- Privacy Policy

Home » Research Paper Conclusion – Writing Guide and Examples

Research Paper Conclusion – Writing Guide and Examples

Table of Contents

Research Paper Conclusion

Definition:

A research paper conclusion is the final section of a research paper that summarizes the key findings, significance, and implications of the research. It is the writer’s opportunity to synthesize the information presented in the paper, draw conclusions, and make recommendations for future research or actions.

The conclusion should provide a clear and concise summary of the research paper, reiterating the research question or problem, the main results, and the significance of the findings. It should also discuss the limitations of the study and suggest areas for further research.

Parts of Research Paper Conclusion

The parts of a research paper conclusion typically include:

Restatement of the Thesis

The conclusion should begin by restating the thesis statement from the introduction in a different way. This helps to remind the reader of the main argument or purpose of the research.

Summary of Key Findings

The conclusion should summarize the main findings of the research, highlighting the most important results and conclusions. This section should be brief and to the point.

Implications and Significance

In this section, the researcher should explain the implications and significance of the research findings. This may include discussing the potential impact on the field or industry, highlighting new insights or knowledge gained, or pointing out areas for future research.

Limitations and Recommendations

It is important to acknowledge any limitations or weaknesses of the research and to make recommendations for how these could be addressed in future studies. This shows that the researcher is aware of the potential limitations of their work and is committed to improving the quality of research in their field.

Concluding Statement

The conclusion should end with a strong concluding statement that leaves a lasting impression on the reader. This could be a call to action, a recommendation for further research, or a final thought on the topic.

How to Write Research Paper Conclusion

Here are some steps you can follow to write an effective research paper conclusion:

- Restate the research problem or question: Begin by restating the research problem or question that you aimed to answer in your research. This will remind the reader of the purpose of your study.

- Summarize the main points: Summarize the key findings and results of your research. This can be done by highlighting the most important aspects of your research and the evidence that supports them.

- Discuss the implications: Discuss the implications of your findings for the research area and any potential applications of your research. You should also mention any limitations of your research that may affect the interpretation of your findings.

- Provide a conclusion : Provide a concise conclusion that summarizes the main points of your paper and emphasizes the significance of your research. This should be a strong and clear statement that leaves a lasting impression on the reader.

- Offer suggestions for future research: Lastly, offer suggestions for future research that could build on your findings and contribute to further advancements in the field.

Remember that the conclusion should be brief and to the point, while still effectively summarizing the key findings and implications of your research.

Example of Research Paper Conclusion

Here’s an example of a research paper conclusion:

Conclusion :

In conclusion, our study aimed to investigate the relationship between social media use and mental health among college students. Our findings suggest that there is a significant association between social media use and increased levels of anxiety and depression among college students. This highlights the need for increased awareness and education about the potential negative effects of social media use on mental health, particularly among college students.

Despite the limitations of our study, such as the small sample size and self-reported data, our findings have important implications for future research and practice. Future studies should aim to replicate our findings in larger, more diverse samples, and investigate the potential mechanisms underlying the association between social media use and mental health. In addition, interventions should be developed to promote healthy social media use among college students, such as mindfulness-based approaches and social media detox programs.

Overall, our study contributes to the growing body of research on the impact of social media on mental health, and highlights the importance of addressing this issue in the context of higher education. By raising awareness and promoting healthy social media use among college students, we can help to reduce the negative impact of social media on mental health and improve the well-being of young adults.

Purpose of Research Paper Conclusion

The purpose of a research paper conclusion is to provide a summary and synthesis of the key findings, significance, and implications of the research presented in the paper. The conclusion serves as the final opportunity for the writer to convey their message and leave a lasting impression on the reader.

The conclusion should restate the research problem or question, summarize the main results of the research, and explain their significance. It should also acknowledge the limitations of the study and suggest areas for future research or action.

Overall, the purpose of the conclusion is to provide a sense of closure to the research paper and to emphasize the importance of the research and its potential impact. It should leave the reader with a clear understanding of the main findings and why they matter. The conclusion serves as the writer’s opportunity to showcase their contribution to the field and to inspire further research and action.

When to Write Research Paper Conclusion

The conclusion of a research paper should be written after the body of the paper has been completed. It should not be written until the writer has thoroughly analyzed and interpreted their findings and has written a complete and cohesive discussion of the research.

Before writing the conclusion, the writer should review their research paper and consider the key points that they want to convey to the reader. They should also review the research question, hypotheses, and methodology to ensure that they have addressed all of the necessary components of the research.

Once the writer has a clear understanding of the main findings and their significance, they can begin writing the conclusion. The conclusion should be written in a clear and concise manner, and should reiterate the main points of the research while also providing insights and recommendations for future research or action.

Characteristics of Research Paper Conclusion

The characteristics of a research paper conclusion include:

- Clear and concise: The conclusion should be written in a clear and concise manner, summarizing the key findings and their significance.

- Comprehensive: The conclusion should address all of the main points of the research paper, including the research question or problem, the methodology, the main results, and their implications.

- Future-oriented : The conclusion should provide insights and recommendations for future research or action, based on the findings of the research.

- Impressive : The conclusion should leave a lasting impression on the reader, emphasizing the importance of the research and its potential impact.

- Objective : The conclusion should be based on the evidence presented in the research paper, and should avoid personal biases or opinions.

- Unique : The conclusion should be unique to the research paper and should not simply repeat information from the introduction or body of the paper.

Advantages of Research Paper Conclusion

The advantages of a research paper conclusion include:

- Summarizing the key findings : The conclusion provides a summary of the main findings of the research, making it easier for the reader to understand the key points of the study.

- Emphasizing the significance of the research: The conclusion emphasizes the importance of the research and its potential impact, making it more likely that readers will take the research seriously and consider its implications.

- Providing recommendations for future research or action : The conclusion suggests practical recommendations for future research or action, based on the findings of the study.

- Providing closure to the research paper : The conclusion provides a sense of closure to the research paper, tying together the different sections of the paper and leaving a lasting impression on the reader.

- Demonstrating the writer’s contribution to the field : The conclusion provides the writer with an opportunity to showcase their contribution to the field and to inspire further research and action.

Limitations of Research Paper Conclusion

While the conclusion of a research paper has many advantages, it also has some limitations that should be considered, including:

- I nability to address all aspects of the research: Due to the limited space available in the conclusion, it may not be possible to address all aspects of the research in detail.

- Subjectivity : While the conclusion should be objective, it may be influenced by the writer’s personal biases or opinions.

- Lack of new information: The conclusion should not introduce new information that has not been discussed in the body of the research paper.

- Lack of generalizability: The conclusions drawn from the research may not be applicable to other contexts or populations, limiting the generalizability of the study.

- Misinterpretation by the reader: The reader may misinterpret the conclusions drawn from the research, leading to a misunderstanding of the findings.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Research Methods – Types, Examples and Guide

Limitations in Research – Types, Examples and...

Dissertation vs Thesis – Key Differences

Thesis – Structure, Example and Writing Guide

Data Verification – Process, Types and Examples

Research Paper Abstract – Writing Guide and...

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Research paper

Writing a Research Paper Conclusion | Step-by-Step Guide

Published on October 30, 2022 by Jack Caulfield . Revised on April 13, 2023.

- Restate the problem statement addressed in the paper

- Summarize your overall arguments or findings

- Suggest the key takeaways from your paper

The content of the conclusion varies depending on whether your paper presents the results of original empirical research or constructs an argument through engagement with sources .

