13 Market Research Tools: Best in Class for 2023

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Most market research tools are designed to make it quicker and easier to find relevant data . Whatever the market, product, or purpose, the right research tools can do just that.

But, let’s be honest, some do it far better than others.

Whether you’re an enterprise firm with complex needs and a budget to suit or a smaller business needing free market research tools, read on to discover which online tools for market research are hot right now.

Note: The top market research tools list has been collated using review platforms like G2 , along with direct feedback I collected from over 500 business leaders in June, 2o22.

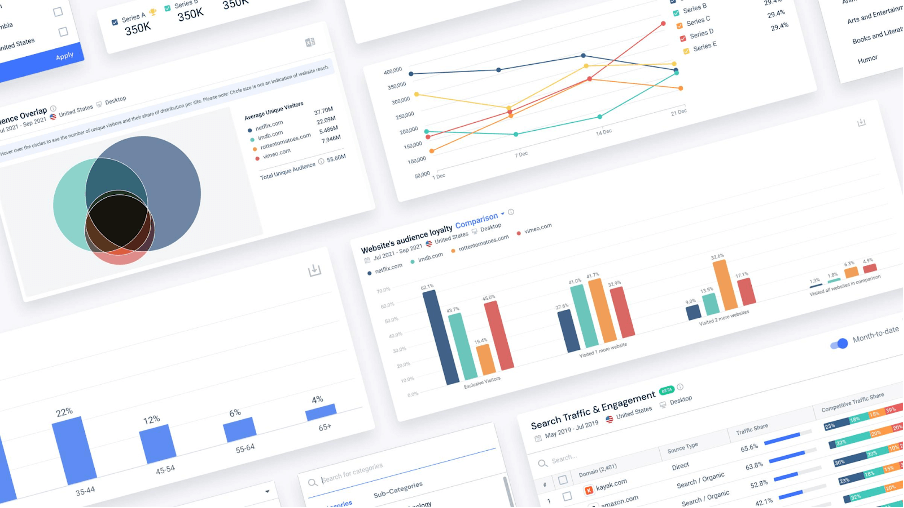

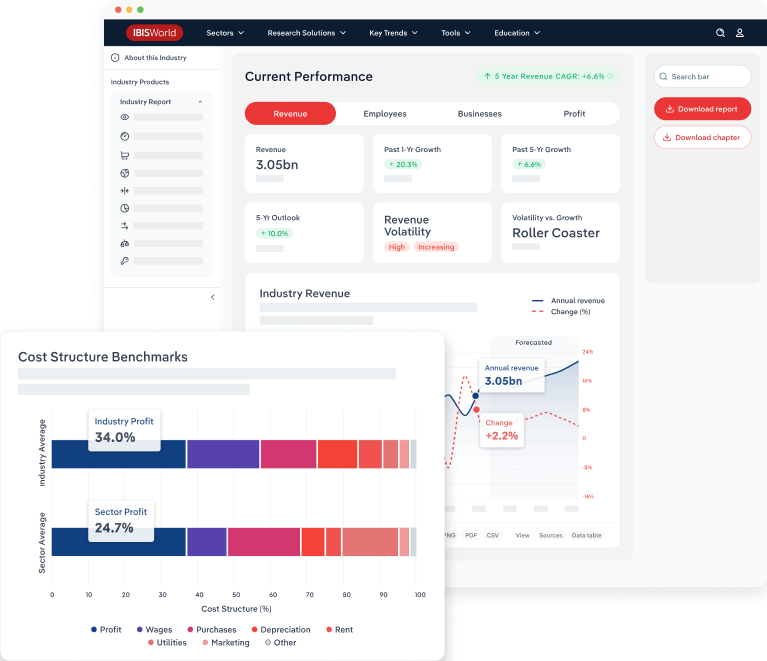

#1 Best overall market research tool: Similarweb Digital Research Intelligence

Most-loved feature: The Benchmarking tool

We might be a little biased, but this really is the fastest way to see how you measure up against competitors in any sector or location. Analyze market leaders and rising stars to unpack and track their digital success instantly.

Quick Explainer

Similarweb Research Intelligence is a single source of truth for the online world. Giving any business the ability to quickly analyze the online aspects of any industry or market in an instant. It displays critical insights in a way that makes it easy to view trends, competitive performance, audience insights, growth opportunities, and more. It’s the only market research analysis tool that brings together data from desktop, mobile web, and apps to provide a complete view of the digital landscape.

Key abilities

- Competitive benchmarking

- Market research

- Company research tool

- Audience analysis

- Consumer journey tracker

- Mobile app intelligence

Freemium Version: Yes, there is a lite version of the product that provides limited data for a single user, and a single location.

Free Trial: Yes, there’s a 7-day trial available. Try it out here .

Ongoing Subscription: Yes, you can pay monthly or annually for a subscription. Different levels are available, and each package is tailored. Review pricing and plans for Similarweb here.

Like what you’ve seen so far?

See our market-leading digital research tool in action in this quick 2-minute clip.

#2 Best free market research tool: Think with Google

Most-loved feature: Find my Audience

A way to discover new audiences on YouTube based on things like habits, interests, and intended plans to purchase.

Think with Google is a suite of digital research tools that curate resources from a huge pool of data across the web. It presents them as insights that aren’t typically available elsewhere. It’s a unique way to view trends, insights, and stats. Data isn’t offered in real-time but serves more as a library of figures and facts that take the form of articles, videos, interviews, case studies, and more. In addition to being a place people can go for forward-looking perspectives and data, there are several tools designed to help marketers.

Key functions

- High-level insights into most local or national markets

- Behind the scenes look at cross-platform digital campaigns

- Consumer insights

- Deck-ready stats (not in real-time)

- A range of tools to inform marketing objectives and actions

Freemium Version: The entire suite of market intelligence tools is free.

Free Trial: As a free market research tool, no trial is needed.

Ongoing Subscription: You can subscribe to a newsletter, but not the product.

#3 Best digital research tool for content and FAQ development: Answer the Public

Most-loved feature: Search listening alerts

A pro feature that sends you weekly emails that indicate how search behaviors shift over time. It takes the specific phrase or keywords you’re tracking in the platform and updates you weekly.

Quick Explainer

Discover the questions people are asking online about key terms, products, or services. It’s designed to help content teams and website owners develop new content ideas, and relevant FAQs that are based on the types of queries people ask online.

- Track important keywords and phrases

- Get weekly emails about changes in search behavior

- Enter any keyword to uncover relevant questions or search terms

- Folders to help organize your research

Freemium Version: Yes. You get a limited number (3) of searches per day.

Free Trial: No.

Ongoing Subscription: Yes. You can pay monthly or annually for this service. Pay-monthly fees are a flat rate of $99. Discounts are offered for yearly subscriptions.

#4 Best tool for market research surveys: SurveyMonkey

Most-loved feature: Question bank

A library of hundreds of questions, pre-written by survey methodologists.

As far as market research surveys go, it’s the leading online research tool for surveys worldwide. With plans to suit the individual through to the enterprise, it’s a feature-rich, easy-to-use platform that encompasses creation, collection, and analysis under one roof. Surveys are optimized for any device and integrate with platforms like Zoom, Salesforce, Marketo, and more.

Key functions

- Create and send unlimited surveys, quizzes, and polls

- Pop-up online surveys

- Mobile app access to create, send and analyze surveys on-the-go

- Team collaboration function (unlocked with a team plan)

- Survey builder

- Customization and branded surveys (available with advantage or premier plans only)

Freemium Version: Yes

Free Trial: Occasionally, free trials are offered for premium plans.

Ongoing Subscription: Yes, you can pay annually or monthly. There are three different plans to choose from, ranging from $25 to $129 per month.

Helpful: Check out our blog and see 18 different ways to use market research surveys .

#5 Best online research tool for marketplaces: Similarweb Shopper Intelligence

Most-loved feature: Cross-shopping analysis

Cross-shopping analysis shows you how loyal a segment of customers is to a brand, along with what other brands they browsed or bought from. Uncover competitors and discover new partnership opportunities; these are game-changing insights if you sell on any marketplace.

Similarweb Shopper Intelligence is a type of online market research tool that helps you uncover and analyze browsing and buying behavior across marketplaces. Using its data, businesses can track category, product, and brand performance with ease. It helps ecommerce organizations to detect potential threats, unearth new product or category opportunities, discover new potential partnerships, and optimize search strategy and performance.

- Monitor consumer demand for any product, brand, or category

- Retail search strategy optimization

- Consumer behavior insights

- Track cross-shopping, loyalty, and purchase frequency

- Analyze brand awareness

Note: This solution uses a unique data methodology via multiple networks and partnerships. At the time of writing, there is no other consumer behavior insights tool for market research that offers this quality of data for marketplaces.

Freemium Version: No.

Free Trial: Yes. There is usually a 7-day trial available here .

Ongoing Subscription: The price is determined by things like the number of categories and/or domains you want to access. Each quote is customized to a client’s specific needs.

Want to know a little more?

Watch this quick clip to see the best ecommerce digital market research tool in action.

#6 Best market research tool for brand tracking: Latana

Most-loved feature: MoE (margin of error) Readings

To deliver transparency on data confidence levels, Latana’s dashboard includes a feature that allows clients to toggle-on, or toggle-off, margin of error (MoE) readings on all data points. These are highlighted using a traffic-light system of confidence (red=low confidence, orange=medium confidence, and green=high confidence). This small feature makes a big impact — it helps clients to correctly interpret the data and to visibly see quality shortcomings.

Latana is a B2C brand tracking tool that provides granular insights about online audiences. It helps organizations understand how key segments of consumers feel about brands and portrays relevant standings vs. industry rivals.

- Focus on niche consumer segments that matter to your business

- Uncover rival’s audience data and identify opportunities to grow

- Understand brand perception, and track how it changes over time

- Discover the most well-known brands in your industry

- Track rival’s brand awareness across gender, age income, location, and education

- Find out the main purchase drivers for your industry

- Infrastructure gives reach to over 6 billion smartphone users globally for representative brand opinions

I caught up with Latana’s CMO, Angeley Mullens. Here’s what she has to say about their offering.

Ongoing Subscription: Pricing for Latana isn’t available online. All packages are tailored to individual brands and their specific needs.

Enjoy 360 Visibility 24/7

Get the data you need to adapt to market changes and industry trends in an instant.

#7 Best research tool for social media listening: Hootsuite

Most-loved feature: Multi-channel insights

It’s a legacy feature, but one which makes it the best online research tool for social listening and monitoring. Having the ability to easily schedule posts, ad campaigns, and handle responses for every social media channel from within a single platform is what makes this a market-leading digital research tool.

Hootsuite continues to claim the number 1 spot on G2’s list of digital research tools for social media monitoring . It’s a tool to help you manage all aspects of business social media, across multiple channels, in a single platform. As well as being able to manage your socials, it also keeps you up-to-date with the latest trends and activities of your rival’s social media channels.

- Publish and schedule social media posts

- Measure cross-platform results

- Message management

- Social media trend analysis

- Social media ad-campaign management

Freemium Version: Yes. You can get a free version that supports 2 social accounts and 1 user.

Free Trial: Yes. A 30-day free trial is available here .

Ongoing Subscription: There are four plans; professional, team, business, and enterprise; ranging from $49-$739.

#8 Best digital research tool for prospecting: Similarweb Sales Intelligence

Most-loved feature: Insights generator tool

The insights generator shows you unique facts for your prospects and accounts; with complete visibility into their digital strategy and performance. It’s ideal for refining sales and marketing efforts while staying focused on growth.

Similarweb Sales Intelligence helps organizations find viable prospects by showing you who to reach out to, when to do it, and how to capture their attention. The lead generator tool helps you find the right prospects, and key insights help create engaging outreach emails. For sales departments, ecommerce and mar-tech sectors, this type of digital research tool can take prospecting and engagement to a completely new level; along with revenue and growth.

Key functions:

- Lead generation and enrichment

- Digital insights for 100M+ ecommerce websites, publishers, and advertisers

- Fraud detection

- Sales engagement

- SFDC integration

Free Trial: Yes, if you would like a free trial, please request that here.

Ongoing Subscription: Prices for this digital market research tool varies depending on the package and options chosen. Grab a live demo of the product and get a tailored quote here .

Insightful : If you’re looking at market research tools for the ecommerce industry, bookmark our Ecommerce Trends and Predictions for 2023 to read later.

#9 Best market research analysis tool for data visualization: Tableau

Most-loved feature : Connects to almost any data source

As a clear market leader, and a no-brainer for larger organizations with business intelligence analytics and teams. Tableau leads the way in online research tools for data visualization . It connects to a huge range of data sources and pulls information into a highly-appealing dashboard that is designed to make it easier and faster to explore and manage data . It takes data from platforms like Similarweb, then combines it with other data sources before presenting crisp, clear, insights that have the power to shape strategies and drive key transformations.

