Research on Risk Management of Scientific Research Projects

New citation alert added.

This alert has been successfully added and will be sent to:

You will be notified whenever a record that you have chosen has been cited.

To manage your alert preferences, click on the button below.

New Citation Alert!

Please log in to your account

Information & Contributors

Bibliometrics & citations, index terms.

Social and professional topics

Professional topics

Recommendations

Research on risk integrated management of defense research projects based on three-dimensional structure.

Based on Hall's "three-dimensional structure system", combined with the characteristics of defense research projects, according to the theory, technology and methods of project risk management, the multilevel defense research project risk management ...

Risk management for IT and software projects

Risk management can be defined as a systematic process for identifying, analyzing and controlling risks in projects or organizations. Definitions and illustrations of risks are given; in particular, a list of ten risk factors which occur most frequently ...

Risk and risk management in software projects: A reassessment

Controlling risk in software projects is considered to be a major contributor to project success. This paper reconsiders the status of risk and risk management in the literature and practice. The analysis is supported by a study of risk practices in ...

Information

Published in.

In-Cooperation

- Beijing University of Technology

Association for Computing Machinery

New York, NY, United States

Publication History

Permissions, check for updates, author tags.

- Risk management

- Scientific research project

- member change

- Research-article

- Refereed limited

Contributors

Other metrics, bibliometrics, article metrics.

- 0 Total Citations

- 146 Total Downloads

- Downloads (Last 12 months) 13

- Downloads (Last 6 weeks) 0

View Options

Login options.

Check if you have access through your login credentials or your institution to get full access on this article.

Full Access

View options.

View or Download as a PDF file.

View online with eReader .

Share this Publication link

Copying failed.

Share on social media

Affiliations, export citations.

- Please download or close your previous search result export first before starting a new bulk export. Preview is not available. By clicking download, a status dialog will open to start the export process. The process may take a few minutes but once it finishes a file will be downloadable from your browser. You may continue to browse the DL while the export process is in progress. Download

- Download citation

- Copy citation

We are preparing your search results for download ...

We will inform you here when the file is ready.

Your file of search results citations is now ready.

Your search export query has expired. Please try again.

Project Risk Management

- First Online: 06 April 2021

Cite this chapter

- Gündüz Ulusoy 3 &

- Öncü Hazır 4

Part of the book series: Springer Texts in Business and Economics ((STBE))

1657 Accesses

Risk management is essential to effective project management. We summarize project risk management and its phases in this Chapter. Project risk items are discussed and building a risk register is addressed. The design of a risk management process is introduced in detail. Qualitative and quantitative risk analysis methods are presented. We explore the application of the decision trees in project risk management. Finally, we present a team discussion case study illustrating the implementation of these concepts.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Borgonovo, E., & Plischke, E. (2016). Sensitivity analysis: A review of recent advances. European Journal of Operational Research, 248 , 869–887.

Article Google Scholar

Brânzei, R., Ferrari, G., Fragnelli, V., & Tijs, S. (2002). Two approaches to the problem of sharing delay costs in joint projects. Annals of Operations Research, 109 (1–4), 359–374.

Chapman, R. J. (2001). The controlling influences on effective risk identification and assessment for construction design management. International Journal of Project Management, 19 (3), 147–160.

Choi, T. M., Chan, H. K., & Yue, X. (2017). Recent development in big data analytics for business operations and risk management. IEEE Transactions on Cybernetics, 47 (1), 81–92.

Cooper, D., Bosnich, P., Grey, S., Raymond, G., Purdy, G., Walker, P., & Wood, M. (2014). Project risk management guidelines: Managing risk with ISO 31000 and IEC 62198 . New York: Wiley.

Google Scholar

Graves, R. (2000) Qualitative risk assessment. PM Network, October: 61–66.

Herroelen, W. (2014). A risk integrated methodology for project planning under uncertainty. In P. S. Pulat, S. Sarin, & R. Uzsoy (Eds.), Essays in planning, scheduling and optimization: A festschrift in honor of Prof. S. E. Elmaghraby (pp. 203–217). Boston: Springer.

Chapter Google Scholar

Hillson, D. (2002). Use a risk breakdown structure (RBS) to understand your risks (Paper presented at Project Management Institute Annual Seminars and Symposium, San Antonio, TX). Newtown Square: Project Management Institute.

Hillson, D., Grimaldi, S., & Rafele, C. (2006). Managing project risks using a cross risk breakdown matrix. Risk Management, 8 (1), 61–76.

Hu, Y., Du, J., Zhang, X., Hao, X., Ngai, E. W. T., Fan, M., & Liu, M. (2013). An integrative framework for intelligent software project risk planning. Decision Support Systems, 55 (4), 927–937.

Kangari, R., & Boyer, L. T. (1989). Risk management by expert systems. Project Management Journal, 20 (1), 40–45.

Komendantova, N., Patt, A., Barras, L., & Battaglini, A. (2012). Perception of risks in renewable energy projects: The case of concentrated solar power in North Africa. Energy Policy, 40 , 103–109.

Krane, H. P., Rolstadås, A., & Olsson, N. O. (2010). Categorizing risks in seven large projects-which risks do the projects focus on? Project Management Journal, 41 (1), 81–86.

Larson, E. W., & Gray, C. F. (2014). Project management. The managerial process (6th ed.). New York: McGraw Hill.

Marcelino-Sádaba, S., Pérez-Ezcurdia, A., Lazcano, A. M. E., & Villanueva, P. (2014). Project risk management methodology for small firms. International Journal of Project Management, 32 (2), 327–340.

Olsson, N. O., & Bull-Berg, H. (2015). Use of big data in project evaluations. International Journal of Managing Projects in Business, 8 (3), 491–512.

Patterson, F. D., & Neailey, K. (2002). A risk register database system to aid the management of project risk. International Journal of Project Management, 20 , 365–374.

PMI. (2009). Practice standard for project risk management . Newtown Square: Project Management Institute. ISBN: 978-1-933890-38-8.

PMI. (2013). A guide to the project management body of knowledge (PMBOK ® guide) (5th ed.). Newtown Square: Project Management Institute.

Rees, M. (2015). Business risk and simulation modelling in practice: Using excel, VBA and@ RISK . Singapore: Wiley.

Book Google Scholar

Sanchez-Cazorla, A., Alfalla-Luque, R., & Irimia-Dieguez, A. I. (2016). Risk identification in megaprojects as a crucial phase of risk management: A literature review. Project Management Journal, 47 (6), 75–93.

Wideman, R. M. (Ed.). (1992). Project and program risk management: A guide to managing project risks and opportunities . Newtown Square: Project Management Institute.

Download references

Author information

Authors and affiliations.

Faculty of Engineering and Natural Sciences, Sabancı University, Orhanlı, Tuzla, Istanbul, Turkey

Gündüz Ulusoy

Rennes School of Business, Rennes, France

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this chapter

Ulusoy, G., Hazır, Ö. (2021). Project Risk Management. In: An Introduction to Project Modeling and Planning. Springer Texts in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-61423-2_11

Download citation

DOI : https://doi.org/10.1007/978-3-030-61423-2_11

Published : 06 April 2021

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-61422-5

Online ISBN : 978-3-030-61423-2

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Frontiers in Applied Mathematics and Statistics

- Mathematical Finance

- Research Topics

Risk Management Models and Theories

Total Downloads

Total Views and Downloads

About this Research Topic

Volume 2 of this Research Topic is available here . The aim of this Research Topic is to create a platform for authors to explore, analyze and discuss current and innovative financial models ...

Keywords : Risk Models, Risk Management, Risk Measurement, Risk Forecasting, Risk Theories

Important Note : All contributions to this Research Topic must be within the scope of the section and journal to which they are submitted, as defined in their mission statements. Frontiers reserves the right to guide an out-of-scope manuscript to a more suitable section or journal at any stage of peer review.

Topic Editors

Topic coordinators, recent articles, submission deadlines.

Submission closed.

Participating Journals

Total views.

- Demographics

No records found

total views article views downloads topic views

Top countries

Top referring sites, about frontiers research topics.

With their unique mixes of varied contributions from Original Research to Review Articles, Research Topics unify the most influential researchers, the latest key findings and historical advances in a hot research area! Find out more on how to host your own Frontiers Research Topic or contribute to one as an author.

