Transfer data from Billing to Accounting document

When i post the billing document the accoutning document is being automatically generated. This is great for me. However i will like to know where i can configure what is copied into the accounting document text field (BSEG-SGTXT). Right now it is pulling the sales order number and I will like the PO Number field (VBKD-BSTKD) to be copied instead.

Suggest you check copy control → header → either assignment or reference number. Quite sure the PO number is an option there.

Please look at copy control between delivery doc type and billing doc type.

First of all, may I know how the Sales Order number is getting populated in text field of accounting document?

You need to set up an FI sustitution for this (Tcode GGB1) Go to application area FInancial accounting → line item. Either add a step to an existing substitution or create a new substitution. If this is the first substitution your are creating you need to do some customizing (OBBH) If you need to do some ABAP programming, you need also to create and assign a substitution program (GCX2)

Try the Assignment Number and Reference No fields in the Delivery → Billing Copy Control customisings. Maintain them as A and check by re initiating the end to end cycle again.

Related Topics

| Topic | Replies | Views | Activity | |

|---|---|---|---|---|

| Software , | 33 | 96 | July 2, 2009 | |

| Business , | 2 | 283 | March 15, 2017 | |

| Business , | 4 | 108 | August 18, 2004 | |

| Software , | 6 | 163 | August 23, 2005 | |

| Software , | 1 | 126 | July 11, 2005 |

CUSTOMER SUCCESS STORY

Productive Serves Makerstreet as a Single Source of Truth

Makerstreet is an Amsterdam-based collective of agencies with over 300 employees in four offices.

Agency Valuation Calculator Report

See the 2023 Global Agency Valuations Report

Book a Demo

Try Productive

Comparisons

{{minutes}} min read

Project Billing Guide: Stages, Types, And All You Need to Know

Lucija Bakić

August 8, 2024

Project billing is the cornerstone process of managing a professional services project.

If you can complete a project to a client’s satisfaction, you’ll be more likely to get positive referrals and repeat work. But even more importantly, how can you finalize a project in a way that’s beneficial not only to the client but to your agency? In this article, we’ll discuss the basics of successful project accounting . This includes how to create an effective billing process and manage your invoice creation and sending, all while supporting business profitability.

Key Takeaways

- Project billing is the comprehensive process of pricing services, creating invoices, and collecting payments according to client agreement.

- The most popular billing methods include fixed-cost, time-and-materials, and retainer billing.

- The main stages of the billing process include the initial budget estimation and planning, change management during project execution, invoice creation, sending, and management.

- Project cost management software can help businesses make their billing more efficient with automated workflows, accurate time tracking, and real-time reporting and forecasting.

What Is Project Billing?

Project billing is the comprehensive process of pricing your services, creating invoices, and collecting payment according to client agreements. It can be complicated as it involves many moving parts: setting project fees, recognizing expenses, monitoring budgets and profit, providing visibility to both parties and ensuring your work is compensated fairly and on time. The latter is a particular roadblock for agencies — according to project billing research, 48% of invoices issued by small businesses pass their payment date, which significantly impacts their growth, decision-making, and productivity. However, the importance of effective project billing extends beyond timely payments. It encompasses several critical aspects that contribute to the successful financial management of projects .

The Main Stages of Project Billing

The project billing process has multiple stages, beginning with planning, going over to project execution and invoicing, and ending with full payment received.

Let’s go through these stages in more detail to showcase their importance and key elements.

Estimation and Planning Stage

The estimation and planning stage is the foundation of successful project billing. Estimation incorporates various key insights and strategies: understanding your historical data (e.g., estimated vs. real completion time), having a firm grasp on employee availability and skills, and accurately forecasting costs and potential risks. You’ll also need to know how to set your agency rates to remain profitable and competitive. Accurate estimation helps set realistic budgets and expectations for both the project team and the client. To learn more, check out our guide on how to manage a project budget . Joi Polloi, a UK creative tech agency, used the agency management software Productive to get better control over their budgeting and improve estimating for future engagements:

It’s really helpful to see the budget you get for a piece of work and the actual amount of time spent on that piece of work. Whether that’s a cost to the business or something we’ll charge to the client—the evidence is plain to see for work that is underestimated.

Jason Devoy, Delivery Director at Joi Polloi

Read the full story to learn more.

Creating Documentation

During the project planning phase, you’ll need to create and sign certain documentation that contains financial terms, details on the execution (scope, objective, deliverables), and may include requirements such as achieving specific project management metrics , depending on your project billing type (for example, in performance-based projects). The statement of work (SOW) is one of the most crucial documents, as it involves details including:

- what the project is

- high-level description of work performed

- timeline with project milestones and reporting schedules

- parties responsible for various project areas, teams, and roles

- budgets, additional costs, estimates with dates

According to certain research, such as the Standish Group Chaos Report, incomplete requirements (12%), changing specifications (12%), and unclear objectives (5%) are some of the main causes of project challenges. Even details that might seem obvious at first, for ex. what constitutes a bug fix vs. change request in web dev project management , should be clearly defined to avoid issues down the line.

Monitoring Resources and Finances

During the project execution and management stage, the focus shifts to implementing the project plan and managing resources and finances effectively. This stage involves resource scheduling, budget tracking, and expense management to ensure that the project stays on track and within budget.

Resource Scheduling and Forecasting

While your resource scheduling should be planned out in advance, changes will need to be implemented along the way according to various internal or external demands. For example, a team member might go on unexpected sick leave, or the client might request additional work on a deliverable. Effective resource management means that the right team members are utilized on the right tasks. Depending on their seniority and skill levels, some team members’ time will be more expensive than others. In T&M projects, this gap is usually accounted for, but in fixed-price projects, the situation is different. And when a single project manager needs to balance these resources across multiple projects, it can get even more complicated. Resource scheduling tools can help in planning and managing resource allocation; for example, with Productive’s Resource Planning , you can view the impacts of scheduling on profitability and revenue. Changing your allocation impacts these metrics in real time.

Productive lets you visualize and forecast key capacity management metrics

Gathering Data and Invoice Creation

Creating clear, detailed, and, above all, accurate invoices is crucial for prompt payments. While this sounds like a no-brainer, research by Endava shows that as many as 29% of agencies have a high number of discrepancies in their invoices. Project accounting software can help professional services firms get better control of actual hours spent on projects, generate invoices faster and more reliably, and monitor unpaid vs paid invoices more easily.

