Revenue models: 11 types and how to pick the right one

Finding the right revenue model for your company and products is an incredibly important part of starting and expanding your business. It's a key part of building a brand. Explore popular revenue models and how to choose the right one.

What is a revenue model?

- 11 different types of revenue models

Costs associated with revenue models

How to choose your revenue model.

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

In one of the most famous lines from the 1941 classic Citizen Kane , Mr. Bernstein proclaims: “ It's no trick to make an awful lot of money... if what you want is to do is make a lot of money .” If only that statement were as true as it seemed. It's probably more accurate to say, “There are a lot of ways to make a lot of money.”

That’s particularly true for software businesses, with the rise of the mobile internet stimulating an explosion in the number of viable revenue models. Choosing which revenue model works best for your SaaS business, though, is not easy (even if that's all you want to do is choose a revenue model for your SaaS business). Your choice will help determine your sales strategy , and from there the growth rates, the amount of money you’ll need to invest initially, and the kind of relationship you’re likely to build with your customers. More than that — the choice determines the future of your business. Let’s take a look at some of the most popular revenue models used today — why they’re popular, why they work, and why they will (or won’t) work for you.

A revenue model is the income generating framework that is part of a company’s business model. Common revenue models include subscription, licensing and markup. The revenue model helps businesses determine their revenue generation strategies such as: which revenue source to prioritize, understanding target customers, and how to price their products.

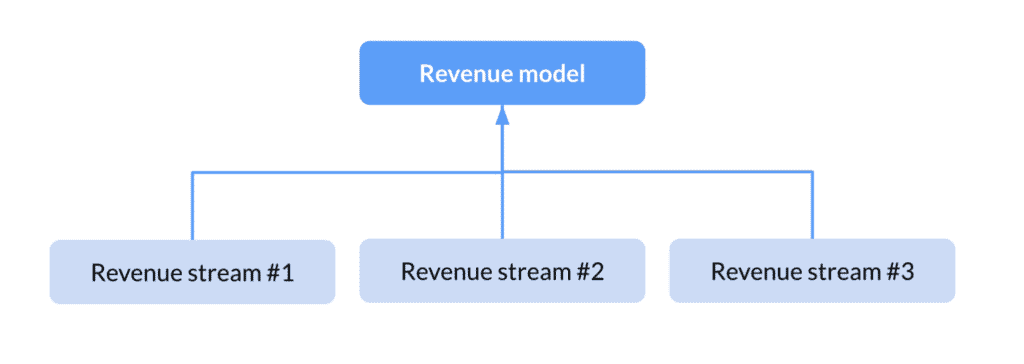

Revenue models often get conflated with revenue streams, probably because each is a single revenue generation source. They are also confused with business models, of which revenue models are a part. Revenue models help business owners determine how to manage their revenue streams and are required to complete a business model.

Without a considered revenue model, your business will incur costs it cannot sustain. With a revenue model, you can set, track, and forecast business growth based on specific customer segments.

11 different types of revenue models

There is no such thing as a perfect revenue model, but the popularity of some of the methods below suggests that many of them are well-tailored for the current state of the market. Here we’ll walk through each type of revenue model and when they may be most beneficial and applicable.

1. Subscription

The subscription model is the “vanilla” SaaS revenue model, not that there’s anything boring about a well-worked subscription plan. Businesses charge a customer every month or year for use of a product or service. All revenue is deferred and then fulfilled in installments. The subscription model is perhaps the most popular among SaaS companies because of its versatility, promise of recurring revenue , and high value:customer lifetime balance. Done right it's a one-way-ticket to sustainable growth .

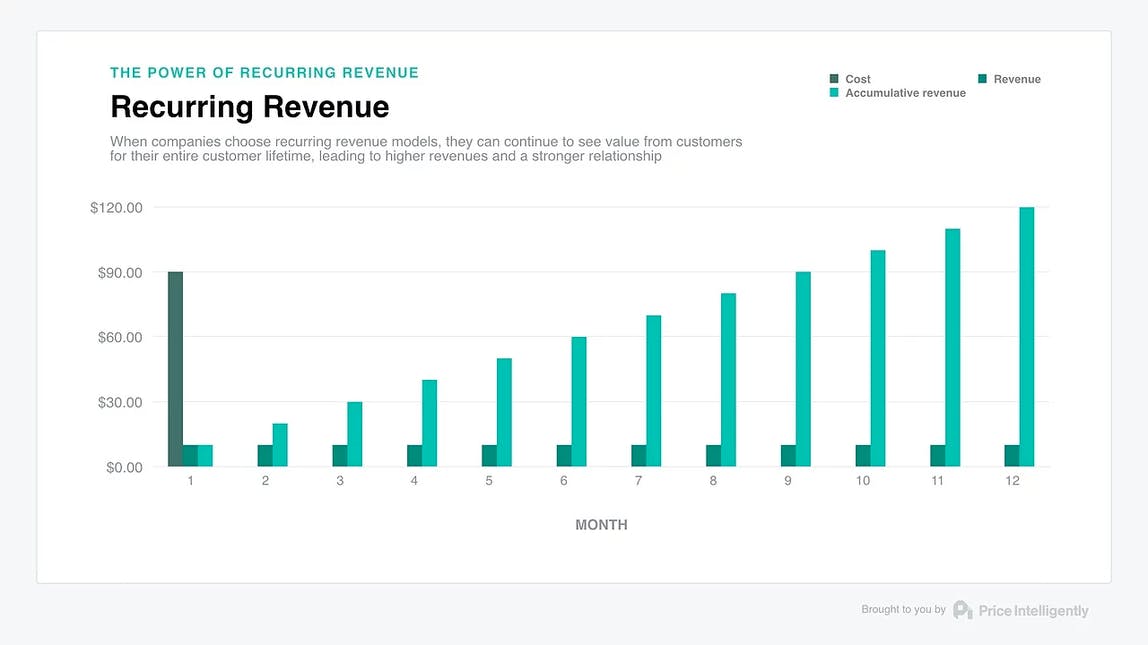

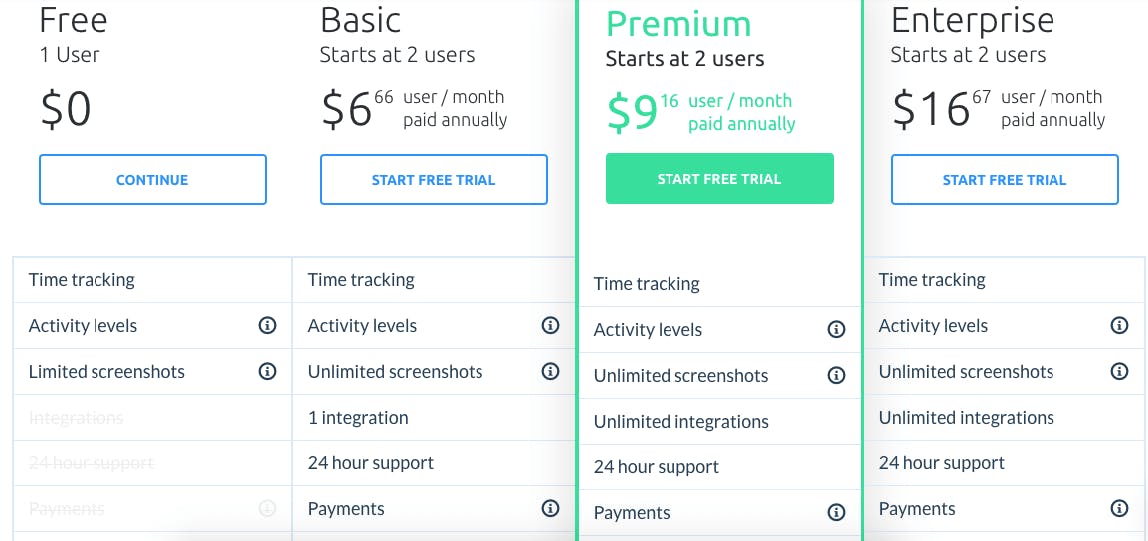

Companies working with recurring revenue models, such as subscription or licensing , see more value from a customer across a given customer lifetime. Being able to offer a variety of value options means your company can respond to more than one set of customer needs, expanding your appeal. Hubstaff’s subscription plan, seen below, is a classic of the genre:

Hubstaff’s various plans are distinct from one another in price and feature. This flexibility in the subscription model means that tentative or lower-budgeted customers can still get what they need, all the while maintaining visibility of what extra they could get for a few dollars more a month.

The freemium model is often described as a subscription revenue model, but in fact it’s an acquisition model, not a revenue model. Freemium involves giving users free access to an app and then selling subscriptions for a premium tier that includes more features.

Markup is a very common revenue model for buyer companies (i.e., companies that buy the products they sell). It’s as simple as can be: Take the cost of goods you just bought, mark it up X%, and make a profit margin on the original purchase. There are various subgenres of the markup model, including the following:

- Wholesale: Sale of goods or merchandise to retailers, business users, or other wholesalers

- Retail: Identification of demand, and satisfaction of it through a supply chain via a number of possible outlets, including physical and ecommercial ones

Markup is particularly used by mediators like ecommerce marketplaces — Amazon, for example. On average, Amazon charges a seller who uses their site 15% of the sale, plus FBA fees (including storage, pick & pack, shipping).

5. Pay-Per-User

One of the most enduring legacies of SaaS in the world of business is the introduction of pay-per-user (PPU). It involves giving a customer potentially unlimited to access to a range of features while charging them only for the services they use. At the dawn of SaaS, as the software required no physical delivery and deployed so quickly and cheaply, PPU appeared to be the most sensible revenue model. However, as natural as it seemed back in the day, pay-per-user is not popular anymore. Ascribing value to your product is one of the key considerations of your revenue model, and that includes demonstrating why it’s worth your target customers’ valuable dollars, not just making everything so cheap and easy that they can’t refuse. The issue with PPU, then, is that it’s rarely where value is ascribed to your product. Moreover, PPU kills your Monthly Active User metric. The per-user metric is not the most useful to customers in terms of deriving value — its take-it-or-leave-it approach actively works against your Daily Active Users number, and thus contributes to your churn rate.

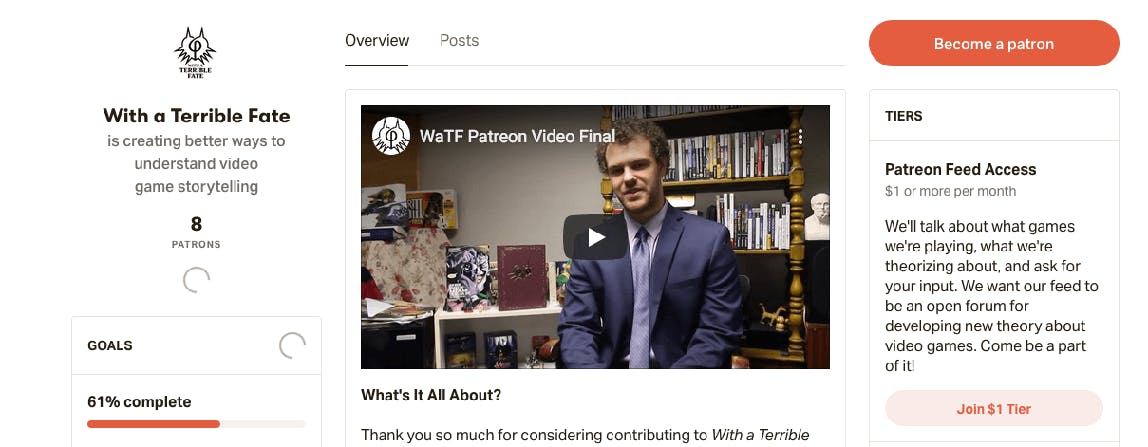

6. Donation

As evidenced by the rise and rise of Kickstarter - and Patreon -based ventures, altruism is, if unpredictable, a pretty effective revenue model by itself. Relying on the donations of regular users is a common revenue model for nonprofits, online media (i.e., YouTubers) and independent news outlets.

7. Affiliate

What is affiliate marketing ? This new, popular model works by promoting referral links to relevant products and collecting commission on any subsequent sales of those products. Leverage your product’s synergy with another product in an adjacent space and you both stand to gain. The affiliate model can be as simple as including in an article an outlink to a book or other product mentioned or offering your customers specialized recommendations relative to purchase history (again, Amazon is a master of this art). Some companies, such as Etsy, even have a specific program for their affiliates, where other companies can earn a commission on qualifying sales that result from featuring links to Etsy products and services. The affiliate revenue model is increasingly popular, owing to the way it dovetails effectively with other revenue models, particularly ad-based models.