- Contact sales

Start free trial

The Risk Management Process in Project Management

When you start the planning process for a project, one of the first things you need to think about is: what can go wrong? It sounds negative, but pragmatic project managers know this type of thinking is preventative. Issues will inevitably come up, and you need a mitigation strategy in place to know how to manage risks when project planning .

But how do you work towards resolving the unknown? It sounds like a philosophical paradox, but don’t worry—there are practical steps you can take. In this article, we’ll discuss strategies that let you get a glimpse at potential risks, so you can identify and track risks on your project.

What Is Risk Management on Projects?

Project risk management is the process of identifying, analyzing and responding to any risk that arises over the life cycle of a project to help the project remain on track and meet its goal. Risk management isn’t reactive only; it should be part of the planning process to figure out the risk that might happen in the project and how to control that risk if it in fact occurs.

A risk is anything that could potentially impact your project’s timeline, performance or budget. Risks are potentialities, and in a project management context, if they become realities, they then become classified as “issues” that must be addressed with a risk response plan . So risk management, then, is the process of identifying, categorizing, prioritizing and planning for risks before they become issues.

Risk management can mean different things on different types of projects. On large-scale projects, risk management strategies might include extensive detailed planning for each risk to ensure mitigation strategies are in place if project issues arise. For smaller projects, risk management might mean a simple, prioritized list of high, medium and low-priority risks.

Get your free

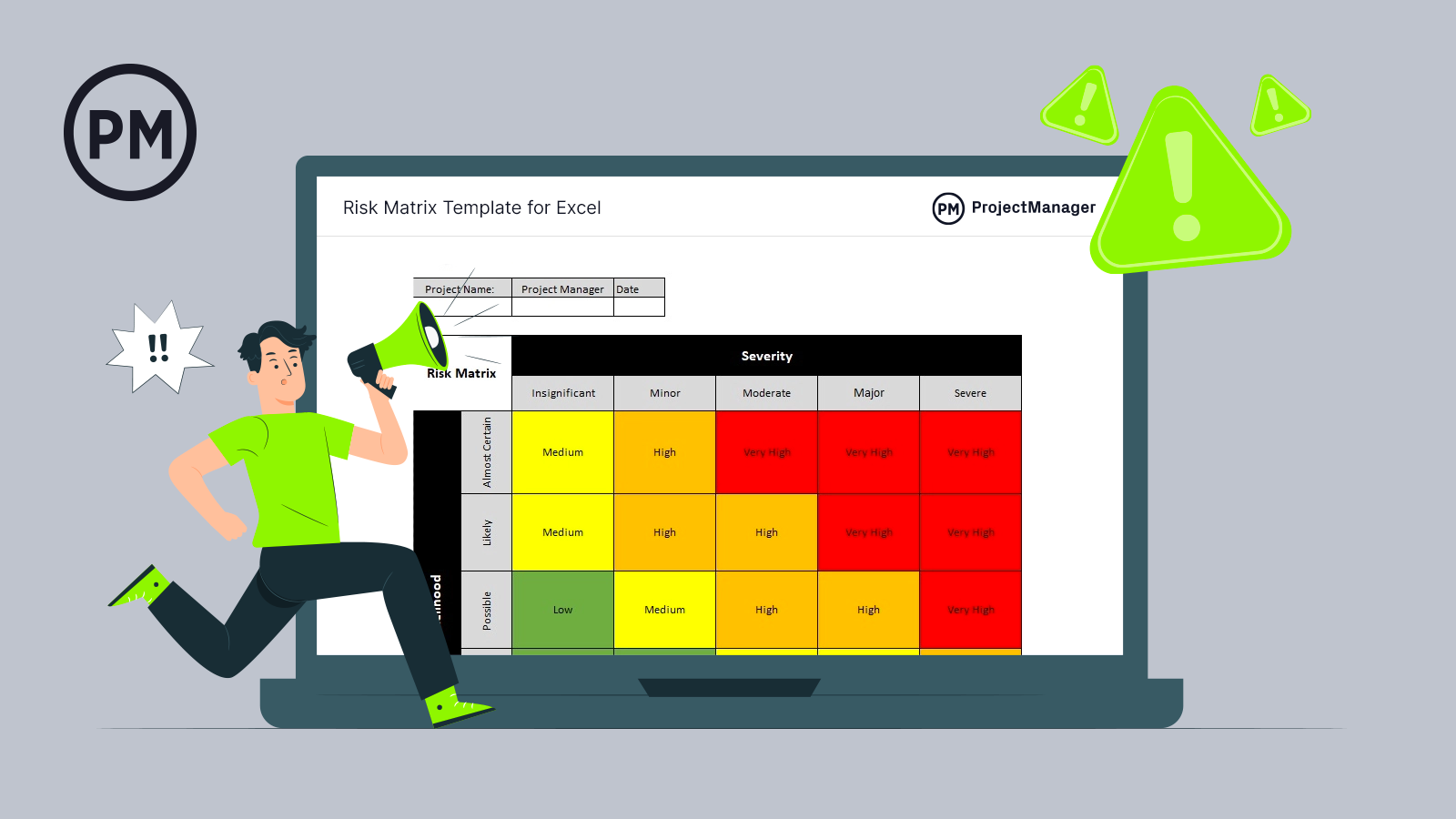

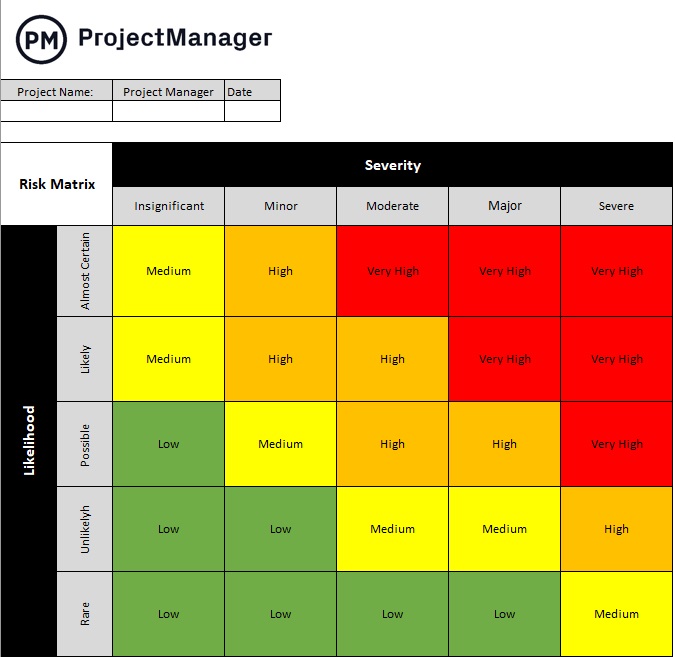

Risk Matrix Template

Use this free Risk Matrix Template for Excel to manage your projects better.

How to Manage Project Risk

To begin managing risk, it’s crucial to start with a clear and precise definition of what your project has been tasked to deliver. In other words, write a very detailed project charter , with your project vision, objectives, scope and deliverables. This way risks can be identified at every stage of the project. Then you’ll want to engage your team early in identifying any and all risks.

Don’t be afraid to get more than just your team involved to identify and prioritize risks, too. Many project managers simply email their project team and ask to send them things they think might go wrong on the project. But to better plot project risk, you should get the entire project team, your client’s representatives, and vendors into a room together and do a risk identification session.

With every risk you define, you’ll want to log it somewhere—using a risk tracking template helps you prioritize the level of risk. Then, create a risk management plan to capture the negative and positive impacts of the project and what actions you will take to deal with them. You’ll want to set up regular meetings to monitor risk while your project is ongoing. Transparency is critical.

