ECON 4370: Econometrics

- Data & Statistics

- Finding Articles

- Guides and Examples for How to Write an Econometric Analysis Paper

Guides and Examples of econometrics paper for undergrads

- Econometric Analysis Undergraduate Research Papers: Georgia Tech Library

- Format for an Econometrics Paper: Skidmore College

- Research Paper in Introductory Econometrics: Carleton College

- Writing in Economics: Duke University

- The Young Economist’s Short Guide to Writing Economic Research: Pomona College

- << Previous: Finding Articles

- Last Updated: Aug 4, 2023 10:48 AM

- URL: https://libguides.trinity.edu/4370econometrics

Your Comprehensive Guide to a Painless Undergrad Econometrics Project

Use a spreadsheet program to compile your data

- U.S. Economy

- Supply & Demand

- Archaeology

- Ph.D., Business Administration, Richard Ivey School of Business

- M.A., Economics, University of Rochester

- B.A., Economics and Political Science, University of Western Ontario

Most economics departments require second- or third-year undergraduate students to complete an econometrics project and write a paper on their findings. Many students find that choosing a research topic for their required econometrics project is just as difficult as the project itself. Econometrics is the application of statistical and mathematical theories and perhaps some computer science to economic data.

The example below shows how to use Okun's law to create an econometrics project. Okun's law refers to how the nation's output—its gross domestic product —is related to employment and unemployment. For this econometrics project guide, you'll test whether Okun's law holds true in America. Note that this is just an example project—you'll need to chose your own topic—but the explanation shows how you can create a painless, yet informative, project using a basic statistical test, data that you can easily obtain from the U.S. government, and a computer spreadsheet program to compile the data.

Gather Background Information

With your topic chosen, start by gathering background information about the theory you're testing by doing a t-test . To do so, use the following function:

Y t = 1 - 0.4 X t

Where: Yt is the change in the unemployment rate in percentage points Xt is the change in the percentage growth rate in real output, as measured by real GDP

So you will be estimating the model: Y t = b 1 + b 2 X t

Where: Y t is the change in the unemployment rate in percentage points X t is the change in the percentage growth rate in real output, as measured by real GDP b 1 and b 2 are the parameters you are trying to estimate.

To estimate your parameters, you will need data. Use quarterly economic data compiled by the Bureau of Economic Analysis, which is part of the U.S. Department of Commerce. To use this information, save each of the files individually. If you've done everything correctly, you should see something that looks like this fact sheet from the BEA, containing quarterly GDP results.

Once you've downloaded the data, open it in a spreadsheet program, such as Excel.

Finding the Y and X Variables

Now that you've got the data file open, start to look for what you need. Locate the data for your Y variable. Recall that Yt is the change in the unemployment rate in percentage points. The change in the unemployment rate in percentage points is in the column labeled UNRATE(chg), which is column I. By looking at column A, you see that the quarterly unemployment rate change data runs from April 1947 to October 2002 in cells G24-G242, according to Bureau of Labor Statistics figures.

Next, find your X variables. In your model, you only have one X variable, Xt, which is the change in the percentage growth rate in real output as measured by real GDP. You see that this variable is in the column marked GDPC96(%chg), which is in Column E. This data runs from April 1947 to October 2002 in cells E20-E242.

Setting Up Excel

You've identified the data you need, so you can compute the regression coefficients using Excel. Excel is missing a lot of the features of more sophisticated econometrics packages, but for doing a simple linear regression, it is a useful tool. You're also much more likely to use Excel when you enter the real world than you are to use an econometrics package, so being proficient in Excel is a useful skill.

Your Yt data is in cells G24-G242 and your Xt data is in cells E20-E242. When doing a linear regression, you need to have an associated X entry for every Yt entry and vice-versa. The Xt's in cells E20-E23 do not have an associated Yt entry, so you will not use them. Instead, you will use only the Yt data in cells G24-G242 and your Xt data in cells E24-E242. Next, calculate your regression coefficients (your b1 and b2). Before continuing, save your work under a different filename so that at any time, you can revert back to your original data.

Once you've downloaded the data and opened Excel, you can calculate your regression coefficients.

Setting Excel Up for Data Analysis

To set up Excel for data analysis, go to the tools menu on the top of the screen and find "Data Analysis." If Data Analysis is not there, then you'll have to install it . You cannot do regression analysis in Excel without the Data Analysis ToolPak installed.

Once you've selected Data Analysis from the tools menu, you'll see a menu of choices such as "Covariance" and "F-Test Two-Sample for Variances." On that menu, select "Regression." Once there, you'll see a form, which you need to fill in.

Start by filling in the field that says "Input Y Range." This is your unemployment rate data in cells G24-G242. Choose these cells by typing "$G$24:$G$242" into the little white box next to Input Y Range or by clicking on the icon next to that white box then selecting those cells with your mouse. The second field you'll need to fill in is the "Input X Range." This is the percent change in GDP data in cells E24-E242. You can choose these cells by typing "$E$24:$E$242" into the little white box next to Input X Range or by clicking on the icon next to that white box then selecting those cells with your mouse.

Lastly, you will have to name the page that will contain your regression results. Make sure you have "New Worksheet Ply" selected, and in the white field beside it, type in a name like "Regression." Click OK.

Using the Regression Results

You should see a tab at the bottom of your screen called Regression (or whatever you named it) and some regression results. If you've gotten the intercept coefficient between 0 and 1, and the x variable coefficient between 0 and -1, you've likely done it correctly. With this data, you have all of the information you need for analysis including R Square, coefficients, and standard errors.

Remember that you were attempting to estimate the intercept coefficient b1 and the X coefficient b2. The intercept coefficient b1 is located in the row named "Intercept" and in the column named "Coefficient." Your slope coefficient b2 is located in the row named "X variable 1" and in the column named "Coefficient." It will likely have a value, such as "BBB" and the associated standard error "DDD." (Your values may differ.) Jot these figures down (or print them out) as you will need them for analysis.

Analyze your regression results for your term paper by doing hypothesis testing on this sample t-test . Though this project focused on Okun's Law, you can use this same kind of methodology to create just about any econometrics project.

- What Does "Hedonic" Mean in an Economic Context?

- Definition and Example of a Markov Transition Matrix

- Econometrics Research Topics and Term Paper Ideas

- Books to Study Before Going to Graduate School in Economics

- Ace Your Econometrics Test

- What You Should Know About Econometrics

- What Is Mathematical Economics?

- An Introduction to Akaike's Information Criterion (AIC)

- Definition and Use of Instrumental Variables in Econometrics

- A Guide to the Term "Reduced Form" in Econometrics

- What Is the Augmented Dickey-Fuller Test?

- The Definition of Asymptotic Variance in Statistical Analysis

- What Is Panel Data?

- What Is a Market?

- Good Reasons to Study Economics

- Economics for Beginners: Understanding the Basics

Introductory Econometrics Examples

Justin m shea, introduction.

This vignette reproduces examples from various chapters of Introductory Econometrics: A Modern Approach, 7e by Jeffrey M. Wooldridge. Each example illustrates how to load data, build econometric models, and compute estimates with R .

In addition, the Appendix cites a few sources using R for econometrics. Of note, in 2020 Florian Heiss published a 2nd edition of Using R for Introductory Econometrics ; it is excellent. The Heiss text is a companion to wooldridge for R users, and offers an in depth treatment with several worked examples from each chapter. Indeed, his example use this wooldridge package as well.

Now, install and load the wooldridge package and lets get started!

Chapter 2: The Simple Regression Model

Example 2.10: a log wage equation.

Load the wage1 data and check out the documentation.

The documentation indicates these are data from the 1976 Current Population Survey, collected by Henry Farber when he and Wooldridge were colleagues at MIT in 1988.

\(educ\) : years of education

\(wage\) : average hourly earnings

\(lwage\) : log of the average hourly earnings

First, make a scatter-plot of the two variables and look for possible patterns in the relationship between them.

It appears that on average , more years of education, leads to higher wages.

The example in the text is interested in the return to another year of education , or what the percentage change in wages one might expect for each additional year of education. To do so, one must use the \(log(\) wage \()\) . This has already been computed in the data set and is defined as lwage .

The textbook provides excellent discussions around these topics, so please consult it.

Build a linear model to estimate the relationship between the log of wage ( lwage ) and education ( educ ).

\[\widehat{log(wage)} = \beta_0 + \beta_1educ\]

Print the summary of the results.

| lwage | |

| educ | 0.08274 (0.00757) |

| Constant | 0.58377 (0.09734) |

| Observations | 526 |

| R | 0.18581 |

| Adjusted R | 0.18425 |

| Residual Std. Error | 0.48008 (df = 524) |

| F Statistic | 119.58160 (df = 1; 524) |

| p<0.1; p<0.05; p<0.01 | |

Plot the \(log(\) wage \()\) vs educ . The blue line represents the least squares fit.

Chapter 3: Multiple Regression Analysis: Estimation

Example 3.2: hourly wage equation.

Check the documentation for variable information

\(exper\) : years of potential experience

\(tenutre\) : years with current employer

Plot the variables against lwage and compare their distributions and slope ( \(\beta\) ) of the simple regression lines.