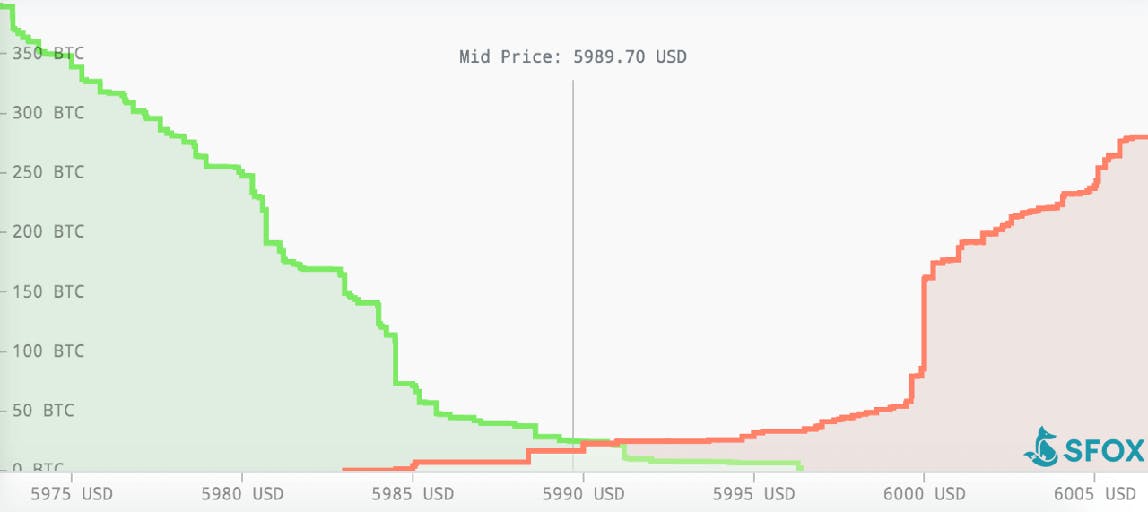

8. Arbitrage

Applicable mainly to sellers or marketplace-oriented companies, the arbitrage revenue model uses the price difference in two different markets of the same good/service to make a profit. You buy in one market (a security/currency/commodity) and simultaneously sell in another market, at a higher price, what you just bought, pocketing the temporary price difference. Arbitrage is popular with affiliate marketers , as well as with many cryptocurrency firms, SFOX being a prime example.

9. Commission

This transactional revenue model involves a middleman charging commission for each transaction it handles between two parties or for any lead it provides to the other party. It’s particularly popular with online marketplaces and aggregators, as well as businesses like independent music distributors. It’s particularly easy to get up and running with a commission-based business model because you’re working off of existing products. However, unless your field is well-conditioned for a monopoly, and unless your company is (or can become) that monopoly, you’ll find the commission model very tough to scale .

10. Data Sales

Ever heard the phrase, “If you can’t see how the money’s made, you’re the product”? That’s data-selling in action. Many companies selling digital goods and services could not exist without core underlying data assets. In the data sale revenue model, this data is sold directly to a consumer or business customer. While certain companies will use data sale as their primary revenue model, the use of data sales to augment another revenue model is virtually ubiquitous. While some are using it as an entrepreneurial venture , it is also the subject of considerable justified public concern and should be handled with care in the event you decide to go with it as your revenue model.

11. Web/Direct Sales

The old-fashioned revenue model made new, web sales and direct sales involve payment for goods or services through a digital medium. Web sales involve a customer finding your product via outbound marketing (or a web search) and can used for software, hardware, and subscription-based offerings. Direct sales revolve around inbound marketing and is good for handling multiple buyers and influencers in big-ticket markets.

A good revenue model is not just about squeezing as much revenue possible out of a sales cycle; it’s also about balancing your ambitions in the market with your resourcing requirements. A startup revenue model may be significantly different than one for an established business because their resources are vastly different. When choosing your model, factoring in costs is paramount to ensure profitability.

Cost of revenue

The first cost you’ll be likely to factor in is your cost of goods — how much it costs to produce the goods or service that you then sell. For hardware, this can comprise testing and manufacture; for software, it’ll include the whole development cycle. Regardless of what you produce, administrative overheads will also apply. You will find cost of goods a considerably less comprehensive metric than cost of revenue, which is the total cost of manufacturing and delivering a product or service to consumers. That includes everything we’ve just covered, plus distribution and marketing costs. Cost of revenue is more often used in SaaS and other service-oriented industries because it makes the many costs incurred outside of production in SaaS easier to track.

Prototyping costs

Prototyping is a fundamental aspect of any production cycle and, unfortunately, is one of the most expensive. While testing prototypes or beta versions of your new product, even the smallest revisions can necessitate costly changes to your production/development process. This usually comprises a base-level cost, plus iteration costs on top of that. When forecasting prototyping costs, it’s wise to plan for several iterations; it’s highly unlikely you’ll get everything right the first time around, especially if your product is innovative or is composed of a number of features.

Equipment costs

One of the beautiful things about being a SaaS company is that there are no production lines to run. Nevertheless, equipment costs still factor into the bottom line. Firmware, app development tools , server rental, plus any other administrative services bought on subscription (e.g. Slack or Hubstaff) will play a part in your equipment costs, but, generally, equipment costs should be the easiest of all to forecast.

Labor costs

An underpaid workforce is an unhappy workforce (if it’s a workforce at all); wage costs come out of your bottom line. Based on the interaction of salary and commission in your compensation plan , as well as the type of commission you offer (entirely open-ended or capped? Will there be accelerators/decelerators involved?), you will have to plan for your expenditure on labor costs differently.

Advertising & marketing costs

Your advertising and marketing costs will be determined by the following:

- The size of your respective advertising and marketing teams

- The scale of exposure you’re shooting for

- Your method of approach to advertising and marketing: undefinedundefinedundefined

With all of those options, how could you possibly be expected to choose? The answer is in your product itself.

Know your market

Where are your customers? How are they accessible to you? If your buyer personas are mainly single customers, address subscription options to them that are expertly targeted to their needs and how your product can fulfill them . On the other hand, if you’re looking to sell to larger companies who need a customized version of your core product, consider a licensing-based option that will allow you to establish a solid, high-return relationship that has the legs to run for the long term. Knowing your market also means knowing your competitors. Before choosing a revenue model, make sure you have a firm grasp of industry benchmarks: Where is the baseline value for equivalent products to yours in the market? Where does your product sit? Interrogate your product honestly. Not only will a frank assessment of your product’s value save you the mistake of pricing your product too high (or too low), but it will also show you how to capitalize on its value and where your developmental compass should be pointed. Consider the strength of your connections with compatible peer companies. For instance, if you’re running time-management software and have connections to a neighboring company selling compatible HR software, reach out to them. A strong network connection can be leveraged with an effective affiliate revenue model–based strategy.

Know your product

Knowing your product is every bit as important as knowing your market, if not more so. Sometimes, the nature of a product dictates the best revenue model for it by itself. If you have a suite of products, is it most sensible to have them as a subscription service or as one-off purchased products? The smart money in this case, for the sake of your growth and daily-user figures, would be on the subscription option. Again, evaluate your product’s performance honestly. How does your product perform compared with its competitors? How wide is your feature array compared with the rest? An awareness of your product enables you to choose a revenue model that hits the value/willingness-to-pay sweet spot. Consider your options further if your product is not a straightforward software proposition. For example, if your product is platform-based, investigate your advertising prospects to capitalize on your traffic buzz, and think laterally to find possible partners for an affiliate strategy that will give your revenue an added kick.

Pitchfork’s affiliate program with makers of craft beer can be seen on the leftmost tab. Music blog platform Pitchfork sussed out that the only thing their readers like more than left-field music is craft beer, so they introduced an affiliate feature with brewer’s outlet October. It’s a smart exhibition of affiliate revenue scoring.

Expect the unexpected

As your product line changes and as your company grows, your initial revenue model may change. You may begin with a subscription revenue model that then assimilates aspects from the affiliate, advertising, and data sales models with time and opportunity. You might start off as a fledgling independent blog on donation with a little bit of advertising, then find yourself with an audience big enough that you can shun the advertisers, install a subscription model, and keep the integrity of your writing safeguarded. Alternatively, you may begin with subscription, see only a fraction of your potential success realized, and move to a licensing revenue model. The important thing is to be willing to shift your revenue model or bring in additional models to complement what you already use, if the situation calls for it.

Take the headache out of growing your software business

We handle your payments, tax, subscription management and more, so you can focus on growing your software and subscription business.

Your revenue model is unique

So many revenue sources, so many revenue models, so little time. There are some fundamental differences between revenue models. For instance, if you’re a SaaS company producing your own software product, you’re unlikely to get all that far with an arbitrage model. Likewise, if your product is a medium or if you’re a seller, a subscription-based revenue model won’t do the trick. A product with a high ceiling for potential revenue is not best served by a donation model. Nevertheless, the choice of a main revenue model out of the batch that do work for your product, and how you then combine them with appropriate aspects of other models, is yours, and yours only. Your product and the market should be in mind at all times while you’re settling on, adding to, and refining your model. After that, bringing in the revenue itself should be as easy as Citizen Kane said.

Related reading

Revenue Model Types in Software Business: Examples and Model Choice

- 12 min read

- Last updated: 28 Dec, 2022

- No comments Share

Here's our video breakdown of revenue models

For those exploring the world of business strategy planning, we’ll elaborate on the definition of the revenue model, and the correlation between business models and revenue streams. We’ll also analyze different types of revenue models and look at some examples to scrutinize the pros and cons of each approach. Finally, we’ll reflect on how to choose or develop a model for your business.

What is a revenue model?

A revenue model is a plan for earning revenue from a business or project. It explains different mechanisms of revenue generation and its sources. Since selling software products is an online business, a plan for making money from it is also called an eCommerce revenue model. The simplest example of a revenue model is a high-traffic blog that places ads to make money. Web resources that present content, e.g., news (value), to the public will make use of its traffic (audience) to place ads. The ads in turn will generate revenue that a website will use to cover its maintenance costs and staff salaries, leaving the profit. Revenue models are often confused with business models and revenue streams. To avoid any misinterpretations, let’s quickly define these three terms that form a business strategy.

Revenue model vs business model

A business model (BM) is a broad term outlining everything concerning the main aspects of the business, all of which are contained in the answers to the following questions.

- What value will we create?

- How will we deliver it?

- How will we bring in revenue?

- How will we earn profit?

