- Case Studies

- Choosing a Software

- Implementation

- Manufacturing Tips

- Production planning

- Supply Chain

Product Costing in 7 Easy Steps

Product costing is a necessity not only for accountants but also for managers. Understanding the costs related to manufacturing your products gives you the chance to determine optimal selling prices and take steps toward cost reduction. Here is a simple guide to performing product costing.

Table of Contents

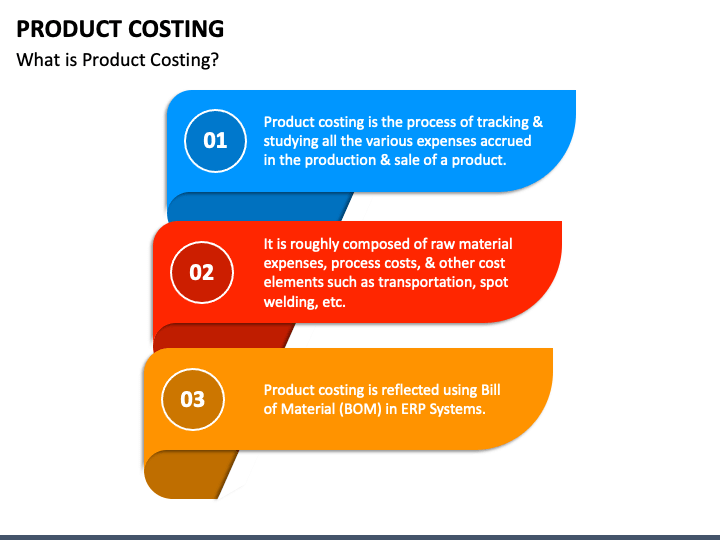

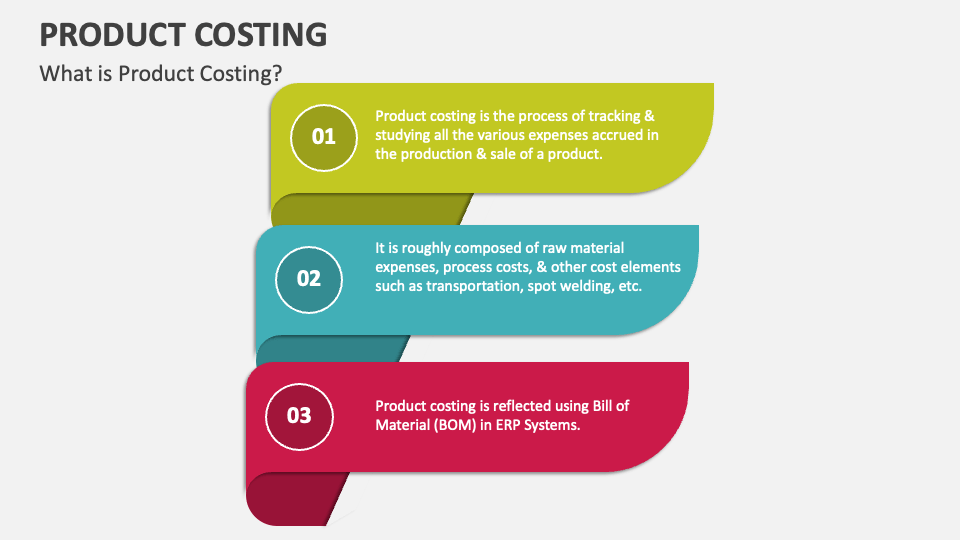

What is Product Costing?

Product costing is the process of calculating the costs incurred with manufacturing a single product. This total cost includes the consumption of raw materials and components, labor, and overhead allocated to a sole unit.

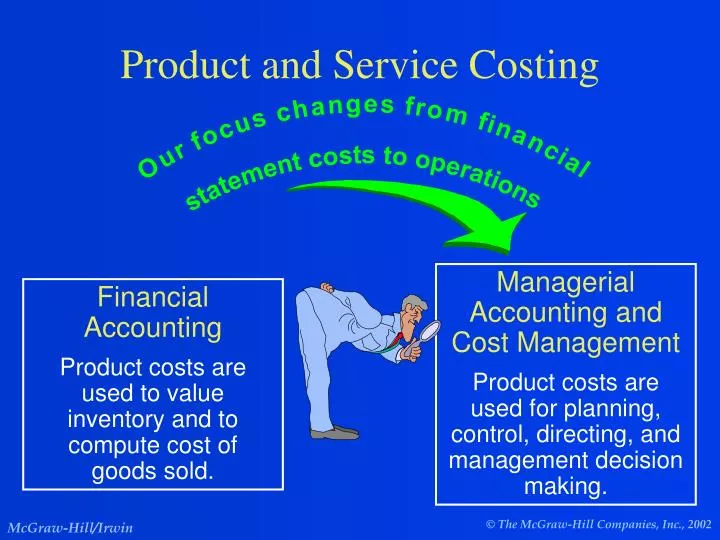

For accountants, product costing is essential for inventory valuation and for calculating the cost of goods sold. Managers, however, use product costing as a jumping-off point for deciding which products to manufacture as well as for pricing the manufactured products. After calculating the cost per unit, you can use various pricing methods to determine an optimal selling price for the product. The cost per unit also serves as a manufacturing performance metric to help keep tabs on production costs.

Types of manufacturing costs

Every business operation incurs both direct and indirect production costs . Direct costs are expenses directly related to manufacturing the product (raw materials, shop floor employees) while indirect costs are incurred with auxiliary activities, materials, and services, i.e. overhead.

In a manufacturing company, direct costs are made up of raw material costs, packaging costs, and factory floor employee salaries, i.e. of people and items that are directly involved in the manufacture of goods. Indirect or overhead costs, however, include indirect materials such as fastenings, glue, lubricants, etc.; indirect labor costs for supervisors, production planning, QA, and maintenance workers, and other manufacturing overhead expenses (rent, utilities, insurance, etc.).

Simplify product costing with MRPeasy

Product Costing in 7 easy steps

Although there are several different ways to approach product costing, you can follow these seven basic steps in any situation.

- Identify the cost object. If your company manufactures standard products, you can take a single product as the cost object . If you build custom products, then you can also use job costing to determine the costs related to a full order.

- Track the direct costs of individual items. Simply add together all direct material and direct labor costs that go into making a particular product.

- Pool together the overhead costs. These include indirect materials (lubricants, fasteners, and other goods used for manufacturing that are not tracked), indirect labor (production planning, maintenance, quality assurance and control, supervisors, shop floor janitors, etc.), and manufacturing overhead (rent, utilities, insurance, depreciation, etc.).

- Pick the overhead cost allocation base. You may just pool together the indirect costs and apply it evenly over all your products. But for better accuracy and decision-making, you should allocate the overhead according to how resource-heavy a product is. In this case, more overhead is allocated to those items that take more time or materials to make, and less overhead is allocated to those products that consume less. Generally, either machine hours or labor hours are used as the overhead cost allocation base.

- Calculate the overhead allocation rate. If you apply the same amount of overhead to each product, you can skip this step. However, if you use machine or labor hours, then use the following formula: Overhead allocation rate = Total overhead / Total hours For example, if the total overhead incurred over a month is estimated at $24,000 and production workers put in a total of 800 hours of work, the overhead allocation rate would be: 24,000 / 800 = $30/hour

- Allocate the overhead costs. If you apply the same amount of overhead to each product, and you produced 600 products during the period, the formula would be: Overhead cost per product = Total overhead / Total products With the numbers from the previous example, the overhead per product would be: 24,000 / 600 = $40 If you use the overhead allocation rate, however, you would also need to know how much time was spent on making different products. Let’s say you make three distinct products: tables, chairs, and coffee tables. Producing a table takes 1.25 hours, a chair takes 0.75 hours, and a coffee table takes 1 hour to finish. Therefore, the overhead allocated to each product would be: Table: 1.25 x 30 = $37.50 Chair: 0.75 x 30 = $22.50 Coffee table: 1 x 30 = $30

- Calculate the total cost. To do this, just take the direct costs of a product and add them to the overhead allocated to the product. Let’s say the table consists of a tabletop that costs $30 and four table legs that cost $20 per set. The direct material costs are therefore $50. Furthermore, the labor cost of the workers assembling and finishing the table is $30/hour, with one person working on the table at a time. As a table takes 1.25 hours to finish, the labor cost per table is: $30 x 1.25 = $37.50 Now, adding together the direct costs and the applied overhead per table, we will get the cost per unit. CPU = Direct labor + Direct materials + Overhead $37.50 + $50 + $37.50 = $125 The production costs incurred with the manufacture of one table total $125.

As you have arrived at the cost per unit of your products, you can use these numbers as a jumping-off point for determining their optimal selling prices .