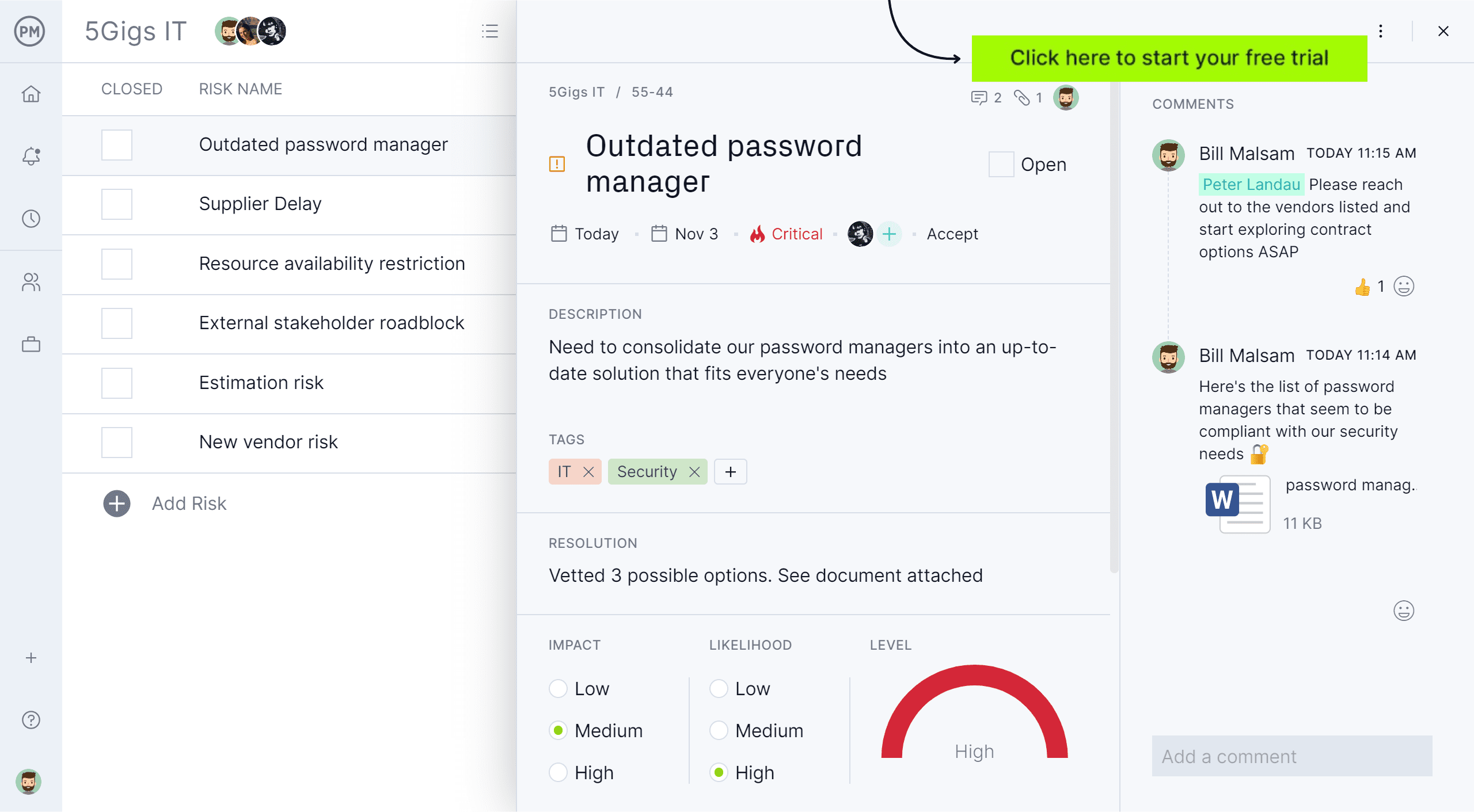

Project management software can help you keep track of risk. ProjectManager is online software that helps you identify risks, track them and calculate their impact. With our Risk view, you can make a risk list with your team and stay on top of all the risks within your project. Write a description, add tags, identify a resolution, mark impact and likelihood, even see a risk matrix—all in one place. Get started today with a free trial.

What Is Positive Risk in Project Management?

Not all risk is created equally. Risk can be either positive or negative, though most people assume risks are inherently the latter. Where negative risk implies something unwanted that has the potential to irreparably damage a project, positive risks are opportunities that can affect the project in beneficial ways.

Negative risks are part of your risk management plan, just as positive risks should be, but the difference is in approach. You manage and account for known negative risks to neuter their impact, but positive risks can also be managed to take full advantage of them.

There are many examples of positive risks in projects: you could complete the project early; you could acquire more customers than you accounted for; you could imagine how a delay in shipping might open up a potential window for better marketing opportunities, etc. It’s important to note, though, that these definitions are not etched in stone. Positive risk can quickly turn to negative risk and vice versa, so you must be sure to plan for all eventualities with your team.

Managing Risk Throughout the Organization

Can your organization also improve by adopting risk management into its daily routine? Yes! Building a risk management protocol into your organization’s culture by creating a consistent set of risk management tools and templates, with training, can reduce overhead over time. That way, each time you start a new project, it won’t be like having to reinvent the wheel.

Things such as your organization’s records and history are an archive of knowledge that can help you learn from that experience when approaching risk in a new project. Also, by adopting the attitudes and values of your organization to become more aware of risk, your organization can develop a risk culture . With improved governance comes better planning, strategy, policy and decisions.

Free Risk Matrix Template

To manage project risks throughout your organization, it’s important to create a risk matrix. A risk matrix is going to help you organize your risks by severity and likelihood, so you can stay on top of potential issues that threaten the greatest impact. Try this free risk matrix template for Excel so you and your team can organize project risks.

6 Steps in the Risk Management Process

So, how do you handle something as seemingly elusive as project risk management? You make a risk management plan. It’s all about the process. Turn disadvantages into an advantage by following these six steps.

Identify the Risk

You can’t resolve a risk if you don’t know what it is. There are many ways to identify risk. As you do go through this step, you’ll want to collect the data in a risk register .

One way is brainstorming with your team, colleagues or stakeholders. Find the individuals with relevant experience and set up interviews so you can gather the information you’ll need to both identify and resolve the risks. Think of the many things that can go wrong. Note them. Do the same with historical data on past projects. Now your list of potential risks has grown.

Make sure the risks are rooted in the cause of a problem. Basically, drill down to the root cause to see if the risk is one that will have the kind of impact on your project that needs identifying. When trying to minimize risk, it’s good to trust your intuition. This can point you to unlikely scenarios that you just assume couldn’t happen. Use a risk breakdown structure process to weed out risks from non-risks.

Analyze the Risk

Analyzing risk is hard. There is never enough information you can gather. Of course, a lot of that data is complex, but most industries have best practices, which can help you with your risk analysis . You might be surprised to discover that your company already has a framework for this process.

When you assess project risk you can ultimately and proactively address many impacts, such as avoiding potential litigation, addressing regulatory issues, complying with new legislation, reducing your exposure and minimizing impact.

So, how do you analyze risk in your project? Through qualitative and quantitative risk analysis, you can determine how the risk is going to impact your schedule and budget.

Project management software helps you analyze risk by monitoring your project. ProjectManager takes that one step further with real-time dashboards that display live data. Unlike other software tools, you don’t have to set up our dashboard. It’s ready to give you a high-level view of your project from the get-go. We calculate the live date and then display it for you in easy-to-read graphs and charts. Catch issues faster as you monitor time, costs and more.

Prioritize Risks & Issues

Not all risks are created equally. You need to evaluate the risk to know what resources you’re going to assemble towards resolving it when and if it occurs.

Having a large list of risks can be daunting. But you can manage this by simply categorizing risks as high, medium or low. Now there’s a horizon line and you can see the risk in context. With this perspective, you can begin to plan for how and when you’ll address these risks. Then, if risks become issues, it’s advisable to keep an issue log so you can keep track of each of them and implement corrective actions.

Some risks are going to require immediate attention. These are the risks that can derail your project. Failure isn’t an option. Other risks are important, but perhaps do not threaten the success of your project. You can act accordingly. Then there are those risks that have little to no impact on the overall project’s schedule and budget . Some of these low-priority risks might be important, but not enough to waste time on.

Assign an Owner to the Risk

All your hard work identifying and evaluating risk is for naught if you don’t assign someone to oversee the risk. In fact, this is something that you should do when listing the risks. Who is the person who is responsible for that risk, identifying it when and if it should occur and then leading the work toward resolving it?

That determination is up to you. There might be a team member who is more skilled or experienced in the risk. Then that person should lead the charge to resolve it. Or it might just be an arbitrary choice. Of course, it’s better to assign the task to the right person, but equally important in making sure that every risk has a person responsible for it.

Think about it. If you don’t give each risk a person tasked with watching out for it, and then dealing with resolving it when and if it should arise, you’re opening yourself up to more risk. It’s one thing to identify risk, but if you don’t manage it then you’re not protecting the project.

