Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Recommended Articles

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

How many stocks are sufficient for equity portfolio diversification a review of the literature.

1. Introduction

2. data and methods, 3. results of bibliometric analysis, 4. risk diversification thematic review, 4.1. measuring risk diversification, 4.2. number of stocks required for risk diversification, 4.3. optimal portfolio size across different capital markets, 4.4. impact of crises on risk diversification, 5. discussion, 6. conclusions, author contributions, institutional review board statement, informed consent statement, data availability statement, conflicts of interest.

- Aboura, Sofiane, and Julien Chevallier. 2017. A new weighting-scheme for equity indexes. International Review of Financial Analysis 54: 159–75. [ Google Scholar ] [ CrossRef ]

- Ahmed, Awais, Rizwan Ali, Abdullsh Ejaz, and Ishfaq Ahmad. 2018. Sectoral integration and investment diversification opportunities: Evidence from Colombo Stock Exchange. Entrepreneurship and Sustainability Issues 5: 514–27. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Ahuja, Aakash. 2015. Portfolio Diversification in the Karachi Stock Exchange. Pakistan Journal of Engineering, Technology & Science 1: 37–44. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Aigner, Philipp, Georg Beyschlag, Tim Friederich, Markus Kalepky, and Rudi Zagst. 2012. Modeling and managing portfolios including listed private equity. Computers & Operations Research 39: 753–64. [ Google Scholar ] [ CrossRef ]

- Alekneviciene, Vilija, Egle Alekneviciute, and Rasa Rinkeviciene. 2012. Portfolio Size and Diversification Effect in Lithuanian Stock Exchange Market. Engineering Economics 23: 338–47. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Alexeev, Vitali, and Mardi Dungey. 2015. Equity portfolio diversification with high frequency data. Quantitative Finance 15: 1205–15. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Alexeev, Vitali, and Francis Tapon. 2012. Equity Portfolio Diversification: How Many Stocks are Enough? Evidence from Five Developed Markets. SSRN Electronic Journal . [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Alexeev, Vitali, and Francis Tapon. 2014. How Many Stocks Are Enough for Diversifying Canadian Institutional Portfolios? Hobart: University of Tasmania. [ Google Scholar ]

- Alexeev, Vitali, Giovanni Urga, and Wenying Yao. 2019. Asymmetric jump beta estimation with implications for portfolio risk management. International Review of Economics & Finance 62: 20–40. [ Google Scholar ] [ CrossRef ]

- Alqahtani, Faisal, Nader Trabelsi, Nahla Samargandi, and Syed Jawad Hussain Shahzad. 2020. Tail Dependence and Risk Spillover from the US to GCC Banking Sectors. Mathematics 8: 2055. [ Google Scholar ] [ CrossRef ]

- Anas, Muhammad, Ghulam Mujtaba, Sadaf Nayyar, and Saira Ashfaq. 2020. Time-Frequency Based Dynamics of Decoupling or Integration between Islamic and Conventional Equity Markets. Journal of Risk and Financial Management 13: 156. [ Google Scholar ] [ CrossRef ]

- Ang, Andrew, and Geert Bekaert. 2002. International Asset Allocation With Regime Shifts. The Review of Financial Studies 15: 1137–87. [ Google Scholar ] [ CrossRef ]

- Angelidis, Timotheos, and Nikolaos Tessaromatis. 2010. The efficiency of Greek public pension fund portfolios. Journal of Banking & Finance 34: 2158–67. [ Google Scholar ] [ CrossRef ]

- Arjoon, Vaalmikki, and Chandra Shekhar Bhatnagar. 2017. Dynamic herding analysis in a frontier market. Research in International Business and Finance 42: 496–508. [ Google Scholar ] [ CrossRef ]

- Azmi, Wajahat, Adam Ng, Ginanjar Dewandaru, and Ruslan Nagayev. 2019. Doing well while doing good: The case of Islamic and sustainability equity investing. Borsa Istanbul Review 19: 207–18. [ Google Scholar ] [ CrossRef ]

- Babalos, Vassilios, and Stavros Stavroyiannis. 2017. Modelling correlation dynamics of EMU sovereign debt markets during the recent turmoil. Research in International Business and Finance 42: 1021–29. [ Google Scholar ] [ CrossRef ]

- Bai, Min, Yafeng Qin, and Huiping Zhang. 2021. Stock price crashes in emerging markets. International Review of Economics & Finance 72: 466–82. [ Google Scholar ] [ CrossRef ]

- Bajgrowicz, Pierre, Olivier Scaillet, and Adrien Treccani. 2016. Jumps in High-Frequency Data: Spurious Detections, Dynamics, and News. Management Science 62: 2198–217. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Baker, Kent, Adri De Ridder, and Annalien De Vries. 2018. Stockholdings of first-time and more experienced investors. Review of Behavioral Finance 10: 146–62. [ Google Scholar ] [ CrossRef ]

- Balcılar, Mehmet, Rıza Demirer, and Shawkat Hammoudeh. 2015. Regional and global spillovers and diversification opportunities in the GCC equity sectors. Emerging Markets Review 24: 160–87. [ Google Scholar ] [ CrossRef ]

- Ban, Gah-Yi, Noureddine El Karoui, and Andrew E. B. Lim. 2016. Machine Learning and Portfolio Optimization. Management Science 64: 1136–54. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Barber, Brad M., and Terrance Odean. 2000. Too Many Cooks Spoil the Profits: Investment Club Performance. Financial Analysts Journal 56: 17–25. [ Google Scholar ] [ CrossRef ]

- Basu, Anup K., and Jason Huang-Jones. 2015. The performance of diversified emerging market equity funds. Journal of International Financial Markets, Institutions and Money 35: 116–31. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Batten, Jonathan A., Peter G. Szilagyi, and Niklas F. Wagner. 2015. Should emerging market investors buy commodities? Applied Economics 47: 4228–46. [ Google Scholar ] [ CrossRef ]

- Batten, Jonathan A., Harald Kinateder, Peter G. Szilagyi, and Niklas F. Wagner. 2017. Can stock market investors hedge energy risk? Evidence from Asia. Energy Economics 66: 559–70. [ Google Scholar ] [ CrossRef ]

- Beck, Kristine L., Sieven B. Perfect, and Pamela P. Peterson. 1996. The Role of Alternative Methodology on the Relation Between Portfolio Size and Diversification. The Financial Review 31: 381–406. [ Google Scholar ] [ CrossRef ]

- Bekaert, Gert, Claude B. Erb, Campbell R. Harvey, and Tadas E. Viskanta. 1998. Distributional characteristics of emerging market returns and asset allocation. The Journal of Portfolio Management 24: 102–16. [ Google Scholar ] [ CrossRef ]

- Benjelloun, Hicham. 2010. Evans and Archer—Forty years later. Investment Management and Financial Innovations 7: 8. [ Google Scholar ]

- Berger, Dave, Kuntara Pukthuanthong, and J. Jimmy Yang. 2011. International diversification with frontier markets. Journal of Financial Economics 101: 227–42. [ Google Scholar ] [ CrossRef ]

- Bergmann, Daniel Reed, Jose Roberto Ferreira Savoia, Claudio Felisoni de Angelo, Eduardo Augusto do Rosário Contani, and Fabiana Lopes da Silva. 2018. Portfolio management with tail dependence. Applied Economics 50: 5510–20. [ Google Scholar ] [ CrossRef ]

- Bhatti, M. Ishaq, and Cuong C. Nguyen. 2012. Diversification evidence from international equity markets using extreme values and stochastic copulas. Journal of International Financial Markets, Institutions and Money 22: 622–46. [ Google Scholar ] [ CrossRef ]

- Bradfield, David, and Brian Munro. 2017. The number of stocks required for effective portfolio diversification: The South African case. South African Journal of Accounting Research 31: 44–59. [ Google Scholar ] [ CrossRef ]

- Brands, Simone, and David R. Gallagher. 2005. Portfolio selection, diversification and fund-of-funds: A note. Accounting & Finance 45: 185–97. [ Google Scholar ] [ CrossRef ]

- Branger, Nicole, Katarína Lučivjanská, and Alex Weissensteiner. 2019. Optimal granularity for portfolio choice. Journal of Empirical Finance 50: 125–46. [ Google Scholar ] [ CrossRef ]

- Campbell, John Y., Martin Lettau, Burton G. Malkiel, and Yexiao Xu. 2001. Have Individual Stocks Become More Volatile? An Empirical Exploration of Idiosyncratic Risk. The Journal of Finance 56: 1–43. [ Google Scholar ] [ CrossRef ]

- Cha, Heung-Joo, and Thadavillil Jithendranathan. 2009. Time-varying correlations and optimal allocation in emerging market equities for the US investors. International Journal of Finance & Economics 14: 172–87. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Chen, Feng, Ole-Kristian Hope, Qingyuan Li, and Xin Wang. 2018. Flight to Quality in International Markets: Investors’ Demand for Financial Reporting Quality during Political Uncertainty Events. Contemporary Accounting Research 35: 117–55. [ Google Scholar ] [ CrossRef ]

- Chen, Ke, Luiz Vitiello, Stuart Hyde, and Ser-Huang Poon. 2018. The reality of stock market jumps diversification. Journal of International Money and Finance 86: 171–88. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Chiou, Wan-Jiun Paul. 2008. Who benefits more from international diversification? Journal of International Financial Markets, Institutions and Money 18: 466–82. [ Google Scholar ] [ CrossRef ]

- Chong, James, and G. Michael Phillips. 2013. Portfolio Size Revisited. The Journal of Wealth Management 15: 49–60. [ Google Scholar ] [ CrossRef ]

- Conlon, Thomas, John Cotter, and Ramazan Gençay. 2018. Long-run wavelet-based correlation for financial time series. European Journal of Operational Research 271: 676–96. [ Google Scholar ] [ CrossRef ]

- Conover, C. Mitchell, Gerald R. Jensen, and Robert R. Johnson. 2002. Emerging Markets: When Are They Worth It? Financial Analysts Journal 58: 86–95. [ Google Scholar ] [ CrossRef ]