Productive Billing provides flexibility, real-time, and integrations with Xero and QuickBooks

The essential elements of an invoice include:

- Client and Service Provider Information : Include the client’s and agency’s name, address, and contact details.

- Invoice Number and Date : Assign a unique invoice number and include the invoice date for tracking and record-keeping purposes.

- Description of Services : Provide a description of the work performed, including dates, hours worked, and specific tasks completed.

- Costs : Itemize the charges for each service or task, including any applicable taxes or discounts.

Sending Invoices and Following Up

Following up on sent invoices is essential to maintain a steady cash flow. Depending on how many projects your business is handling at once, things can start to slip through the cracks. Here are some tips on how to streamline your invoice management (all of these features are offered by Productive, but some Productive alternatives may have them too):

- Create a custom automation for your invoicing; for ex. send a Slack message when an invoice is sent from the platform

- Set up a custom email sequence that sends automated reminders for outstanding invoices

- Use the Reporting feature for a high-level view of your invoicing, for ex. amounts invoiced and left to be invoiced

Types of Project Billing

Different projects and client relationships may require different billing approaches. Which is the most appropriate method for your project and professional service firm? Here’s a quick overview:

Here are some more details:

Fixed-Price

Fixed-cost billing involves charging a predetermined amount for the entire project, regardless of the time or resources used. This method is often used for projects with well-defined scopes and deliverables. According to research by SoDa & Productive , this model is the most popular among agencies, accounting for almost 50% of net revenue. Billing can occur before the project is delivered, upfront (though this is rare due to the risk to the client), or upon completion. It’s also possible to do a mix of the two, where a percentage of payment is paid as an advance, with the full amount being invoiced upon completion.

- Provides financial certainty for clients

- Simplifies the actual billing process

- Requires accurate budgeting estimation

- Incurs the risk of scope creep, leading to lower agency profit margins

Time-and-Materials

In a time-and-materials project, clients are charged based on the actual time spent and materials used during the project. This method is suitable for projects where the scope is not clearly defined or may change. According to research, it accounts for about 15% of global agency net revenue. Billing can be periodic (weekly/monthly), based on particular project milestones, or handled as a lump sum in case of shorter projects.

- Allows agencies to react to accurately bill changes in scope

- Ties payment to specific work done and hours billed

- Requires more admin work

- Can lead to disputes between agencies and clients

Retainer billing involves charging a regular, upfront fee for ongoing services. Clients pay a set amount, usually monthly, for the benefits of regular services and continued availability. According to research, retainers account for about 20% of annual net revenue.

- Provides predictable and steady revenue to agencies

- Simplifies billing as fees are consistent and regular

- Can be less profitable if prices aren’t renegotiated at least annually

- Requires clear and regular client-provider communication

Cost-Plus Billing

Cost-plus billing is specific to the construction industry. It means that the clients are charged for the direct costs of construction, while the plus refers to the contractor’s fee, usually a fixed percentage of total costs. There are other business-specific types of billing, such as commission-based for advertising agencies. You can head over to our guide on the different pricing models to learn which one is best for your business.

The Importance of Revenue Recognition

Revenue recognition is another important part of the billing management process. It’s the process of recording revenue on your financial statements, and it’s crucial for meeting accounting standards and providing a clear picture of the company’s financial performance. While revenue can be recognized when payment from customers is received (cash-based revenue recognition), this method doesn’t accurately reflect the period in which billable work was completed. For that, the accrual-based method is more accurate, as it records revenue when it is earned. Smaller businesses usually start with the simpler cash-based method, but it’s recommended that they switch to accrual-based accounting once they reach a particular revenue threshold (usually $1M). Check out our list of the best RevOps software to learn more.

Key Roles in Project Billing

The key business roles for project billing include:

- Project Manager : The project manager’s managerial roles include monitoring all project activities. This includes project milestones, budgets, expenses, and resources. Project managers also usually handle administrative elements such as timesheets (including approving and categorizing time as billable or non-billable).

- Finance Team : The finance team handles the financial nitty gritty, such as generating invoices, ensuring timely payments, and analyzing key metrics such as profitability and cash flow. Depending on the business size, a project manager may take on some or all of these responsibilities.

- Clients : Even if your clients are not directly included in executing a project, they’re essential to project-based billing. If your project billing methods are transparent and efficient, it’s less likely that disputes will arise during invoicing reviews and that payments will be timely.

Learn more about different professional service company roles, such as the agency traffic manager or project analyst .

Overview of Main Benefits

Effective project billing ensures that:

- Projects remain financially viable by covering the cost of resources and time, helping maintain profit margins for digital agencies

- Data on costs and expenses related to project progress is accurate and easily accessible

- Relationships between clients and agencies are improved through transparency and clear communication.

- Businesses can better manage various risk factors and ensure a steady cash flow

- Future projects have enhanced forecasting and estimation based on historical data

5 Common Challenges in Project Billing

Project billing challenges can disrupt an agency’s cash flow, ultimately leading to less profitable projects, a reduced capacity to grow, and employee burnout and attrition. Understanding these challenges is the first step in addressing them, starting with:

Unbilled or Underbilled Time

Unbilled or underbilled time can be an underrated issue in professional services businesses. It can specifically affect projects that are connected to creative work, such as marketing or design projects. Inevitably, a lot of hours will go towards brainstorming and conceptualizing, but your employees might hesitate to track these hours, which can lead to burnout and incorrect future estimations. Consider this post by a designer on social media:

Source: Reddit

In some cases, the project managers might perpetuate and encourage this line of thinking to leave the impression of a project being completed more quickly and at less cost. Some solutions to this billing challenge include encouraging a healthy mindset toward tracking hours, determining exactly what falls into hours chargeable to clients on a case-by-case basis, and ensuring all project participants understand this.

Expense Management

An important aspect of expense management is how you’re handling your overhead. Things like facility costs, time spent on internal meetings, or paychecks for administrative staff impact all of your projects. Recording fixed and variable overhead separately or as part of a single project leads to inaccurate financial insights. Productive provides a handy solution: with its overhead algorithm, overhead is calculated per hour, adding the cost on top of standard cost rates. This ensures that overhead is distributed evenly across all projects, providing a better understanding of true profit per project. Extra expenses can also be billed and approved across your budgets.