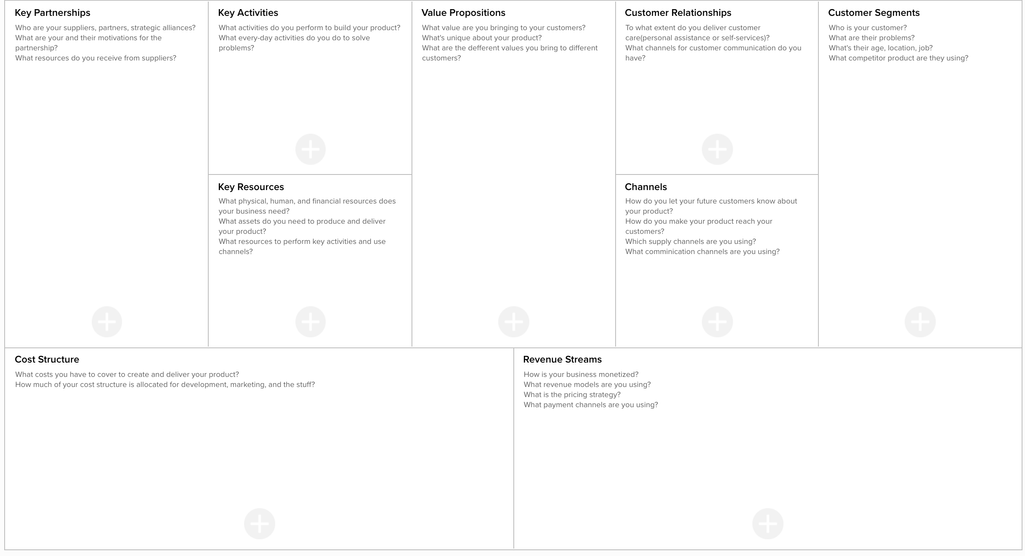

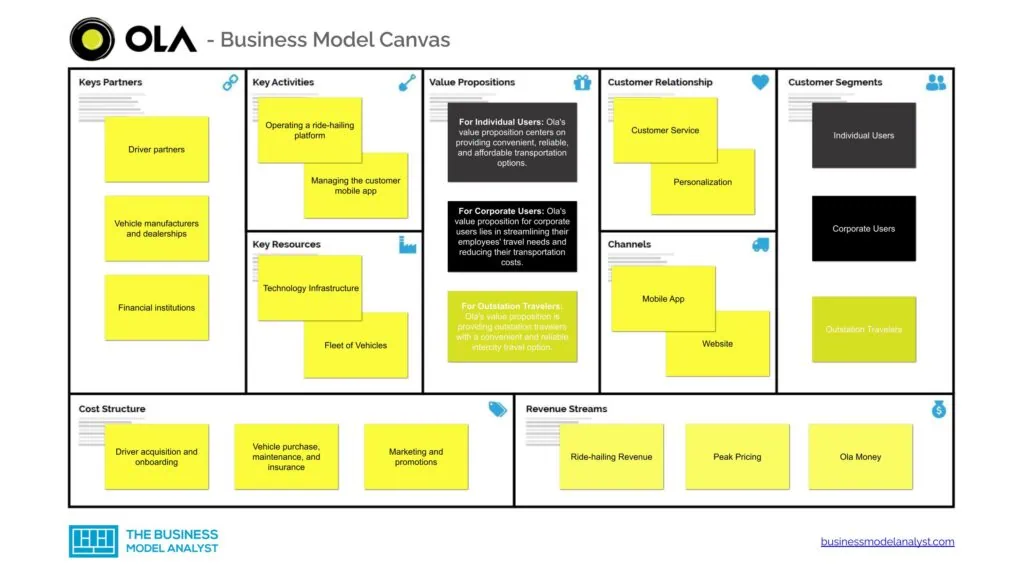

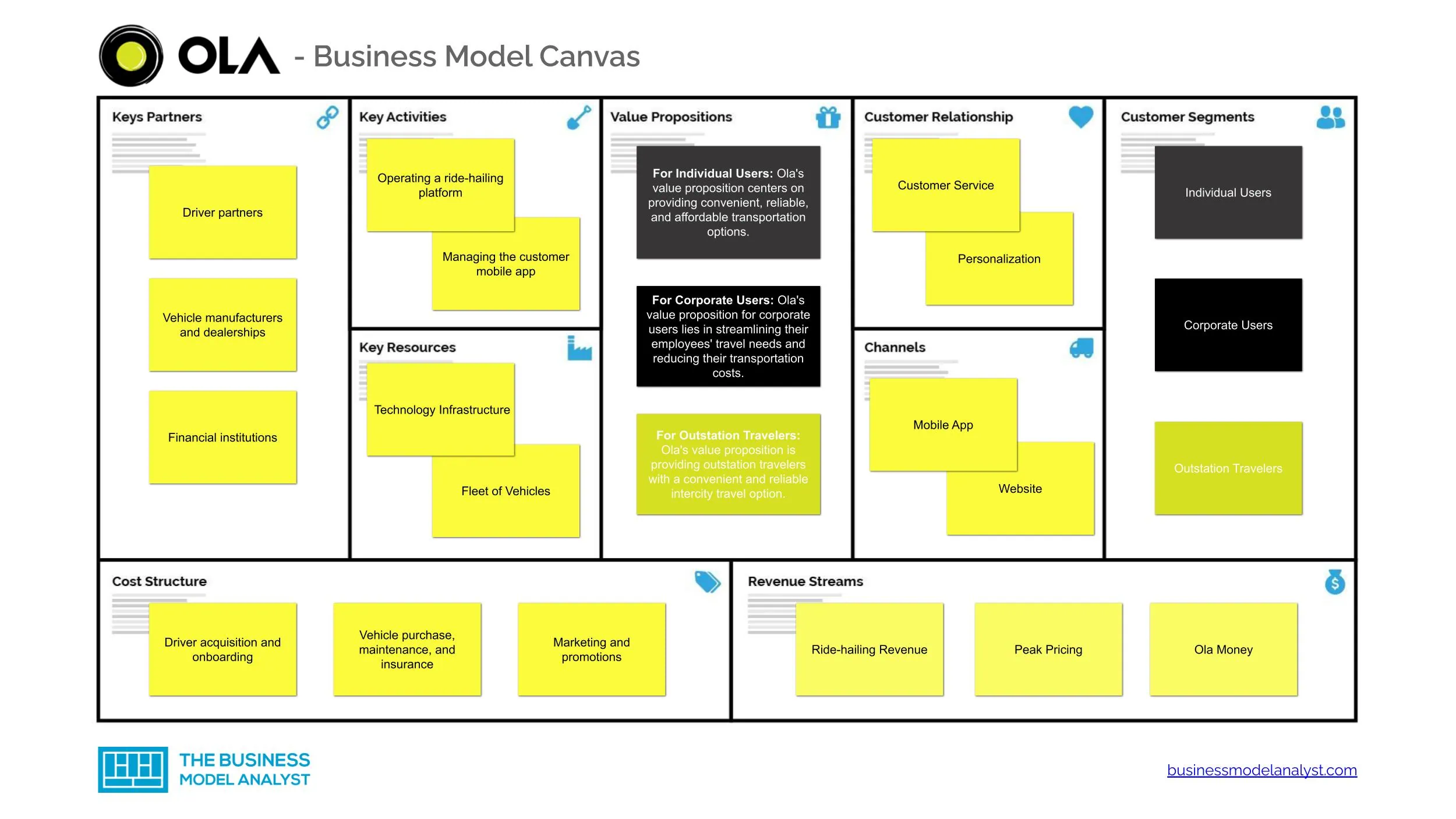

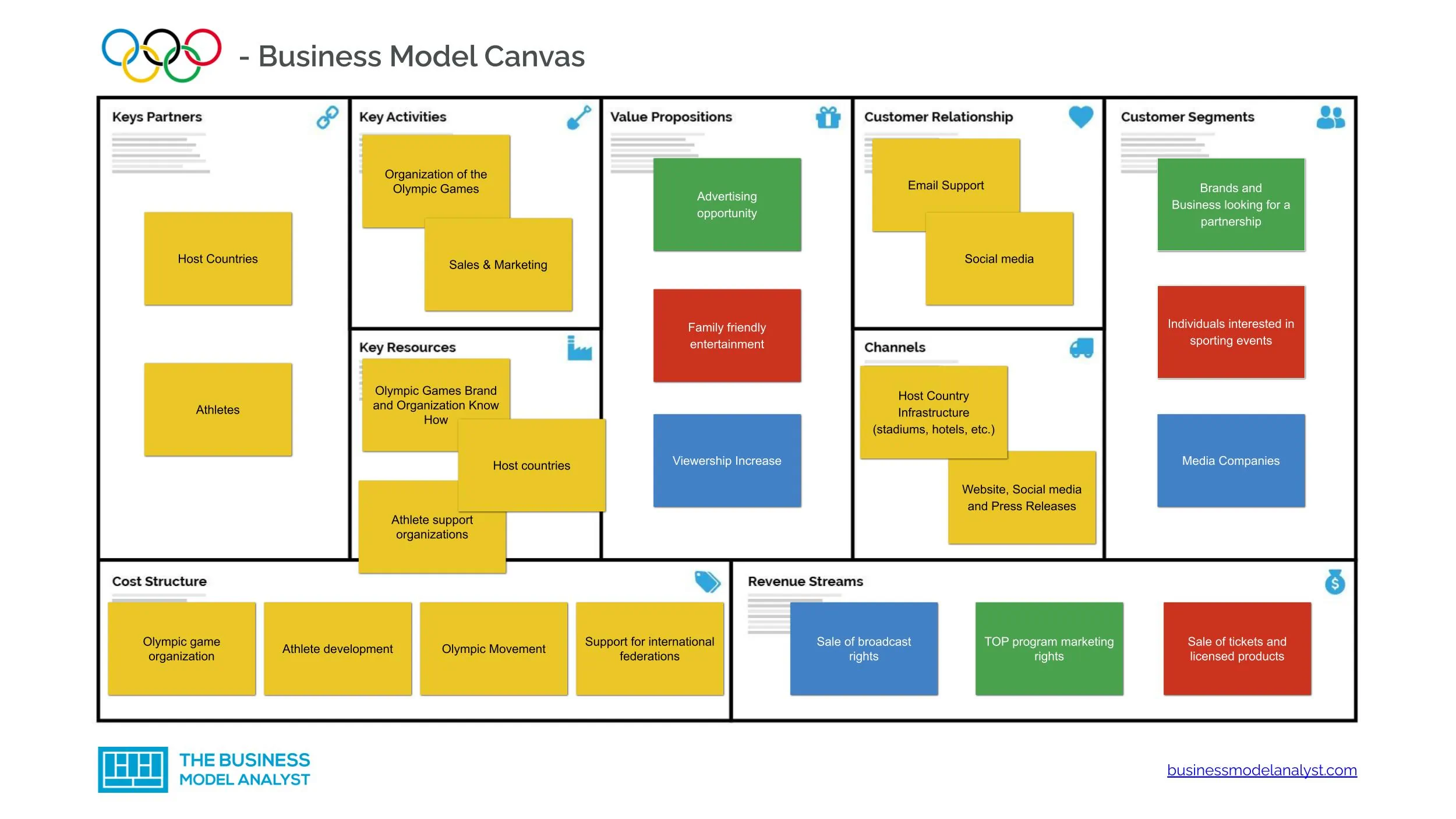

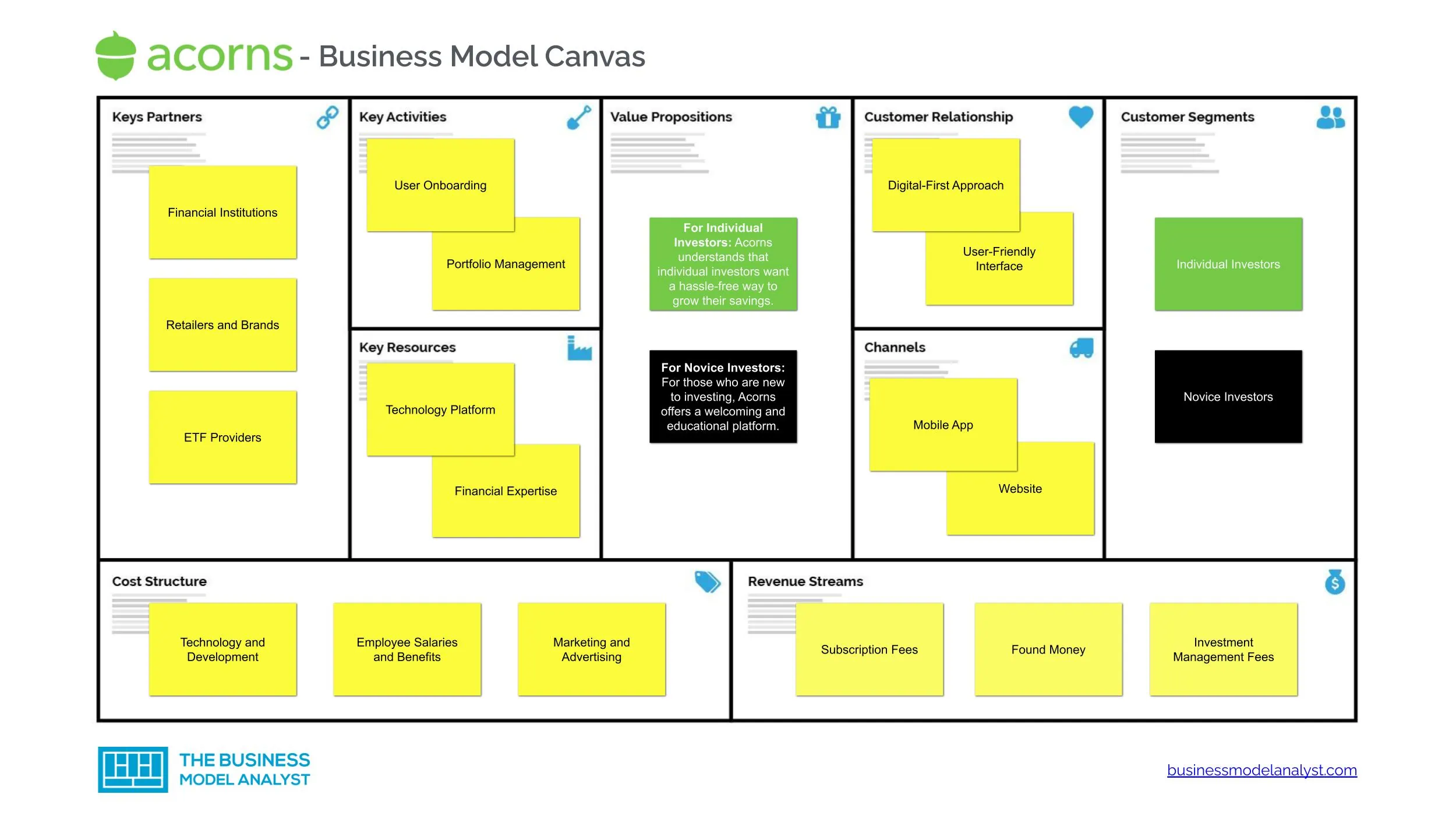

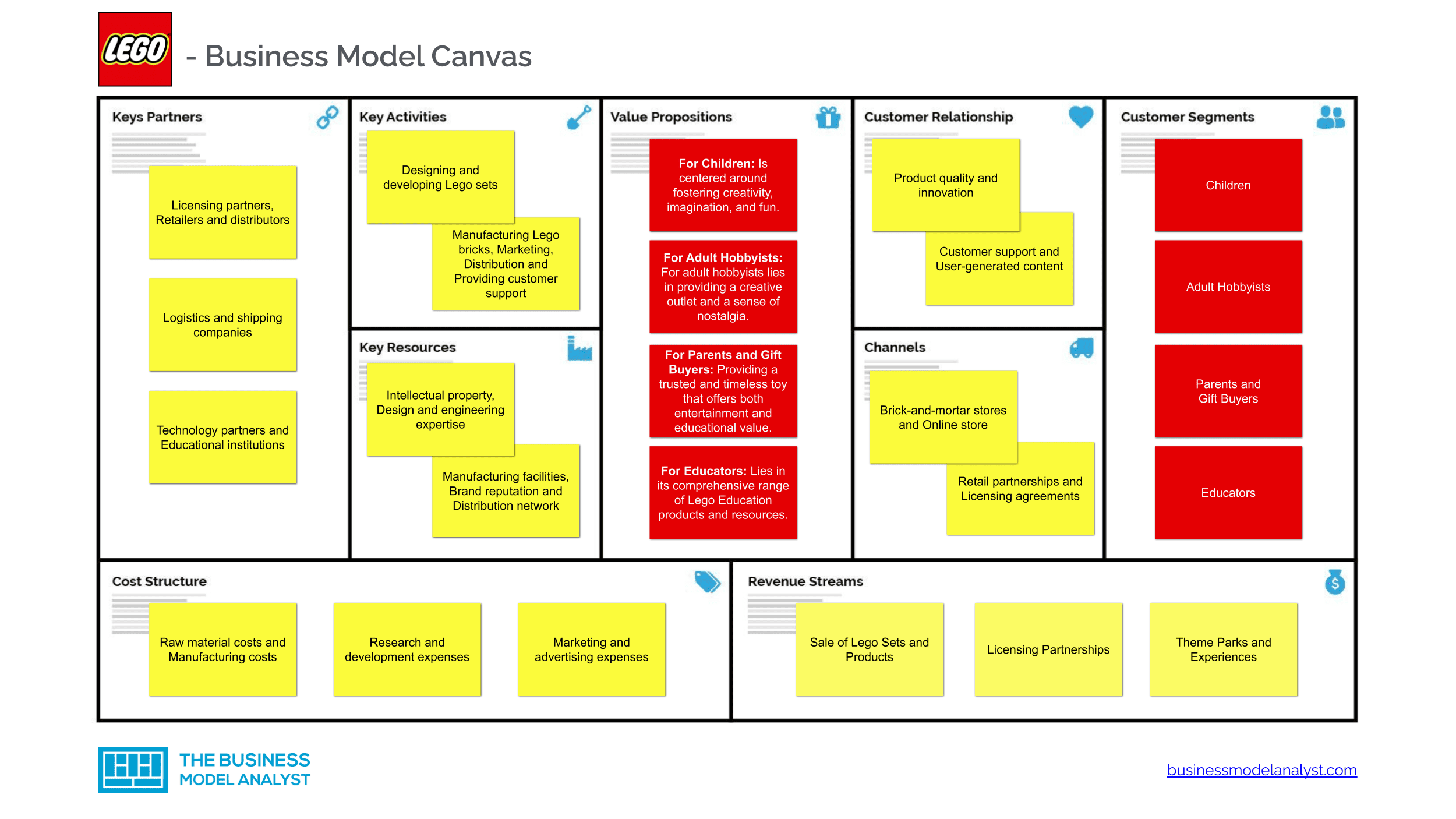

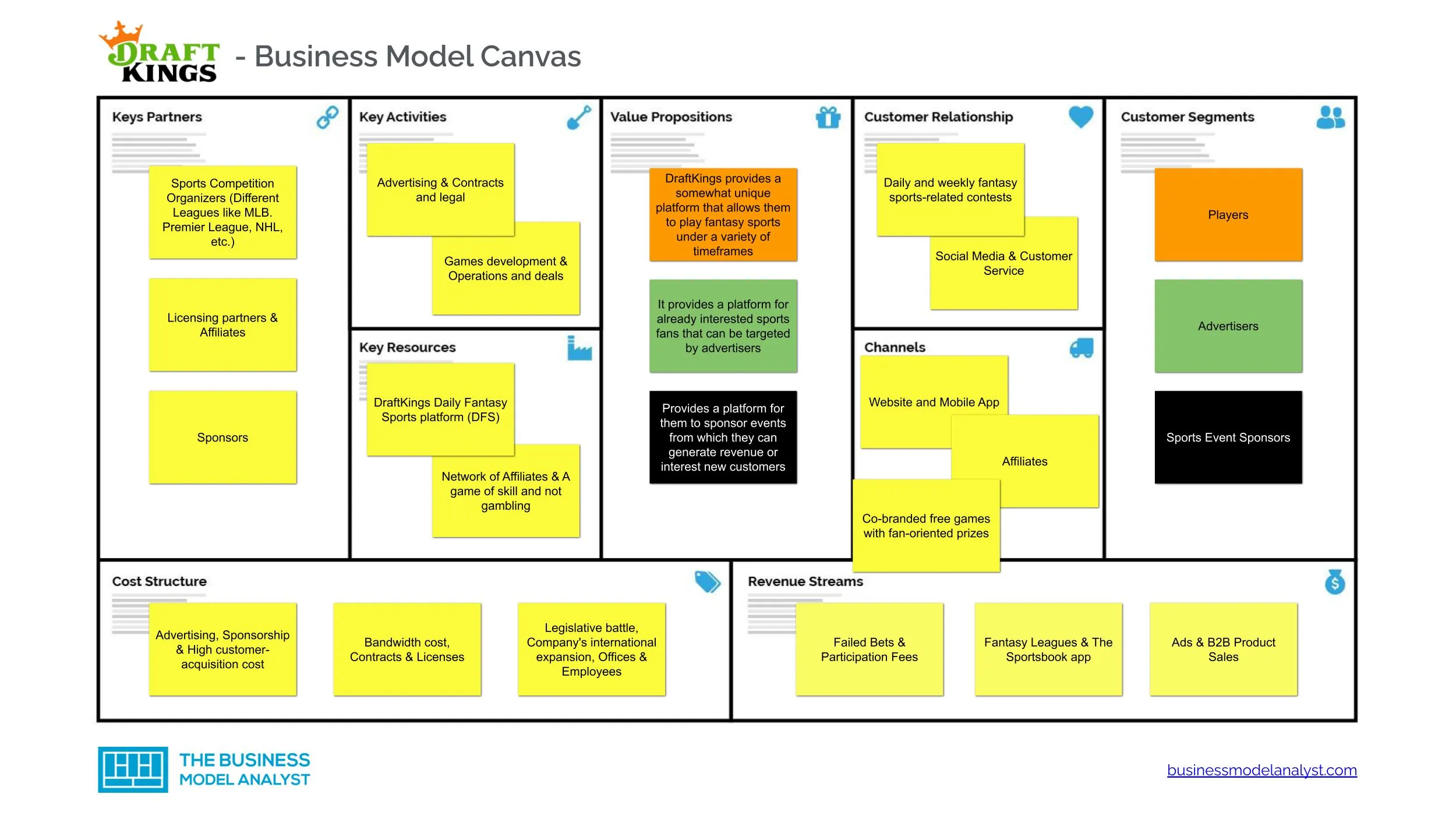

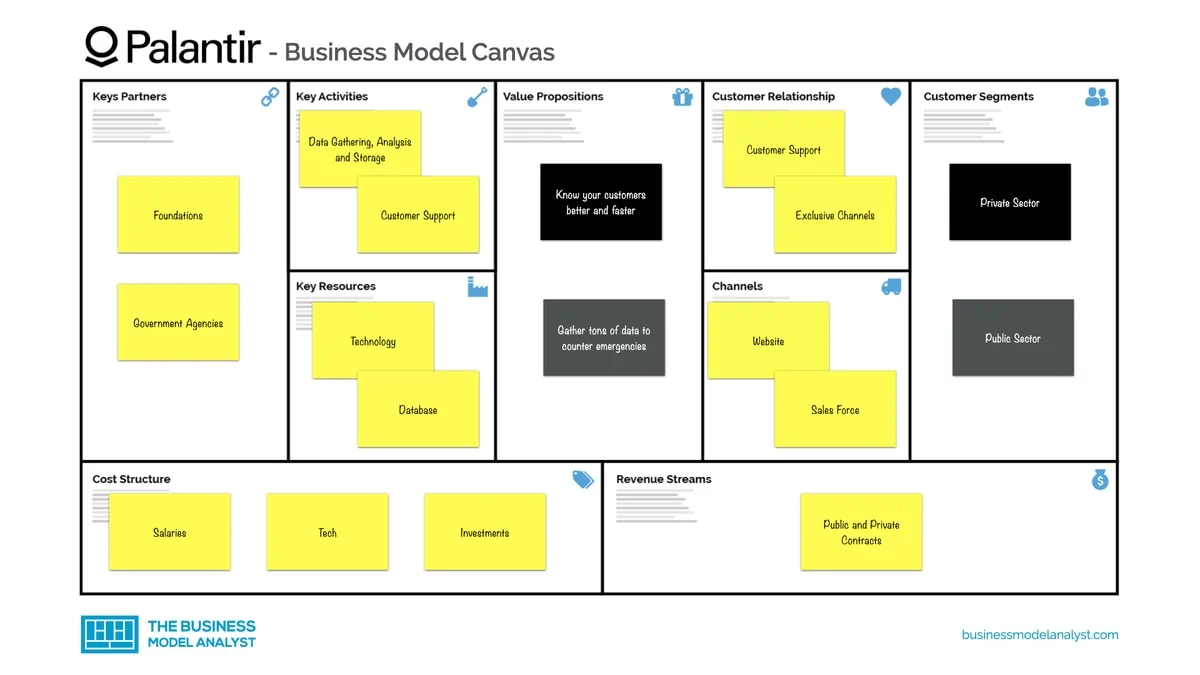

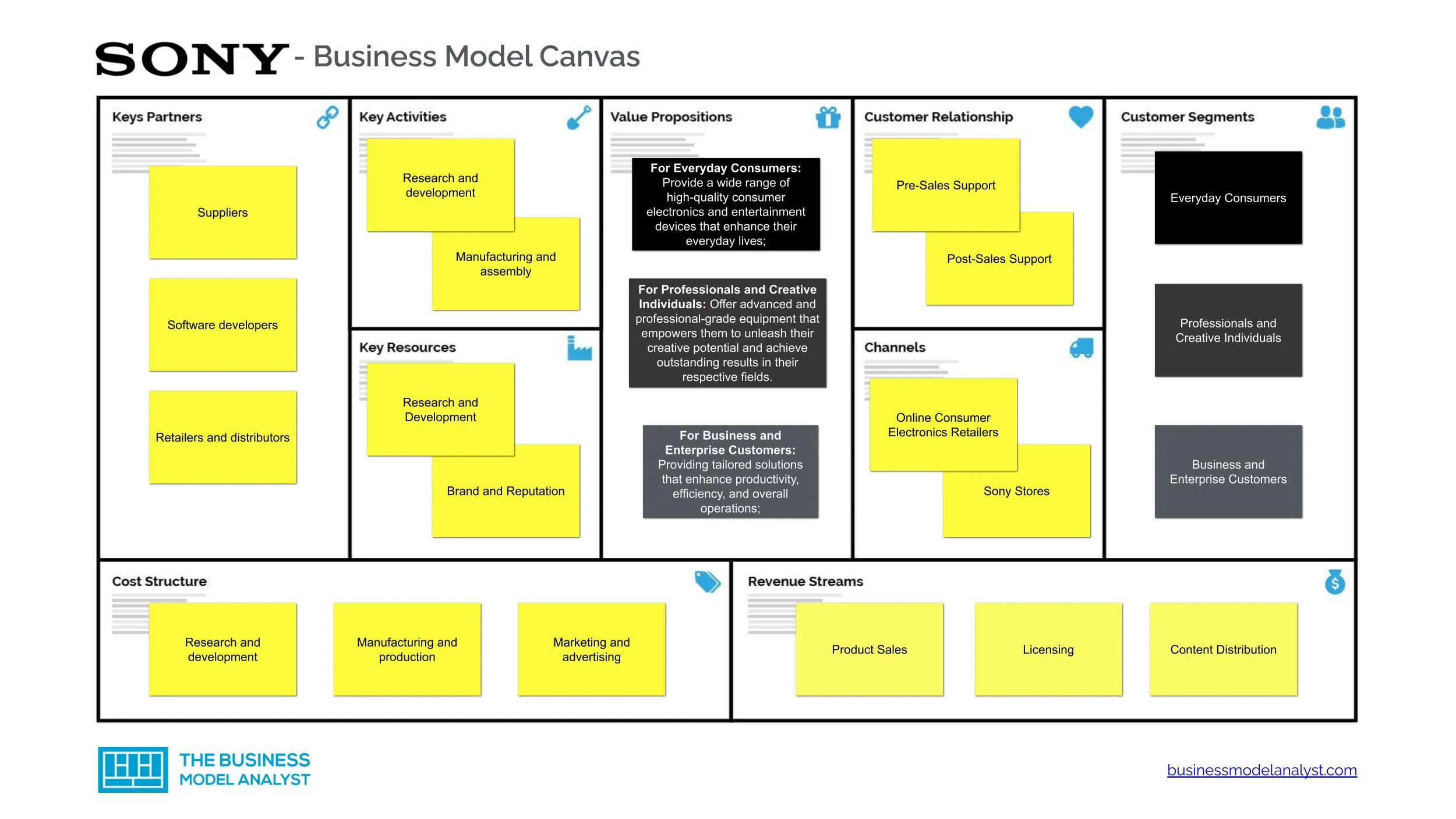

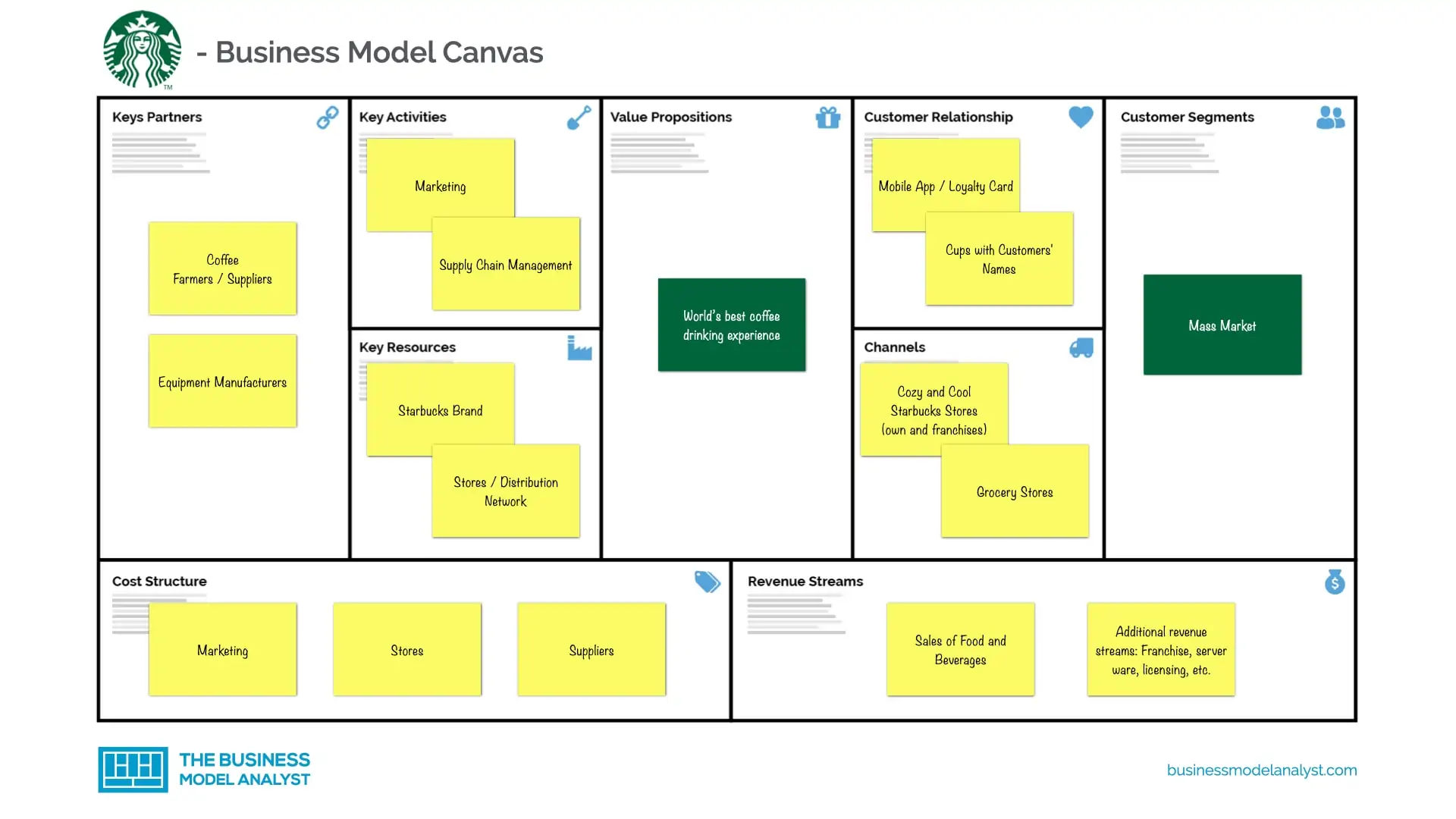

Numerous forms of business models can’t be classified in a single list because each part is highly individual to the industry, type of product/service, audience, or profitability. Business models are often depicted strategically on a business model canvas . This is a compound representation of all the key elements of a BM.

A business model canvas template by AltexSoft

So the BM describes how a business will work from the standpoint of value generation. Revenue models, on the other hand, are a part of the business model used to describe how the company gets gross sales.

Revenue model vs revenue stream

A revenue model is used to manage a company’s revenue streams, predict income, and modify revenue strategy. The revenue itself is one of the main KPIs for a business. Measuring it annually or quarterly allows you to understand how your business operates in general and whether you should change the way you sell the products or charge for them. But what are revenue streams ? A revenue stream is a single source of revenue that a business has. There can be many of them. Streams are often divided by customer segments that bring revenue via a given method. The two terms – revenue stream and revenue model – are often used interchangeably, since, from a business perspective, the subscription revenue model will have a revenue stream coming from subscriptions. However, models can name multiple streams divided into customer segments, while the principle of revenue generation (subscription) will remain the same.

Revenue model types

Any start-up, tech company, or digital business may combine different revenue models. The revenue model will look different depending on the industry and the product/service type. Here we will pay more attention to the most common revenue models used in the software industry and online business.

Transaction-based revenue model

A transaction-based model is a classic way a business can earn money. The revenue is generated by directly selling an item or a service to a customer. The customer can be another company (B2B) or a consumer (B2C). The price of the product or service constitutes the production costs and margin. By increasing the margin, the business can generate more income from sales. Selling products or services entails using different pricing tactics. While some of them may be considered separate revenue models, these tactics are often used in pairs. Because pricing tactics can be seen as pricing plans in a software business, we can clearly define the following types. Licensing/one-time purchase. This entails selling a software product by license that can be used by a single user or a group of users. The general idea is to offer a product that requires making only one payment for it, e.g., Microsoft Windows, Apache Server, and some video games. Subscription/recurring payment. Unlike licensing, a user receives access to the software by paying a subscription fee on a monthly/annual basis, e.g., Netflix, Spotify, and Adobe products. Pay-per-use. This pricing tactic is mostly used by different cloud-based products and services that charge you for the computing powers/memory/resources/time used. Examples are Amazon Web Services and Google Cloud Platform. Freemium/upselling. Freemium is a type of app monetization in which a user may access the main product for free, but will be charged for additional functions, services, bonuses, plugins, or extensions, e.g., Skype, Evernote, LinkedIn, and