Estimate the model regressing educ , exper , and tenure against log(wage) .

\[\widehat{log(wage)} = \beta_0 + \beta_1educ + \beta_3exper + \beta_4tenure\]

Print the estimated model coefficients:

| Coefficients | |

|---|---|

| (Intercept) | 0.2844 |

| educ | 0.0920 |

| exper | 0.0041 |

| tenure | 0.0221 |

Plot the coefficients, representing percentage impact of each variable on \(log(\) wage \()\) for a quick comparison.

Chapter 4: Multiple Regression Analysis: Inference

Example 4.1 hourly wage equation.

Using the same model estimated in example: 3.2 , examine and compare the standard errors associated with each coefficient. Like the textbook, these are contained in parenthesis next to each associated coefficient.

| lwage | |

| educ | 0.09203 (0.00733) |

| exper | 0.00412 (0.00172) |

| tenure | 0.02207 (0.00309) |

| Constant | 0.28436 (0.10419) |

| Observations | 526 |

| R | 0.31601 |

| Adjusted R | 0.31208 |

| Residual Std. Error | 0.44086 (df = 522) |

| F Statistic | 80.39092 (df = 3; 522) |

| p<0.1; p<0.05; p<0.01 | |

For the years of experience variable, or exper , use coefficient and Standard Error to compute the \(t\) statistic:

\[t_{exper} = \frac{0.004121}{0.001723} = 2.391\]

Fortunately, R includes \(t\) statistics in the summary of model diagnostics.

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | 0.28436 | 0.10419 | 2.72923 | 0.00656 |

| educ | 0.09203 | 0.00733 | 12.55525 | 0.00000 |

| exper | 0.00412 | 0.00172 | 2.39144 | 0.01714 |

| tenure | 0.02207 | 0.00309 | 7.13307 | 0.00000 |

Plot the \(t\) statistics for a visual comparison:

Example 4.7 Effect of Job Training on Firm Scrap Rates

Load the jtrain data set.

From H. Holzer, R. Block, M. Cheatham, and J. Knott (1993), Are Training Subsidies Effective? The Michigan Experience , Industrial and Labor Relations Review 46, 625-636. The authors kindly provided the data.

\(year:\) 1987, 1988, or 1989

\(union:\) =1 if unionized

\(lscrap:\) Log(scrap rate per 100 items)

\(hrsemp:\) (total hours training) / (total employees trained)

\(lsales:\) Log(annual sales, $)

\(lemploy:\) Log(umber of employees at plant)

First, use the subset function and it’s argument by the same name to return observations which occurred in 1987 and are not union . At the same time, use the select argument to return only the variables of interest for this problem.

Next, test for missing values. One can “eyeball” these with R Studio’s View function, but a more precise approach combines the sum and is.na functions to return the total number of observations equal to NA .

While R ’s lm function will automatically remove missing NA values, eliminating these manually will produce more clearly proportioned graphs for exploratory analysis. Call the na.omit function to remove all missing values and assign the new data.frame object the name jtrain_clean .

Use jtrain_clean to plot the variables of interest against lscrap . Visually observe the respective distributions for each variable, and compare the slope ( \(\beta\) ) of the simple regression lines.

Now create the linear model regressing hrsemp (total hours training/total employees trained), lsales (log of annual sales), and lemploy (the log of the number of the employees), against lscrap (the log of the scrape rate).

\[lscrap = \alpha + \beta_1 hrsemp + \beta_2 lsales + \beta_3 lemploy\]

Finally, print the complete summary diagnostics of the model.

| lscrap | |

| hrsemp | -0.02927 (0.02280) |

| lsales | -0.96203 (0.45252) |

| lemploy | 0.76147 (0.40743) |

| Constant | 12.45837 (5.68677) |

| Observations | 29 |

| R | 0.26243 |

| Adjusted R | 0.17392 |

| Residual Std. Error | 1.37604 (df = 25) |

| F Statistic | 2.96504 (df = 3; 25) |

| p<0.1; p<0.05; p<0.01 | |

Chapter 5: Multiple Regression Analysis: OLS Asymptotics

Example 5.1: housing prices and distance from an incinerator.

Load the hprice3 data set.

\(lprice:\) Log(selling price)

\(ldist:\) Log(distance from house to incinerator, feet)

\(larea:\) Log(square footage of house)

Graph the prices of housing against distance from an incinerator:

Next, model the \(log(\) price \()\) against the \(log(\) dist \()\) to estimate the percentage relationship between the two.

\[price = \alpha + \beta_1 dist\]

Create another model that controls for “quality” variables, such as square footage area per house.

\[price = \alpha + \beta_1 dist + \beta_2 area\]

Compare the coefficients of both models. Notice that adding area improves the quality of the model, but also reduces the coefficient size of dist .

| lprice | ||

| (1) | (2) | |

| ldist | 0.31722 (0.04811) | 0.19623 (0.03816) |

| larea | 0.78368 (0.05358) | |

| Constant | 8.25750 (0.47383) | 3.49394 (0.49065) |

| Observations | 321 | 321 |

| R | 0.11994 | 0.47385 |

| Adjusted R | 0.11718 | 0.47054 |

| Residual Std. Error | 0.41170 (df = 319) | 0.31883 (df = 318) |

| F Statistic | 43.47673 (df = 1; 319) | 143.19470 (df = 2; 318) |

| p<0.1; p<0.05; p<0.01 | ||

Graphing illustrates the larger coefficient for area .

Chapter 6: Multiple Regression: Further Issues

Example 6.1: effects of pollution on housing prices, standardized..

Load the hprice2 data and view the documentation.

Data from Hedonic Housing Prices and the Demand for Clean Air , by Harrison, D. and D.L.Rubinfeld, Journal of Environmental Economics and Management 5, 81-102. Diego Garcia, a former Ph.D. student in economics at MIT, kindly provided these data, which he obtained from the book Regression Diagnostics: Identifying Influential Data and Sources of Collinearity, by D.A. Belsey, E. Kuh, and R. Welsch, 1990. New York: Wiley.

\(price\) : median housing price.

\(nox\) : Nitrous Oxide concentration; parts per million.

\(crime\) : number of reported crimes per capita.

\(rooms\) : average number of rooms in houses in the community.

\(dist\) : weighted distance of the community to 5 employment centers.

\(stratio\) : average student-teacher ratio of schools in the community.

\[price = \beta_0 + \beta_1nox + \beta_2crime + \beta_3rooms + \beta_4dist + \beta_5stratio + \mu\]

Estimate the usual lm model.

Estimate the same model, but standardized coefficients by wrapping each variable with R’s scale function:

\[\widehat{zprice} = \beta_1znox + \beta_2zcrime + \beta_3zrooms + \beta_4zdist + \beta_5zstratio\]

Compare results, and observe

| price | scale(price) | |

| (1) | (2) | |

| nox | -2,706.43300 (354.08690) | |

| crime | -153.60100 (32.92883) | |

| rooms | 6,735.49800 (393.60370) | |

| dist | -1,026.80600 (188.10790) | |

| stratio | -1,149.20400 (127.42870) | |

| scale(nox) | -0.34045 (0.04450) | |

| scale(crime) | -0.14328 (0.03069) | |

| scale(rooms) | 0.51389 (0.03000) | |

| scale(dist) | -0.23484 (0.04298) | |

| scale(stratio) | -0.27028 (0.02994) | |

| Constant | 20,871.13000 (5,054.59900) | |

| Observations | 506 | 506 |

| R | 0.63567 | 0.63567 |

| Adjusted R | 0.63202 | 0.63203 |

| Residual Std. Error | 5,586.19800 (df = 500) | 0.60601 (df = 501) |

| F Statistic | 174.47330 (df = 5; 500) | 174.82220 (df = 5; 501) |

| p<0.1; p<0.05; p<0.01 | ||

Example 6.2: Effects of Pollution on Housing Prices, Quadratic Interactive Term

Modify the housing model from example 4.5 , adding a quadratic term in rooms :

\[log(price) = \beta_0 + \beta_1log(nox) + \beta_2log(dist) + \beta_3rooms + \beta_4rooms^2 + \beta_5stratio + \mu\]

Compare the results with the model from example 6.1 .

| lprice | ||

| (1) | (2) | |

| lnox | -0.95354 (0.11674) | -0.90168 (0.11469) |

| log(dist) | -0.13434 (0.04310) | -0.08678 (0.04328) |

| rooms | 0.25453 (0.01853) | -0.54511 (0.16545) |

| I(rooms2) | 0.06226 (0.01280) | |

| stratio | -0.05245 (0.00590) | -0.04759 (0.00585) |

| Constant | 11.08386 (0.31811) | 13.38548 (0.56647) |

| Observations | 506 | 506 |

| R | 0.58403 | 0.60281 |

| Adjusted R | 0.58071 | 0.59884 |

| Residual Std. Error | 0.26500 (df = 501) | 0.25921 (df = 500) |

| F Statistic | 175.85520 (df = 4; 501) | 151.77040 (df = 5; 500) |

| p<0.1; p<0.05; p<0.01 | ||

Estimate the minimum turning point at which the rooms interactive term changes from negative to positive.

\[x = \frac{\hat{\beta_1}}{2\hat{\beta_2}}\]

Compute the percent change across a range of average rooms. Include the smallest, turning point, and largest.

| Rooms | Percent.Change |

|---|---|

| 3.56000 | -10.181324 |

| 4.00000 | -4.702338 |

| 4.37763 | 0.000000 |

| 5.00000 | 7.749903 |

| 5.50000 | 13.976023 |

| 6.45000 | 25.805651 |

| 7.50000 | 38.880503 |

| 8.78000 | 54.819367 |

Graph the log of the selling price against the number of rooms. Superimpose a simple model as well as a quadratic model and examine the difference.

