Home Blog Business How to Create an Appealing Report Presentation (Guide + Templates)

How to Create an Appealing Report Presentation (Guide + Templates)

Sharing data, insights, and recommendations extracted from detailed analysis is a practice that consultants and heads of departments view as part of their everyday workload. Yet, effective communication techniques make a difference in whether the information disclosed is actionable, makes a lasting impact, or becomes critical for a decision’s outcome.

In this article, we will guide you through the process of creating a good report presentation, from general aspects to specifics by niche, recommended PowerPoint templates to use, and which aspects you should avoid in the presentation design process.

What is a Report?

What is a report presentation, business report presentations, academic report presentations, technical report presentations, sales report presentations, marketing report presentations, project report presentations, non-profit and ngo report presentations, healthcare report presentations, environmental report presentations, do’s and don’ts on a report presentation, recommended report powerpoint templates.

A report is a formal, high-level document that compiles data, research findings, and recommendations tailored to a specific topic. Its core purpose is to grant stakeholders a detailed understanding of a situation and provide background for decision-making processes.

We can define a report presentation as the visual and verbal method of communicating the key elements of a written report. Typically, report presentations happen in meeting or conference settings, where the scale of the report presentation depends on any of these three factors:

- Topic of the report presentation

- People or teams involved in the outcome of the report

- People or teams that must be aware of the information retrieved from the report

Depending on its topic, the amount of slides or specific slide design to include, which we shall mention in the upcoming section.

Types of Report Presentations

Business report presentations focus on a business’s performance, strategy, and operations, conveying important information to stakeholders for decision-making purposes. These presentation slides are used during board meetings, business plan presentations , quarterly reviews, strategic planning sessions, and investor meetings.

A typical business report presentation should contain the following slides on its slide deck:

- Title Slide : Title, presenter’s name, date, and company logo.

- Agenda Slide : Outline of main sections.

- Executive Summary Slide : Key takeaways and highlights.

- Financial Overview Slide : Revenue, expenses, profit, and loss.

- Performance Metrics Slide : Key performance indicators (KPIs).

- Strategic Initiatives Slide: Current and future projects.

- Market Analysis Slide : Market trends and competitive analysis.

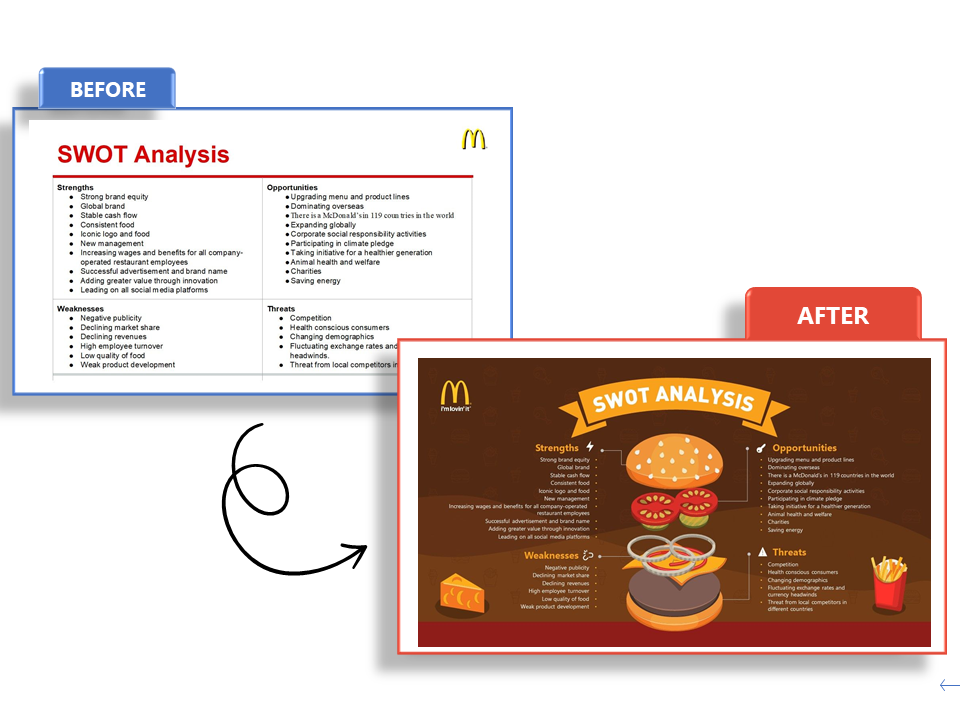

- SWOT Analysis Slide: Strengths, weaknesses, opportunities, and threats.

- Recommendations Slide : Suggested actions and next steps.

- Q&A Slide : Invite questions from the audience.

- Conclusion Slide : Summary of key points.

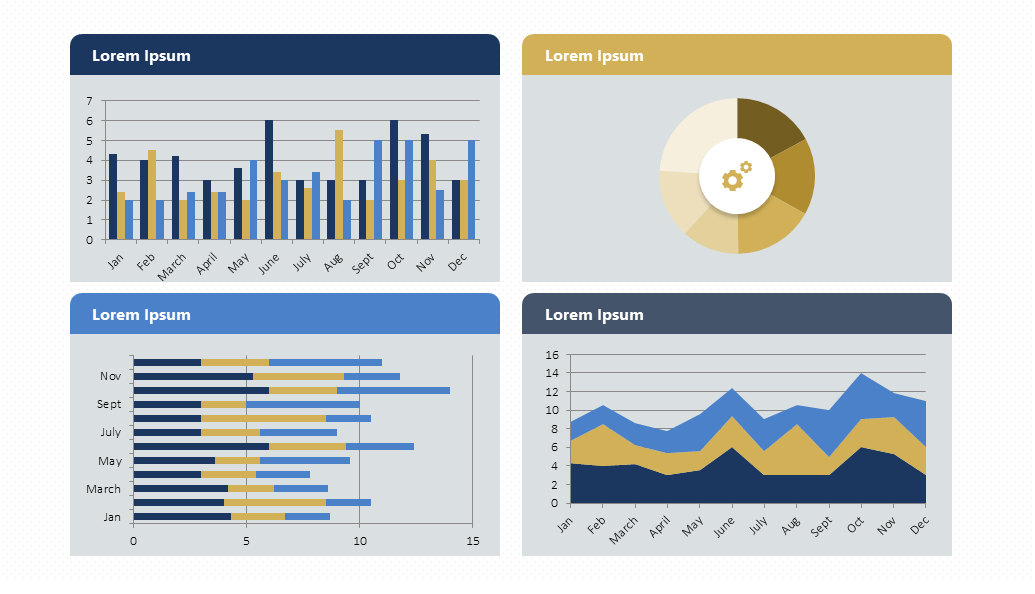

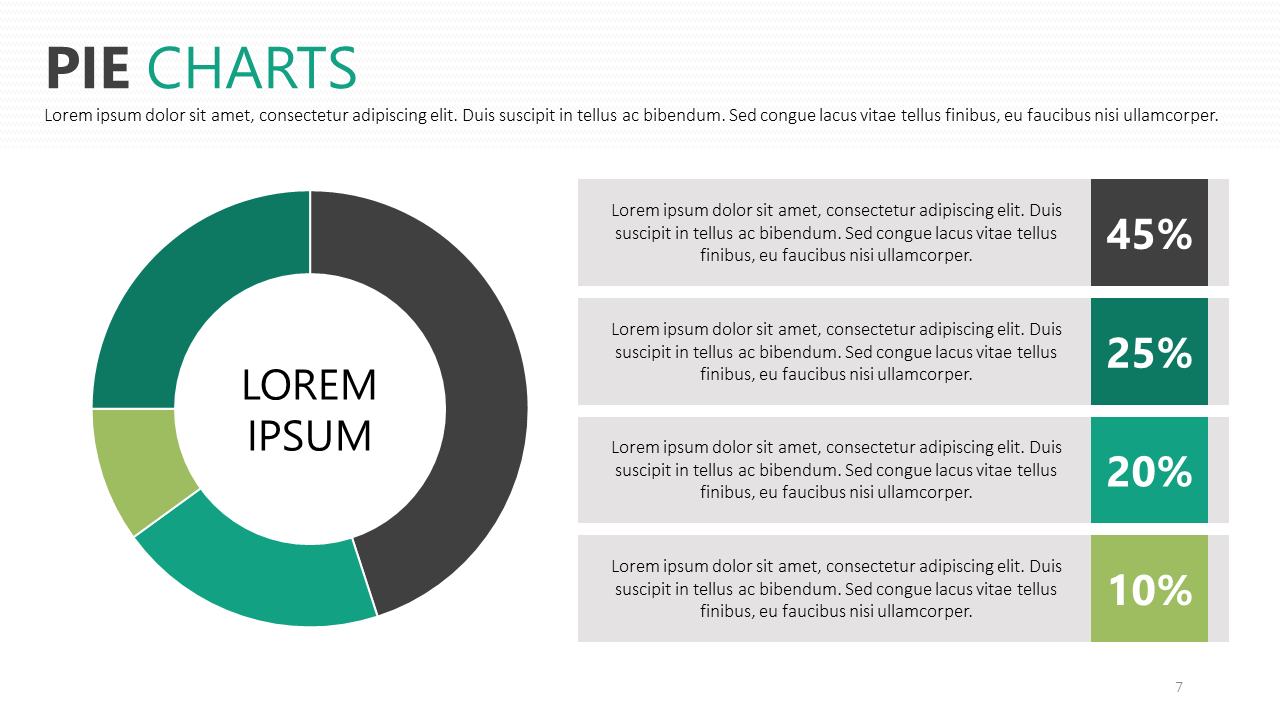

Presenters must generally focus on clearly expressing the key points and insights, using charts and graphs to illustrate their findings easily. Opt for a SWOT analysis PowerPoint template to simply the SWOT representation process.

Academic report presentations communicate research findings, project outcomes, and scholarly work to academic peers and professionals. They are common at academic conferences, seminars, workshops, and in classrooms (post-graduate settings).

To build a high-quality academic report presentation, consider the following slides:

- Title Slide: Title, author’s name, institution, and date.

- Introduction Slide: Background and research question.

- Literature Review Slide: Summary of relevant research.

- Methodology Slide : Research methods and design.

- Data Slide: Key data and statistics.

- Analysis Slide: Interpretation of data.

- Results Slide: Main findings.

- Discussion Slide : Implications and significance.

- Conclusion Slide: Summary of findings and future research directions.

- References Slide: List of sources and citations.

- Q&A Slide

Avoid jargon at all costs unless specifically required by your tutor. Aiming to create an interactive presentation out of it can be a plus.

Technical report presentations detail technical data, research findings, and project updates (i.e., project status report templates ) to a specialized audience, often in fields like engineering, IT, and science. They are used in technical meetings, conferences, project updates, and during product development cycles.

The slides a technical report presentation should include are:

- Title Slide

- Problem Statement Slide: Definition and scope of the problem.

- Objectives Slide: Goals of the technical work.