Instantly correct all language mistakes in your text

Upload your document to correct all your mistakes in minutes

Table of contents

Step 1: restate the problem, step 2: sum up the paper, step 3: discuss the implications, research paper conclusion examples, frequently asked questions about research paper conclusions.

The first task of your conclusion is to remind the reader of your research problem . You will have discussed this problem in depth throughout the body, but now the point is to zoom back out from the details to the bigger picture.

While you are restating a problem you’ve already introduced, you should avoid phrasing it identically to how it appeared in the introduction . Ideally, you’ll find a novel way to circle back to the problem from the more detailed ideas discussed in the body.

For example, an argumentative paper advocating new measures to reduce the environmental impact of agriculture might restate its problem as follows:

Meanwhile, an empirical paper studying the relationship of Instagram use with body image issues might present its problem like this:

“In conclusion …”

Avoid starting your conclusion with phrases like “In conclusion” or “To conclude,” as this can come across as too obvious and make your writing seem unsophisticated. The content and placement of your conclusion should make its function clear without the need for additional signposting.

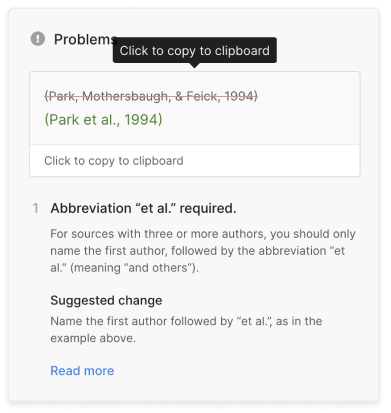

Scribbr Citation Checker New

The AI-powered Citation Checker helps you avoid common mistakes such as:

- Missing commas and periods

- Incorrect usage of “et al.”

- Ampersands (&) in narrative citations

- Missing reference entries

Having zoomed back in on the problem, it’s time to summarize how the body of the paper went about addressing it, and what conclusions this approach led to.

Depending on the nature of your research paper, this might mean restating your thesis and arguments, or summarizing your overall findings.

Argumentative paper: Restate your thesis and arguments

In an argumentative paper, you will have presented a thesis statement in your introduction, expressing the overall claim your paper argues for. In the conclusion, you should restate the thesis and show how it has been developed through the body of the paper.

Briefly summarize the key arguments made in the body, showing how each of them contributes to proving your thesis. You may also mention any counterarguments you addressed, emphasizing why your thesis holds up against them, particularly if your argument is a controversial one.

Don’t go into the details of your evidence or present new ideas; focus on outlining in broad strokes the argument you have made.

Empirical paper: Summarize your findings

In an empirical paper, this is the time to summarize your key findings. Don’t go into great detail here (you will have presented your in-depth results and discussion already), but do clearly express the answers to the research questions you investigated.

Describe your main findings, even if they weren’t necessarily the ones you expected or hoped for, and explain the overall conclusion they led you to.

Having summed up your key arguments or findings, the conclusion ends by considering the broader implications of your research. This means expressing the key takeaways, practical or theoretical, from your paper—often in the form of a call for action or suggestions for future research.

Argumentative paper: Strong closing statement

An argumentative paper generally ends with a strong closing statement. In the case of a practical argument, make a call for action: What actions do you think should be taken by the people or organizations concerned in response to your argument?

If your topic is more theoretical and unsuitable for a call for action, your closing statement should express the significance of your argument—for example, in proposing a new understanding of a topic or laying the groundwork for future research.

Empirical paper: Future research directions

In a more empirical paper, you can close by either making recommendations for practice (for example, in clinical or policy papers), or suggesting directions for future research.

Whatever the scope of your own research, there will always be room for further investigation of related topics, and you’ll often discover new questions and problems during the research process .

Finish your paper on a forward-looking note by suggesting how you or other researchers might build on this topic in the future and address any limitations of the current paper.

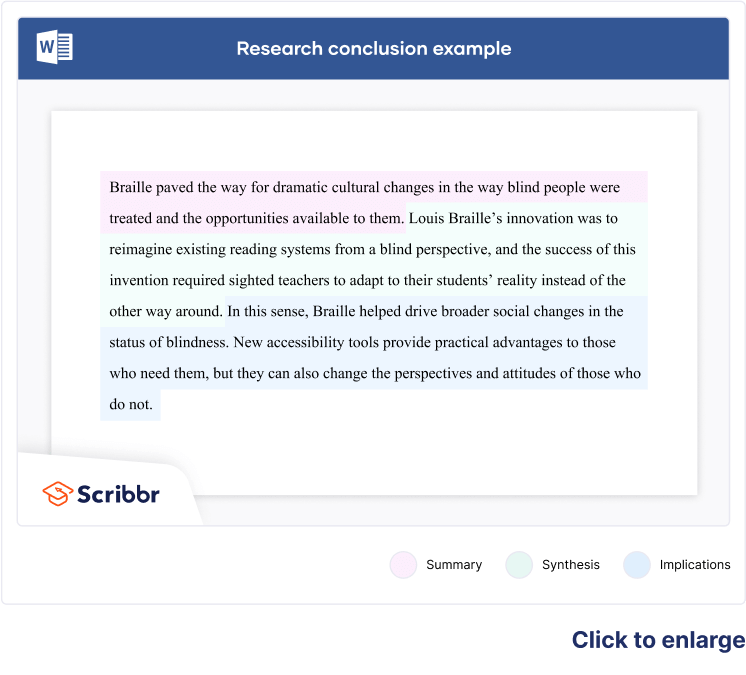

Full examples of research paper conclusions are shown in the tabs below: one for an argumentative paper, the other for an empirical paper.

- Argumentative paper

- Empirical paper

While the role of cattle in climate change is by now common knowledge, countries like the Netherlands continually fail to confront this issue with the urgency it deserves. The evidence is clear: To create a truly futureproof agricultural sector, Dutch farmers must be incentivized to transition from livestock farming to sustainable vegetable farming. As well as dramatically lowering emissions, plant-based agriculture, if approached in the right way, can produce more food with less land, providing opportunities for nature regeneration areas that will themselves contribute to climate targets. Although this approach would have economic ramifications, from a long-term perspective, it would represent a significant step towards a more sustainable and resilient national economy. Transitioning to sustainable vegetable farming will make the Netherlands greener and healthier, setting an example for other European governments. Farmers, policymakers, and consumers must focus on the future, not just on their own short-term interests, and work to implement this transition now.

As social media becomes increasingly central to young people’s everyday lives, it is important to understand how different platforms affect their developing self-conception. By testing the effect of daily Instagram use among teenage girls, this study established that highly visual social media does indeed have a significant effect on body image concerns, with a strong correlation between the amount of time spent on the platform and participants’ self-reported dissatisfaction with their appearance. However, the strength of this effect was moderated by pre-test self-esteem ratings: Participants with higher self-esteem were less likely to experience an increase in body image concerns after using Instagram. This suggests that, while Instagram does impact body image, it is also important to consider the wider social and psychological context in which this usage occurs: Teenagers who are already predisposed to self-esteem issues may be at greater risk of experiencing negative effects. Future research into Instagram and other highly visual social media should focus on establishing a clearer picture of how self-esteem and related constructs influence young people’s experiences of these platforms. Furthermore, while this experiment measured Instagram usage in terms of time spent on the platform, observational studies are required to gain more insight into different patterns of usage—to investigate, for instance, whether active posting is associated with different effects than passive consumption of social media content.

