- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Lease Accounting and Why Is It Important?

- 05 Oct 2021

Today, there are more than 44 million rental properties in the United States, and the US apartment rental market is worth upwards of $174 billion in revenue . Renting building space—such as an apartment, office, or storefront—is one of the most common examples of leasing , or the process of exchanging money to access an asset for a predetermined period. Similarly, a lease is a contractual document outlining an agreement’s terms. Companies also lease equipment, vehicles, machinery, and technology.

If your business rents its assets or leases from others, you need to track the financial impact those activities have on your business's financial health. This is called lease accounting and, in addition to being legally required, can help you run an organized, successful business.

Access your free e-book today.

What Is Lease Accounting?

Lease accounting is the process by which a company records the financial impacts of its leasing activities. Leases that meet specific classification requirements must be recorded on a company’s financial statements. Here’s a brief review of each financial statement:

- Balance sheets track a company’s assets, liabilities, and shareholder equity and must always balance.

- Cash flow statements show the movement of money into and out of a company during a specific period.

- Income statements track a company’s income and expenses over time.

The way a lease is recorded on each financial statement differs based on whether you’re the lessor (you own the asset and are receiving payment from the lessee) or the lessee (you’re paying to use the lessor’s asset). When recorded correctly, these three documents provide a clear picture of the value of a company’s assets and the impact the lease has on its overall financial health.

There are two lease classifications—operating and financing—that determine how your company should account for its leases in financial statements, depending on the length of the lease term.

Related: Financial Statement Analysis: The Basics for Non-Accountants

Operating Leases vs. Financing Leases

Operating leases.

Operating leases are leases that don't present an opportunity for the lessee to gain ownership of an asset.

Under the new accounting standards, operating leases must be reported on a company’s balance sheet only if the lease term is greater than 12 months. If the lease term is equal to or less than 12 months, the Financial Accounting Standards Board (FASB) doesn't require their inclusion on the balance sheet.

For an operating lease with a term equal to or less than 12 months:

- The lessor reports the individual lease payments as income on the income and cash flow statements.

- The lessee reports the individual lease payments as operating expenses on the income and cash flow statements.

For an operating lease with a term of more than 12 months:

- The lessor reports the lease as an asset on the balance sheet and individual lease payments as income on the income and cash flow statements. They must also account for the asset’s depreciation over time.

- The lessee reports the lease as both an asset and a liability on the balance sheet and reports individual lease payments as expenses on the income and cash flow statements.

Financing Leases

Financing leases , formerly called capital leases , are leases in which the lessee has reasonable expectation to gain ownership of an asset. Under the United States Generally Accepted Accounting Principles (US GAAP) , there are five criteria, only one of which needs to be met for a lease to be considered a financing lease:

- The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

- The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise.

- The lease term is for the major part of the remaining economic life of the underlying asset unless the commencement date of the lease falls at or near the end of the economic life of the underlying asset.

- The present value of the sum of lease payments and any residual value guaranteed by the lessee (not already reflected in lease payments) equals or substantially exceeds all of the fair value of the underlying asset.

- The underlying asset is of such a specialized nature that it’s expected to have no alternative use to the lessor at the end of the lease term.

For financing leases, regardless of the term length:

- The lessor reports the lease as a leased asset on the balance sheet and individual lease payments as income on the income and cash flow statements.

- The lessee reports the lease as both an asset and a liability on the balance sheet due to their stake as a potential owner of the asset and their required payment. They also report individual lease payments as expenses on the income and cash flow statements.

Old vs. New Lease Accounting Standards

The original lease accounting standards, called the Statement of Financial Accounting Standards 13 (SFAS13) or US GAAP Accounting Standards Codification (ASC) 840, were issued in 1976 by the FASB.

A financing lease, which was called a capital lease at the time, had different criteria than those stated above:

- The lease transfers ownership of the leased asset to the lessee at the end of the lease term.

- The lease contains an option allowing the lessee to purchase the leased asset at a bargain price at the end of the lease term.

- The lease term is greater than or equal to 75 percent of the asset’s economic life.

- The present value of the minimum lease payments (including any required lessee guarantee of residual value of the leased asset to the lessor at the end of the lease term) is greater than or equal to 90 percent of the fair value of the leased asset at the inception of the lease.

Previously, it was standard that no operating leases were reported on the balance sheet. To avoid having to report capital leases, lessors would skirt the criteria of a capital lease (for instance, cutting it as close as possible to the 75 and 90 percent benchmarks) and make it look like an operating lease. This is because keeping those leases off the balance sheet would reduce tax liabilities.

To address this, the new lease accounting standards—called the Accounting Standards Update 2016-02 (ASU-2016-02) or US GAAP ASC 842—were issued by the FASB in February 2016 and went into effect for public companies in December 2018, and one year later for private entities.

Now, all leases with terms greater than 12 months—regardless of classification—must appear on the balance sheet.

Why Is Lease Accounting Important?

Accounting is crucial to understanding a company's financial health; with so many facets of accounting to consider, each plays a key role in providing financial insights that can influence organizational strategy and guide decision-making.

“Accounting is a tool that opens doors to key information, provides useful insights, helps gain perspective, and aids in decision-making,” says Harvard Business School Professor V.G. Narayanan in Financial Accounting , one of the three courses that comprise the Credential of Readiness (CORe) program.

Lease accounting was recently added to the course content of Financial Accounting . Professor Narayanan explains lease accounting’s importance and the full course update in the video below:

It’s important to understand the ins and outs of lease classification and stay up to date on the current lease accounting standards. You also need to know how lease accounting fits into each financial statement so you can base decisions and strategies on accurate financial information.

Whether your company is the lessor or the lessee, the way you keep track of assets, liabilities, income, and expenses generated by leasing activities will have an impact on the overall picture of your company’s financials and, as such, its strategy.

Are you interested in sharpening your financial accounting skills? Explore our eight-week online Financial Accounting course or three-course Credential of Readiness (CORe) program to learn how strong accounting skills can enable you to meaningfully contribute to your organization and advance your career.

About the Author

Operating Lease

An agreement to use and operate an asset without ownership

What is an Operating Lease?

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Common assets that are leased include real estate, automobiles, aircraft, or heavy equipment. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses.

Operating Lease vs. Capital Lease

An operating lease is different from a capital lease and must be treated differently for accounting purposes. Under an operating lease, the lessee enjoys no risk of ownership, but cannot deduct depreciation for tax purposes.

For a lease to qualify as a capital lease , it must meet any of the following criteria as outlined by GAAP :

- The lease term is greater than or equal to 75% of the asset’s estimated useful life

- The present value of the lease payments is greater than or equal to 90% of the fair value of the asset

- Ownership of the asset may be transferred to the lessee at the end of the lease

- The lease contains a bargain purchase option for the lessee to buy the equipment below market value at the end of the lease

Additionally, under IFRS , there are a few more criteria that a lease can meet to qualify as a capital lease:

- The leased assets are specialized to the point that only the lessee can utilize these assets without major changes being made to them

Under a capital lease, the lessee is considered an owner and can claim depreciation and interest expense for tax purposes. The leased asset and lease obligation are shown on the balance sheet .

Capitalizing an Operating Lease

If a lease does not meet any of the above criteria, it is considered an operating lease. Assets acquired under operating leases do not need to be reported on the bal ance sheet. Likewise, operating leases do not need to be reported as a liability on the balance sheet, as the y are not treated as debt. The firm does not record any depreciation for assets acquired under operating leases.

However, if a lease does meet any of the above criteria, it is instead considered a capital lease. A capital lease is treated differently from an operating lease. Instead of being treated as an operating expense, a capital lease is considered a financing expense. Therefore, we need to adjust the lease expense, depreciation expense, and interest expense numbers to account for this shift.

This will have an effect on operating income, which will always increase when these expenses are recategorized. However, it will not have any net effect on net income, as the change in numbers will balance out.

There are two methods to capitalize operating leases: the full adjustment method and the approximation method.