Activity-based Product Costing

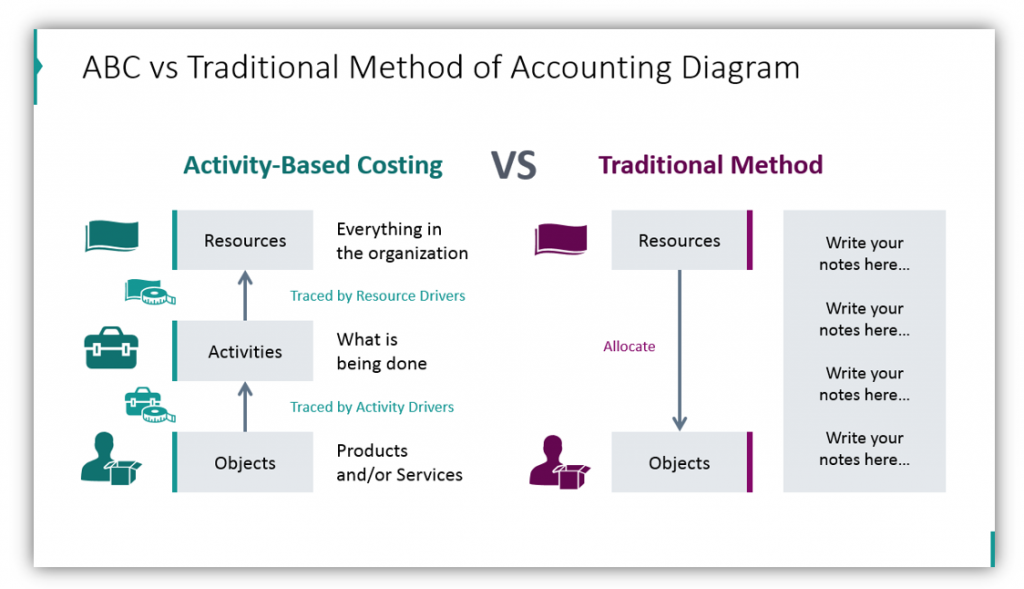

There are several costing systems that differ in how the overhead allocation is done. First, you have to decide which costs you will treat as direct and indirect costs. Secondly, you can decide on having one or multiple cost pools with different cost allocation bases. Instead of the simple approach taken above, you can use a two-stage costing system like activity-based costing where costs are divided between departments according to the activity through which the costs are incurred.

For example, you could opt for allocating overhead to sectors such as inspections, material handling, and purchasing. These are your activity allocation pools. The allocation bases, however, may differ in each of those. For instance, the allocation base for the inspection pool could be the number of inspections performed on a product; for the material handling pool, the number of material handling interactions each product needs to arrive at the end of the production line; for the purchasing pool, the number of purchase orders needed to procure the materials or components for making the product.

Simple products need fewer inspections, fewer material handling transactions, and fewer purchase orders and therefore the overhead applied to those items will be lower than that of the more complex products.

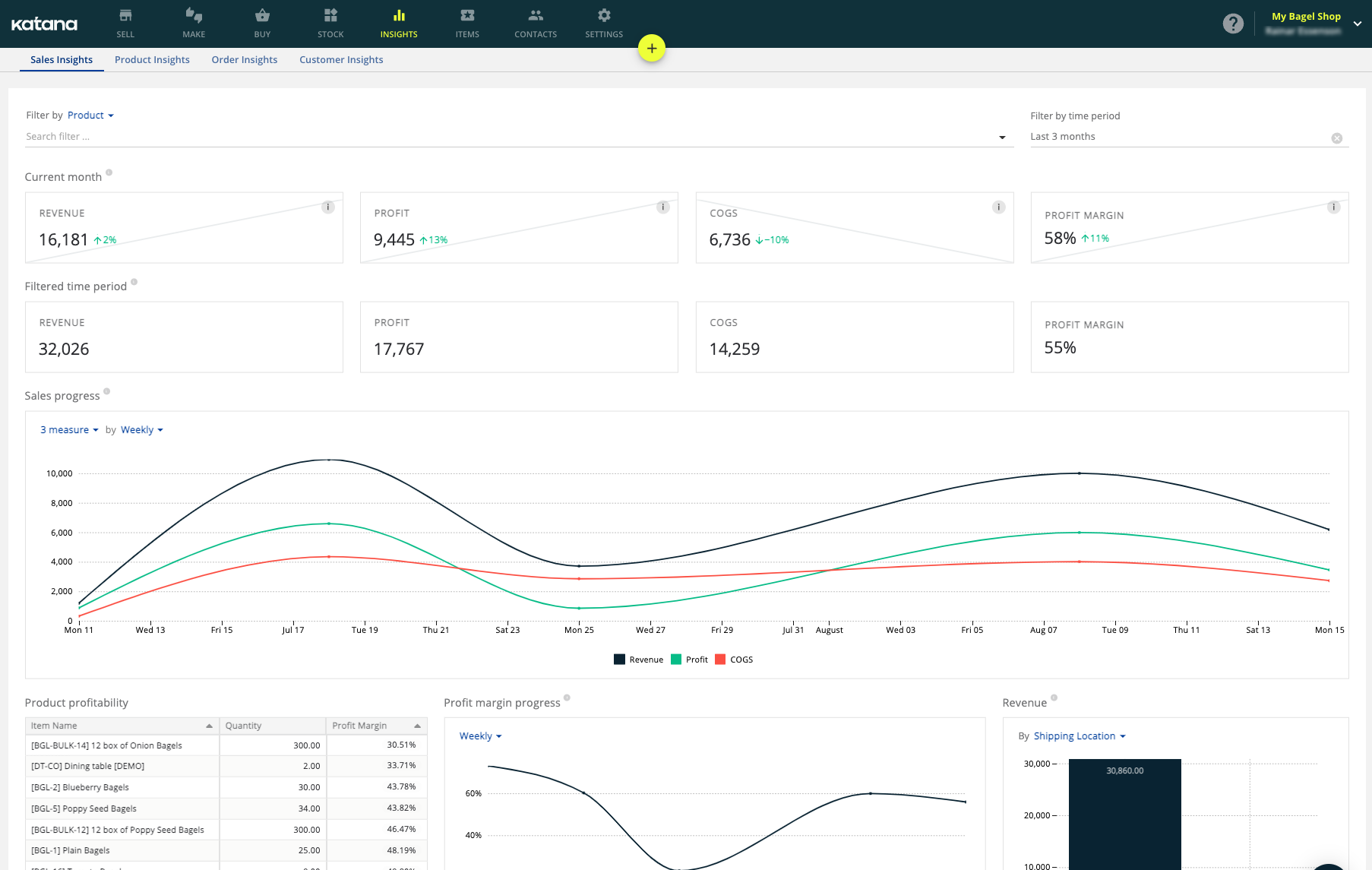

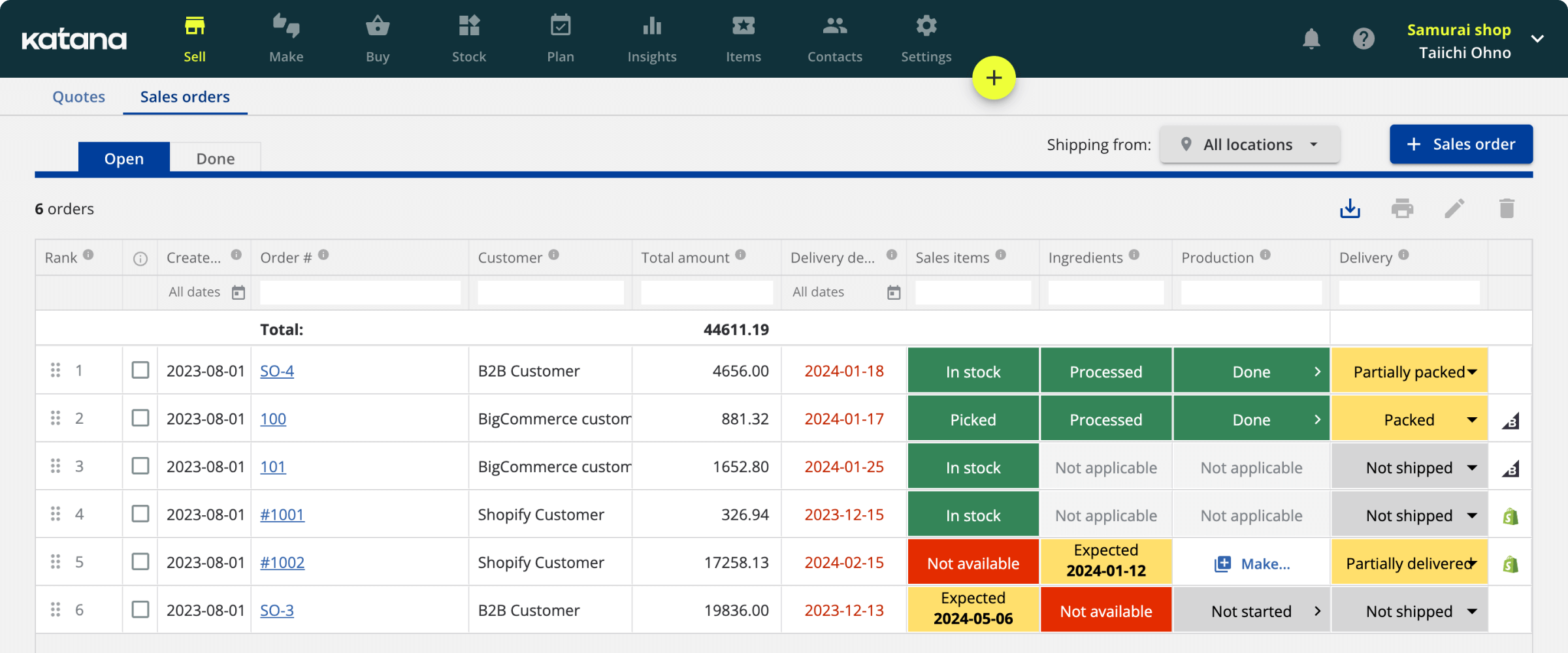

Product Costing with an ERP/MRP software

Product costing can be made much easier with the help of manufacturing software. A proper ERP/MRP system can help you easily track the costs incurred with manufacturing products. The best solutions initially estimate and later, after production, accurately calculate the cost per unit based on some of those inputs.