Chapter 7: Multiple Regression Analysis with Qualitative Information

Example 7.4: housing price regression, qualitative binary variable.

This time, use the hrprice1 data.

Data collected from the real estate pages of the Boston Globe during 1990. These are homes that sold in the Boston, MA area.

\(lprice:\) Log(house price, $1000s)

\(llotsize:\) Log(size of lot in square feet)

\(lsqrft:\) Log(size of house in square feet)

\(bdrms:\) number of bdrms

\(colonial:\) =1 if home is colonial style

\[\widehat{log(price)} = \beta_0 + \beta_1log(lotsize) + \beta_2log(sqrft) + \beta_3bdrms + \beta_4colonial \]

Estimate the coefficients of the above linear model on the hprice data set.

| lprice | |

| llotsize | 0.16782 (0.03818) |

| lsqrft | 0.70719 (0.09280) |

| bdrms | 0.02683 (0.02872) |

| colonial | 0.05380 (0.04477) |

| Constant | -1.34959 (0.65104) |

| Observations | 88 |

| R | 0.64907 |

| Adjusted R | 0.63216 |

| Residual Std. Error | 0.18412 (df = 83) |

| F Statistic | 38.37846 (df = 4; 83) |

| p<0.1; p<0.05; p<0.01 | |

Chapter 8: Heteroskedasticity

Example 8.9: determinants of personal computer ownership.

\[\widehat{PC} = \beta_0 + \beta_1hsGPA + \beta_2ACT + \beta_3parcoll + \beta_4colonial \] Christopher Lemmon, a former MSU undergraduate, collected these data from a survey he took of MSU students in Fall 1994. Load gpa1 and create a new variable combining the fathcoll and mothcoll , into parcoll . This new column indicates if either parent went to college.

Calculate the weights and then pass them to the weights argument.

Compare the OLS and WLS model in the table below:

| PC | ||

| (1) | (2) | |

| hsGPA | 0.06539 (0.13726) | 0.03270 (0.12988) |

| ACT | 0.00056 (0.01550) | 0.00427 (0.01545) |

| parcoll | 0.22105 (0.09296) | 0.21519 (0.08629) |

| Constant | -0.00043 (0.49054) | 0.02621 (0.47665) |

| Observations | 141 | 141 |

| R | 0.04153 | 0.04644 |

| Adjusted R | 0.02054 | 0.02556 |

| Residual Std. Error (df = 137) | 0.48599 | 1.01624 |

| F Statistic (df = 3; 137) | 1.97851 | 2.22404 |

| p<0.1; p<0.05; p<0.01 | ||

Chapter 9: More on Specification and Data Issues

Example 9.8: r&d intensity and firm size.

\[rdintens = \beta_0 + \beta_1sales + \beta_2profmarg + \mu\]

From Businessweek R&D Scoreboard , October 25, 1991. Load the data and estimate the model.

Plotting the data reveals the outlier on the far right of the plot, which will skew the results of our model.

So, we can estimate the model without that data point to gain a better understanding of how sales and profmarg describe rdintens for most firms. We can use the subset argument of the linear model function to indicate that we only want to estimate the model using data that is less than the highest sales.

The table below compares the results of both models side by side. By removing the outlier firm, \(sales\) become a more significant determination of R&D expenditures.

| rdintens | ||

| (1) | (2) | |

| sales | 0.00005 (0.00004) | 0.00019 (0.00008) |

| profmarg | 0.04462 (0.04618) | 0.04784 (0.04448) |

| Constant | 2.62526 (0.58553) | 2.29685 (0.59180) |

| Observations | 32 | 31 |

| R | 0.07612 | 0.17281 |

| Adjusted R | 0.01240 | 0.11372 |

| Residual Std. Error | 1.86205 (df = 29) | 1.79218 (df = 28) |

| F Statistic | 1.19465 (df = 2; 29) | 2.92476 (df = 2; 28) |

| p<0.1; p<0.05; p<0.01 | ||

Chapter 10: Basic Regression Analysis with Time Series Data

Example 10.2: effects of inflation and deficits on interest rates.

\[\widehat{i3} = \beta_0 + \beta_1inf_t + \beta_2def_t\] Data from the Economic Report of the President, 2004 , Tables B-64, B-73, and B-79.

| Tbill3mo | |

| cpi | 0.60587 (0.08213) |

| deficit | 0.51306 (0.11838) |

| Constant | 1.73327 (0.43197) |

| Observations | 56 |

| R | 0.60207 |

| Adjusted R | 0.58705 |

| Residual Std. Error | 1.84316 (df = 53) |

| F Statistic | 40.09424 (df = 2; 53) |

| p<0.1; p<0.05; p<0.01 | |

Now lets update the example with current data, pull from the Federal Reserve Economic Research (FRED) using the quantmod package . Other than the convenient API, the package also formats time series data into xts: eXtensible Time Series objects, which add many feature and benefits when working with time series.

Now that all data has been downloaded, we can calculate the deficit from the federal outlays and receipts data. Next, we will merge our new deficit variable with inflation and TB3MS variables. As these are all xts times series objects, the merge function will automatically key off each series time date index, insuring integrity and alignment among each observation and its respective date. Additionally, xts provides easy chart construction with its plot method.

Now lets run the model again. Inflation plays a much more prominent role in the 3 month T-bill rate, than the deficit.

| TB3MS | |

| inflation | 0.88001 (0.09313) |

| deficit | 0.20756 (0.09259) |

| Constant | 1.79353 (0.52477) |

| Observations | 61 |

| R | 0.63996 |

| Adjusted R | 0.62755 |

| Residual Std. Error | 1.97754 (df = 58) |

| F Statistic | 51.54762 (df = 2; 58) |

| p<0.1; p<0.05; p<0.01 | |

Chapter 11: Further Issues in Using OLS with with Time Series Data

Example 11.7: wages and productivity.

\[\widehat{log(hrwage_t)} = \beta_0 + \beta_1log(outphr_t) + \beta_2t + \mu_t\] Data from the Economic Report of the President, 1989 , Table B-47. The data are for the non-farm business sector.

| lhrwage | diff(lhrwage) | |

| (1) | (2) | |

| loutphr | 1.63964 (0.09335) | |

| t | -0.01823 (0.00175) | |

| diff(loutphr) | 0.80932 (0.17345) | |

| Constant | -5.32845 (0.37445) | -0.00366 (0.00422) |

| Observations | 41 | 40 |

| R | 0.97122 | 0.36424 |

| Adjusted R | 0.96971 | 0.34750 |

| Residual Std. Error (df = 38) | 0.02854 | 0.01695 |

| F Statistic | 641.22430 (df = 2; 38) | 21.77054 (df = 1; 38) |

| p<0.1; p<0.05; p<0.01 | ||

Chapter 12: Serial Correlation and Heteroskedasticiy in Time Series Regressions

Example 12.8: heteroskedasticity and the efficient markets hypothesis.

These are Wednesday closing prices of value-weighted NYSE average, available in many publications. Wooldridge does not recall the particular source used when he collected these data at MIT, but notes probably the easiest way to get similar data is to go to the NYSE web site, www.nyse.com .

\[return_t = \beta_0 + \beta_1return_{t-1} + \mu_t\]

\[\hat{\mu^2_t} = \beta_0 + \beta_1return_{t-1} + residual_t\]

| return | return_mu2 | |

| (1) | (2) | |

| return_1 | 0.05890 (0.03802) | -1.10413 (0.20140) |

| Constant | 0.17963 (0.08074) | 4.65650 (0.42768) |

| Observations | 689 | 689 |

| R | 0.00348 | 0.04191 |

| Adjusted R | 0.00203 | 0.04052 |

| Residual Std. Error (df = 687) | 2.11040 | 11.17847 |

| F Statistic (df = 1; 687) | 2.39946 | 30.05460 |

| p<0.1; p<0.05; p<0.01 | ||

Example 12.9: ARCH in Stock Returns

\[\hat{\mu^2_t} = \beta_0 + \hat{\mu^2_{t-1}} + residual_t\]

We still have return_mu in the working environment so we can use it to create \(\hat{\mu^2_t}\) , ( mu2_hat ) and \(\hat{\mu^2_{t-1}}\) ( mu2_hat_1 ). Notice the use R ’s matrix subset operations to perform the lag operation. We drop the first observation of mu2_hat and squared the results. Next, we remove the last observation of mu2_hat_1 using the subtraction operator combined with a call to the NROW function on return_mu . Now, both contain \(688\) observations and we can estimate a standard linear model.

| mu2_hat | |

| mu2_hat_1 | 0.33706 (0.03595) |

| Constant | 2.94743 (0.44023) |

| Observations | 688 |

| R | 0.11361 |

| Adjusted R | 0.11231 |

| Residual Std. Error | 10.75907 (df = 686) |

| F Statistic | 87.92263 (df = 1; 686) |

| p<0.1; p<0.05; p<0.01 | |

Chapter 13: Pooling Cross Sections across Time: Simple Panel Data Methods

Example 13.7: effect of drunk driving laws on traffic fatalities.