many video games. Hybrid pricing. Sometimes pricing plans are a mixture of more than one. So that freemium plan might morph into some form of pay-per-use tiered plan. After passing some limit in computation or resources, a user can be forced to use or offered another type of pricing. Examples are Mailchimp, Amazon Web Services, and SalesForce. Various combinations of pricing tactics can be used simultaneously, which is more often seen in cloud-based products that offer multiple payment options at once. The revenue model in this case remains based on the transaction and purchases made by the customers. The difference in pricing tactics will modify how the revenue is generated and basically depends on the type of product/service you sell. The pros. You have full control over the pricing strategy. The cons. The cons will depend on the industry/product type and pricing tactics, as the model itself imposes a constant generation of sales with the help of advertising and marketing strategies. The only con we might mention here is the financial burden connected with sales you will carry on your own. Transaction-based revenue model examples. Nearly any company that produces and sells its products uses this type of revenue model. Examples are Samsung, Rolls Royce, Nike, Microsoft, Apple, Boeing, and McDonald’s, to name a few.

Advertisement-based revenue model

The advertisement-based revenue model is a plan with which businesses make money by selling ad spaces. It is one of the most standard methods of producing top-line growth, and it’s valid both for online and offline businesses. It’s often used by websites/applications/marketplaces or any other web resource that attracts huge amounts of traffic. The pros. Having a high-traffic resource allows you to monetize the ad space nearly instantly. Often, there is a strong demand for advertising space, especially with organic traffic and platforms with the target audience. The cons. Running advertising campaigns to gain web visibility on various platforms like social networks is a standard marketing activity with targeting instruments more precise than ever. However, advertisements are everywhere, so you might think twice about whether you want to distract a user by placing an ad in your app – even if it is a secondary revenue stream. Ad-based revenue model examples. YouTube, Instagram, Facebook, and Google are just a few prominent examples. All these platforms generate revenue by displaying advertisements to users and charging businesses for exposure. In addition to promotion, these platforms may also generate revenue through other sources, such as premium subscriptions or licensing agreements.

Commission-based revenue models

A commission-based revenue model is one of the most common ways businesses make money today. A commission is a sum of money a retailer adds to the total cost of a product or service. A commission may be charged per marketplace or transaction and can be assigned as a

- flat rate, a fixed sum of money for any type of transaction, e.g., a $450/300/1500 transaction is charged with a $20 commission;

- percent of transaction size, e.g., a $100 transaction is charged with a 10 percent commission – $10; or

- tiered commission, a percent or flat rate that grows based on the transaction volume, e.g., 50,000 transactions are charged a 4 percent commission, 150,000 transactions a 7 percent commission.