From an internal standpoint, Productive has shifted the way we look at things because we’re able to see things very clearly now. This is a person, this is how much that person makes, this is our overhead, this is how much we’re charging our client. The tool gives us full transparency, across the board.

Michelle Pittell, Co-President at Brand Labs

Learn how Productive helps businesses get full process transparency .

Cash Flow Delays

Cash flow delays happen when there is a lag between invoicing and receiving payment. According to research by QuickBooks, 20% of businesses spend between 1 to 4 hours each week chasing overdue invoices. This can have pronounced negative effects on small businesses, and according to research by Xero and Paypal, as many as 50,000 businesses fail each year due to cash flow issues. Efficient invoicing and follow-up processes can help mitigate these delays (we’ve covered some potential solutions earlier in the article ).

Client Disputes

Client disputes over billing can arise from misunderstandings or discrepancies in invoices. Other common issues may occur: dissatisfaction with the quality or quantity of deliverables, unclear project terms, processing errors, etc. While most invoice disputes can be easily resolved, they will lead to delays in your payment schedule and require valuable manpower and hours to resolve. Providing detailed breakdowns of work performed, accurate time tracking, addressing client concerns promptly and regularly, and maintaining transparency throughout the billing process can help prevent disputes.

Scope Creep

Scope creep is a common issue for professional services businesses, especially those that don’t work on hourly rates but instead provide fixed-price billing. In fact, according to IEEE research, the inability to manage scope creep is the main cause of 80% of failing software projects. The best way to counter scope creep is to have a clear overview of project progress and how potential changes may impact it. If you can accurately forecast the impact a change has on budgets and show this impact to your clients, you’ll be more likely to come to a mutually satisfactory agreement.

How to Improve Project Billing

Improving practices in your project’s billing can lead to better financial management, enhanced client satisfaction, and more successful projects. Here are some strategies to consider:

Reliable Time Tracking

Use robust time tracking tools to ensure all billable hours are recorded accurately. This helps in capturing all work performed and ensures accurate billing. Some useful features of timekeeping software include integrated timers for capturing time, quick and reliable timesheet creation, time off approval and management, etc.

Identifying Billable vs. Non-Billable Time

Clearly distinguish between billable and non-billable activities to ensure accurate invoicing. This can help in avoiding disputes and ensuring that all billable work is compensated. Keep in mind that while non-billable work is not chargeable to clients, it’s no less valuable to your business operations.

Managing Your Documentation

Maintain comprehensive documentation for all project activities, expenses, and changes to support accurate billing. This includes keeping detailed records of work performed, expenses incurred, and any changes to the project scope.

Use Productive’s Docs to manage all project information in one platform

Clear Payment Terms

Establish and communicate clear payment terms in your contracts to avoid misunderstandings and delays. This includes specifying payment due dates, accepted payment methods, and potential late fees for overdue payments.

Client Communication and Visibility

Maintain open communication with clients and provide regular updates on project progress and billing status to build trust and ensure transparency. Software solutions that provide a client portal can streamline this process, so that clients or customers can proactively review their data and reports.

PSA Automation

Implement professional services automation tools for invoicing, time tracking, and expense management to improve efficiency and reduce errors. This can help in streamlining the billing process and ensuring that all billable work is captured accurately. One of the best solutions for this is Productive, and here’s why:

Bill Your Projects Effectively By Using Productive

Productive is often described by customers as an all-in-one solution for managing your business workflows. It combines key features for business operations management , including project management, resource planning, budgeting and billing, reporting, and more. The benefits of using Productive is that you’ll be able to combine the functionalities of multiple software into a single platform. This reduces tech stack costs, makes processes more efficient, and supports richer and more reliable data.

The main challenge for us was consolidating everything we needed into one tool, we were using six different tools at the time, and Productive really delivered on that note.

Alex Streltsov, General Manager at Prolex Media

When it comes to project billing in particular, Productive includes:

- Integrated time tracking and timesheet creation

- Agency rate card management and project budgeting

- Overhead, expenses, and purchase orders management

- In-platform invoicing (Xero and QuickBooks integrations are available)

- Real-time insights into financial health and revenue

- Financial forecasting for improved decision making

Book a demo today to learn more about supporting your processes and business growth.

Wrapping Up: Billing 101

In conclusion, mastering project billing is crucial for the financial health and success of any professional services agency. By implementing effective billing processes, utilizing modern software such as Productive, and maintaining clear communication with clients, businesses can ensure timely payments, accurate financial tracking, and enhanced project profitability. Embrace automation to address challenges such as expense management and scope creep and build stronger client relationships.

Support Your Agency’s Project Billing

Switch from multiple tools and spreadsheets to a single platform for invoicing, cash flow management, and project profitability.

Start Free Trial

Book a demo

Content Specialist

Related articles

Top project cost management software: 2024 comparison, agency accounting: in-depth guide for agencies, billability: what is it and how to measure it.

Building Productive

Brand Guidelines

Trust Center

Integrations

Automations

Permission and User Access

Software Development

Marketing Agency

Business Consultancy

Design Studio

In-house Team

Customer Stories

End-to-end Agency Management

Agency Resource Management

Product Updates

The Bold Community

Workflowmax

TOP GUIDES & TOOLS

Resource Planning Guide

Capacity Planning Guide

Workforce Planning Guide

Workload Management Guide

Billable Hours Guide

Project Budget Guide

Revenue Operations Guide

Agency Valuation Calculator

Billable Hours Calculator

© The Productive Company

Privacy Policy

Terms & Conditions

We need your consent to continue

Necessary cookies

Cookies for the basic functionality of the Productive website.

Functional cookies

Cookies for additional functionality and increased website security.

Targeting cookies

Advertising and analytics service cookies that create day-to-day statistics and show ads on their site and on the advertiser’s partners websites.

Save changes

Manage cookies and help us deliver our services. By using our services, you agree to our use of cookies.

Try Productive for free

Free 14-day trial. No credit card required. Cancel any time.

Already using Productive? Sign in with an existing account

- Claims reimbursement

Yuichiro Chino/Moment via Getty

Exploring the Fundamentals of Medical Billing and Coding

Medical billing and coding are the backbone of the healthcare revenue cycle, ensuring payers and patients reimburse providers for services delivered..