Wooldridge collected these data from two sources, the 1992 Statistical Abstract of the United States (Tables 1009, 1012) and A Digest of State Alcohol-Highway Safety Related Legislation , 1985 and 1990, published by the U.S. National Highway Traffic Safety Administration. \[\widehat{\Delta{dthrte}} = \beta_0 + \Delta{open} + \Delta{admin}\]

| cdthrte | |

| copen | -0.41968 (0.20559) |

| cadmn | -0.15060 (0.11682) |

| Constant | -0.49679 (0.05243) |

| Observations | 51 |

| R | 0.11867 |

| Adjusted R | 0.08194 |

| Residual Std. Error | 0.34350 (df = 48) |

| F Statistic | 3.23144 (df = 2; 48) |

| p<0.1; p<0.05; p<0.01 | |

Chapter 18: Advanced Time Series Topics

Example 18.8: forecasting the u.s. unemployment rate.

Data from Economic Report of the President, 2004 , Tables B-42 and B-64.

\[\widehat{unemp_t} = \beta_0 + \beta_1unem_{t-1}\]

Estimate the linear model in the usual way and note the use of the subset argument to define data equal to and before the year 1996.

\[\widehat{unemp_t} = \beta_0 + \beta_1unem_{t-1} + \beta_2inf_{t-1}\]

| unem | ||

| (1) | (2) | |

| unem_1 | 0.73235 (0.09689) | 0.64703 (0.08381) |

| inf_1 | 0.18358 (0.04118) | |

| Constant | 1.57174 (0.57712) | 1.30380 (0.48969) |

| Observations | 48 | 48 |

| R | 0.55397 | 0.69059 |

| Adjusted R | 0.54427 | 0.67684 |

| Residual Std. Error | 1.04857 (df = 46) | 0.88298 (df = 45) |

| F Statistic | 57.13184 (df = 1; 46) | 50.21941 (df = 2; 45) |

| p<0.1; p<0.05; p<0.01 | ||

Now, use the subset argument to create our testing data set containing observation after 1996. Next, pass the both the model object and the test set to the predict function for both models. Finally, cbind or “column bind” both forecasts as well as the year and unemployment rate of the test set.

| year | unem | AR1_forecast | VAR1_forecast | |

|---|---|---|---|---|

| 50 | 1997 | 4.9 | 5.526452 | 5.348468 |

| 51 | 1998 | 4.5 | 5.160275 | 4.896451 |

| 52 | 1999 | 4.2 | 4.867333 | 4.509137 |

| 53 | 2000 | 4.0 | 4.647627 | 4.425175 |

| 54 | 2001 | 4.8 | 4.501157 | 4.516062 |

| 55 | 2002 | 5.8 | 5.087040 | 4.923537 |

| 56 | 2003 | 6.0 | 5.819394 | 5.350271 |

Using R for Introductory Econometrics

This is an excellent open source complimentary text to “Introductory Econometrics” by Jeffrey M. Wooldridge and should be your number one resource. This excerpt from the book’s website:

This book introduces the popular, powerful and free programming language and software package R with a focus on the implementation of standard tools and methods used in econometrics. Unlike other books on similar topics, it does not attempt to provide a self-contained discussion of econometric models and methods. Instead, it builds on the excellent and popular textbook “Introductory Econometrics” by Jeffrey M. Wooldridge.

Heiss, Florian. Using R for Introductory Econometrics . ISBN: 979-8648424364, CreateSpace Independent Publishing Platform, 2020, Dusseldorf, Germany.

url: http://www.urfie.net/ .

Applied Econometrics with R

From the publisher’s website:

This is the first book on applied econometrics using the R system for statistical computing and graphics. It presents hands-on examples for a wide range of econometric models, from classical linear regression models for cross-section, time series or panel data and the common non-linear models of microeconometrics such as logit, probit and tobit models, to recent semiparametric extensions. In addition, it provides a chapter on programming, including simulations, optimization, and an introduction to R tools enabling reproducible econometric research. An R package accompanying this book, AER, is available from the Comprehensive R Archive Network (CRAN) at https://CRAN.R-project.org/package=AER .

Kleiber, Christian and Achim Zeileis. Applied Econometrics with R . ISBN 978-0-387-77316-2, Springer-Verlag, 2008, New York. https://www.springer.com/us/book/9780387773162

Bibliography

Jeffrey M. Wooldridge (2020). Introductory Econometrics: A Modern Approach, 7th edition . ISBN-13: 978-1-337-55886-0. Mason, Ohio :South-Western Cengage Learning.

Jeffrey A. Ryan and Joshua M. Ulrich (2020). quantmod: Quantitative Financial Modelling Framework. R package version 0.4.18. https://CRAN.R-project.org/package=quantmod

R Core Team (2021). R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. URL https://www.R-project.org/ .

Marek Hlavac (2018). stargazer: Well-Formatted Regression and Summary Statistics Tables . R package version 5.2.2. URL: https://CRAN.R-project.org/package=stargazer

van der Loo M (2020). tinytest “A method for deriving information from running R code.” The R Journal , Accepted for publication. <URL: https://arxiv.org/abs/2002.07472 >.

Yihui Xie (2021). knitr: A General-Purpose Package for Dynamic Report Generation in R . R package version 1.33. https://CRAN.R-project.org/package=knitr

Econometrics Practice Problems: Where to Find Them

- The Albert Team

- Last Updated On: March 1, 2022

Introduction

While studying principles of econometrics, it is essential that you not only understand the basic concepts but also practice a sufficient number of questions to understand the applications and help while taking econometrics tests. While previous econometrics test papers may be available along with econometrics exam solutions, a systematic approach to studying along with practice questions on each topic is quite helpful.

This article outlines some of the resources on the internet and some professors in different universities who post-practice econometrics test questions along with econometrics exam solutions. Thereafter, the article shifts to focus on how Albert.io Econometrics is the best place for practicing questions for a test on principles of econometrics.

Econometrics Practice Problems Online

There is no shortage of econometrics practice problems on the internet. There are several econometrics problems of various levels that a learner can find on the internet. Just to give you an idea:

Professor Yu Jun of SMU posts lectures on econometrics along with problem sets and their solutions. These can be found here . Various assignments along with projects and econometrics exam solutions are also posted.

Professor Joseph Herriges of renowned Iowa State University also posts problem sets along with solutions on principles of econometrics.

Professor Victor Lima of the University of Chicago also posts several problem sets along with exam questions on his web page. Some of the problem sets do not have solutions; however, they are extremely useful as they are a good collection of econometrics practice problems for students. These can be found here .

The practice problems described above are not all multiple choice questions. They are lengthy problems but provide excellent applications of econometrics principles. Academia.edu has a huge repository of multiple choice questions related to econometrics. These questions are not lengthy and a learner can solve them quickly. Typically, a question doesn’t include more than one concept. While it an excellent collection of problems, they do not have detailed solutions.

While there are numerous such practice problems online, the fact is that they are not customized and in short, are a nuisance to study from. Often a student of econometrics would like to practice problems as and when they study. The practice problems available on internet and web pages of different professors are usually based on a broader topic which has several concepts within it. For a beginner, who is learning the concepts for the first time and has not practiced enough questions, it is easy to deviate from the targeted concept. They will probably end up wasting a lot of time figuring out which concept to use and most importantly why.

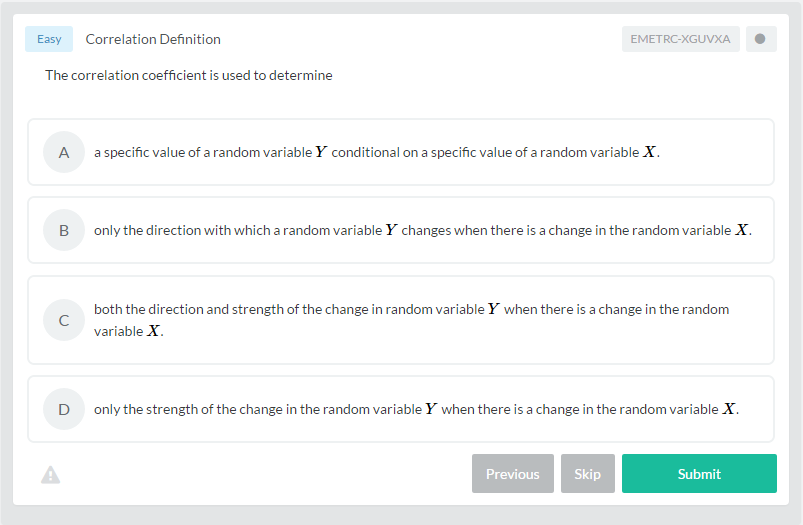

Why Albert.io Econometrics?