1. Full Adjustment Method

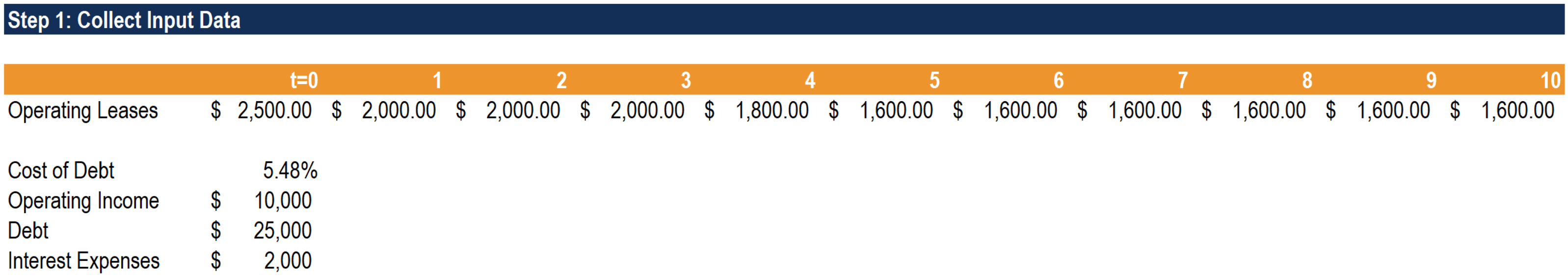

Step 1: collect input data.

Find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses.

Cost of debt can be found using the firm’s bond rating. If there is no existing bond rating, a “synthetic” bond rating can be calculated using the firm’s interest coverage ratio. Using the interest coverage ratio, compare it to this table created by New York University, Stern Business School professor Aswath Damodaran.

The remaining input data can be found in the company’s financial statements or the notes to the financial statements.

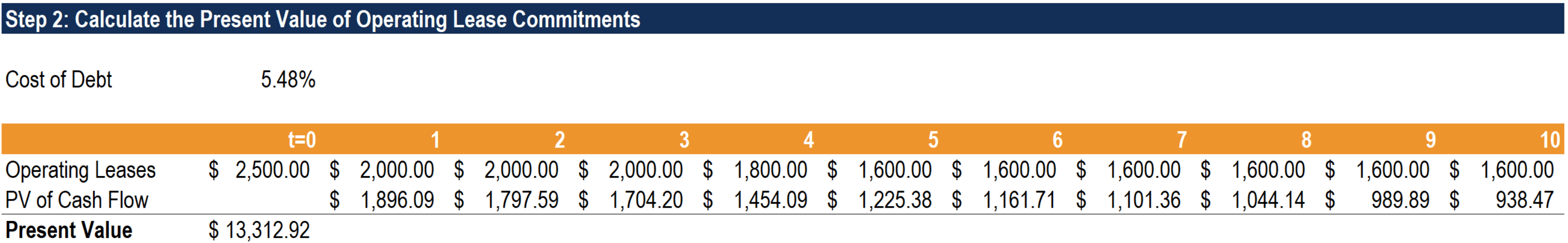

Step 2: Calculate the Present Value of Operating Lease Commitments

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt.

To do this, you must find the debt value of the operating leases. Find the present value of future operating lease expenses by discounting each year’s expense by the cost of debt . The annuity method can be used if lease expenses are provided and remain constant over a timeframe of multiple years (e.g. years 6-10).

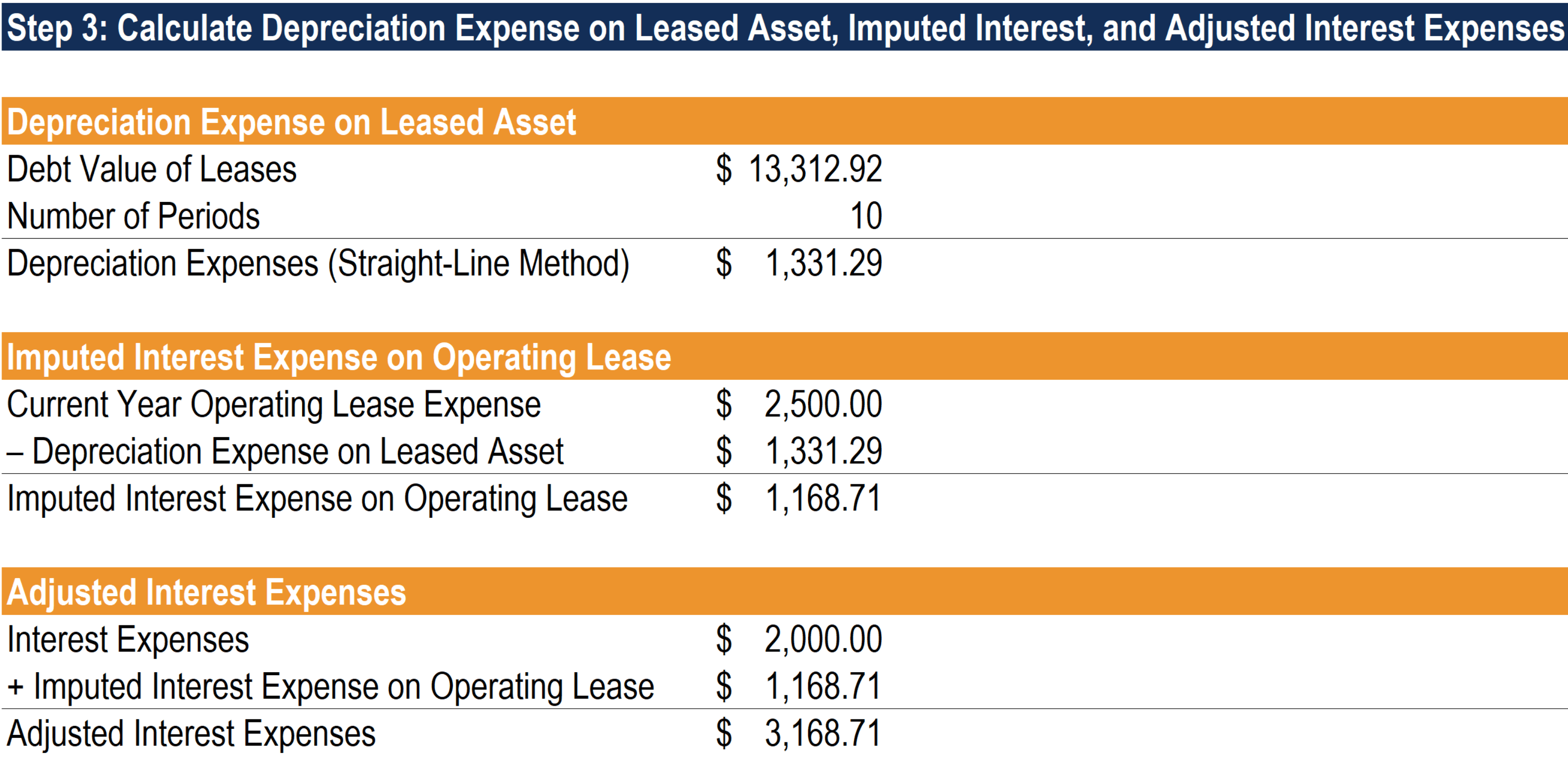

Step 3: Calculate Depreciation Expenses, Imputed Interest, and Adjusted Interest Expenses

We need to calculate depreciation and adjust interest expenses. To calculate depreciation, we use the debt value of leases and employ the straight-line method of depreciation .

To adjust interest expenses, we begin with a simplifying assumption: operating lease expense is equal to the sum of imputed interest expense and depreciation. With this assumption, we can use our newly calculated depreciation value to find imputed interest expense on an operating lease. Take the difference between the current year operating lease expense and our calculated depreciation value to find the imputed interest on the lease.

Finally, add the imputed interest expense on an operating lease to interest expenses to find adjusted interest.