- Methodology Slide: Technical approach and procedures.

- Data Slide: Key data points and measurements.

- Analysis Slide: Interpretation of technical data.

- Results Slide: Main findings and outcomes.

- Technical Challenges Slide: Issues encountered and solutions.

- Recommendations Slide: Suggested actions based on findings.

- Future Work Slide: Next steps or future research.

- Conclusion Slide

Diagrams, infographics, and graphs are handy for explaining complex data. Presenters should encourage the audience to ask questions about the topic and break down the complex elements into easy-to-understand chunks of information.

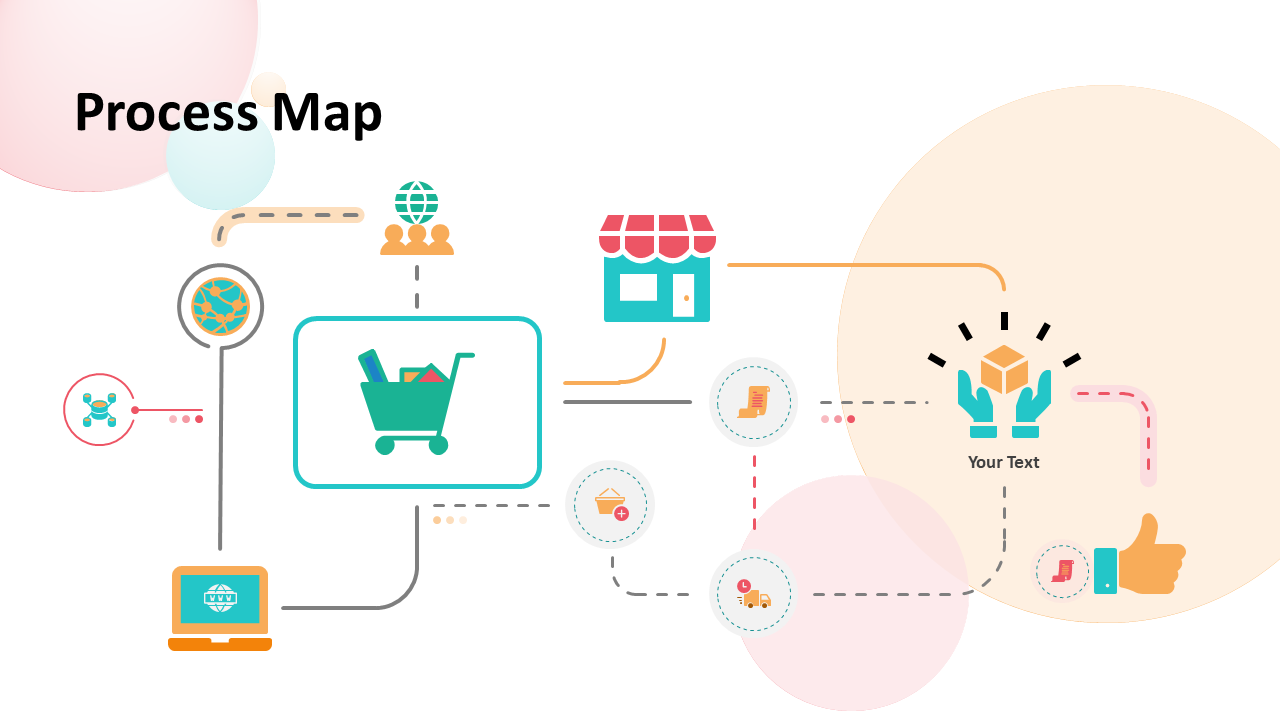

Sales report presentations provide insights into sales performance, trends, and forecasts to understand market conditions and sales strategies . Presenters who are looking how to make a presentation in the sales niche can apply it for sales meetings, quarterly reviews, strategy sessions, and performance evaluations.

A successful sales report presentation features the following slides on its deck:

- Agenda Slide

- Sales Performance Slide: Sales figures and trends.

- Target vs Actual Slide: Comparison of targets and actual sales.

- Sales by Region/Product Slide: Breakdown of sales data.

- Sales Pipeline Slide: Status of sales leads and opportunities.

- Customer Insights Slide: Key customer trends and feedback.

- Competitor Analysis Slide: Competitive landscape.

- Strategies Slide: Current and future sales strategies.

- Recommendations Slide: Suggested improvements and actions.

As a recommendation, in our experience, it’s a good practice to include a sales dashboard slide highlighting the key sale metrics. It would be beneficial if a new sales strategy were implemented and the team wanted to extract conclusive data from it.

Marketing report presentations analyze marketing campaigns, strategies, and performance metrics to assess the impact and plan future initiatives. We can come across this kind of report and presentation in situations like marketing meetings, marketing plan presentations , campaign reviews, strategy sessions, and performance evaluations.

Consider to list the following slides to create an effective marketing report presentation:

- Campaign Overview Slide: Summary of marketing campaigns.

- Performance Metrics Slide: Key metrics like ROI, conversion rates, and engagement.

- Audience Insights Slide: Data on target demographics and customer behavior.

- Channel Performance Slide: Performance by marketing channel (e.g., social media, email).

- Competitor Analysis Slide: Competitive landscape and benchmarking.

- Strategies Slide: Current and future marketing strategies.

This is a type of report presentation where you should encourage audience participation due to the importance of the creativity factor in new campaigns. Use infographics to represent dense groups of data related to social media reports . Strategy presentation templates are also a good fit to enhance your report presentation slide deck.

Additionally, we include on this following link a Free Social Media Report PowerPoint template for users to create professional-looking slides in seconds.

Project report presentations detail project progress, challenges, and outcomes, providing updates to stakeholders and ensuring alignment with goals. Typical use cases of these report presentations are project meetings, status updates, and post-project reviews.

To create a slide deck for project report presentations, consider to include these slides:

- Title Slide: Title, presenter’s name, date, and project name.

- Project Overview Slide: Summary of project goals and scope.

- Timeline Slide: Key milestones and project schedule.

- Progress Slide: Status of project phases and tasks.

- Challenges Slide: Issues encountered and mitigation strategies.

- Budget Slide: Financial status and budget adherence.

- Risk Management Slide: Identified risks and their management.

- Next Steps Slide: Upcoming tasks and milestones.

Gantt charts , progress bars , and budget graphs are excellent presentation tools for showcasing key information in project presentations . Be sure to include the exact dates for project updates.

Non-profit and NGO report presentations highlight the organization’s activities, achievements, and financial status, communicating with donors, volunteers, and the public. They are a key element of transparency in relationships with the public and donors, and they are used in board meetings, fundraising events, annual reviews, and community outreach.

To create this kind of report presentation, we need to include these slides:

- Mission Slide: Organization’s mission and goals.

- Activities Slide: Summary of recent activities and programs.

- Impact Slide: Data on the impact and outcomes of programs.

- Financial Overview Slide: Income, expenses, and budget status.

- Donor Recognition Slide: Acknowledgment of key donors and supporters.

- Challenges Slide: Issues faced and solutions implemented.

- Future Plans Slide: Upcoming projects and initiatives.

Harness the power of storytelling . Include success stories, impact charts, infographics, and program photos. Highlight the outcomes and benefits this organization has brought to its target community. Annual Report PowerPoint templates can speed up the design creation phase of your report presentation.

Healthcare report presentations provide data on patient outcomes, research findings, and healthcare initiatives aimed at improving medical practices and policies. They are used in medical conferences, healthcare meetings, research symposiums, and policy briefings.

The slides we must count on for building an effective healthcare report presentation are:

- Background Slide: Context and objectives of the report.

- Methodology Slide: Research methods and data collection.

- Data Slide: Key statistics and findings.

- Analysis Slide: Interpretation of data and implications.

- Recommendations Slide: Suggested actions or policy changes.

- Future Research Slide: Areas for further investigation.

If you need to share a patient’s data concerning a newly developed technique or as findings from research, be sure you are authorized to disclose that information.

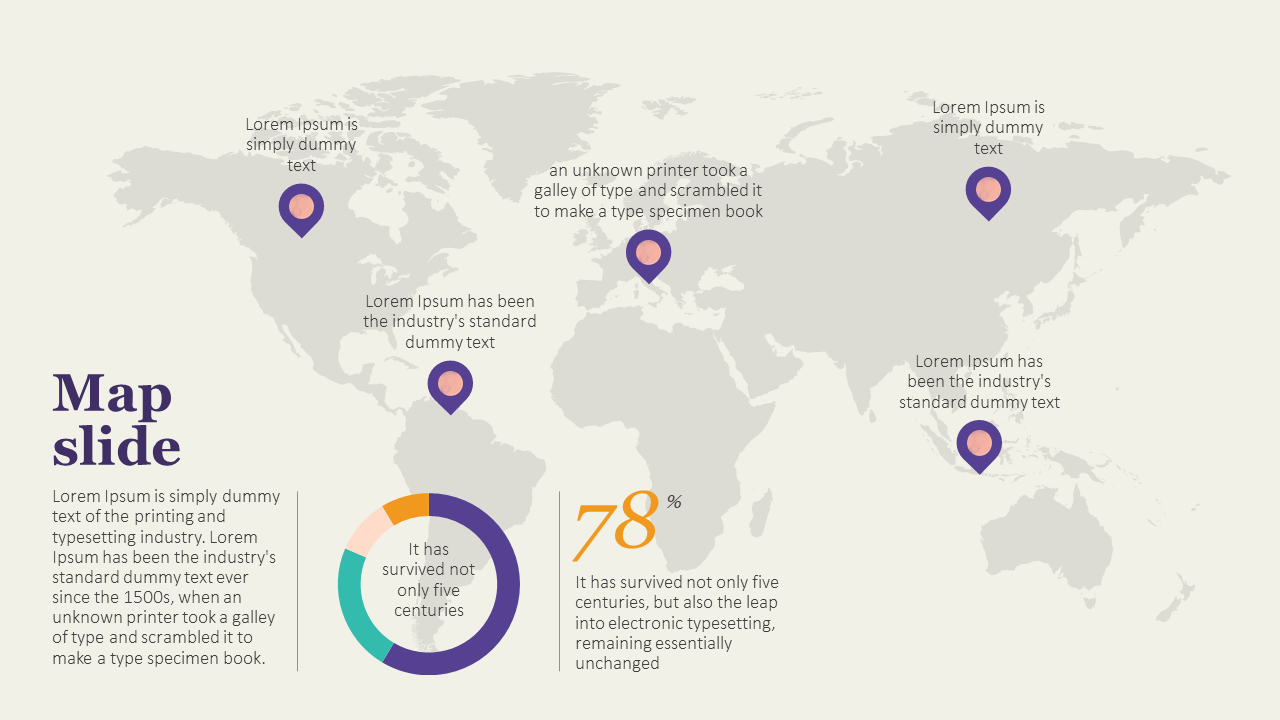

Finally, environmental report presentations focus on environmental research, sustainability projects, and ecological impact assessments to inform stakeholders and promote environmental protection. We can attend these kinds of presentations at ecological conferences, policy briefings, project reviews, and community meetings.