For example, when issuing a quote for a customer, you can estimate what the costs will be and see how they are broken down.

As manufacturing progresses, direct materials, direct labor, and manufacturing overhead are calculated in real-time by the software system itself according to the reporting inputs from workers.

Once manufacturing is completed, all costs are automatically added together for a clear overview. Plus, without any extra work, you get reports that tell you exactly how the cost per unit is changing over time.

Following the journey of a product from raw material suppliers through production to the customer, modern MRP software helps you record each direct and indirect cost, material handling transaction, inspection, and various other events, helping you achieve full traceability as well as transparency in your costs.

The manufacturing accounting module of these types of systems can help you track your assets and liabilities, calculate the cost of goods sold, profit or loss, and much more.

Key takeaways

- Product costing is the process of calculating the costs incurred with manufacturing a single product.

- For accountants, product costing is essential for inventory valuation and for calculating the cost of goods sold. Managers use product costing as a jumping-off point for pricing the manufactured products and taking steps toward cost reduction.

- Production costs are divided into direct and indirect costs: direct costs are materials and labor that are directly involved in the manufacture of the product; indirect costs are overhead for rent, utilities, indirect materials like adhesives and fastenings, and indirect labor like production supervisors, planners, procurement, etc.

- To find the cost per unit, overhead must be allocated to the specific product and added to the product’s direct costs. This can be done in several different ways.

- Use an ERP/MRP system to automatically perform product costing and track your costs per unit.

You may also like: Inventory Costs – A Quick Overview

Get manufacturing know-how delivered to your inbox!

Madis Kuuse

Madis is an experienced content writer and translator with a deep interest in manufacturing and inventory management. Combining scientific literature with his easily digestible writing style, he shares his industry-findings by creating educational articles for manufacturing novices and experts alike. Collaborating with manufacturers to write process improvement case studies, Madis keeps himself up to date with all the latest developments and challenges that the industry faces in their everyday operations.

Related articles

Privacy Policy Update

You can read our full privacy policy and terms of service .

These cookies help us track site metrics to improve our sites and provide a better user experience.

These cookies used to serve advertisements aligned with your interests.

These cookies are required to provide basic functions like page navigation and access to secure areas of the website.

Don't Leave Yet!

Product Cost Management PowerPoint Template

Template with explanations and examples of product cost management.

| Quantity of slides | : | 48 |

| Price / Slide | : | 0,60 € |

| Format of slides | : | 16:9 + 4:3 |

| Languages | : | DE + EN |

Instant Download:

- 100% Editable Powerpoint Slides / Graphics

- Outstanding Customer Support

- SSL Secure Payment

- Made in Germany

- Information

- Template (16:9)

- Template (4:3)

Statistics, charts, checklists and more to visualize your strategies and steps for effective product cost management.

Focus on Costs

Competitors’ products often have varying characteristics, such as price and quality. Production costs, including those accrued during the product’s design and development phase, must also be taken into account. With the Design to Cost (DTC) approach, product manufacturing and sales cycles can be controlled, allowing predefined cost targets to be achieved and delivering value to the customer.

Product Cost Management for PowerPoint

Marketing, production type, compatibility, competition, quantity, as well as a large number of employees can all have an influence product costs. A product cost manager faces the challenge of overseeing the various cost factors and practices that influence target costing.

Our set includes definitions, factors and methods providing you with the tools you need for effective cost analysis. We also offer charts and slides with explanations and overviews of all that goes into product cost management. Along with checklists and examples, these tools allow you to explain the challenges of product cost management and the appropriate measures to take.

With Our Product Cost Management Template You Can

- have a visual overview of the most important product cost management processes

- consider the right design elements to represent your cost strategy

- customize charts to your cost definitions and steps

Our Product Cost Management Template Includes:

- method descriptions, determining factors, responsibilities, challenges, quotes and definitions

- charts for Design-to-Cost, target costing, value analysis, quality function deployment, Poka Yoke, bottom-up estimating, reverse engineering, etc.,

- study results and statistics of current trends

- checklist for implementation

- graphics and background photos

Management KPI Dashboards

Online marketing strategy, product launch strategy, marketing-toolbox, social media strategy, corporate services.

We’ll optimize your existing PowerPoint presentation and create slides in your corporate design.

New PowerPoint Templates

We are continually bringing you new PowerPoint templates on current business topics and in modern designs.

Product costing methods for business success

Have you ever opened your banking app and been struck with a wave of panic? Or found yourself staring at your phone screen in utter bewilderment, wondering where all your money went? These are all-too-common experiences that can be easily remedied with a well-implemented product costing system.

While personal finance can be daunting, the stakes are even higher when it comes to running a successful business. Without a solid understanding of where your expenses are going, you risk losing money and valuable resources.

That’s why product costing is a vital component of any thriving business. This article delves into the intricacies of product costing to help you gain a deeper understanding of its importance.

What is product costing?

Product costing is the process of calculating the comprehensive expenses associated with creating or acquiring a product, including direct costs like raw materials and labor, as well as indirect costs such as overhead and administrative expenses. By meticulously accounting for all cost components, product costing provides a holistic understanding of the true production expenses, allowing companies to set appropriate prices that cover costs and generate a profit.

Having precise and up-to-date product costing information empowers companies to make well-informed decisions about pricing strategies, production quantities, and resource allocation. With this valuable insight, businesses can determine the most cost-effective ways to produce goods, identify areas for cost reduction, and optimize their operations to drive profitability and competitiveness in the market.

Additionally, product costing plays a crucial role in budgeting, financial forecasting, and assessing the financial viability of product lines or projects, giving businesses a comprehensive view of their financial health and aiding in long-term planning.

Let’s take a closer look at the importance of product costing and the benefits it brings.

Importance of product costing

Product costing plays a pivotal role in the success and financial health of any business, regardless of its size or industry. It serves as a critical tool that enables companies to make informed and strategic decisions that can directly impact profitability and overall business performance. Here are some key reasons why product costing is of paramount importance:

- Accurate pricing — Product costing allows businesses to determine the true cost of manufacturing or acquiring a product. With precise cost data, companies can set appropriate prices that cover production expenses and provide a reasonable profit margin. This prevents underpricing, which can lead to losses, or overpricing, which may deter potential customers.

- Cost control and efficiency — By analyzing the detailed costs involved in the production process , companies can identify areas of inefficiency and take measures to control expenses. Whether it’s optimizing raw material usage, streamlining production processes, or reducing overhead costs, product costing provides insights that drive cost-saving initiatives and boost overall efficiency.

- Resource allocation — Understanding the cost breakdown of each product helps companies allocate their resources wisely. They can focus on high-margin products or those with strong market demand while phasing out less profitable ones. This strategic allocation ensures that resources are channeled where they can yield the highest returns, maximizing the company’s profitability.

- Budgeting and financial planning — Product costing provides a solid foundation for creating budgets and forecasting financial performance. Accurate cost estimates help businesses set realistic revenue targets, plan investments, and assess the financial feasibility of new product developments or business expansions.

- Competitive advantage — In a highly competitive market, having a comprehensive understanding of product costs can be a significant differentiator. Businesses that are adept at managing costs can offer competitive prices while maintaining healthy profit margins, positioning themselves favorably in the market.

- Decision-making — Product costing empowers management with valuable insights when making critical decisions. Whether it’s choosing between in-house production and outsourcing , introducing new product lines, or discontinuing unprofitable ones, the data-driven decision-making facilitated by product costing ensures well-considered choices that align with business objectives.

- Performance evaluation — Comparing actual costs to estimated costs helps in evaluating the performance of different product lines or production processes. Businesses can identify areas that need improvement, set performance benchmarks, and incentivize teams to achieve cost-saving goals.