- Lightning-fast analytics

- Smart dashboards for richer insights

- Live connection to almost any data source, with automatic updates

- Drag-and-drop style UI: easy to use

Freemium Version: No. However, students and teachers get a year’s free access to the platform.

Free Trial: Yes. You can subscribe to a free 30-day trial.

Ongoing Subscription: Most plans are offered annually, with prices ranging from $15 per month upwards. The price depends on whether you use their hosted or on-premise versions, the number of users, and the inclusion of specific plugins.

#10 Best market research tool for UX testing: Loop11

Most-loved feature: Online usability testing

This feature analyzes the usability of a website with users performing live tasks on a site. It helps you understand user behavior, and shows how and why a website is used.

Loop11 is a market research tool that provides usability testing to help organizations build better websites and products. It comes with a pack of useful features that provide both moderated and unmoderated testing, helping businesses to find the right audience to test prototypes and products. It’s designed to help you see how appealing a product is to a particular audience, determine their preferences, then build these insights into a design.

- Ability to test across multiple devices, including tablet, mobile, or desktop

- User-friendly test builder that requires no coding

- Easy-to-add surveys that collect psychographic and demographic data

- Provides useful metrics like time on task, task completion rates, and NPS

- Mapping of customer journeys during a test period

Free Trial: Yes, a 14-day trial is available here .

Ongoing Subscription: All plans come with the option to pay monthly or annually. Prices range from $199-$599 per month.

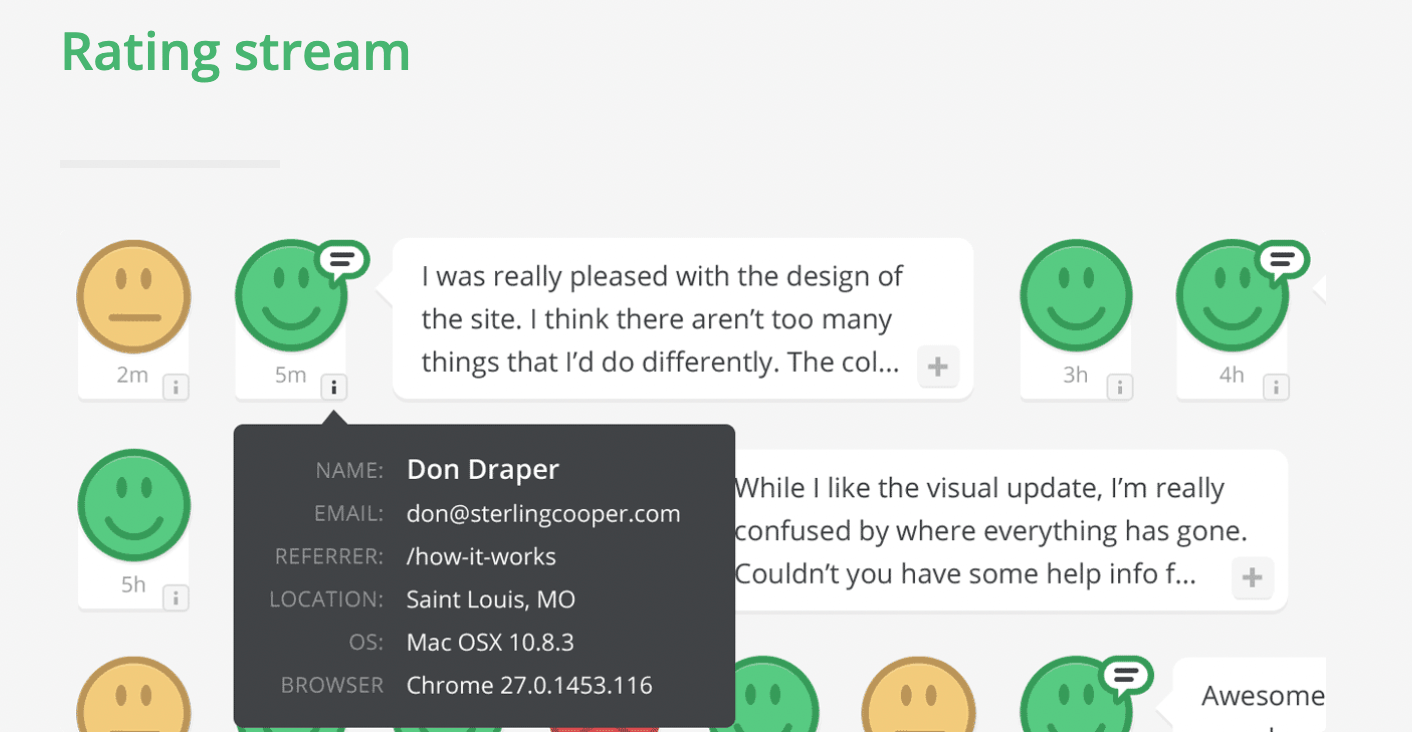

#11 Best research tool for measuring customer experience: Temper

Most-loved feature: Rating stream

See real-time feedback as customers respond to questions via website or email channels. The stream provides a detailed view of ratings, comments, locations, referrers, email addresses, and more.

Temper allows any company to find out how customers feel about their product at all times. It directly provides first-party data to a business, preventing the need to design and distribute complex surveys. It can be placed as a widget on the site or in emails, and questions are asked to gain real-time feedback from visitors and customers alike.

- Easily deploy questions across website and email channels

- Quickly spot poor experiences to identify problematic areas of a business or product

- The rating graph gives you a real-time view of results for any question asked

- Public rating wall shows how you’re performing, instilling confidence and trust

- Ratings come with open text fields to give additional context to responses

- Referrer data gives you the ability to segment feedback and relative performance

- Tracking variables let you send data with ratings, such as order numbers, user IDs, etc.

- User targeting lets you determine who sees questions and how often they see them

Freemium Version: There is no freemium version. However, their hobby plan gives you a slimmed-down version of the product and costs $12 per month.

Ongoing Subscription: Four plans are available, ranging from hobbyist to enterprise. The lowest pricing tier starts at $12 monthly, and their top-tier solution costs $199 monthly. All plans are pay-monthly, with a 60-day money-back guarantee.

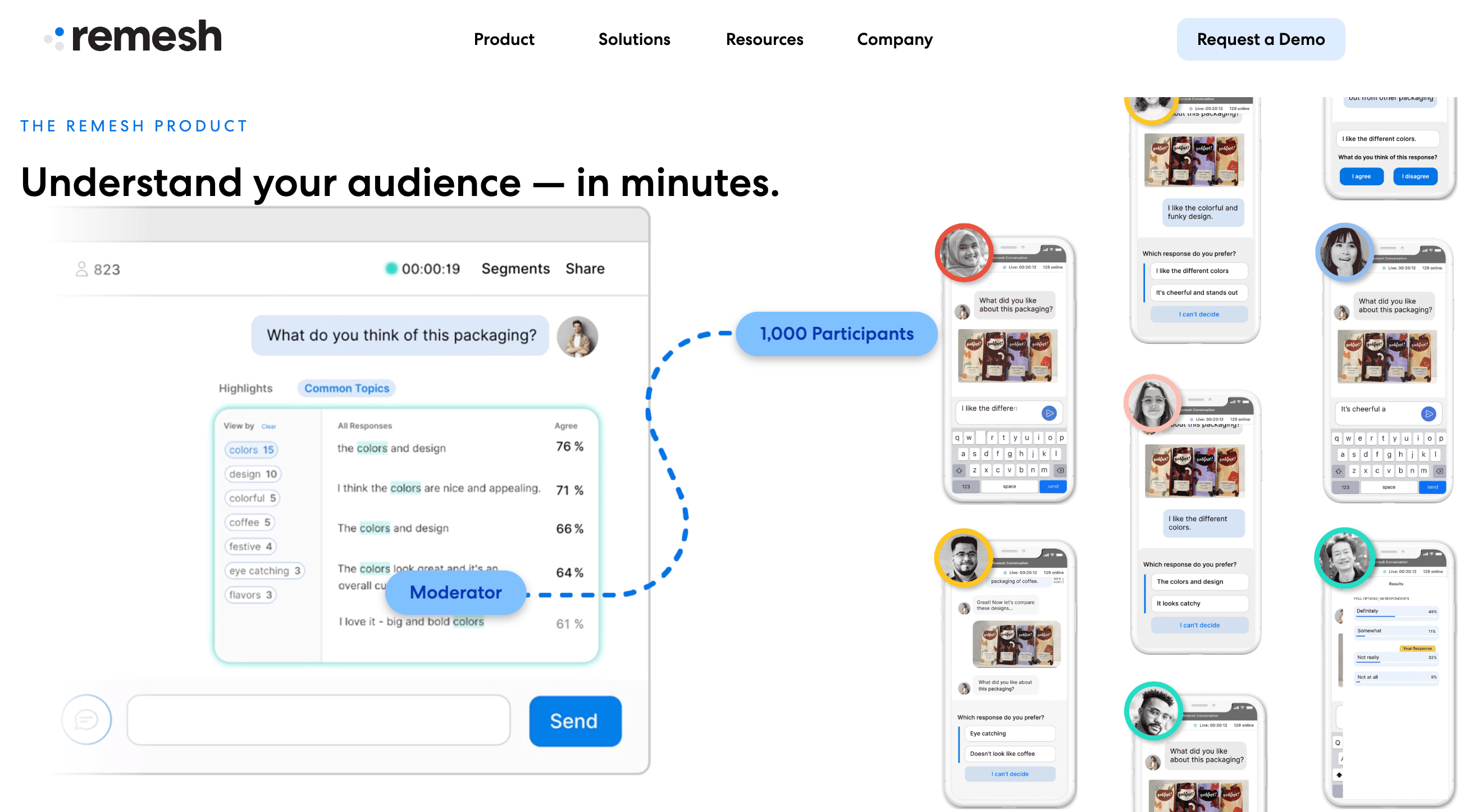

#12 Best online market research tool for focus groups: Remesh

Most-loved feature: Common topics

In just a few clicks, you can view the themes and topics that are most common with your focus group across an entire session. It groups similar responses, specific phrases, and interesting responses in seconds.

Remesh facilitates live, qualitative conversations with focus groups of up to 1000 people at a time. Replicating the focus group format online delivers powerful segmentation and dynamic capabilities that speed up your time to insight and let you hold a real-time conversation at scale.

- Launch a live conversation with up to 1000 people at a time

- Organize and analyze responses in an instant

- Segment your audience based on demographic and response data

- Share visuals and text-based content with the group to get instant feedback

- The algorithm analyzes open-ended responses in real-time

Freemium Version: No

Free Trial: Yes. However, you must first book a demo with a member of their team.

Ongoing Subscription: Remesh provides custom pricing plans that can only be obtained once you’ve taken a demonstration of their platform with a member of their team.

#13 Top collaboration and documentation tool for market research: BIT.AI

Most-loved feature: Content library + smart search

While it sounds quite basic; in essence, this tool for market research professionals makes it quicker and easier to keep track, share, and store key data. Forget trawling through emails, slack, and g-docs to find files; the smart search feature helps you locate files in an instant.

A dynamic platform that helps researchers collaborate, track, share, and manage research data in a single place. This is one of the best online market research tools for those who need a place to bring together resources like websites, PDFs, articles, images, infographics, blogs, reports, videos, etc. it’s low-cost and connects to some of the most widely used tools. Being able to share multidimensional data with others, or simply keeping track of secondary market research in a single place makes it a firm favorite.

- Over 100 integrations with applications like Tableau, Miro, G-docs, Onedrive, and more

- Real-time editing and live collaboration

- Content Library

- Smart search

- Supports a huge range of content and file types

Freemium Version: Yes. Available for teams of up to 5 collaborators.

Free Trial: Yes, a free trial is available here .

Ongoing Subscription: A range of packages are available, costing between $8-$20 monthly.

Best market research tools for startups

There is another often-forgotten set of tools used for market research that are ideal for startups. If you’ve got zero budget and a little time on your hands, you can do most types of desk research for free. Sources include:

- Company reports, case studies, and whitepapers

- Research and trade associations

- Media coverage

- Internal sales or usage reports

- Academic or scientific journals

- Government and non-government agencies

- Public library records

- Competitor websites

- Educational institutions

Helpful: Check out this article about how to do market research for a startup .

Wrapping up….

With cost and time key considerations for anyone looking at tools for market research, it’s vital to choose wisely. While free market research tools are all good and well, they won’t always serve you when you’re on a deadline or require key insights on a specific competitor, market, or product.

Similarweb helps companies win in the digital world. Whatever the market, goal, or business size, its solutions are designed to help organizations understand their market and compete and beat rivals.

Take it for a test run today. Trial any Similarweb solution free for the first 7-days using this link .

Need to know more about the ROI of Similarweb?