Include the following slides in your deck to create an outstanding environmental report presentation:

- Impact Slide: Environmental impact and sustainability metrics.

- Recommendations Slide: Suggested actions and policy changes.

Video presentations are ideal for adding an extra emotional factor and connecting with the audience about the importance of environmental causes, and they are also applicable to any kind of consulting report . Another key approach is to include testimonials from well-accredited sources or individuals affected by the environmental factor.

- Do start with a clear objective.

- Do use visuals to support your message.

- Do practice how to start your presentation .

- Do engage with your audience by asking questions and inviting feedback.

- Do end your presentation with powerful graphics

- Don’t overload slides with text.

- Don’t ignore your audience’s needs and interests.

- Don’t rush through the presentation.

- Don’t rely solely on the slides; use them to complement your speech.

How long should a report presentation be?

The length depends on the context and audience, but 15-30 minutes is a standard time for most report presentations.

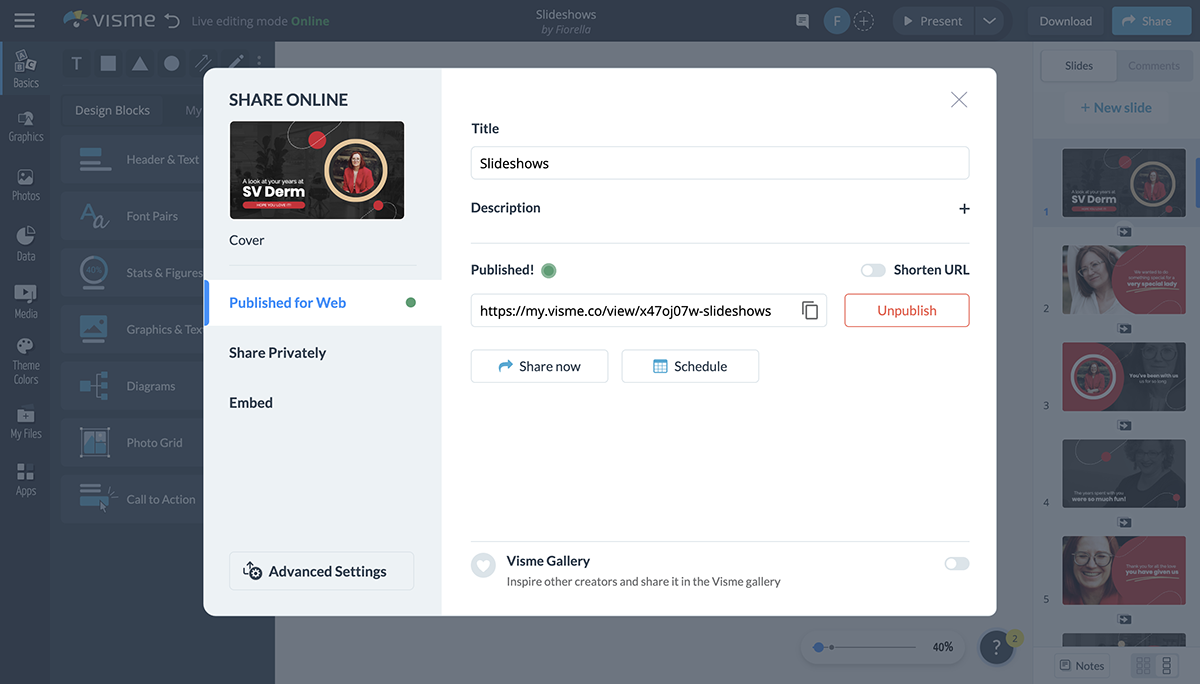

What tools can I use to create a report presentation?

Common tools include PowerPoint, Google Slides templates , and Keynote. Specialized data visualization tools like Tableau can also be useful.

How can I make my report presentation more engaging?

Use storytelling techniques, interactive elements, and visual aids to engage your audience .

Should I distribute copies of the report?

It’s often a good idea to provide copies or a summary handout for the audience to follow along and refer to after the presentation.

In this section, you can find a list of curated report presentation slides to make your work easier. You can work with any of these designs or opt to use the ones presented above.

1. Expense Report Presentation Slide

This Expense Report PowerPoint Template is perfect for detailed financial presentations. Easily document and display expenses, including lodging, meals, supplies, parking, and airfare, with clear sections for reporting periods, submission details, and expense descriptions. Ideal for corporate reporting, budget reviews, and financial audits, ensuring organized and professional presentations.

Use This Template

2. Business Progress Report Slides for PowerPoint

This Business Progress Report Template is designed to track project milestones and performance metrics. Listing a profile section for team members and a color-coded progress indicator allows for clear visualization of project status. It is ideal for team meetings, stakeholder updates, and performance reviews, ensuring a concise and effective presentation.

3. Book Report Presentation Slide Deck for PowerPoint

This Book Report PPT template is ideal for structuring narrative elements in presentations. We can outline a story’s theme, setting, and characters with visual aids to enhance understanding. This template is perfect for writers, educators, and marketers to convey story concepts effectively, ensuring a cohesive and engaging presentation.

4. Annual Report Template for PowerPoint

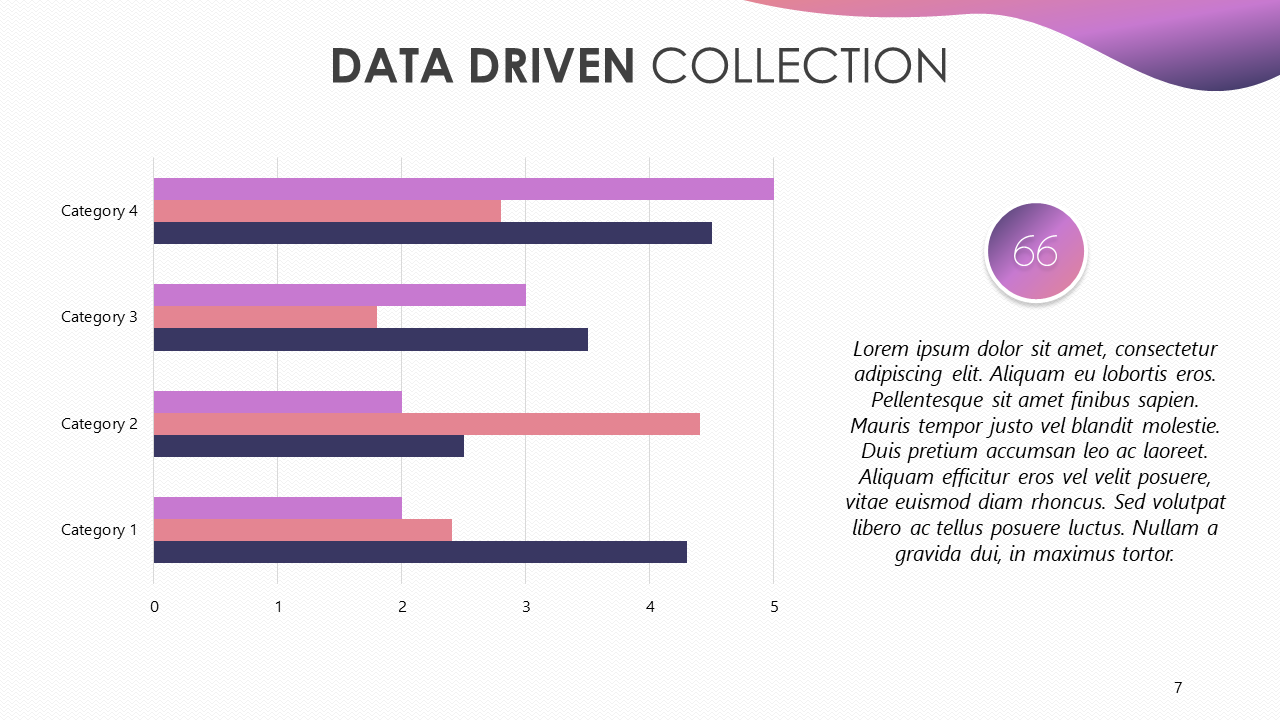

This Annual Report slide deck is designed for clear financial analysis. It features sections for detailed descriptions, bar charts, and pie charts to represent expense data visually. Perfect for financial reviews, investor presentations, and budget meetings, this template ensures a comprehensive and professional overview of total expenses, facilitating informed decision-making.

5. Business Annual Report PowerPoint Template

A slide deck designed to showcase key financial metrics and achievements. We include sections for displaying significant figures, percentages, and growth indicators, making it perfect for annual reports, investor meetings, and financial reviews. With clear and visually appealing graphics, this template ensures a concise and impactful presentation of financial performance highlights.

6. Financial Dashboard Report Template for PowerPoint

Accurately represent financial information that’s critical for your organization by implementing this PPT report template. It is a data-driven layout containing different boxes to showcase KPIs; managers and team leaders can use this template to align organizational efforts toward a strategic goal.

Like this article? Please share

Consumer Reports, Design, Executive Reports, Financial Report Filed under Business

Related Articles

Filed under Google Slides Tutorials • July 16th, 2024

How to Make a Google Slides Presentation Look Good

Polish your presentation slides with these 10 tips by design professionals. Learn how to make Google Slides look good now!

Filed under Google Slides Tutorials • July 6th, 2024

How to Insert Icons in Google Slides

Learn how to insert icons in Google Slides and customize your slide design for maximum audience engagement.

Filed under PowerPoint Tutorials • July 4th, 2024

How to Change Slide Dimensions in PowerPoint

Get to know how to change slide dimensions in PowerPoint to create custom designs with this guide.

Leave a Reply

- Collections

- Sales Report

Free Sales Report Presentation Templates

Turn bland sales reports into captivating presentations with free sales report powerpoint templates and google slides themes. impress bosses, wow clients, and motivate your team with creative visuals, editable charts, and easy-to-understand layouts. grab attention, secure funding, and crush goals - all without design headaches. get started for free.

- Simple Sales Report: Perfect for a quick overview, these sales data presentation templates get straight to the point with clear visuals and concise data summaries.

- Sales Performance Dashboard : Track your progress with interactive charts and graphs that showcase your team's wins and areas for improvement.

- Sales Portfolio : Highlight your most successful projects and showcase the value you bring to your clients.