- Financial transparency — Accurate product costing enhances financial transparency within the organization. It enables stakeholders, investors, and lenders to have a clear picture of the company’s financial health, fostering trust and confidence in the business.

In conclusion, product costing is not merely a financial exercise but a fundamental business practice that guides sound decision-making, cost control, and resource optimization.

It empowers companies to stay competitive, achieve sustainable growth, and navigate the complexities of the market with confidence, all while ensuring the efficient and profitable delivery of products to customers. By investing in robust product costing practices, businesses position themselves for success and create a strong foundation for long-term prosperity.

Want to see Katana in action?

Book a demo to get all your questions answered regarding Katana’s features, integrations, pricing, and more.

Product costing methods

Businesses of all shapes and sizes aim to produce high-quality products that meet customer needs while ensuring profitability. In this quest for success, product costing plays a vital role. It helps determine the cost of goods sold , which eventually determines the price of a product . While there are various types of product costing , we will delve into the four main categories that businesses typically use to categorize their expenses.

Job costing

Job costing is used to calculate the cost of producing a specific product or service. This method takes into account the labor, material, and overhead costs associated with the job. It’s commonly used in industries such as construction, where each project is unique and requires custom pricing.

Process costing

Process costing is used to calculate the cost of producing a large number of identical products. This method is typically used in manufacturing environments where products are made in large batches . The total cost of production is divided by the number of units produced to arrive at the cost per unit.

Activity-based costing

Activity-based costing, or ABC costing, allocates indirect costs to specific products or services based on the activities involved in producing them. This method is useful when many indirect costs are associated with a product, and it’s difficult to determine how to allocate those costs. By identifying the activities involved in producing a product, it becomes easier to determine how much of the indirect costs should be allocated to that product.

Standard costing

Standard costing uses predetermined standard costs for materials, labor, and overhead. The actual costs are then compared to the predetermined costs to identify variances and make adjustments. This method is useful when a company wants to identify areas of inefficiency and reduce costs.

How to find product cost?

Wondering how to calculate product cost? Finding out the product cost of your business is as simple as applying a quick product cost formula. All you have to do is add up the costs associated with the item’s production and divide them by the total number of units.

The following formula can be used to calculate the product unit cost of your business:

Product unit cost = (Direct labor + direct materials + consumable production supplies + factory overhead) / number of units produced

Product costing examples

Now that you know the formula, let’s take a look at some practical examples of what a product cost analysis looks like:

- A company manufactures 2,000 chairs, and the total cost of producing them is $20,000 . This means that each chair has a product unit cost of $10 ( $20,000/2,000 ).

- A toy manufacturer produces 2,500 toys, and the total cost for materials and labor is $50,000 . Thus, the result is a product unit cost of $20 ( $50,000/2,500 ).

It’s important to include all related costs of manufacturing the product when you calculate product cost. For the chair example, this would include the wood, nails, glue, and labor, among other costs. If these costs exceed the selling price of the chair, then your business is undoubtedly making a loss and needs to re-evaluate the product costing system immediately.

Activity-based costing vs. product costing

A more intricate way of calculating your costs is known as activity-based costing. It’s a step deeper into understanding your costs. Activity-based costing looks at the activities that go into making a product and assigns costs to those activities rather than the product itself.

For example, let’s say you manufacture computers as your main product. Your activity-based cost analysis might consider the following activities: design, assembly, testing, and shipping. Each of these activities has its own associated cost, which is then added together for an accurate total unit cost for each computer produced.

Nevertheless, every company should at least know their product cost as a bare minimum, as this knowledge alone can be used to make effective pricing decisions. When combined with activity-based costing, product costing can be a powerful tool for running an even more efficient business.

Accounting for product cost

This wasn’t meant to be a pun, but product costs are also accounted for in accounting. They are essentially categorized as inventory on the balance sheet and can be tracked in the inventory account (which is often referred to as a current asset).

The total product costs you have incurred for any given period should be reported on the income statement only when sold. This will give you an accurate view of your cost structure, and it’s also essential information when calculating taxes owed or other financial statements.

How Katana helps with product costing

Managing the financial aspect of your business can be daunting, but with Katana’s cloud inventory platform , you can say goodbye to the hassle and embrace seamless product cost accounting. The software provides an array of tools that simplify the cost-tracking process and allow you to focus on what really matters — your business.

One of the standout features of Katana is the automated production orders system. From the moment an order is placed, the system tracks all costs associated with each product. This ensures that you have access to real-time cost data, enabling you to make informed decisions about pricing and other financial matters quickly and with ease.

With the inventory management feature, you can monitor your stock levels in real time. At the same time, Katana provides accurate information on how much it will cost to produce or purchase more products if needed. This feature helps you to optimize your inventory levels and improve your cash flow.

Katana’s reporting tools offer insights into your company’s financial performance, giving you a clear picture of where your money is heading and where it should be heading in the future. With this information, you can make data-driven decisions about your product costing and confidently take your business to new heights. Book a demo with Katana today!

Product costing FAQs

Product costing is a system used by businesses to determine the total expenses associated with manufacturing a product, which includes direct costs (like materials and labor) and indirect costs (such as overhead and administrative expenses). This information helps in setting appropriate prices and making informed business decisions.

Product cost can be calculated by summing up all the direct costs (materials, labor) and indirect costs (overhead, administrative expenses) incurred in manufacturing a product.

What are product costing examples?

Examples of product costing include determining the total expenses to produce a smartphone (materials, assembly labor, factory overhead) or calculating the cost of producing a handmade artisanal chair (wood, varnish, craftsman’s labor).

What are the four types of costing?

The four types of costing are

- Job costing — Used for customized products or services

- Process costing — For mass-produced items

- Activity-based costing — Allocating costs based on activities

- Standard costing — Compares actual costs to predetermined standards

How is product costing done?

Product costing involves identifying and accumulating all costs associated with producing a specific product, usually through cost accounting systems, allocation methods, and cost allocation bases to ensure accurate cost calculations.

Table of contents

Accounting guide.

1. Manufacturing accounting

1.1 WIP manufacturing

1.2 Inventory accounting

1.3 Inventory costing

1.4. Costing methods

1.5. Job order costing

1.6. Process costing

1.7. Product costing methods

2. QuickBooks for manufacturing

2.1. QuickBooks Online inventory limitations

2.2. QuickBooks raw materials inventory woes

2.3. QuickBooks Online serial number tracking

2.4. QuickBooks bill of materials

2.5. QuickBooks inventory scanner

2.6. QuickBooks inventory asset

3. Xero Manufacturing

3.1. Xero bill of materials (BOM)

3.2. Xero raw materials

3.3. Xero barcode inventory system

3.4. Xero inventory add-ons

4. Ecommerce accounting

5. QuickBooks vs. Xero: which is best?

6. Best accounting software for manufacturing

Readers also liked

Get visibility over your sales and stock

Wave goodbye to uncertainty by using Katana Cloud Inventory for total inventory control

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Product Costing – Assigning Product Costs

Published by Sonny Setiabudi Modified over 5 years ago

Similar presentations

Presentation on theme: "Product Costing – Assigning Product Costs"— Presentation transcript:

Basics of Job-Order Costing

Actual Product Costing

Chapter 20 Part two.

Copyright © 2008 Prentice Hall. All rights reserved 3-1 Job Costing Chapter 3.

JOB ORDER COST ACCOUNTING Accounting Principles, Eighth Edition

Chapter 2 Job Order Cost Systems.

Prepared by Diane Tanner University of North Florida Chapter 2 1 Normal Costing.

Click to edit Master title style 1 Job Order Cost Systems 17.

Actual Product Costing Managerial Accounting Prepared by Diane Tanner University of North Florida Chapter 30.

JOB ORDER COST ACCOUNTING University of Louisiana at Lafayette

Accounting Principles, Ninth Edition

Job Order Costing Systems

19 Job Order Costing Accounting 26e C H A P T E R Warren Reeve Duchac

CHAPTER 19 JOB ORDER COSTING.

Managerial Accounting

Manufacturing Costs Managerial Accounting Prepared by Diane Tanner University of North Florida Chapter 29.

WHAT IS THE PROFIT ON A JERSEY? Does C&C Sports make a profit if a baseball jersey sells for $14.80? What does it really cost C&C Sports to make a baseball.

CHAPTER20 Job Order Costing. CHAPTER20 Job Order Costing.

Cost of Goods Reporting Managerial Accounting Prepared by Diane Tanner University of North Florida Chapter 33.