- Editorial Staff

Medical billing and coding translate a patient encounter into the languages healthcare facilities use for claims submission and reimbursement.

Billing and coding are separate processes, but both are necessary for providers to receive payment for healthcare services.

Medical coding involves extracting billable information from the medical record and clinical documentation, while medical billing uses those codes to create insurance claims and bills for patients. Creating claims is where medical billing and coding intersect to form the backbone of the healthcare revenue cycle.

The process starts with patient registration and ends when the provider receives full payment for all services delivered to patients.

The medical billing and coding cycle can take anywhere from a few days to several months, depending on the complexity of services rendered, claim denial management, and how organizations collect a patient’s financial responsibility.

Ensuring healthcare organizations understand the fundamentals of medical billing and coding can help providers and other staff operate a smooth revenue cycle and recoup all the allowable reimbursement for quality care delivery.

WHAT IS MEDICAL CODING?

Medical coding starts with a patient encounter in a physician’s office, hospital, or other healthcare facility. When a patient encounter occurs, providers detail the visit or service in the patient’s medical record and explain why they delivered specific services, items, or procedures.

Accurate and complete clinical documentation during the patient encounter is critical for medical billing and coding, AHIMA explains . The golden rule of healthcare billing and coding departments is, “Do not code it or bill for it if it’s not documented in the medical record.”

Providers use clinical documentation to justify reimbursements to payers when a conflict with a claim arises. If a provider does not sufficiently document a service in the medical record, the organization could face a claim denial and potentially a write-off.

Providers could also face a healthcare fraud or liability investigation if they attempt to bill payers and patients for services incorrectly documented in the medical record or missing from the patient’s data altogether.

Once a patient leaves the healthcare facility, a professional medical coder reviews and analyzes clinical documentation to connect services with billing codes related to a diagnosis, procedure, charge, and professional and/or facility code.

Coders use the following code sets during this process.

ICD-10 DIAGNOSIS CODES

Diagnosis codes are key to describing a patient’s condition or injury, as well as social determinants of health and other patient characteristics. The industry uses the International Statistical Classification of Diseases and Related Health Problems, Tenth Revision (ICD-10) to capture diagnosis codes for billing purposes.

ICD-10-CM (clinical modification) codes classify diagnoses in all healthcare settings, while ICD-10-PCS (procedure coding system) codes are for inpatient services at hospitals.

ICD codes indicate a patient’s condition, the location and severity of an injury or symptom, and if the visit is related to an initial or subsequent encounter.

There are more than 70,000 unique identifiers in the ICD-10-CM code set alone. The World Health Organization (WHO) maintains the ICD coding system, which is used internationally in modified formats.

CPT AND HCPCS PROCEDURE CODES

Procedure codes complement diagnosis codes by indicating what providers did during an encounter. Current Procedural Terminology (CPT) codes and the Healthcare Common Procedure Coding System (HCPCS) make up the procedure coding system.

The American Medical Association (AMA) maintains the CPT coding system , which describes the services rendered to a patient during an encounter for private payers. AMA publishes CPT coding guidelines each year to support medical coders with coding-specific procedures and services.

CPT codes have modifiers that describe the services in greater specificity. CPT modifiers indicate if providers performed multiple procedures, the reason for a service, and where on the patient the procedure occurred. Using CPT modifiers helps ensure providers receive accurate reimbursement for all services.

While private payers tend to use CPT codes, CMS and some third-party payers require providers to submit claims with HCPCS codes . The Health Information Portability and Accountability Act (HIPAA) requires organizations to use HCPCS codes in certain cases.

Many HCPCS and CPT codes overlap, but HCPCS codes describe non-physician services, such as ambulance rides, durable medical equipment, and prescription drug use. CPT codes only indicate the procedure, not the items a provider used.

HSPCS codes also have modifiers that help specify services further.

CHARGE CAPTURE CODES

Coders connect physician order entries, patient care services, and other clinical items with a chargemaster code. A chargemaster is a collection of standard prices for services and items that a provider organization offers.

Charge capture codes may include procedure descriptions, time reference codes, departments involved in the medical service, and billable items and supplies.

The CMS Hospital Price Transparency rule requires hospitals to publish their chargemasters on their website and display the prices of 300 shoppable services.

In a process known as charge capture, revenue cycle management leaders use these prices to negotiate claims reimbursement rates with payers. Coders submit the codes and corresponding charges to the payers, and then providers bill patients for the remaining balance.

PROFESSIONAL AND FACILITY CODES

When applicable, medical coders also translate the medical record into professional and facility codes.

Professional codes capture physician and other clinical services delivered and connect the services with a code for billing. These codes stem from the documentation in a patient’s medical record.

On the other hand, hospitals use facility codes to account for the cost and overhead of providing healthcare services. These codes capture the charges for medical equipment, supplies, medication, nursing staff, and other technical care components.

Hospitals can include professional codes on claims when a provider employed by the hospital performs clinical services. However, if a non-hospital provider uses the hospital’s space and supplies, the facility cannot include a professional code.

Integrating professional and facility coding into one platform may help facilitate the process for hospitals. Leveraging technology, such as computer-assisted coding (CAC) solutions, can help speed up the medical coding process and increase coding accuracy and efficiency , according to AHIMA.

WHAT IS MEDICAL BILLING?

Medical billing is the process by which healthcare organizations submit claims to payers and bill patients for their own financial responsibility. While coders are busy translating medical records, the front-end billing process has already started.

FRONT-END MEDICAL BILLING

Medical billing begins when a patient registers at the office or hospital and schedules an appointment.

During pre-registration , administrative staff members ensure patients complete required forms and confirm patient information, including home address and insurance coverage. After verifying that the patient’s health plan will cover the requested services and submitting any prior authorizations, staff should confirm patient financial responsibility.

During the front-end medical billing process, staff informs patients of any costs they are responsible for. Ideally, the office can collect any copayments from the patient at the appointment.

Once a patient checks out, medical coders obtain the medical records and begin to turn the information into billable codes.

BACK-END MEDICAL BILLING

Together, medical coders and back-end medical billers use codes and patient information to create a “superbill,” according to AAPC.