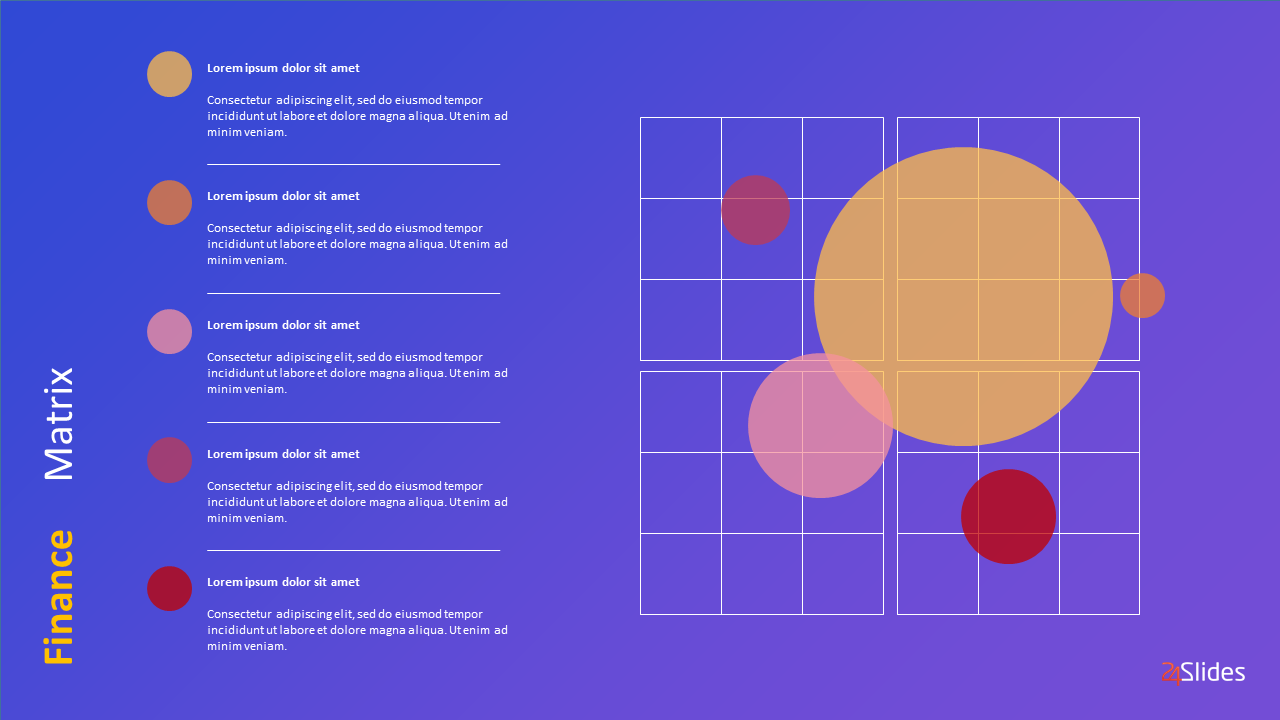

- Finance: Present your revenue, budgets, and ROI clearly and effectively.

- Sales managers: Impress your boss and secure that promotion with a data-driven report that showcases your team's brilliance.

- Marketing teams: Align your sales efforts with your marketing strategy using templates that tell the story of your customer journey.

- Business owners: Secure funding, attract new investors, and make informed decisions with presentations that leave a lasting impression.

- Team meetings: Keep your team informed and motivated with clear, concise presentations.

- Client meetings: Impress potential clients and secure new deals with professional, data-driven presentations.

- Industry events: Share your insights and expertise with a wider audience using engaging and informative slides.

We're here to help you!

Where can i find free sales report templates.

Slide Egg offers a huge library of free sales report PowerPoint and Google Slides themes. Simply browse the category and download your favorites!

Do I need any special design skills to use these templates?

Absolutely not! Our templates are designed for everyone, regardless of design experience. Simply edit the text, charts, and colors to match your data and brand.

What types of sales reports can I create with these templates?

Our selection covers a wide range, from simple summaries to detailed forecasts, portfolio showcases, and performance dashboards. Find the perfect template to match your specific needs.

Can I customize the templates?

Yes, you can! All elements are fully editable, including text, charts, graphics, and colors. Make the templates your own and tell your unique story.

Are these templates compatible with PowerPoint and Google Slides?

Yes! Our templates are available in both PowerPoint and Google Slides formats, so you can choose your preferred platform.

Can I add my company logo and branding to the templates?

Of course! Add your logo, colors, and fonts to personalize the templates and match your brand identity.

How can I make my sales report presentation stand out?

Using high-quality visuals, clear storytelling, and concise data presentation is key. Explore our creative slide layouts, editable charts, and infographic elements to add visual interest.

Can I share my presentation with others?

Yes, you can share your finished presentation with others, either offline or online, depending on your chosen platform.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Marketing 15 Sales Presentation Examples to Drive Sales

15 Sales Presentation Examples to Drive Sales

Written by: Danesh Ramuthi Oct 31, 2023

A sales presentation is not merely a brief introduction to a product or service. It’s a meticulously constructed sales pitch tailored to showcase the unique features and key elements of what’s being offered and to resonate deeply with the prospective customers.

But what stands out in the best sales presentation is their ability to weave an engaging story, integrating customer testimonials, success stories and sales performances to maintain the audience’s attention span and to persuade them to take action.

The right tools, like those provided by Venngage presentation Maker and its sales presentation templates , can greatly aid in this endeavor. The aim is to have a presentation memorable enough that it lingers in the minds of potential clients long after the pitch.

Its ultimate aim is not just to inform but to persuasively secure the audience’s commitment.

Click to jump ahead:

6 Sales presentation examples

What to include and how to create a sales presentation, sales presentation vs pitch deck.

- Final thoughts

A sales presentation can be the differentiating factor that turns a potential client into a loyal customer. The manner in which a brand or individual presents their value proposition, product, or service can significantly impact the buying decisions of their audience.

Hence, drawing inspiration from various sales presentation examples can be an instrumental step in crafting the perfect pitch.

Let’s explore a few examples of sales presentations that cater to different needs and can be highly effective when used in the right context.

Clean sales presentation examples

The concept of a “clean” sales presentation reflects more than just its visual aesthetic; it captures an ethos of straightforward, concise and effective communication. A clean presentation offers a professional and efficient way to present your sales pitch, making it especially favorable for brands or individuals looking to be perceived as trustworthy and reliable.

Every slide in such a presentation is meticulously designed to be aesthetically pleasing, balancing visuals and text in a manner that complements rather than competes.

Its visual appeal is undeniably a draw, but the real power of a clean sales presentation lies in its ability to be engaging enough to hold your audience’s attention. By minimizing distractions, the message you’re trying to convey becomes the focal point. This ensures that your audience remains engaged, absorbing the key points without being overwhelmed.

A clean design also lends itself well to integrating various elements such as graphs, charts and images, ensuring they’re presented in a clear and cohesive manner. In a business environment where attention spans are continually challenged, a clean presentation stands as an oasis of clarity, ensuring that your audience walks away with a clear understanding of what you offer and why it matters to them.

Minimalist sales presentation examples

Minimalism, as a design and communication philosophy, revolves around the principle of ‘less is more’. It’s a bold statement in restraint and purpose. In the context of sales presentations, a minimalist approach can be incredibly powerful.

It ensures that your content, stripped of any unnecessary embellishments, remains at the forefront. The primary objective is to let the core message shine, ensuring that every slide, every graphic and every word serves a precise purpose.

This design aesthetic brings with it a sense of sophistication and crispness that can be a potent tool in capturing your audience’s attention. There’s an inherent elegance in simplicity which can elevate your presentation, making it memorable.

But beyond just the visual appeal, the minimalist design is strategic. With fewer elements on a slide, the audience can focus more intently on the message, leading to better retention and engagement. It’s a brilliant way to ensure that your message doesn’t just reach your audience, but truly resonates with them.

Every slide is crafted to ensure that the audience’s focus never wavers from the central narrative, making it an excellent choice for brands or individuals seeking to create a profound impact with their pitches.

Simple sales presentation examples

A simple sales presentation provides a clear and unobstructed pathway to your main message, ensuring that the audience’s focus remains undivided. Perfect for highlighting key information, it ensures that your products or services are front and center, unobscured by excessive design elements or verbose content.

But the beauty of a simple design is in its flexibility. With platforms like Venngage , you have the freedom to customize it according to your brand voice and identity. Whether it’s adjusting text sizes, incorporating vibrant colors or selecting standout photos or icons from expansive free stock libraries, the power to enhance and personalize your presentation lies at your fingertips.

Creating your ideal design becomes a seamless process, ensuring that while the presentation remains simple, it is every bit as effective and captivating.

Professional sales presentation example

A professional sales presentation is meticulously crafted, reflecting the brand’s guidelines, voice and core values. It goes beyond just key features or product benefits; it encapsulates the brand’s ethos, presenting a cohesive narrative that resonates deeply with its target audience.

For sales professionals, it’s more than just a slide deck; it’s an embodiment of the brand’s identity, from the great cover image to the clear call to action at its conclusion.

These presentations are tailored to address potential pain points, include sales performances, and present solutions in a compelling and engaging story format.

Integrating elements like customer success stories and key insights, ensuring that the presentation is not just good, but memorable.

Sales performance sales presentation example

A company’s sales performance presentation is vital to evaluate, refine and boost their sales process. It’s more than just numbers on a slide deck; it’s a comprehensive look into the effectiveness of sales campaigns, strategies and the sales team as a whole.

This type of sales presentation provides key insights into what’s working, what isn’t and where there’s potential for growth.

It’s an invaluable tool for sales professionals, often serving as a roadmap guiding future sales pitches and marketing campaigns.

An effective sales performance presentation might begin with a compelling cover slide, reflecting the brand’s identity, followed by a brief introduction to set the context. From there, it delves into specifics: from the sales metrics, customer feedback and more.

Ultimately, this presentation is a call to action for the sales team, ensuring they are equipped with the best tools, strategies and knowledge to convert prospective customers into paying ones, driving more deals and growing the business.

Testimonial-based sales presentation examples

Leveraging the voices of satisfied customers, a testimonial-based sales presentation seamlessly blends social proof with the brand’s value proposition. It’s a testament to the real-world impact of a product or service, often making it one of the most effective sales presentation examples.

By centering on customer testimonials, it taps into the compelling stories of those who have experienced firsthand the benefits of what’s being offered.

As the presentation unfolds, the audience is introduced to various customer’s stories, each underscoring the product’s unique features or addressing potential pain points.

These success stories serve dual purposes: they not only captivate the audience’s attention but also preemptively handle sales objections by showcasing how other customers overcame similar challenges.

Sales professionals can further augment the presentation with key insights derived from these testimonials, tailoring their sales pitch to resonate deeply with their potential clients.

Creating a good sales presentation is like putting together a puzzle. Each piece needs to fit just right for the whole picture to make sense.

So, what are these pieces and how do you put them together?

Here, I’ll break down the must-have parts of a sales presentation and give you simple steps to build one.

What to include in a sales presentation?

With so much information to convey and a limited time to engage your audience in your sales presentation, where do you start?

Here, we’re going to explore the essential components of a successful sales presentation, ensuring you craft a compelling narrative that resonates with your prospects.

- A captivating opening slide: First impressions matter. Start with a great cover image or slide that grabs your audience’s attention instantly. Your opening should set the tone, making prospects curious about what’s to come.