- Corzo, Teresa, Laura Lazcano, Javier Márquez, Laura Gismera, and Sara Lumbreras. 2020. A common risk factor in global credit and equity markets: An exploratory analysis of the subprime and the sovereign-debt crises. Heliyon 6: e03980. [ Google Scholar ] [ CrossRef ] [ PubMed ]

- Dbouk, Wassim, and Lawrence Kryzanowski. 2009. Diversification benefits for bond portfolios. The European Journal of Finance 15: 533–53. [ Google Scholar ] [ CrossRef ]

- De Keyzer, Olivier, and Michiel De Schaepmeester. 2014. How Many Stocks Does an Investor Need to Diversify within Europe? Master’s thesis, University of Ghent, Ghent, Belgium. [ Google Scholar ]

- Delpini, Danilo, Stefano Battiston, Guido Caldarelli, and Massimo Riccaboni. 2019. Systemic risk from investment similarities. PLoS ONE 14: e0217141. [ Google Scholar ] [ CrossRef ] [ PubMed ] [ Green Version ]

- Dimitrios, Kydros, and Oumbailis Vasileios. 2015. A Network Analysis of the Greek Stock Market. Procedia Economics and Finance 33: 340–49. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Dimitriou, Dimitrios, Dimitris Kenourgios, and Theodore Simos. 2017. Financial crises, exchange rate linkages and uncovered interest parity: Evidence from G7 markets. Economic Modelling 66: 112–20. [ Google Scholar ] [ CrossRef ]

- Diyarbakırlıoğlu, Erkin, and Mehmet H. Satman. 2013. The Maximum Diversification Index. Journal of Asset Management 14: 400–9. [ Google Scholar ] [ CrossRef ]

- Domian, Dale L., David A. Louton, and Marie D. Racine. 2007. Diversification in Portfolios of Individual Stocks: 100 Stocks Are Not Enough. Financial Review 42: 557–70. [ Google Scholar ] [ CrossRef ]

- Dopfel, Frederick E. 2003. Asset Allocation in a Lower Stock-Bond Correlation Environment. The Journal of Portfolio Management 30: 25–38. [ Google Scholar ] [ CrossRef ]

- Dorn, Daniel, and Gur Huberman. 2010. Preferred risk habitat of individual investors. Journal of Financial Economics 97: 155–73. [ Google Scholar ] [ CrossRef ]

- Duarte, Flávio Gabriel, and Leandro Nunes De Castro. 2020. A Framework to Perform Asset Allocation Based on Partitional Clustering. IEEE Access 8: 110775–88. [ Google Scholar ] [ CrossRef ]

- Eom, Cheoljun, Taisei Kaizoji, Giacomo Livan, and Enrico Scalas. 2021. Limitations of portfolio diversification through fat tails of the return Distributions: Some empirical evidence. The North American Journal of Economics and Finance 56: 101358. [ Google Scholar ] [ CrossRef ]

- Evans, John L., and Stephen H. Archer. 1968. Diversification and the Reduction of Dispersion: An Empirical Analysis. The Journal of Finance 23: 761–67. [ Google Scholar ] [ CrossRef ]

- Fang, Kuangnan, Ji Wu, and Cuong Nguyen. 2017. The Risk-Return Trade-Off in a Liberalized Emerging Stock Market: Evidence from Vietnam. Emerging Markets Finance and Trade 53: 746–63. [ Google Scholar ] [ CrossRef ]

- Fazil, Gökgöz, and Altintaş İpek. 2013. Does Idiosyncratic Volatility Matter in the Emerging Markets? Istanbul Stock Exchange Evidence. Economic Research-Ekonomska Istraživanja 26: 133–50. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Fielitz, Bruce D. 1974. Indirect versus Direct Diversification. Financial Management 3: 54–62. [ Google Scholar ] [ CrossRef ]

- Flavin, Thomas J., and Michael R. Wickens. 2006. Optimal International Asset Allocation with Time-Varying Risk. Scottish Journal of Political Economy 53: 543–64. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Fong, Tom Pak Wing, Angela Kin Wan Sze, and Edmund Ho Cheung Ho. 2018. Determinants of equity mutual fund flows—Evidence from the fund flow dynamics between Hong Kong and global markets. Journal of International Financial Markets, Institutions and Money 57: 231–47. [ Google Scholar ] [ CrossRef ]

- Fugazza, Carolina, Maela Giofré, and Giovanna Nicodano. 2011. International diversification and industry-related labor income risk. International Review of Economics & Finance 20: 764–83. [ Google Scholar ] [ CrossRef ]

- Gasser, Stephan M., Margarethe Rammerstorfer, and Karl Weinmayer. 2017. Markowitz revisited: Social portfolio engineering. European Journal of Operational Research 258: 1181–90. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Gilmore, Claire G., and Ginette M. McManus. 2002. International portfolio diversification: US and Central European equity markets. Emerging Markets Review 3: 69–83. [ Google Scholar ] [ CrossRef ]

- Grauer, Robert R., and Frederick C. Shen. 2000. Do constraints improve portfolio performance? Journal of Banking & Finance 24: 1253–74. [ Google Scholar ] [ CrossRef ]

- Guidolin, Massimo, and Allan Timmermann. 2008. International asset allocation under regime switching, skew, and kurtosis preferences. The Review of Financial Studies 21: 889–935. [ Google Scholar ] [ CrossRef ]

- Gupta, G. S., and Ch’ng Huck Khoon. 2001. How many securities make a diversified portfolio: KLSE stocks? Asian Academy of Management Journal 6: 63–79. [ Google Scholar ]

- Habibah, Ume, Ranjeeta Sadhwani, and Pervaiz Memon. 2018. Selecting Optimal Portfolio in Pakistan. Sukkur IBA Journal of Economics and Finance 2: 68–77. [ Google Scholar ] [ CrossRef ]

- Haddad, Michel Ferreira Cardia. 2019. Sphere-sphere intersection for investment portfolio diversification—A new data-driven cluster analysis. MethodsX 6: 1261–78. [ Google Scholar ] [ CrossRef ]

- Hadhri, Sinda. 2021. The nexus, downside risk and asset allocation between oil and Islamic stock markets: A cross-country analysis. Energy Economics 101: 105448. [ Google Scholar ] [ CrossRef ]

- Hadhri, Sinda, and Zied Ftiti. 2019. Asset allocation and investment opportunities in emerging stock markets: Evidence from return asymmetry-based analysis. Journal of International Money and Finance 93: 187–200. [ Google Scholar ] [ CrossRef ]

- Haensly, Paul J. 2020. Risk decomposition, estimation error, and naïve diversification. The North American Journal of Economics and Finance 52: 101146. [ Google Scholar ] [ CrossRef ]

- Halunga, Andreea G., and Christos S. Savva. 2019. Neglecting structural breaks when estimating and valuing dynamic correlations for asset allocation. Econometric Reviews 38: 660–78. [ Google Scholar ] [ CrossRef ]

- Haroon, Omair, Mohsin Ali, Abdullah Khan, Mudeer A. Khattak, and Syed Aun R. Rizvi. 2021. Financial Market Risks during the COVID-19 Pandemic. Emerging Markets Finance and Trade 57: 2407–14. [ Google Scholar ] [ CrossRef ]

- Helberg, Stig, and Snorre Lindset. 2020. Collateral affects return risk: Evidence from the euro bond market. Financial Markets and Portfolio Management 34: 99–128. [ Google Scholar ] [ CrossRef ]

- Herold, Ulf, and Raimond Maurer. 2003. Bayesian Asset Allocation and U.S. Domestic Bias. Financial Analysts Journal 59: 54–65. [ Google Scholar ] [ CrossRef ]

- Horvath, Roman, and Petr Poldauf. 2012. International Stock Market Comovements: What Happened during the Financial Crisis? Global Economy Journal 12: 1850252. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Hu, Jin-Li, Tzu-Pu Chang, and Ray Yeutien Chou. 2014. Market conditions and the effect of diversification on mutual fund performance: Should funds be more concentrative under crisis? Journal of Productivity Analysis 41: 141–51. [ Google Scholar ] [ CrossRef ]

- Hwang, Inchang, Simon Xu, and Francis In. 2018. Naive versus optimal diversification: Tail risk and performance. European Journal of Operational Research 265: 372–88. [ Google Scholar ] [ CrossRef ]

- Irala, Lokanandha Reddy, and Prakash Patil. 2007. Portfolio Size and Diversification. SCMS Journal of Indian Management 4: 6. [ Google Scholar ]

- Jain, Prayut, and Shashi Jain. 2019. Can Machine Learning-Based Portfolios Outperform Traditional Risk-Based Portfolios? The Need to Account for Covariance Misspecification. Risks 7: 74. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Kang, Jun-Koo, and Rene´M. Stulz. 1997. Why is there a home bias? An analysis of foreign portfolio equity ownership in Japan. Journal of Financial Economics 46: 3–28. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Kim, Woohwan, Young Min Kim, Tae-Hwan Kim, and Seungbeom Bang. 2018. Multi-dimensional portfolio risk and its diversification: A note. Global Finance Journal 35: 147–56. [ Google Scholar ] [ CrossRef ]

- Kisaka, Sifunjo E., Joseph Aloise Mbithi, and Hilary Kitur. 2015. Determining the Optimal Portfolio Size on the Nairobi Securities Exchange. Research Journal of Finance and Accounting 6: 215. [ Google Scholar ]

- Kiymaz, Halil, and Koray Simsek. 2017. The performance of US-based emerging market mutual funds. Journal of Capital Markets Studies 1: 58–73. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Koedijk, Kees G., Alfred M. H. Slager, and Philip A. Stork. 2016. Investing in Systematic Factor Premiums: Investing in Systematic Factor Premiums. European Financial Management 22: 193–234. [ Google Scholar ] [ CrossRef ]

- Kreso, Inda, Amra Kapo, and Lejla Turulja. 2020. Data mining privacy preserving: Research agenda. Wiley Interdisciplinary Reviews: Data Mining and Knowledge Discovery 1: 1–29. [ Google Scholar ] [ CrossRef ]