What are the best market research tools for secondary research?

The internet is probably the best tool for market research there is. It’s a goldmine of secondary market research data. But beware of data validity and check your information is coming from a trusted source.

What are the best market research tools for surveys?

Survey monkey is considered the best online market research tool for surveys, but key players like Typeform and Zoho follow closely behind. Budget and features usually determine the right tool for your needs.

What are the best free market research tools?

The best free tools for market research include: Answer the Public, Think with Google, Similarweb lite, SurveyMonkey’s basic plan, and Hootsuite’s free plan.

What are the best market research tools for qualitative research?

Qualitative research includes things like focus groups, open-ended surveys, case studies, and observation research. As such, the best tool for online research like this would be something like BIT.ai’s documentation and collaboration tool. Another useful tool for qualitative market research would be an online survey provider, like SurveyMonkey, Typeform, or Google Forms.

What are the best market research tools for quantitative research?

As this type of research is focused more on numbers, the best quantitative market research tools include things like Similarweb Digital Research Intelligence and Tableau. Each performs a different function but works together to collect, analyze, and present data in the most useful way possible.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

Importance of Market Research: 9 Reasons Why It’s Crucial for Your Business

Audience Segmentation: Definition, Importance & Types

Geographic Segmentation: Definition, Pros & Cons, Examples, and More

Demographic Segmentation: The Key To Transforming Your Marketing Strategy

Unlocking Consumer Behavior: What Makes Your Customers Tick?

Customer Segmentation: Expert Tips on Understanding Your Audience

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

6 Key Market Research Industry Trends (2024)

You may also like:

- Key Email Marketing Trends

- Key IT Trends

- Important UX Design Trends

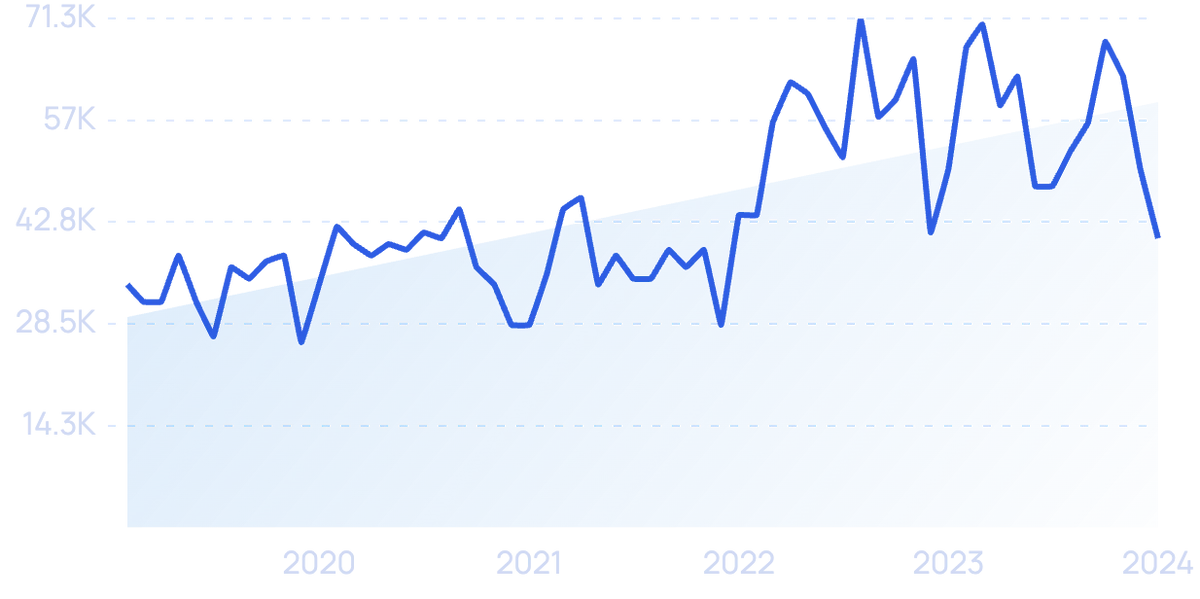

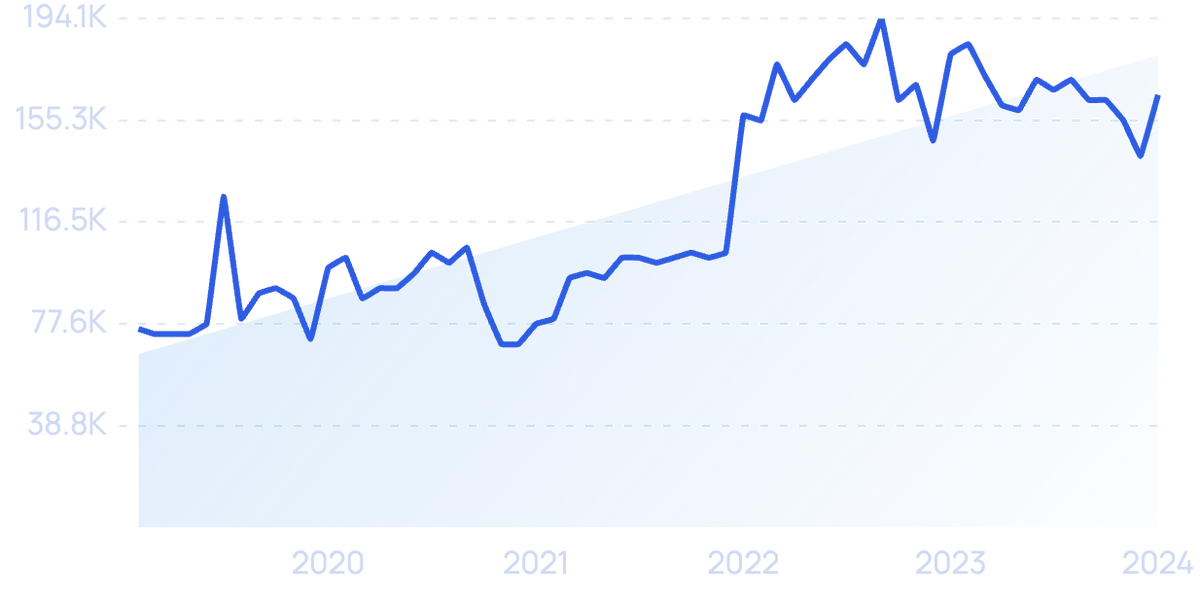

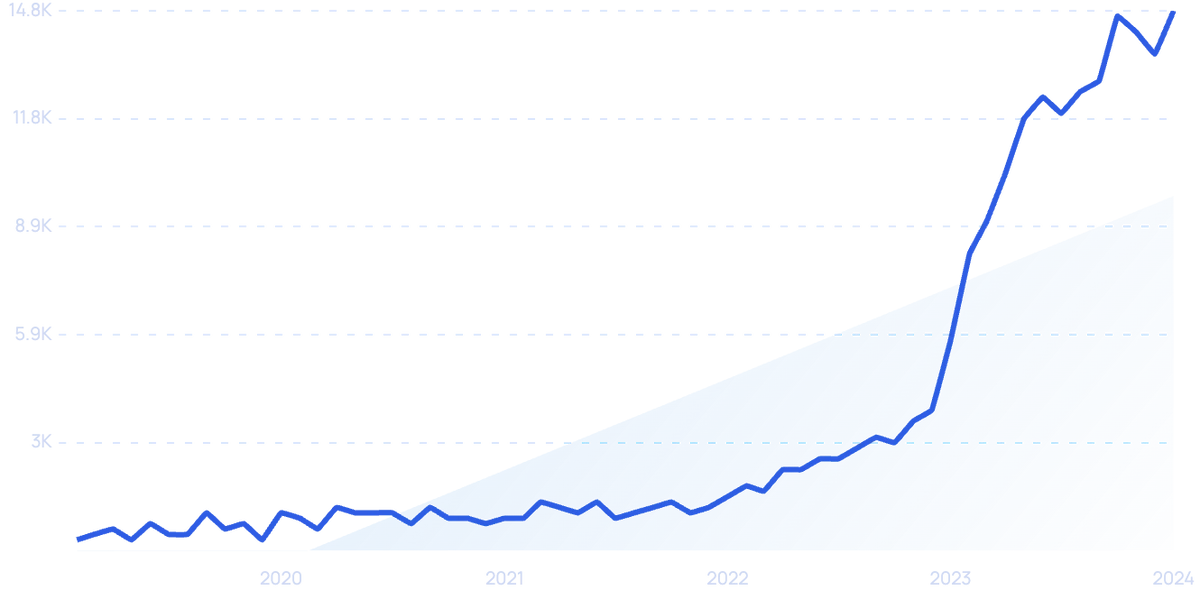

The value of the global market research industry grew by more than $40 billion dollars between 2012 and 2022. The industry is currently worth over $82.62 billion and shows no signs of slowing down.

This valuation isn’t surprising — information is everywhere. Unprecedented volumes of data, up-to-the-minute insights, and truly global audiences mean the market research industry is constantly shifting in an effort to keep up with ever-changing consumer preferences.

In this report, read about the top six trends that we expect to drive the market research industry in 2024 and the years to come.

1. Online surveys transition to mobile-first

In recent years, the market research industry has been sticking to what they know: online surveys work.

Today, nearly 90% of market researchers say they use online surveys regularly.

Market researchers have come to rely on online surveys because they’re fast and cost-effective .

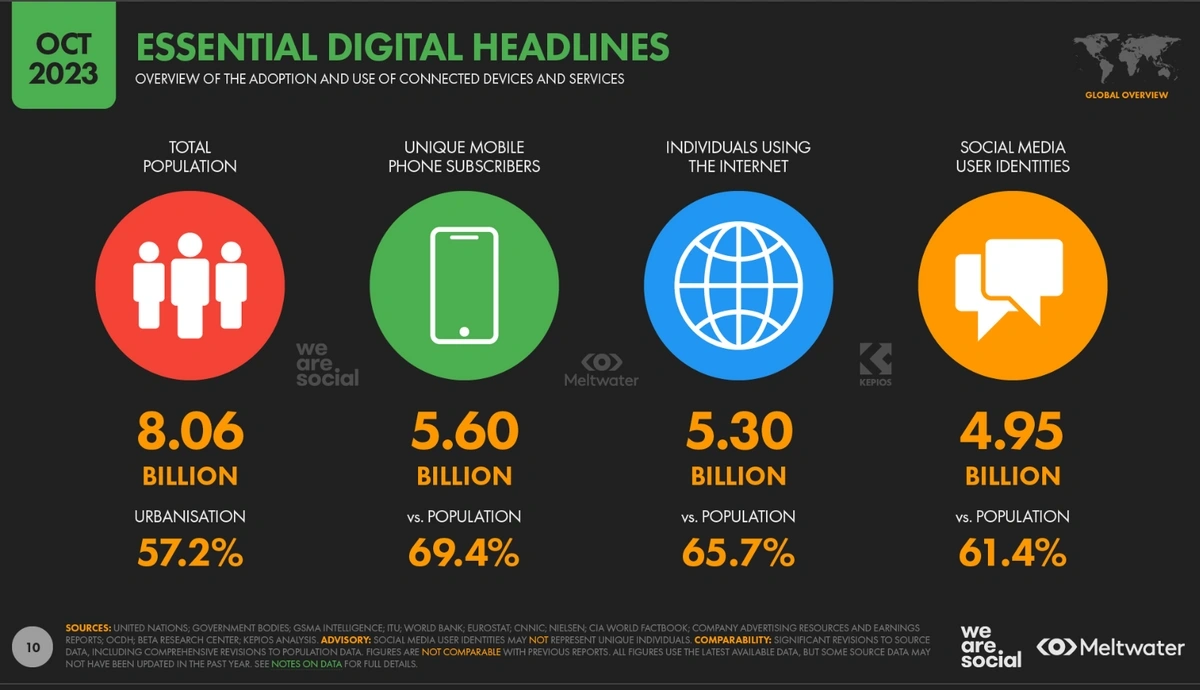

Nearly all consumers are on the internet — only 37% of the world , including people in developing countries, has never been online.

Statistics show that 5.3 billion people use the internet as of late 2023, and that number is growing by 3.7% each year.

Experts expect the popularity of the online survey market to stay high, growing 16% each year through 2026.

With the popularity of online surveys, it’s logical to expect to see similar popularity in mobile surveys.

Across the globe, 68% of website visits in 2020 came from mobile devices. That’s nearly a 5% increase over 2019.

However, only 60% of market researchers say they use mobile surveys regularly.

Experts point to poor UX and survey length as reasons why consumers don’t complete surveys on their smartphones.

Searches for "UX design" have increased by 118% in the last 5 years.

At the end of 2018, 33% of online surveys were started via mobile.

That was a substantial increase from 2013 when only 3-7% of surveys were taken on smartphones .