Job Order Cost System Chapter 21 Accounting Principles

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

Newly Launched - AI Presentation Maker

- Product Costing

- Powerpoint Templates

AI PPT Maker

Design Services

Business PPTs

Business Plan

Introduction PPT

Self Introduction

Startup Business Plan

Cyber Security

Digital Marketing

Project Management

Product Management

Artificial Intelligence

Target Market

Communication

Supply Chain

Google Slides

Research Services

All Categories

Product Costing PowerPoint Templates

Dollar Mobile Bar Graph And Monitor Icons In Circles Powerpoint Templates

Our above slide has been designed with dollar, mobile, bar graph and monitor icons. This infographic slide is best to describe text information. You can provide a fantastic explanation of the topic with this slide.

Man Holding Box With Dollar Notes Powerpoint Template

This business slide has been designed with man holding box with dollar notes. This PowerPoint template helps to display the concept of money saving. Use this PPT slide to make impressive presentations

Stack Of Dollar Notes And Gold Coins PowerPoint Template

Talking about investment is always boring and especially if somebody tries to make you understand the same, people often lose interest early. You have the same problem? Do not want to bore your audience? Choose this creatively designed PPT template having an image of piles of dollars and coins. You can use this design which clearly depicts that you may want to talk about the investment, money growth and much more. This slide can also be taken as to convey message about money planning, wealth management, strategies and planning. There are two icons present at the sides of the image. Percentage and growth icons both depict the returns or the profit you can get by investing your money at the right place. Icon, color and text are customizable. You can change them the way you want. So use this template and make your presentation interesting.

Tablet With Dollars And Folders Financial Growth Powerpoint Template

This business slide displays diagram of tablet with dollars and folders. Download this diagram to display information in visual manner. Visual effect of this diagram helps in maintaining the flow of the discussion and provides more clarity to the subject.

Ramping Up Process Flow For Finance Ppt Slides

This is a ramping up process flow for finance ppt slides. This is a six stage process. The stages in this process are business, success, marketing.

Bar Graph For Statistical Analysis Powerpoint Template

Our above PPT slide contains computer screen on a desk displaying bar graph. This PowerPoint template may be used to display statistical analysis. This template is designed to attract the attention of your audience.

PowerPoint Slides Company Measuring Growth Ppt Design

PowerPoint Slides Company Measuring Growth PPT Design-These high quality powerpoint pre-designed slides and powerpoint templates have been carefully created by our professional team to help you impress your audience. All slides have been created and are 100% editable in powerpoint. Each and every property of any graphic - color, size, orientation, shading, outline etc. can be modified to help you build an effective powerpoint presentation. Any text can be entered at any point in the powerpoint template or slide. Simply DOWNLOAD, TYPE and PRESENT!

Product Comparison Ppt PowerPoint Presentation Portfolio Styles

This is a product comparison ppt powerpoint presentation portfolio styles. This is a stage process. The stages in this process are .

PowerPoint Templates Business Leadership Seesaw Charts Currency Ppt Themes

PowerPoint Templates Business Leadership Seesaw Charts Currency PPT Themes-These high quality powerpoint pre-designed slides and powerpoint templates have been carefully created by our professional team to help you impress your audience. All slides have been created and are 100% editable in powerpoint. Each and every property of any graphic - color, size, orientation, shading, outline etc. can be modified to help you build an effective powerpoint presentation. Any text can be entered at any point in the powerpoint template or slide. Simply DOWNLOAD, TYPE and PRESENT!

Ratings and Reviews

Most relevant reviews.

February 26, 2021

by Ajay Mohan

February 27, 2021

March 1, 2021

March 2, 2021

June 2, 2021

June 3, 2021

by Sumit Kumar

June 4, 2021

by naamsrai

- You're currently reading page 1

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Exclusive access to over 200,000 completely editable slides.

- Diagram Finder

- Free Templates

- Human Resources

- Project Management

- Timelines & Planning

- Health & Wellness

- Environment

- Cause & Effect

- Executive Summary

- Customer Journey

- 30 60 90 Day Plan

- Social Media

- Escalation Matrix

- Communication

- Go to Market Plan/Strategy

- Recruitment

- Pros and Cons

- Business Plan

- Risk Management

- Roles and Responsibilities

- Mental Health

- ISO Standards

- Process Diagrams

- Puzzle Diagrams

- Organizational Charts

- Arrow Diagrams

- Infographics

- Tree Diagrams

- Matrix Charts

- Stage Diagrams

- Text Boxes & Tables

- Data Driven Charts

- Flow Charts

- Square Puzzle

- Circle Puzzle

- Circular Arrows

- Circle Segments

- Matrix Table

- Pillar Diagrams

- Triangle Puzzle

- Compare Diagrams

- Ladder Diagrams

- Google Slides

- North America Maps

- United States (US) Maps

- Europe Maps

- South America Maps

- Apple Keynote

- People & Objects

- Trending Products

- PowerPoint Templates

Product Costing PowerPoint and Google Slides Template

(5 Editable Slides)

Download Now

This template is part of our Pro Plan.

Gain access to over 200,000 slides with pro plan..

Upgrade Now

Already a Pro customer? Login

Related Products

Cost Drivers PowerPoint and Google Slides Template

(13 Editable Slides)

Cost Management PowerPoint and Google Slides Template

(15 Editable Slides)

Cost Efficiency PowerPoint and Google Slides Template

(8 Editable Slides)

Cost Optimization PowerPoint and Google Slides Template

(12 Editable Slides)

Cost Allocation PowerPoint and Google Slides Template

(11 Editable Slides)

Cash Cost Icons for PowerPoint and Google Slides

Cost Reduction PowerPoint and Google Slides Template

(7 Editable Slides)

Total Cost of Risk PowerPoint and Google Slides Template

(6 Editable Slides)

Leverage our Product Costing PPT template to demonstrate the costs incurred in the production and sale of products. Marketing heads and finance managers can use this aesthetically designed set to exhibit the importance of calculating product costing to get the right product price and gain a competitive advantage. Furthermore, you can use these PowerPoint slides to represent the benefits of product costing in financial accounting.

This deck consists of stunning graphics to create a fantastic presentation. The trendy layouts help the viewers get a better perspective of the information. So, download this awesome template right away to convey your thoughts smoothly!

Explanation of the PPT

- An overview of the concept has been explained through a listicle.

- A well-designed illustration incorporated with eye-catching icons shows the components precisely.

- The objectives of product costing have been portrayed through a creative diagram.

- The purpose of product costing has been depicted via a unique diagram clearly and concisely.

- The various costs involved in the manufacturing of a product have been presented via a table.

Salient Features

- You can apply the brand colors to every slide quickly and flawlessly.

- The objects have been prepared after meticulous research to avoid copyright infringement.

- Each graphic can be edited in just a few minutes effortlessly without assistance or technical skills.

- An excellent team of customer care executives is available 24*7 to offer solutions to your problems.

Download this set now and make a splash!

Create compelling presentations in less time

September special: Business Transformation PPT Templates

Explaining Activity-Based Costing Method in PowerPoint

- June 18, 2019

- Financial , PowerPoint templates for download

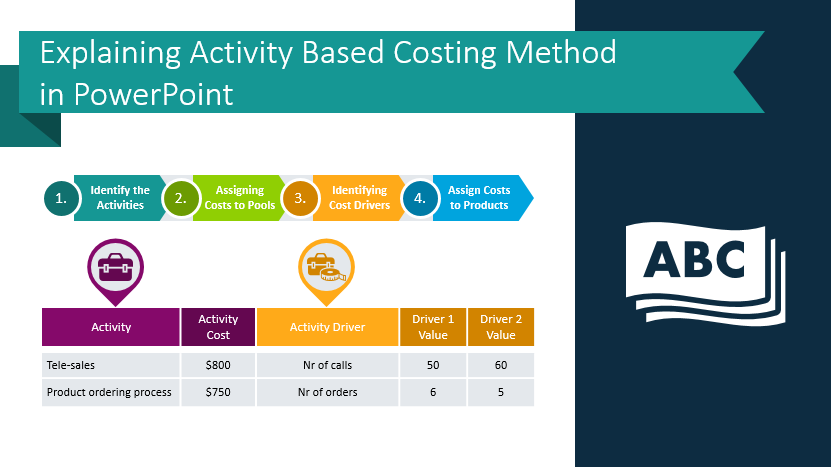

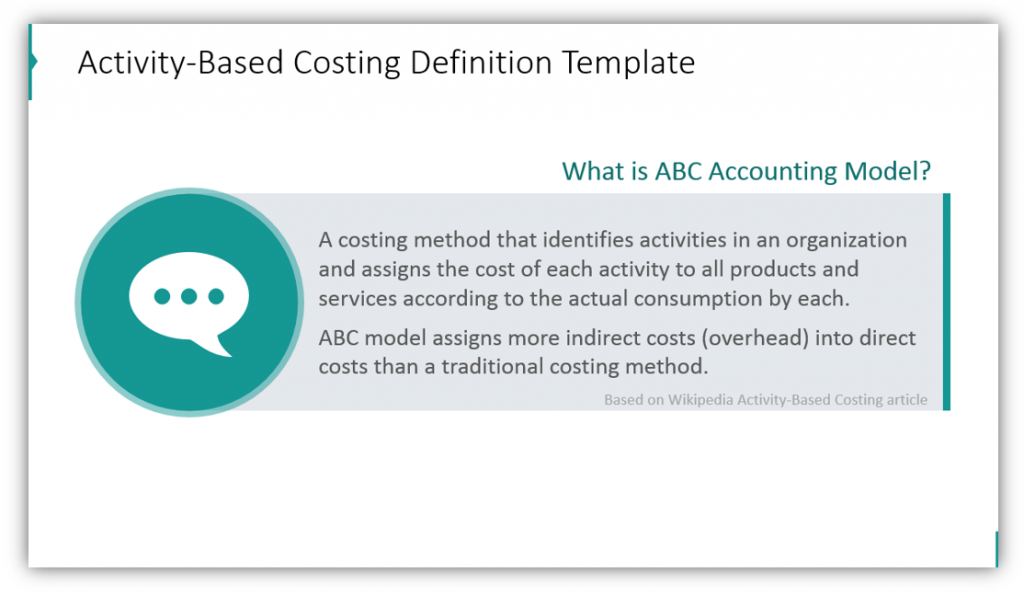

Do you need to present the Activity-Based Costing Method? The ABC Accounting Model identifies the activities in an organization. It then assigns the cost of each activity. The assignment spans products and services according to the actual consumption by each.