Albert.io econometrics ensures a smooth learning experience for anyone who is willing to master the principles of econometrics. Albert.io organizes the content into various themes with several topics within each theme. The list of questions is quite comprehensive, and questions are tagged as easy, moderate or difficult. Using the difficulty filters, one can first solve the easy questions, then moderate and finally the difficult questions.

These are multiple choice questions that provide immediate feedback as soon as an answer is selected. While many practice sets floating around on the internet offer various multiple choice questions on Econometrics along with the answer key, almost none of them provide the detailed explanation of how to solve each question.

At Albert.io Econometrics, the aim is to make sure that you understand what you are studying.

Hence, whenever a question is answered, a detailed explanation of the solution is also displayed, which will help you know how the problem should be solved.

For each econometrics topic, there is a set of practice problems. Once you have answered all the questions, you can see the accuracy level. This helps you identify which topics you have understood properly and have been able to answer the questions with high accuracy. This inbuilt feedback at Albert.io helps learners to identify those topics that they need to study again to enhance their knowledge of basic concepts of principles of econometrics.

Through all this, Albert.io makes learning a pleasant experience. A learner doesn’t have to spend hours on the internet searching for the right set of questions. Even after finding the questions, they do not need to spend time figuring out the solutions and which concepts to use and why. There is a systematic learning experience at Albert.io and one can choose which topics to study and practice depending on their requirements.

No doubt, the internet has a huge collection of questions and possibly all sorts of questions that one can imagine but the need is not just the content but organized content and Albert.io strives to achieve that.

In conclusion, econometrics is an extremely important field and perhaps the most difficult if not studied properly. As much as content on principles of econometrics is important, practicing problems, going through econometrics exam solutions, taking sample econometrics test, etc. are quite important.

While different university professors post several exam questions on their web pages, they are customized to suit their respective universities and may not be optimal for every learner. Hence, an econometrics student should sign up for Albert.io Econometrics because it promises to be a suitable, customized, easy to learn and excel and an interactive platform for learning principles of econometrics.

Featured Image Source

Let’s put everything into practice. Try this Econometrics practice question:

Looking for more Econometrics practice?

You can find thousands of practice questions on Albert.io. Albert.io lets you customize your learning experience to target practice where you need the most help. We’ll give you challenging practice questions to help you achieve mastery of Econometrics.

Start practicing here .

Are you a teacher or administrator interested in boosting AP® Biology student outcomes?

Interested in a school license?

Popular posts.

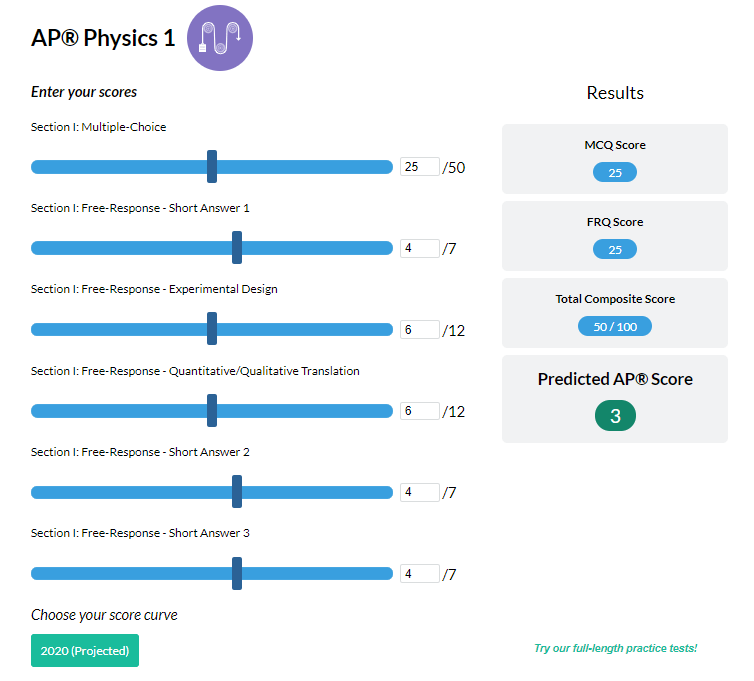

AP® Score Calculators

Simulate how different MCQ and FRQ scores translate into AP® scores

AP® Review Guides

The ultimate review guides for AP® subjects to help you plan and structure your prep.

Core Subject Review Guides

Review the most important topics in Physics and Algebra 1 .