- Data-driven slides: Incorporate key points using charts, graphs, infographics and quotes. Instead of flooding your slides with redundant information, use them as a tool to visually represent data. Metrics from your sales dashboard or third-party sources can be particularly illuminating.

- Social proof through testimonials: Weave in testimonials and case studies from satisfied customers. These success stories, especially from those in the same industry as your prospects, act as powerful endorsements, bolstering the credibility of your claims.

- Competitive context: Being proactive is the hallmark of savvy sales professionals. Address how your product or service fares against competitors, presenting a comparative analysis.

- Customized content: While using a foundational slide deck can be helpful, personalizing your presentation for each meeting can make all the difference. Whether it’s integrating the prospect’s brand colors, industry-specific data or referencing a past interaction, tailored content makes your audience feel acknowledged.

- Clear path to the future: End by offering a glimpse into the next steps. This can include a direct call to action or an overview of the onboarding process. Highlight the unique value your company brings post-sale, such as exceptional training or standout customer support.

- Keep it simple: Remember, simplicity is key. Avoid overcrowding your slides with excessive text. Visual data should take center stage, aiding in comprehension and retention.

Related: 120+ Presentation Ideas, Topics & Example

How to create a sales presentation?

Crafting a good sales presentation is an art that blends structure, content and design.

A successful sales presentation not only tells but also sells, capturing the audience’s attention while conveying the main message effectively.

Here’s a step-by-step guide to ensure that your sales deck becomes a winning sales presentation.

1. Find out your ideal audience

The first step to any effective sales pitch is understanding your audience. Are you presenting to prospective customers, potential clients or an internet marketing agency? Recognize their pain points, buying process and interests to craft a message that resonates. This understanding ensures that your presentation is memorable and speaks directly to their unique needs.

2. Pick a platform to Use

Depending on your target audience and the complexity of your sales literature, you might opt for Venngage presentation maker, PowerPoint templates, Google Slides or any tools that you are comfortable with. Choose a tool that complements your brand identity and aids in keeping your audience’s attention span engaged.

3. Write the ‘About Us’ section

Here’s where you build trust. Give a brief introduction about your organization, its values and achievements. Highlight key elements that set you apart, be it a compelling story of your brand’s inception, a lucrative deal you managed to seal, or an instance where an internet marketing agency hired you for their needs.

4. Present facts and data

Dive deep into sales performance metrics, client satisfaction scores and feedback. Use charts, graphs and infographics to visually represent these facts. Testimonials and customer success stories provide that added layer of social proof. By showcasing concrete examples, like a customer’s story or feedback, you give your audience solid reasons to trust your product or service.

5. Finish with a memorable conclusion & CTA

Now that you’ve laid out all the information, conclude with a bang. Reiterate the value proposition and key insights you want your audience to remember. Perhaps share a compelling marketing campaign or a unique feature of your offering.

End with a clear call to action, directing your prospects on what to do next, whether it’s downloading further assistance material, getting in touch for more deals or moving further down the sales funnel .

Related: 8 Types of Presentations You Should Know [+Examples & Tips]

Sales presentation and the pitch deck may seem similar at first glance but their goals, focuses, and best-use scenarios differ considerably. Here’s a succinct breakdown of the two:

Sales Presentation:

- What is it? An in-depth dialogue designed to persuade potential clients to make a purchase.

- Focuses on: Brand identity, social proof, detailed product features, addressing customer pain points, and guiding to the buying process.

- Best for: Detailed interactions, longer meetings and thorough discussions with potential customers.

- Example: A sales rep detailing a marketing campaign to a potential client.

Pitch Deck:

- What is it? Pitch deck is a presentation to help potential investors learn more about your business. The main goal isn’t to secure funding but to pique interest for a follow-up meeting.

- Focuses on: Brand voice, key features, growth potential and an intriguing idea that captures the investor’s interest.

- Best for: Initial investor meetings, quick pitches, showcasing company potential.

- Example: A startup introducing its unique value proposition and growth trajectory to prospective investors.

Shared traits: Both aim to create interest and engagement with the audience. The primary difference lies in the intent and the audience: one is for selling a product/service and the other is for igniting investor interest.

Related: How to Create an Effective Pitch Deck Design [+Examples]

Final thoughts

Sales presentations are the heart and soul of many businesses. They are the bridge between a potential customer’s needs and the solution your product or service offers. The examples provided—from clean, minimalist to professional styles—offer a spectrum of how you can approach your next sales presentation.

Remember, it’s not just about the aesthetics or the data; it’s about the narrative, the story you tell, and the connection you establish. And while sales presentations and pitch decks have their distinct purposes, the objective remains consistent: to engage, persuade and drive action.

If you’re gearing up for your next sales presentation, don’t start from scratch. Utilize Venngage presentation Maker and explore our comprehensive collection of sales presentation templates .

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

No results found.

Sales presentations: templates, examples and ideas on how to present like a pro

A good sales presentation is more than a simple pitch, a demo or a list of facts and figures. Done well, at the right time in your sales process , it’s a tool for getting your prospects’ attention, drumming up excitement and moving prospects toward a buying decision.

In this guide, you’ll learn how to use the power of storytelling to drive decision-making and close more deals. We’ll also cover the fundamental elements of an effective sales presentation strategy, what to include in your sales decks and practical ideas on how to deliver them.

What is a sales presentation?

A sales presentation is a live meeting where your team showcases your product or service and why it’s the best option for your prospect.

Although the terminology differs from company to company, a sales presentation is not always the same as a sales pitch.

A sales pitch is what your sales professionals do all day long, on the phone, over Zoom or in person with clients.

A sales presentation (although it’s still a sales pitch) is a point-in-time event that usually happens when your sales team is trying to close a more lucrative deal. It’s not a simple phone call, as it often involves a meeting and a demo.

Because you’re likely presenting to a group of senior decision-makers and executives, sales presentations require ample prep time and coordination across multiple team members.

Key takeaways from this sales presentations article

Deliver effective presentations: Make your sales presentations compelling with storytelling, effective slide decks, tailored content and strong delivery techniques. Benefits of great presentations: Sales presentations grab attention, excite prospects and drive decision-making, helping close more deals by showcasing your product’s value. Pipedrive’s tools, including customizable sales dashboards and Smart Docs , help you create professional, tailored presentations that enhance your sales strategy. Try Pipedrive free for 14 days .

How (and why) to use storytelling in your sales presentation

Use stories in your presentations to help people remember and relate to your brand.

Statistics, facts and figures can help when you’re trying to persuade a prospect to become a customer, but they’re more impactful if you can frame them with a memorable story.

For example, tell a story about a customer who faced the same challenges as your prospect and supplement it with powerful data, they are more likely to listen and want to know more.

Human beings have a deep relationship with storytelling. Stories move, teach and, in a sales context, persuade audiences.

Chip Heath, a Stanford professor and the co-author of Made to Stick , demonstrates the importance of storytelling by doing an exercise with his students. He divides them into groups and asks them to deliver a one-minute persuasive pitch based on data he’s just shown them.

After the pitches are delivered, he asks the class to jot down everything they remember about them. Although most students use stats rather than stories, 63% remember the stories, while only 5% remember an individual data point .

The stickiness of stories makes them a useful tool for developing a sales presentation outline. They help prospects understand and remember the key points of the presentation and your product.

Thomas Dredge Sales Manager, Particular Audience

Start with a problem (and a deadline)

Your presentation is about the solution you’re offering your prospects, but it shouldn’t start with that solution.

Instead, lead with the problem your solution was designed to solve.

“ Value selling is key,” says Bradley Davies, business development at Cognism . “It is important to understand your buyer and tailor their journey to what you can do for them.

“First, you need to understand what is motivating them to have a discussion, which allows you to identify their pains and present how your offering solves their pains. Everything presented to a prospect should be based on the value for them specifically.”

You might choose to tell a story that positions your product as the hero, helping the customer vanquish a villain: their pain point.

Your story should be tailored to the pain points of the prospects in the room. For example, a change to their business, industry or the technology they use.

“If an element of your offering is not relevant, then don't distract them from the important features. It will keep them engaged and help to build their user story,” adds Bradley.

Recommended reading

Digging deep to determine customer pain points and make the sale

Create a sense of urgency around your product: It’s a solution to their problem, but if they don’t act now, they could miss an opportunity. Tell a story about what might happen if your prospect doesn’t change, framing the consequences of inaction.

Focus on outcomes

You’ve outlined the problem and, if you’re doing your job, your audience is nodding along. Now it’s time to start talking about the solution.

However, that doesn’t mean you should launch into the features and benefits of your product just yet.

Rather than presenting your product, a good sales presentation draws a picture of what life could look like for a customer once they start doing things differently. How will their workload or productivity improve? What will they be able to do with additional time and resources? How will they reduce spending and increase revenue?

From there, introduce your solution and the features that can make this brave new world possible. Do this in a few ways:

