpayers whether they engaged in tax evasion or not (Alleyne & Harris, 2017 ). As cited by Alkhatib et al. ( 2019 ), the influence of peer groups on tax taxpayers is high, thus affecting the taxpayers’ preferences, personal values, and behaviors to engage in tax evasion (Puspitasari & Meiranto, 2014 ). The stakeholders around the taxpayers might be motivators to push taxpayers in the criminal act of tax evasion. This act called subjective norms meant that the payers are influenced by peers and other stakeholders. When the tax payer is reluctant to pay a tax for the authority, his/her friends are more likely to hide tax. As cited by Abera ( 2019 ), there is a strong relationship between social norms and subjective norms with tax evasion and affects the small business taxpayers (Nabaweesi, 2009 ). The above discussion can support the following hypothesis of the study:

H 4 . Subjective norms have a positive influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is an attitude towards the behavior of taxpayers. Attitude is a means of evaluating the activities whether they are positive or negative of any object. Many studies have been done by different scholars by defining and identifying the relationship between the attitudes of taxpayers with tax evasion (Alleyne & Harris, 2017 ). If the attitude of taxpayers towards taxation is negative, they will be reluctant to pay their obligation to the authority; the reverse is true when taxpayers have positive attitudes towards taxation (Abera, 2019 ). Based on the above discussion, the hypothesis of the study would be as follows:

H 5 . Tax payers’ attitude towards the behavior has a positive influence on taxpayers to engage in tax evasion.

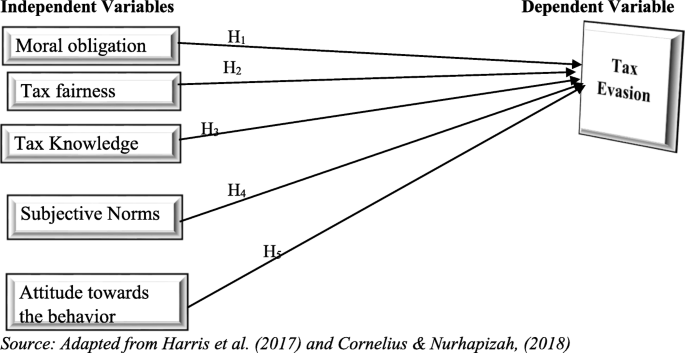

Conceptual framework of the study

The researcher identified the variables and presented the relationship between independent and dependent variables as follows (Fig. 1 ):

Conceptual framework of the study. Adapted from Alleyne and Harris ( 2017 ) and Rantelangi and Majid ( 2018 )

Materials and methods

The researcher applied descriptive and explanatory research design to carry out this study. The explanatory research design enables the researcher to show the cause and effect relationship between independent and dependent variables, and the descriptive research also helps to describe the event as it is. The quantitative approach has been followed by the researcher to analyze and interpret the numerical data collected from the respondents. The researcher used primary and secondary data. The primary data was collected from the respondents by using questionnaires, and the secondary data was also collected from the reports, websites, and other sources.

The target population of the study was 4979 taxpayers (micro, small, and large enterprises). From the total taxpayers, 377 are categorized under level “A,” 207 are under level “B,” and the remaining 4395 taxpayers are categorized under level “C”. From the target population by using a stratified sampling technique, the respondents have been selected. The target population has been divided by the level of taxpayers; after dividing the population by level, the researcher applied a simple random sampling technique to select respondents. To identify the target participants or sample size in this study, the researcher used Yamane’s ( 1967 ) formula. Hence, the formula is described as follows:

where N = target population, n = sample size, e = error term

Based on the sample size, the respondents have participated proportionally as follows from each level. The total population was divided by strata based on the level categorized by the authorities. By using a simple random sampling technique, 28 respondents were from level “A,” 15 respondents from level “B,” and 327 respondents from level “C” have participated.

Regarding data collection instruments , the data was collected by self-administered standardized questionnaires. The variable of the study a moral obligation was measured by 4 items; after conducting factor analysis, the fourth variable or questionnaire has been removed and after that correlation and regression analysis has been done for 3 items; the value of Cronbach’s alpha was .711; the other factor attitude towards the behavior was measured by 4 items with a value of .804 Cronbach’s alpha; the third variable subjective norms was also measured by 4 items; the value of Cronbach’s Alpha was .887, and tax evasion was measured by 5 items; the Cronbach’s alpha value was .868. For the above-listed variables, the questionnaires were adapted from Alleyne and Harris ( 2017 ), and the remaining variable tax fairness was measured by 7 items, the Cronbach’s alpha value was .905, the items were adapted from Benk et al. ( 2012 ), and the last variable tax knowledge was measured by 5 items. However, after conducting factor analysis, the fifth item has been removed due to low value of the variable. After the removal of the fifth item, the Cronbach’s alpha value for the remaining items was .800, the items were adapted from Poudel ( 2017 ). For all variables, the researcher has used a five-point Likert scale from strongly agree to strongly disagree.