If you’re unsure about the conclusion, it can be helpful to ask a friend or fellow student to read your conclusion and summarize the main takeaways.

- Do they understand from your conclusion what your research was about?

- Are they able to summarize the implications of your findings?

- Can they answer your research question based on your conclusion?

You can also get an expert to proofread and feedback your paper with a paper editing service .

Here's why students love Scribbr's proofreading services

Discover proofreading & editing

The conclusion of a research paper has several key elements you should make sure to include:

- A restatement of the research problem

- A summary of your key arguments and/or findings

- A short discussion of the implications of your research

No, it’s not appropriate to present new arguments or evidence in the conclusion . While you might be tempted to save a striking argument for last, research papers follow a more formal structure than this.

All your findings and arguments should be presented in the body of the text (more specifically in the results and discussion sections if you are following a scientific structure). The conclusion is meant to summarize and reflect on the evidence and arguments you have already presented, not introduce new ones.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Caulfield, J. (2023, April 13). Writing a Research Paper Conclusion | Step-by-Step Guide. Scribbr. Retrieved July 30, 2024, from https://www.scribbr.com/research-paper/research-paper-conclusion/

Is this article helpful?

Jack Caulfield

Other students also liked, writing a research paper introduction | step-by-step guide, how to create a structured research paper outline | example, checklist: writing a great research paper, what is your plagiarism score.

How to write a strong conclusion for your research paper

Last updated

17 February 2024

Reviewed by

Short on time? Get an AI generated summary of this article instead

Writing a research paper is a chance to share your knowledge and hypothesis. It's an opportunity to demonstrate your many hours of research and prove your ability to write convincingly.

Ideally, by the end of your research paper, you'll have brought your readers on a journey to reach the conclusions you've pre-determined. However, if you don't stick the landing with a good conclusion, you'll risk losing your reader’s trust.

Writing a strong conclusion for your research paper involves a few important steps, including restating the thesis and summing up everything properly.

Find out what to include and what to avoid, so you can effectively demonstrate your understanding of the topic and prove your expertise.

- Why is a good conclusion important?

A good conclusion can cement your paper in the reader’s mind. Making a strong impression in your introduction can draw your readers in, but it's the conclusion that will inspire them.

- What to include in a research paper conclusion

There are a few specifics you should include in your research paper conclusion. Offer your readers some sense of urgency or consequence by pointing out why they should care about the topic you have covered. Discuss any common problems associated with your topic and provide suggestions as to how these problems can be solved or addressed.

The conclusion should include a restatement of your initial thesis. Thesis statements are strengthened after you’ve presented supporting evidence (as you will have done in the paper), so make a point to reintroduce it at the end.

Finally, recap the main points of your research paper, highlighting the key takeaways you want readers to remember. If you've made multiple points throughout the paper, refer to the ones with the strongest supporting evidence.

- Steps for writing a research paper conclusion

Many writers find the conclusion the most challenging part of any research project . By following these three steps, you'll be prepared to write a conclusion that is effective and concise.

- Step 1: Restate the problem

Always begin by restating the research problem in the conclusion of a research paper. This serves to remind the reader of your hypothesis and refresh them on the main point of the paper.

When restating the problem, take care to avoid using exactly the same words you employed earlier in the paper.

- Step 2: Sum up the paper

After you've restated the problem, sum up the paper by revealing your overall findings. The method for this differs slightly, depending on whether you're crafting an argumentative paper or an empirical paper.

Argumentative paper: Restate your thesis and arguments

Argumentative papers involve introducing a thesis statement early on. In crafting the conclusion for an argumentative paper, always restate the thesis, outlining the way you've developed it throughout the entire paper.

It might be appropriate to mention any counterarguments in the conclusion, so you can demonstrate how your thesis is correct or how the data best supports your main points.

Empirical paper: Summarize research findings

Empirical papers break down a series of research questions. In your conclusion, discuss the findings your research revealed, including any information that surprised you.

Be clear about the conclusions you reached, and explain whether or not you expected to arrive at these particular ones.

- Step 3: Discuss the implications of your research

Argumentative papers and empirical papers also differ in this part of a research paper conclusion. Here are some tips on crafting conclusions for argumentative and empirical papers.

Argumentative paper: Powerful closing statement

In an argumentative paper, you'll have spent a great deal of time expressing the opinions you formed after doing a significant amount of research. Make a strong closing statement in your argumentative paper's conclusion to share the significance of your work.

You can outline the next steps through a bold call to action, or restate how powerful your ideas turned out to be.

Empirical paper: Directions for future research

Empirical papers are broader in scope. They usually cover a variety of aspects and can include several points of view.

To write a good conclusion for an empirical paper, suggest the type of research that could be done in the future, including methods for further investigation or outlining ways other researchers might proceed.

If you feel your research had any limitations, even if they were outside your control, you could mention these in your conclusion.

After you finish outlining your conclusion, ask someone to read it and offer feedback. In any research project you're especially close to, it can be hard to identify problem areas. Having a close friend or someone whose opinion you value read the research paper and provide honest feedback can be invaluable. Take note of any suggested edits and consider incorporating them into your paper if they make sense.

- Things to avoid in a research paper conclusion

Keep these aspects to avoid in mind as you're writing your conclusion and refer to them after you've created an outline.

Dry summary

Writing a memorable, succinct conclusion is arguably more important than a strong introduction. Take care to avoid just rephrasing your main points, and don't fall into the trap of repeating dry facts or citations.

You can provide a new perspective for your readers to think about or contextualize your research. Either way, make the conclusion vibrant and interesting, rather than a rote recitation of your research paper’s highlights.

Clichéd or generic phrasing

Your research paper conclusion should feel fresh and inspiring. Avoid generic phrases like "to sum up" or "in conclusion." These phrases tend to be overused, especially in an academic context and might turn your readers off.

The conclusion also isn't the time to introduce colloquial phrases or informal language. Retain a professional, confident tone consistent throughout your paper’s conclusion so it feels exciting and bold.

New data or evidence

While you should present strong data throughout your paper, the conclusion isn't the place to introduce new evidence. This is because readers are engaged in actively learning as they read through the body of your paper.

By the time they reach the conclusion, they will have formed an opinion one way or the other (hopefully in your favor!). Introducing new evidence in the conclusion will only serve to surprise or frustrate your reader.

Ignoring contradictory evidence

If your research reveals contradictory evidence, don't ignore it in the conclusion. This will damage your credibility as an expert and might even serve to highlight the contradictions.

Be as transparent as possible and admit to any shortcomings in your research, but don't dwell on them for too long.

Ambiguous or unclear resolutions

The point of a research paper conclusion is to provide closure and bring all your ideas together. You should wrap up any arguments you introduced in the paper and tie up any loose ends, while demonstrating why your research and data are strong.

Use direct language in your conclusion and avoid ambiguity. Even if some of the data and sources you cite are inconclusive or contradictory, note this in your conclusion to come across as confident and trustworthy.