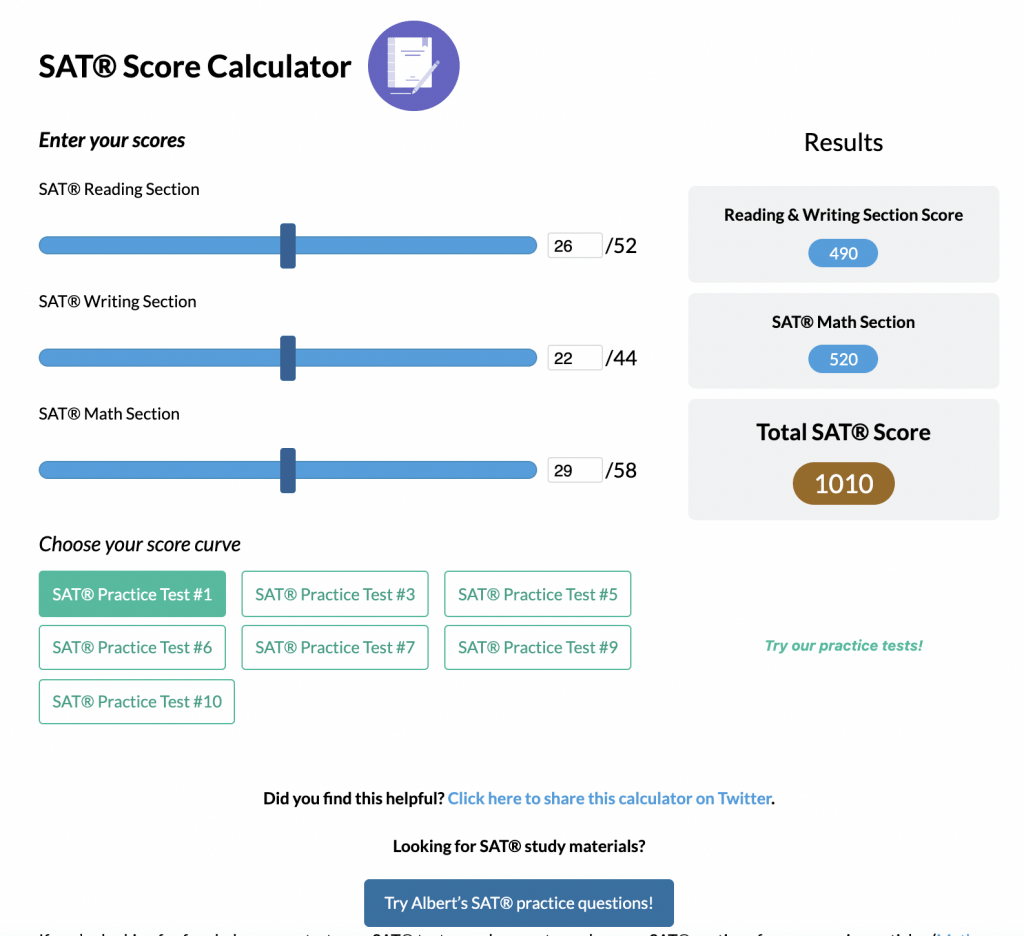

SAT® Score Calculator

See how scores on each section impacts your overall SAT® score

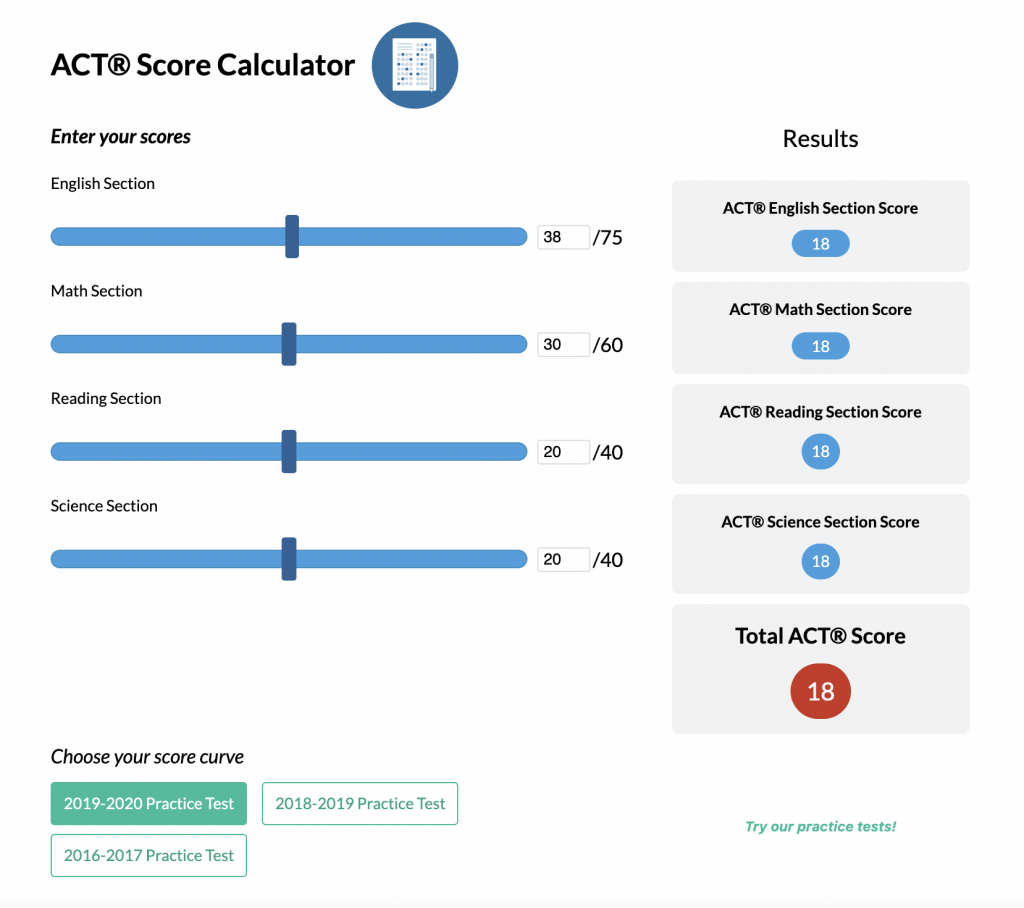

ACT® Score Calculator

See how scores on each section impacts your overall ACT® score

Grammar Review Hub

Comprehensive review of grammar skills

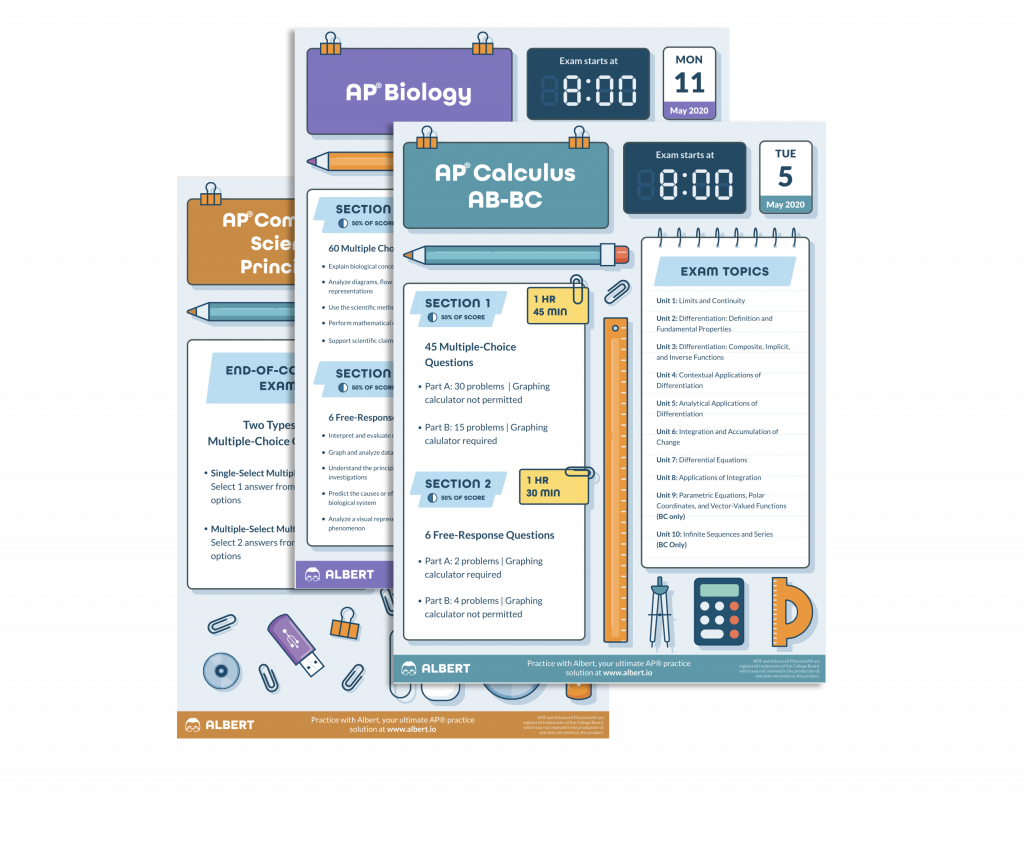

AP® Posters

Download updated posters summarizing the main topics and structure for each AP® exam.

- How It Works

- PhD thesis writing

- Master thesis writing

- Bachelor thesis writing

- Dissertation writing service

- Dissertation abstract writing

- Thesis proposal writing

- Thesis editing service

- Thesis proofreading service

- Thesis formatting service

- Coursework writing service

- Research paper writing service

- Architecture thesis writing

- Computer science thesis writing

- Engineering thesis writing

- History thesis writing

- MBA thesis writing

- Nursing dissertation writing

- Psychology dissertation writing

- Sociology thesis writing

- Statistics dissertation writing

- Buy dissertation online

- Write my dissertation

- Cheap thesis

- Cheap dissertation

- Custom dissertation

- Dissertation help

- Pay for thesis

- Pay for dissertation

- Senior thesis

- Write my thesis

102 Best Econometrics Research Topics

College and university professors require students to write about econometrics research topics to gauge their comprehension of the relationship between mathematical economics, statistics, and economics.

The purpose of this integration is to provide numerical values to economic relationships and parameters. Usually, econometrics involves economic theories and their presentation in mathematical forms and the empirical study of business. Perhaps, this integration explains why some students struggle to choose topics for research in econometrics.

What Is Econometrics?

As hinted, econometrics is an economics branch that focuses on the relationships between economics, statistics, and mathematical economics. Ideally, econometrics entails the quantitative application of mathematical and statistical models using data to test hypotheses and develop economic theories while forecasting future trends based on historical data. Econometricians subject real-world data to various statistical trials while comparing and contrasting the results against the idea under examination.

Writing an econometric research paper is a process that starts with the selection of an interesting topic. Once you’ve chosen a title and the supervisor approves it, embark on extensive research using the prompt from your teacher. Proceed by gathering and analyzing all relevant information from different sources. Engaging in in-depth study and comprehensive analysis will enable you to write an informative paper that will compel the educator to award you the best grade in your class. Below are the steps to follow to write a high-quality econometric thesis or essay.

Write the introduction: Introduce your econometrics topic and tell the audience why it’s crucial. Also, include a thesis statement summarizing the entire paper. Describe the theoretical model: Tell the readers about the theoretical models to structure the empirical work. Present the data: Describe the data, whether time series or cross-sectional. Use descriptive statistics data and graphics if possible. Present the empirical model: Explain the model you intend to estimate and the functional form you intend to use. Present your empirical results: This section presents empirical results using a table to summarize them. Conclude the paper: Describe lessons from the research and state whether it supports the theory. Also, suggest approaches for future research on the topic.

Your paper should also include a reference section comprising the information sources you used to gather data.

Interesting Econometrics Paper Topics

Maybe you know the process of writing a paper on an econometrics topic but don’t have an idea to explore. If so, consider these exciting econometrics paper ideas.

- How privatizing public enterprises could affect economic development and policy

- Cashless economy: How demonetization affects medium and small businesses

- How Gini index dynamics reflect the income inequality problem

- Consumption evolution over the last decade: Consumer behavior and trends

- Investigating salary inequalities and the forces behind them

- How income changes affect consumer choices

- How does allowing the labor force to participate in public budgeting affect the economy

- How the marital status affect the labor force composition

- How consumption attitudes have changed over the last decade

- How economic convergence relates to salary levels

- How income affects life insurance

- The consequences of leaving the rat race

- Testing Okun’s Law in the U.S

- Analysis of spending on disposable income and imports

- Comparing the unemployment rate in the United States to the rest of the world

- Regional labor mobility and unemployment

- Stock market evolution: Analyzing the causes and effects

- How internet productivity relate to connectivity in the workplace

- How currency devaluation affects medium and small companies

- How government spending and inflation relate in an economy

- The relationship between stock prices and inflation in a country

- How income tax revenue affects a developing economy

- How government expenditure affects economic growth

- Factors contributing to the global recession

- How a country’s unemployment rate relates to economic growth

Any of these topics can be an excellent basis for an econometrics paper. However, you require extensive research about any of these topics to develop a winning thesis.

Undergraduate Econometrics Project Ideas

Maybe your school or faculty requires you to write an econometrics paper to graduate from university. In that case, consider these econometrics research topics for undergraduates.