- Kroencke, Tim A., and Felix Schindler. 2012. International diversification with securitized real estate and the veiling glare from currency risk. Journal of International Money and Finance 31: 1851–66. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Kryzanowski, Lawrence, and Shishir Singh. 2010. Should Minimum Portfolio Sizes Be Prescribed for Achieving Sufficiently Well-Diversified Equity Portfolios? SSRN Electronic Journal 7: 1–37. [ Google Scholar ]

- Kurtti, Markku. 2020. How Many stocks Make a Diversified Portfolio in a Continuous-time World? Master’s thesis, University of Oulu, Oulu, Finland. [ Google Scholar ]

- Kushnirovich, Nonna. 2016. Immigrant investors in financial markets: Modes of financial behavior. Journal of Business Economics and Management 17: 992–1006. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lee, Kuan-Hui. 2011. The world price of liquidity risk. Journal of Financial Economics 99: 136–61. [ Google Scholar ] [ CrossRef ]

- Lee, Darren D., Jacquelyn E. Humphrey, Karen L. Benson, and Jason Y. K. Ahn. 2010. Socially responsible investment fund performance: The impact of screening intensity. Accounting & Finance 50: 351–70. [ Google Scholar ] [ CrossRef ]

- Lee, Yongjae, Woo Chang Kim, and Jang Ho Kim. 2020. Achieving Portfolio Diversification for Individuals with Low Financial Sustainability. Sustainability 12: 7073. [ Google Scholar ] [ CrossRef ]

- Lee, Cheng-Few, Chengru Hu, and Maggie Foley. 2021. Differential risk effect of inside debt, CEO compensation diversification, and firm investment. Review of Quantitative Finance and Accounting 56: 505–43. [ Google Scholar ] [ CrossRef ]

- Levy, Haim, and Moshe Levy. 2021. The cost of diversification over time, and a simple way to improve target-date funds. Journal of Banking & Finance 122: 105995. [ Google Scholar ] [ CrossRef ]

- Li, Hong. 2013. Integration versus segmentation in China’s stock market: An analysis of time-varying beta risks. Journal of International Financial Markets, Institutions and Money 25: 88–105. [ Google Scholar ] [ CrossRef ]

- Li, Mingsheng, and Xin Zhao. 2016. Neighborhood effect on stock price comovement. The North American Journal of Economics and Finance 35: 1–22. [ Google Scholar ] [ CrossRef ]

- Ling, David C., and Andy Naranjo. 2002. Commercial Real Estate Return Performance: A Cross-Country Analysis. The Journal of Real Estate Finance and Economics 24: 119–42. [ Google Scholar ] [ CrossRef ]

- Liu, Edith X. 2016. Portfolio Diversification and International Corporate Bonds. Journal of Financial and Quantitative Analysis 51: 959–83. [ Google Scholar ] [ CrossRef ]

- Lu, Xiaomeng, Jiaojiao Guo, and Li Gan. 2020. International comparison of household asset allocation: Micro-evidence from cross-country comparisons. Emerging Markets Review 43: 100691. [ Google Scholar ] [ CrossRef ]

- Lubatkin, Michael, and Sayan Chatterjee. 1994. Extending Modern Portfolio Theory into the Domain of Corporate Diversification: Does it Apply? Academy of Management Journal 37: 109–36. [ Google Scholar ] [ CrossRef ]

- Magas, I. 2007. The changing benefits of global equity investing: Developed and emerging markets, 1997–2007. Acta Oeconomica 57: 343–62. [ Google Scholar ] [ CrossRef ]

- Markowitz, Harry. 1952. Portfolio Selection. The Journal of Finance 7: 77–91. [ Google Scholar ] [ CrossRef ]

- Martin-Bujack, Karin, Teresa Santamaría, and Isabel Figuerola-Ferretti. 2018. International diversification and global credit risk: A methodology for portfolio building 1. UCJC Business and Society Review 15: 92–136. [ Google Scholar ] [ CrossRef ]

- Meng, Xiangcai, and Chia-Hsing Huang. 2019. The time-frequency co-movement of Asian effective exchange rates: A wavelet approach with daily data. The North American Journal of Economics and Finance 48: 131–48. [ Google Scholar ] [ CrossRef ]

- Mensi, Walid, Shawkat Hammoudeh, Ahmet Sensoy, and Seong-Min Yoon. 2017. Analysing dynamic linkages and hedging strategies between Islamic and conventional sector equity indexes. Applied Economics 49: 2456–79. [ Google Scholar ] [ CrossRef ]

- Mensi, Walid, Mobeen Ur Rehman, Debasish Maitra, Khamis Hamed Al-Yahyaee, and Ahmet Sensoy. 2020. Does bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Research in International Business and Finance 53: 101230. [ Google Scholar ] [ CrossRef ]

- Milcheva, Stanimira, and Bing Zhu. 2018. Asset pricing, spatial linkages and contagion in real estate stocks. Journal of Property Research 35: 271–95. [ Google Scholar ] [ CrossRef ]

- Miralles-Marcelo, José Luis, María del Mar Miralles-Quirós, and José Luis Miralles-Quirós. 2012. Asset pricing with idiosyncratic risk: The Spanish case. International Review of Economics & Finance 21: 261–71. [ Google Scholar ] [ CrossRef ]

- Miralles-Quirós, José Luis, María Mar Miralles-Quirós, and José Manuel Nogueira. 2019. Diversification benefits of using exchange-traded funds in compliance to the sustainable development goals. Business Strategy and the Environment 28: 244–55. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Mitton, Todd, and Keith Vorkink. 2007. Equilibrium Underdiversification and the Preference for Skewness. The Review of Financial Studies 20: 1255–88. [ Google Scholar ] [ CrossRef ]

- Mokni, Khaled, and Faysal Mansouri. 2017. Conditional dependence between international stock markets: A long memory GARCH-copula model approach. Journal of Multinational Financial Management 42–43: 116–31. [ Google Scholar ] [ CrossRef ]

- Murthy, Jogalapuram. 2018. The construction of optimal portfolio using sharpe’s single index model-an empirical study on nifty metal index. JIMS8M: The Journal of Indian Management & Strategy 23: 4. [ Google Scholar ] [ CrossRef ]

- Ngene, Geoffrey, Jordin A. Post, and Ann N. Mungai. 2018. Volatility and shock interactions and risk management implications: Evidence from the U.S. and frontier markets. Emerging Markets Review 37: 181–98. [ Google Scholar ] [ CrossRef ]

- Nguyen, Tung Dao, and Pana Elisabeta. 2016. Financial integration and diversification benefits: China and ASEAN4 countries. Managerial Finance 42: 496–514. [ Google Scholar ] [ CrossRef ]

- Norsiman, Nadia, Noor Yakob, and Carl Mcgowan. 2019. The Effect of Portfolio Diversification for the Bursa Malaysia. Accounting and Finance Research 8: 76. [ Google Scholar ] [ CrossRef ]

- O’Neal, Edward S. 1997. How Many Mutual Funds Constitute a Diversified Mutual Fund Portfolio? Financial Analysts Journal 53: 37–46. [ Google Scholar ] [ CrossRef ]

- Oyenubi, Adeola. 2019. Diversification Measures and the Optimal Number of Stocks in a Portfolio: An Information Theoretic Explanation. Computational Economics 54: 1443–71. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Pástor, Ľuboš, Robert F. Stambaugh, and Lucian A. Taylor. 2020. Fund tradeoffs. Journal of Financial Economics 138: 614–34. [ Google Scholar ] [ CrossRef ]

- Pizzutilo, Fabio. 2017. Measuring the under-diversification of socially responsible investments. Applied Economics Letters 24: 1005–18. [ Google Scholar ] [ CrossRef ]

- Platanakis, Emmanouil, Charles Sutcliffe, and Xiaoxia Ye. 2021. Horses for courses: Mean-variance for asset allocation and 1/N for stock selection. European Journal of Operational Research 288: 302–17. [ Google Scholar ] [ CrossRef ]

- Rahiminezhad Galankashi, Masoud, Farimah Mokhatab Rafiei, and Maryam Ghezelbash. 2020. Portfolio selection: A fuzzy-ANP approach. Financial Innovation 6: 17. [ Google Scholar ] [ CrossRef ]

- Raju, Rajan, and Sobhesh Kumar Agarwalla. 2021. Equity Portfolio Diversification: How Many Stocks Are Enough? Evidence from India. SSRN Electronic Journal . [ Google Scholar ] [ CrossRef ]

- Rajwani, Shegorika, and Dilip Kumar. 2016. Asymmetric Dynamic Conditional Correlation Approach to Financial Contagion: A Study of Asian Markets. Global Business Review 17: 1339–56. [ Google Scholar ] [ CrossRef ]

- Rehman, Mobeen Ur, Syed Jawad Hussain Shahzad, Nasir Ahmad, and Xuan Vinh Vo. 2021. Dependence among metals and mining companies of the US and Europe during normal and crises periods. Resources Policy 73: 102199. [ Google Scholar ] [ CrossRef ]

- Rizvi, Syed Aun R., and Shaista Arshad. 2018. Understanding time-varying systematic risks in Islamic and conventional sectoral indices. Economic Modelling 70: 561–70. [ Google Scholar ] [ CrossRef ]

- Sandoval, Leonidas, and Italo De Paula Franca. 2012. Correlation of financial markets in times of crisis. Physica A: Statistical Mechanics and Its Applications 391: 187–208. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Sclip, Alex, Alberto Dreassi, Stefano Miani, and Andrea Paltrinieri. 2016. Dynamic correlations and volatility linkages between stocks and sukuk: Evidence from international markets. Review of Financial Economics 31: 34–44. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Sharma, Prateek, and Vipul. 2018. Improving portfolio diversification: Identifying the right baskets for putting your eggs. Managerial and Decision Economics 39: 698–711. [ Google Scholar ] [ CrossRef ]

- Shawky, Hany A., and David M. Smith. 2005. Optimal Number of Stock Holdings in Mutual Fund Portfolios Based on Market Performance. Financial Review 40: 481–95. [ Google Scholar ] [ CrossRef ]

- Smimou, Kamal. 2014. International portfolio choice and political instability risk: A multi-objective approach. European Journal of Operational Research 234: 546–60. [ Google Scholar ] [ CrossRef ]