Respond to the Risk

Now the rubber hits the road. You’ve found a risk. All that planning you’ve done is going to be put to use. First, you need to know if this is a positive or negative risk. Is it something you could exploit for the betterment of the project? If not you need to deploy a risk mitigation strategy .

A risk mitigation strategy is simply a contingency plan to minimize the impact of a project risk. You then act on the risk by how you prioritize it. You have communications with the risk owner and, together, decide on which of the plans you created to implement to resolve the risk.

Monitor the Risk

You can’t just set forces against risk without tracking the progress of that initiative. That’s where the monitoring comes in. Whoever owns the risk will be responsible for tracking its progress toward resolution. However, you’ll need to stay updated to have an accurate picture of the project’s overall progress to identify and monitor new risks.

You’ll want to set up a series of project meetings to manage the risks. Make sure you’ve already decided on the means of communication to do this. It’s best to have various channels dedicated to communication.

Whatever you choose to do, remember to always be transparent. It’s best if everyone in the project knows what is going on, so they know what to be on the lookout for and help manage the process.

In the video below, Jennifer Bridges, professional project manager (PMP) dives deeper into the steps in the risk management process.

Risk Management Templates

We’ve created dozens of free project management templates for Excel and Word to help you manage projects. Here are some of our risk management templates to help you as you go through the process of identifying, analyzing, prioritizing and responding to risks.

Risk Register Template

A risk register is a risk management document that allows project managers to identify and keep track of potential project risks. Using a risk register to list down project risks is one of the first steps in the risk management process and one of the most important because it sets the stage for future risk management activities.

A risk matrix is a project management tool that allows project managers to analyze the likelihood and potential impact of project risks. This helps them prioritize project risks and build a risk mitigation plan to respond to those risks if they were to occur.

Managing Risk With ProjectManager

Using a risk-tracking template is a start, but to gain even more control over your project risks you’ll want to use project management software. ProjectManager has a number of tools including risk management that let you address risks at every phase of a project.

Make an Online Risk Register

Identify and track all the risks for your project in one place. Unlike other project management software, you can manage risks alongside your project rather than in a separate tool. Set due dates, mark priority, identify resolutions and more.

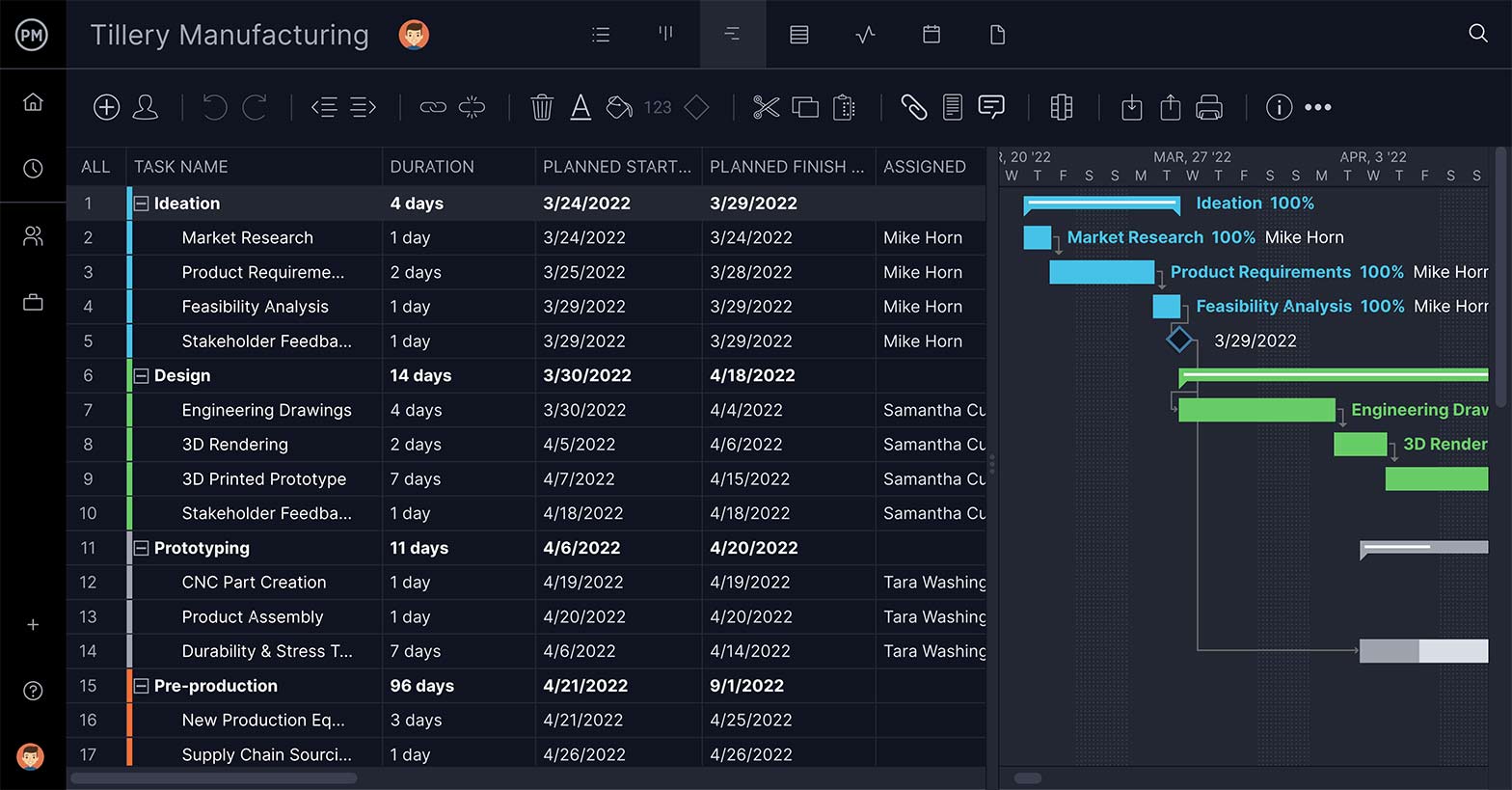

Gantt Charts for Risk Management Plans

Use our award-winning Gantt charts to create detailed risk management plans to prevent risks from becoming issues. Schedule, assign and monitor project tasks with full visibility. Gantt charts allow team members add comments and files to their assigned tasks, so all the communication happens on the project level—in real time.

Risk management is complicated. A risk register or template is a good start, but you’re going to want robust project management software to facilitate the process of risk management. ProjectManager is an online tool that fosters the collaborative environment you need to get risks resolved, as well as provides real-time information, so you’re always acting on accurate data. Try it yourself and see, take this free 30-day trial.

Deliver your projects on time and on budget

Start planning your projects.

- CANDIDATE & STUDENT

- Actuarial Directory Actuarial Directory Search by: Last Name First Name Company Name City Advanced Search Update Profile

What is an Actuary?

Actuarial education, career development, affiliate membership, designations & credentials, exams & requirements, university resources, major meetings, professional development opportunities, about the soa research institute, research by topic, research opportunities, tables, calculators & modeling tools, naaj practical application essays, actuarial research clearing house (arch), experience studies pro, about soa sections, professional development, actuarial practice, publications, our purpose, topics in the news, volunteer program, contact soa, job opportunities, legal center.

- search Close

- Actuarial Directory

Risk Management Research Reports

If you’re looking for research projects and reports on risk management topics, you’ve come to the right place. The SOA offers research, authored by an individual or a team of authors, for download in just a few clicks. Most reports are in PDF format.

- Does Enterprise Risk Management Enhance Insurers’ Resilience?

- Review this empirical study, which examines the impact of the COVID-19 pandemic on insurers.

- United States Earthquake Insurance Overview: Risk and Coverages by Region with a Comparison to Canada and Puerto Rico

- August This report provides a comprehensive guide for actuaries, insurance companies and regulators to understand the scope and challenges of earthquake risk and insurance in the U.S. It also looks at Canada and Puerto Rico due to their proximity.

- Comparison of Regulatory Framework for Non-Discriminatory AI Usage in Insurance August This report aims to provide readers with an up-to-date overview of the regulatory landscape, but the information contained here is likely to change.

- 17th Survey of Emerging Risks

- The Casualty Actuarial Society and the Society of Actuaries Research Institute are pleased to make available the 17th emerging risk survey.

- The Risks of Change in the Insurance Industry: Adapting to the “New” New Normal

- In a constantly changing world, the concept of a ‘new’ new normal refers to that which is different from what was experienced in the past and is now becoming the norm.