SurveySparrow , a company founded in 2017, aims to make mobile-first surveys the future of market research.

The company’s founder was inspired by WhatsApp, keeping the tone of the platform’s surveys convenient and conversational.

SurveySparrow says their approach gets a 40% higher completion rate than traditional online surveys.

Pollfish , another mobile-first survey company, stresses that mobile surveys are a much better option than desktop online surveys.

They say mobile surveys provide a greater reach, especially to consumers in Gen Z, and drive an increased response rate.

Experts suggest that mobile-first surveys must optimize the user experience . Doing so can lead to data differences of 10 percentage points or more.

2. Redefining the representative sample

Market researchers have always been mindful to create their groups of research participants in proportion to the population of the market as a whole.

In other words, they recruit participants that mirror their target audience in terms of gender, age, and location.

In the past few years, there’s been a push to expand what a “ representative sample ” truly means.

In one survey, 80% of market researchers said they were interested in learning best practice solutions for multicultural insights, research, and strategy.

The CEO of ThinkNow , a cultural insights agency, described it this way:

“An inclusive approach to research relies on a diverse sample of respondents and employs cultural understanding to provide psychological safety for them. This enables you to gather open and honest responses”.

The inclusion standard extends beyond ethnicities to include people with physical disabilities, those with intellectual disabilities, and people in LGBTQ+ communities.

Inclusive market research doesn’t present an entirely new way of doing things. But it does include several meaningful changes that can drastically improve the quality of the data collected.

For example, researchers are becoming more mindful of the nature of their questions. Are they offensive or dismissive to certain groups of participants? Are they stereotypical or inclusive?

Conducting market research among Millennials is one example where diversity in the audience is essential.

When it comes to Millennials in the United States, Hispanics make up more than 20% of the group . In order to get accurate data, market researchers must ensure the makeup of their sample is 20% Hispanic.

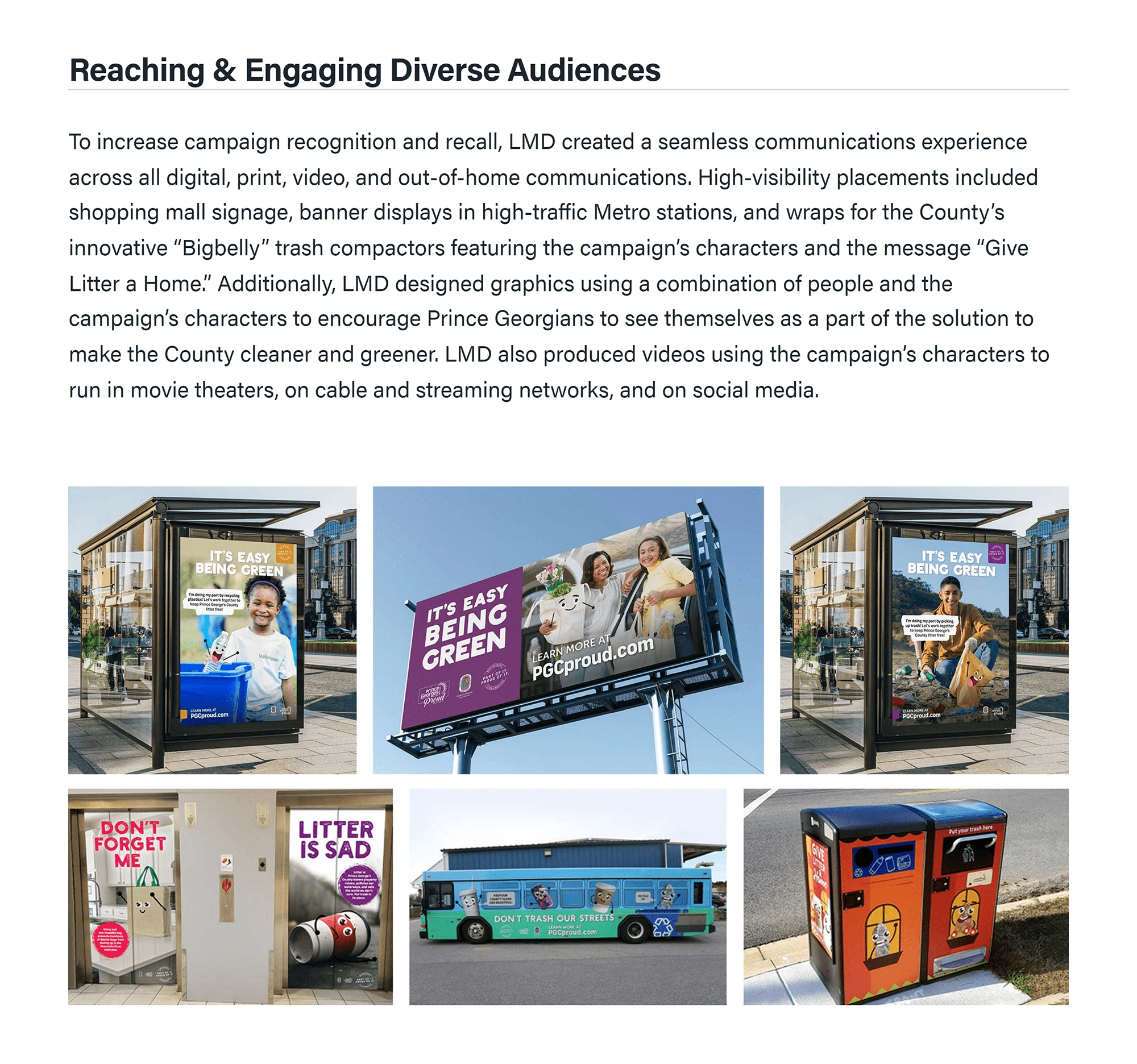

LMD, a Maryland-based communications agency, recently completed market research for a multi-year anti-litter campaign for Prince George’s County.

They were careful to draw upon a diverse group of participants that matched the County’s actual population breakdown: 61% Black, 14% Hispanic/Latinx, 12% white, and 12% other races/ethnicities.

They also completed the research in English and Spanish , further serving the diverse group of research participants.

3. Video becomes the tool of choice for qualitative research

Research from Take Note found that 93% of market researchers are using online/video focus groups more often than three years ago .

They also discovered that 90% are using consumers’ online video submissions and in-depth video interviews more than they were three years ago.

The main reason behind this transition? Consumers are now much more comfortable being “on camera”.

Thanks to the pandemic, video conferencing platforms are now part of daily life for many people. In fact, more than 300 million people used Zoom every day during its peak.

They’re also ready and willing to create user-generated content . More than 5 million videos were shared when Instagram first debuted its video feature.

Experts agree that companies can gain more market insights through video than text.

Video is more interactive, more genuine, and provides “unspoken” data like body language, tone, and facial expressions.

Medallia’s LivingLens video software offers companies the opportunity to capture 6x more information with video surveys compared to open-ended text responses.

Nearly every industry is taking advantage of video-based market research , from automotive companies to the beverage industry, to healthcare organizations.

Del Taco recently launched a video feedback initiative. The company took advantage of more than 10 hours of customer video content in reaction to menu changes.

In the past, market researchers have been concerned about the scalability of video insights. Manually combing through hours of unedited video footage is nowhere near efficient.

But, in today’s market, video delivers fast results at scale.

Dozens of video analytics platforms exist.

Affectiva’s technology can “detect nuanced human emotions, complex cognitive states, activities, interactions, and objects people use”.

The company was recently acquired by Smart Eye , a Swedish technology company focused on eye-tracking systems, for $73.5 million.

Other companies, like Speak , use AI to transcribe consumer videos and analyze the text, creating a searchable database of media and insights.

4. Bringing market research in-house

Another response to the current demands placed on market researchers is bringing their efforts in-house.

Global consumer goods corporation P&G has cut its number of agency relationships by 60% over the past seven years. This has resulted in serious cash savings: $750 million.

One report by SurveyMonkey shows that more than half of market researchers estimate their use of full-service research vendors will decrease.

The same report said 70% of market researchers are very likely or somewhat likely to transition to more DIY tools in the next year.

In one example, Organic Valley adopted user-friendly tools that made it easier for coworkers outside of the research department to dive into the data and discover their own customer insights.

Companies that are investing in in-house research see it as a way to keep their efforts customer-centric and use new technologies to empower their brand.

In essence, brands want more transparency, more control, and a streamlined process for market research.

Investors are taking notice of this trend.

Research platform quantilope raised $28 million in a Series B funding round announced in July 2020.

The company commissioned the Forrester Consulting Total Economic Impact study , which found their market research platform provides an ROI of 319% over three years and $2.7 million in net benefits.

5. Faster, more cost-effective market research

Companies cannot afford to be slow in their market research.

In the post-pandemic world, businesses are acting 20-25x faster than usual when it comes to making certain changes.

As one CEO puts it, companies must have “accurate, up-to-the-minute research ” if they hope to gain useful insights about their consumers and their business.

Traditional market research methods like focus groups still have their place. But speed is not their strength.

That’s where agile market research excels.

This type of market research is defined by gathering consumer feedback, applying technology, and launching campaigns quickly . That way, companies can test and make decisions without extended periods of time being devoted to each step.

Zappi is one agile market research platform that’s showing incredible growth.

The company grew sales by more than 30% in 2021 and launched a new tool, Zappi Amplify TV .

At least part of this dedication to faster results is driven by budget constraints.

According to SurveyMonkey, 56% of companies have continued demand for market research but face limited or shrinking budgets.

Automated market research is one way to support the agile method and deliver quicker insights with fewer people on staff.

The results are pretty convincing : 60% of market researchers say automation allows them to deliver results faster, 50% say it’s allowed them to lower costs, and 80% of market researchers say they believe the trend will continue to grow.

6. Social media listening gives insights in real-time

Social media platforms are full of conversations, interactions, likes, and dislikes that are relevant to a business’ brand.

Each of these interactions is a window into the preferences and attitudes of a company’s target audience.

Social media listening involves gathering historical and real-time data from social media. Like other market research methods, this data can inform decisions and inspire new offerings.

Statistics show that 5.85 billion people worldwide will be using social media by 2027.

Better yet, 80% of what people post on social media is about themselves.

This means businesses that invest in social media research methods essentially have access to their target audience in real-time.

Those that can effectively monitor social media and make sense of the data will get a wealth of valuable information: what customers like, what they dislike, how they use products, what trends they’re interested in and much more.

With a variety of social media listening platforms and price points, this type of market research method is available to businesses of any size.

Talkwalker is one of the most comprehensive social media listening platforms and was recently featured in a Forrester report as one of the “ top 10 providers that matter most ”.

The Talkwalker platform crawls nearly 150 million websites, 30,000 podcasts, more than 10 social media platforms, and 187 different languages.

Businesses should take note, though, that one of the drawbacks of social media market research is the incidence of skewed results caused by herd mentality.

People on social media act impulsively and are largely swayed by other users. Which means the data isn’t always 100% accurate.

The market research trends that lie ahead on the horizon show us that social media, smartphones, and DIY data research should dominate the market in the near future.

Customer needs are constantly changing and that means market research will always be key to any successful organization.

The brands that can quickly and effectively anticipate customer wants and needs are the brands that will be able to surpass the competition and never look back.

Find Thousands of Trending Topics With Our Platform

10 Top Market Research Trends in 2023

AI Generated Summary

Blog Summary The blog discusses the rapid evolution of market research influenced by technologies like AI, and the pressing need for brands to adapt to maintain consumer loyalty and capitalize on emerging market opportunities.

Key Points Overview

- Market research is crucial for adapting to fast-changing consumer expectations and market conditions.

- AI and digital tools are transforming traditional market research methods, making them faster and more effective.

- Brands need to leverage new market research trends to stay competitive and manage risks effectively.

Top Takeaways

- Embrace AI-driven tools for real-time, insightful market analysis.

- Understand and adapt to rapid market changes to maintain consumer engagement.

- Utilize innovative market research methods to identify and act on emerging opportunities.

Conclusion In today’s fast-evolving market landscape, staying ahead requires brands to adopt advanced market research tools and strategies. These allow brands to quickly respond to changes, understand consumer needs, and navigate potential risks, ensuring continued growth and consumer loyalty.

What worked yesterday in your market research strategy won’t work today. The world is evolving and speeding ahead at a frightening pace—and brands that don’t adapt fast enough could experience a decrease in consumer loyalty and love.

However, market research offers white space opportunities that provide insights into emerging trends. It also opens the door to new perceptions of the market and consumers’ fickle moods, which are changing with the wind. Tracking these market research trends over time helps brands connect with consumers in a way that resonates—nurturing long-lasting relationships.

The only constant in business is that tomorrow, the market will change. But with consumer and market intelligence, savvy brands can remain agile and able to pivot at a moment’s notice—keeping shipping lanes open to you.