The superbill is an itemized form that providers use to create claims. The form typically includes:

- Provider information: rendering provider name, location, and signature, as well as name and National Provider Identifier (NPI) of ordering, referring, and attending physicians

- Patient information: name, date of birth, insurance information, date of first symptom, and other patient data

- Visit information: date of service(s), procedure codes, diagnosis codes, code modifiers, time, units, quantity of items used, and authorization information

Providers may also include notes or comments on the superbill to justify medically necessary care. Billers pull information from the superbill to prepare claims.

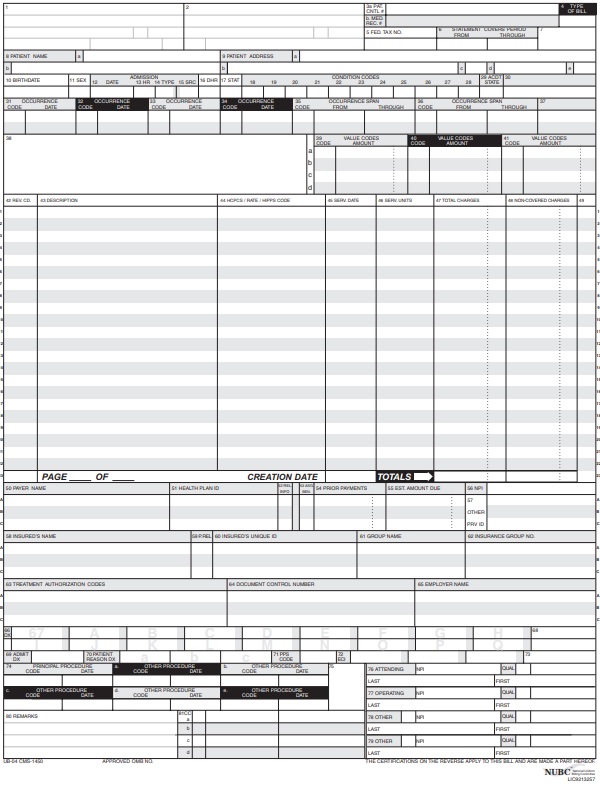

Billers tend to deal with two types of claim forms. Medicare created the CMS-1500 form for non-institutional healthcare facilities, such as physician practices, to submit claims. The federal program also uses the CMS-1450, or UB-04, form for claims from institutional facilities, such as hospitals.

Private payers, Medicaid, and other third-party payers may use different claim forms based on their specific requirements for claim reimbursement. Some payers have adopted the CMS-generated forms, while others have based their unique forms on the CMS format.

During claim preparation, billers “scrub” claims to ensure that procedure, diagnosis, and modifier codes are present and accurate and that necessary patient, provider, and visit information is complete and correct.

Then, back-end medical billers transmit claims to payers. Under HIPAA, providers must submit their Medicare Part A and B claims electronically using the ASC X12 standard transmission format, commonly known as HIPAA 5010 .

Other payers have followed in Medicare’s footsteps by requiring electronic transmission of claims. According to CAQH, electronic claims management adoption could save providers around $9.5 billion per year .

The shift to remote work during the COVID-19 pandemic has prompted more payers and providers to adopt electronic claims management systems .

Medical billers submit claims directly to the payer or use a third-party organization, such as a clearinghouse. A clearinghouse forwards claims from providers to payers. These companies also scrub claims and verify the information to ensure reimbursement.

Clearinghouses may help providers who do not have access to a comprehensive practice management system to edit and submit claims electronically. Clearinghouses can help reduce potential errors stemming from manual processes.

Once a claim makes its way to the payer, adjudication begins. During adjudication, the payer will assess a provider’s claim and determine how much it will pay the provider. Payers can accept, deny, or reject claims.

Payers send Electronic Remittance Advice (ERA) forms back to the provider organization explaining what services received reimbursement, if additional information is needed, and the reason for rejecting or denying a claim. Depending on the reason, billers can correct and resubmit the claims for reimbursement.

After receiving reimbursement for a successful claim, medical billers create statements for patients. Providers will typically charge patients the difference between the rate on their chargemaster and what the payer reimbursed.

Traditionally, if a patient received care at an out-of-network provider, it was the patient’s responsibility to negotiate out-of-pocket expenses with the health plan. However, under the No Surprises Act, which went into effect on January 1, 2022, providers must submit a claim to the health plan for out-of-network services to see if the payer will provide coverage .

The policy calls for providers to comply with new claims submission requirements and communicate with out-of-network plans. Payers and providers have 30 days after a claim is submitted to negotiate the price for a surprise bill. If they cannot agree, they must go through an independent dispute resolution process to determine the payment rate .

The final phase of medical billing is patient collections. Medical billers collect patient payments and submit the revenue to accounts receivable (A/R) management, where payments are tracked and posted.

Some patient accounts may land in “aging A/R,” which indicates that patients have failed to pay their patient financial responsibility, typically after 30 days. Medical billers should follow up with patient accounts in aging A/R batches to remind patients to pay their bills and ensure the organization receives the revenue.

Revenue cycle management automation has helped some practices boost A/R management efficiency , including staff productivity and workflows.

Once a medical biller receives the total balance of a patient’s financial responsibility and payer reimbursement for a claim, they can close the patient account and conclude the medical billing and coding cycle.

HOW COVID-19 IMPACTED MEDICAL BILLING AND CODING

The COVID-19 pandemic prompted several changes to medical billing and coding processes.

For example, in 2020, electronic claims management adoption increased by 2.3 percentage points across the medical and dental industries. In the medical industry, those transactions included eligibility and benefit verification, prior authorization, claim submission, claim status inquiry, claim payment, and remittance advice.

Medical billers and coders had to determine new codes and reimbursement policies with the emersion of a new virus.

In March 2020, the WHO created the first ICD-10 code for COVID-19. Since then, there have been at least a dozen new ICD procedure codes related to the virus and many more changes to CPT and HCPCS codes to document COVID-19 and related conditions.

CMS also made a significant change to the Medicare Physician Fee Schedule during the pandemic that impacted medical billers and coders. The new guidelines stated that physicians could select an evaluation and management (E/M) code based on the total time spent on the date of the patient encounter instead of relying on a patient’s history or physical exam to determine appropriate E/M coding.

Medical billing and coding are integral healthcare revenue cycle processes. Ensuring that the medical billing and coding cycle run smoothly ensures that providers get paid for services delivered, and provider organizations remain open to deliver care to patients.

This article was originally published on June 15, 2018.