Marketplaces and eCommerce platforms, in particular, utilize commissions the most. Another large category includes businesses that connect service providers/renters with consumers. Think of any ride-hailing company, food delivery, online travel agency (OTA) , or alternative accommodation services. The pros. Revenue is easily predictable because of the sheer fee. The cons. There are many problems bound to the concept of a commission, but the major one goes to the scalability of a business that’s attached to a transaction size or volume. In general, dependency on the product supplier’s sales makes generating revenue require upfront investments and competitive superiority. Commission-based revenue model examples. Airbnb is a platform that allows individuals to list and rent their homes or apartments as short-term rentals . It generates revenue by charging a commission on each booking made through its platform. The commission is typically a percentage of the total booking cost and is paid by the host (property owner). Other examples are Booking.com, Uber, Lyft, Ticketmaster, Priceline, and Upwork.

Markup revenue model

Markup is the type of revenue model with which you buy a product at a certain cost and then sell it for a higher price: The difference between the two is your profit margin. This model is often used by wholesale, retail, and service-based businesses. For example, a wholesaler may be a bed bank — a B2B company that purchases rooms from accommodation providers in bulk at a discounted, static price for specific dates, and sells them to OTAs , travel agents, destination management companies, airlines, or tour operators. Pros. Markup revenue models are straightforward, allowing businesses to easily calculate their profit margins on each sale. With this approach, businesses can be flexible with their pricing by adjusting the markup to reflect changes in the cost of goods or changes in market conditions. Cons. While markups provide a great deal of flexibility, some organizations may not have enough resources to manage revenue and apply changes to their markup strategy based on the market state. So they set a uniform markup for all of their products or services. This may lead to prices being too low or too high and businesses may not be able to fully capitalize on the value of certain products. Markup revenue model examples. In addition to bed banks, airline consolidators leverage a markup model to earn revenue: They are brokers that book flight seats in bulk at discount rates and then resell them to travel agencies. Examples are Mondee, Picasso Travel, and Centrav.

Affiliate revenue model

The affiliate model is similar to the commission-based model. The main difference is that, with the affiliate model, you do not sell the product or service on your own platform, but rather redirect the customer to the original provider's platform to make the purchase and earn a commission on any resulting sales. An affiliate model is a contract between a supplier of a product/service and a promoter. A promoter can be another business/media resource/blogger that recommends a supplier’s product. The earnings will come as a percentage of sales or fees for the number of registrations done via referral links. Businesses utilizing the affiliate model include metasearch engines as a unique example. Metasearch tools can be found almost everywhere. Their main difference with retailers is that they don’t sell products directly but offer comparison and search as a value. Advertising and affiliate programs are the main revenue models used to get earnings in this case. The pros. Just like the advertisement-based revenue model, once you have a huge traffic resource, you might apply for an affiliate program to earn money. This will bring you income without any investments because you will basically generate traffic and leads for the affiliate program provider. The cons. Unfortunately, the percentage of affiliate programs promised to the promoter is quite low. Sometimes it fluctuates between 1-2 percent and requires a high volume of sales generated through your links. Affiliate revenue model examples. Blogging and event-promoting platforms like Broadway.com or TheaterMania generate revenue using this model. Among other examples are Amazon affiliate websites, e.g., Cloud Living and ThisIsWhyImBroke.