- Examples of research paper conclusions

Your research paper should provide a compelling close to the paper as a whole, highlighting your research and hard work. While the conclusion should represent your unique style, these examples offer a starting point:

Ultimately, the data we examined all point to the same conclusion: Encouraging a good work-life balance improves employee productivity and benefits the company overall. The research suggests that when employees feel their personal lives are valued and respected by their employers, they are more likely to be productive when at work. In addition, company turnover tends to be reduced when employees have a balance between their personal and professional lives. While additional research is required to establish ways companies can support employees in creating a stronger work-life balance, it's clear the need is there.

Social media is a primary method of communication among young people. As we've seen in the data presented, most young people in high school use a variety of social media applications at least every hour, including Instagram and Facebook. While social media is an avenue for connection with peers, research increasingly suggests that social media use correlates with body image issues. Young girls with lower self-esteem tend to use social media more often than those who don't log onto social media apps every day. As new applications continue to gain popularity, and as more high school students are given smartphones, more research will be required to measure the effects of prolonged social media use.

What are the different kinds of research paper conclusions?

There are no formal types of research paper conclusions. Ultimately, the conclusion depends on the outline of your paper and the type of research you’re presenting. While some experts note that research papers can end with a new perspective or commentary, most papers should conclude with a combination of both. The most important aspect of a good research paper conclusion is that it accurately represents the body of the paper.

Can I present new arguments in my research paper conclusion?

Research paper conclusions are not the place to introduce new data or arguments. The body of your paper is where you should share research and insights, where the reader is actively absorbing the content. By the time a reader reaches the conclusion of the research paper, they should have formed their opinion. Introducing new arguments in the conclusion can take a reader by surprise, and not in a positive way. It might also serve to frustrate readers.

How long should a research paper conclusion be?

There's no set length for a research paper conclusion. However, it's a good idea not to run on too long, since conclusions are supposed to be succinct. A good rule of thumb is to keep your conclusion around 5 to 10 percent of the paper's total length. If your paper is 10 pages, try to keep your conclusion under one page.

What should I include in a research paper conclusion?

A good research paper conclusion should always include a sense of urgency, so the reader can see how and why the topic should matter to them. You can also note some recommended actions to help fix the problem and some obstacles they might encounter. A conclusion should also remind the reader of the thesis statement, along with the main points you covered in the paper. At the end of the conclusion, add a powerful closing statement that helps cement the paper in the mind of the reader.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 18 April 2023

Last updated: 27 February 2023

Last updated: 6 February 2023

Last updated: 6 October 2023

Last updated: 5 February 2023

Last updated: 16 April 2023

Last updated: 9 March 2023

Last updated: 12 December 2023

Last updated: 11 March 2024

Last updated: 4 July 2024

Last updated: 6 March 2024

Last updated: 5 March 2024

Last updated: 13 May 2024

Latest articles

Related topics, .css-je19u9{-webkit-align-items:flex-end;-webkit-box-align:flex-end;-ms-flex-align:flex-end;align-items:flex-end;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-flex-direction:row;-ms-flex-direction:row;flex-direction:row;-webkit-box-flex-wrap:wrap;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;row-gap:0;text-align:center;max-width:671px;}@media (max-width: 1079px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}}@media (max-width: 799px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}} decide what to .css-1kiodld{max-height:56px;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;}@media (max-width: 1079px){.css-1kiodld{display:none;}} build next, decide what to build next.

Users report unexpectedly high data usage, especially during streaming sessions.

Users find it hard to navigate from the home page to relevant playlists in the app.

It would be great to have a sleep timer feature, especially for bedtime listening.

I need better filters to find the songs or artists I’m looking for.

Log in or sign up

Get started for free

- How to Cite

- Language & Lit

- Rhyme & Rhythm

- The Rewrite

- Search Glass

How to Write a Conclusion on a Marketing Research Paper

Writing a marketing research paper is a challenging undertaking that requires a great deal of time and preparation. Writing the conclusion to a marketing research paper is relatively straightforward because you've already done all the hard work. A good conclusion summarizes the main argument of your paper and points to the strengths and limitations of your research. A successful conclusion answers the "so what?" question and paves the road for future studies pertaining to your topic. With a nudge in the right direction, you'll write a conclusion that will bring your paper to an effective close.

Summarize the main argument of your paper without repeating too much. Point out why the argument is significant to the research and issue at hand to bring them to a concluding point.

Explain the strengths and limitations of your research and arguments to suggest what future work is required.

Explain the importance of your work and the significance it has to the real world. Answer the question: "How are my arguments and research useful?"

Demonstrate how all the ideas and research you put forth in the paper work together without having to present new information.

Echo the introduction without repeating it word for word to tie the paper together neatly. Explain how the insights and information found in the body of the paper reinforce the ideas suggested by the thesis in the introduction.

End the conclusion with something you want your readers to think about by issuing a challenge to your readers pertaining to how the information presented in the paper can influence their lives.

- Do not present new information in your conclusion; instead, structure your conclusion to reinforce and validate the arguments and research already presented.

- Don't write more than one concluding paragraph. Exercise brevity by writing to the point without exaggerating the content of your paper.

- LEO: Strategies for Writing a Conclusion; Randa Holewa et. al.; February 2004

- ACC: Tips for Writing a Strong Conclusion; Barry Hamilton; October 2005

Based in Victoria, British Columbia, Sebastian Malysa began his writing career in 2010. His work focuses on the general arts and appears on Answerbag and eHow. He has won a number of academic awards, most notably the CTV Award for best proposed documentary film. He holds a Master of Arts in contemporary disability theater from the University of Victoria.

- Link to facebook

- Link to linkedin

- Link to twitter

- Link to youtube

- Writing Tips

How to Write a Conclusion for a Research Paper

- 3-minute read

- 29th August 2023

If you’re writing a research paper, the conclusion is your opportunity to summarize your findings and leave a lasting impression on your readers. In this post, we’ll take you through how to write an effective conclusion for a research paper and how you can:

· Reword your thesis statement

· Highlight the significance of your research

· Discuss limitations

· Connect to the introduction

· End with a thought-provoking statement

Rewording Your Thesis Statement

Begin your conclusion by restating your thesis statement in a way that is slightly different from the wording used in the introduction. Avoid presenting new information or evidence in your conclusion. Just summarize the main points and arguments of your essay and keep this part as concise as possible. Remember that you’ve already covered the in-depth analyses and investigations in the main body paragraphs of your essay, so it’s not necessary to restate these details in the conclusion.

Find this useful?

Subscribe to our newsletter and get writing tips from our editors straight to your inbox.

Highlighting the Significance of Your Research

The conclusion is a good place to emphasize the implications of your research . Avoid ambiguous or vague language such as “I think” or “maybe,” which could weaken your position. Clearly explain why your research is significant and how it contributes to the broader field of study.

Here’s an example from a (fictional) study on the impact of social media on mental health:

Discussing Limitations

Although it’s important to emphasize the significance of your study, you can also use the conclusion to briefly address any limitations you discovered while conducting your research, such as time constraints or a shortage of resources. Doing this demonstrates a balanced and honest approach to your research.

Connecting to the Introduction

In your conclusion, you can circle back to your introduction , perhaps by referring to a quote or anecdote you discussed earlier. If you end your paper on a similar note to how you began it, you will create a sense of cohesion for the reader and remind them of the meaning and significance of your research.