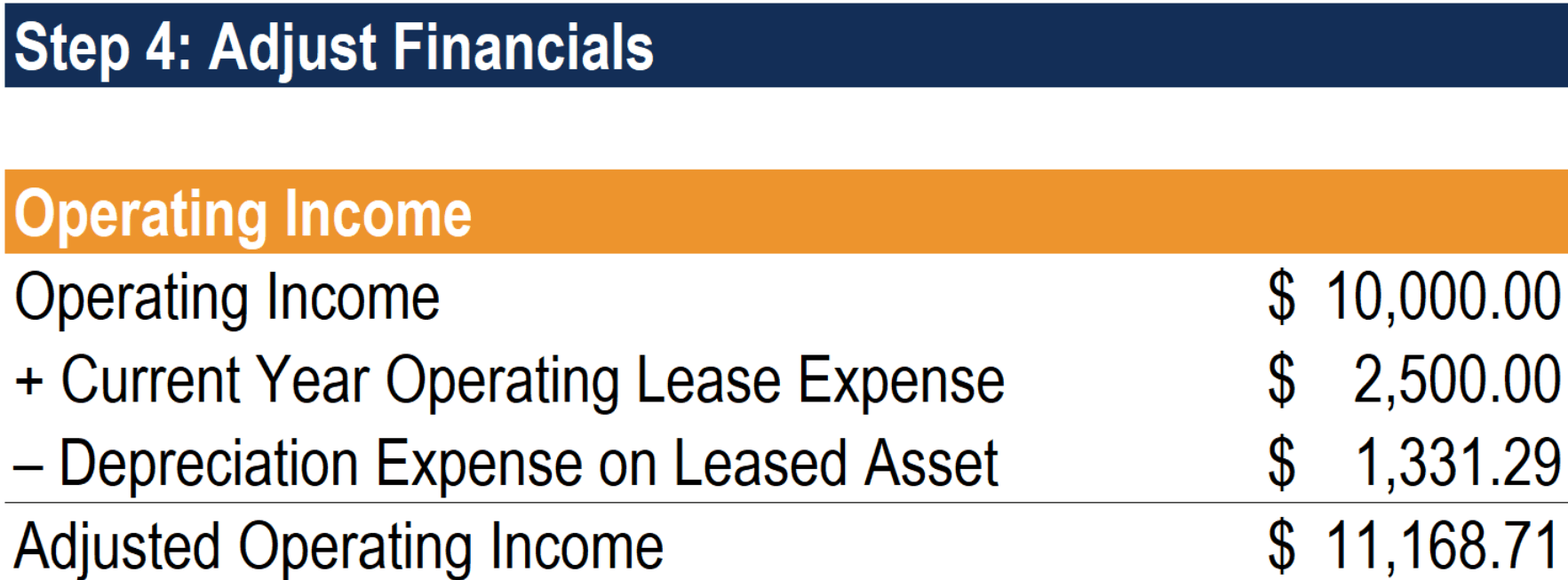

Step 4: Adjust Financials

First, we need to adjust operating income. Begin with the reported operating income (EBIT). Then, add the current year’s operating lease expense and subtract the depreciation on the leased asset to arrive at adjusted operating income.

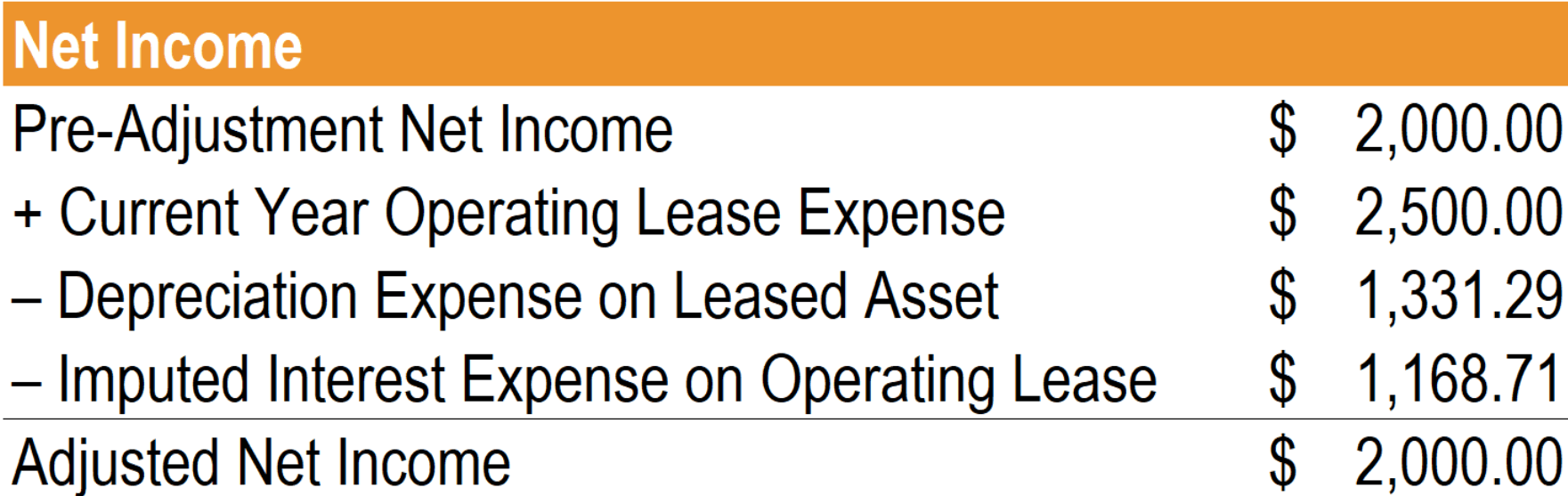

Even though operating income has changed, there should not be a change in net income due to our simplifying assumption. Below are the calculations illustrating this:

Finally, to adjust debt, take the reported value of debt (book value of debt) and add the debt value of the leases.

2. Approximation Method

Like the full adjustment method, we will need to collect the same input data.

The second step for the approximation method is identical to the second step in the full adjustment method as well. We need to calculate the present value of operating lease commitments to arrive at the debt value of the lease.