- Navigating Global Insurance Demand Trends March This report explores the behavioral factors influencing insurance purchase among Gen Z and Millennials for forward-looking purposes, leveraging a rich dataset spanning 22 markets across six continents.

- 17th Annual Survey of Emerging Risks – Key Findings

- January The Casualty Actuarial Society and the Society of Actuaries Research Institute are pleased to make available the key findings from the 17th emerging risk survey.

- Calibrating Stochastic Interest Rate Models

- This paper introduces practitioners to the selection and calibration of stochastic interest rate models. Six continuous time interest rate models and their calibration are presented. Actual code and data examples are added to help the practitioner implement them. The emphasis is on hands-on calibration with RStudio. The reader is assumed to have a working knowledge of RStudio, including writing R scripts.

- Rating Agency Perspectives on Insurance Company Capital

- The SOA Research Institute along with the Corporate Finance & Enterprise Risk Management Curriculum Committee, Financial Reporting Section, and Individual Life & Annuity Curriculum Committee are pleased to make available a research report that aids students and practitioners with their understanding of the rating agencies as they affect the insurance industry.

- Regulatory Capital Adequacy for Life Insurance Companies: A Comparison of Four Jurisdictions

- The purpose of this paper is to introduce the concept of capital and key related terms, as well as to compare and contrast four key regulatory capital regimes.

- 16th Survey of Emerging Risks

- The Casualty Actuarial Society and the Society of Actuaries Research Institute are pleased to make available the 16th emerging risk survey.

- What Can Insurers and Pension Funds Learn from Bank Failures – Expert Panel Discussion

- Over a short span of two weeks, the financial system has observed the collapse of two mid-sized U.S. commercial banks, California-based Silicon Valley Bank (“SVB”) and New York-based Signature Bank, and a takeover of troubled Credit Suisse by a rival in Europe. The current turmoil in the financial system is a stark reminder of the importance of effective risk management and regulation.

- 16th Survey of Emerging Risks - Key Findings January The Casualty Actuarial Society and the Society of Actuaries Research Institute are pleased to make available the key findings from the 16th emerging risk survey.

- Inspiring Actuarial Education through Learning Communities and Research Experiences October This project pertained to the development of a new Actuarial Science Learning Community model, involving four types of students' engagement: academic coursework, residential life, research, and professional development. The model provided students an immersive exposure to Data Science from the Actuarial perspective, which will result in Actuarial students greatly expanding their skill set and future job opportunities, at the intersection of Actuarial Science and Data Science.

- US and Canada: An Era of Value-added Enterprise Risk Management September Enterprise risk management (ERM) is an orderly or guided conduct of an enterprise to deal with risks. For insurers, ERM requires full support and commitment of the senior management. ERM in the U.S. and Canada has evolved over the years into a complex ecosystem.

- Understanding the Connection between Real-World and Risk-Neutral Scenario Generators September Scenario generators used in financial models to quantify risk are sometimes described as being as either “real-world” or “risk-neutral." The difference is in the treatment of the market price of risk. This report explores the relationship between real-world and risk-neutral scenarios and when it is appropriate to use each type.

- India: Growth Opportunities on the Rise September The Indian market holds tremendous potential for insurance products, especially in segments that remain untapped. The market is evolving in terms of market penetration, product innovation, regulatory changes, government initiatives, capital adequacy and customer experience. In this report, we have highlighted insurance trends in India based on insights gathered from practitioners' interviews, available research and literature, with a particular focus on the enterprise risk management (ERM) function of insurance companies.

- U.S. Insurance Company Earnings Review, Second Quarter 2022 August In the second quarter of 2022, publicly traded life insurers reported some of their best financial results since the pandemic began. COVID-19-related claims fell sharply in many product categories. Sales, which had taken a big hit, showed significant improvement as well, though not always to pre-pandemic levels. Sales activity was enough, however, for industry executives to report confidently in their quarterly conference calls that in this regard the worst consequences of the pandemic are over.

- 15th Survey of Emerging Risks August The Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries Research Institute are pleased to make available the full report from the 15th Survey of Emerging Risks.

- China: An Era of Insurance Innovation July The Chinese insurance market is grappling with product innovation, business growth and regulatory oversight as it tries to keep pace with a sharp growth in demand across product segments. In this context, the authors have highlighted insurance trends in China, based on available research and literature, with a particular focus on topics that will drive the enterprise risk management (ERM) function of insurance companies.

- Survey of Emerging Risks in China and Greater Asia June In March 2022, the Society of Actuaries (SOA) Research Institute surveyed actuarial and risk management professionals in China and Greater Asia for their opinions on emerging risks in the local market. The results are presented in this inaugural China and Greater Asia survey report which provides a comparison with findings from the North American emerging risks survey , now in its 15th year.

- Pension Risk Transfer in Canada and the U.S. April This report was prepared to provide an overview of pension risk transfer for use in the educational curriculum of the Society of Actuaries. It presents general principles and highlights major differences between Canada and the U.S. from a life insurer’s perspective. The focus is on group annuities, which are the most common solution for pension risk transfer.

- 15th Emerging Risks Key Finding January This report summarizes the key findings from the 15th Annual Survey of Emerging Risks.

- Modeling the Variety of Decision Making August The Joint Risk Management Research Committee is pleased to present new research that enhances existing actuarial modeling practice. This report discusses management decision making practices and the need for actuaries to build the appropriate level of variability for management actions in stochastic models to achieve a more realistic range of future experience among the stochastic scenarios.

- 14th Annual Survey of Emerging Risks August Read the findings from the 14th Annual Survey of Emerging Risks.

- Resurrecting the White Swan Mindset August This monograph walks the reader through the hindsight, insight and foresight building process while discussing theoretical and practical issues supporting the building of valid forecasts with provenance for each of these schema examples.

- Early Detection of Insurer Insolvency July This study aims to develop a market-based insolvency prediction model to detect financially distressed insurers at an early stage.

- Managing Investment Risks of Insurance Contractual Designs May The Society of Actuaries’ Committee on Finance Research and Joint Risk Management Section Research Committee are pleased to make available a research report developing a framework for quantifying and analyzing various forms of contractual designs.

- Society of Actuaries Research Brief: Impact of COVID-19, June 12, 2020 June This Society of Actuaries Research Brief has been constructed to highlight some of the key features of the COVID-19 epidemic and contemplate the risks for the actuarial profession to consider in their work.

- Future Long-Term Care in Canada May The Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries' Joint Risk Management Section and the Joint Risk Management Research Committee are pleased to make available a new report demonstrating how ERM can be used for informing decision makers on the future of long-term care in Canada.

The Society of Actuaries Financial Reporting Section and the Joint Risk Management Research Committee are pleased to make available new research introducing actuaries and others to dynamic stochastic general equilibrium (DSGE) models, a type of macroeconomic model.

- Negative Interest Rates March View the new study examining negative interest rates and the insurance industry.

- Systemic Risk in China’s Insurance Industry March This report looks at identifying drivers of systemic risk in China’s insurance industry and develops a measurement method for systemic risk as well as systemic risk dependence between the insurance industry and other industries.

- 13th Annual Survey Of Emerging Risks March The Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries' Joint Risk Management Section is pleased to make available the full report from 13th annual emerging risk survey.

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2019 Survey Results March As part of its work, the PBITT working group issued its annual survey to gather the range of assumptions actuaries use in pricing, reserving, and risk management of minimum guarantees on Variable Annuity products, such as death benefits, income benefits, withdrawal benefits and maturity benefits.

- A Reconciliation of the Top-Down and Bottom-Up Approaches to Risk Capital Allocations: Proportional Allocations Revisited December Sponsored by the Society of Actuaries Research Expanding Boundaries Pool, this report examines an encompassing method to allocating economic capital in insurance conglomerates.

- 2019 Universal Life with Secondary Guarantees Survey: Survey of Assumptions for Policyholder Behavior in the Tail December The PBITT Working Group presents a summary of the 2019 UL with Secondary Guarantees Survey.

- 12th Annual Survey Of Emerging Risks October The Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries' Joint Risk Management Section is pleased to make available the full report from the 2018 Emerging Risks Survey, the twelfth in the series.

- 2019 ERM Monograph August In a collaborative effort, the Joint Risk Management Section, the Canadian Institute of Actuaries (CIA), the Casualty Actuarial Society (CAS), the Society of Actuaries (SOA), and The Actuarial Foundation are pleased to present papers from the 2019 ERM Symposium Call for Papers.