- Solnik, Bruno H. 1974. Why Not Diversify Internationally Rather Than Domestically? Financial Analysts Journal 30: 48–54. [ Google Scholar ] [ CrossRef ]

- Statman, Meir. 1987. How Many Stocks Make a Diversified Portfolio? Journal of Financial and Quantitative Analysis 22: 353–63. [ Google Scholar ] [ CrossRef ]

- Statman, Meir. 2002. How Much Diversification Is Enough? Working Paper. Santa Clara: Leavey School of Business, Santa Clara University. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Statman, Meir. 2004. The Diversification Puzzle. Financial Analysts Journal 60: 44–53. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Stotz, Andrew, and Wei Lu. 2014. Eight Stocks are Enough in China. SSRN Electronic Journal . [ Google Scholar ] [ CrossRef ]

- Susmel, Raul. 2001. Extreme observations and diversification in Latin American emerging equity markets. Journal of International Money and Finance 20: 971–86. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Syriopoulos, Theodore, Beljid Makram, and Adel Boubaker. 2015. Stock market volatility spillovers and portfolio hedging: BRICS and the financial crisis. International Review of Financial Analysis 39: 7–18. [ Google Scholar ] [ CrossRef ]

- Tai, Chu-Sheng. 2018. International diversification during financial crises. Managerial Finance 44: 1434–45. [ Google Scholar ] [ CrossRef ]

- Tang, Gordon Y. N. 2004. How efficient is naive portfolio diversification? an educational note. Omega 32: 155–60. [ Google Scholar ] [ CrossRef ]

- Tang, Xuan, Xing Gao, Qiuping Zhou, and Jian Ma. 2020. The BSS-FM Estimation of International Assets Allocation for China Mainland Investors. Emerging Markets Finance and Trade 56: 1224–36. [ Google Scholar ] [ CrossRef ]

- Topaloglou, Nikolas, Hercules Vladimirou, and Stavros A. Zenios. 2002. CVaR models with selective hedging for international asset allocation. Journal of Banking & Finance 26: 1535–61. [ Google Scholar ] [ CrossRef ]

- Tripathi, Vanita, and Varun Bhandari. 2015. Socially responsible stocks: A boon for investors in India. Journal of Advances in Management Research 12: 209–25. [ Google Scholar ] [ CrossRef ]

- Wander, Brett H., and Ron D’Vari. 2003. The Limitations of Standard Deviation as a Measure of Bond Portfolio Risk. The Journal of Wealth Management 6: 35–38. [ Google Scholar ] [ CrossRef ]

- Wang, Kehluh, Yi-Hsuan Chen, and Szu-Wei Huang. 2011. The dynamic dependence between the Chinese market and other international stock markets: A time-varying copula approach. International Review of Economics & Finance 20: 654–64. [ Google Scholar ] [ CrossRef ]

- Warken, Peter, and Christian Hille. 2018. A risk-based approach to construct multi asset portfolio solutions. The Journal of Investment Strategies 7: 33–51. [ Google Scholar ] [ CrossRef ]

- Wilson, Bonnie. 2004. Diversification of risk and growth. Macroeconomic Dynamics 8: 335–61. [ Google Scholar ] [ CrossRef ]

- Wu, Chih-Chiang, and Shin-Shun Liang. 2011. The economic value of range-based covariance between stock and bond returns with dynamic copulas. Journal of Empirical Finance 18: 711–27. [ Google Scholar ] [ CrossRef ]

- Yilmaz, Tolgahan, and Sema Dube. 2014. Asset allocation and stock selection: Evidence from static and dynamic strategies in Turkish markets. Iktisat Isletme ve Finans 29: 73–94. [ Google Scholar ] [ CrossRef ]

- Zaremba, Adam. 2018. Country Risk and Expected Returns Across Global Equity Markets. Czech Journal of Economics and Finance 68: 374–98. [ Google Scholar ] [ CrossRef ]

- Zhou, Yuan. 2014. Number of Stocks in Portfolio and Risk Reduction. Master’s thesis, University of California, Los Angeles, CA, USA. [ Google Scholar ]

- Zhu, Hui-Ming, Rong Li, and Sufang Li. 2014. Modelling dynamic dependence between crude oil prices and Asia-Pacific stock market returns. International Review of Economics & Finance 29: 208–23. [ Google Scholar ] [ CrossRef ]

Click here to enlarge figure

| Author(s) and Year | Research Focus | Market(s) and the Observed Period | Method(s) | Research Findings | Number of Stocks or Other Information |

|---|---|---|---|---|---|

| ( ) | To study the rate at which return fluctuations decrease for randomly selected portfolios as a function of the number of securities in the portfolio. | U.S. 1958–1967 | Equally Weighted Portfolio, Standard Deviation | The results also cast doubt on whether it is economically justified to increase portfolio size beyond 10 or more securities and suggest that both analysts and private investors need to incorporate some form of marginal analysis into their portfolio selection model. | 8–10 stocks |

| ( ) | Analyze how much to invest in each security to ensure that the return on the investment is not significantly affected by commission charges. | U.S. 1964–1968 | Mean Absolute Deviation (MAD), Equally Weighted Portfolio | Direct investment in a randomly diversified portfolio of common stocks is preferable because the return on the random stock portfolio is, on average, higher than that achievable with mutual funds. | 8 stocks |

| ( ) | To show that substantial risk reduction benefits can be achieved by portfolio diversification into foreign securities as well as domestic common stocks. | U.S., UK, Germany, France, Switzerland, Italy, Belgium and Netherland 1966–1971 | Standard Deviation | Foreign capital markets differ significantly from the U.S. market. Because European investors often find that their domestic markets do not offer the variety of investment opportunities that Americans enjoy, international diversification is relatively more attractive to them. | 10–15 stocks |

| ( ) | To show that no fewer than 30 stocks are required for a well-diversified portfolio and to compare this result with the levels of diversification observed in studies of individual investors’ portfolios. | U.S. 1979–1984 | Standard Deviation | The benefits of diversification for stock portfolios are exhausted when the number of stocks reaches 10 or 15. | 30 for borrowing investors and 40 for the lending investors |

| ( ) | To investigate the development of alternative methods that reduce the impact of repeated replications on test results. | U.S. 1982–1991 | Variance, Correlations, Kruskal-Wallis test, Chi-square test | Researchers studying the issue of portfolio size and portfolio variance may be misled by replication-sensitive tests. | 14–20 securities |

| ( ) | To examine the impact of holding various numbers of mutual funds on the expected variability of investors’ terminal wealth. | U.S. 1976–1994 | Standard Deviation, Semi-variance, Terminal Wealth Standard Deviation | Two out of three downside risk measures are also substantially reduced by including multiple funds in a portfolio. | 16–18 FoF |

| ( ) | To investigate the size of a well-diversified portfolio in Malaysia and determine the size of the diversified portfolio for each of the lending and borrowing investors. | Malaysia 1988–1997 | Standard Deviation, T-test | A portfolio of 30 securities results in a well-diversified portfolio for borrowing investors, and one of 50 securities for lending investors. | 27 securities |

| ( ) | To analyze the performance of a randomly selected sample of 166 investment clubs. | U.S. 1991–1997 | CAPM, Jensen’s Alpha, Fama–French Three-Factor Model | The average club invested in high beta common stocks, small-cap growth stocks, and turned over 65% of its portfolio annually; 60% of clubs underperformed the index. | 7–8 stocks |

| ( ) | To analyze the optimal number of stocks needed to achieve maximum diversification effects and compare the benefits and costs of diversification using mean-variance and behavioral portfolio theory. | U.S. 1926–2001 | Mean-variance Portfolio Theory, Behavioral Portfolio Theory | The behavior of investors is better described with behavioral portfolio theory; the benefits and costs of diversification under the rules of mean-variance portfolio theory are different from those under the rules of behavioral portfolio theory. | More than 120 stocks |

| ( ) | To analytically examine the efficiency of naive diversification from an educational point of view. | International 1991–2002 | Variance | Given an infinite population of stocks, a portfolio size of 20 is required to eliminate 95% of the diversifiable risk on average; adding 80 stocks is required to eliminate an additional 4% of the diversifiable risk on average. | 20 stocks |

| ( ) | To investigate whether the number of stocks required to reduce unsystematic risk has changed over time. | U.S. 1926–2001 | Standard Deviation, Mean-variance Portfolio Theory, Behavioral Portfolio Theory | The diversification puzzle can be solved within the framework of behavioral portfolio theory. | More than 300 stocks |

| ( ) | Attention to FoF portfolio configuration for Australian investors, examining FoF performance and risk characteristics within traditional asset classes. | Australia 1989–1999 | Standard Deviation, Terminal Wealth Standard Deviation, Sharpe Ratio, Skewness, Kurtosis | As the number of funds in an FoF portfolio increases, performance improves in a mean-variance setting; adding funds to the FoF structure leads to deterioration in FoF portfolio skewness and kurtosis. | 6 FoF |

| ( ) | Investigate the relationship between the risk-adjusted return and the number of stocks. | U.S. 1992–2000 | Correlation, Ordinary Least Squares Regression (OLS) | Changes in the number of stocks are closely related to the number of new investments and redemptions, but not to changes in fund size due to market returns. | 40–120 stocks |

| ( ) | To compare results of random diversification with portfolios diversified by industry group. | U.S. 1985–2004 | Shortfall Risk, Ending Wealth, F-test, Industry Diversification | For small portfolios, a small reduction in risk can be achieved by diversifying across industries, but a larger reduction is achieved by simply increasing the number of stocks. | More than 100 stocks |

| ( ) | To analyze the optimal number of stocks required to achieve maximum diversification effect in the Indian market. | India 1999–2005 | Standard Deviation | A very high degree of diversification is possible in India; a portfolio size of 10–15 stocks is considered appropriate as the risk reduction is marginal thereafter. | 10–15 stocks |

| ( ) | Evaluate diversification benefits and optimal bond portfolio sizes (PS) for investment opportunity (IO) sets differentiated by issuer type, credit ratings, and term-to-maturity. | U.S. 1985–1997 | Correlations, Skewness, Kurtosis | Minimum PSs vary not only by issuer type, term-to-maturity, and bond rating but also by the metric used to measure the marginal benefits of further diversification. | 25–40 bonds |