Explore our Business Performance PPT Reports category on the website for more resources to boost your presentation impact.

As with most things, explaining the ABC Accounting Model is easier for your audience to understand if you use visual templates and graphics.

Note: All example slides below are accessible in Activity Based Costing Accounting PPT Charts (see details by clicking the pictures).

How can Creative Graphics Improve Your Activity-Based Costing Presentations?

Define terms for your audience.

The obvious benefit of using graphics is their ability to make dense, boring information visually appealing. In this example, we are able to explain the ABC Accounting Model. The icons can be customized based on what you’re defining. The text bubble or measuring tape could easily be changed into a different, relevant icon based on the term you’re defining. The multi-definition slide or others like it could be used for shorter, less in-depth explanations.

Highlight the differences between the ABC Accounting Model and Traditional Models

In traditional costing models, fewer indirect costs are assigned to direct costs. What does that mean for your audience? Show them! Highlight what makes the ABC Accounting Model different.

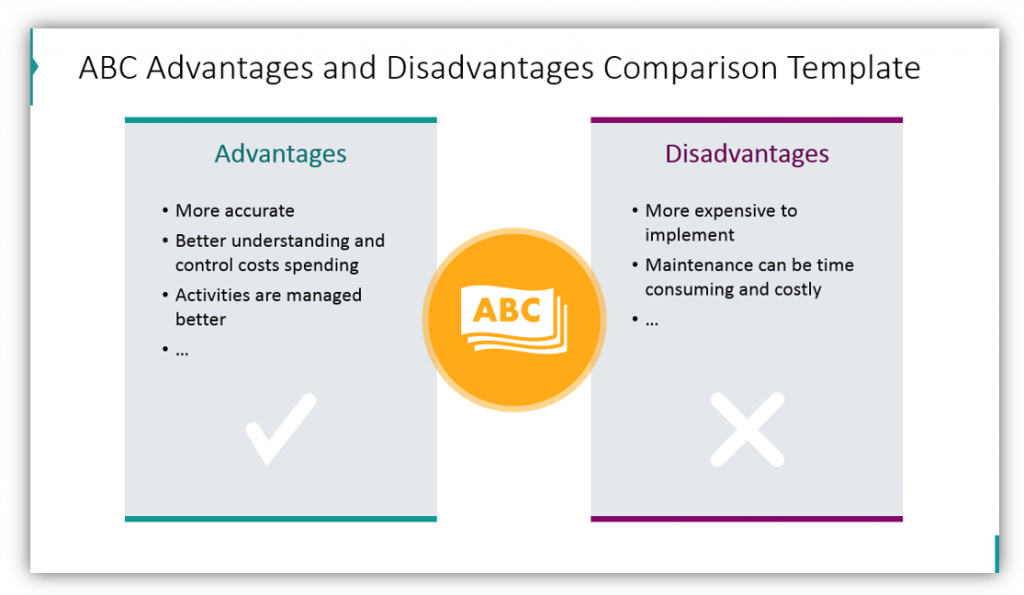

Explain the Pros & Cons of the ABC Accounting Model

Explain the pros and cons of the Activity-Based Costing Model. Share the advantages and disadvantages. Explain how those advantages and disadvantages stack up against different models.

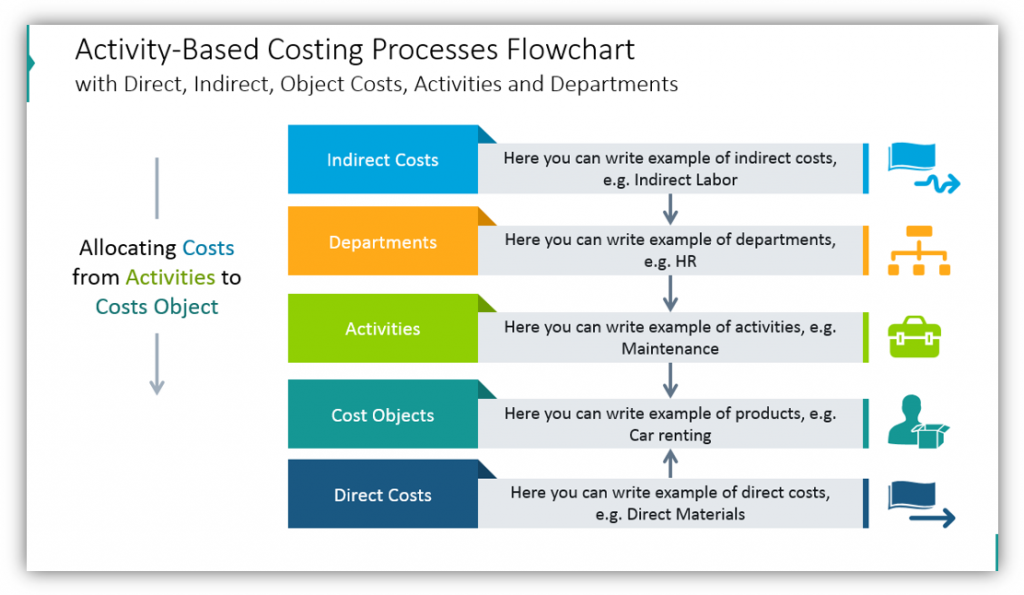

Utilize Activity Based Costing Flowcharts and Implementation Steps

Share what the processes involved look like. The flow chart example features indirect costs, departments, activities, cost objects, and direct costs. The implementation steps diagram describes the steps required to make the ABC Model a functional reality.

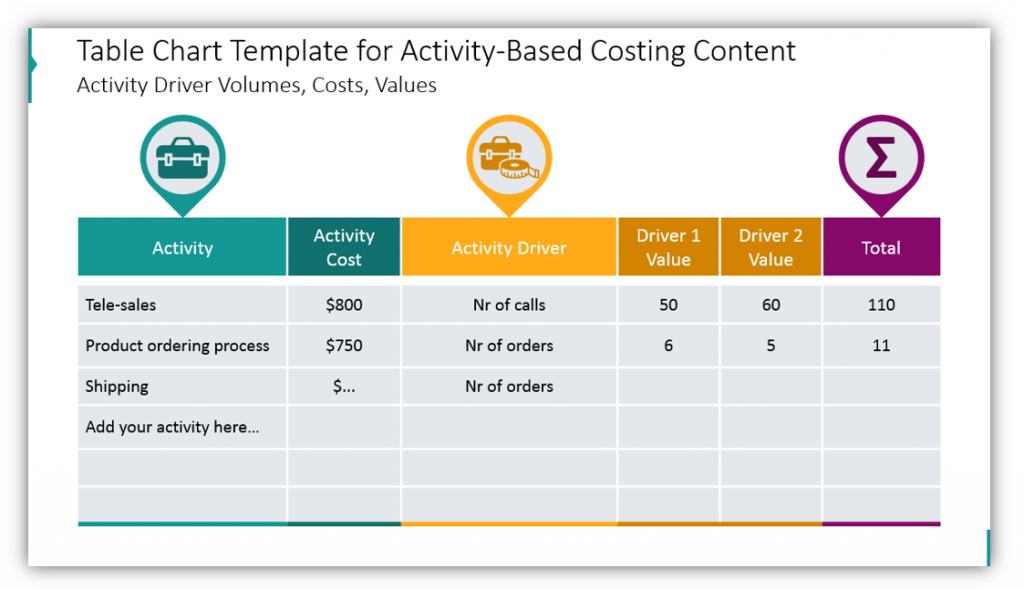

Use a Table to Bring Examples to Life

A table chart can be beneficial for demonstrating what the ABC Accounting Method looks like in practice. You can customize the colors, icons, and sizes of the images in question. After making changes, you’ll have a customized table that’s useful for breaking down how activities can be deconstructed. An activity can be looked at in terms of activity cost, activity driver, and multiple driver values.