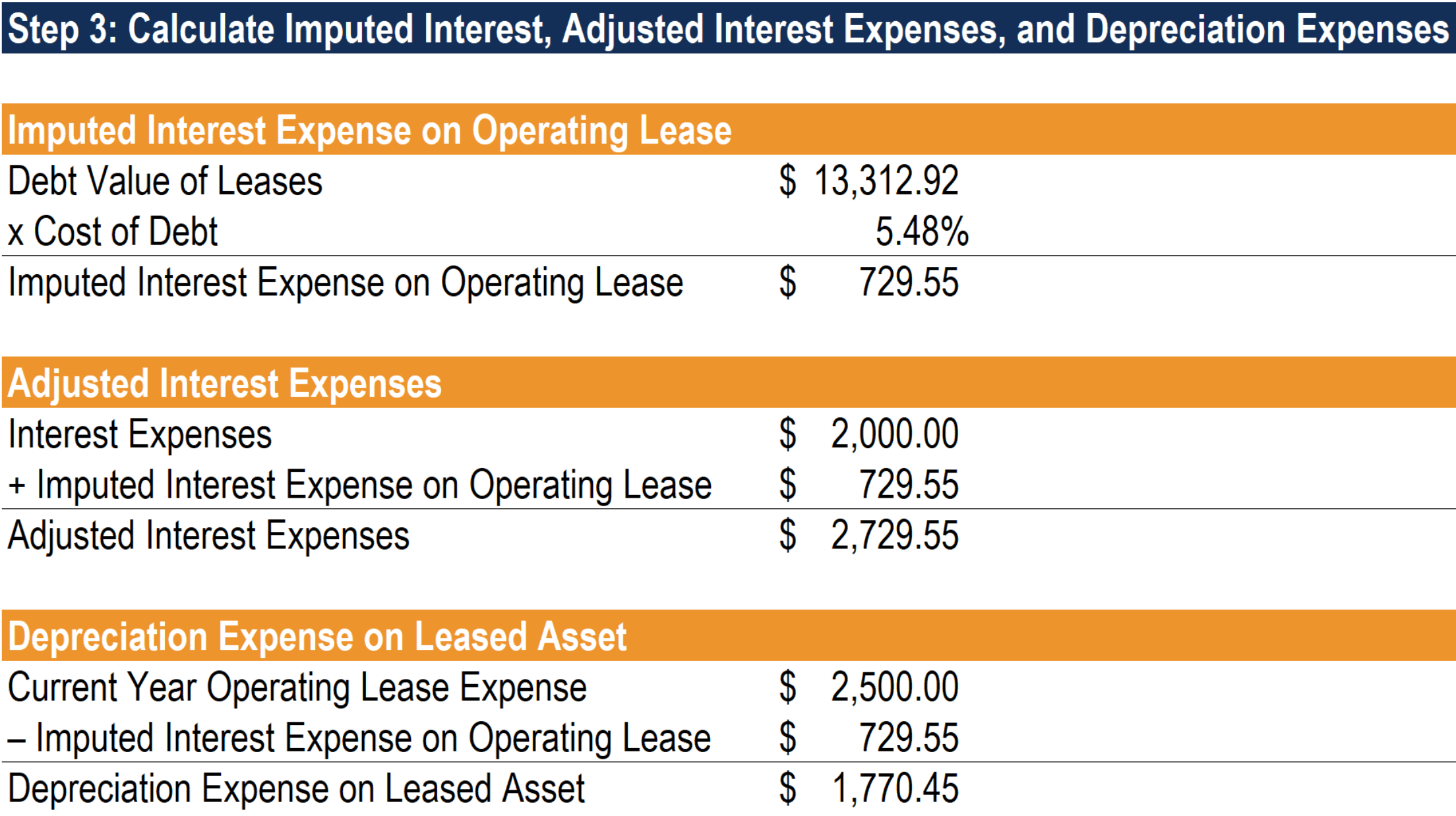

Step 3: Calculate Imputed Interest, Adjusted Interest Expenses, and Depreciation Expenses

Unlike the full adjustment method, the approximation method begins with calculating imputed interest. This is simpler because there is no need to worry about depreciation methods and guidelines. To calculate the imputed interest on the operating lease, multiply the debt value of the lease by the cost of debt.

We can use this imputed interest value to adjust the interest expense. We do this by adding the imputed interest to interest expense.

Finally, using our simplifying assumption from earlier, take the difference between the current year’s operating lease expense and the imputed interest to find depreciation expenses.

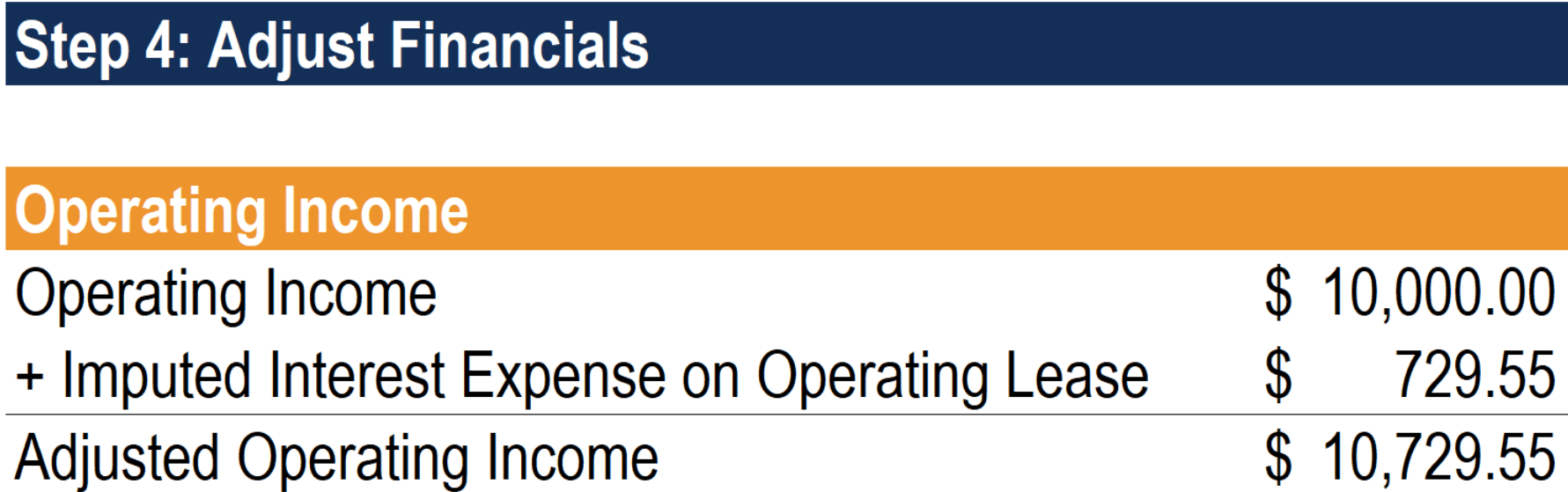

Adjusting financials with the approximation method is slightly different from the full adjustment method. Begin by adjusting operating income. Take the reported operating income (EBIT) for the year and add the calculated imputed interest on an operating lease to obtain the adjusted operating income.

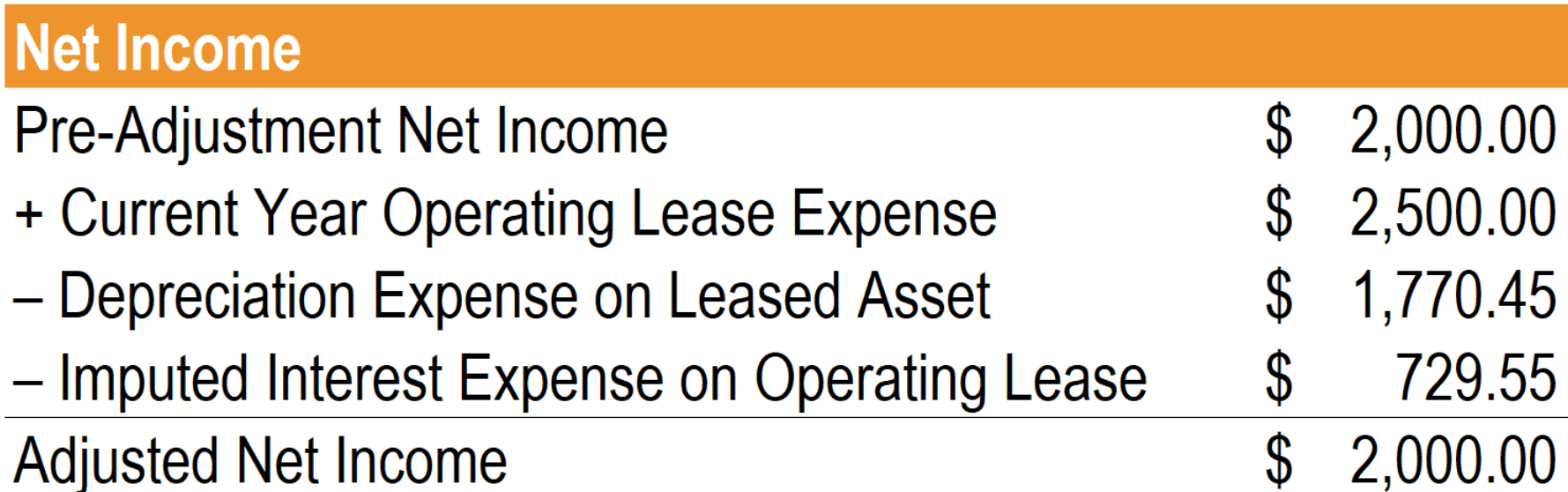

Like with the full adjustment method, though operating income has changed, net income should not. Below are the calculations to illustrate this effect:

Finally, adjusting debt is the same as the full adjustment method. Add the debt value of the leases to the reported debt value.

Impact on Valuation

There are two effects on free cash flow to the firm (FCFF) when we treat operating lease expenses as financing expenses by capitalizing them:

- FCFF will increase because the imputed interest expense on the capitalized operating leases is added back to the operating income (EBIT).

- FCFF will decrease if the present value of leases increases (and vice versa) due to the net change in capital expenditures . This occurs because we must treat operating leases like capital expenditures if we capitalize them.