- Analyzing the impact of income inequality on the poverty level

- Analyzing gender differences in education between developing and developed countries

- How immigration affects unemployment in the European Union

- How economic growth relates to trade

- Are immigrants more in countries with a high income?

- How high taxations affect GSP

- Analyzing the relationship between local income level and house prices

- How income, education, and life expectancy affect the human development index

- How inflation affects national savings

- How life expectancy relates to national income

- How financial development affects the economic growth of a country

- Crime index versus the average education years

- Investigating the correlation between youth unemployment and minimum wage

- How economic prosperity relate to government systems

- Economic factors that affect housing prices in the United States

- Economic factors contributing to homelessness in the U.S

- Socioeconomic and economic determinants of infant mortality

- Econometric analysis: Impact of trade barriers

- Why matching methods are essential in econometrics

- How a randomized experiment can aid econometrics

- Why instrumental variables matter in econometrics

- Can experts predict the future using econometrics?

- Econometrics as a numerical estimates source for economic relationship variables

- Ways of testing economic theories that econometricians present

- Regression discontinuity: Describe its application

These are great ideas to consider for an econometrics project. Nevertheless, you require sufficient time to research any of these topics and write a winning essay or dissertation.

Easy Econometric Research Topics

Perhaps, you need an easy topic for an econometrics paper. Maybe you have a short time to complete your assignment. In that case, these econometrics topics are ideal for you.

- Theory suggestion- The initial econometrics methodology step

- Why estimating variables is important

- The importance of Proof-reading once you have evaluated the variables

- Why testing a hypothesis matters

- The impact of poverty on education

- How poverty relates to childhood obesity

- Human development and income inequality

- The link between religion and ideologies on a country’s economy

- Income and importation- How do they connect?

- Personal income and life expectancy- What is the connection?

- The effects of minimum wage on unemployment

- Investigating monetary policies and bank regulations

- A study of the economies of scale

- The impact and relevance of comparative institutional economics

- Analyzing the effect of making a company international

- Studying the macroeconomics of rare events

- Investigating customer behavior towards green products

- Trade patterns: Investigating different trade patterns and their applications

- Different stochastic processes concepts

- Accurate stochastic processes prediction

Any of these topics can be a sound basis of a simple paper. Nevertheless, you still require time to research the idea and analyze data to develop a quality paper.

Financial Econometrics Research Paper Topics

Perhaps, you want to write an academic paper about a financial econometrics topic. If so, consider these ideas.

- How does bank regulation affect the economy?

- A critical look into the loan markets

- How a cashless policy affects the economy

- Structure and implementation of the monetary policy

- Lessons to learn from financial crises

- Investigating regression models

- Statistical tools in the financial econometrics

These are good topics to explore in financial econometrics. However, follow the prompt from your teacher to write an impressive paper.

Econometrics Empirical Project Ideas FExor Ph.D. Level

Maybe you’re pursuing your Ph.D. and want to write a dissertation about an econometrics topic. In that case, this category comprises excellent ideas for you.

- Analytical statistics versus theoretical statistics

- The effects of the low and high demand of labor on an economy

- The arbitrage pricing theory

- How goods production and productivity affect econometrics at a national level

- Applied econometrics- Its essence in turning qualitative economic ideas into quantitative ones

- Definition, relevance, and application of the general line model

- Theoretical econometrics’ study and application

- The macro behavioral theory

- Panel data methods applications- A microeconomics subsection

- The impacts of the spillover effect on econometrics

- The impact of labor supply on a local economy

- Why labor markets are essential to econometrics

- What is micro-econometrics modeling?

- Micro-econometrics methods and applications

- Statistical tools and their use in financial econometrics

This list also has fantastic economics paper topic ideas. But like the topics in the other sections, each of these notions requires extensive research to write a quality paper.

Exciting Econometrics Questions

Maybe you need a question to serve as the basis of your econometrics research. In that case, here are exciting queries to inspire you.

- What is the current state of your country’s economy?

- What’s the difference between the current state of the local and international trades?

- What are the latest forecasts for the global economy?

- How do the foreign exchange market and the local businesses relate?

- What’s the impact of exportation and importation on the local economy?

- How do businesses monopolies affect a country’s economy?

- What are the effects of international banks on the local banking sector?

- How does population growth affect economic development?

- How can a natural disaster affect an emerging economy?

- What techniques do companies use to “nudge” consumers into spending more?

This comprehensive list has some of the best econometrics ideas for essays and research papers. Nevertheless, having a topic is not a guarantee that you’ll write a good essay. You might still need help with your assignment after choosing a topic.

Get Help With Thesis About Econometrics Topic

Our crew comprises the most skilled, talented, and experienced econometrics writers. These professionals have helped many students complete their econometrics papers on varied topics. If stuck with an econometric essay or an MBA thesis , for example, and require a cheap dissertation writing service , our native, educated experts can help you. We’re the most knowledgeable econometrics writers online. Contact us now to get a custom, high-quality research paper on any econometrics topic!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Comment * Error message

Name * Error message

Email * Error message

Save my name, email, and website in this browser for the next time I comment.

As Putin continues killing civilians, bombing kindergartens, and threatening WWIII, Ukraine fights for the world's peaceful future.

Ukraine Live Updates

Browse Course Material

Course info.

- Prof. Jonathan Gruber

Departments

As taught in.

- Microeconomics

Learning Resource Types

Principles of microeconomics, assignments.

| Problem Sets | Solutions |

|---|---|

| | |

| | |

| | |

| | |

| | |

| | |

| ) | |

You are leaving MIT OpenCourseWare

What is Econometrics?

How does econometrics work, examples of using econometrics, what is applied econometrics, what is theoretical econometrics, econometrics.

An area of economics where statistical and mathematical methods are used to analyze economic data

Econometrics is an area of economics where statistical and mathematical methods are used to analyze economic data. Individuals who are involved with econometrics are referred to as econometricians.

Econometricians test economic theories and hypotheses by using statistical tools such as probability, statistical inference, regression analysis , frequency distributions, and more. After testing economic theories, econometricians can compare the results with real data and observations, which can be helpful in forecasting future economic trends.

The purpose is to use statistical modeling and analysis in order to transform qualitative economic concepts into quantitative information that individuals can use. For example, policymakers can use the information to create new fiscal and monetary policies to stimulate the economy.

Suppose that policymakers are creating a new policy to increase the number of jobs in order to improve the unemployment rate and boost the economy. Econometricians test if this hypothesis will be true or not by using statistical models.

The following steps are the methodology of econometrics:

- Econometricians who are examining a dataset will suggest a theory or hypothesis to explain the data. At this stage, econometricians would define variables found in the economic model and the relationship between different variables. In order to come up with a hypothesis to explain the relationships, econometricians would look at existing economic theories.

- The second stage is to define a statistical model to quantify the economic theory that is being analyzed in the first step.

- In the third stage, statistical procedures are used to forecast unknown points in the statistical model. Econometricians may even use econometric software in order to assist with this step.

- Hypothesis testing is done in order to determine whether or not the hypothesis should be rejected or not. If it is rejected, the econometrician should come up with new definitions in the statistical model. The purpose of doing so is to assess the validity of the economic model.

There are various approaches to econometrics, and it is not limited to the methodology described above. Other methodologies include the vector autoregression approach and the Cowles Commission approach.

In the past, econometricians have studied patterns and relationships between different economic concepts, including:

- Income and expenditure

- Production, supply, and cost

- Labor and capital

- Salary and productivity

Econometrics can be separated into two main categories: applied and theoretical . The main goal for an applied econometrician is to turn qualitative data into something quantitative.

Applied econometrics refers to the idea of how economic data and theories are used to draw conclusions to improve decision-making and assist in solving economic issues. Its purpose is to enable the government, policymakers, businesses, and financial institutions to gain insight into possible solutions that can be used to solve economic problems. In order to do so, applied econometricians would analyze economic metrics, try to find out if there are any statistical trends, and predict what the outcome would be for an economic issue.

For example, suppose an applied econometrician is comparing household income with inflation rates and concludes that there is a relationship between the two. As a result, the government can use the research from econometricians to impose changes to policies that can increase household income during times of inflation .

Theoretical econometrics is about analyzing existing statistical procedures in order to predict anomalies or unknown parameters in economic data. Besides analyzing current statistical procedures, theoretical econometricians also develop new statistical procedures and methodologies in order to explain anomalies found in economic data .

As a result, theoretical econometricians depend on mathematical techniques and statistical theories to ensure that the new procedures that they develop can successfully generate correct economic conclusions.

CFI is the official provider of the Capital Markets & Securities Analyst (CMSA®) certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

- Demographics

- Economic Indicators

- Keynesian Economic Theory

- Quantitative Analysis

- See all economics resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Pardon Our Interruption

As you were browsing something about your browser made us think you were a bot. There are a few reasons this might happen:

- You've disabled JavaScript in your web browser.

- You're a power user moving through this website with super-human speed.

- You've disabled cookies in your web browser.

- A third-party browser plugin, such as Ghostery or NoScript, is preventing JavaScript from running. Additional information is available in this support article .

To regain access, please make sure that cookies and JavaScript are enabled before reloading the page.