Ending With a Thought-Provoking Statement

Consider ending your paper with a thought-provoking and memorable statement that relates to the impact of your research questions or hypothesis. This statement can be a call to action, a philosophical question, or a prediction for the future (positive or negative). Here’s an example that uses the same topic as above (social media and mental health):

Expert Proofreading Services

Ensure that your essay ends on a high note by having our experts proofread your research paper. Our team has experience with a wide variety of academic fields and subjects and can help make your paper stand out from the crowd – get started today and see the difference it can make in your work.

Share this article:

Post A New Comment

Got content that needs a quick turnaround? Let us polish your work. Explore our editorial business services.

6-minute read

How to Write a Nonprofit Grant Proposal

If you’re seeking funding to support your charitable endeavors as a nonprofit organization, you’ll need...

9-minute read

How to Use Infographics to Boost Your Presentation

Is your content getting noticed? Capturing and maintaining an audience’s attention is a challenge when...

8-minute read

Why Interactive PDFs Are Better for Engagement

Are you looking to enhance engagement and captivate your audience through your professional documents? Interactive...

7-minute read

Seven Key Strategies for Voice Search Optimization

Voice search optimization is rapidly shaping the digital landscape, requiring content professionals to adapt their...

4-minute read

Five Creative Ways to Showcase Your Digital Portfolio

Are you a creative freelancer looking to make a lasting impression on potential clients or...

How to Ace Slack Messaging for Contractors and Freelancers

Effective professional communication is an important skill for contractors and freelancers navigating remote work environments....

Make sure your writing is the best it can be with our expert English proofreading and editing.

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

9 Key stages in your marketing research process

You can conduct your own marketing research. Follow these steps, add your own flair, knowledge and creativity, and you’ll have bespoke research to be proud of.

Marketing research is the term used to cover the concept, development, placement and evolution of your product or service, its growing customer base and its branding – starting with brand awareness , and progressing to (everyone hopes) brand equity . Like any research, it needs a robust process to be credible and useful.

Marketing research uses four essential key factors known as the ‘marketing mix’ , or the Four Ps of Marketing :

- Product (goods or service)

- Price ( how much the customer pays )

- Place (where the product is marketed)

- Promotion (such as advertising and PR)

These four factors need to work in harmony for a product or service to be successful in its marketplace.

The marketing research process – an overview

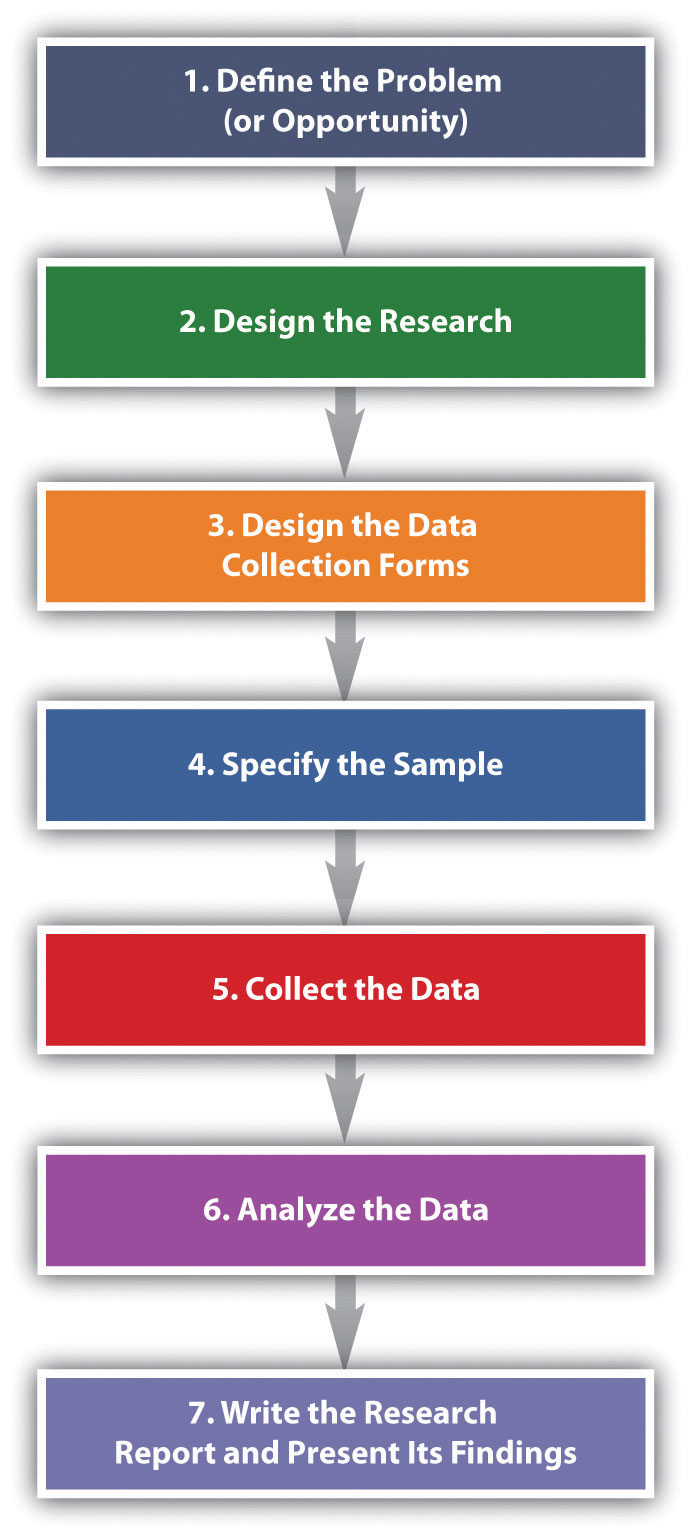

A typical marketing research process is as follows:

- Identify an issue, discuss alternatives and set out research objectives

- Develop a research program

- Choose a sample

- Gather information

- Gather data

- Organize and analyze information and data

- Present findings

- Make research-based decisions

- Take action based on insights

Step 1: Defining the marketing research problem

Defining a problem is the first step in the research process. In many ways, research starts with a problem facing management. This problem needs to be understood, the cause diagnosed, and solutions developed.

However, most management problems are not always easy to research, so they must first be translated into research problems. Once you approach the problem from a research angle, you can find a solution. For example, “sales are not growing” is a management problem, but translated into a research problem, it becomes “ why are sales not growing?” We can look at the expectations and experiences of several groups : potential customers, first-time buyers, and repeat purchasers. We can question whether the lack of sales is due to:

- Poor expectations that lead to a general lack of desire to buy, or

- Poor performance experience and a lack of desire to repurchase.

This, then, is the difference between a management problem and a research problem. Solving management problems focuses on actions: Do we advertise more? Do we change our advertising message? Do we change an under-performing product configuration? And if so, how?

Defining research problems, on the other hand, focus on the whys and hows, providing the insights you need to solve your management problem.

Step 2: Developing a research program: method of inquiry

The scientific method is the standard for investigation. It provides an opportunity for you to use existing knowledge as a starting point, and proceed impartially.

The scientific method includes the following steps:

- Define a problem

- Develop a hypothesis

- Make predictions based on the hypothesis

- Devise a test of the hypothesis

- Conduct the test

- Analyze the results

This terminology is similar to the stages in the research process. However, there are subtle differences in the way the steps are performed:

- the scientific research method is objective and fact-based, using quantitative research and impartial analysis

- the marketing research process can be subjective, using opinion and qualitative research, as well as personal judgment as you collect and analyze data

Step 3: Developing a research program: research method

As well as selecting a method of inquiry (objective or subjective), you must select a research method . There are two primary methodologies that can be used to answer any research question:

- Experimental research : gives you the advantage of controlling extraneous variables and manipulating one or more variables that influence the process being implemented.