| ( ) | To find out whether minimum portfolio sizes should be prescribed to achieve sufficiently well-diversified equity portfolios. | Canada 1975–2003 | Correlations, Mean Derived Dispersion, Mean Realized Dispersion, Normalized Portfolio Variance, Skewness, Kurtosis | Minimum sizes for a fixed investment opportunity set differ both within and across categories of metrics used to measure diversification benefits. | Depends upon different factors |

| ( ) | Examine the reduction in time series risk, as measured by the standard deviation of the time series, and cross-sectional risk, as measured by the standard deviation of terminal wealth. | U.S. 1980–2000 | Equally Weighted and Market Weighted Portfolios, Standard Deviation, Terminal Wealth Standard Deviation | Regardless of how risk is measured or how a portfolio is constructed, a randomly selected portfolio of about 40 to 50 stocks can be considered well diversified. | 40–50 stocks |

| ( ) | Analyze whether the theory of risk reduction through portfolio diversification applies to the Karachi Stock Exchange. | Pakistan 2007–2009 | Standard Deviation | The theory of portfolio diversification applies to Karachi Stock Exchange: a 52.25% reduction in risk was achieved. | 10 stocks |

| ( ) | Evaluate the diversification opportunities when portfolios consist of differentially weighted stocks and compare the diversification effect of naive and differentially weighted stock portfolios. | Lithuania 2009–2010 | Standard Deviation, HHI index | A greater diversification effect is obtained in naive portfolios. | 22 stocks for equally-weighted portfolios and 25 stocks for differently-weighted portfolios |

| ( ) | Estimating confidence bands around two central measures to provide portfolio size recommendations that achieve the most diversification benefits 90% of the time, rather than on average. | U.S., UK, Japan, Canada and Australia 1975–2011 | Standard Deviation, Terminal Wealth Standard Deviation, MAD, ES, LMP, Skewness, Kurtosis | The correlation structures in the five markets change in times of financial market crisis, and these changes differ in times of market-wide crises and industry-specific meltdowns. | Influenced by different factors |

| ( ) | Analyze whether the MDI might prove a useful tool for practitioners seeking to improve portfolio diversification within a smaller and therefore more manageable subset of assets. | U.S. 2006–2011 | Portfolio Diversification Index (PDI), Maximum Diversification Index (MDI) | The MDI can be efficiently implemented to narrow down a large set of investable assets by eliminating those issues that do not improve the diversification characteristics of the underlying portfolio pool. | 90–99 stocks |

| ( ) | Study the effect of the number of holdings in a portfolio on the properties of the portfolio. | U.S. 2003–2010 | Standard Deviation, Downside Risk, Sharpe Ratio, Beta, Correlations | Massive portfolios are not necessary to achieve diversified portfolios. | 31 stocks on average |

| ( ) | Analyze the specific relationship between portfolio size and risk reduction. | U.S. 2008–2013 | Standard Deviation, Regression, T-test, F-test | There is a strong relationship between portfolio size and risk, and this relationship could be captured by a decreasing asymptotic function. The results of the analysis using modern stock data are consistent with the result of the analysis using securities data from the 1950s and 1960s. | 10 stocks |

| ( ) | Determine the number of stocks in a portfolio required to minimize diversifiable risk for Canadian institutional investors using various risk measures, including those that take into account black swan events. | Canada 1975–2011 | Heavy-Tailed Risk, Expected Shortfall, Time Series Standard Deviation, Terminal Wealth Standard Deviation | The recommended number of stocks is influenced by market conditions as well as the average correlations between stocks in the Canadian market. | More than 50 stocks |

| ( ) | To determine the optimal number of stocks that an active fund manager should hold in a portfolio of stocks in Asia and a portfolio of stocks in the domestic Chinese stock market. | China, India, Korea, Taiwan, Hong-Kong, Malaysia, Singapore, Thailand, Indonesia, Philippines 2003–2013 | Standard Deviation, Risk-Adjusted Return Measure | Adding additional stocks put more downward pressure on returns than in Asia, and market risk in China was almost twice as high as in Asia. | 10 (Asia) and 8 stocks (China) |

| ( ) | To analyze how the use of higher frequency data affects the recommendations for the number of shares required to reduce risk to a given level. | U.S. 2003–2011 | Unconditional Correlation, Standard Deviation | Investors may not need to hold as large portfolios as lower frequency risk measures suggest, especially during financial crises. During the crisis, the correlation between the best-performing stocks increased more than that between the worst-performing stocks. | 7 (10) stocks |

| ( ) | Analysis of the impact of the GFC on the optimal number of stocks, and of whether this number differs between better-performing countries and PIIGS or between different sectors. | Europe 2000–2014 | Standard Deviation | For five better-performing countries, the optimal required number of stocks in a portfolio was higher than for the PIIGS countries; the number of stocks is significantly affected by the financial crisis. | Depends on the observed period, sector, as well as on the economic development of the country itself |

| ( ) | Investigating the optimal portfolio size for an investor at Nairobi Securities Exchange. | Kenya 2009–2013 | Mean-variance Optimization Model, Standard Deviation | Portfolio risk decreased as the number of securities in the portfolio increased, but beyond the optimal portfolio size, risk began to increase again. | 18–22 stocks |

| ( ) | To analyze the number of stocks that should be held in concentrated markets in South Africa. | South Africa 2002–2014 | Standard Deviation, 4 Different Weighting Schemes | Equally-weighted portfolios require far fewer stocks for effective risk reduction because of the concentrated stock environment in South Africa. | 15–19 for equally-weighted portfolios and 33–60 for SWIX-weighting scheme |

| ( ) | To explain why the optimal number of stocks in a portfolio is hard to find, the relationship between portfolio diversification and concentration studied using a genetic algorithm. | U.S. 2005–2013 | Portfolio Diversification Index (PDI), HHI index, Variance | For a given universe, there is a set of Pareto-optimal portfolios with a different number of stocks that simultaneously maximizes diversification and minimizes concentration. | 30–40 stocks |

| ( ) | Determine the number of stocks required to form a well-diversified portfolio in Pakistan, as each investor has limited funds to invest in securities. | Pakistan 2009–2015 | Variance, Correlation, Kurtosis, Skewness | The data are normally distributed and the average return on most securities is positive. | 20 stocks |

| ( ) | The study focuses on finding an optimal portfolio using Sharpe’s single index model. | India 2012–2016 | Sharpe Single Index Model, Beta, Variance | Only two stocks, namely Vedanta and Tata Steel, are included in the Optimal Portfolio constructed in this study, suggesting a maximum investment of 86% in Vedanta and 14 % in Tata Steel. | 14 stocks |

| ( ) | Two different bases are used to determine the significant number of stocks required for well-diversified portfolio risk. | Malaysia 2010–2014 | Standard Deviation, Covariance, Correlation | Data frequency affects the number of stocks in a portfolio required to achieve optimal diversification. | 45 stocks (daily basis) 35 stocks (weekly basis) |

| ( ) | Evaluate the impact of extreme market shifts on equity portfolios and analyze the difference between negative and positive responses to market jumps with implications for portfolio risk management. | U.S. 2003–2017 | Beta, Regression (OLS) | The number of holdings required to stabilize portfolio sensitivity to negative jumps is higher than for positive jumps, and the asymmetry is more pronounced for more extreme events. | 35 (if the asymmetry is ignored) or 54 stocks |

| ( ) | To examine the factors that determine diversification effects in a real continuous time, as opposed to a thoroughly studied theoretical single period timespan. | U.S. 1973–2018 | Risk Premium Ratio, Gross Compound Excess Wealth Ratio, Shannon Limit, Kelly Criterion, Sharpe Ratio, Variance | These factors are the number of stocks in the benchmark, the Sharpe ratio and variance of the benchmark, the idiosyncratic variance of an average stock, the investment proportion, and time. | 20, 40, or 200 stocks for a short-term risk-neutral investor |

| ( ) | Investigate different approaches for dividing total portfolio risk into a diversifiable and a non-diversifiable component. | U.S. 2007–2016 | Naive Diversification, Portfolio Risk Decomposition, OLS, Variance | Simulation analysis shows that diversifiable risk cannot be easily diversified away. Regardless of the model used, the dispersion of the cross-sectional distributions of diversifiable risk is not negligible for portfolio sizes up to and including 300 stocks. | 300 stocks |

| ( ) | To investigate whether it is theoretically possible to construct fully risk-diversified portfolios, even for small numbers of not-so-wealthy individuals. | U.S., UK, Germany, France, Canada and Japan 2008–2019 | Mean-variance Optimization model | Constructing fully risk-diversified portfolios requires more money when the required rate of return is lower; diversification is most expensive in the United Kingdom. | $10,000–$100,000 |

| ( ) | To examine how many stocks make up a well-diversified portfolio of Indian stocks and to propose a practical heuristic that investors can use to evaluate the number of stocks in their portfolios. | India 2014–2020 | Standard Deviation | The actual number of stocks would depend on the investor’s preferences in terms of risk-reduction preferences, the desired confidence level to meet his objectives, and the weighting scheme used for portfolio construction. | 40–50 stocks |

| MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

Share and Cite

Zaimovic, A.; Omanovic, A.; Arnaut-Berilo, A. How Many Stocks Are Sufficient for Equity Portfolio Diversification? A Review of the Literature. J. Risk Financial Manag. 2021 , 14 , 551. https://doi.org/10.3390/jrfm14110551

Zaimovic A, Omanovic A, Arnaut-Berilo A. How Many Stocks Are Sufficient for Equity Portfolio Diversification? A Review of the Literature. Journal of Risk and Financial Management . 2021; 14(11):551. https://doi.org/10.3390/jrfm14110551

Zaimovic, Azra, Adna Omanovic, and Almira Arnaut-Berilo. 2021. "How Many Stocks Are Sufficient for Equity Portfolio Diversification? A Review of the Literature" Journal of Risk and Financial Management 14, no. 11: 551. https://doi.org/10.3390/jrfm14110551

Article Metrics

Article access statistics, further information, mdpi initiatives, follow mdpi.