Switch language:

Post Covid, China is no longer the “undisputed leader” in attracting FDI

The EU Chamber of Commerce in China’s latest report outlines the obstacles for European investors in Asia’s biggest economy.

- Share on Linkedin

- Share on Facebook

The risks of investing in China are outweighing the benefits, according to the European Business in China Position Paper 2024/2025 .

EU Chamber of Commerce in China President Jens Eskelund said China’s status as the “undisputed leader” of FDI is slipping further away as he expressed “concern about there being a tipping point now”.

Go deeper with GlobalData

Hong Kong PESTLE Insights - A Macroeconomic Outlook Report

Impact of china in insurance - thematic research, data insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

China gas holdings ltd.

The main obstacles that foreign companies face nowadays are not necessarily different than what they were ten years ago. Market access and regulatory barriers have been mainstay complaints since before the pandemic.

However, at the time, China’s rapid economic growth meant that the benefits outweighed the negatives. This made China, with its established infrastructure and a large supply of cheap labour, well-placed to attract FDI.

Post-pandemic, slow consumption has caused growth to lag in the country. The environment for foreign businesses has also been uncertain at times. Raids, strict rules on handling data and tough anti-espionage laws that have seen foreign workers jailed have all made the investment environment more unpredictable.

The rise of export control policies regarding the microchip and advanced computing sector in China is also expected to “significantly impact a substantial proportion of EU companies operating in China”. Almost 25% of respondents to the European Chambers Business Confidence Survey 2024 expect their operations to be affected, while 30% are unsure about the potential impact on their businesses.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

China has also been accused of encouraging overcapacity, where output exceeds demand, leading to artificially low prices (this has especially been the case for the electric vehicle sector). If investment in the manufacturing sector continues, paired with low domestic demand, it will lead to higher exports and more trade friction, according to Eskelund. Of the chamber’s members, 42% claim they are suffering from this overcapacity issue.

He urged government officials to aim for a more balanced approach between supply and demand and to focus on policies that will spur domestic consumption.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

VPI to invest €450m in German battery storage projects

Sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Investment Monitor In Brief

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

IMAGES

VIDEO

COMMENTS

ln(Qt) = 0 + 1ln(Pt) + 2ln(Yt) + ut, where Qt and Pt are the quantity (number) and price of haircuts obtained in Cambridge in year t and Yt is mean income in Cambridge in year t. Express the price elasticity of demand in terms of the coefficients in (1). [6 points] Answer: The price elasticity of demand is 1, which is the derivative of ln(Qt ...

This is a sample research paper for an introductory course in econometrics. It shows how to communicate econometric work in written form. The paper integrates many writing instructions and rules into a single example and shows how they all fit together. You should pay attention to the structure of the paper: how it is divided into sections and ...

WRITING ASSIGNMENTS IN ECONOMICS 970 In Sophomore Tutorial (Economics 970), you will receive several writing assignments including a term paper, an empirical exercise, short essays, response papers, and possibly a rewrite. Below is a description of these types: • Term Paper (10-15pp.). In all tutorials, you will be required to write a

Published annually, the Economic Report of the President includes: (1) current and foreseeable trends in and annual goals for employment, production, real income, and Federal budget outlays; (2) employment objectives for significant groups of the labor force; and (3) a program for carrying out these objectives.

Guides and Examples of econometrics paper for undergrads. Econometric Analysis Undergraduate Research Papers: Georgia Tech Library. Format for an Econometrics Paper: Skidmore College. Research Paper in Introductory Econometrics: Carleton College. Writing in Economics: Duke University.

This section contains the assignments and associated files for homework #2. Browse Course Material Syllabus Lecture Notes Assignments Homework 1 ... Economics; As Taught In Spring 2017 Level Graduate. Topics Social Science. Economics. Econometrics; Learning Resource Types assignment Problem Sets ...

The schedule is subject to change. Prerecorded materials. nt. ractive lectureMaterialsProblem sets1. ntroduction: Econometrics is Eating the WorldEconometrics and data analysis underl. ing policy debates and changes in the ec. nomy. Motivating example of income inequality. Course skills: ske.

Econometrics is the application of statistical and mathematical theories and perhaps some computer science to economic data. The example below shows how to use Okun's law to create an econometrics project. Okun's law refers to how the nation's output—its gross domestic product —is related to employment and unemployment.

Econometrics A Practice Problems #1 1. Suppose that (X;Y) is a random vector, where X 1, Y M (each with probability one) and E[YjX] = X. Let Z= Y=X. ... Assume that the sample size, n, is large. i. How would you test the null hypothesis that 1 = 0 versus the alterna-tive that 1 6= 0 at the 5% signi cance level?

For empirical questions we encourage you to go beyond the analysis in the lectures to deepen your own understanding of the concepts we are covering and their implication for real economics research. You can use any software you like. The link to data for empirical problems is available below. Write-ups should be concise and presented in the ...

The research has an i.i.d. sample of observations on testscore, smallclass and regaide. Suppose the fourth moments of these variable exist and that there is no perfect colinearity in (1;smallclass;regaide). The researcher estimates the equation by OLS and nd that ^ 0 = 918:04; s.e.( ^ 0) = 1:63 ^ 1 = 13:90; s.e.( ^ 1) = 2:45 ^ 2 = :31; s.e ...

Solve problem 5 in Lecture 4 or problems 3 or 4 or both in Lecture 5. For each one of the problems you solve correctly, we will increase the previous homework grades up by 2 brackets. For example, if you earned a check- on a homework question in one the previous or current homeworks, and you solve 1 bonus problem correctly, that check- gets ...

economic and -nancial data in the -rst year, statistics in the second year, and econometrics in the third year. Use the index in the text book to -nd the topics covered in this course. These notes cross-reference introductory statistics to Barrow (2009) and the econometrics and more advanced statistics to Verbeek (2008). This is one of the

We are. 1and3 = 0(in other w. rds, you test the 2 restrictions on th. cients simultaneously). Assume that the X0X matrix is given as. 15 0 10 0 1. X0X = B 10 20 0 C : @ A. 0 0 1. tions) are1 :5 = ^ ^ 2 = :8^3 = 3and that you also found s2 = 3Explain which test you would use to test the restriction and g.

This vignette reproduces examples from various chapters of Introductory Econometrics: A Modern Approach, 7e by Jeffrey M. Wooldridge. Each example illustrates how to load data, build econometric models, and compute estimates with R. In addition, the Appendix cites a few sources using R for econometrics. Of note, in 2020 Florian Heiss published ...

There are several econometrics problems of various levels that a learner can find on the internet. Just to give you an idea: Professor Yu Jun of SMU posts lectures on econometrics along with problem sets and their solutions. These can be found here. Various assignments along with projects and econometrics exam solutions are also posted.

This is a sample research paper for an introductory course in econometrics. It shows how to communicate econometric work in written form. The paper integrates many writing instructions and rules into a single example and shows how they all fit together. You should pay attention to the structure of the paper: how it is divided into sections and ...

Maybe you know the process of writing a paper on an econometrics topic but don't have an idea to explore. If so, consider these exciting econometrics paper ideas. How privatizing public enterprises could affect economic development and policy. Cashless economy: How demonetization affects medium and small businesses.

Much of the economic literature on crime treats criminal activity just like any other economic activity, i.e. a criminal act will be carried out if its expected value outweighs the expected costs that it involves for the individual in question. Seminal work by Becker (1968) presents the following model for crime: E[U] = PU(Y − f) + (1 − P)U ...

Econometrics uses economic theory, mathematics, and statistical inference to quantify economic phenomena. In other words, it turns theoretical economic models into useful tools for economic policymaking. The objective of econometrics is to convert qualitative statements (such as "the relationship between two or more variables is positive ...

Problem Set 7 Solutions (PDF) Problem Set 8 (PDF) Problem Set 8 Solutions (PDF) Problem Set 9 (PDF) Problem Set 9 Solutions (PDF) Problem Set 10 (PDF) Problem Set 10 Solutions (PDF) Instructor. This section contains the problem sets and solutions for the course.

Econometrics can be separated into two main categories: applied and theoretical. The main goal for an applied econometrician is to turn qualitative data into something quantitative. Applied econometrics refers to the idea of how economic data and theories are used to draw conclusions to improve decision-making and assist in solving economic issues.

Answer: - Other things being equal, over the sample period a 1% increase in the index of the real labor output resulted in about 0% increase in the index of real output. The t variable in the model represents time. Very often there is taken as a proxy for technical change. The coefficient of 0 suppose that over the sample

ECON 322 Group assignment 2 3. AI Usage: • At each step of the assignment, students must use AI large language models (such as ChatGPT) to enhance their research and analysis. They should take screenshots of the prompts they used and the AI's responses. 4. Format: • The assignment should be presented as a well-structured report or essay, following the appropriate academic format (e.g ...

The risks of investing in China are outweighing the benefits, according to the European Business in China Position Paper 2024/2025.. EU Chamber of Commerce in China President Jens Eskelund said China's status as the "undisputed leader" of FDI is slipping further away as he expressed "concern about there being a tipping point now".