Position your features against the old way of doing things

Present those features as “superpowers” that will solve your prospect’s problems

Compare those features to competitors’ features

Quantify the value your features bring vs. the cost of doing nothing

Use a combination of some or all of the above

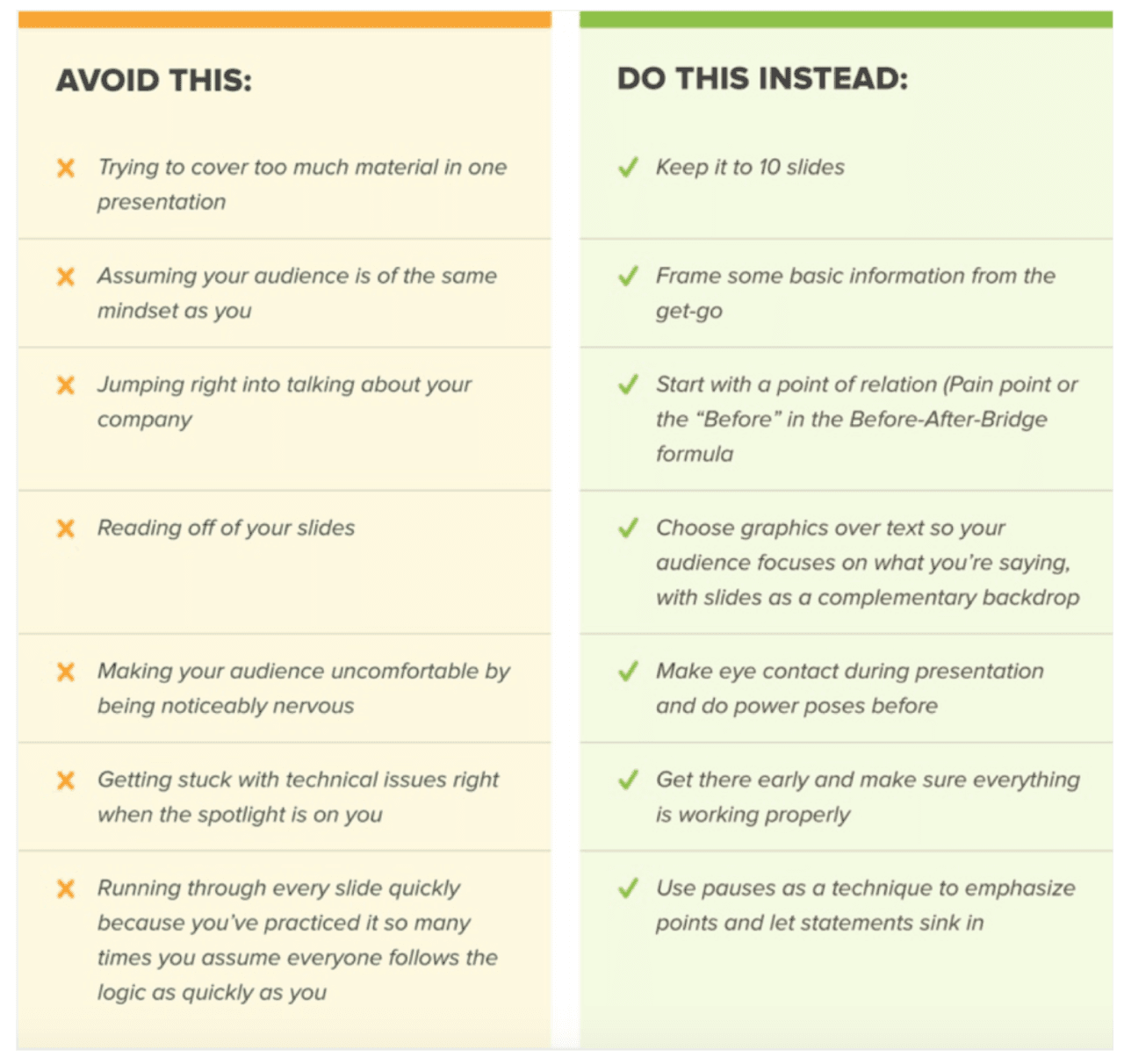

Creating a winning sales presentation slide deck

Most sales presentations include a slide deck to deliver facts, case studies and statistics that convey the value of your solution.

Create your sales pitch deck in an application like PowerPoint or Google slides to ensure your presentation is visible to everyone in the room (or in a virtual setting).

The best sales decks have a few key elements:

A great cover image or opening slide. Like the story you open your presentation with, your cover slide should grab your audience’s attention.

Data and key points . Charts, graphs, infographics, quotes and other information back up your presentation. Your slides should support your presentation by visualizing data, not repeating what you’re saying. You can get metrics from third-party sources or (if appropriate) from your own sales dashboard .

Testimonials and case studies from other customers. Quotes and success stories from or information about other customers, preferably in the same industry as your prospects, will act as social proof and go a long way to backing up your claims.

Competitive context. In all likelihood, your product isn’t the only one a potential customer is evaluating. Savvy sales professionals take the opportunity to proactively communicate how their product stacks up to their competitors’ and anticipate objections.

Customized content. While it might seem tempting to use the same content for every presentation, you should personalize your presentation for each meeting. You might want to use your prospect’s brand colors, find data specific to their market or industry, or reference an earlier exchange. You can find ready-to-use customizable sales decks through a graphic design app, such as Canva.

A glimpse into next steps. Give your prospects an understanding of what new customer onboarding looks like with a slide that includes a direct call to action offering next steps. For some companies, the training and customer support experience can be a value proposition in and of itself.

A note about text in your sales deck : Keep the slides simple and light on text. Your prospects don’t want to look at a wall of words to read. According to data from Venngage , 84% of presenters use visual data in their presentations – and for good reason: You don’t want to overwhelm your audience with text as they listen to you, look at your sales deck and watch the demo.

When you do include text, ensure you use a font (and font size) that can be easily read by everyone sitting in on your presentation.

Download the Sales Presentation Templates ebook

Your data is processed according to our privacy notice . You may unsubscribe at any time.

What else to bring to your sales presentation

Now that we’ve discussed the story elements of a sales presentation and your slide deck, what else should you bring to the meeting?

Most sales presentations are in-person affairs and include visual elements like a sales deck, handouts or even an in-person demonstration of the physical product. Here are a few things to think about including in your pitch.

13 examples of sales collateral you need to drive revenue

The product.

Nothing sells a product like seeing it in action.

Take Scrub Daddy, a sponge that changes shape depending on the heat of the water. When Aaron Krause, Scrub Daddy’s founder and inventor, presented the product on Shark Tank in 2012 , he demonstrated the sponge cleaning dirty kitchenware and greasy countertops. He also used bowls of water and two 10-pound weights to show the sponge’s amazing morphic abilities.

The tactic paid off: Scrub Daddy partnered with Lori Greiner for $200,000, in return for 20% equity in the business and is now considered one of Shark Tank’s most successful products.

Not all products are easy to demo, so you may have to improvise.

With a physical product, think of the perfect environment for a demo. What would show the product at its best?

With a digital product, make sure you have the technology on hand to show what your product can do (and check beforehand that the tech works). If it’s a mobile app, have your prospects download it. If it’s a platform, consider producing recorded or interactive product demos that can be embedded in your sales presentation.

For items that are too big to be brought in or which are location-specific, you may have to rely on a video as part of the presentation.

7 steps to putting together a brilliant sales demo

Leave behinds.

Depending on the nature of your solution, you may want to have materials you can leave with the prospects in the room.

This can be as simple as contact information or sales literature you pass out at the end of the presentation. It can also be something that’s part of the presentation, like a QR code that allows them to download the demo on their phones. Whatever format you choose, make sure the material is concise and to the point.

Tailoring your sales presentation to speak to your audience

Once you develop a strong sales deck template, it’s tempting to use it over and over with your target audience. Remember, personalization is essential in sales.

During lead generation , prospecting and sales calls, you know that prospects are more interested in buying if your pitches are tailored to them. It’s the same with your sales presentations, especially if you have an unusual prospect.

Let’s say your product is a CRM that’s normally used by sales organizations, but a human resources department is interested in using it to create a recruiting pipeline.

You wouldn’t use a sales deck with sales-related examples to sell it during the presentation.

Instead, you’d research talent acquisition challenges, ask your product department to create a template or a demo aimed at recruiting and build your sales deck accordingly.

Different industries have unique challenges and opportunities. It’s your responsibility to tailor your value proposition and key bullet points accordingly.

“To craft the perfect sales presentation pitch,” advises Danny Hayward, Sales Manager at Unruly , “ensure you take care of these three things:

Ask the right questions beforehand to understand the needs of the client, especially their flaws

Learn your product inside and out

Rehearse, rehearse and rehearse again

Danny Hayward Sales Manager, Unruly

How to nail your sales presentation delivery

Here are a few tried and true sales presentation techniques to make sure you close the deal.

Whether you’re presenting solo or as part of a team, it’s important to plan in advance. Follow these sales presentation tips for preparation.

Practice, practice, practice . You’ll need to get the timing right, especially if your presentation has a lot of moving parts. Go through it to make sure your timing works, so that you can nail the meeting itself.

Make sure everything works . You don’t want to go into a meeting with a faulty PowerPoint presentation or a broken sample – or find out there is no whiteboard when one is integral to your demonstration. Do your best to make sure everything goes to plan.

Decide on everyone’s roles . This one is just for those presenting as a team. Will different sales reps speak through each section? Will one rep talk while the others handle the sales deck and demo? Decide who will do and say what ahead of time.

Know your attendees. Make sure you know who from the prospect company will be in the meeting, their titles and the roles they each play in the buying process. Conducting light social media research can also clue you into attendees’ past experiences or alma maters (information that can fuel pre-presentation small talk and forge closer connections with your audience).

Practice confident body language

Presentations usually happen in person, which is why you need to practice strong body language. You want to look relaxed and confident (even if you’re shaking in your shoes).

Here are some ways you can improve your body language:

Eye contact . Make and maintain eye contact, even in virtual meetings. This shows people you’re interested in them and invested in what they have to say.

Stand up straight . Pull your shoulders back and straighten your spine; fixing your posture is an easy way to convey confidence. You’ll also feel better if you’re not hunched over.

Chin up. It’s hard when you’re in front of people, but don’t look at the floor or your shoes. Face straight ahead and make eye contact (or look at the back wall rather than the floor.)

Have a firm handshake. Some people judge others by their handshakes. Offer a firm handshake to make a good first impression.

Engage your audience

Presentations can span 30 to 60 minutes or more, so you need to be able to hold your prospects’ attention. There are a number of ways to keep everyone interested:

1. Understand your audience’s attention span

The beginning and the end of your presentation are the most memorable, so that’s where you want to use your strongest material.

Rather than leading with your product’s features, use the first few minutes of a presentation to briefly introduce yourself, and share the compelling story we mentioned earlier. If your demo itself is compelling, lead with that.

Then talk about product features and pricing. Your prospects might have already researched it or can look it up afterward, so it’s fine that it’s occupying real estate in the middle of the presentation.

Lastly, finish strong. Return to your story, sharing how your product solved an important problem. Close with confidence, and open the floor for questions.

2. Be funny

Humor can be tricky, so if you’re not comfortable making jokes, don’t force it. If, however, humor is part of your brand voice and you think it will be well-received by your audience, go for it. Humor can be a good way to connect with prospects, make your presentation memorable and relax everyone in the room.

3. Use a little showmanship

The best thing about a sales presentation is that it lets you show off your product. Unlike a pitch, a presentation lets you pull out the stops, make a splash and showcase your solution.

Use this to your advantage and be as memorable as you possibly can.

Sophie Cameron Business Development Representative, CAKE

What to do after the sales presentation to close the deal

The sales cycle isn’t over when the sales presentation ends. Here are some tips on how to wrap up loose ends and close the deal.

Take questions

Encourage questions to show prospects you care about their experience.

Sometimes prospects may want a question answered right in the middle of a presentation. Interactivity is a great sign of engagement. If that happens, stop the presentation and take their questions head-on to show you’re listening and validate their thoughts.

Other times they may sit silently waiting for you to give them all the information they need.

In either case, proactively ask for questions once you’ve ended your presentation. Encourage them to share their concerns. This is a consultative selling approach that works to build a relationship with your prospects.

By the end of your sales pitch, your prospect should be ready to come along with you and start your business relationship.

Outline the next steps of the process. The first could be offering a trial of your product, scheduling a follow-up meeting or sending over a proposal.

Whatever the steps, make sure they’re clearly defined. If you don’t hear from the prospect soon after the proposal, check back in with a follow-up email or call.

How to write a response-worthy follow-up email (with 15 templates)

Great sales presentation examples (and why they worked)

Here are some sales pitch examples you can use to inform your next sales presentation; these examples range from great sales decks to presentations and we’ll explain why they worked so well.

The successful demo

Stephen Conway of vegan chocolate brand Pure Heavenly opened his elevator pitch on the UK’s Dragons’ Den in 2019 by handing out samples of his chocolate. The product, paired with Stephen’s story about wanting to create an allergen-free treat that his young daughters could enjoy, led to three offers.