Related Resources

- Midwestern Health System Recovers $12 Million In Auto Claims Reimbursement –Revecore

Dig Deeper on Claims reimbursement

Exploring the role of medical claim clearinghouses

Out-of-pocket costs for patient portal messages reach $25

Breaking Down the Back-End Revenue Cycle, Key Best Practices

The Role of the Hospital Chargemaster in Revenue Cycle Management

Generative AI in clinical documentation can ease EHR burdens and enhance patient communication, but issues with accuracy ...

LOINC release 2.78 includes nearly 3,000 terminology updates across various domains, including social determinants of health (...

The Sequoia Project has launched a workgroup in collaboration with Surescripts that aims to close pharmacy interoperability gaps ...

Most community health centers are bogged down by provider and staff shortages, but they're still able to offer next-day and ...

Corporate social responsibility in healthcare can include SDOH work and investing in community benefits.

Community health center access rises during the nation's primary care crisis, prompting calls for more funding.

UC Davis Health is using telehealth to improve postpartum visit attendance among Black people, thereby enhancing maternal health ...

Rural hospitals are losing patients to urban hospitals that provide telehealth, resulting in negative financial repercussions, a ...

Health systems nationwide are implementing virtual nursing programs, but a carefully thought-out deployment process is critical ...

/support/notes/service/sap_logo.png)

2826591 - Accounting Document Number same as Billing Document Number - SAP S/4HANA Cloud Public Edition

The requirement is to have billing document number same as accounting document number.

Environment

SAP S/4HANA Cloud Public Edition

For synchronization, mark the billing as internal and the accounting as external.

Detailed steps:

- SSCUI ID 102819 - Setup the number range for SD billing, mark as "Internally"

- SSCUI ID 102495 - Setup billing type, assign Number range for the billing and the default accounting document type

- SSCUI ID 101702 - Setup the number range for accounting document per company code, make sure the number range here is exactly the same range as the one defined for billing. Mark it as "Externally"

- SSCUI ID 101522 - Assign the number range to the accounting document type

RV, VN01, VOFA, FBN1, OBA7, , KBA , SD-BIL-IV , Processing Billing Documents , Problem

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

Attacks on Walz’s Military Record

By Robert Farley , D'Angelo Gore and Eugene Kiely

Posted on August 8, 2024 | Corrected on August 9, 2024

Este artículo estará disponible en español en El Tiempo Latino .

In introducing her pick for vice presidential running mate, Kamala Harris has prominently touted Tim Walz’s 24 years of service in the Army National Guard. Now, however, GOP vice presidential nominee JD Vance and the Trump campaign are attacking Walz on his military record, accusing the Minnesota governor of “stolen valor.”

We’ll sort through the facts surrounding the three main attacks on Walz’s military record and let readers decide their merit. The claims include:

- Vance claimed that Walz “dropped out” of the National Guard when he learned his battalion was slated to be deployed to Iraq. Walz retired to focus on a run for Congress two months before his unit got official word of impending deployment, though the possibility had been rumored for months.

- Vance also accused Walz of having once claimed to have served in combat, when he did not. While advocating a ban on assault-style weapons, Walz said, “We can make sure that those weapons of war that I carried in war, is the only place where those weapons are at.”

- The Republican National Committee has criticized Walz for misrepresenting his military rank in campaign materials. The Harris campaign website salutes Walz for “rising to the rank of Command Sergeant Major.” Walz did rise to that rank, but he retired as a master sergeant because he had not completed the requirements of a command sergeant major.

A native of West Point, Nebraska, Walz joined the Nebraska Army National Guard in April 1981, two days after his 17th birthday. When Walz and his wife moved to Minnesota in 1996, he transferred to the Minnesota National Guard, where he served in 1st Battalion, 125th Field Artillery.

“While serving in Minnesota, his military occupational specialties were 13B – a cannon crewmember who operates and maintains cannons and 13Z -field artillery senior sergeant,” according to a statement released by Army Lt. Col. Kristen Augé, the Minnesota National Guard’s state public affairs officer.

According to MPR News , Walz suffered some hearing impairment related to exposure to cannon booms during training over the years, and he underwent some corrective surgery to address it.

On Aug. 3, 2003, “Walz mobilized with the Minnesota National Guard’s 1st Battalion, 125th Field Artillery … to support Operation Enduring Freedom. The battalion supported security missions at various locations in Europe and Turkey. Governor Walz was stationed at Vicenza, Italy, during his deployment.” Augé stated. The deployment lasted about eight months.

“For 24 years I proudly wore the uniform of this nation,” Walz said at a rally in Philadelphia where he was announced as Harris’ running mate on Aug. 6. “The National Guard gave me purpose. It gave me the strength of a shared commitment to something greater than ourselves.”

Walz’s Retirement from the National Guard

In recent years, however, several of his fellow guard members have taken issue with the timing of Walz’s retirement from the National Guard in May 2005, claiming he left to avoid a deployment to Iraq.

Vance, who served a four-year active duty enlistment in the Marine Corps as a combat correspondent, serving in Iraq for six months in 2005, advanced that argument at a campaign event on Aug. 7.

“When the United States of America asked me to go to Iraq to serve my country, I did it,” Vance said. “When Tim Walz was asked by his country to go to Iraq, you know what he did? He dropped out of the Army and allowed his unit to go without him, a fact that he’s been criticized for aggressively by a lot of the people that he served with. I think it’s shameful to prepare your unit to go to Iraq, to make a promise that you’re going to follow through and then to drop out right before you actually have to go.”

In early 2005, Walz, then a high school geography teacher and football coach at Mankato West High School, decided to run for public office. In a 2009 interview Walz provided as part of the Library of Congress’ veterans oral history project, Waltz said he made the decision to retire from the National Guard to “focus full time” on a run for the U.S. House of Representatives for Minnesota’s 1st Congressional District (which he ultimately won in 2006). Walz said he was “really concerned” about trying to seek public office and serve in the National Guard at the same time without running afoul of the Hatch Act , which limits political speech by federal employees, including members of the National Guard.

Federal Election Commission records show that Walz filed to run for Congress on Feb. 10, 2005.

On March 20, 2005, Walz’s campaign put out a press release titled “Walz Still Planning to Run for Congress Despite Possible Call to Duty in Iraq.”