Baseline metrics help you plot your course to your destination, while the ebb and flow of global trends can help you best determine when and where to put out to sea. Here, we’ll look at the top ten market research trends in 2023 that will get you from point A to point B with the least amount of frustration. And they’ll help you maneuver around and avoid any storms.

To begin, let’s look at a few market research statistics of interest:

- Artificial intelligence (AI) is rapidly changing how market research is done. According to Statista , in 2022, revenues from the global artificial intelligence market were expected to reach 433 billion USD. Additionally, it’s expected that the global AI market will see exceptional growth, reaching more than half a trillion USD by 2023.

- The global revenue of the Market Research industry exceeded 76.4 billion USD in 2021. This growth has been twofold since 2008 and is projected to continue.

- According to Knowledge Sourcing Intelligence , the global online survey market is expected to grow at a CAGR of more than 16% through 2026.

First, we’ll share how market research tools have changed, and then we’ll dig into the research trends!

How Market Research Tools Have Evolved

In the 1920s, the first inklings of proper market research began, and qualitative questionnaires were king. It all started with a man named Daniel Starch, a trained psychologist and mathematician, who started approaching people on the streets and asking if they remembered any particular ads from popular publications they had read. Then, he’d take this information and cross-reference it with circulation counts to determine which advertisements were the most effective.

In hindsight, it seems extraordinarily rudimentary, but it was a step in the right direction. The only tools you needed were a pair of shoes and a notepad. And while the results were by no means exhaustive, they were a vast improvement over the methods employed in the past – which were next to none. Journalists simply wrote advertisements and hoped people read them.

Quantitative surveys and focus groups remained the primary market research methods for collecting consumer intelligence into the 1960s. Then, as computers became accessible for research, focus on statistics and hard data became the aim. It had become apparent in the industry that there was a disconnect between what consumers said they did – and what they really did. Market research that captured insight into these discrepancies became attainable through processing power.

The ubiquity of the internet opened new doors to data acquisition for researchers expanding accessibility to consumers’ thoughts, feelings, and behaviors. We are now firmly rooted in the digital era, where advances in cloud computing and artificial intelligence elevate 24/7 access to consumer data with the means to store and evaluate vast data sets.

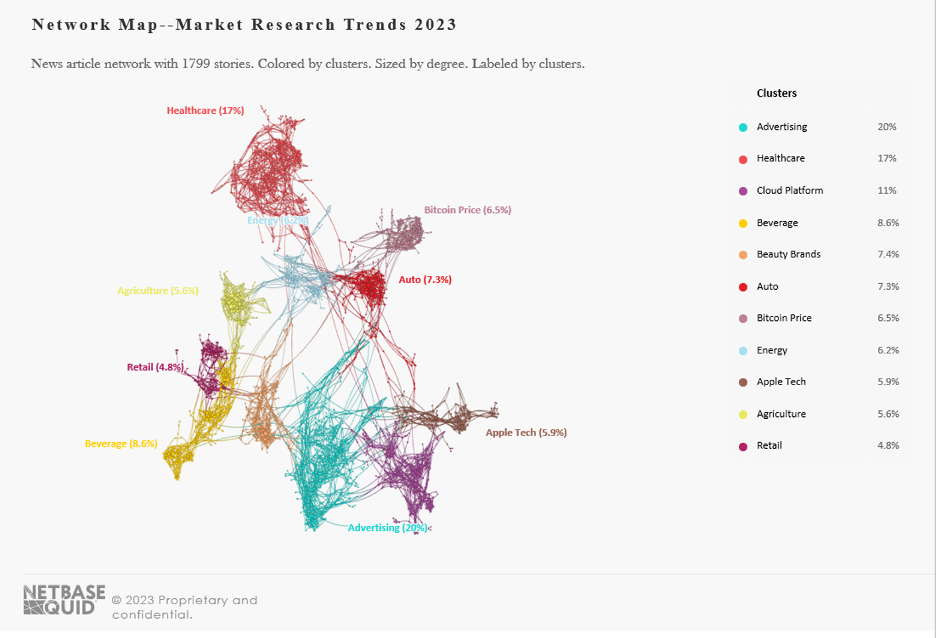

Data visualization of top ten thematic clusters in market research from top-tier US news sources. 1/1/21-1/1/23

Disruption has been the name of the game for the past few years, so it pays for brands to be on top of the latest research. So let’s dig into those research trends to see what’s on tap this year!

Trend #1: Tracking Consumer & Market Intelligence to Keep Pace with Turbulent Times

Your brand needs an all-encompassing view that aggregates consumer and market intelligence to be in the best position to strategize and minimize risk. That means pulling data from every conceivable resource.

The more data sets you can get your hands on, the better informed you’ll be, plain and simple. But like everything in life, balance is crucial. If you lean too heavily into the social conversations surrounding your brand without understanding the market forces at work, then your knowledge of your brand positioning will be lopsided.

Conversely, a rock-solid understanding of market conditions without firm footing along social media trend lines could cause you to undershoot your messaging with vast swaths of your target audience.

If your competitors are consistently outmaneuvering you in a particular area, odds are they’re more informed than you. Agility in business isn’t built on bravado but on a holistic consumer and market intelligence approach. After the past few chaotic years brought on by the pandemic, and now with the risk of a recession in North America and Euro zones looming, brands across industries are in an arms race for intelligence. It’s a race to the top, and the winner is the one that can pivot first. Without good intel, brands make costly mistakes that negatively affect the bottom line.

2021 was a definitive year for brands coming out of the pandemic; consumers emerged changed as well. They became more vocal, calling out companies for any misstep—a trend that would flow into 2022. And the entire past year had its fair share of turbulence for brands trying to understand the voice of the consumer—a voice that has grown louder and more demanding.

Additionally, “two-thirds of consumers were feeling somewhat or a lot worse regarding prices for food/consumer goods, fuel/gasoline prices, cost of housing, the overall cost of living, and international relations/wars,” according to DriveResearch. With an expected recession on the horizon and consumer demands that brands get everything right, the importance of turning on a dime is top of mind. Brands have become tenacious about guarding against unforeseen risk, and with that has come a deep thirst for accessible and actionable intel built on a robust data network.

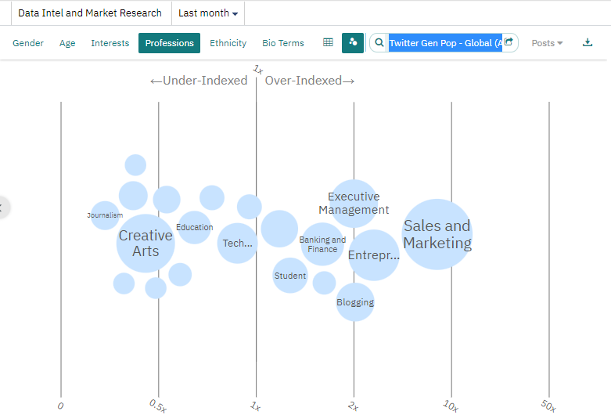

When examining who is generating the most conversation about data intelligence, we see Sales and Marketing, Entrepreneurs, Executive Management, and Banking and Finance over-indexing – as these groups recognize the growing importance of making data-informed decisions.

For the sake of speed, siloed data is a pent-up resource and a barrier to agile decision-making. So now more than ever, your understanding of brand position should cut across every data silo, including internal data, consumer and social intel, and strategic market intelligence.

Your consumer intelligence should be built on social media analytics, employee and product reviews, surveys, etc., in addition to your logistical purchase data to inform a deep and robust viewpoint into your voice of the customer (VoC). Likewise, your competitive intelligence should include the same insights and be as vigorously informed.

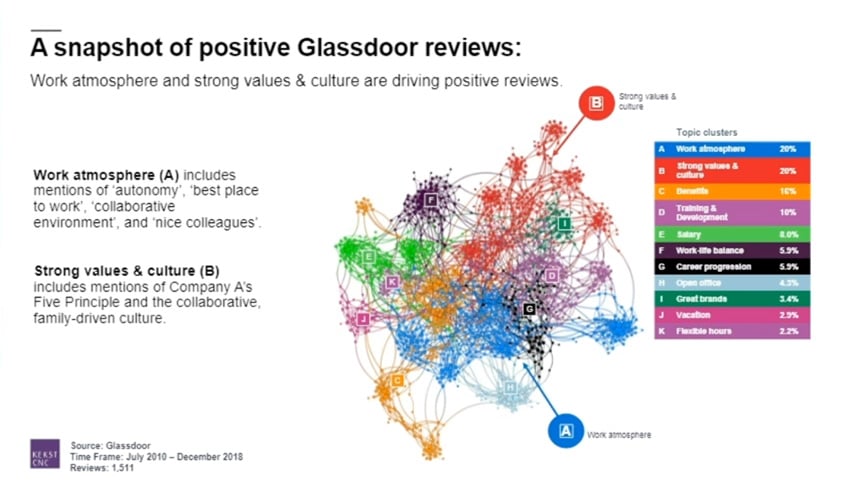

For example, look at the intel from Glassdoor reviews alone. And this is precisely the kind of data that can be uploaded into your market research tool to form a complete understanding of your organization.

Your market intelligence should be a top-down approach with a cohesive understanding of global positioning, trends, and competitive movement. Dialing down into your category, you may need access to data on the M&A and patent landscape surrounding you. Any unstructured data you can get your hands on, such as earnings call transcripts, that informs about the competition is paramount to gaining the edge.

This year, the difference between first movers and laggards will be bountiful access to meaningful data across the consumer and market spectrum. To come out on top, your market research tools need to handle whatever you throw at them – and that should be a lot.

Trend #2: AI-driven Real-time Research Replacing Traditional Methods

Traditional research methods are going the way of the horse and buggy. Markets move too fast in our global economy for them to maintain relevancy. For instance, uploading available consumer product reviews into your data analytics tools takes moments and allows you to parse the data down to a granular level.

Achieving insight at speed is a game-changer by integrating artificial intelligence into your market research. The speed and functionality of machine learning is growing daily, leading to a rush to adopt the technology as the fastest means to overall market intelligence.

Standard methods, such as surveys, focus groups, etc., are too slow and cumbersome to compete. By the time company A has acquired and processed its survey results, company B has already informed its decision-makers, formed a strategy, and made a move. In the future, those brands and institutions that still need to implement artificial intelligence at scale will be forced to play a perpetual game of catchup. As such, this is one of the hottest research trends on the planet right now.

Artificial intelligence enables you to parse massive data sets, cut away the noise and find deep insights that traditional methods could only dream about. And it doesn’t need to take a lunch break.

AI-powered data analytics breaks down the VoC into components to reveal trends and insight across a spectrum of indicators within the human language. The cost of human researchers using traditional methods to achieve such rich insights at scale would be so prohibitive that it’d be ludicrous to attempt. And it wouldn’t approach real-time processing rates that are standard for next-generation AI.

Agility is the future of business, and speed to insight is one of the most important aspects of being a front-runner in today’s marketplace. AI is gorging on market share at an estimated 46% CAGR through 2025, with market growth reaching USD by this year. And the market research industry has a big appetite for the tech. Those companies and industries that need to adapt will find themselves starved for information.

Trend #3: Adjacent Market Competition

You have enough trouble keeping up with your market, and now you need to understand adjacencies better too? Yes. We’ve mentioned the importance of turning on a dime, and you’re one pivot away from intruding on each other.

When it comes to a crisis, it’s not a matter of if … it’s a matter of when. For example, suppose you are underinformed on adjacent markets when a crisis hits. In that case, you very well may have an unwelcome guest eating from your table – especially if they were already informed about you.

What do you do then, should a natural disaster or supply disruption throw off your standard business approach? When external events, like a recession, impact consumers’ buying behaviors, brands need to have other ideas up their sleeves to pull through. If the market for your business dried up today, what strengths do you have that could get your foot in the door of an adjacent segment?

It’s hard not to mention the pandemic as an example of why brands need agility to pivot as needed. And with the following year posing financial challenges to consumers via a recession, we hope companies have learned their lesson so they can make the necessary changes before it hits their bottom line too hard. So let’s dive into an example of one company that has weathered the changes brought on by the unforeseeable

Uber Eats was the vehicle that brought Uber through the most challenging part of the pandemic. Then, they pivoted to focus on what consumers needed most—comfort in the form of their favorite foods delivered safely to their door. And Uber hasn’t stopped innovating since.

Most recently, Uber Technologies announced a long-term partnership with autonomous vehicle developer Nuro: this zero-occupant, self-driving EVs will deliver food to Uber Eats customers around the US.