Why it worked: Conway knew the strength of his product and packaged it in a personal story, betting (correctly) that it would sell itself.

The data-driven presentation

Lunchbox is a restaurant technology company that specializes in online ordering, customer loyalty and guest engagement software. The sales deck the company used to raise its $50 million Series B in 2022 relied on bold visuals and graphs to illustrate its market opportunity, ARR history and competitive differentiators.

Why it worked: The deck tells two stories, one about the company itself and another about the way consumer dining habits have changed in the wake of COVID-19. Lunchbox used data to show how it met the industry’s new pain points for both itself and other companies.

Sales data: How to analyze sales data and a sample Excel spreadsheet

The presenters with overwhelming confidence

When Brian and Michael Speciale went on Shark Tank in 2017 to pitch their product, The Original Comfy, they had very little – no numbers or inventory, just a prototype of a big fleece blanket/hoodie and video of that hoodie being worn everywhere from the couch to the beach. What they did have was a good product and confidence in that product. Their presentation earned them an offer of $50,000 for 30% from Barbara Corcoran.

Why it worked: Corcoran says she bought in because the Speciale brothers had a good idea, the guts to present it and knew they had to strike while the iron was hot. While you probably should be more prepared for your own sales presentation, the Original Comfy story shows just how important confidence is in a sales presentation.

Begin your sales presentation by capturing your audience’s attention and establishing a solid foundation for the rest of your presentation. Here are some steps to consider:

Greet and introduce yourself

Establish rapport

State the purpose and agenda

Address the pain points

Present a compelling hook

Outline the benefits

Establish credibility

Set expectations

Remember to maintain a confident and enthusiastic demeanor throughout your presentation.

The ideal length of a sales presentation can vary depending on factors such as the complexity of the product or service, the audience’s attention span and the context in which the presentation is being delivered. However, keeping a sales presentation concise, focused and within the timeframe is generally recommended.

The conclusion of a sales presentation is a significant opportunity to leave a lasting impression and inspire action from your audience. Here are a few steps you should take to end your presentation effectively.

Include a call to action

Summarize key points

Showcase success stories

Open the floor to questions

Offer additional resources

Here’s an example of how to end your presentation:

“To quickly recap, we’ve covered these key points today: [Summarize the main features and benefits briefly].

“Now, let’s revisit our success stories. Our clients, like [Client A] and [Client B], achieved [mention their specific results]. These successes demonstrate how our product/service can deliver tangible benefits for your business.

“I’d be happy to address any questions or concerns you may have. Please feel free to ask about anything related to our offering, implementation process or pricing.

“Before we finish, I’d like to encourage you to take the next step. Schedule a demo, request a trial or start a conversation with our team. Don’t miss the opportunity to experience the advantages firsthand.

“Lastly, we have additional resources available, such as case studies and whitepapers, to provide you with more insights. Feel free to reach out to our team for any further assistance.

“Thank you all for your time and consideration today.”

Final thoughts

It can be tempting to play it safe with a sales presentation by keeping it to a sales deck and a speech – but a sales presentation should be a show-stopper.

The best sales presentation tells your customer’s story, validates with data, offers a demo and more. It’s a major undertaking that shows the strength of your product. Done well, it keeps your prospects engaged and will make them want to do business with you.

Show customers how your product can push their business forward (or better yet, how your product can make them the superhero) and you’ll have a winning sales presentation that sparks your customer’s interest and drives revenue.

Driving business growth

Full access. No credit card needed.

Recommended

Win-win situations in sales: creating value for both sides

Explore how to achieve a win-win situation and master win-win negotiations to succeed in sales and foster lasting business relationships.

Sales collateral gives customers the right information to make a decision. Build this toolbox of 13 revenue-driving resources to help push deals forward.

A good sales demo does more than just showcase your offering. It can help you win over prospects by connecting your product directly to their needs. In this article, we’ll walk you through the steps to putting together a brilliant sales demo with questions designed to put you in the shoes of your prospects.

35+ Best Sales PowerPoint Templates (Sales PPT Pitches)

Learning to craft successful and better-looking sales presentations is one of the key skills you should master as a marketer or sales rep.

In this digital era, being able to deliver great presentations is not enough. You also need to be able to design attractive and beautiful slides that engage with your audience while adding more context to your speech.

The good news is that you don’t have to be a designer or take courses to design such effective PowerPoint presentations. All you need is the right PowerPoint template.

In this post, we bring you a collection of PowerPoint sales presentation templates to help you find the right designs for your sales plan, proposal, and pitch slide decks. Be sure to save these templates for future events and meetings.

2 Million+ PowerPoint Templates, Themes, Graphics + More

Download thousands of PowerPoint templates, and many other design elements, with a monthly Envato Elements membership. It starts at $16 per month, and gives you unlimited access to a growing library of over 2,000,000 presentation templates, fonts, photos, graphics, and more.

Business PPT Templates

Corporate & pro.

Pitch PowerPoint

Animated PPT Templates

Fully animated.

Maximus Template

Pitch Deck Templates

Startup pitch deck.

Explore PowerPoint Templates

SalesUp – Sales & Marketing PowerPoint Template

SalesUp is a dynamic PowerPoint template designed for effective sales and marketing presentations. With 15 unique slides, a light background, and a widescreen format, this template also includes a handmade infographic feature that can be fully customized for any business. It’s ideal for making your business propositions more impactful.

Sales Growth – Marketing PowerPoint Template

This PowerPoint template is perfect for showcasing your sales and business development journey. It features 15 unique slides, a light background, and captivating handmade infographics, all housed within a widescreen format. The template is fully customizable, allowing a personalized touch to your presentations.

Sales Deck Presentation PowerPoint Template

A versatile PowerPoint template designed to enhance your sales and business presentations. It boasts features like a 16:9 widescreen size, unique slide variations, editable charts and elements, a preset color scheme, and more. This easy-to-use template equips you with infographics for each stage of business development, aiming to boost user satisfaction and improve your brand’s presence.

Modern Sales Strategy PowerPoint Template

This PowerPoint template is a highly customizable slideshow for creating impactful presentations. Featuring a yellow and purple design, the template includes 20 unique slide layouts with easily editable graphics, infographics, and placeholders for pictures. Ideal for a range of business purposes like sales strategies or company profiles.

Dark Sales Strategy PowerPoint Template

A stylish PowerPoint template aimed at enhancing your sales presentations. Featuring a widescreen format, unique slides, editable charts, and elements, it is user-friendly and adaptable to your brand’s needs. From kick-starting a project to improving goal propositions, this template is designed to give your talks an edge.

Sales Plan PowerPoint Template

An expertly crafted PowerPoint template designed to communicate sales strategies and objectives clearly to varied audiences. Its presentation potential spans from showcasing marketing campaigns to 30-60-90 day plans. The template allows for easy customization of features such as pie charts, colors, and text to fit your specific needs.

Sales Growth Strategy PowerPoint Presentation

This is an impressive PowerPoint template that allows you to build sales presentations in minutes. It’s perfect for various needs – be it a sales pitch, an innovative sales strategy display, or regular business meeting. The template includes useful features like fonts, color schemes, and image placeholders.

Sales Growth PowerPoint Template

A carefully crafted PowerPoint template perfect for illustrating sales tactics, performance indicators, and growth plans in a professional and engaging way. Tailored for sales pros, business development teams, and marketing managers, this template, presented in PowerPoint format, offers uncomplicated personalization options.

Business Funnels Infographics PowerPoint Template

This is a unique and professional PowerPoint template to enhance your sales presentations. With 16 characterized slides, it’s easily customizable and comes with drag-and-drop image options, editable charts, and distinctive mockup devices. This template is specially designed to emphasize text readability and usability, ensuring your ideas are well communicated.

Sales Dashboard Infographic PowerPoint Template

This PowerPoint template is perfect for dynamic business and sales presentations and showcasing company profiles. This package features 30 unique, widescreen (16:9) infographic slides, designed for accessibility and ease of use.

Business Sales PowerPoint Presentation Template

Sales presentations don’t always have to be all stats and data, they can be beautiful too. This PowerPoint template allows you to design more effective slideshows with modern layouts with creative animations. There are more than 50 unique slide designs included in this template. You can easily edit and customize them to your preference.

Sales Strategy Powerpoint Template

If you want to make your sales strategy presentations more effective, you should consider creating a slideshow with more visual elements. This PowerPoint template will help you get that job done. It includes 30 unique slides you can use to present your sales plan and strategy in a step-by-step approach.

Sales Pitch PowerPoint Template

A great pitch deck goes a long way to make sure your sales pitch stays on point. It will also help convince your audience of your skills and knowledge on the topic. Be sure to use this PowerPoint template to design such a killer slide deck for your sales pitch presentations. It includes 20 master slide layouts with fully customizable layouts.

Marketing & Sales Strategy PowerPoint Template

There are many different types of charts, graphs, and infographics you need to use in your sales presentations to visualize data and key points. This PowerPoint template includes 30 unique slides you can use to add some of the most popular charts and graphs to your presentations. There are slides for sales cycles, planning, strategy model, B2C and B2B strategy plans, and much more.

B2B Marketing and Sales PowerPoint Template

Whether you’re working on a smart strategy for your B2B marketing approach or creating a master plan to beat your competitors, this B2B marketing PowerPoint template will help you create the best presentation to showcase your plan. It includes a total of 60 slide layouts that can be used to create both marketing and sales presentations.

Sales Meeting – Free PowerPoint Template

This is a free PowerPoint template that comes with a set of slides you can create professional slide decks for sales meetings. It features 30 unique slides with modern designs and fully customizable layouts.

Free Sales Planning Process PowerPoint Template

With this free PowerPoint template, you can create visual presentations for your sales process presentations. There are 35 different slides included in this template that you can edit and customize to change colors, fonts, and images.

Sales – Marketing PowerPoint Presentation

This professional PowerPoint sales presentation template uses a beautiful color scheme to create a consistent look across all its slides. The template lets you choose from 40 different slide designs to create slideshows for all kinds of sales and marketing presentations. The template includes master slides as well.

Sales Funnel PowerPoint Template

Sales funnels are an important part of creating an effective sales strategy. With this PowerPoint template, you can create a presentation to showcase your plan for sales funnels with lots of visual elements. There are 20 unique master slide layouts included in this template that feature important charts, graphs, and infographics for sales funnel presentations.

Sales Proposal PowerPoint Template

With this PowerPoint presentation, you can create professional slideshows for presenting your sales proposals. The template comes with some of the most important slides for sales slide decks, including slides for showcasing your marketing plan and business strategy. Each slide comes in 5 pre-made color schemes as well.

Anasalez – Sales Analysis PowerPoint Presentation

You can make a complete visual analysis of your sales process or plans using this useful PowerPoint template. It comes with more than 50 unique slides that are designed specifically for sales presentations. Each slide is available in both light and dark color themes as well as 10 pre-made color schemes.