- Non-experimental research : allows observation but not intervention – all you do is observe and report on your findings.

Step 4: Developing a research program: research design

Research design is a plan or framework for conducting marketing research and collecting data. It is defined as the specific methods and procedures you use to get the information you need.

There are three core types of marketing research designs: exploratory, descriptive, and causal . A thorough marketing research process incorporates elements of all of them.

Exploratory marketing research

This is a starting point for research. It’s used to reveal facts and opinions about a particular topic, and gain insight into the main points of an issue. Exploratory research is too much of a blunt instrument to base conclusive business decisions on, but it gives the foundation for more targeted study. You can use secondary research materials such as trade publications, books, journals and magazines and primary research using qualitative metrics, that can include open text surveys, interviews and focus groups.

Descriptive marketing research

This helps define the business problem or issue so that companies can make decisions, take action and monitor progress. Descriptive research is naturally quantitative – it needs to be measured and analyzed statistically , using more targeted surveys and questionnaires. You can use it to capture demographic information , evaluate a product or service for market, and monitor a target audience’s opinion and behaviors. Insights from descriptive research can inform conclusions about the market landscape and the product’s place in it.

Causal marketing research

This is useful to explore the cause and effect relationship between two or more variables. Like descriptive research , it uses quantitative methods, but it doesn’t merely report findings; it uses experiments to predict and test theories about a product or market. For example, researchers may change product packaging design or material, and measure what happens to sales as a result.

Step 5: Choose your sample

Your marketing research project will rarely examine an entire population. It’s more practical to use a sample - a smaller but accurate representation of the greater population. To design your sample, you’ll need to answer these questions:

- Which base population is the sample to be selected from? Once you’ve established who your relevant population is (your research design process will have revealed this), you have a base for your sample. This will allow you to make inferences about a larger population.

- What is the method (process) for sample selection? There are two methods of selecting a sample from a population:

1. Probability sampling : This relies on a random sampling of everyone within the larger population.

2. Non-probability sampling : This is based in part on the investigator’s judgment, and often uses convenience samples, or by other sampling methods that do not rely on probability.

- What is your sample size? This important step involves cost and accuracy decisions. Larger samples generally reduce sampling error and increase accuracy, but also increase costs. Find out your perfect sample size with our calculator .

Step 6: Gather data

Your research design will develop as you select techniques to use. There are many channels for collecting data, and it’s helpful to differentiate it into O-data (Operational) and X-data (Experience):

- O-data is your business’s hard numbers like costs, accounting, and sales. It tells you what has happened, but not why.

- X-data gives you insights into the thoughts and emotions of the people involved: employees, customers, brand advocates.

When you combine O-data with X-data, you’ll be able to build a more complete picture about success and failure - you’ll know why. Maybe you’ve seen a drop in sales (O-data) for a particular product. Maybe customer service was lacking, the product was out of stock, or advertisements weren’t impactful or different enough: X-data will reveal the reason why those sales dropped. So, while differentiating these two data sets is important, when they are combined, and work with each other, the insights become powerful.

With mobile technology, it has become easier than ever to collect data. Survey research has come a long way since market researchers conducted face-to-face, postal, or telephone surveys. You can run research through:

- Social media ( polls and listening )

Another way to collect data is by observation. Observing a customer’s or company’s past or present behavior can predict future purchasing decisions. Data collection techniques for predicting past behavior can include market segmentation , customer journey mapping and brand tracking .

Regardless of how you collect data, the process introduces another essential element to your research project: the importance of clear and constant communication .

And of course, to analyze information from survey or observation techniques, you must record your results . Gone are the days of spreadsheets. Feedback from surveys and listening channels can automatically feed into AI-powered analytics engines and produce results, in real-time, on dashboards.

Step 7: Analysis and interpretation

The words ‘ statistical analysis methods ’ aren’t usually guaranteed to set a room alight with excitement, but when you understand what they can do, the problems they can solve and the insights they can uncover, they seem a whole lot more compelling.

Statistical tests and data processing tools can reveal:

- Whether data trends you see are meaningful or are just chance results

- Your results in the context of other information you have

- Whether one thing affecting your business is more significant than others

- What your next research area should be

- Insights that lead to meaningful changes

There are several types of statistical analysis tools used for surveys. You should make sure that the ones you choose:

- Work on any platform - mobile, desktop, tablet etc.

- Integrate with your existing systems

- Are easy to use with user-friendly interfaces, straightforward menus, and automated data analysis

- Incorporate statistical analysis so you don’t just process and present your data, but refine it, and generate insights and predictions.

Here are some of the most common tools:

- Benchmarking : a way of taking outside factors into account so that you can adjust the parameters of your research. It ‘levels the playing field’ – so that your data and results are more meaningful in context. And gives you a more precise understanding of what’s happening.

- Regression analysis : this is used for working out the relationship between two (or more) variables. It is useful for identifying the precise impact of a change in an independent variable.

- T-test is used for comparing two data groups which have different mean values. For example, do women and men have different mean heights?

- Analysis of variance (ANOVA) Similar to the T-test, ANOVA is a way of testing the differences between three or more independent groups to see if they’re statistically significant.

- Cluster analysis : This organizes items into groups, or clusters, based on how closely associated they are.

- Factor analysis: This is a way of condensing many variables into just a few, so that your research data is less unwieldy to work with.

- Conjoint analysis : this will help you understand and predict why people make the choices they do. It asks people to make trade-offs when making decisions, just as they do in the real world, then analyzes the results to give the most popular outcome.

- Crosstab analysis : this is a quantitative market research tool used to analyze ‘categorical data’ - variables that are different and mutually exclusive, such as: ‘men’ and ‘women’, or ‘under 30’ and ‘over 30’.

- Text analysis and sentiment analysis : Analyzing human language and emotions is a rapidly-developing form of data processing, assigning positive, negative or neutral sentiment to customer messages and feedback.

Stats IQ can perform the most complicated statistical tests at the touch of a button using our online survey software , or data from other sources. Learn more about Stats iQ now .

Step 8: The marketing research results

Your marketing research process culminates in the research results. These should provide all the information the stakeholders and decision-makers need to understand the project.

The results will include:

- all your information

- a description of your research process

- the results

- conclusions

- recommended courses of action

They should also be presented in a form, language and graphics that are easy to understand, with a balance between completeness and conciseness, neither leaving important information out or allowing it to get so technical that it overwhelms the readers.

Traditionally, you would prepare two written reports:

- a technical report , discussing the methods, underlying assumptions and the detailed findings of the research project

- a summary report , that summarizes the research process and presents the findings and conclusions simply.

There are now more engaging ways to present your findings than the traditional PowerPoint presentations, graphs, and face-to-face reports:

- Live, interactive dashboards for sharing the most important information, as well as tracking a project in real time.

- Results-reports visualizations – tables or graphs with data visuals on a shareable slide deck

- Online presentation technology, such as Prezi

- Visual storytelling with infographics

- A single-page executive summary with key insights

- A single-page stat sheet with the top-line stats

You can also make these results shareable so that decision-makers have all the information at their fingertips.