Interest revenue model

An interest or investment revenue model relates to any type of business that generates revenue in the form of interest on their loans or deposit payments. These are most often banking or electronic wallet companies that work with financial operations. The revenue is generated by making a loan to a customer or by a customer depositing or investing money (or other resources) into the business. At the end of a return period, a percentage of the loan sum will return as revenue. Debit/credit money provided with the bank accounts also relates to this model. That’s just one of the ways financial companies can make money, combining it with transaction fees for using their e-wallet/bank account. The pros. The interest rate provides a clear view of what revenue a business will generate, as the percentage stays unchanged until the return period is over. The cons. The regulations of an interest rate impact both the customer and the business. Sometimes it depends on the economic environment. Think of currency rate changes that influence potential and existing borrowers. Interest revenue model examples. Many banks, credit card companies, and other financial institutions use the interest revenue model. For example, peer-to-peer lending platforms, such as LendingClub and Prosper, generate revenue by charging interest on loans funded by investors.

Donation-based or pay-what-you-want revenue models

This is a revenue model based on investments made by businesses or customers on a voluntary basis. The product or service itself is free to use by default, so that’s the primary value a company brings to the customer. The revenue is generated in the form of donations, or sometimes in the form of “pay-what-you-want.” It’s important to mention that there is a difference between a donation-based business and a charity organization. A donation-based company is still required to pay taxes. The pros. Because of the free access to the product, some companies manage to get increasingly popular, resulting in donations becoming a major part of their revenue. The cons. The model is never used on its own and the revenue generated by it remains a secondary source because of its random/unstable nature. Donation-based revenue model examples. AdBlock generates revenue through donations from users who support the development and maintenance of the software. At the same time, AdBlock offers a premium version of the software for a fee, which includes additional features and support. Among other examples is Wikipedia which relies on donations as a significant source of revenue. Additionally, the platform makes money through grants and partnerships. There are many other revenue models, and a business or project may use more than one revenue model. It is important for businesses and projects to carefully consider their revenue model as it can have a significant impact on the overall success of the venture.

How to choose a revenue model for your business?

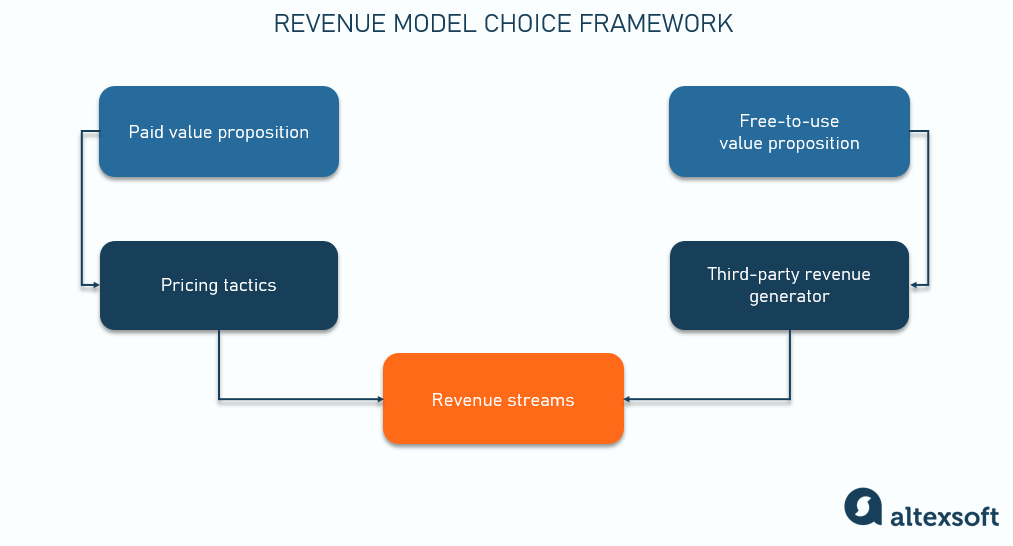

Before choosing a revenue model, you need a fully developed business strategy that will include a prepared business model with all its key instances. That means you must take a few steps prior to selecting the revenue model. Define your value proposition. Map out your product strategy by describing what the product is and what value it brings to the customer. Not all products can be sold: Can you recall the last time you upgraded your WinRAR to a full license? Also, you can analyze the future traffic for your app to understand if you can use ads in it. Explore the market state and customer groups. This step is to define your user persona and understand how these users usually buy things. Some markets are inclined to purchase just one product, some are inclined to ignore upgrades or in-app purchases. A good example in this field is the death of music-selling platforms that were totally replaced by subscription-based streaming services like YouTube Music, Apple Music, Spotify, and others. You may also explore the techniques on how to market your product in our dedicated article. Analyze competitors and their products. You’ll need to learn what mechanisms and revenue streams your competitors use and how they manage their costs. This information will probably show you the market’s pitfalls and dead ends. Looking at this simple matrix below, we can analyze the capabilities and needs of your company to help you decide the type of revenue model to use.

How to choose a revenue model framewor k

Depending on your business model, the product or service you’re presenting to the user is a subject of exchange. This is your value proposition on the market, so you are in charge of choosing what you want to get back based on the market factors, target audience, etc. Paid value proposition. In most cases, your value proposition costs money to use. Whether it’s a service or a software product, a customer will need to pay in some form to gain access to your value. Your revenue model in this case will be based on transactions. So develop pricing tactics that will depend on the nature of the product, the type of audience you’re trying to reach, the type of deployment, specifics of product usage, etc. Free-to-use value proposition. If the value proposition doesn’t require money to use or you choose it to be free, then you need a third party to generate revenue for you. This could be anything based on the previously mentioned types, whether it’s ad space, donations, affiliate programs, or reselling. The combination of the two will basically present you with the revenue streams that will focus on each of the customer segments. In the case of the paid value proposition, each pricing plan will be a separate revenue stream.

Maximizing Profitability: Explore Effective Revenue Models for Your Business

Choosing the right revenue model can help you earn more and create an effective pricing strategy. Explore the different types of revenue models here.

Imagine you're walking down the street on a hot summer day and see the neighborhood kids setting up a lemonade stand. Nothing sounds better on a day like this than an ice-cold lemonade. You approach their stand and find the price is $2 for a cup. While you know it wouldn't cost $2 to make just a glass of lemonade at home, you are willing to pay this price because you are thirsty and also want to support the kids.

From a business perspective, these kids are making a good amount of profit from their lemonade stand. They're actually using a markup revenue model where they increase the price of a cup of lemonade to account for their operating costs. It seems like the perfect model for making money. However, this might not be the case in every business situation. Depending on the scale and complexity of your business model , you need to consider different methods of developing revenue streams.

There are various revenue models implemented by businesses across the board. Many business models are far more complex than a simple lemonade stand and thus require a different revenue model strategy. There are subscription-based, advertising, and commission-based models, to name a few—but what is a revenue model, and how do you choose one?

If you're considering which revenue model to incorporate into your business strategy, keep reading to learn more.

What is a revenue model?

A revenue model is a blueprint for how a company produces income from its services or products. Simply put, it outlines the methods through which a business makes money. There are several components within a revenue model, including how you price your products and which sales channels you choose. A revenue model is established to answer how a company plans to financially optimize its business model.

Revenue models can be seen as roadmaps for understanding how your business will operate financially. They define how a company generates revenue, covers costs, and eventually turns a profit. A revenue model should outline the various sources of income to help guide decision-making related to the overall business strategy.

Benefits of implementing revenue models

Developing a revenue model is an essential step for growing your business. Here are some of the main benefits of implementing revenue models:

Financial sustainability

An effective revenue model establishes consistent income streams, providing financial security and sustainability. Your revenue model should help you understand how much revenue to expect so you can properly plan expenses, growth, and investments.

Pricing strategy

Factors such as market demand, competition, and product costs are considered within a revenue model. Each of these factors can inform your pricing strategy. Based on the revenue model, you can determine which prices maximize revenue while remaining appealing to customers.

Profitability analysis

Revenue models show how your business generates revenue. Understanding the costs incurred by creating your products or services, along with the generated revenue, allows you to analyze the profit margin of your business. Subsequently, you can make informed decisions to improve your resource allocation and pricing strategy.

Scalability

Growth is key to your business revenue model thriving. Implementing a revenue model provides insight into the scalability potential of your business. You can easily assess potential revenue growth by attracting more customers and introducing new products or services. Knowledge is power—the more information you have about how your business operates, the better you can plan for the future and make smarter investments.

Decision-making

A sound revenue model produces meaningful insights to influence strategic decision-making. Your revenue model indicates which products or services generate the highest income, enabling you to better allocate resources and focus on areas with the highest profitability potential.

Investor confidence

A smart revenue model will inspire investor and stakeholder confidence. Potential investors will be impressed by a well-defined revenue model that demonstrates a clear plan for generating multiple revenue streams.

Types of revenue models

There are various revenue models that can be implemented based on your specific business operations and needs. Understanding when and how to choose different types of revenue models will help you better calculate revenue growth rates.

Here are just a few revenue model examples:

Advertisement-based

An advertising revenue model is a popular type of revenue model. The main source of income is generated by displaying advertisements. In this model, your company sells advertising space to other businesses or brands who want to advertise with your customer base and users. How your business earns revenue is by charging advertisers for ad placements.

Pros of advertising-based revenue models

- Successful advertisement-based revenue models typically generate significant income.

- An advertising model can greatly boost revenue streams if you have a large user base or a popular platform.

- There's a low barrier to entry, meaning it's relatively easy to set up and requires minimal investment upfront.

- This revenue model also offers flexibility and opportunities for diversification since you can provide many ad types and have a full roster of advertisers.

Cons of advertising-based revenue models

- Advertisers aren't guaranteed.

- You need to attract advertisers who are willing to pay for placements on your platform.

- The advertising market constantly fluctuates, meaning your revenue may fluctuate whenever advertisers reduce their budgets and don't buy ad space.

- You must also consider user experience and how incorporating display ads will impact your engagement.

YouTube is well-known for using an advertising model. Content creators on the platform can monetize their content by displaying ads on their videos. YouTube earns revenue by selling advertising space to companies that want to reach a vast audience. In this case, content creators can also receive a share of the ad revenue based on several metrics, including clicks, view time, and impressions.

The affiliate model is a more common type of revenue model. It's where a company or person makes a profit by promoting and selling products on behalf of another business. In the affiliate revenue model, an affiliate acts as the middleman between potential customers and the products or services.

Pros of affiliate revenue models

- Affiliate models are generally low-risk and cost-effective.

- As an affiliate, you don't need to create your own products, nor do you handle inventory or customer segments.

- It offers the potential for passive income by earning commissions without active involvement.

- You can also generate income from various affiliate partners, making this model great for diversification and scalability.

Cons of affiliate revenue models

- As an affiliate, you have little to no control over the products or services you promote. This means that negative customer experiences may harm your reputation.

- This type of model also creates revenue dependence on partners.

- Generating a profit with affiliate marketing may be easy, but intense competition and market saturation can make it difficult to generate significant income.

Affiliate marketing is a common revenue model. Amazon Associates is an example of an affiliate revenue model that allows individuals or businesses to make money through commissions on Amazon products they promote. Amazon provides unique affiliate links that lead to participants earning a percentage of the sales on products they advertise.

Commission-based

Similar to the affiliate model, commission-based revenue models allow companies to generate revenue by receiving a commission from each transaction it facilitates. Again, the company acts as a mediator between sellers and buyers.

Pros of commission-based revenue models

- The commission-based revenue model can be extremely scalable.

- The more users you gain, the more transactions will occur, leading to an increase in revenue growth.

- Another benefit of this model type is risk-sharing between the company and the sellers.

Cons of commission-based revenue models

- One of the major downsides to this model is dependency on transaction volume. If there are few transactions happening, the opportunities for generating revenue significantly decrease.

- You'll also experience limited control over pricing, which can lead to price competition among sellers and lower commission rates.

Airbnb uses a commission-based model. The platform makes money by connecting individuals with accommodation. Airbnb earns a commission on every booking made on the platform, making the company reliant on users securing lodging through their platform in order to generate revenue.

Another popular revenue model is donation-based. This strategy is implemented by soliciting and accepting voluntary donations instead of selling services or products.

Pros of donation revenue models

- One of the main benefits of a donation revenue model is the flexibility of revenue generation.

- Organizations can receive revenue streams from diverse donors.

- It's one of the most common revenue models implemented by charitable organizations and comes with tax benefits.

Cons of donation revenue models

- The downside of relying on donations is having an unsteady and uncertain revenue stream.

- Organizations are dependent on donors and are also required to spend money and time on fundraising.

- There are certain stipulations associated with receiving donations and how that money can be used

The Red Cross uses a donation revenue model. As a global humanitarian organization, the Red Cross relies on voluntary contributions to fund its services and programs. The Red Cross doesn't sell products, but they provide services for the community. The donation model is used to support the execution of these services.

The markup model entails a pricing strategy of marking up the cost or adding a margin on top to ensure financial viability. This strategy is used to cover expenses and generate profit despite external factors.

Pros of markup revenue models

- A markup revenue model is simple in practice.

- It doesn't require complex calculations and ensures the profit calculation is straightforward and transparent.

- The markup model also offers flexibility in pricing, meaning businesses can adjust the markup percentage depending on market conditions, supply, competition, and more.

Cons of markup revenue models

- The markup model can be difficult to implement in competitive markets.