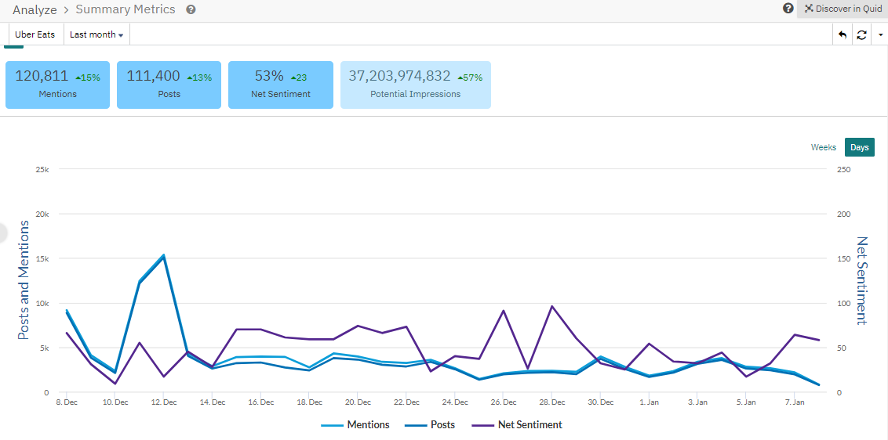

Uber Eats has weathered the worst and shown that they have staying power, cementing its spot at the top of the meal delivery segment. And we can tell by the most recent consumer intelligence that their audience base approves, with sentiment sitting at 53%.

Uber Eats social media conversation and net sentiment. 8/3/21-1/3/22

Pivoting to another focus area and quickly transitioning catapulted Uber to the top of the food delivery game.

Do you have a plan B for when things go south or a plan to diversify when needed? You do now, and it’s to move sideways.

You should know your adjacent markets backward and forwards, and there’s a secondary reason for doing so. What if it’s not you that has a crisis but your adjacent sector? They could potentially turn their eyes to your piece of the pie. Of course, you can’t plan for every scenario under the sun, but if you are already aware of who they are and what they do, you are better prepared to fend them off your territory than if you were starting from scratch.

Nevertheless, take a page from Uber’s playbook. That’s how it’s done.

Trend 4: Aligning Mission Statement with Consumer Values

Consumers are researching brands like never before, a trend showing no signs of slowing down. At the onset of the pandemic, we found that people were beginning to look for brands aligned with their values. Three years later, that has become standard consumer behavior – particularly with Gen Z.

Whether it’s the environment, sustainability, black-owned businesses, saving the whales, or ethical fashion, consumers are doing their homework on you. Brands that need to pay more attention here stand to lose customers to their competitors who’ve taken it to heart.

Silence isn’t a viable option here, and neither is having an archaic mission statement. Forward-thinking brands paying attention to consumer trends have already made adjustments and backed them up with action. If a customer goes on your website and your mission statement reads like a webpage from 1998, those dollars will not end up in your war chest.

Savvy consumers are looking at brands now as an extension of their personalities. They’ve done the hard work of researching where their money goes, and it’s essential to them. To them, if your mission statement has aged like milk, it’s incredibly off-putting. They want products and services from a brand that pays attention to the social and environmental concerns they’re concerned with – and acts on them in a meaningful way.

That means you need a new mission statement backed up by action. If you really want to go over the top, have your work independently verified by a third-party organization to build trust. Consumers are naturally skeptical of brands, so anything you can do to lessen that tension is a win.

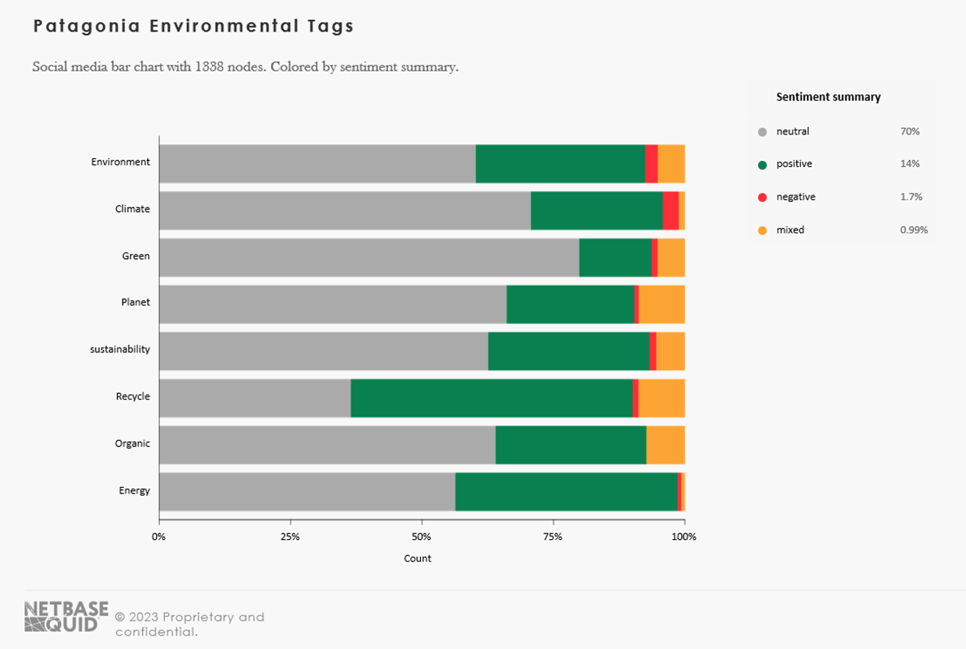

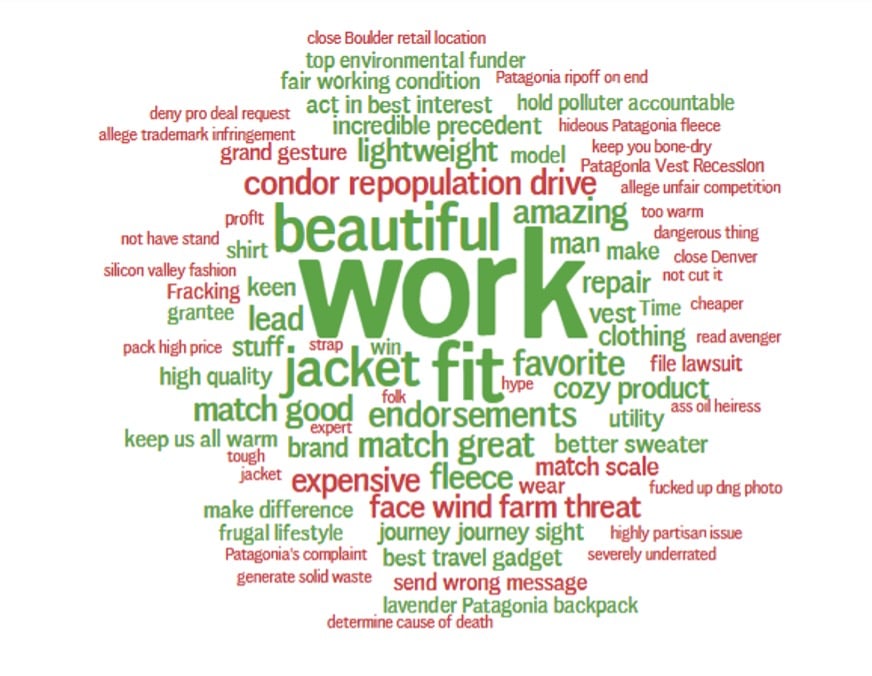

Patagonia is an excellent example of a mission statement done right. They’ve stayed true to who they are as a company and built a legion of loyal customers along the way. Additionally, they walk the walk.

Recently, Patagonia co-founder transferred his ownership to a trust that will combat climate change and protect undeveloped land around the globe. Patagonia recognized what was important to their target demographics, and put rubber to the road.

“One of the things that we’re really focused on … is aiding and educating civil society to be more able to make a positive environmental impact.” Alex Weller, Director of Marketing at Patagonia Europe (from Brand The Change interview )

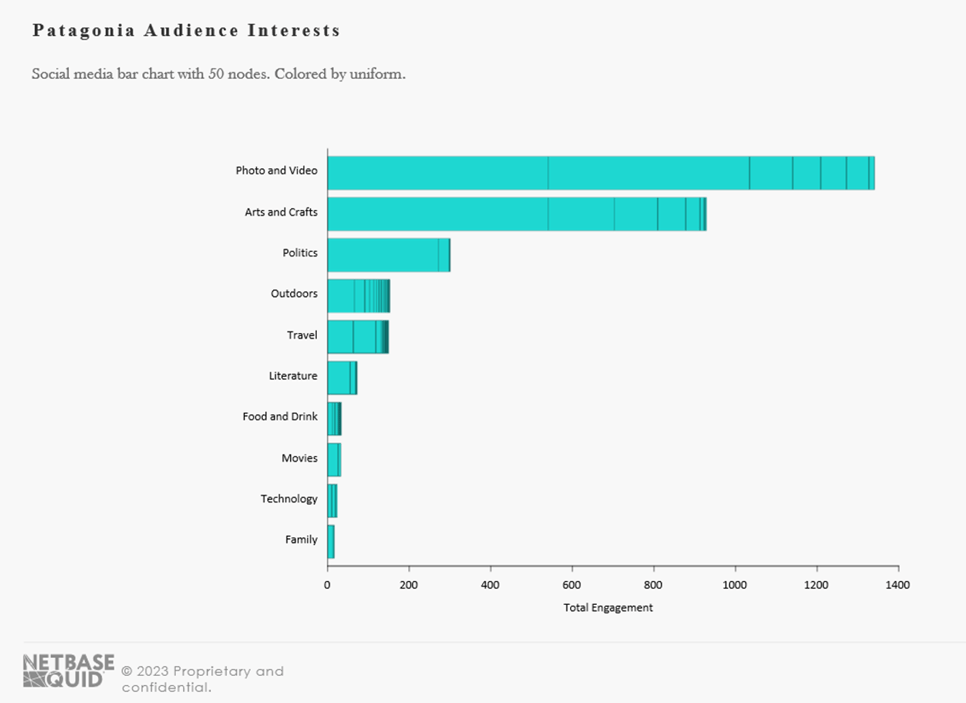

They’re outright aggressive with their environmental activism and great about telling the stories surrounding the brand’s actions. A look shows social media users talking about ecological issues relative to the brand. Isolating environmental keywords from the narrative on a bar chart colored by sentiment shows us whether these conversations are healthy. Sentiment plays an active role in how consumers perceive your brand and whether or not they’ll choose to purchase from you, so brands should always count sentiment.

Eight environmental keywords used by social users discussing Patagonia. Colored by sentiment. 10/3/22-1/3/23

In any case, revisiting your mission statement isn’t a pie-in-the-sky endeavor. It still represents who you are as a brand. But showing that you’re paying attention goes a long way. Putting actions behind your words is the icing on the cake in the consumer’s mind.

Use your market research to inform your efforts here, as it’s foolish – and potentially harmful – to guess. For example, armed with an understanding of global trends, Patagonia’s mission statement could practically write itself based on the top keywords alone.

Your brand’s social media conversations will indicate what trends closely resonate with your target audience. Highlight them in your mission statement. Show the customer that you have noticed and aligned with their values, and you will strengthen your brand story and the customer experience.

Trend #5: Mobile-first Smart Surveys for Targeted Insight

Smart surveys are another trend within the broader torrent of the global digital transformation rush that is gaining heavy adoption within the market research industry. And it makes sense as traditional methods of collecting survey data are comparatively slow and cumbersome. Not only that, but a well-implemented digital survey also captures a better response rate and does it faster than traditional methods.

Since speed to insight is the name of the game in modern market research, adding this data collection tool to your arsenal is critical to capturing targeted intel. Surveys are how market research started, and they still have a place in today’s methodology to extract insights from crucial moments in the customer journey. The goal is the same, but the tactics are better.

A traditional survey sent through the mail is a gamble. Getting a response depends on whether the consumer receives the survey, is in the mood to fill it out, and if the response choices align with their opinions. If any of these pieces are missing, then you’ll receive nothing, and it’s throwing money in the trash. Additionally, one consideration is accessibility.

A mobile-first approach is showing promise as more consumers use their cell phones for everyday tasks—in fact, mobile accounts for approximately 50% of web traffic worldwide. Yet, only 64% of market researchers presently use mobile surveys.

If the past few years have taught us anything, it’s that you have to meet the consumer where they are. Unfortunately, consumers are increasingly looking for scammers and nefarious motives on the digital spectrum. If surveys are poorly timed or incentivized in a way that makes the consumer feel like it’s a bait and switch, then they’ll feel taken advantage of.

It’s an unfortunate reality for consumers that brands should keep top of mind when developing their smart surveys. When you get it right, your audience will jump at the chance to provide feedback.

Once you design and implement smart surveys that capture honest feedback at an opportune moment in the customer journey , the rewards will be well worth the effort. And your customers won’t feel imposed upon. On the contrary, if your survey properly incentivizes the consumer, they will be happy to provide feedback since you’ve given them a sense of additional value for their time.