Three days prior, the release said, “the National Guard Public Affairs Office announced a possible partial mobilization of roughly 2,000 troops from the Minnesota National Guard. … The announcement from the National Guard PAO specified that all or a portion of Walz’s battalion could be mobilized to serve in Iraq within the next two years.”

According to the release, “When asked about his possible deployment to Iraq Walz said, ‘I do not yet know if my artillery unit will be part of this mobilization and I am unable to comment further on specifics of the deployment.’ Although his tour of duty in Iraq might coincide with his campaign for Minnesota’s 1st Congressional seat, Walz is determined to stay in the race. ‘As Command Sergeant Major I have a responsibility not only to ready my battalion for Iraq, but also to serve if called on. I am dedicated to serving my country to the best of my ability, whether that is in Washington DC or in Iraq.'”

On March 23, 2005, the Pipestone County Star reported, “Detachments of the Minnesota National Guard have been ‘alerted’ of possible deployment to Iraq in mid-to-late 2006.”

“Major Kevin Olson of the Minnesota National Guard said a brigade-sized contingent of soldiers could be expected to be called to Iraq, but he was not, at this time, aware of which batteries would be called,” the story said. “All soldiers in the First Brigade combat team of the 34th Division, Minnesota National Guard, could be eligible for call-up. ‘We don’t know yet what the force is like’ he said. ‘It’s too early to speculate, if the (soldiers) do go.’

“He added: ‘We will have a major announcement if and when the alert order moves ahead.’”

ABC News spoke to Joseph Eustice, a retired command sergeant major who served with Walz, and he told the news organization this week that “he remembers Walz struggling with the timing of wanting to serve as a lawmaker but also avoiding asking for a deferment so he could do so.”

“He had a window of time,” Eustice told ABC News. “He had to decide. And in his deciding, we were not on notice to be deployed. There were rumors. There were lots of rumors, and we didn’t know where we were going until it was later that, early summer, I believe.”

Al Bonnifield, who served under Walz, also recalled Walz agonizing over the decision.

“It was a very long conversation behind closed doors,” Bonnifield told the Washington Post this week. “He was trying to decide where he could do better for soldiers, for veterans, for the country. He weighed that for a long time.”

In 2018, Bonnifield told MPR News that Walz worried in early 2005, “Would the soldier look down on him because he didn’t go with us? Would the common soldier say, ‘Hey, he didn’t go with us, he’s trying to skip out on a deployment?’ And he wasn’t. He talked with us for quite a while on that subject. He weighed that decision to run for Congress very heavy. He loved the military, he loved the guard, he loved the soldiers he worked with.”

But not all of Walz’s fellow Guard members felt that way.

In a paid letter to the West Central Tribune in Minnesota in November 2018, Thomas Behrends and Paul Herr — both retired command sergeants major in the Minnesota National Guard — wrote, “On May 16th, 2005 he [Walz] quit, leaving the 1-125th Field Artillery Battalion and its Soldiers hanging; without its senior Non-Commissioned Officer, as the battalion prepared for war. His excuse to other leaders was that he needed to retire in order to run for congress. Which is false, according to a Department of Defense Directive, he could have run and requested permission from the Secretary of Defense before entering active duty; as many reservists have.”

“For Tim Walz to abandon his fellow soldiers and quit when they needed experienced leadership most is disheartening,” they wrote. “When the nation called, he quit.”

Walz retired on May 16, 2005. Walz’s brigade received alert orders for mobilization on July 14, 2005, according to the National Guard and MPR News . The official mobilization report came the following month, and the unit mobilized and trained through the fall. It was finally deployed to Iraq in the spring of 2006.

The unit was originally scheduled to return in February 2007, but its tour was extended four months as part of President George W. Bush’s “surge” strategy , the National Guard reported. In all, the soldiers were mobilized for 22 months.

Responding to Vance’s claim that Walz retired to avoid deploying to Iraq, the Harris-Walz campaign released a statement saying, “After 24 years of military service, Governor Walz retired in 2005 and ran for Congress, where he was a tireless advocate for our men and women in uniform – and as Vice President of the United States he will continue to be a relentless champion for our veterans and military families.”

Walz on Carrying a Weapon ‘in War’

Vance also called Walz “dishonest” for a claim that Walz made in 2018 while speaking to a group about gun control.

“He made this interesting comment that the Kamala Harris campaign put out there,” Vance said, referring to a video of Walz that the Harris campaign posted to X on Aug. 6. “He said, ‘We shouldn’t allow weapons that I used in war to be on America’s streets.’ Well, I wonder, Tim Walz, when were you ever in war? What was this weapon that you carried into war given that you abandoned your unit right before they went to Iraq and he has not spent a day in a combat zone.”

In the video , Walz, who was campaigning for governor at the time, talked about pushing back on the National Rifle Association and said: “I spent 25 years in the Army and I hunt. … I’ve been voting for common sense legislation that protects the Second Amendment, but we can do background checks. We can do [Centers for Disease Control and Prevention] research. We can make sure we don’t have reciprocal carry among states. And we can make sure that those weapons of war that I carried in war, is the only place where those weapons are at.”

But, as Vance indicated, there is no evidence that Walz carried a weapon “in war.”

As we said, Augé, in her statement, said Walz’s battalion deployed “to support Operation Enduring Freedom” on Aug. 3, 2003, and “supported security missions at various locations in Europe and Turkey.” During his deployment, Walz was stationed in Vicenza, Italy, and he returned to Minnesota in April 2004, Augé said. There was no mention of Walz serving in Afghanistan, Iraq or another combat zone.

In the 2009 interview for the veterans history project, Walz said he and members of his battalion initially thought they would “shoot artillery in Afghanistan,” as they had trained to do. That didn’t happen, he said, explaining that his group ended up helping with security and training while stationed at an Army base in Vicenza.

“I think in the beginning, many of my troops were disappointed,” Walz said in the interview. “I think they felt a little guilty, many of them, that they weren’t in the fight up front as this was happening.”

In a statement addressing his claim about carrying weapons “in war,” the Harris campaign noted that Walz, whose military occupational specialties included field artillery senior sergeant, “fired and trained others to use weapons of war innumerable times” in his 24 years of service.

Walz’s National Guard Rank

The Republican National Committee has criticized Walz for saying “in campaign materials that he is a former ‘Command Sergeant Major’ in the Army National Guard despite not completing the requirements to hold the rank into retirement.”