Subscribe to receive issue release notifications and newsletters from MDPI journals

Measuring the Benefits of Diversification Across Portfolios

24 Pages Posted: 29 Mar 2021 Last revised: 5 Aug 2021

Dilip B. Madan

University of Maryland - Robert H. Smith School of Business

Morgan Stanley

Date Written: March 26, 2021

A portfolio diversification index is defined as the ratio of an equivalent number of independent assets to the number of assets. The equivalence is based on either attaining the same diversification benefit or spread reduction. The diversification benefit is the difference in value of a value maximizing portfolio and the maximum value of the components. The spread reduction is the percentage reduction attained by a spread minimizing portfolio relative to the smallest spread for the components. Asset values, bid and ask, are given by conservative valuation operators from the theory of two price economies. The diversification indices fall with the number of assets in the portfolio and they are explained by a measure of concentration applied to normalized eigenvalues of the correlation matrix along with the average level of correlation. A time series of the indices constructed on the basis of the S&P 500 index and the nine sector ETF's reveals a collapse during the final crisis with no recovery until 2016, peaking in February 2020 and a COVID crash in March of 2020. Furthermore factor diversification possibilities are richer than those found in equity indices. Diversification benefits across global indices are not as strong as diversification across an equal number of domestic assets, but they rise substantially for longer horizons of up to three years.

Keywords: Bilateral Gamma, Acceptable Risks, Distorted Expectations.

JEL Classification: G10, G11, G12.

Suggested Citation: Suggested Citation

Dilip B. Madan (Contact Author)

University of maryland - robert h. smith school of business ( email ).

College Park, MD 20742-1815 United States 301-405-2127 (Phone) 301-314-9157 (Fax)

Morgan Stanley ( email )

1585 Broadway New York, NY 10036 United States

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, stochastic models ejournal.

Subscribe to this fee journal for more curated articles on this topic

Econometric Modeling: Capital Markets - Portfolio Theory eJournal

Econometric modeling: capital markets - risk ejournal, investing ejournal.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

- We're Hiring!

- Help Center

Portfolio Diversification

- Most Cited Papers

- Most Downloaded Papers

- Newest Papers

- Last »

- Equity Markets Integration Follow Following

- Balkans Region Follow Following

- International Stock Markets Follow Following

- Finace Follow Following

- Portfolio Optimization Follow Following

- Optimization (Mathematical Programming) Follow Following

- Risk Management and Insurance Follow Following

- Study on pricing behavior in Indian equity market Follow Following

- Emerging Markets Follow Following

- International Finance Follow Following

Enter the email address you signed up with and we'll email you a reset link.

- Academia.edu Journals

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Portfolio selection: from under-diversification to concentration

- Published: 12 September 2022

- Volume 64 , pages 1539–1557, ( 2023 )

Cite this article

- Jiawen Xu 1 ,

- Yixuan Li 2 , 3 ,

- Kai Liu 3 , 4 &

- Tao Chen ORCID: orcid.org/0000-0003-2987-6711 2 , 3 , 5

572 Accesses

Explore all metrics

The two opposing investment strategies, diversification and concentration, have often been directly compared. While there is much less dispute regarding Markowitz’s approach as the benchmark for diversification, the precise meaning of concentration in portfolio selection remains unclear. This paper offers a novel definition of concentration, along with an extreme value theory-based estimator for its implementation. When overlaying the performances derived from diversification (in Markowitz’s sense) and concentration (in our definition), we find an implied risk threshold, at which the two polar investment strategies reconcile—diversification has a higher expected return in situations where risk is below the threshold, while concentration becomes the preferred strategy when the risk exceeds the threshold. Different from the conventional concave shape, the estimated frontier resembles the shape of a seagull, which is piecewise concave. Further, taking the equity premium puzzle as an example, we demonstrate how the family of frontiers nested inbetween the estimated curves can provide new perspectives for research involving market portfolios.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Diversification and portfolio theory: a review

Portfolio Optimization Using Modified Herfindahl Constraint

Harry markowitz, the cowles commission, and portfolio theory.

A concise way of saying the estimated efficient frontier implied by Markowitz’s mean-variance optimization method.

The Brazil stock pool includes all stocks currently listed at the B3 Stock Exchange. The China stock pool includes all stocks currently listed at the Shanghai and the Shenzhen Stock Exchanges. The India stock pool includes all stocks currently listed at the Bombay Stock Exchange and the National Stock Exchange of India. The Japanese stock pool includes all stocks currently listed at the Tokyo Stock Exchange. The US stock pool includes all stocks currently listed at the New York Stock Exchange and the NASDAQ Stock Market. The UK stock pool includes all stocks currently listed at the London Stock Exchange.

The method to estimate the concentrated market frontier is nonparametric, which is generally known for boundary bias. This is the reason we follow the common practice in nonparametric estimation by trimming the observations close to the boundaries. To ensure comparability, both frontiers are estimated based on the same trimmed data set.

Andersen TG, Bollerslev T (1998) Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. Int Econ Rev 885–905

Bali TG, Peng L (2006) Is there a risk-return trade-off? Evidence from high-frequency data, Journal of Applied Econometrics 21:1169–1198

Google Scholar

Bird R, Pellizzari P, Yeung D, Woolley P, et al (2012) The strategic implementation of an investment process in a funds management firm. Technical report

Blume ME, Friend I (1975) The asset structure of individual portfolios and some implications for utility functions. The Journal of Finance 30:585–603

Article Google Scholar

Brands S, Brown SJ, Gallagher DR (2005) Portfolio concentration and investment manager performance. International Review of Finance 5:149–174

Buffett W (1994) Letter to shareholders, Berkshire Hathaway Annual Report

Buser SA (1977) Mean-variance portfolio selection with either a singular or nonsingular variance-covariance matrix. Journal of Financial and Quantitative Analysis 12:347–361

Campbell JY (2018) Financial Decisions and Market - A Course in Asset Pricing. Princeton

Campbell R, Huisman R, Koedijk K (2001) Optimal portfolio selection in a Value-at-Risk framework. Journal of Banking & Finance 25:1789–1804

Caselli F, Ventura J (2000) A representative consumer theory of distribution. The American Economic Review 90:909–926

Chen T, Yang F (2020) Think outside the envelop—efficiency bound estimation through extreme value theory, Working Paper

Choi N, Fedenia M, Skiba H, Sokolyk T (2017) Portfolio concentration and performance of institutional investors worldwide. Journal of Financial Economics 123:189–208

Daniels MJ, Kass RE (1999) Nonconjugate Bayesian estimation of covariance matrices and its use in hierarchical models. Journal of the American Statistical Association 94:1254–1263

Dekkers AL, Einmahl JH, De Haan L et al (1989) A moment estimator for the index of an extreme-value distribution. The Annals of Statistics 17:1833–1855

Dietrich, D., L. Haan, and J. Hüsler (2002): Testing extreme value conditions, Extremes, 5, 71–85.

Ekholm A, Maury B (2014) Portfolio concentration and firm performance. Journal of Financial and Quantitative Analysis 49:903–931

Evans JL, Archer SH (1968) Diversification and the reduction of dispersion: An empirical analysis. J Finance 23:761–767

Fang C-R, You S-Y (2014) “The impact of oil price shocks on the large emerging countries’ stock prices: Evidence from China. India and Russia”, International Review of Economics 29:330–338.

Feibel BJ (2003) Investment performance measurement, Vol 116, Wiley

Fisher L, Lorie JH (1970) Some studies of variability of returns on investments in common stocks. The Journal of Business 43:99–134

Floros C (2005) Price linkages between the US, Japan and UK stock markets. Financial Markets and Portfolio Management 19:169–178

Gay Jr RD et al (2008) Effect of macroeconomic variables on stock market returns for four emerging economies: Brazil, Russia, India, and China. Int Business Econ Res J (IBER), 7

Ghysels E, Santa-Clara P, Valkanov R (2005) There is a risk-return trade-off after all. Journal of Financial Economics 76:509–548

Goetzmann WN, Kumar A (2008) Equity portfolio diversification. Review of Finance 12:433–463

Goetzmann WN, Li L, Rouwenhorst KG et al (2005) Long-term global market correlations. The Journal of Business 78:1–38

Goldman E, Sun Z, Zhou X (2016) The effect of management design on the portfolio concentration and performance of mutual funds. Financial Analysts Journal 72:49–61

Hamao Y, Masulis RW, Ng V (1990) Correlations in price changes and volatility across international stock markets. The Review of Financial Studies 3:281–307

Ivković Z, Sialm C, Weisbenner S (2008) Portfolio concentration and the performance of individual investors. Journal of Financial and Quantitative Analysis 43:613–655

Jenkinson AF (1955) The frequency distribution of the annual maximum (or minimum) values of meteorological elements. Quarterly Journal of the Royal Meteorological Society 81:158–171

Jorion P (2010) Financial risk manager handbook. Wiley

Kacperczyk M, Sialm C, Zheng L (2005) On the industry concentration of actively managed equity mutual funds. The Journal of Finance 60:1983–2011

Kent, J. T. (1983): Information gain and a general measure of correlation, Biometrika, 70, 163–173.