- Competing while maintaining profit margins can be challenging when competitors implement aggressive pricing.

The retail industry generally relies on the markup model. There are specific production costs associated with making a pair of shoes. Retailers typically purchase the shoes from wholesalers at a fixed price. Then, they add a markup percentage to determine the selling price so it covers operating expenses and allows the retailer to earn money.

An interest revenue model refers to businesses generating income by earning interest. In this case, companies are making money by leveraging interest rates rather than making direct sales.

Pros of interest revenue models

- Interest models allow companies to earn passive income and diversify their revenue streams.

- This revenue model is also highly scalable and can benefit from changes in interest rates, leading to enhanced earning potential.

Cons of interest revenue models

- There's a level of risk associated with the interest revenue model. Risks include borrowers defaulting on loans, interest rate fluctuations, regulatory and compliance laws, and intense market competition.

Credit card companies use the interest operating model. They lend money to borrowers and earn interest back based on interest rates. These companies manage credit and loan portfolios while taking advantage of interest rates to increase profitability.

Subscription

A subscription revenue model relies on customers who subscribe and pay for your products or services. Customers pay fees to access the company's collection of products or services, allowing for steady revenue sources. The subscription-based revenue model allows a company to generate revenue by offering long-term subscriptions, resulting in consistent income such as monthly recurring revenue .

Pros of subscription revenue models

- The subscription model provides a reliable and predictable revenue stream.

- Customers pay in regular installments, allowing businesses to easily forecast finances.

- This revenue model also promotes customer retention and loyalty while lending itself to upselling and cross-selling opportunities.

Cons of subscription revenue models

- Acquiring customers with the subscription model can be challenging, meaning you may need to spend more time and money on marketing and sales.

- Customers can also cancel their subscriptions, leading to an increase in customer turnover.

Netflix is one of the most popular subscription revenue model examples. Users pay a monthly fee to access the streaming platform. Revenue generation results from monthly subscriptions. Not all subscription models are successful, but Netflix is the best example of how a subscription model can succeed in making money.

Which revenue model is right for you?

Choosing which revenue model is right for your business will depend on a variety of factors, such as your target audience, operating costs, and overall business model.

The first step for choosing a revenue model is to understand your market and the needs of your target audience. For example, media organizations will have different audiences than healthcare companies. Conduct market research to understand your customers and their needs, preferences, and pain points. These findings will inform your business strategy and how you decide to conduct business operations.

The next step is to specify your value proposition by clearly defining the unique value of your product or service. Identify key benefits and determine what sets your business apart from the competition. Consider how your business performs in terms of innovation, convenience, and quality. Communicating these benefits clearly and concisely enables your target customers to connect with your company.

Know your product or service inside-out. Understanding how your product functions, what it offers to target customers, and what your mission is will help you determine your company's business model. The ultimate goal is to generate revenue, so the more you understand your product or service, the better you can make sound business decisions.

There are several common revenue models to choose from. Online businesses, such as an e-commerce platform, might consider an advertising revenue model to diversify income streams. A local bakery may opt for other revenue models more suitable for their needs and production model. Select a revenue model after thorough research and consideration to ensure a steady and effective revenue stream.

Grow your profits with the right revenue model

Business models rely on generating income. The best way to grow your profits is to choose a revenue model that fits your company's unique needs. A company's revenue streams are dependent on more than just direct sales. Make sure to consider all different revenue model types when developing your strategy. A smart strategy is essential for a scalable business .

Whether you're just getting started or considering a switch in your revenue model, you can land more sales by leveraging market insights . Unlock your full earning potential by exploring the different tools and resources available for choosing a revenue model and growing your business. Rely on actionable data to make informed business decisions and hit your targets.

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Revenue Models: The Advanced Guide To Revenue Modeling

Revenue modeling is a process of incorporating a sustainable financial model for revenue generation within a business model design. Revenue modeling can help to understand what options make more sense in creating a digital business from scratch; alternatively, it can help in analyzing existing digital businesses and reverse engineer them.

Table of Contents

Myth: A revenue model is a business model

I noticed over the years of research I’ve put into business modeling how pervasive the confusion between revenue and business model is.

In the startup world, those are often used as synonyms.

Which is fine as long as it doesn’t limit the understanding of what you can do within a business model.

Indeed, a revenue model actually does inform the business model, and it often influences it from the foundation.

However, those are not the same. In fact, in many cases, a revenue model and stream are the only building blocks of an overall business model.

Take the case of Netflix, which for years has been running with a subscription business model, and that much much later on (only in 2021), Netflix started to roll out an ad-based revenue model.

Changing a revenue model is not just about changing the way you make money, but it implies changing a set of assumptions within a business model.

Going back to the case of Netflix, adding the ad-supported tier within its business model, requires an understanding of the implications that might carry on the overall business model.

Thus, Netflix is not just about running ads on top of its platform. It’s about understanding how the streaming ad ecosystem works, how to integrate it within its business model, and what consequences that might have on a current subscription model.

That is why, if you’re on Netflix when you start running ads, it’s not just about how and how much money you can make from it; it’s about asking a few fundamental questions about the overall business model, such as:

- What’s the impact of advertising on the overall business model?

- How is advertising different from subscriptions?

- What scalability advertising has vs. subscriptions?

- What margins do we have with advertising vs. subscriptions?

- Is advertising helping us build a better acquisition funnel?

- Who are the key players within the advertising ecosystem?

- How do we build a scalable advertising platform?

In other words, my argument here is if you plug in a new revenue stream, that is not a business model.

And it’s not just about how you make money; that is also about how that stream integrates within the overall business model and how it changes its distribution , marketing , and financial model.

With this holistic understanding, you are not constrained by a narrowed definition.

Revenue modeling as the avenue into the business model

Once you take into account the above, then, of course, you know that revenue modeling can be an avenue into a business model.

Thus, an understanding of the revenue model will help you:

- Reverse engineering any business (by starting the analysis by simply following the money).

- Speed up the experimentation process by plugging in new revenue models for your business.

- Start building or scaling a business model!

What is a business model?

What is a revenue model?

For the sake of this guide, we’ll look at a key distinction: symmetrical vs. asymmetrical in several contexts.

Remember that all classification methods have flaws and we can only take them into account as long as they help us better tune an existing business model .

I decided to use this classification, but any alternative classification works as long as we are able to grasp and understand the possibilities we have in terms of business model design.

Symmetrical vs. Asymmetrical business models

Business models can be of various types.

For that matter, there might be as many business models as the companies we have in the marketplace.

In this guide, we’ll use as reference symmetry vs. asymmetry to distinguish across two main business models categories.

In this particular case, we’ll look at revenue modeling by keeping a key distinction between symmetry and asymmetry from three different perspectives.

Cash: who pays the bill?

In many cases, platform business models success depends upon two key players:

- Users : who don’t pay for some or all the services offered by a platform (on the user-side), but they help the platform build it’s a core asset

- Customers : who pay for the services offered (on the customer-side) to take advantage of the core asset of the platform

In such a business model, the platform assembles the anonymized data of its users who get a free service in exchange.

The assembled data gets processed (by the platform AI and algorithms) and it’s used to scale the platform, build a valuable core asset that can be financed by a set of customers willing to pay for it.

Asymmetrical: users ≠ customers

The asymmetry here stands in the fact that users and customers are two separate entities (asymmetrical cash model: users ≠ customers).

Think of how Google sells ads to companies, while its core products are all free to users.

Symmetrical: users = customers

Thus, in a symmetrical revenue model, users and customers are the same entity (symmetrical cash model: users = customers).

Think of how Netflix’s users are also its customers.

However, it’s worth highlighting how Netflix has now launched an ad-supported version, which starts at $6.99 and is an ad-supported tier.

This is an interesting business model transition. Indeed, for all its life, Netflix has relied on a linear and symmetrical revenue model, where users were also customers.

As of now, that is still true. In fact, in the ad-supported tier, users are still paying customers. However, it’s worth emphasizing that users are now advertisers’ target.

Thus, by October 2022, as Netflix started to roll out its ad-supported plan, the company also started to move into an asymmetrical business model type.

Why is Netflix moving toward an asymmetric business model? The answer is simple: Scale!

To reach a subsequent stage of scale, where the company can successfully reach a billion users, an ad-supported business model can help with that.

Information: does the user know how the platform makes money?

If there is information asymmetry, it means there is one of the parties knows more than the other side.

Asymmetrical: hidden revenue generation

In a hidden revenue generation model , the users of the platform ignore how it makes money while the platform knows a lot about its users.

Symmetrical: revealed revenue generation

In a symmetrical model, revenue generation is revealed, thus enabling the customers to know what they get for the service paid.

Scale: does the platform retain its margins as it scales?

Scale is the ability of a company to grow exponentially while keeping its margins growing with the platform’s revenues.

Symmetrical and Linear: margins tighten as the platform scales

In a linear symmetrical revenue model as the platform scales its margins tighten up, thus reducing the profitability of the platform.

Asymmetrical and Non-linear: margins keep growing as the platform scales

In a non-linear asymmetrical revenue model as the platform scales margins keep growing, thus keeping the platform highly profitable.

Revenue model examples

In this chapter, we’ll see some revenue model examples you can use or borrow to build your business model .

Ad-supported

Subscription-based

Consumption-based

Commission-based

Hidden Revenue

Razor and blade

Hybrid revenue models

A good example of a business model that has different revenue models is Amazon. Based on each side of its business, Amazon has different revenue streams and models:

Within the Amazon core consumer e-commerce platform, there are two main types of revenue streams:

- Amazon-branded products : on those products which are labeled and sourced by Amazon, the company sells them directly to consumers. Therefore, this is part of the revenue model, where Amazon has the highest margins and more control.

- Amazon’s third-parties products : those are products that Amazon hosts on its own e-commerce platform. Those products benefit from Amazon’s e-commerce visibility and sustained traffic. At the same time, Amazon will have the advantage of increasing the variety of products available in its stores, thus making them more appealing to consumers. However, compared to the branded product, Amazon will have less control and reduced margins. Indeed, Amazon will split the revenues with third-party sellers.

To enable more capabilities to third-party e-commerce stores, and at the same time, guarantee a better experience on its e-commerce (and we can argue also to have more control and margins) Amazon introduced over the years the third-party seller services:

- Amazon third-party seller services: fulfilled by Amazon , perhaps enables sellers to host their inventories, and deliver with Amazon , thus collecting a royalty as a result of the sales made on the platform. Here, the revenue model is flipped. Indeed, Amazon will collect most of the revenues coming from the product sales (remember that Amazon also takes care of storing the inventory and fulfilling it to customers) and the seller will collect a royalty, thus a % of the sale.

Other revenue streams comprise:

- Product advertising: Amazon is the most popular product search engine. Over the years it gave the options to e-commerce built on top of Amazon, to gain more visibility both on an impression or on a click-through rate basis. This means that Amazon sells advertising with a bidding model (similar to Google Ads) .

- Amazon Prime: born as an attempt by Amazon to increase the repeat business on the e-commerce platform, Prime turned into a real streaming entertaining business, competing with other companies, like Netflix. This revenue stream follows a subscription-based model .

- Amazon AWS: Amazon AWS turned into a cloud infrastructure able to support many small, medium, and enterprise customers. The revenue model here runs primarily based on a consumption basis. Therefore, with a logic of pay-as-you-go.

Revenue model vs. cost structure

To complete the picture, it’s critical to trace the difference between the revenue model and cost structure.

And from there, how the two elements come together to help build a viable business model.

The cost structure is tightly connected to the revenue model. Each revenue stream might carry

Remove model and distribution

In many cases, having a more holistic view of how the revenue model and cost structure interact is critical also to assess when a revenue model goes beyond making money alone.

Don’t get me wrong; a revenue model does focus primarily on how to make money for a business.

However, in some cases, a revenue model might bring in the money as a side-effect of building distribution for the business.

Let’s take a few examples.

When you look at Spotify’s business model , there is no doubt that the premium members’ revenue stream (for now) is the one that most contributes to the business.

Above, you can see how the premium membership revenue is many times over that of the ad-supported tier.

And there is more to it.

Even if we look at it from a cost structure standpoint, the premium membership revenue has a much lower cost compared to the ad business.

Indeed, Spotify, in 2021, generated €8.46 billion in revenues from the premium members’ revenue stream.

And of that, an almost 30% gross profit margin.

On the other hand, in the same period, Spotify generated €1.2 billion in revenue from the ad-supported stream at a 20% gross profit margin.

Does that mean the ad-supported revenue stream is not as good as the premium members?

If you look at it from a revenue generation standpoint alone. That is what you can imply.

However, you do understand that the ad-supported side of the business also represents the marketing funnel, which helps Spotify get recognized by hundred of millions of users across the world.

And that many of these free, ad-supported members become, over time, paid subscribers.

You can get a more comprehensive picture.

As the ad-supported side of the business is not only a revenue stream but it’s also a marketing and distribution channel.

In addition, the ad-supported side of the business, if scaled up, can also enable Spotify to generate much more revenues, in the future, at much wider margins.