- Copula Models of Economic Capital for Life Insurance Companies June This report examines the use of a copula approach to build a predictive model to estimate the amount of economic capital a life insurance company needs to protect itself against an adverse movement in interest rates, mortality, and other risk drivers.

- Policyholder Behavior in the Tail Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2018 Survey Results January The Joint Risk Management Section is trying to develop better estimates of policyholder behavior in the tail (PBITT). The mission of the PBITT working group is to examine and ultimately give guidance to actuaries on how to set policyholder assumptions in extreme scenarios.

- Machine-Learning Methods for Insurance Applications-A Survey January The Society of Actuaries is pleased to make available a research report that provides a literature survey of methodologies applying machine learning to insurance claim modeling.

- 11th Annual Survey Of Emerging Risks October The Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries' Joint Risk Management Section is pleased to make available results from the 2017 Emerging Risks Survey, the eleventh in the series.

- 2018 Universal Life with Secondary Guarantees Survey: Survey of Assumptions for Policyholder in the Tail September The PBITT Working Group presents a summary of the 2018 UL with Secondary Guarantees Survey.

- Applying Image Recognition to Insurance June This research report discusses the impact of image recognition on the insurance industry.

- National Risk Management: A Practical ERM Approach for Federal Governments April The Canadian Institute of Actuaries, the Society of Actuaries and the Joint Risk Management Section of the Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries are pleased to make available a whitepaper on the application of enterprise risk management at a federal government level.

- Effective ERM Stakeholder Engagement March The Joint Risk Management Research Committee announces the release of a new report on enterprise risk management (ERM) stakeholder engagement. Authored by Kailan Shang, this report examines current practices and identifies challenges to achieving ERM stakeholder buy-in. It also offers strategies to help overcome these challenges and improve ERM stakeholder engagement.

- Actuarial Review of Insurer Insolvencies, Future Preventions January Sponsored by the Canadian Institute of Actuaries (CIA), Casualty Actuarial Society (CAS), and Society of Actuaries (SOA), this study looks at causes of insolvency and decisions made by management, regulators, and policyholders over the life cycle of the insolvency. This study is intended to educate insurance professionals on historical insurer impairments and insolvencies and possible future prevention indicators.

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2017 Survey Results January As part of its work, the PBITT working group issued its annual survey to gather the range of assumptions actuaries use in pricing, reserving, and risk management of minimum guarantees on Variable Annuity products, such as death benefits, income benefits, withdrawal benefits and maturity benefits.

- 10th Survey Of Emerging Risks October The Casualty Actuarial Society, Canadian Institute of Actuaries, and the Society of Actuaries' Joint Risk Management Section is pleased to make available a research report describing the results of the 2016 Emerging Risks Survey, the tenth in the series.

- 2017 Universal Life with Secondary Guarantees Survey Summary July As part of its work, the PBITT working group issued a survey that gathered the range of assumptions actuaries use in pricing, reserving, and risk management of UL with Secondary Guarantees. This report summarizes the findings of the survey.

- 2017 Enterprise Risk Management Symposium April

- Parameter Uncertainty April Sponsored by the Casualty Actuarial Society (CAS), Canadian Institute of Actuaries (CIA), and the Society of Actuaries' (SOA) Joint Risk Management Section and the Joint Risk Management Research Committee, this study examines and describes parameter uncertainty.

- Mitigating Extreme Risks through Securitization March Sponsored by the Society of Actuaries Research Expanding Boundaries Pool, this research report introduces readers to Insurance-linked securities (ILSs) emphasizing catastrophe bonds (CAT) and industry loss warranties (ILWs). The report also discusses the pricing of ILSs and issues in utilizing them as hedging tools.

- Reviewing Systemic Risk in the Insurance Industry February

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2016 Survey Results October

- Modeling the Unemployment Risk in Insurance Products October

- 2015 Emerging Risks Survey September

- Social Media Analysis of Catastrophic Responses: Twitter Data Analysis of Tornadoes June

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2015 Survey Results April

- 2016 Enterprise Risk Management Symposium April

- 2014 Emerging Risks Survey December

- Risk Implications of Unemployment and Underemployment December

- Emerging Risks Survey Reports and Articles December

- Life Insurance Regulatory Structures and Strategy: EU Compared to US September

- ORSA Process Implementation for Internal Stakeholders September

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2015 Survey Results September

- Extreme Events for Insurers: Correlation, Models and Mitigation Study May

- Front-Page Risks: Risks Commonly Occurring and Reported in the Canadian News April

- 2015 Enterprise Risk Management Symposium April

- Risk Assessment Applications of Fuzzy Logic March

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2014 Survey Results February

- Regulatory Risk and North American Insurance Organizations: A Company Perspective February

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2014 Survey Results September

- Regulatory Risk and North American Insurance Organizations August

- Sustained Low Interest Rate Environment: Can it Continue? Why it Matters June

- Model Validation for Insurance Enterprise Risk and Capital Models April

- 2014 Enterprise Risk Management Symposium April

- 2013 Emerging Risks Survey March

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2013 Survey Results January

- Assessing High-Risk Scenarios by Full-Range Tail Dependence Copulas December

- Applying Fuzzy Logic to Risk Assessment and Decision-Making November

- Natural Resource Sustainability Summit November

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2012 Survey Results September

- 2012 Emerging Risks Survey May

- 2013 Enterprise Risk Management Symposium April

- When Black Swans Aren’t: Holistically Training Management to Better Recognize, Assess, and Respond to Extreme Events March

- Comparative Failure Experience in the U.S. and Canadian Life Insurance and Banking Industries from 1980 to 2010 March

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2012 Survey Results March

- Application of Actuarial Science to Systemic Risk February

- Value Investing and Enterprise Risk Management: Two Sides of the Same Coin January

- Determining the Impact of Climate Change on Insurance Risk and the Global Community Phase 1: Key Climate Indicators November

- Development of a Network Model for Identification and Regulation of Systemic Risk in the Financial System October

- 2011 Emerging Risks Survey April

- Risk Appetite: Linkage with Strategic Planning April

- 2012 Enterprise Risk Management Symposium April

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2011 Survey Results March

- The Scope of Developing Optimization Models for Insurer's Operational Risk from Risk-Return Trade-Off Perspective February

- Actuarial Methods for Valuing Illiquid Assets December

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2011 Survey Results November

- 2011 Enterprise Risk Management Symposium April

- 2010 Emerging Risks Survey March

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2010 Survey Results January

- A Study of International Solvency Regimes November

- Determinants of Insurers' Reputational Risk October

- Reflecting Risk in Pricing Survey Report September

- Potential Impact of Pandemic Influenza on the U.S. Health Insurance Industry July

- 2009 Emerging Risks Survey May

- Exploration of Reputational Risk from the Perspective of a Variety of Stakeholders May

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2009 Survey Results April

- 2010 Enterprise Risk Management Symposium April

- Enterprise Risk Management (ERM) Practice as Applied to Health Insurers, Self-Insured Plans, and Health Finance Professionals January

- Policyholder Behavior in the Tail Joint Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2009 Survey Results October

- The Financial Crisis and Lessons for Insurers September

- Corporate Reputational Risk and ERM: An Analysis from the Perspective of Various Stakeholders May

- 2009 Enterprise Risk Management Symposium April

- Emerging Risks Survey January

- Policyholder Behavior in the Tail Risk Management Section Working Group UL with Secondary Guarantee 2008 Survey Results November

- Copula Phase Transitions Report September

- Economic Capital: Correlation Matrices and Other Techniques–A Survey and Discussion September

- Policyholder Behavior in the Tail Risk Management Section Working Group Variable Annuity Guaranteed Benefits 2007 & 2008 Survey Results August

- 2008 Enterprise Risk Management Symposium April

- Risk Based Capital Covariance Project September

- Application of Structural Equation Modeling to the Linkage of Risk Management, Capital Management and Financial Management for the Insurance Industry July

- Risk Management Terminology June

- Linkage of Risk Management, Capital Management and Financial Management April

- 2007 Enterprise Risk Management Symposium April

- Policyholder Behavior in the Tail Project–Annuity Lapse Modeling November

- Enterprise Risk Management for Property–Casualty Insurance Companies August

- 2006 Enterprise Risk Management Symposium April

- Policyholder Behavior in the Tail Risk Management Section Working Group Variable Annuity Guaranteed Benefits Survey Results November

Related Links

- Risk Management Research

Project Management Research Topics: Breaking New Ground

According to a study by the Project Management Institute (PMI), a significant 11.4% of business investments go to waste due to subpar project performance.