You can define terms and highlight differences between the ABC method and traditional methods. You can break down the pros and cons of either, and then use flow charts and tables to make the concepts real to your audience.

Check our video guide on how to redesign the ABC Costing Model step by step:

Resource: Activity Based Costing Accounting Charts

By using icons and slide templates you can achieve a more professional look and consistent visual style. Professionalism goes hand in hand with competency in many cases. Why wouldn’t you take this easy step to improve the efficacy of your presentation?

Want to see the full slide deck? If you found this sampling of features of this graphics set helpful, see the full thing by clicking here:

Need more inspiration? Simple Flat Icons for the infographics collection will give you even more icon variety.

Customer Happiness & Marketing

Related Posts

How to Present Inventory and Stock Metrics in PowerPoint

- August 8, 2024

Eye-catching ways to present Debtors AR report in PowerPoint

- July 31, 2024

How to Present OpEx Analysis with Visual Impact in PowerPoint

- July 4, 2024

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

- My Wish List

- Compare Products

- Presentations

Product Costing

You must be logged in to download this file*

item details (5 Editable Slides)

(5 Editable Slides)

Related Products

Don't miss downloading our ground-breaking Product Costing PowerPoint template to describe the entire cost of a product, from manufacturing to selling it to the market. Innovation and modernism come together in this professionally made PPT.

Product managers and accounting heads can utilize these distinguished PowerPoint slides to explain product costing components, including cost planning, cost object controlling, etc. You can also highlight the purposes and objectives of product costing.

Sizing Charts

| Size | XS | S | S | M | M | L |

|---|---|---|---|---|---|---|

| EU | 32 | 34 | 36 | 38 | 40 | 42 |

| UK | 4 | 6 | 8 | 10 | 12 | 14 |

| US | 0 | 2 | 4 | 6 | 8 | 10 |

| Bust | 79.5cm / 31" | 82cm / 32" | 84.5cm / 33" | 89.5cm / 35" | 94.5cm / 37" | 99.5cm / 39" |

| Waist | 61.5cm / 24" | 64cm / 25" | 66.5cm / 26" | 71.5cm / 28" | 76.5cm / 30" | 81.5cm / 32" |

| Hip | 86.5cm / 34" | 89cm / 35" | 91.5cm / 36" | 96.5cm / 38" | 101.5cm / 40" | 106.5cm / 42" |

| Size | XS | S | M | L | XL | XXL |

|---|---|---|---|---|---|---|

| UK/US | 34 | 36 | 38 | 40 | 42 | 44 |

| Neck | 37cm / 14.5" | 38cm /15" | 39.5cm / 15.5" | 41cm / 16" | 42cm / 16.5" | 43cm / 17" |

| Chest | 86.5cm / 34" | 91.5cm / 36" | 96.5cm / 38" | 101.5cm / 40" | 106.5cm / 42" | 111.5cm / 44" |

| Waist | 71.5cm / 28" | 76.5cm / 30" | 81.5cm / 32" | 86.5cm / 34" | 91.5cm / 36" | 96.5cm / 38" |

| Seat | 90cm / 35.4" | 95cm / 37.4" | 100cm / 39.4" | 105cm / 41.3" | 110cm / 43.3" | 115cm / 45.3" |

Product and Service Costing

Nov 11, 2014

210 likes | 844 Views

Product and Service Costing. Managerial Accounting and Cost Management Product costs are used for planning, control, directing, and management decision making. Financial Accounting Product costs are used to value inventory and to compute cost of goods sold. Manufacturing overhead (OH)

Share Presentation

- manufacturing overhead

- activity based

- direct labor

- manufacturing overhead costs

- activity based costing abc

Presentation Transcript

Product and Service Costing Managerial Accounting and Cost Management Product costs are used for planning, control, directing, and management decision making. Financial Accounting Product costs are used to value inventory and to compute cost ofgoods sold.

Manufacturingoverhead (OH) Applied to eachjob using apredeterminedrate Accumulating Costs in aJob-Order Costing System Directmaterials Traced directly to each job THE JOB Traced directly to each job Direct labor

Budgeted manufacturing overhead cost POHR = Budgeted amount of cost driver (or activity base) Manufacturing Overhead Costs Overhead is applied to jobs using a predetermined overhead rate (POHR) based on estimates made at the beginning of the accounting period. Overhead applied = POHR × Actual activity Based on estimates, anddetermined before the period begins Actual amount of the allocation base, such as direct labor hours, incurred during the period

Job Cost Sheets Job Cost Sheets Job Cost Sheets Job-Cost Records Manufacturing Overhead Account Job-Order CostingDocument Flow Summary The materials requisition indicates the cost of direct materialto charge tojobsand the cost of indirect materialto charge to overhead. Direct materials Materials Ledger Cards Materials Ledger Cards Materials Ledger Cards MaterialsRequisition Indirect materials

Job Cost Sheets Job Cost Sheets Job Cost Sheets Job-Cost Records Manufacturing Overhead Account Job-Order CostingDocument Flow Summary Direct Labor Employee time tickets indicate the cost of direct laborto charge tojobsand the costofindirect laborto charge to overhead. Employee Time Ticket Employee Time Ticket Employee Time Ticket Employee Time Ticket Indirect Labor

Job-Order CostingDocument Flow Summary IndirectLabor EmployeeTime Ticket Overhead AppliedwithPOHR OtherActual OHCharges Manufacturing Overhead Account Job-Cost Records MaterialsRequisition IndirectMaterial

The Concept of Activity-Based Costing (ABC) Activity-Based Costing Departmental Overhead Rates Level of Complexity Plantwide Overhead Rate Overhead Allocation

Activity-Based Costing In the ABC method, we recognize that many activities within a department drive overhead costs.

Assigning Costs to Activity Centers Assign costs to the activity centers where they are accumulated while waiting to be applied to products.

Assign costs from the activity center to the product using appropriate cost drivers. When selecting a cost driver consider: The ease of obtaining data. The degree to which the cost driver measures actual consumption by products. Selecting Cost Drivers

- More by User

Joint Product and By-Product Costing

Joint Product and By-Product Costing. Joint Production Process. Pork Meat. Material: Hog. Processing. Hides. Split-Off Point. Joint Production Process. Joint products are two or more products produced simultaneously by the same process up to a “split-off” point.

1.97k views • 17 slides

TRADITIONAL PRODUCT COSTING METHODS

TRADITIONAL PRODUCT COSTING METHODS. Accounting Principles II AC 2102 - Fall Semester, 1999. Unit Product Costs. The unit cost is the total costs associated with the units divided by the number of units produced The concept is deceptively simple

2.34k views • 30 slides

Product Costing Systems

Product Costing Systems. JOIN KHALID AZIZ. ECONOMICS OF ICMAP, ICAP, MA-ECONOMICS, B.COM. FINANCIAL ACCOUNTING OF ICMAP STAGE 1,3,4 ICAP MODULE B, B.COM, BBA, MBA & PIPFA. COST ACCOUNTING OF ICMAP STAGE 2,3 ICAP MODULE D, BBA, MBA & PIPFA. CONTACT: 0322-3385752 0312-2302870

938 views • 58 slides

Product costing

Three Sections – Three Cases. AC 440 Cost Accounting. Product costing. Budgetary control and decision making. Incentives in decentralized organizations. Puzzle Pieces. Learning from each other. Knowledge base. Analyzing business issues. Fun. Drawing connections. Problem-solving:

248 views • 5 slides

Product Costing Systems: Concepts and Design Issues

Product Costing Systems: Concepts and Design Issues. Chapter 2. What is the Cost?. Several years ago you purchased a bottle of wine for $25. Today it is worth $75. If you give the bottle to a friend as a gift, what is the cost of your gift? $0 $25 $25+ $75 ($50). Cost Objects.

932 views • 25 slides

Product and Service Costing: Job-Order System

5. CHAPTER. Product and Service Costing: Job-Order System. 1. OBJECTIVE. Characteristics of the Production Process. Manufacturing Firms versus Service Firms. Manufacturing firms Combines direct materials, direct labor, and overhead to produce a new product. Service firms

464 views • 23 slides

Product Costing in Service and Manufacturing Entities

Product Costing in Service and Manufacturing Entities. Chapter 11. Introduction. Financial Accounting Product costs are used to value inventory and to compute cost of goods sold. . Managerial Accounting Product costs are used for planning, control, directing, and management decision making.

911 views • 57 slides

PRODUCT COSTING

PRODUCT COSTING. Süleyman ÜSTEK Industrial Engineering Department, Dokuz Eyl ü l University , Turkey. WHAT IS COST?. To have a good or service what is put forward as direct and indirect expenditures is the total cost .