Sales and Digital Funnel PowerPoint Templates

This professional PowerPoint template allows you to create more effective slides for showcasing your sales funnels. There are 20 different styles of sales funnel designs included in this template. Each slide can be customized to your preference to change colors, fonts, and images.

Free Creative Sales Strategy Presentation Template

Another free PowerPoint template for creating sales strategy presentations. This template has over 30 unique slides with very creative designs. It features colorful shapes, illustrations, and graphs as well.

Free Sales Process PowerPoint Infographic Slides

Grab this free PowerPoint template to design effective presentations for outlining your sales process. It includes 32 unique slides with many different styles of sales infographic designs.

Dashi – Sales Report PowerPoint Presentation

Dashi is a PowerPoint template made just for professional marketers. You can use it to design visual and beautiful slideshows for presenting your sales dashboards and reports. The template has 10 slides featuring more than 30 character positions, over 2000 vector icons, and 30 business concepts. Each slide is available in light and dark color themes as well as 30 pre-made color schemes.

Sales Pitch Presentation PowerPoint Template

This is a multipurpose PowerPoint template for making all kinds of pitch proposals. Whether it’s a sales pitch, marketing pitch, or even startup pitch decks, this template can handle them all. There are more than 120 unique slides in this template with 6 different color schemes to choose from, making it a total of over 800 slides.

Sales Playbook PowerPoint Template

Creating an attractive slideshow for your sales and marketing campaigns will get much easier when you have this PowerPoint template at your side. It features over 35 unique slide layouts with professional designs. Everything in each slide design, including the colors, fonts, shapes, and images are fully customizable as well.

Sales Process PowerPoint Presentation Template

Use this PowerPoint template to create slides with visual diagrams and graphs for presenting your sales process in a professional way. There are 40 unique slides in this template with useful sales process designs. Each slide is available in 10 different pre-made color schemes, which makes it a total of 400 slides to choose from.

Kanigara – Marketing & Sales PowerPoint Template

Kanigara is another multipurpose PowerPoint template that comes with modern and stylish slides for making all kinds of sales presentations. The template features over 40 slides with beautiful layouts. There are lots of creative graphs, charts, and graphics included in this presentation.

Felicia – Free Sales Presentation PowerPoint Template

This PowerPoint template comes with lots of colorful and creative slide designs for making sales presentations that will surely leave your mark. It includes more than 20 unique slides. And it comes in both PowerPoint and Google Slides versions.

Ardall – Free Sales Presentation Template

Ardall is another free PowerPoint template that’s also available in Google Slides format. This template features a set of modern and professional slides for making sales and marketing presentations. There are 20 slide layouts included in the template.

B2B and B2C Digital Marketing & Sales Presentation

This PowerPoint template works perfectly for creating presentations for both B2B and B2C marketing slideshows. The template includes over 35 unique slides and you can choose from 5 pre-made color schemes as well. The slides are easily customizable to your preference.

Real Estate Marketing & Sales PowerPoint Template

If you’re working on a marketing presentation for a real estate agency, this PowerPoint template will come in handy. It includes 50 unique slides that are designed with property and real estate marketing presentations in mind. They are available in 7 different color schemes.

3D Stairs Diagram for Sales Process Presentation

The stairs diagram is commonly used in marketing and sales presentations to showcase various stats and reports. This PowerPoint template will help you add such diagrams to your presentations with ease. It includes 6 unique slides with 3D-like stair diagram designs.

Ozone – Sales & Marketing Portrait PowerPoint Template

Ozone is a creative PowerPoint template that comes in portrait-style slide designs. There are 50 unique slides included in the template with over 60 master slide layouts to choose from. It features transition animations and infographics as well.

For more great presentation templates, check out our best professional PowerPoint templates collection.

7 Amazing Sales Presentation Examples (And How to Make Them Your Own)

7 Types of Slides to Include In Your Sales Presentation

Inside the mind of your prospect: change is hard, before-after-bridge: the only formula you need to create a persuasive sales presentation, facebook — how smiles and simplicity make you more memorable, contently — how to build a strong bridge, brick by brick, yesware — how to go above and beyond with your benefits, uber — how to cater your content for readers quick to scan, dealtap — how to use leading questions to your advantage, zuora — how to win over your prospects by feeding them dots, linkedin sales navigator — how to create excitement with color, how to make a sales pitch in 4 straightforward steps, 7 embarrassing pitfalls to avoid in your presentation, over to you.

A brilliant sales presentation has a number of things going for it.

Being product-centered isn’t one of them. Or simply focusing on your sales pitch won’t do the trick.

So what can you do to make your offer compelling?

From different types of slides to persuasive techniques and visuals, we’ve got you covered.

Below, we look at data-backed strategies, examples, and easy steps to build your own sales presentations in minutes.

- Title slide: Company name, topic, tagline

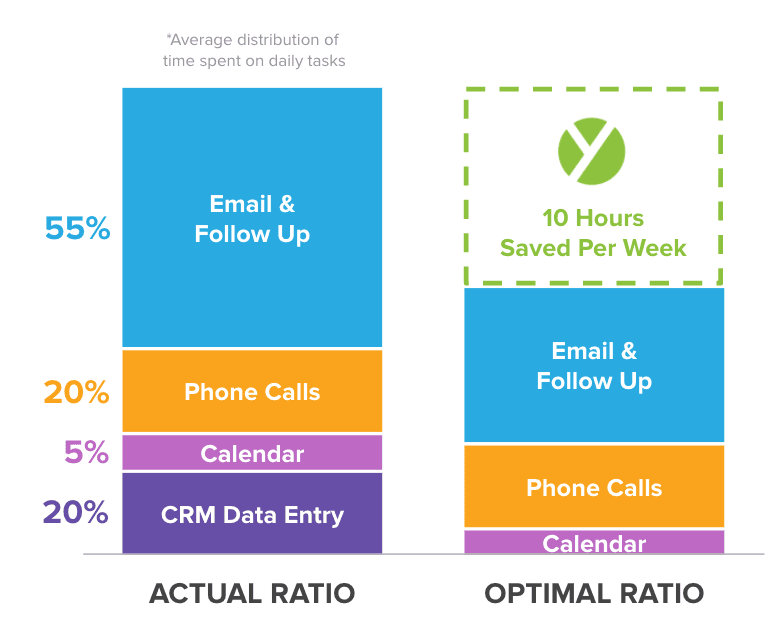

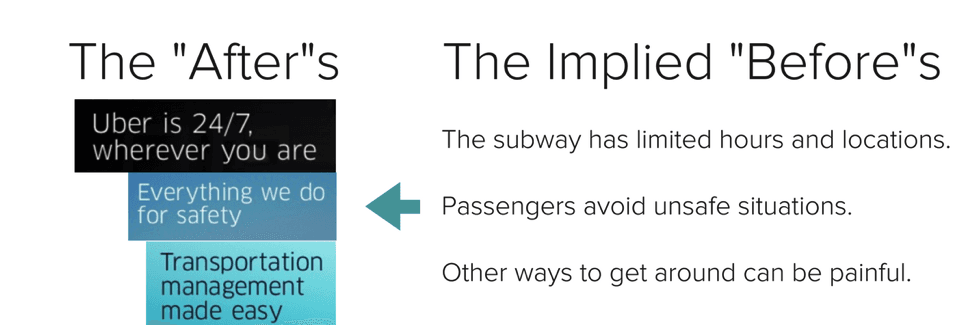

- The “Before” picture: No more than three slides with relevant statistics and graphics.

- The “After” picture: How life looks with your product. Use happy faces.

- Company introduction: Who you are and what you do (as it applies to them).

- The “Bridge” slide: Short outcome statements with icons in circles.

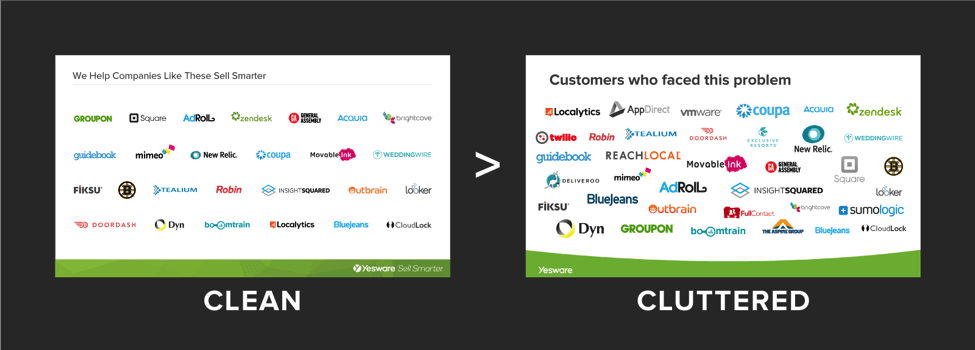

- Social proof slides: Customer logos with the mission statement on one slide. Pull quote on another.

- “We’re here for you” slide: Include a call-to-action and contact information.

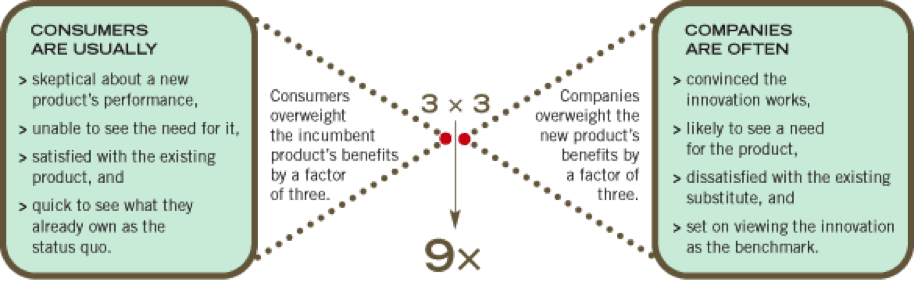

Many sales presentations fall flat because they ignore this universal psychological bias: People overvalue the benefits of what they have over what they’re missing.

Harvard Business School professor John T. Gourville calls this the “ 9x Effect .” Left unchecked, it can be disastrous for your business.

According to Gourville, “It’s not enough for a new product simply to be better. Unless the gains far outweigh the losses, customers will not adopt it.”

The good news: You can influence how prospects perceive these gains and losses. One of the best ways to prove value is to contrast life before and after your product.

Luckily, there’s a three-step formula for that.

- Before → Here’s your world…

- After → Imagine what it would be like if…

- Bridge → Here’s how to get there.

Start with a vivid description of the pain, present an enviable world where that problem doesn’t exist, then explain how to get there using your tool.

It’s super simple, and it works for cold emails , drip campaigns , and sales discovery decks. Basically anywhere you need to get people excited about what you have to say.

In fact, a lot of companies are already using this formula to great success. The methods used in the sales presentation examples below will help you do the same.

We’re all drawn to happiness. A study at Harvard tells us that emotion is contagious .