That’s why students need to study project management in college - to move the progress further and empower businesses to perform better. It is crucial for students as it equips them with essential skills, including organization, teamwork, problem-solving, and leadership, which are highly transferable and sought after in the professional world. It enhances their career prospects, teaches adaptability, and fosters a global perspective, preparing them for success in a diverse and rapidly evolving job market.

In this article, you will learn the definition of a project management research paper, discover 120 excellent topics and ideas, as well as receive pro tips regarding how to cope with such an assignment up to par.

Definition of What is Project Management

Project management is the practice of planning, executing, controlling, and closing a specific project to achieve well-defined goals and meet specific success criteria. It involves efficiently allocating resources, including time, budget, and personnel, to ensure that a project is completed on time, within scope, and within budget while delivering the intended results or deliverables.

Project management encompasses various methodologies, tools, and techniques to ensure that projects are successfully initiated, planned, executed, monitored, and completed in an organized and systematic manner.

Students can learn project management in colleges and universities, online courses, professional associations, specialized schools, and continuing education programs. Despite the type of institution, most students rely on an essay writing service to ensure their academic progress is positive.

Achieve Excellence in Project Management Essays

Need a standout essay on the latest project management trends? Our experienced writers are here to provide you with a meticulously researched and expertly written paper, ensuring you stay ahead in your academic journey.

What Is a Project Management Research Paper?

Project management research papers are academic documents that explore various aspects of project management as a field of study. These papers typically delve into specific topics, issues, or questions related to project management and aim to contribute new knowledge or insights to the discipline. Project management research papers often involve rigorous analysis, empirical research, and critical evaluation of existing theories or practices within the field.

Key elements of a project management research paper include:

%20(1).webp)

- Research Question or Problem: Clearly defines the research question, problem, or topic the paper aims to address.

- Literature Review: A comprehensive review of existing literature, theories, and relevant studies related to the chosen topic.

- Methodology: Describing the research methods, such as surveys, case studies, interviews, or data analysis techniques.

- Data Collection and Analysis: If applicable, presenting and analyzing data to support the research findings.

- Discussion: An in-depth discussion of the research findings and their implications for the field of project management.

- Conclusion: Summarizing the key findings, their significance, and potential future research directions.

Project management research papers can cover various topics, from best practices in project management to emerging trends, challenges, and innovations in the field. They are a valuable resource for both academics and practitioners, offering insights that can inform project management practices and decision-making.

Project Management Research Topics Selection Tips

Selecting an appropriate topic for a project management research paper is crucial for the success of your research. Here are some tips to help you choose the right research topic:

- Start by considering your own interests and passion within the field of project management.

- Choose a topic that has practical applications and can contribute to the discipline.

- Avoid overly broad topics. Instead, narrow down your focus to a specific aspect or issue within project management.

- Seek guidance from your professors, academic advisors, or mentors.

- Conduct a preliminary literature review to see what research has already been done in your area of interest.

- Aim for originality by proposing a research topic or question that hasn't been extensively explored in the existing literature.

- Consider the feasibility of your research. Ensure your research is practical and achievable within your constraints.

- Clearly define your research questions or objectives.

- Think about the practical applications of your research.

- Ensure that your research topic and methodology adhere to ethical standards.

- Think about the research methods you will use to investigate your topic.

- Consider involving stakeholders from the industry, as their insights can provide practical relevance to your research.

- Keep in mind that your research may evolve as you delve deeper into the topic.

- Be open to adapting your research questions and methodology if necessary.

By following these tips, you can select a project management research topic that is not only relevant and original but also feasible and well-aligned with your academic and career goals. Sounds challenging and time-consuming? Simply type ‘ write an essay for me ,’ and our experts will help you settle the matter.

Best Project Management Research Topics and Ideas

Here is a list of the 50 best topics for a project management paper. These topics cover many project management areas, from traditional project management methodologies to emerging trends and challenges in the field. You can further refine and tailor these topics to match your specific research interests and objectives.

- Agile Project Management in Non-IT Industries.

- Risk Management Strategies for Large-Scale Projects.

- The Role of Leadership in Project Success.

- Sustainability Integration in Project Management.

- Challenges in Virtual Project Management.

- The Impact of Artificial Intelligence on Project Management.

- Project Management Best Practices in Healthcare.

- Lean Project Management Principles.

- Project Portfolio Management in Multinational Corporations.

- The Use of Blockchain in Project Management.

- Cultural Diversity and Its Effects on Global Project Teams.

- Managing Scope Creep in Project Management.

- Project Management in Crisis Situations.

- Agile vs. Waterfall: A Comparative Analysis.

- Project Governance and Compliance.

- Critical Success Factors in Public Sector Projects.

- Benefits Realization Management in Project Management.

- Agile Transformation in Traditional Organizations.

- Project Management in the Digital Age.

- Sustainable Project Procurement Practices.

- The Role of Emotional Intelligence in Project Leadership.

- Project Management in the Healthcare Industry.

- Effective Communication in Virtual Project Teams.

- Agile Project Management in Software Development.

- The Impact of Project Management Offices (PMOs).

- Project Management in the Construction Industry.

- Project Risk Assessment and Mitigation.

- IT Project Management Challenges and Solutions.

- Project Management in Startups and Entrepreneurship.

- Lean Six Sigma in Project Management.

- Project Management Software Tools and Trends.

- The Role of Change Management in Project Success.

- Conflict Resolution in Project Teams.

- Project Management in the Pharmaceutical Industry.

- Scrum vs. Kanban: A Comparative Study.

- Managing Cross-Cultural Teams in International Projects.

- The Future of Project Management: Trends and Forecasts.

- Effective Resource Allocation in Project Management.

- Project Procurement and Vendor Management.

- Quality Assurance in Project Management.

- Risk Assessment in IT Project Management.

- Benefits and Challenges of Hybrid Project Management Models.

- Agile Transformation in Large Organizations.

- The Role of Data Analytics in Project Management.

- Project Management for Non-Profit Organizations.

- Continuous Improvement in Project Management.

- The Impact of COVID-19 on Project Management Practices.

- The Role of Project Management in Innovation.

- Project Management in the Aerospace Industry.

- The Influence of Project Management on Organizational Performance.

Simple Project Management Research Ideas

Here are 10 simple project management research ideas that can serve as a foundation for more in-depth research:

The Impact of Effective Communication on Project Success: Investigate how clear and efficient communication within project teams influences project outcomes.

Project Management Software Adoption and Its Effects: Examine the adoption of project management software tools and their impact on project efficiency and collaboration.

Factors Affecting Scope Creep in Project Management: Identify the key factors contributing to scope creep and explore strategies to prevent it.

The Role of Project Management Offices (PMOs) in Organizational Performance: Analyze the performance, improving project success rates and enhancing overall project management maturity.

Agile Project Management in Non-Software Industries: Study how Agile project management principles can be adapted and applied effectively in non-IT industries, such as manufacturing, healthcare, or construction.

Project Risk Management Strategies: Investigate the best practices and strategies for identifying, assessing, and mitigating risks in project management.

Stakeholder Engagement in Project Success: Explore the significance of stakeholder engagement and its impact on project outcomes, including scope, quality, and stakeholder satisfaction.

Project Management in Small Businesses: Analyze the unique challenges and opportunities of project management in small businesses and startups, considering resource constraints and growth objectives.

Sustainability Practices in Project Management: Investigate how project managers can integrate sustainability principles into project planning and execution, with a focus on environmental and social responsibility.

Change Management in Project Transitions: Examine the role of change management in ensuring smooth transitions between project phases or methodologies, such as moving from Waterfall to Agile.

Interesting Project Management Research Paper Topics

These research paper topics offer opportunities to explore diverse aspects of project management, from leadership and ethics to emerging technologies and global project dynamics.

- The Impact of Effective Communication on Project Success.

- Project Management Software Adoption and Its Effects.

- Factors Affecting Scope Creep in Project Management.

- The Role of Project Management Offices (PMOs) in Organizational Performance.

- Agile Project Management in Non-Software Industries.

- Project Risk Management Strategies.