Step 9 Turn your insights into action

Insights are one thing, but they’re worth very little unless they inform immediate, positive action. Here are a few examples of how you can do this:

- Stop customers leaving – negative sentiment among VIP customers gets picked up; the customer service team contacts the customers, resolves their issues, and avoids churn .

- Act on important employee concerns – you can set certain topics, such as safety, or diversity and inclusion to trigger an automated notification or Slack message to HR. They can rapidly act to rectify the issue.

- Address product issues – maybe deliveries are late, maybe too many products are faulty. When product feedback gets picked up through Smart Conversations, messages can be triggered to the delivery or product teams to jump on the problems immediately.

- Improve your marketing effectiveness - Understand how your marketing is being received by potential customers, so you can find ways to better meet their needs

- Grow your brand - Understand exactly what consumers are looking for, so you can make sure that you’re meeting their expectations

Download now: 8 Innovations to Modernize Market Research

Scott Smith

Scott Smith, Ph.D. is a contributor to the Qualtrics blog.

Related Articles

May 20, 2024

Best strategy & research books to read in 2024

May 13, 2024

Experience Management

X4 2024 Strategy & Research Showcase: Introducing the future of insights generation

November 7, 2023

Brand Experience

The 4 market research trends redefining insights in 2024

June 27, 2023

The fresh insights people: Scaling research at Woolworths Group

June 20, 2023

Bank less, delight more: How Bankwest built an engine room for customer obsession

April 1, 2023

Academic Experience

How to write great survey questions (with examples)

March 21, 2023

Sample size calculator

November 18, 2022

Statistical analysis software: your complete guide to getting started

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

- Become an Expert

How to Do Market Research: A Definitive Guide

Article Snapshot

Section 1: introduction to market research.

Before we dive into the intricacies of market research, let's first establish a solid understanding of what it entails. Market research is the systematic process of collecting, analyzing, and interpreting data about a target market or industry. It involves gathering information about potential customers, their needs and preferences, as well as assessing the overall market landscape and identifying opportunities for growth.

Market research plays a vital role in shaping business strategies and decision-making processes. It helps businesses identify market trends, evaluate product or service viability, understand customer behavior, and develop effective marketing campaigns. By leveraging market research, companies can minimize risks, optimize resources, and increase their chances of success.

Section 2: Preparing for Market Research

Before embarking on any market research endeavor, it is crucial to establish clear objectives and determine the appropriate research methodology. In this section, we will guide you through the essential steps of preparing for market research.

Defining Research Objectives

The first step in any market research project is to define clear research objectives. These objectives should align with your business goals and provide a framework for your research efforts. Whether you aim to understand customer satisfaction, evaluate market potential for a new product, or analyze competitor strategies, defining specific and measurable objectives is essential to ensure the research is focused and effective.

Choosing the Right Research Methodology

Once you have defined your research objectives, the next step is to select the most appropriate research methodology. There are various methodologies available, each with its strengths and limitations. Qualitative research methods, such as interviews and focus groups, allow for in-depth exploration of customer opinions and perceptions. On the other hand, quantitative research methods, like surveys and data analysis, provide statistical insights and numerical data.

Creating a Research Plan

To ensure the success of your market research endeavor, it is essential to develop a comprehensive research plan. A research plan outlines the steps, timeline, budget, and resources required for your market research project. By creating a well-structured plan, you can effectively manage your research activities, allocate resources efficiently, and stay on track to achieve your research objectives.

Section 3: Conducting Primary Market Research

Primary market research involves collecting firsthand data directly from your target audience. This section will explore various primary research methods and provide insights into how to conduct effective primary market research.

Survey Research

Surveys are a popular and effective method for gathering primary research data. They allow businesses to collect a large volume of data from a diverse audience. Designing effective survey questions, selecting appropriate survey administration methods, and maximizing response rates are crucial elements to consider when conducting survey research.

Interviews and Focus Groups

Interviews and focus groups offer a more in-depth understanding of customer opinions and behaviors. By engaging directly with participants, businesses can explore complex topics and gain valuable insights. This section will cover techniques for conducting successful interviews and focus groups, as well as analyzing and interpreting the qualitative data obtained.

Observational Research

Observational research involves observing and analyzing consumer behavior in real-life situations. This method provides rich insights into consumer interactions, preferences, and decision-making processes. We will discuss different types of observational research and address ethical considerations associated with this methodology.

Section 4: Gathering and Analyzing Secondary Market Research

Secondary market research involves gathering existing data and information from various sources. This section will explore reliable sources for secondary research data, data collection methods, and techniques for analyzing and interpreting secondary research findings.

Sources of Secondary Research Data

Identifying reputable sources for secondary market research data is crucial for obtaining accurate and reliable information. We will explore a wide range of sources, including market research firms, industry reports, government publications, and online databases.

Data Collection and Analysis

Once you have gathered the secondary research data, the next step is to organize and analyze it effectively. This section will provide insights into various data collection methods and techniques for analyzing and interpreting secondary research findings. We will also discuss the utilization of data visualization tools to present data in a visually appealing and informative manner.

Section 5: Utilizing Market Research Findings

Market research findings hold immense value only when they are effectively utilized to drive business growth. In this section, we will explore how to interpret and apply research findings, communicate results, and continually monitor and evaluate market research efforts.

Interpreting and Applying Research Findings

Interpreting research findings accurately is vital to extract actionable insights. We will discuss techniques and strategies for interpreting research findings and applying them to make informed business decisions. Real-world case studies will be presented to illustrate the practical application of market research findings.

Communicating Research Results

Effectively communicating research results is essential for ensuring that the insights gained are understood and utilized by key stakeholders. This section will provide tips for creating visually appealing and informative research reports and delivering impactful presentations to stakeholders and decision-makers.

Monitoring and Evaluating Market Research

Market research is an ongoing process, and continuous monitoring and evaluation are crucial to stay abreast of market trends and changes. We will explore strategies for tracking market dynamics, monitoring the effectiveness of research efforts, and adjusting research strategies based on feedback and evolving market conditions.

Understanding the Importance of Market Research

Market research is an indispensable component of any successful business strategy. It provides crucial insights into customer behavior, market trends, and competitor analysis, enabling businesses to make informed decisions and gain a competitive edge. In this section, we will explore the significance of market research and its role in driving business success.

The Value of Market Research

Market research serves as a guiding light for businesses, helping them navigate the complex landscape of consumer demands and market dynamics. By conducting thorough research, businesses can gain a deep understanding of their target audience, identify unmet needs, and develop products or services that truly resonate with their customers.

One of the primary benefits of market research is its ability to minimize risk. By gathering data and insights before launching a new product or expanding into a new market, businesses can assess market potential, evaluate customer preferences, and anticipate potential challenges. This proactive approach reduces the likelihood of costly mistakes and increases the chances of success.

Moreover, market research plays a vital role in identifying and capitalizing on market opportunities. By staying attuned to market trends, businesses can spot emerging consumer needs, industry shifts, and technological advancements. Armed with this knowledge, they can adapt their strategies, develop innovative solutions, and stay ahead of the competition.

Market research also provides a solid foundation for effective marketing campaigns. By understanding the target audience's preferences, motivations, and pain points, businesses can tailor their messaging, positioning, and communication channels to effectively reach and engage their customers. This targeted approach not only increases customer acquisition but also enhances customer loyalty and brand advocacy.