Furthermore, the weighted average cost of capital (WACC) will decrease as the debt ratio increases, which has a positive impact on the value of the firm. It is important to note that the increase in firm value derives solely from the value of debt, and not the value of equity. If the debt ratio stays stable, and the leases are fairly valued, treating operating leases as debt should have a neutral effect on the value of equity.

Other Resources

We hope you’ve enjoyed reading this CFI guide to leases. To learn more, see the following free CFI resources.

- Lease Classifications

- Lease Accounting

- Prepaid Lease

- Projecting Balance Sheet Items

- See all accounting resources

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes . These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Assignment of Lease: How It Works and Parties Involved

Jump to section, what is an assignment of lease.

The assignment of lease is a title document that transfers all rights possessed by a lessee or tenant to a property to another party. The assignee takes the assignor’s place in the landlord-tenant relationship.

You can view an example of a lease assignment here .

How Lease Assignment Works

In cases where a tenant wants to or needs to get out of their lease before it expires, lease assignment provides a legal option to assign or transfer rights of the lease to someone else. For instance, if in a commercial lease a business leases a place for 12 months but the business moves or shuts down after 10 months, the person can transfer the lease to someone else through an assignment of the lease. In this case, they will not have to pay rent for the last two months as the new assigned tenant will be responsible for that.

However, before the original tenant can be released of any responsibilities associated with the lease, other requirements need to be satisfied. The landlord needs to consent to the lease transfer through a “License to Assign” document. It is crucial to complete this document before moving on to the assignment of lease as the landlord may refuse to approve the assignment.

Difference Between Assignment of Lease and Subletting

A transfer of the remaining interest in a lease, also known as assignment, is possible when implied rights to assign exist. Some leases do not allow assignment or sharing of possessions or property under a lease. An assignment ensures the complete transfer of the rights to the property from one tenant to another.

The assignor is no longer responsible for rent or utilities and other costs that they might have had under the lease. Here, the assignee becomes the tenant and takes over all responsibilities such as rent. However, unless the assignee is released of all liabilities by the landlord, they remain responsible if the new tenant defaults.

A sublease is a new lease agreement between the tenant (or the sublessor) and a third-party (or the sublessee) for a portion of the lease. The original lease agreement between the landlord and the sublessor (or original tenant) still remains in place. The original tenant still remains responsible for all duties set under the lease.

Here are some key differences between subletting and assigning a lease:

- Under a sublease, the original lease agreement still remains in place.

- The original tenant retains all responsibilities under a sublease agreement.

- A sublease can be for less than all of the property, such as for a room, general area, portion of the leased premises, etc.

- Subleasing can be for a portion of the lease term. For instance, a tenant can sublease the property for a month and then retain it after the third-party completes their month-long sublet.

- Since the sublease agreement is between the tenant and the third-party, rent is often negotiable, based on the term of the sublease and other circumstances.

- The third-party in a sublease agreement does not have a direct relationship with the landlord.

- The subtenant will need to seek consent of both the tenant and the landlord to make any repairs or changes to the property during their sublease.

Here is more on an assignment of lease here .

Parties Involved in Lease Assignment

There are three parties involved in a lease assignment – the landlord or owner of the property, the assignor and the assignee. The original lease agreement is between the landlord and the tenant, or the assignor. The lease agreement outlines the duties and responsibilities of both parties when it comes to renting the property. Now, when the tenant decides to assign the lease to a third-party, the third-party is known as the assignee. The assignee takes on the responsibilities laid under the original lease agreement between the assignor and the landlord. The landlord must consent to the assignment of the lease prior to the assignment.

For example, Jake is renting a commercial property for his business from Paul for two years beginning January 2013 up until January 2015. In January 2014, Jake suffers a financial crisis and has to close down his business to move to a different city. Jake doesn’t want to continue paying rent on the property as he will not be using it for a year left of the lease. Jake’s friend, John would soon be turning his digital business into a brick-and-mortar store. John has been looking for a space to kick start his venture. Jake can assign his space for the rest of the lease term to John through an assignment of lease. Jake will need to seek the approval of his landlord and then begin the assignment process. Here, Jake will be the assignor who transfers all his lease related duties and responsibilities to John, who will be the assignee.

You can read more on lease agreements here .

Image via Pexels by RODNAE

Assignment of Lease From Seller to Buyer

In case of a residential property, a landlord can assign his leases to the new buyer of the building. The landlord will assign the right to collect rent to the buyer. This will allow the buyer to collect any and all rent from existing tenants in that property. This assignment can also include the assignment of security deposits, if the parties agree to it. This type of assignment provides protection to the buyer so they can collect rent on the property.

The assignment of a lease from the seller to a buyer also requires that all tenants are made aware of the sale of the property. The buyer-seller should give proper notice to the tenants along with a notice of assignment of lease signed by both the buyer and the seller. Tenants should also be informed about the contact information of the new landlord and the payment methods to be used to pay rent to the new landlord.

You can read more on buyer-seller lease assignments here .

Get Help with an Assignment of Lease

Do you have any questions about a lease assignment and want to speak to an expert? Post a project today on ContractsCounsel and receive bids from real estate lawyers who specialize in lease assignment.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment of Lease Lawyers

I am a solo-practitioner with a practice mostly consisting of serving as a fractional general counsel to start ups and growth stage companies. With a practical business background, I aim to bring real-world, economically driven solutions to my client's legal problems and pride myself on efficient yet effective work.

Billy Joe M.

I graduated from the University of Illinois at Urbana-Champaign in 2006 with a degree in Political Science, Finance, and Economics. I stayed around Champaign for law school and graduated in 2009. I then worked at a big law firm in downtown Chicago. It was boring, so I quit in early 2011. I thought that I could not be happy practicing law - I was wrong. After I quit the traditional law firm life, I began representing my own clients. I realize now that I love helping normal people, small business owners, and non-profits address a variety of legal issues. I hope to hear from you.

G'day, my name is Michele! I work with startups, entrepreneurs and small/medium-sized businesses across the country in a wide array of industries. I help them with all of their ongoing, daily legal needs. This includes entity formation, M&A, contract drafting and review, employment, asset sale & acquisition, and business sales or shareholder exits. I'm half-Australian, half-Italian, and I've lived the last 20+ years of my life in America. I've lived all over the USA, completing high school in the deep south, graduating cum laude from Washington University in St. Louis, and then cum laude from Georgetown University Law Center. After law school I worked for the Los Angeles office of Latham & Watkins, LLP. After four intense and rewarding years there, I left to become General Counsel and VP of an incredible, industry-changing start-up called Urban Mining Company (UMC) that manufactures rare earth permanent magnets. I now work for Phocus Law where I help run our practice focused on entrepreneurs, startups, and SMEs. I love what I do, and I'd love to be of help! My focus is on providing stress-free, enjoyable, and high-quality legal service to all of my clients. Being a good lawyer isn't enough: the client experience should also be great. But work isn't everything, and I love my free time. I've been an avid traveler since my parents put me on a plane to Italy at 9-months old. I'm also a music nut, and am still looking for that perfect client that will engage me to explain why Dark Side Of The Moon is the greatest album of all time. Having grown up in a remote, and gorgeous corner of Australia, I feel a strong connection to nature, and love being in the elements.

The Law Office of David Watson, LLC provides comprehensive and individualized estate-planning services for all stages and phases of life. I listen to your goals and priorities and offer a range of estate-planning services, including trusts, wills, living wills, durable powers of attorney, and other plans to meet your goals. And for convenience and transparency, many estate-planning services are provided at a flat rate.