Walz’s biography on the Harris campaign website correctly says that the governor “served for 24 years” in the National Guard, “rising to the rank of Command Sergeant Major.”

Walz’s official biography on the Minnesota state website goes further, referring to the governor as “Command Sergeant Major Walz.”

“After 24 years in the Army National Guard, Command Sergeant Major Walz retired from the 1-125th Field Artillery Battalion in 2005,” the state website says.

Walz did serve as command sergeant major , but Walz did not complete the requirements to retire with the rank of command sergeant, Augé told us in an email.

“He held multiple positions within field artillery such as firing battery chief, operations sergeant, first sergeant, and culminated his career serving as the command sergeant major for the battalion,” Augé said. “He retired as a master sergeant in 2005 for benefit purposes because he did not complete additional coursework at the U.S. Army Sergeants Major Academy.”

This isn’t the first time that Walz’s National Guard rank has come up in a campaign.

In their 2018 paid letter to the West Central Tribune, when Walz was running for governor, the two Minnesota National Guard retired command sergeants major who criticized Walz for retiring before the Iraq deployment also wrote: “Yes, he served at that rank, but was never qualified at that rank, and will receive retirement benefits at one rank below. You be the judge.”

Correction, Aug. 9: We mistakenly said a 2007 “surge” strategy in Iraq occurred under President Barack Obama. It was President George W. Bush.

Editor’s note: FactCheck.org does not accept advertising. We rely on grants and individual donations from people like you. Please consider a donation. Credit card donations may be made through our “Donate” page . If you prefer to give by check, send to: FactCheck.org, Annenberg Public Policy Center, 202 S. 36th St., Philadelphia, PA 19104.

COMMENTS

In the Display Billing Documents and Change Billing Documents apps, you can view the two numbers by choosing Goto Header Header Detail <Reference or Assignment Field> You can also view the reference number and assignment number in the header section of the Billing Document object page and the embedded object page within the Manage Billing ...

Reference number (VBRK-XBLNR) and Assignment number (VBRK-ZUONR) not or incorrectly filled in billing document. SAP Knowledge Base Article - Preview. 3444642-Determination of reference number (XBLNR) and assignment number (ZUONR) in billing document. Symptom.

To keep your business records clear, you create a numbering system for your invoices that lets you quickly search them if questions later arise. Here's an invoice numbering example for assigning numbers for monthly billings: SA0001: January invoice number. SA0002: February invoice number. SA0003: March invoice number.

As for the assignment number, it is possible to set the customer reference, the customer order number, the delivery number or the external delivery number as allocation numbers. In order to solve the issue, please go to your configuration settings, and find "Define Copying Control for Sales Document to Billing Document (102762)".

Standard Billing Document Numbering. When documents (for example, sales orders or billing documents) are created in Sales, the system assigns unique document numbers to them by drawing consecutive numbers from predefined number range intervals of the number range object RV_BELEG.For newly created billing documents, the system by default draws the document numbers from number range interval 19 ...

Assignment Number; Turkey. 2023 Latest. Available Versions: 2023 Latest ; 2023 (Oct 2023) 2022 Latest ; 2022 FPS02 (May 2023) 2022 FPS01 (Feb 2023) 2022 (Oct 2022) ... Bill of Exchange Liability Account . Interim Account . Assignment Number . Creating a Validation . Creating a Substitution .

Assignment Number (ZUONR) Download problem From AL11 Using CG3Y - SAP Q&A Relevancy Factor: 1.0 Now the problem when i see it in AL11 data looks correct but same data when i download from CG3Y transaction I am finding the issue i.e. number is replaced with zeros Please find below screen shots.

Billing Assigned and Billing Non-Assigned Denise M. Leard, Esq. Brown & Fortunato. Introduction. 3 ACHCU is a brand of ACHC. ... model number, MSRP of the repair item provided, and the justification for the repair. ACHCU is a brand of ACHC. 20 Commercial Insurance Mandates Assignment

Number assignment; Specify a number range for number assignment. For billing documents numbers can only be assigned internally by the SAP System. To define a common number assignment for different billing types, you have to specify the same number range in each case. To do this, the number ranges must have been defined beforehand.

The difference this analysis showed was Reference document number and Assignment number. In our customizing it was set to copy the sales order number into above-mentioned invoice header fields (Implementation guide-Sales and Distrib-Billing-Billing documents-Maintain copying control for billing documents).

Go to application area FInancial accounting → line item. Either add a step to an existing substitution or create a new substitution. Try the Assignment Number and Reference No fields in the Delivery → Billing Copy Control customisings. Maintain them as A and check by re initiating the end to end cycle again.

Open the "Display billing documents" app. Choose one Credit Memo Project Services (billing type:CM01). Check the "Assignment" field in the header detail. This field is filled with the preceding reference invoice number (billing type:CI01), although the assignment number is not maintained in the copying control settings from CI01 to CM01.

Invoice Number and Date: Assign a unique invoice number and include the invoice date for tracking and record-keeping purposes. Description of Services: Provide a description of the work performed, including dates, hours worked, and specific tasks completed.

Share. When a new billing document is created, the system can evaluate specific billing document header fields to dynamically determine an appropriate number range interval from which to draw the new document number.

The process starts with patient registration and ends when the provider receives full payment for all services delivered to patients. The medical billing and coding cycle can take anywhere from a few days to several months, depending on the complexity of services rendered, claim denial management, and how organizations collect a patient's financial responsibility.

SSCUI ID 101702 - Setup the number range for accounting document per company code, make sure the number range here is exactly the same range as the one defined for billing. Mark it as "Externally" SSCUI ID 101522 - Assign the number range to the accounting document type

Vance, who served a four-year active duty enlistment in the Marine Corps as a combat correspondent, serving in Iraq for six months in 2005, advanced that argument at a campaign event on Aug. 7 ...

The Assignment with Audie Cornish ... which provides up to $1,750 per kid with no limit on the number of ... The bill also raised the sales tax in the seven-county Twin Cities metropolitan area by ...

To mark this page as a favorite, you need to log in with your SAP ID. If you do not have an SAP ID, you can create one for free from the login page. Download PDF. The following PDF options are available for this document: Share.

Walz signed a bill last year designating Minnesota as a legal refuge for transgender people. Chris Cameron covers politics for The Times, focusing on breaking news and the 2024 campaign.