The brand-specific consumer intelligence that smart surveys can unlock adds to your holistic consumer and market intelligence. The widening adoption of AI, chatbots and personalization at scale allows you to craft personalized surveys in-app or pre/post-checkout to humanize the interaction further when the customer is most heavily invested in your brand.

Examples of forward-thinking smart surveys can include emotion-based surveys using facial recognition cues in focus groups, or unintrusive feedback gleaned through curated communities attached to your CX strategy. Sentiment around smart surveys is riding a wave of positivity right now, so outmaneuvering your competition here is the intelligent thing to do. Whatever way you choose to approach smart surveys, market research will inform you of your target audience’s best approaches, minimizing wasted time and maximizing response rates.

Trend #6: Real-Time Social Listening Adoption

In the future, a trend that will be the differentiator between brands that outlast their competitors is social media listening in real time. With the always-on manner of social media echoing social, economic, and political trends, doing business is akin to running through a minefield. Of course, some social listening is better than none, but if you’re going to make the long run, real-time monitoring is where it’s at.

Your brand’s longevity depends on avoiding social missteps and capitalizing on consumer intelligence. A study by Innosight found that in 1964 the average age of companies on the S&P 500 was 33 years old. By 2016 the average age had dropped to 24, and by 2027 is forecast to dwindle to just 12 years.

Couple that with the fact that 88% of companies that comprised the Fortune 500 in 1955 no longer exist, and you can see that longevity is not guaranteed. The way to hedge against going the course of the dinosaurs is by keeping tabs on the social climate as it happens with a thorough understanding of emerging trends .

If you were to run an analysis on social listening mentions, you’d find that monitoring and managing misinformation are in the top five conversational themes. These are the issues your competitors are paying attention to. Since social never sleeps, that means the potential for market influence doesn’t either.

So, if you’re on the golf course on Sunday and your brand mentions go through the roof because one of your social media posts hits on the wrong side of a hot-button social issue, you need to know that – fast. And setting up alerts on your social media analytics tools for when activity moves outside your baseline metrics ensures

Consider real-time social listening like a stop-loss order against a potential crisis to safeguard your brand’s longevity. The sooner you’re informed, the better.

Trend #7: Quality of Metrics Will Make or Break Brands

Speaking of baseline metrics, accuracy is paramount. When aggregating your metrics from disparate analytics tools, you must pay extra careful attention to ensure something isn’t lost between your sources. Even if you use a dedicated social listening platform, you should ensure that your metrics are uncluttered by noise.

What does that mean exactly? If you are doing a social media audit on your brand to reassess your brand’s sentiment, for example, you have to know that your data is untainted by off-topic mentions, similar hashtags, or spam content. A clean dataset gives you clarity on the health of your brand. If it’s muddied by clutter, then you will not have an accurate representation of your brand to start with.

And that means your subsequent brand health analyses will be measured against faulty metrics. And this will also be the case if the data analytics tools you are using are incapable of slicing your data down to a granular level.

Quality is king when establishing your brand’s metrics. Otherwise, your measurements are an exercise in futility and of little use to your efforts. As such, your tools should be transparent enough to dig all through the mentions it pulls in. A robust set of filters and Boolean search capabilities allow you to eliminate all the excess, leaving you with a new data set relevant to your query.

For example, setting up our brand analysis on Patagonia, we knew we’d have to separate the brand from its namesake region in South America for accurate consumer insights. Knowing this, we excluded terms such as Chile, Argentina, and South America. If our analysis of Patagonia’s brand left any of those mentions included, it would skew our brand metrics.

However, you can see in the sentiment drivers below that the ‘condor repopulation drive’ and “face wind farm threat” terms don’t look like they belong. These terms come from articles about people freeing Andean condors in South America. Fortunately, it’s a quick fix to filter out this term along with any others we find along the way. And this is great for any analysis where your terms share similarities with other products, people, brands, and places.

The ability to drill down and cut away all irrelevant posts gives us a clear picture of the brand we can trust. And that’s what’s driving this research trend – a hunger for quality metrics built on unflinching accuracy.

Getting clean results in your social data sets is supremely important, and your tools have to get you there. Social media will talk about any significant event. So, as an example, if the news of condor repopulation were to trend and we’d negligently leave those mentions in our brand analysis–when we went to benchmark over time, we’d then be left wondering why our impressions and “mentions” were vastly different.

That’s a headache you don’t have to have. Clearing away the social media clutter makes your analysis actionable – and you can confidently measure against it in the future.

Patagonia brand discussion summary metrics. 10/8/22-1/8/23

That’s why top brands demand pinpoint accuracy from the start, with transparent and fine-tuned results. And you should too.

Trend #8: Extended Trend Tracking

Understanding how trends fluctuate over time provides the context for market movements. Trend tracking is not a ‘set it and forget it’ scenario for your market intelligence. Instead, ongoing trend analysis is critical in informing your brand when to pull back and when to push through.

Yes, some trends gushed last year, and others retracted due to the change in consumer behaviors born out of the events of the past few years–from the pandemic to social unrest. And while this year presents its own challenges in moving past turmoil and into the future, there is no guarantee that trends will behave logically.

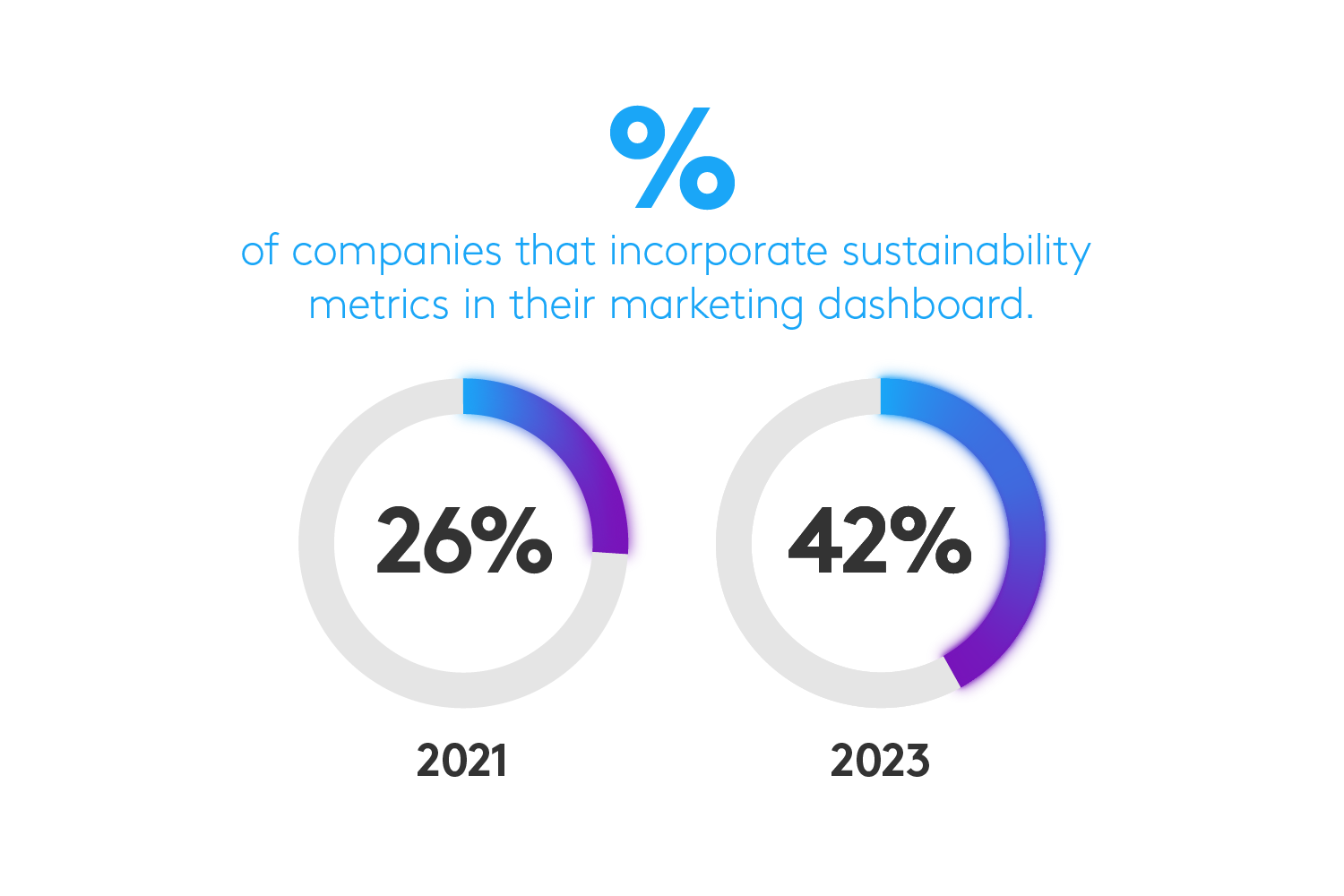

Since markets are temperamentally unpredictable, trends are directly affected by the moods that influence the whole. So just because sustainability has been a growing trend for many years doesn’t mean you can base your initiatives around it and ride off into the sunset.

That kind of thinking is trouble and why many brands no longer exist. In other words, hitching your brand to a current trend may pay dividends in the short run, but it’s a giant gamble to set anything on autopilot long-term. Trends have a way of swelling, retracting, and branching off in new directions, and brands are paying attention to long-term movements to inform their strategy like never before.