To analyze the collected data, the researcher used descriptive statistics analysis, factor analysis, correlation analysis, and multiple regression analysis to know the result of variables by using SPSS Version 22. Moreover, the model of the study is described as follows:

where Y = tax evasion, X 1 = moral obligation, X 2 = tax fairness, X 3 = tax knowledge, X 4 = subjective norms, and X 5 = attitude towards the behavior, β = beta coefficient, B 0 = constant, e = other factors not included in the study (0.05 random error).

Results and discussion

Level of respondents.

As indicated in Table 1 from the total respondents, 88.4% are categorized under level “C,” 4.1% are leveled under “B,” and the remaining 7.6% of respondents have been categorized under level “A”.

Factor analysis of the study variables

To undertake exploratory factor analysis, the data should fulfill the following assumptions. The first assumption is the variables should be ratio, interval, and ordinal; the second one is within the variables there should be linear associations; the third assumption is a simple size should range from 100 to 500; and the last assumption is the data without outliers. Thus, this study data have been checked by the researcher whether the data meets the assumption or not. After checking the assumptions, factor analysis was conducted as follows.

KMO and Bartlett’s test

Conducting KMO and Bartlett’s test is a precondition to conduct the factor analysis of the study measuring variables. KMO measures the adequacy of the sample of the study. In the result reported in Table 2 , the value was 0.883 and enough for the factor analysis. Related with Bartlett test as shown in Table 2 , the value is 5727.623 ( p < 0.001), which reveals the adequacy of data using factor analysis.

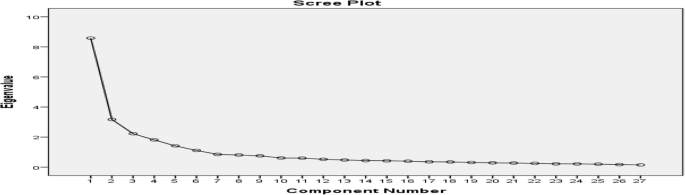

As shown in Table 3 , factors were extracted from study data; there was a linear relationship between variables. From the table, we can understand that 6 variables have more than one eigenvalue. The first factor scored the value 31.782 of the variance, the second value is 11.739 of the variance, the third factor scored 8.246 of the variance, the fourth factor accounts for 6.725 of the variance, the fifth factor also accounts for 5.233, and the last factor scored 4.123 of the variance. All six factors were explained cumulatively by 67.85% of the variance.

As shown in the Fig. 2 , the scree plot starts to turn down slowly at the low eigenvalue which is less than 1. The six factors eigenvalue is greater than one.

Scree plot. Source: own survey (2020)

The pattern matrix is shown in Table 4 which is able to show the loading of each variable and the relationship of variables in the study. The highest value among the factors measured the variable considerably. The cutoff point of loading was set at .35 and above. Based on the loading cutoff point except two factors, all are significant and analyzed under this study. From the six variables (five independent and one dependent) incorporated under this study, the identified factors show that how significantly enough to measure the situation. These factors have scored greater than 1 eigenvalue and able to explain 67.85% of the variance. In general, the detail variables and their factor are described as follows:

The first component tax fairness has 7 factors; the eigenvalue is 8.58 and able to explain 31.78 of the total variance. In this component, the highest contributed factor was item TF3 (weight = .925), TF5 (weight = .865), TF1 (weight = .859), TF2 (weight = .778), TF4 (.668), TF6 (weight = .614), and TF7 (weight = .568). The second component was tax evasion and has 5 items; the eigenvalue is 3.17 and explaining 11.73 of the variance. The factor weight of the items, TE4 (factor weight = .860), TE5 (factor weight = .810), TE3 (factor weight = .730), TE2 (factor weight = .650), and the last one is TE1 (factor weight = .606). The third component was subjective norms; it has 4 factors the weight of each factor described as follows. The first item SNS1 weight = .898, SNS2 factor weight = .887, SNS4 factor weight = .846, and SNS3 factor weight = .820. Moreover, the eigenvalue of this component is 2.226 and explained 8.246 of the variance of the study. The fourth component is an attitude towards the behavior. This variable has four factors that have 1.816 eigenvalue and explained 6.725 of the total variance. Among the items, ATB2 factor weight = .863, ATB1 factor weight = .792, ATB3 factor weight = .791 and the last factor is ATB4 factor weight = .500. The fifth component of the study is tax knowledge; at the very beginning of this variable, the researcher adapted five items. However, one item (TK5) was not significant and removed from this analysis. In this component, the highest value was scored by TK3 (factor weight = .866), the second highest TK2 (factor weight = .801), the third highest factor weight (weight = .700), and the last factor is TK4 (weight = .690). The eigenvalue of this component was 1.413 and explained 5.233% of the variance. The last component is a moral obligation; like tax knowledge, the researcher adapted for this variable 4 items, though, one item (MO4) was not significant and removed from the items list. The eigenvalue of this component was 1.113 and explained 4.123 of the variance. From the items, MO1 scored the highest factor weight of .891, the second highest weight in this component was MO3 with a factor weight of .854, and the third highest factor weight was scored by MO3 with a value of .508.

Association analysis of the study variables