The Risks of Neglecting Market Research

Failing to conduct market research can have dire consequences for businesses. Without a deep understanding of their target audience, businesses risk developing products or services that do not meet customer needs or preferences. This can lead to low customer satisfaction, decreased sales, and ultimately, business failure.

Additionally, neglecting market research can result in missed opportunities. In a rapidly evolving marketplace, failing to track consumer trends, competitor strategies, and industry shifts can leave businesses lagging behind. By the time they realize the need for change, it may be too late to catch up, leading to lost market share and diminished competitiveness.

Furthermore, without market research, businesses may struggle to effectively allocate their resources. They may invest in marketing campaigns that do not resonate with their target audience or allocate resources to markets with limited potential. This misalignment of resources can drain finances and hinder overall business growth.

The Role of Market Research in Decision-Making

Market research serves as a compass for decision-making, guiding businesses in making strategic choices based on data-driven insights. Whether it is launching a new product, entering a new market, or adjusting pricing strategies, market research provides the necessary information to make informed decisions.

By conducting market research, businesses can gain a comprehensive understanding of their target audience's preferences, needs, and behaviors. This knowledge allows them to develop products or services that align with customer expectations, resulting in higher customer satisfaction and increased sales.

Market research also empowers businesses to assess the competitive landscape. By studying competitors' strengths, weaknesses, and market positioning, businesses can identify gaps and opportunities for differentiation. This knowledge enables them to develop unique value propositions and competitive strategies that set them apart from their rivals.

Additionally, market research helps businesses evaluate the effectiveness of their marketing efforts. By measuring key performance indicators (KPIs) and analyzing consumer responses, businesses can identify areas for improvement and refine their marketing strategies. This iterative approach ensures that marketing budgets are optimized and yields the highest return on investment (ROI).

In conclusion, market research is an invaluable tool for businesses aiming to thrive in a competitive marketplace. By understanding the importance of market research and leveraging its insights, businesses can make informed decisions, minimize risks, seize opportunities, and ultimately drive sustainable growth. Now that we have established the significance of market research, let's delve into the practical steps of preparing for and conducting market research.

Preparing for Market Research

Before diving into market research, it is crucial to lay a solid foundation by preparing for the research process. This section will explore the essential steps involved in preparing for market research, including defining research objectives, selecting the appropriate research methodology, and creating a comprehensive research plan.

Clearly defining research objectives is the cornerstone of any successful market research project. Research objectives serve as guiding principles that outline the specific goals and outcomes you hope to achieve through your research efforts. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART).

When defining your research objectives, consider what you aim to accomplish. Are you seeking to understand customer preferences for a new product? Do you want to assess market potential for a specific geographic region? Defining clear and focused research objectives will help you stay on track and ensure that your research efforts yield actionable insights.

Once you have defined your research objectives, the next step is to select the most appropriate research methodology. Different research methodologies offer unique advantages and are suited for different research objectives.

Qualitative research methods, such as interviews and focus groups, provide in-depth insights into customer opinions, attitudes, and perceptions. These methods allow for rich, nuanced data collection and are particularly useful for exploring complex topics or understanding the underlying motivations and emotions driving consumer behavior.

Quantitative research methods, on the other hand, involve the collection and analysis of numerical data. Surveys and questionnaires are common quantitative research tools that allow for large-scale data collection. These methods are useful for measuring customer satisfaction, analyzing customer preferences, and identifying statistical relationships between variables.

It's important to choose a research methodology that aligns with your research objectives, budget, and time constraints. Consider the advantages and limitations of each methodology and select the one that will provide the most relevant and accurate data for your specific research needs.

A well-structured research plan is essential for conducting market research efficiently and effectively. A research plan serves as a roadmap that outlines the steps, timeline, budget, and resources required for your research project.

By creating a comprehensive research plan, you can ensure that your market research efforts are well-organized, efficient, and yield valuable insights. The plan will also serve as a reference point to track progress and make adjustments as needed throughout the research process.

Now that you understand the importance of preparing for market research, we will delve into the practicalities of conducting primary market research in the next section.

Conducting Primary Market Research

Survey research is one of the most commonly used methods for collecting primary research data. Surveys allow businesses to gather a large volume of data from a diverse audience efficiently. They can be conducted through various channels, including online surveys, phone interviews, or in-person questionnaires.

When designing a survey, it is important to carefully craft the survey questions to ensure they are clear, unbiased, and relevant to the research objectives. Use a combination of open-ended and closed-ended questions to gather both qualitative and quantitative data. Open-ended questions provide respondents with the opportunity to express their opinions and provide detailed feedback, while closed-ended questions offer predefined response choices that can be easily analyzed.

To maximize response rates, it is essential to carefully consider the survey administration method. Online surveys are cost-effective and convenient, allowing respondents to complete the survey at their convenience. Phone interviews provide a personal touch and allow for follow-up questions, while in-person questionnaires enable businesses to interact directly with respondents. Choosing the appropriate survey administration method depends on factors such as target audience demographics, research objectives, and available resources.

Additionally, it is crucial to consider respondent fatigue and survey length. Long and tedious surveys can lead to decreased response rates and inaccuracies in responses. Keep the survey concise, focused, and engaging to ensure higher participation and reliable data.

Interviews and focus groups provide valuable qualitative insights into consumer opinions, preferences, and behaviors. These methods allow businesses to engage directly with participants and gain a deeper understanding of their thoughts and motivations.

Interviews can be conducted in-person, over the phone, or through video calls. They provide an opportunity to ask probing questions, delve into specific topics, and explore in-depth responses. The interviewer can adapt the questioning based on the participant's responses, allowing for a dynamic and personalized conversation.

Focus groups involve bringing together a small group of individuals to discuss a specific topic or product. This method allows participants to interact with one another, share their opinions, and generate insights through group discussions. Focus groups provide a unique perspective by capturing the collective thoughts and experiences of the participants.

To conduct successful interviews and focus groups, it is essential to carefully plan the session. Develop a discussion guide or interview script that includes a set of key questions or topics to cover. This will ensure consistency and enable comparability across interviews or focus groups. Actively listen to participants, encourage open and honest responses, and create a comfortable environment for sharing opinions.

Qualitative data obtained from interviews and focus groups require careful analysis. Use techniques such as thematic analysis or coding to identify recurring themes, patterns, and insights. These qualitative insights can provide valuable context and depth to complement quantitative data collected through surveys or other methods.

Observational research involves observing and analyzing consumer behavior in real-life settings. This method allows businesses to gain insights into consumer interactions, preferences, and decision-making processes. It can be particularly useful in retail environments, public spaces, or during product usage.

Participant observation involves immersing oneself in the context being studied and actively participating in the observed activities. This method allows researchers to gain firsthand experience and capture the nuances of behavior and interactions. Non-participant observation, on the other hand, involves observing from a distance without directly engaging with the participants. This method allows for more objective observations and avoids potential biases that may arise from researcher-participant interaction.

When conducting observational research, it is essential to consider ethical considerations and obtain necessary permissions, especially in public spaces or when observing sensitive behavior. Maintain confidentiality and anonymity of participants and ensure that the research does not infringe upon their privacy.

Observational research often involves recording observations through notes, photographs, or video recordings. These records serve as valuable data for analysis and interpretation. Analyze the collected data by identifying patterns, behaviors, and trends. Observational research findings can be used to supplement and validate other primary research methods, providing a comprehensive understanding of consumer behavior.