My clients know me as more than just an attorney. First and foremost, my background is much broader than that. Prior to attending the Valparaiso University School of Law, I earned a Master of Business Administration and ran a small business as a certified public accountant. Thanks to this experience, I possess unique insight which in turn allows me to better assist my clients with a wide range of business and tax matters today. In total, I have over 20 years of experience in financial management, tax law, and business consulting, and I’m proud to say that I’m utilizing the knowledge I’ve gained to assist the community of Round Rock in a variety of ways. In my current practice, I provide counsel to small to medium-sized businesses, nonprofit organizations, and everyday individuals. Though my primary areas of practice are estate planning, elder law, business consulting, and tax planning, I pride myself on assisting my clients in a comprehensive manner. Whenever I take on a new client, I make an effort to get to know them on a personal level. This, of course, begins with listening. It is important that I fully understand their vision so I can help them successfully translate it into a concrete plan of action that meets their goals and expectations. I appreciate the individual attributes of each client and know firsthand that thoughtful, creative, and customized planning can maximize both financial security and personal happiness. During my time as a certified public accountant, I cultivated an invaluable skill set. After all, while my legal education has given me a deep understanding of tax law, I would not be the tax attorney I am today without my background in accounting. Due to my far-reaching experience, I am competent in unraveling even the most complex tax mysteries and disputes. My CPA training benefits my estate planning practice, too. In the process of drafting comprehensive wills and trusts, I carefully account for every asset and plan for any tax burdens that may arise, often facilitating a much smoother inheritance for the heirs of my clients. Prior to becoming certified as a CPA, I made sure to establish a solid foundation in business both in and out of the classroom, and the acumen I’ve attained has served me well. Not only am I better able to run my own practice than I otherwise would be; I am able to help other small business owners fulfill their dreams, as well.

James David W.

I graduated from Harvard Law School and worked first for a federal judge and then a leading DC firm before starting a firm with a law school classmate. My practice focuses on company formations, early-stage investments, and mergers & acquisitions.

Anna is an experienced attorney, with over twenty years of experience. With no geographical boundaries confining her practice, Anna works on corporate, healthcare and real estate transactions. Anna brings extensive big firm experience, garnered as an associate in the Miami office of the world's largest law firm, Baker and McKenzie, and the Miami office of the international law firm Kilpatrick Townsend. Her areas of expertise include: mergers and acquisitions, initial public offerings, private placements, healthcare transactions, corporate finance, commercial real estate transaction and acting as a general corporate counsel. Anna is certified to practice law in Florida and was admitted to the Florida Bar in 1998. Anna is also a Certified Public Accountant. She passed May 1995 CPA Exam on the first sitting. She is fluent in Russian (native).

Find the best lawyer for your project

Assignment of Lease

Contract to lease land from a church?

I’m planning on leasing land from a church. Putting a gym on the property. And leasing it back to the school.

Ok; first step is that you will need a leasing contract with the church. Ask them to prepare one for you so you would just need an attorney to review the agreement and that should cost less than if you had to be the party to pay a lawyer to draft it from scratch. You need to ensure that the purpose of the lease is clearly stated - that you plan to put a gym on the land so that there are no issues if the church leadership changes. Step 2 - you will need a lease agreement with the school that your leasing it do (hopefully one that is similar to the original one your received from the church). Again, please ensure that all the terms that you discuss and agree to are in the document; including length of time, price and how to resolve disputes if you have one. I hope this is helpful. If you would like me to assist you further, you can contact me on Contracts Counsel and we can discuss a fee for my services. Regards, Donya Ramsay (Gordon)

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Real Estate lawyers by top cities

- Austin Real Estate Lawyers

- Boston Real Estate Lawyers

- Chicago Real Estate Lawyers

- Dallas Real Estate Lawyers

- Denver Real Estate Lawyers

- Houston Real Estate Lawyers

- Los Angeles Real Estate Lawyers

- New York Real Estate Lawyers

- Phoenix Real Estate Lawyers

- San Diego Real Estate Lawyers

- Tampa Real Estate Lawyers

Assignment of Lease lawyers by city

- Austin Assignment of Lease Lawyers

- Boston Assignment of Lease Lawyers

- Chicago Assignment of Lease Lawyers

- Dallas Assignment of Lease Lawyers

- Denver Assignment of Lease Lawyers

- Houston Assignment of Lease Lawyers

- Los Angeles Assignment of Lease Lawyers

- New York Assignment of Lease Lawyers

- Phoenix Assignment of Lease Lawyers

- San Diego Assignment of Lease Lawyers

- Tampa Assignment of Lease Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

IFRScommunity.com

Skip to content

- Unanswered topics

- Active topics

- IFRScommunity.com Forums Accounting and financial reporting IFRS-related topics

IFRS 16 Assignment of Lease

Post by BrinZ » 16 Jan 2021, 01:30

Re: IFRS 16 Assignment of Lease

Post by Marek Muc » 16 Jan 2021, 08:57

Post by BrinZ » 17 Jan 2021, 00:35

Post by Marek Muc » 17 Jan 2021, 16:35

Post by BrinZ » 19 Jan 2021, 04:14

Post by Marek Muc » 19 Jan 2021, 09:45

Post by BrinZ » 20 Jan 2021, 00:56

Post by nauman » 26 Jan 2021, 12:34

Post by Andreas Kyriacou » 27 Jan 2021, 17:11

Post by JRSB » 28 Jan 2021, 23:43

Return to “IFRS-related topics”

- IFRScommunity.com Forums

- All times are UTC+02:00

- Delete cookies

Powered by phpBB ® Forum Software © phpBB Limited

Privacy | Terms

Lease Accounting Considerations in Business Combinations

As part of a business combination, an acquirer may assume the existing leases of the acquiree, under which the acquiree is the lessee. Based on this transaction type, the acquirer must consider several factors.

Specifically, the acquired leases are measured, as of the acquisition date, as if they are newly signed by the acquirer. This requires the acquirer to assess the discount rate and remaining lease payments, considering the extension, purchase, and termination options.

This assessment may result in a different measurement of the lease liability and right-of-use (ROU) asset (discussed below) as compared to what is reflected on the acquiree's closing balance sheet. However, lease classification does not require reassessment unless leases are modified as a result of the acquisition. Assignment of a lease to the acquirer with no changes to the lease term or payments is generally not considered a modification.

Lease Liability

The lease liability is measured as the present value of the remaining lease payments, based on the assessment of factors included above, and using the acquirer's discount rate, which may vary from the acquiree's original rate. As a result, the same remaining lease payments may result in a higher or lower balance than recorded on the acquiree's balance sheet.

Additionally, as part of the acquire's reassessment of the lease term, the acquirer's reasonable certainty around exercising renewal, termination, and/or purchase options in the context of its own operations may differ from that of the acquiree. For example, the acquiree may have concluded that it was reasonably certain that the lease would be renewed following the base term because the location was critical for a business unit. However, if the business unit is not significant to the acquirer (e.g., the intent of the acquisition was to achieve synergies with another part of the business), then the acquirer may reach a different conclusion. Only the renewal or termination options that the acquirer is reasonably certain to exercise are included in the lease term, regardless of the acquiree's previous conclusions.

The ROU asset, as of the acquisition date, is initially measured at an amount equal to the lease liability, adjusted for above or below market terms of the lease, consistent with acquisition accounting and fair value principles under ASC 805: Business Combinations. Thus, the ROU asset may be adjusted up or down to reflect the current state of the market. Previously, under ASC 840, this favorable or unfavorable adjustment was captured as an intangible asset. Under ASC 842, however, the ROU asset is adjusted directly.

In assessing the extent of procedures to perform in determining any fair value adjustment, companies should consider:

- When was the lease executed? If it was executed recently in an arms length transaction, it may already be at market.

- What is the remaining lease term? If, for example, there are only a few months left, the acquirer may conclude that the fair value is not materially different from the acquiree's carrying value.

Other Considerations

An acquirer may choose to apply the short-term lease practical expedient (i.e., leases with remaining terms of 12 months or less) for any leases acquired under which the acquiree is the lessee. This means that the acquirer would not recognize a lease liability or ROU asset or separately record the impact of above- or below-market terms.

As with all other areas, the acquiree must conform its accounting policies to those of the acquirer. If the acquirer is a public business entity and has already adopted ASC 842, but the acquiree was a private company still reporting under ASC 840, the acquiree must immediately adopt ASC 842, generally on a more compressed timeline.

Even if both parties have adopted ASC 842, adjustments may still be necessary if private company practical expedients were initially applied and are no longer permissible. For instance, an acquisition resulting in a private acquiree becoming part of a public business entity would require eliminating any expedients only available to private companies (e.g., use of the risk-free rate rather than the implicit or incremental borrowing rate).