- Stakeholder Engagement in Project Success.

- Project Management in Small Businesses and Startups.

- Sustainability Practices in Project Management.

- Change Management in Project Transitions.

Still can’t find an interesting topic? Maybe you’re in writer’s block. But we have a solution to this, too - a research paper writing service from real academic professionals!

Research Project Topics in Business Management

Here are ten research project topics in business management. They encompass various aspects of business management, from leadership and diversity to sustainability and emerging trends in the business world.

- The Impact of Leadership Styles on Employee Motivation and Productivity.

- Strategies for Enhancing Workplace Diversity and Inclusion.

- The Role of Emotional Intelligence in Effective Leadership.

- Sustainable Business Practices and Their Effects on Corporate Social Responsibility.

- Innovation and Technology Adoption in Small and Medium-Sized Enterprises (SMEs).

- Financial Management Strategies for Small Businesses and Startups.

- Effective Marketing Strategies in the Digital Age.

- The Challenges and Opportunities of Global Expansion for Multinational Corporations.

- Supply Chain Management in a Post-Pandemic World: Resilience and Adaptability.

- Consumer Behavior and Market Trends in E-Commerce.

Software Project Management Dissertation Topics

These dissertation topics cover a range of critical issues and strategies in software project management, from risk management to AI integration and agile methodologies.

- Effective Software Project Risk Management Strategies.

- Agile vs. Waterfall: Comparative Analysis in Software Project Management.

- Requirements Management in Software Development Projects.

- The Role of DevOps in Accelerating Software Project Delivery.

- Software Project Management Challenges in Distributed and Remote Teams.

- Quality Assurance and Testing Practices in Software Project Management.

- Managing Scope Changes and Requirements Volatility in Software Projects.

- Vendor Management in Outsourced Software Development Projects.

- Project Portfolio Management in Software Organizations.

- The Impact of Artificial Intelligence in Enhancing Software Project Management.

Remember that easy research paper topics might also be used to write a dissertation. Check them out as well!

Ten Construction Project Management Research Topics

Offering you ten research topics in construction project management, which delve into various aspects of construction project management, from sustainability and safety to technology adoption and stakeholder engagement.

- Optimizing Construction Project Scheduling and Time Management.

- Risk Assessment and Mitigation in Large-Scale Construction Projects.

- Green Building Practices and Sustainable Construction Management.

- The Role of Technology in Improving Construction Project Efficiency.

- Safety Management and Accident Prevention in Construction.

- Contract Management in Public Infrastructure Projects.

- Resource Allocation and Cost Control in Construction Project Management.

- The Impact of Lean Construction Principles on Project Delivery.

- Innovations in Prefabrication and Modular Construction Methods.

- Stakeholder Collaboration and Communication in Complex Construction Projects.

Ten Outstanding Project Administration Ideas for Research Paper

Let’s gain insights into the key aspects and focus areas of each research paper topic in project administration. Researchers can further refine these 10 topics to address specific research questions and objectives.

Innovative Strategies for Effective Project Communication and Collaboration: This topic explores innovative communication and collaboration methods that enhance project team coordination and overall project success. It may include the use of technology, virtual tools, or novel approaches to foster effective communication.

Integrating Sustainability into Project Management Practices: This research examines how project managers can incorporate sustainability principles into project planning, execution, and decision-making, contributing to environmentally and socially responsible project outcomes.

The Role of Emotional Intelligence in Project Leadership and Team Dynamics: This topic delves into the significance of emotional intelligence in project leadership, focusing on how emotional intelligence influences team dynamics, motivation, and project performance.

Agile Project Management in Non-Traditional Industries: Opportunities and Challenges: It explores adopting Agile project management methodologies outside the software development domain, discussing the opportunities and challenges of applying Agile in industries like healthcare, manufacturing, or construction.

Crisis Management and Resilience in Project Administration: This topic investigates crisis management strategies and the development of project resilience to navigate unexpected disruptions, disasters, and unexpected events affecting project progress.

The Impact of Change Management in Successful Project Implementation: It examines the critical role of change management in ensuring smooth transitions between project phases, methodologies, or organizational changes, contributing to project success.

Ethical Decision-Making in Project Management: Balancing Objectives and Integrity: This research delves into the ethical dilemmas and decision-making processes project managers face and explores frameworks for ethical behavior in project management.

Technology Integration and Digital Transformation in Project Administration: It discusses how the integration of technology, such as AI, IoT, and automation, is transforming project administration practices and improving efficiency and project outcomes.

Risk Management and Contingency Planning in Large-Scale Projects: This topic focuses on risk management strategies and the development of effective contingency plans to mitigate risks in complex, large-scale projects.

Project Governance and the Influence of Regulatory Compliance: It explores project governance structures, including the impact of regulatory compliance on project management, risk management, and decision-making processes. In case you need aid with complex senior year papers, consult capstone project writing services .

Ten Healthcare Project Management Research Topics

These research topics address various aspects of healthcare project management, from facility construction and technology implementation to quality improvement and crisis management. Researchers can explore these topics to contribute to the improvement of healthcare project outcomes and patient care.

- Optimizing Healthcare Facility Construction and Renovation Projects.

- Effective Implementation of Electronic Health Records (EHR) in Hospitals.

- Managing Change in Healthcare Organizations: A Project Management Perspective.

- Telemedicine Project Management and its Impact on Healthcare Delivery.

- Healthcare Project Risk Management: A Case Study Analysis.

- Patient-Centered Care Initiatives and Project Management Best Practices.

- Quality Improvement Projects in Healthcare: Challenges and Success Factors.

- Healthcare Supply Chain Management and Project Efficiency.

- The Role of Project Management in Healthcare Crisis Response (e.g., Pandemics).

- Measuring the Impact of Lean Six Sigma in Healthcare Process Improvement Projects.

When you find a topic - what’s next? Check out this guide on how to research a topic !

Project management is a dynamic and ever-evolving discipline, offering a rich landscape for research and exploration. Whether you are a student seeking captivating project management research topics or a seasoned professional looking to address real-world challenges, our list of topics provides a valuable starting point.

The key to successful research in project management lies in identifying a topic that aligns with your interests and objectives, allowing you to make meaningful contributions to the field while addressing the pressing issues of today and tomorrow. If you need support executing your research or project, you might consider the convenience of our online services. Simply request " do my project for me " and connect with experts ready to assist you in navigating the complexities of your project management tasks.

So, delve into these research topics, choose the one that resonates with your passion, and embark on a journey of discovery and advancement in the world of project management. If you feel stressed or overwhelmed with the workload at some point, pay for a research paper to gain a competitive edge and save valuable time.

Elevate Your Project Management Research

Let our team of expert writers help you create a comprehensive and well-researched essay, tailored to your specific academic requirements!

Annie Lambert

specializes in creating authoritative content on marketing, business, and finance, with a versatile ability to handle any essay type and dissertations. With a Master’s degree in Business Administration and a passion for social issues, her writing not only educates but also inspires action. On EssayPro blog, Annie delivers detailed guides and thought-provoking discussions on pressing economic and social topics. When not writing, she’s a guest speaker at various business seminars.

is an expert in nursing and healthcare, with a strong background in history, law, and literature. Holding advanced degrees in nursing and public health, his analytical approach and comprehensive knowledge help students navigate complex topics. On EssayPro blog, Adam provides insightful articles on everything from historical analysis to the intricacies of healthcare policies. In his downtime, he enjoys historical documentaries and volunteering at local clinics.

.webp)

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important

1. protects organization’s reputation.

In many cases, effective risk management proactively protects your organization from incidents that can affect its reputation.

“Franchise risk is a concern for all businesses,“ Simons says in Strategy Execution . “However, it's especially pressing for businesses whose reputations depend on the trust of key constituents.”

For example, airlines are particularly susceptible to franchise risk because of unforeseen events, such as flight delays and cancellations caused by weather or mechanical failure. While such incidents are considered operational risks, they can be incredibly damaging.

In 2016, Delta Airlines experienced a national computer outage, resulting in over 2,000 flight cancellations. Delta not only lost an estimated $150 million but took a hit to its reputation as a reliable airline that prided itself on “canceling cancellations.”

While Delta bounced back, the incident illustrates how mitigating operational errors can make or break your organization.

2. Minimizes Losses

Most businesses create risk management teams to avoid major financial losses. Yet, various risks can still impact their bottom lines.