Keynes JM, Moggridge DE, Johnson ES et al (1983) The collected writings of John Maynard Keynes, vol. XII, Macmillan, London

Ledoit O, Wolf M (2003) Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. Journal of Empirical Finance 10:603–621

Ledoit O, Wolf M (2004) Honey, I shrunk the sample covariance matrix, The. J Portfolio Manag 30:110–119

Ledoit O, Wolf M (2012) Nonlinear shrinkage estimation of large-dimensional covariance matrices. The Annals of Statistics 40:1024–1060

Ledoit O, Wolf M (2017) Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets Goldilocks. The Review of Financial Studies 30:4349–4388

Leonard T, Hsu JS et al (1992) Bayesian inference for a covariance matrix. The Annals of Statistics 20:1669–1696

Liu EX (2016) Portfolio diversification and international corporate bonds. Journal of Financial and Quantitative Analysis 51:959–983

Liu K (2017) Effective dimensionality control in quantitative finance and insurance, PhD thesis, University of Waterloo

Loeb GM (2007) Battle for investment survival, Vol 36, Wiley

Longin F (2016) Extreme events in finance: a handbook of extreme value theory and its applications. Wiley

Longin FM (2000) From Value-at-Risk to stress testing: The extreme value approach. Journal of Banking & Finance 24:1097–1130

Madaleno M, Pinho C (2012) International stock market indices comovements: A new look. International Journal of Finance & Economics 17:89–102

Markowitz H (1952) Portfolio selection, The. Journal of Finance 7:77–91

McNeil AJ, Frey R (2000) Estimation of tail-related risk measures for heteroscedastic financial time series: An extreme value approach. Journal of Empirical Finance 7:271–300

Mehra R (2008) Handbook of the equity risk premium. Elsevier

Mehra R, Prescott EC (1985) The equity premium: A puzzle. Journal of Monetary Economics 15:145–161

Merton R (1972) An analytic derivation of the efficient portfolio frontier. Journal of Financial and Quantitative Analysis 7:1851–1872

Mises RV (1954) La distribution de la plus grande de n valeurs. American Mathematical Society, Providence. RI. II:271–294

Modigliani F, Leah M (1997) Risk-adjusted performance. Journal of Portfolio Management 23:45–54

Oyenubi A (2019) Diversification measures and the optimal number of stocks in a portfolio: An information theoretic explanation. Computational Economics 54:1443–1471

Pappas D, Kiriakopoulos K, Kaimakamis G (2010) Optimal portfolio selection with singular covariance matrix. International Mathematical Forum 5:2305–2318

Pownall RA, Koedijk KG (1999) Capturing downside risk in financial markets: The case of the Asian Crisis. J Int Money Finance 18:853–870

Rocco M (2014) Extreme value theory in finance: A survey. Journal of Economic Surveys 28:82–108

Saranya K, Prasanna PK (2014) Portfolio selection and optimization with higher moments: evidence from the Indian stock market. Asia Pac FinanMarkets 21:133–149

Sharkasi A, Crane M, Ruskin HJ, Matos JA (2006) The reaction of stock markets to crashes and events: A comparison study between emerging and mature markets using wavelet transforms. Physica A: Statistical Mechanics and its Applications 368:511–521

Statman M (1987) How many stocks make a diversified portfolio? Journal of Financial and Quantitative Analysis 22:353–363

Yang R, Berger JO (1994) Estimation of a covariance matrix using the reference prior. Ann Statist 1195–1211

Yeung D, Pellizzari P, Bird R, Abidin S, et al (2012) Diversification versus concentration... and the Winner is? Technical report

Download references

Acknowledgements

The corresponding author would like to thank Francisco Gonzalez and Tony Wirjanto for multiple insightful discussions of this topic.

Author information

Authors and affiliations.

School of Economics, Shanghai University of Finance and Economics, Shanghai, China

Department of Economics, University of Waterloo, Waterloo, ON, Canada

Yixuan Li & Tao Chen

Big Data Research Lab, University of Waterloo, Waterloo, ON, Canada

Yixuan Li, Kai Liu & Tao Chen

School of Mathematical and Computational Sciences, University of Prince Edward Island, Charlottetown, PEI, Canada

Senior Research Fellowship of Labor and Worklife Program, Harvard University, Cambridge, MA, USA

You can also search for this author in PubMed Google Scholar

Contributions

Not applicable

Corresponding author

Correspondence to Tao Chen .

Ethics declarations

The authors did not receive support from any organization for the submitted work.

Conflict of interest

The authors have no relevant financial or nonfinancial interests to disclose.

Ethics approval

Not applicable.

Consent to participate

Consent for publication, availability of data and materials.

The data that support the findings of this study are available from the corresponding author upon request.

Code availability

The code that support the findings of this study are available from the corresponding author upon reasonable request.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Derivations of the statistical methods

1.1 a.1: the mean-variance optimization.

This section provides the general setup of Markowitz’s mean-variance optimization. Let \(\varvec{E}\) be the vector of expected asset returns in the stock pool, \(\varvec{\mathrm {V}}\) be the covariance matrix of the returns, and \(\varvec{w}\) be the vector of weights indicating the fraction of portfolio wealth held in each asset. Assuming that short sales are permitted, the constrained minimization problem is as follows:

where \(\mu \) denotes the target expected return of the portfolio, and \(\varvec{1}\) denotes a vector of ones. The analytical solution to this problem is derived following Merton ( 1972 ), which we will not expand on here.

1.2 A.2: The DR method

We elaborate on the DR method first introduced by Liu ( 2017 ), which effectively reduces the number of stocks, while still preserves the variance in the market. Suppose that there are N assets with asset prices \(S^{(1)},S^{(2)},...,S^{(N)}\) in the market. Based on the multivariate Black-Scholes model, the asset price processes \(\left\{ S_t^{(h)}\right\} \) for \(h = 1,2,...,N\) solves the stochastic differential equation

where \(B_t^{(1)},B_t^{(2)},...,B_t^{(N)}\) follow the independent standard Brownian motions, \(r_t\) is the short rate of interest, and \([\sigma _{hl}]\) is the matrix capturing the correlation among the assets. Then, the solution to Equation ( 1 ) is

Let \(t_0=0\) , \(t_1 = \Delta ,...,t_m=m\Delta \) be the time steps with equal space \(\Delta \) , and suppose that the continuous forward rate is constant within each period. We denote \(f_j\) as the annualized continuous forward rate for period \(\left( t_{j-1},t_j\right) \) such that

Then, we have

For \(j=1,2,...,m\) , let \(A_j^{(h)}\) be the accumulation factor of the \(h^{th}\) index for the period \((t_{j-1},t_j)\) , that is,

Combining Equation ( 2 ) to ( 4 ), we get

By the property of Brownian motion, we know that \(Z_1^{(l)},Z_2^{(l)},...,Z_m^{(l)}\) are independent random variables with a standard normal distribution. From Equation ( 5 ), we derive the continuous return for the period \((t_{j-1},t_j)\)

The mean and covariance matrix of the returns are given by

Let \(\Sigma \) be the covariance matrix of the annualized continuous returns of the N stocks and

be the Cholesky decomposition of \(\Sigma \) such that

where \({\mathbf {A}}^\intercal \) is the transpose of \({\mathbf {A}}\) . Then, the variance contribution, also known as the explained variance (e.g., Kent 1983 ), of the first \(N_{DR}\) assets with the highest Sharpe ratios can be defined as

where \(A_i\) is the \(i^{th}\) column of \({\mathbf {A}}\) . In this paper, the reduced dimensionality \(N_{DR}\) is the minimum number of assets needed to reach the \(95\%\) explained variance, and the dimensionality reduction is achieved when \(N_{DR}<<N\) .

1.3 A.3: The EVT method

In this section, we discuss the EVT method in further details. We take one stock market, say the China market, as an example and exclude all non-positive returns since our concern is the right-tail return. Let \(X_{1},X_{2},...,X_{n}\) denote the observations of returns in one group, say G1. We consider these n returns as i . i . d . observations from some distribution function F . Let \(X_{1,n} \le X_{2,n} \le ... \le X_{n,n}\) be the associated order returns, so that \(X_{n,n}\) denotes the maximum return in G1. Then, according to Mises ( 1954 ) and Jenkinson ( 1955 ), if the maximum \(X_{n,n}\) , suitably centered and scaled, converges to a non-degenerate random variable, then there exist sequences \(\{a_n\}\) \((a_n > 0)\) and \({b_n}\) \((b_n \in {\mathbb {R}})\) such that

for some \(\gamma \in {\mathbb {R}}\) , with x such that \(1+\gamma x > 0\) . That is, F is in the domain of attraction of some extreme value distribution function \(G_\gamma \) and \(\gamma \) is the extreme-value index. By taking logarithms, Equation ( 6 ) can be written as

where \(q \in {\mathbb {R}}^+\) and \(a_q\) and \(b_q\) are defined by interpolation. We take \(b_q = U(q)\) with

where \(-1\) denotes the left-continuous inverse.

We then estimate \(\gamma \) , \(a_q\) and \(b_q\) as follows. Let, for \(1 \le k < n\) ,

We use the moment estimators for \(\gamma \in {\mathbb {R}}\) introduced by Dekkers et al. ( 1989 ):

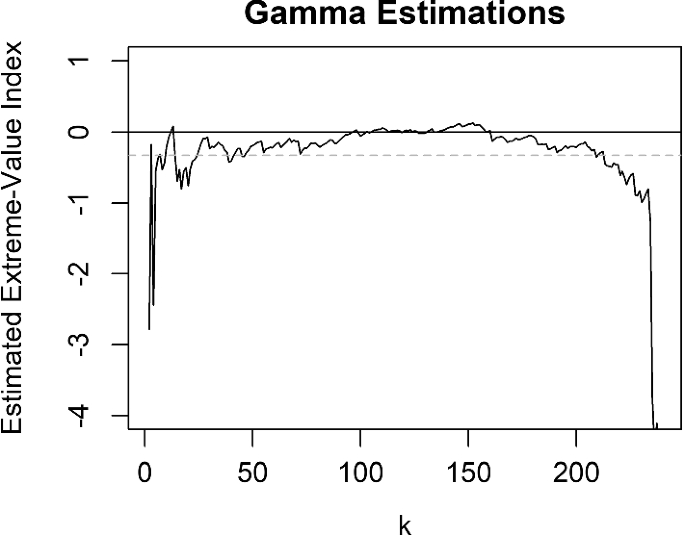

Specifically, we first test that \(\gamma \) exists for all groups according to Dietrich et al. ( 2002 ). Next, we plot \(\hat{\gamma }\) as a function of k , which is the number of upper order statistics used for estimation minus 1. Then, we determine the first stable region in k of the estimate from the moment estimator plot. Namely, we try to identify a set of consecutive values of k where the estimated values do not fluctuate much, so that the procedure is insensitive to the choice of k in such a region. For the moment estimator in G1 for the China market, as illustrated in Fig. 9 , such a stable region runs from around \(k = 30\) to \(k = 200\) .