Steve Hills

Jeremy enuson.

- Accounting Advisory

Related Topics

Related professionals.

+1.720.681.6823

+1.312.237.4856

Related experience.

Performed full adoption of ASC 842 leases for energy company

Related insights.

Key Considerations for Private Companies Adopting ASC 842

How to Calculate the Balance Sheet Impact of ASC 842 Adoption

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

CHAPTER 21 Accounting for Leases ASSIGNMENT CLASSIFICATION TABLE

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Practice Management for Accountants IRIS’s market-leading practice management software will improve your efficiency and enable you to make better business decisions. Streamline and automate time-consuming admin duties, track jobs and workflow, and store and maintain all your valuable data in one place.

- IRIS Firm Management IRIS Firm Management gives you a complete overview of your firm’s performance in real-time.

- IRIS Star Practice Management Innovative, feature rich and technically advanced practice management suite.

- Creating a frictionless environment in your firm Download this guide to learn how to meet global expansion goals for your firm with software technology, whilst creating as little friction as possible.

- IRIS Document Management Accounting document management software that provides a centralized, simple dashboard for document organization, customer data and workflows.

- Lease Accounting IRIS Lease Accounting automates compliance with the latest lease accounting standards, streamlines leasing processes, improves transparency and reporting, and aligns strategies across your whole organization.

- Lease Accounting Software ASC 842 and IFRS 16 compliance made easy.

- Lease Management Services Flexible lease management services, tools and expertize.

- Managed Accounting IRIS Outsourcing provides comprehensive accounting management services, to cost-effectively handle core accounting and payroll processes for you. Trust us to become your extended team of experts.

- Outsourced Accounting Services A complete service encompassing CPA outsourcing, tax solutions, financial statements and more.

- Partner With Us Working together, we can do more! Create new revenue streams, recommend valuable solutions, reinforce your trusted advisor status, and build additional credibility and confidence with your clients while making it easier to reach new markets.

- Affinity Partner Program See what success you can achieve as an IRIS Affinity Partner. We provide you with everything you need to deliver fast results with minimum effort, resources, and time needed from your firm.

- Accounting Software

- myPay Solutions Complete payroll solutions for accountants and accounting firms.

- Global Workforce Management Services Payroll and payment solutions for organizations expanding globally.

- Payroll Solutions in Canada Payroll management for North American and International companies with employees in Canada.

- IRIS HCM: Human Capital Management A comprehensive suite of Payroll and HR services designed to streamline payroll, human resources, and more, scalable to grow with your business.

- IRIS Payroll Solutions brochure Download this brochure to learn more about the IRIS fully managed payroll services and payroll software solutions.

- Apex HCM Payroll Software Simple, efficient and reliable cloud-based payroll platform – Visit apexhcm.com

- Payroll Relief Payroll software for accountants – Visit accountantsworld.com

- Partner With Us Increase revenue in line with your client’s revenue growth by delivering payroll & HR services to your clients.

- HR & Payroll Partners Find out more about partnering with IRIS.

- Global HR Services & Consulting Discover our HR services for organizations looking to expand their workforce globally.

- HR Consulting Services in Canada Support for compliantly hiring, recruiting, and ongoing management of employees in Canada.

- IRIS HCM A suite of Human Capital Management services designed to help you with payroll, HR and more.

- Textile Exchange case study Discover how IRIS Human Resources Consulting (HRC) helped Textile Exchange expand and strengthen its international footprint.

- Apex HCM HR Software Full HCM platform – Visit apexhcm.com

- Apex HCM Timesheet Software Timekeeping made easy – Visit apexhcm.com

- Recruitment Software Browse our range of recruitment software

- Recruitment Services Discover our recruitment services

- Support Browse our helpful support documents or find a list of options to get in touch.

- Contact Us Find all the ways to get in touch.

- Get help with your product Get help and support for your IRIS products.

- About Us Find out more about IRIS.

- Product Help Get help and support for your IRIS products.

- Resources Find a range of helpful articles and resources to help you with accounting, HR and payroll.

- Blog Read helpful articles and the latest insights on our blog.

- Case Studies See how our solutions have helped our customers.

- Guides Find helpful advice around accounting, payroll, HR and more.

- Webinars Watch our free webinars and sign up for upcoming webinars.

- Talking Points Read a wide range of top level business topics around accounting, HR, Payroll.

- Our Company Find out all about IRIS Software Group. Who we are, what we do, and the people behind the business.

- Leadership Discover the leadership team at IRIS.

- About IRIS We exist to simplify the lives of businesses by helping create greater operational accuracy and efficiencies in everyday tasks and look forward with confidence.

- News Get the latest scoop on what’s going on at IRIS.

- Careers We’re always on the lookout for talented people like you. Find the latest vacancies and details on how to apply.

- Careers (North America) Find the latest vacancies at IRIS.

- Careers (UK) Find the latest UK vacancies at IRIS.

- Product Developers Find the latest product development vacancies.

- Acquisitions & Partnerships We’re experts with both acquisitions and partnerships. Let’s help you throughout the whole process.

- Payroll M & A Thinking of selling your payroll business? Let’s help.

- IRIS Global Product Development Center Find the latest product development vacancies.

- Legal | Product and Services Legal Documentation Find details and review our consumer products and services General Terms and Conditions of supply.

- Product and Services Terms and Conditions

- Customer Data Processing Terms

- Privacy Policy

Power up your portfolio with lease accounting software

How do you ensure compliance with lease accounting standards while making the most of your portfolio? By finding the right lease accounting software.

Let’s explore how software can help you effectively tackle lease management.

What is lease management software?

Lease management software (or lease accounting software) is a digital program or application designed to streamline and simplify the management of lease agreements.

It automates various tasks, from tracking lease terms to ensuring compliance with accounting standards like ASC 842 and IFRS 16.

By centralizing all lease-related information, lease management software provides companies with a comprehensive overview of their lease obligations and financial impacts.

How can lease management software help?

For companies who want to manage their lease portfolio in-house, lease accounting software is an invaluable tool that can help companies:

- Track and monitor lease agreements from one, centralized location

- Use automation to complete complex calculations and generate detailed reports

- Manage their lease portfolio from anywhere with an internet connection (in the case of cloud-based products like IRIS Innervision )

What are the benefits of lease management software?

Designed to make lease management easier and more accessible, leasing management software can be a great choice for companies looking to power up their portfolios – and here’s why.

Improve efficiency through automation

With lease accounting software, you can hit ‘close’ on complex spreadsheets and sit back while automation takes care of your calculations.

Labor-intensive tasks like ensuring compliance with accounting standards like ASC 842 and IFRS 16 are all taken care of. And that means you and your team have more time to focus on what matters – running your business.

Make cost-effective decisions

Lease portfolio management software has a significantly lower upfront investment than solutions like lease management services.

For businesses that aren’t in a position to make big upfront investments, lease management software can give you almost all the benefits of a managed service but at a lower cost point.

Rely on higher levels of accuracy

When you’ve only got people behind your portfolio calculations, human error is inevitable – and it only takes one inaccurate financial report to land your company in hot water.

Lease accounting software ensures accuracy by automating complex calculations and providing real-time updates.

Get a clearer picture

By centralizing and organizing all your lease data in one place, you can finally get a crystal clear overview of your lease portfolio.

Whether you’re tracking lease terms, monitoring obligations, or flagging renewal dates, your lease management software gives you an invaluable overview of everything that’s happening.

Scale to what you need

Lease management software is designed to grow with your business, making it suitable for organizations of all sizes.

Because software can be easily adjusted to suit different levels of need, it’s easy to scale up or down according to your shifting requirements.

Whether you have a small lease portfolio or manage hundreds of leases, the best lease management software has the ideal solution for you.

Use with complete confidence

Modern lease management software is designed to be used by busy professionals who want to get in, get what they need, and get out again.

The best lease management systems will have user-friendly interfaces, so anyone can log in and get to grips with how it works quickly.