385 views • 22 slides

2. Product Costing Systems: Concepts and Design Issues. Learning Objective 1. The Meaning of Cost. The use of valuable resources, in order to achieve a stated purpose. In accounting, cost is reported in monetary terms. . Product Costs

1.29k views • 72 slides

Fundamentals of Product and Service Costing

Fundamentals of Product and Service Costing. Cost Accounting-II Dr. Salah Hammad Lecture 1. 6 - 1. Cost System. Keys to a good cost system:. Oriented to the needs of the decision makers. Designed so that benefits exceed costs. 6 - 2. Cost Management Systems.

373 views • 15 slides

2. Product Costing Systems: Concepts and Design Issues. Learning Objective 1. The Meaning of Cost. The use of valuable resources, in order to achieve a stated purpose. In accounting, cost is reported in monetary terms. Product Costs

925 views • 73 slides

PRODUCT COSTING 2

PRODUCT COSTING 2. JOIN KHALID AZIZ. ECONOMICS OF ICMAP, ICAP, MA-ECONOMICS, B.COM. FINANCIAL ACCOUNTING OF ICMAP STAGE 1,3,4 ICAP MODULE B, B.COM, BBA, MBA & PIPFA. COST ACCOUNTING OF ICMAP STAGE 2,3 ICAP MODULE D, BBA, MBA & PIPFA. CONTACT: 0322-3385752 0312-2302870

762 views • 43 slides

Product and Service Costing: Overhead Application and Job-Order System

Product and Service Costing: Overhead Application and Job-Order System. Prepared by Douglas Cloud Pepperdine University. Objectives. 1. Differentiate the cost accounting systems of service and manufacturing firms and of unique and standardized products.

726 views • 51 slides

Chapter 9 Joint Product and By-Product Costing

Chapter 9 Joint Product and By-Product Costing. Key Topics: Joint processes and common costs Main products and byproducts Allocation methods Choosing a method Using joint cost allocation information Decisions to process further Choosing a method Uses of joint costing information.

957 views • 14 slides

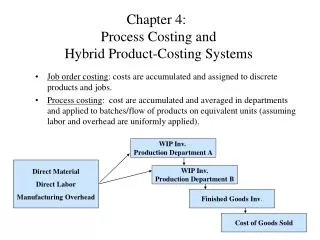

Chapter 4: Process Costing and Hybrid Product-Costing Systems

Chapter 4: Process Costing and Hybrid Product-Costing Systems. Job order costing : costs are accumulated and assigned to discrete products and jobs.

785 views • 5 slides

Joint Product and By-Product Costing. Prepared by Douglas Cloud Pepperdine University. Objectives. 1. Identify the characteristics of the joint production process. 2. Allocate joint product costs according to the benefits-received approaches and the relative market value approaches.

574 views • 20 slides

Product Costing in Service and Manufacturing Entities. Chapter 11. Introduction. Financial Accounting Product costs are used to value inventory and to compute cost of goods sold. Managerial Accounting Product costs are used for planning, control, directing, and management decision making.

698 views • 57 slides

Fundamentals of Product and Service Costing. Chapter 6. Edited by Dr. Charles Bailey for ACCT3310. Learning Objectives. LO 6-1 Explain the fundamental themes underlying the design of cost systems. LO 6-2 Explain how cost allocation is used in a cost management system.

705 views • 36 slides

Joint and by-product costing

CHAPTER 7. Joint and by-product costing. 7.1. Figure 1 Production process for joint and by-products. Joint products are not identifiable as different individual products until split- off point. Therefore, joint costs cannot be traced to individual products.

141 views • 9 slides

Product and Process Costing

Product and Process Costing. Module 10. Product & Process Costing. Introduction Product costing Job costing Process costing Cost Sheet Costing Procedure Loss treatment Equivalent units Operation costing. Product Costing. Financial Accounting

495 views • 43 slides

Product and Service Costing: Job-Order System. ChapteR 5. chapter 5 Objectives. Differentiate the cost accounting systems of service and manufacturing firms and of unique and standardized products Discuss the interrelationship of cost accumulation, cost measurement, and cost assignment

696 views • 47 slides

Newly Launched - AI Presentation Maker

AI PPT Maker

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Product costing template powerpoint presentation

Interest in your idea will increase exponentially due to our Product Costing Template Powerpoint Presentation. It generates intense focus.

- Add a user to your subscription for free

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting product costing template powerpoint presentation. Presenting product costing template powerpoint presentation. This is a product costing template powerpoint presentation. This is six stage process. The stages in this process are equivalent production, computation of cost, valuation of output units, raw material expenses, process costs, tool cost.

People who downloaded this PowerPoint presentation also viewed the following :

- Diagrams , Business

- Equivalent Production ,

- Computation Of Cost ,

- Valuation Of Output Units ,

- Raw Material Expenses ,

- Process Costs ,

Product costing template powerpoint presentation with all 7 slides:

Leave your audience totally enraptured. Your thoughts and our Product Costing Template Powerpoint Presentation will definitely delight.

Ratings and Reviews

by Liam Perez

May 31, 2021

by Cristobal West

May 30, 2021

- Preferences

Product And Service Costing PowerPoint PPT Presentations

COMMENTS

A product cost analysis is a financial assessment that focuses on the various costs associated with manufacturing a particular service or product. It involves distinguishing costs such as materials, labor, overhead, and other production-related expenditures.

Find predesigned Product Cost Powerpoint Presentation Slides PowerPoint templates slides, graphics, and image designs provided by SlideTeam.

Product costing gives you the chance to determine optimal selling prices and take steps toward cost reduction.

Presenting our new, product cost management PowerPoint presentation slides. We have conceptualized these slides around tools, processes, methods, and culture used by firms who develop and manufacture products to ensure that a product meets its profit target.

Presentation transcript: 1 Module 17 Product Costing. 2 Product and Period Costs. For production companies all costs are either: Product Costs Period Costs All production costs necessary to get products ready to sell All costs other than product costs. 3 Product Costs and Accounts. 4 Direct Materials Costs of primary raw materials that are ...

Product Costing/Job Costing. Cost Classification Manufacturing Cost - Is the cost of manufacturing a product, it consists of direct and indirect costs Direct Costs - Are costs that are directly linked to a product/service e.g. raw materials, direct labour, direct expenses e.g. hire of special equipment Indirect Cost - Not directly linked to ...

Template (4:3) Statistics, charts, checklists and more to visualize your strategies and steps for effective product cost management. Competitors' products often have varying characteristics, such as price and quality. Production costs, including those accrued during the product's design and development phase, must also be taken into account.

Product Costing.pptx - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. This document discusses key concepts in managerial accounting including: 1) Managerial accounting provides internal managers with information for planning, control, and decision making, unlike financial accounting which is for external users. 2 ...

Product costing is the process of calculating the total expenses incurred in manufacturing a product, including direct materials, labor, and overheads.

Presenting this set of slides with name product costing systems ppt powerpoint presentation outline tips cpb. This is an editable Powerpoint five stages graphic that deals with topics like product costing systems to help convey your message better graphically.

10 Incurring Direct Labor Costs. 1 Employees fill out time tickets to record the time spent on each product/service Factory/Production Area 2 The processed form is sent to Accounting. Direct labor cost = Gross wages + fringe benefits Gross wages = Wage rate × Hours worked DR Work in Process Inventory CR Wages Payable or Cash 10.

Utilize our PPT templates to discuss various product costing methodologies - process costing, job costing, direct and throughput costings - and decide a suitable one as per your product and organization's environment. You can use these PowerPoint slides to compare the product costing against the benefits you acquire from that product.

SAP Product Costing 101 - Product Costing Overview - Free download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online.

Leverage our Product Costing PPT template to demonstrate the costs incurred in the production and sale of products. Marketing heads and finance managers can use this aesthetically designed set to exhibit the importance of calculating product costing to get the right product price and gain a competitive advantage. Furthermore, you can use these PowerPoint slides to represent the benefits of ...

Template 5: New Product Cost Analysis PPT Slide. This 19-slide expertly crafted PPT Template covers everything you need to know about new product development. It highlights the production and operation cost analysis, cost-benefit charts, and marketing and launch price estimates.

If you are presenting or explaining the Activity Based Costing Method, make sure to illustrate complex concepts. For this, use PPT slides.

Download our stimulating Product Costing PPT template to explain various expenses incurred to manufacture a product and sell it to the customers.

Presentation Transcript. Product and Service Costing Managerial Accounting and Cost Management Product costs are used for planning, control, directing, and management decision making. Financial Accounting Product costs are used to value inventory and to compute cost ofgoods sold. Budgeted manufacturing overhead cost POHR = Budgeted amount of ...

Creating stunning presentation on Product Costing Template Powerpoint Presentation with predesigned templates, ppt slides, graphics, images, and icons.

View Product And Service Costing PPTs online, safely and virus-free! Many are downloadable. Learn new and interesting things. Get ideas for your own presentations. Share yours for free!