Moment estimator versus k for G1 of the China Market

Next, we define the following estimators for \(a_n/k\) and \(b_n/k\) :

Then, our goal is to estimate the right endpoint

of the distribution function F , that is, the ultimate return of G1 based on the observed returns. When estimating the endpoint, we assume that \(\gamma < 0\) . Next, it can be shown that Equation ( 6 ) is equivalent to

As t gets large, we can write

Because \(\gamma <0\) this yields, for large x and setting \(q=n/k\) ,

Therefore, \(x^*\) can be estimated as

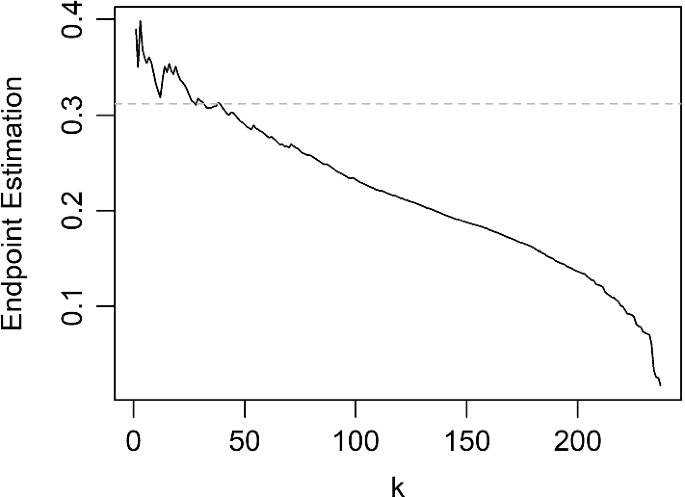

where \(\hat{\gamma } <0\) , and \(\hat{x}^*:=\infty \) otherwise. The endpoint estimate of G1 for the China is shown in Fig. 10 , and the selected estimate is the dotted horizontal line.

Endpoint estimators versus k for G1 of the China Market

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Xu, J., Li, Y., Liu, K. et al. Portfolio selection: from under-diversification to concentration. Empir Econ 64 , 1539–1557 (2023). https://doi.org/10.1007/s00181-022-02300-x

Download citation

Received : 24 August 2021

Accepted : 18 August 2022

Published : 12 September 2022

Issue Date : April 2023

DOI : https://doi.org/10.1007/s00181-022-02300-x

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Diversification and concentration

- Efficient frontier

- Market portfolio

- Extreme value theory

- Dimensional reduction

JEL Classification

- Find a journal

- Publish with us

- Track your research

- Open access

- Published: 16 June 2023

Portfolio diversification benefits before and during the times of COVID-19: evidence from USA

- Eman F. Attia ORCID: orcid.org/0000-0002-2006-0823 1 , 2 ,

- Sharihan Mohamed Aly 1 ,

- Ahmed said ElRawas 3 &

- Ebtehal Orabi Awad 4

Future Business Journal volume 9 , Article number: 26 ( 2023 ) Cite this article

3478 Accesses

1 Citations

Metrics details

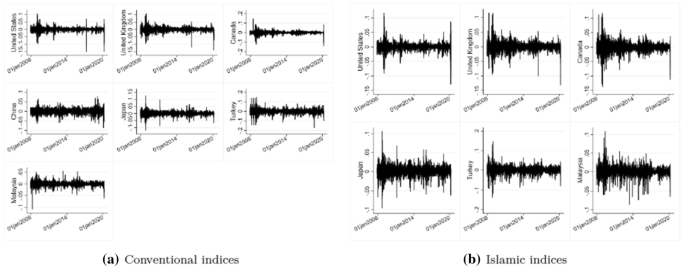

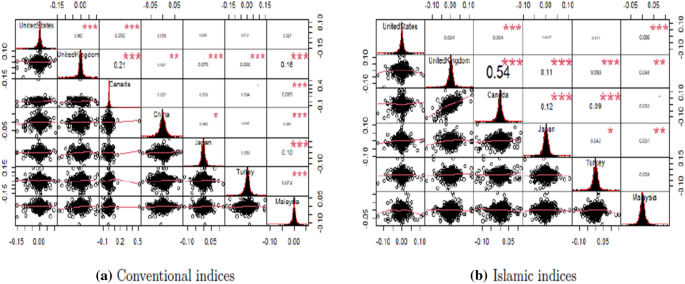

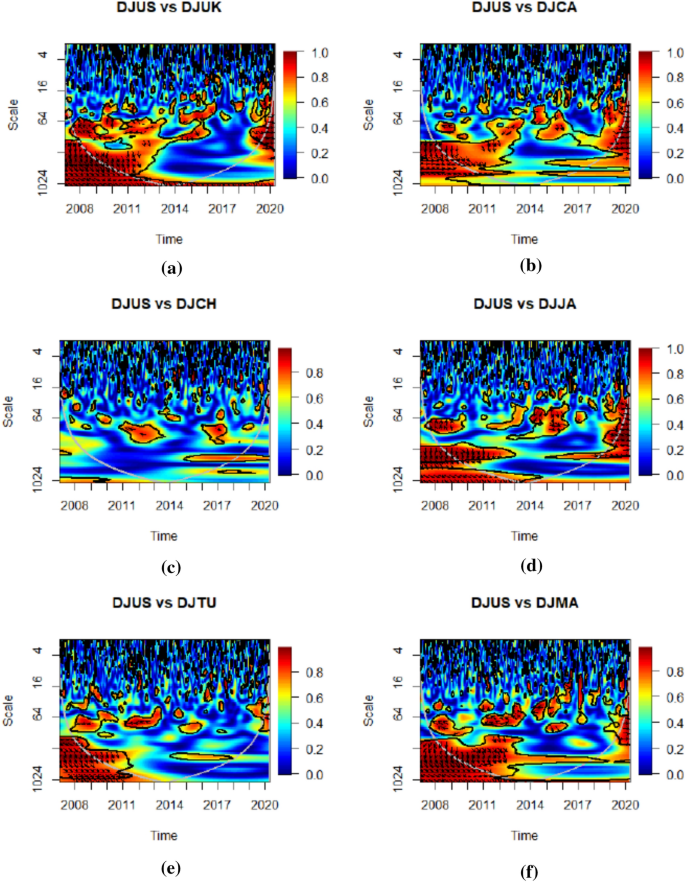

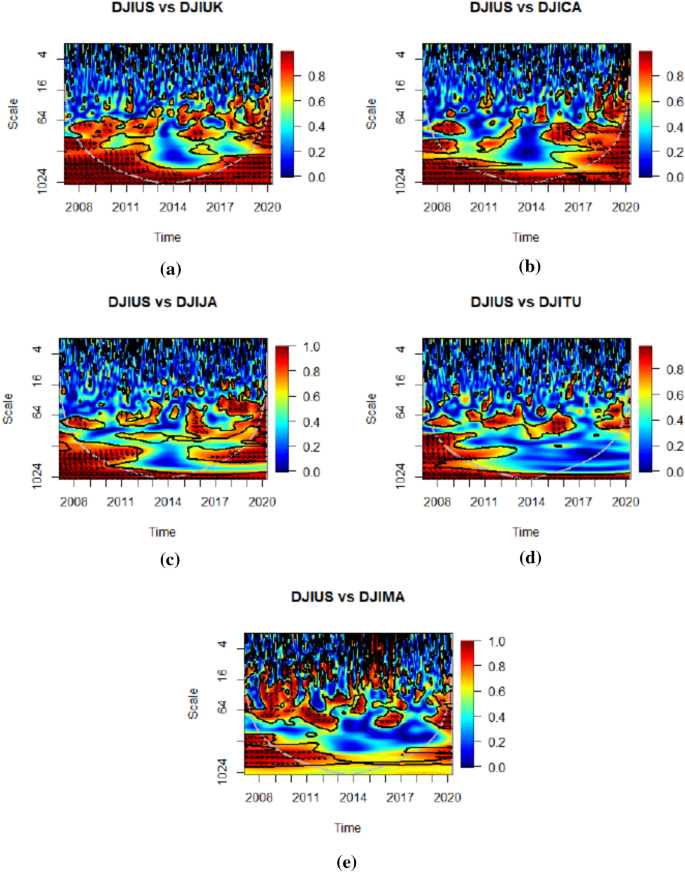

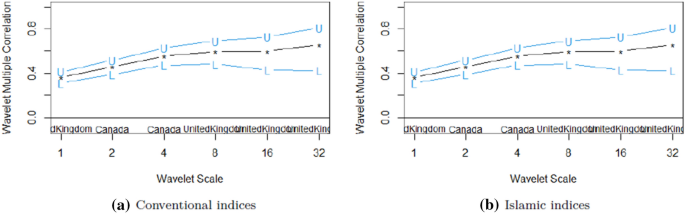

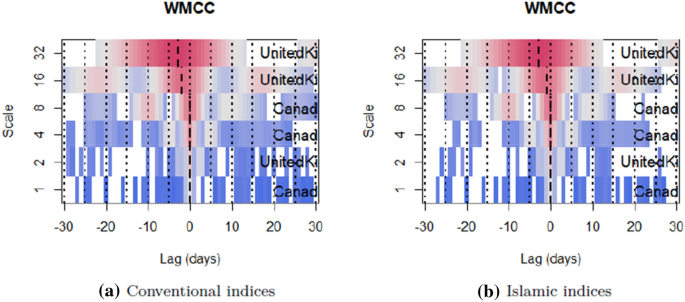

This paper investigates the portfolio diversification benefits for Islamic and conventional investors in the USA with its major trading partners (United Kingdom, Canada, China, Japan, Malaysia, and Turkey) before and during the COVID-19 crisis period. Using daily data from 2007 to 2020, we employ three relevant time-varying and timescale-dependent techniques, the continuous wavelet transform (CWT) analysis, the wavelet multiple correlation (WMC), and the wavelet multiple cross-correlation (WMCC). The findings suggest that conventional and Islamic US investors who invest with major trading partners may reap large diversification benefits for very short investment horizons (4–8), except for Sharia Malaysia index. However, they may not reap benefits for investment horizons of 8–16 and longer, except for China. In addition, COVID-19 crisis caused a poor diversification opportunity for US investors regardless of the regime they follow (conventional or Islamic). Moreover, the American industrial market depicts a state of impending perfect market integration. Finally, the UK and Canada seem to be the potential market leaders in different wavelet scales. These findings yield important policy implications.

Introduction