All this means your team will have less of a learning curve to becoming confident users – and you can transition to the new system smoothly.

Integrate with your existing systems

By integrating and communicating with your existing systems, the best lease accounting software allows for seamless data flow across your company. In practice, this means:

- Less manual data entry, minimizing any risk of error and improving accuracy

- A reduced administrative strain on your staff, freeing up their time

- You can effectively track all lease agreements from one place, ensuring no critical dates or terms are overlooked.

Featured Guide

Lease accounting: a guide for businesses, cpas, and finance professionals .

Download this go-to resource on lease accounting management, including solutions like lease accounting software and lease portfolio management.

An ASC 842 and IFRS 16 software solution

Ensuring compliance with legislation like ASC 842 and IFRS 16 is crucial – but how does lease accounting software help you achieve this?

- Automatically updating to reflect changes to lease accounting standards

- Identifying and collating detailed information about lease terms, timing, and amounts

- Automating journal entries for lease-related transactions, ensuring accuracy and simplifying the audit process

- Storing and organizing all lease data in a secure centralized system.

What about lease accounting services?

Lease management software isn’t the only way to manage your portfolio and ensure compliance with leasing standards.

Lease accounting services can help you optimize your lease portfolio, ensuring you remain fully compliant with accounting standards and allowing you to pursue better financial outcomes.

Learn more about lease management services, including how IRIS Innervision can support your business.

IRIS Innervision “We decided upon IRIS Lease Accounting as our preferred technology partner for transitioning to IFRS 16 as we were seeking a comprehensive end-to-end solution that would support the complexities of our multifaceted lease portfolio.”

National Express

Unlock ASC 842 compliance with IRIS Innervision

IRIS Lease Accounting software is a powerful solution that ensures you’re fully compliant ASC 842 and other accounting standards.

From streamlining leasing processes to aligning strategies across your whole organization, IRIS Innervision is your key to unlocking lease management.

- Our Products

- Practice Management

- Document Management Software

- Lease Accounting Software

- HR & Payroll Solutions

- Contact Support

- Our Company

- Case Studies

- Careers at IRIS

- Terms and conditions

© IRIS Software Group Ltd 2024

You seem to be using an unsupported browser

To get the best user experience please use a supported browser. Here are a few we recommend:

- Department of Accounting

Department of Accounting / Department of Accounting is located in Moscow, ID, in a small setting.

Degrees & Awards

Degrees offered.

| Degree | Concentration | Sub-concentration |

|---|---|---|

| Master of Accounting (M Acct) | Accountancy |

Degrees Awarded

| Degree | Number Awarded |

|---|---|

| Master's Degrees | 26 |

Earning Your Degree

| Part-time study available? | No |

| Evening/weekend programs available? | No |

Application Deadlines

| Type | Domestic | International | Priority date |

|---|---|---|---|

| Fall deadline | July 1st | May 15th | No |

| Spring deadline | December 1st | October 15th | No |

| Summer deadline | April 15th | March 15th | No |

Entrance Requirements

| Exam | Details | |

|---|---|---|

| Master's Degree Requirements | Minimum GPA of 3.0 | |

| Exam | Details | |

| TOEFL: Required | TOEFL IBT score: 88 | '); |

Tuition & Fees

Financial support.

| Financial award applicants must submit: | FAFSA |

|---|---|

| Application deadlines for financial awards | December 1 |

Location & Contact

- Grad Schools

- Search Results

- University of Idaho

- College of Graduate Studies

- College of Business and Economics

FDS Law, Tax & Accounting

FDS Law is an international law and accounting firm with offices in Moscow and London.

FDS Law has been advising foreign and Russian corporate and private clients in Russia and abroad for over 20 years.

Our main areas of practice include corporate and mergers and acquisitions, commercial cross-border transactions and dispute resolution involving Russian assets.

FDS Law also advises Russian corporate and private clients who wish to do business or settle abroad on legal, immigration, accounting and tax matters.

The firm employs foreign and Russian qualified lawyers and accountants, many of whom have two decades of professional experience. All professional members of FDS Law speak Russian and English.

FDS Law is a member of the American Chamber of Commerce and the TAGLaw worldwide alliance of law firms.

As a member of TAGLaw FDS Law is capable of providing legal support to its clients in more than 100 jurisdictions around the world working closely with other TAGLaw firms.

For more information about FDS Law please visit the "About Us" section of this website.

If you are interested in learning more about the services we provide and industries we service, please click on one of the links above or contact us.

IMAGES

VIDEO

COMMENTS

About the Leases guide LG 2, Scope Example LG 2-14, Example LG 2-15 and Example LG 2-16 in LG 2.4.6.1 were updated to illustrate the impact of adopting ASU 2021-05 on the allocation of variable consideration between

14.1 Leases (ASC 842 and IFRS 16) - Viewpoint - PwC

About the Leases guide & Full guide PDF - Viewpoint - PwC

Roadmap for ASC 842 - Lease Accounting Guide

What Is Lease Accounting? Expert Guide & Examples

What Is Lease Accounting & Why Is It Important? - HBS Online

Lease Accounting

Step 1: Collect input data. Find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses. Cost of debt can be found using the firm's bond rating. If there is no existing bond rating, a "synthetic" bond rating can be calculated using the firm's interest coverage ratio.

Assignment of Lease: Definition & How They Work (2023)

Accounting for a Lease Assignment. Entity B has opted to exit a particular retail location and will assign the rights and obligations of the existing lease arrangement (the "original lease") to the new tenant (the "sublessee") through an agreement with the sublessee (the "lease assignment"). ...

Based on the 2013 draft, it is likely that, once implemented, the new rules will require that virtually all leases will be recognized as creating, for lessees, assets known as "rights-of-use," together with corresponding obligations. However, in terms of income statement effects, some of these will be given full "capital lease ...

IFRS 16 Assignment of Lease. by BrinZ » Sat Jan 16, 2021 12:30 am. Our head office lease has been legally assigned to a third party who now occupies the space and is making rent payments to the landlord. This is not a sublease although we remain liable for the lease payments if the third party defaults on the lease during the original lease term.

5.2.1 Lessee accounting for a lease modification. As illustrated in Figure LG 5-1, a lessee's accounting treatment of a lease modification depends on the type of modification made to the lease. A lease modification can result in either a separate new contract that is accounted for separate from the original contract or a single modified ...

Assignment of a lease to the acquirer with no changes to the lease term or payments is generally not considered a modification. ... is initially measured at an amount equal to the lease liability, adjusted for above or below market terms of the lease, consistent with acquisition accounting and fair value principles under ASC 805: Business ...

Case 21-4 (Time 15-25 minutes) Purpose—to provide the student with an assignment to describe: (a) the accounting for a capital lease both at inception and during the first year and (b) the accounting for an operating lease. The student is also required to compare and contrast a sales-type lease with a direct financing lease.

With lease accounting software, you can hit 'close' on complex spreadsheets and sit back while automation takes care of your calculations. Labor-intensive tasks like ensuring compliance with accounting standards like ASC 842 and IFRS 16 are all taken care of. And that means you and your team have more time to focus on what matters ...

Department of Accounting at University of Idaho provides on-going educational opportunities to those students seeking advanced degrees. Department of Accounting - University of Idaho - Graduate Programs and Degrees

Revenue assignment The period up to 1994 was characterized by a revenue assignment system which was non-transparent and unpredictable owing to very frequent changes in basic sharing parameters, and assignments which were ad hoc and negotiated with individual regions. The "regulation" approach basically aimed at

Contact us 3-y Pavlovskiy pereulok, 1 Stroyenie 57, Suite 227 Moscow, 115093, Russia Phone: +7 (495) 258 35 00 FAX: +7 (495) 258 35 01 Email: [email protected]

5.5 Accounting for a lease termination - lessee - Viewpoint

services represent consulting, legal, accounting, mar-keting, advertising, engineering, data collection or data processing, research and development, or human resources-related services, and certain other types of services,3 they are deemed provided in Russia if the customer is located in Russia. With respect to licensing and assignment of intel-

Financing transactions | Viewpoint - PwC