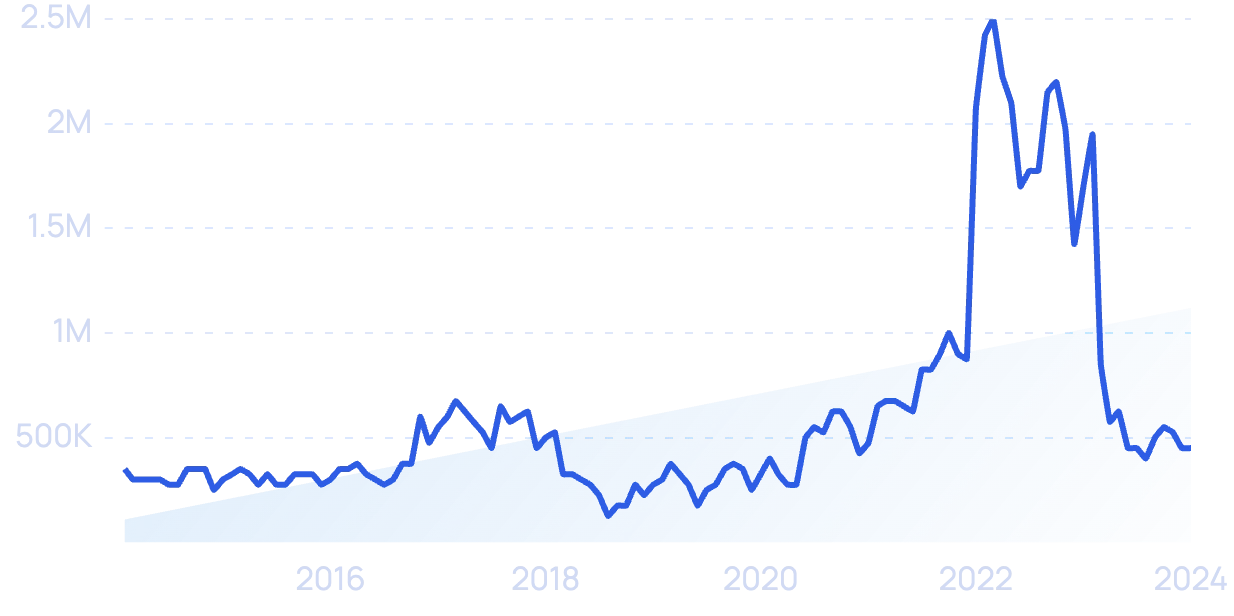

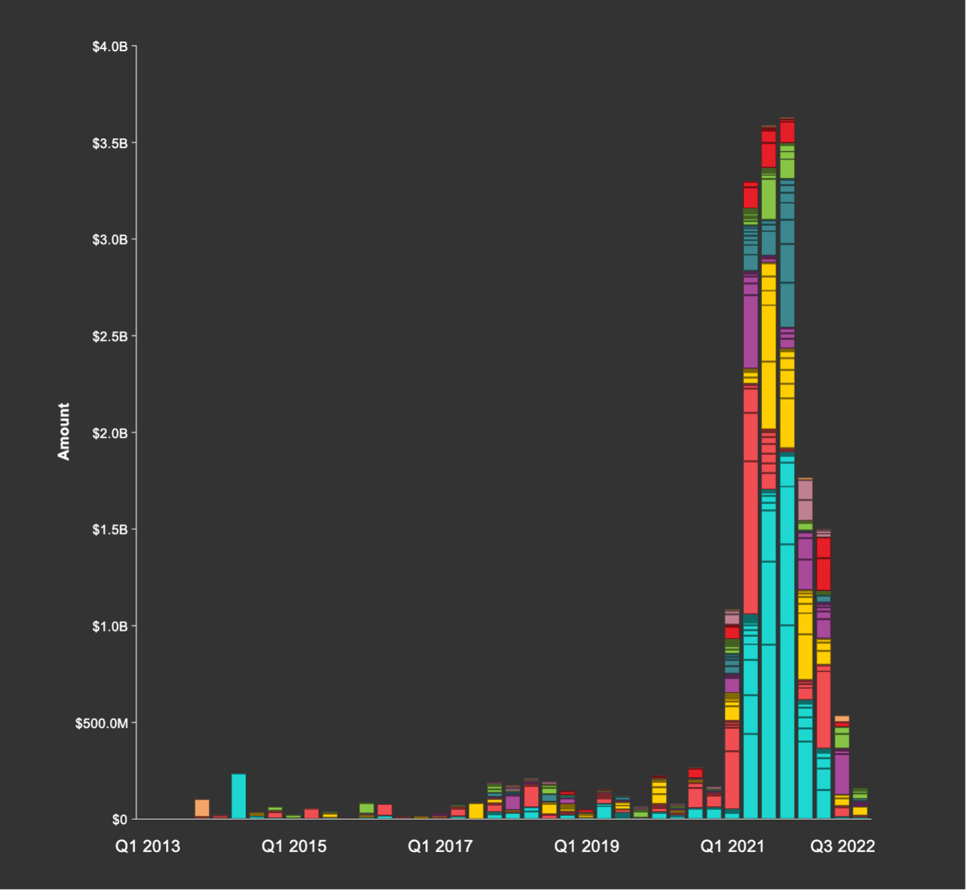

Cryptocurrency and blockchain technology has been white-hot over the past few years, and it has grabbed the attention of influential people such as Elon Musk. However, it has been a tumultuous year for cryptocurrency . In 2022, we witnessed Terra Luna being worthless, Celsius going bankrupt, and FTX’s founder getting arrested on alleged fraud charges. That being said, industry professionals are optimistic that the cryptocurrency trend will continue into 2023 .

This optimism relies on the past performance of crypto markets, which suggests that this will be a good year for virtual currencies. And regardless, Bitcoin is in for a wild ride this year, according to Forbes —with other industry professionals predicting more crashes even worse than in 2022, and some thinking Bitcoin will disappear forever.

Nevertheless, the decentralization properties of blockchain technology still have disruptive potential for governments and financial institutions – and they are paying attention. Others are getting in on the action, too. But companies will want to track it over time to ensure they don’t get too far in over their head if the bottom drops out of cryptocurrency as some predict. Here’s a look at a company dataset in NetBase Quid ® showing a timeline view of investment into companies involved with Bitcoin.

Investment in companies dealing with Bitcoin. 2013-2023

If this industry could touch you, you’d want to know about the considerable spikes, or dips, in investment over the past year. A look at the patent activity in the cryptocurrency space over the last five years is also telling. For example, there have been over 1,200 patents applied for in that time, of which 345 have been granted. In 2021, that number stood at 235—something to think about and watch as the next year unfolds, particularly as it seems 2022 was light in comparison.

Longitudinal trend tracking keeps surprises to a minimum, leaving your brand in the best position to pivot no matter how the tides turn. And following the money and the innovation shows whether a trend has teeth.

Trend #9: Redefining Customer Experiences

Due to the rapid adoption of e-commerce on the back of consumers wanting more convenience and a safer way to shop during the pandemic, many brands have been rethinking their CX strategy. Our “new normal” has become “just normal,” and it’s doubtful we’ll ever return to the way things were. And e-commerce is reaping the benefits of this new era of shopping.

Brands must find new ways to create unique and memorable customer experiences in a crowded market. Your focus here should continue in the digital transformation vein and look for opportunities to make stronger connections with your consumers online.

Your market research will be invaluable to this end. And while demographic data has its place, your focus should be on collecting psychographic data. This means you’re going beyond age, race, and gender to inform your strategy into your target audience’s values, interests, attitudes, and personality type. These psychographic traits often transcend demographic markers to ensure your messaging is tailored to fit your ideal customer.

Additionally, personalization at scale is seeing tremendous interest. While many brands are still struggling to implement it on an enterprise level, those that have are reaping the benefits.

McKinsey reports , “Research shows that personalization most often drives 10 to 15 percent revenue lift (with company-specific lift spanning 5 to 25 percent, driven by sector and ability to execute). The more skillful a company becomes in applying data to grow customer knowledge and intimacy, the greater the returns.” Including the customer’s name in emails and chatbot conversations is a great place to start. Personalized recommendations or pain point suggestions based on consumer insights are additional ways to provide a customized consumer experience.

That little something extra adds a touch of humanity to digital interaction. It simply works.

Trend #10: Aggregating Business Intelligence for More Powerful Results

As mentioned, speed to accurate intel is mission-critical with the global economy’s non-stop activity. Unfortunately, many companies still use too many platforms to cobble together their market research. If your Martech Stack has grown unwieldy, it’s time to change.

That’s because streamlined efficiency is the name of the game. When your market research analytics tools are under one umbrella, it makes all the difference in the world. Just remember, the spoils almost always go to the first mover. Cumbersome research methods and tools are not the recipe for success in today’s fast-paced climate.

When it comes to auditing your Martech Stack, you’ve got to be honest with what you need and what you don’t. Platforms and resources change over time, leading to unnecessary overlap, incompatibility issues, bloatware, and a general slowing down of your workflow. In addition, the more tools you’re working with, you heighten your chance of running into issues between tools.

Your data analytics tools are your eyes and ears in the marketplace and, therefore, one of your best hedges against threats. They inform every single one of the trends that we’ve covered here and more. If a robust suite of data analytics tools under one roof meets your brand’s needs, then that is the direction you need to go.

The entirety of the past few years has underscored the importance of being well-informed and staying agile. Brands across the globe are taking their market research to the next level in response and recognizing the value of an Quid Connect that makes every bit of insight accessible via one powerful BI platform.

This year will offer its unique challenges as the world attempts to keep the ship upright and steer around any icebergs. What’s left to be seen is how consumers will react to yet another wave of changes. Brands doing their due diligence in consumer and market intelligence will be ahead of the rest. Undoubtedly, this list of research trends represents a challenging set of objectives for any brand. But much of it builds upon the other. So analyze your goals, approach your low-hanging fruit and then expand your market research horizons from there. Finally, break it down and take a systematic approach .

What matters most is that you build upon accurate insights. Once your foundation is firm, the speed will come. Be sure to reach out for a demo , and we’ll be happy to help you kick your market research into high gear with world-class data analytics tools built on next-generation artificial intelligence .

Market Research Components | 2023 comprehensive Guide

Introduction What is Market Research? Market Research is the systematic […]

Published on

Introduction

Market size, potential growth, market trends, consumer analysis, competitor analysis, swot analysis, pestel analysis.

- Porter’s Five Forces Analysis

Frequently Asked Questions (FAQs)

What is market research.

Market Research is the systematic process of gathering, analyzing, and interpreting information about a specific market. This includes understanding the target audience, identifying market trends, assessing competitors, and more.

The information collected through market research helps businesses make well-informed decisions, reduce risks, and identify new opportunities.

For a comprehensive guide on initiating and executing successful market research, be sure to explore our detailed post on Conducting Market Research 101 .

Why is Market Research Important?

In an increasingly competitive and dynamic business environment, market research has become an essential tool for success. It provides the insights needed to:

- Understand Consumers: It helps businesses know their customers’ needs, preferences, and behaviors.

- Identify Opportunities: Market research uncovers gaps in the market that can be filled with innovative products or services.

- Mitigate Risks: By understanding the external environment, businesses can avoid potential pitfalls.

- Shape Strategies: It informs decision-making processes, ensuring that strategies are aligned with market realities.

In this comprehensive guide, we will explore the many facets of market research, leveraging decades of industry experience and knowledge. Whether you’re a business owner, a marketing professional, or simply interested in the field, this article will provide you with the expertise you need.

Here’s what we’ll cover:

- Market Size: Understanding the total volume of a given market.

- Potential Growth: Forecasting market expansion and opportunities.

- Market Trends: Analyzing current and future trends affecting the market.

- Consumer Analysis: Examining consumer behaviors and preferences.

- Competitors Analysis: Assessing your competitors’ strengths and weaknesses.

- SWOT Analysis: A strategic tool for evaluating a business’s internal and external environment.

- PESTEL Analysis: Investigating macro-environmental factors affecting the market.

- Porter’s Five Forces Analysis: Analyzing the competitive forces within your industry.

- Additional Analyses: Exploring other relevant tools and frameworks.

From understanding the market size to employing advanced analytical tools like SWOT and PESTEL, this article offers a complete guide to market research. It’s built on years of professional expertise and aims to be a reliable and authoritative source for anyone seeking to navigate the complex world of market research.

Uncover the role of SWOT analysis in decoding the restaurant industry’s intricacies in our article: SWOT Analysis for Restaurant.

Market Size refers to the total number of potential buyers or the total volume of sales for a particular product or service within a given market. It’s a critical metric that offers valuable insights into the landscape of an industry and can significantly impact strategic business decisions.

Understanding market size allows businesses to:

- Identify Potential: Knowing the market size helps in assessing the potential demand and the feasibility of entering a new market or launching a new product.

- Allocate Resources Efficiently: With accurate market size data, companies can allocate their marketing and production resources more effectively.

- Benchmark Performance: It enables businesses to compare their sales and performance against the total market potential.

Calculating the market size can be complex, depending on the industry and the information available. Here are some common approaches used by experts:

- Top-Down Approach: This method starts with a broad view of the industry and narrows down to a specific segment or product. It often involves using existing research and industry reports.

- Bottom-Up Approach: A more granular method, this starts with the smallest part of the market and builds up. It often involves primary research, such as surveys and interviews.

- Demand and Supply Analysis: Examining both supply and demand factors within the market to understand the overall size and potential.

Market size isn’t just a number; it’s a vital part of strategic planning:

- Segmentation and Targeting: Understanding market size helps in segmenting the market and targeting specific customer groups effectively.

- Investment Decisions: Investors and stakeholders often use market size to gauge the potential returns and risks associated with a market.

- Competitive Positioning: It helps businesses understand where they stand in comparison to competitors and the overall market.

Potential Growth refers to the future expansion opportunities within a given market. It’s a forecast that provides insights into the possible growth of a market segment, industry, or economy. Understanding potential growth helps businesses in strategic planning, investment decisions, and resource allocation.

Identifying potential growth requires careful analysis using various methods and tools. Here are some commonly utilized techniques:

- Market Segmentation Analysis: Breaking down the market into smaller segments to identify underserved or emerging areas.

- Trend Analysis: Studying current market trends and extrapolating them to predict future growth paths.

- Competitive Landscape Analysis: Evaluating competitors’ strategies and performance to uncover opportunities for differentiation and growth.

- Economic Forecasting: Using economic indicators and models to predict the overall growth potential of a market.

Potential growth isn’t just a projection; it’s a critical component of business strategy:

- Product Development: Guides the innovation and development of new products to meet future market demands.

- Investment Planning: Assists in making investment decisions based on expected returns and growth prospects.

- Marketing Strategy: Helps in shaping marketing campaigns and channels to reach emerging market segments.

- Risk Management: Aids in understanding potential risks and uncertainties associated with market expansion.

Market Trends refer to the general direction or movement of a market or industry over time. These trends can be upward, downward, or even sideways and are typically influenced by various factors such as economic conditions, consumer behaviors, technological advancements, and more.

Understanding market trends is pivotal for businesses for several reasons:

- Strategic Alignment: Aligning products, services, and marketing strategies with current trends enhances relevance and competitiveness.

- Opportunity Identification: Recognizing emerging trends can lead to the discovery of new business opportunities or potential threats.

- Consumer Engagement: By resonating with current trends, businesses can create a stronger connection with their target audience.

Examples of Market Trends:

- E-commerce Growth: The ongoing shift towards online shopping, especially amplified by the COVID-19 pandemic.

- Sustainability Focus: Increasing consumer interest in environmentally friendly products and sustainable business practices.

- Personalization in Marketing: The use of data analytics to provide personalized experiences and offerings to consumers.

Utilizing Market Trends for Competitive Advantage

Successfully leveraging market trends can give businesses a significant competitive edge:

- Product Innovation: Developing new products that align with emerging trends.

- Marketing Adaptation: Adapting marketing messages and channels to resonate with current market sentiments.

- Strategic Partnerships: Collaborating with other businesses or influencers that align with trending topics or values.

- Investment Decisions: Allocating investments into areas that are trending upward, providing better returns.

Market trends are a vital aspect of market research, offering insights that can shape business strategies and drive success in today’s fast-paced and ever-changing business environment.