Indeed, advertising networks, compared to membership networks, work better as they are scaled up!

That is why it’s critical to develop a holistic mindset to grasp the complete picture of how companies’ business models work.

This is the essence of business engineering .

Breaking down the wall between product and distribution

The lesson we learned from the Internet playbook and way of doing business is the aspiration, over time, to break the walls between product and distribution .

In short, the product becomes both a revenue generator and a marketing /distribution channel.

When you combine the two, that is when you’re able to build an incredible growth engine that will enable a company to establish a scalable business model built on solid moats!

Key Highlights:

- Revenue Modeling Defined : Revenue modeling involves creating a sustainable financial plan for generating income within a business model. It aids in analyzing existing digital businesses, reverse engineering them, and designing new digital ventures.

- Distinguishing Revenue Model and Business Model : While often used interchangeably, a revenue model and a business model are not the same. A revenue model is a foundational element within a business model that informs and influences various aspects of the business.

- Netflix Case Study : The example of Netflix demonstrates how changing a revenue model (adding an ad-based tier) impacts the entire business model. This shift requires considerations about the impact on the overall model, differences from subscriptions, scalability, margins, acquisition funnel, ecosystem players, and platform scalability.

- Holistic Approach to Revenue Modeling : Revenue modeling goes beyond just making money; it involves understanding how a new revenue stream integrates with the business model, impacting distribution, marketing , and financial aspects.

- Importance of Asking Fundamental Questions : When introducing a new revenue stream, it’s crucial to address fundamental questions about its effects on the overall business model, differences from existing streams, scalability, margins, and more.

- Avenue into Business Model Design : Revenue modeling serves as an entry point to designing a business model. It helps in reverse engineering businesses, accelerating experimentation with new revenue models, and facilitating the process of building or scaling a business.

- Business Model Defined : A business model is a comprehensive framework that systematically creates long-term value for an organization by delivering value to customers and capturing value through monetization strategies. It guides understanding, design, and testing of business assumptions.

- Revenue Model Defined : A revenue stream is a foundational component of a business model, representing the economic value customers pay for products and services. It influences how a business model functions and delivers value.

- Symmetrical vs. Asymmetrical Business Models : Asymmetrical models don’t directly monetize users but leverage user data and technology, often having a key customer pay to sustain the core asset. Google’s data-driven ad monetization is an example of an asymmetrical model.

- Various Business Model Types : Business models come in different types, such as scalability, incubator, pivot, freemium, open source, seed funding, cash flow, accessibility, blue ocean, churn, evangelist, growth hacking, MVP, leaner MVP, product-market fit, business engineering, and more.

- Transitional Business Models : Transitional models are used to enter markets, gain traction, and shape long-term scalability visions.

- Revenue Streams Matrix : Classification of revenue streams based on customer interactions and ownership of those interactions aids in revenue modeling.

- Pricing Strategies : Developing pricing models that align with customer needs and financial sustainability is an integral aspect of revenue modeling.

- Considerations in Designing Business Models : A holistic understanding of revenue modeling is crucial, as it influences distribution, marketing , financial models, and other key aspects of a business model.

- Applying Holistic Approach to Business Growth : Utilizing revenue modeling for designing innovative revenue strategies contributes to business growth and sustainability.

Other Case Studies

| Company | Revenue Model | Case Study | Analysis |

|---|---|---|---|

| Netflix | Subscription-Based Model | Netflix’s subscription streaming service | Netflix relies on monthly subscription fees, providing access to a vast library of content with no ads. |

| Spotify | Freemium Model | Spotify’s free and premium music streaming | Spotify offers both free ad-supported and premium ad-free subscriptions, generating revenue from premium users and advertisers. |

| Amazon | E-commerce and Marketplace Model | Amazon’s online retail and third-party sellers | Amazon generates revenue through product sales, third-party seller fees, and Amazon Web Services (AWS). |

| Advertising Model | Google’s online advertising, AdWords, and AdSense | Google earns revenue by displaying ads on its search results pages and partner websites. | |

| Apple | Hardware and Ecosystem Model | Apple’s sale of hardware and services | Apple generates revenue from the sale of hardware (iPhone, Mac) and services (Apple Music, App Store). |

| Airbnb | Commission Model | Airbnb’s commission from host and guest bookings | Airbnb earns a percentage from hosts and guests for each booking facilitated on its platform. |

| Uber | Commission and Ride Fees Model | Uber’s commission from drivers and ride fees | Uber takes a commission from driver earnings and charges riders based on distance and time. |

| Subscription and Recruitment Model | LinkedIn’s premium subscriptions and job postings | LinkedIn generates revenue from premium subscriptions, talent solutions, and marketing solutions. | |

| Dropbox | Freemium and Subscription Model | Dropbox’s cloud storage and file-sharing | Dropbox offers free storage with premium subscriptions for additional features and space. |

| Facebook (Meta) | Advertising and Data Monetization Model | Facebook and Instagram’s advertising and user data | Meta earns revenue by displaying targeted ads to users and monetizing user data. |

| Etsy | Handmade and Artisanal Goods Marketplace | Etsy’s platform for artisans and crafters | Etsy provides a platform for artisans to sell their unique handmade products to a global audience. |

| Upwork | Freelance Talent Marketplace | Upwork’s platform for freelancers and clients | Upwork connects businesses with freelance talent for various projects, spanning from writing to programming. |

| eBay | Online Auction and Sales Marketplace | eBay’s platform for auctions and sales | eBay allows individuals and businesses to buy and sell a wide range of goods through auctions and direct sales. |

| Alibaba Group | B2B and B2C E-commerce Marketplace | Alibaba’s e-commerce and wholesale platforms | Alibaba connects global buyers and sellers, facilitating trade and e-commerce transactions on a massive scale. |

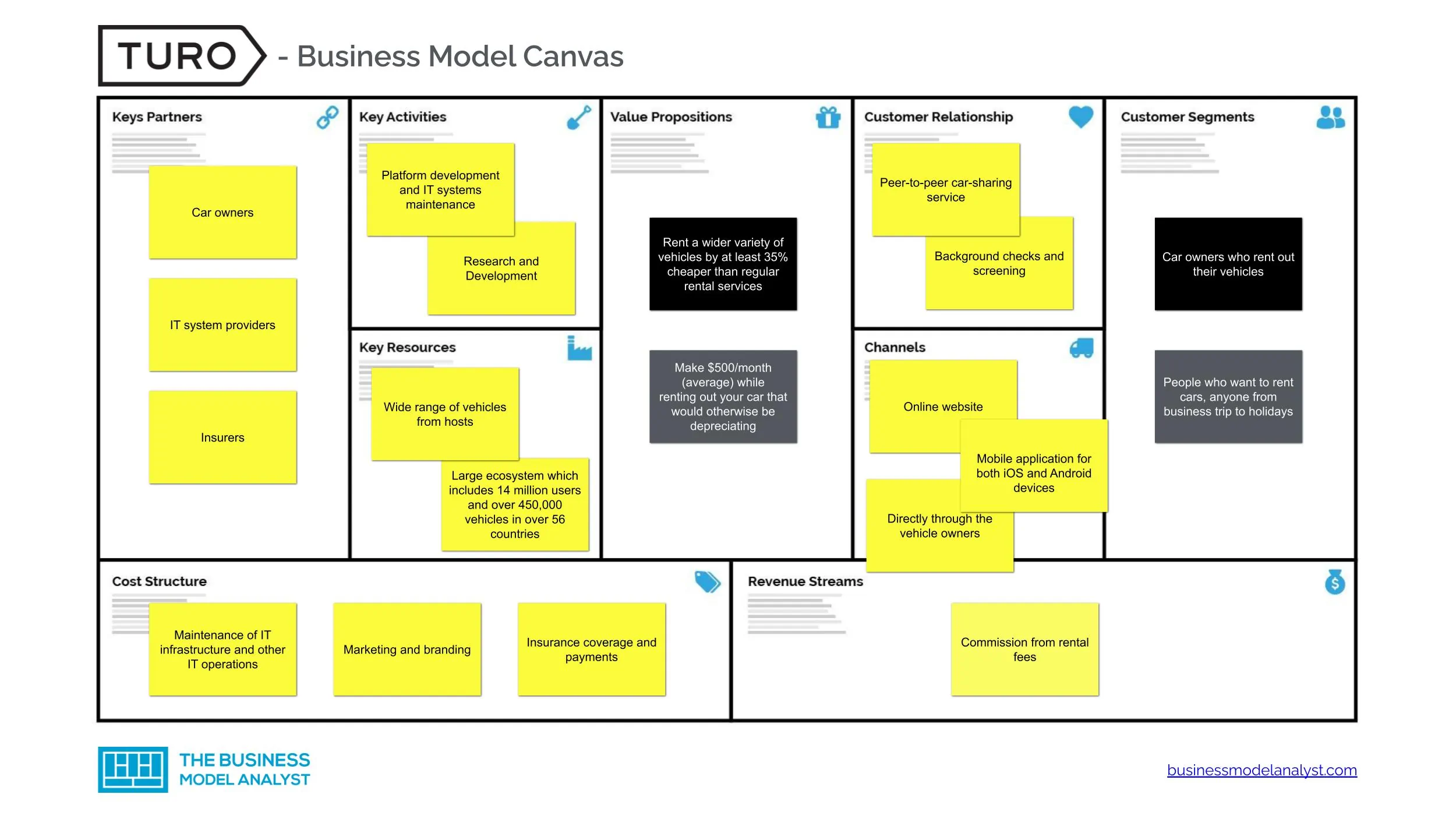

| Turo | Peer-to-Peer Car Rental | Turo’s platform for car owners and renters | Turo enables individuals to rent their vehicles to travelers, disrupting the traditional car rental industry. |

| Fiverr | Freelance Services Marketplace | Fiverr’s platform for freelance services | Fiverr offers a marketplace for freelancers to offer a wide range of services, from graphic design to content writing. |

| TaskRabbit | On-Demand Task and Service Marketplace | TaskRabbit’s platform for taskers and clients | TaskRabbit connects individuals with skilled taskers who can complete a variety of household and business tasks. |

| OpenTable | Restaurant Reservation Marketplace | OpenTable’s platform for restaurant reservations | OpenTable allows users to book restaurant reservations and helps restaurants manage their tables efficiently. |

| StockX | Sneaker and Collectibles Marketplace | StockX’s platform for sneakers and collectibles | StockX provides a marketplace for authenticated sneaker and collectible sales, ensuring transparency and trust. |

| Poshmark | Fashion Resale Marketplace | Poshmark’s platform for fashion resale | Poshmark connects fashion enthusiasts to buy and sell gently used clothing and accessories. |

| Thumbtack | Local Services Marketplace | Thumbtack’s platform for local service providers | Thumbtack helps users find and hire local service professionals, from plumbers to wedding photographers. |

| HomeAway (Vrbo) | Vacation Rental Marketplace | HomeAway’s platform for vacation rentals | HomeAway offers a marketplace for vacation rentals, connecting travelers with property owners. |

| Booking.com | Hotel and Accommodation Booking | Booking.com’s online travel agency platform | Booking.com enables travelers to book hotels and accommodations worldwide, serving as an intermediary between customers and hotels. |

| Zillow | Real Estate Marketplace | Zillow’s platform for buying and selling homes | Zillow provides tools for home buyers, sellers, and renters, simplifying the real estate process. |

| Freelancer.com | Freelance Job Marketplace | Freelancer.com’s platform for freelance jobs | Freelancer.com connects employers with freelancers to complete a wide range of projects, from software development to graphic design. |

| Rover | Pet Services Marketplace | Rover’s platform for pet care services | Rover connects pet owners with pet sitters and walkers, offering a range of pet care services. |

| 99designs | Design Services Marketplace | 99designs’ platform for design contests | 99designs hosts design contests, allowing businesses to receive custom designs from a global community of designers. |

| Subscription and In-App Purchases Model | WhatsApp’s subscription and in-app sticker purchases | WhatsApp offers a free messaging service with revenue generated from subscriptions and in-app purchases. | |

| Patreon | Membership and Crowdfunding Model | Patreon’s support for content creators | Patreon allows creators to offer exclusive content to paying members, generating income through memberships. |

| Shopify | Subscription and E-commerce Model | Shopify’s e-commerce platform and subscription fees | Shopify offers e-commerce solutions and earns revenue through monthly subscription fees and transaction fees. |

| HubSpot | Inbound Marketing and SaaS Model | HubSpot’s inbound marketing and SaaS services | HubSpot provides inbound marketing and sales software on a subscription basis, generating recurring revenue. |

| Airbnb for Work | Corporate Travel and Service Fees Model | Airbnb for Work’s service fees for corporate travel | Airbnb for Work charges service fees for businesses booking accommodations and experiences. |

| Coursera | Online Education and Certification Model | Coursera’s online courses and specialization certificates | Coursera offers courses for free or as part of a subscription, with revenue generated from paid certificates. |

| Yelp | Advertising and Local Business Model | Yelp’s advertising and partnerships with local businesses | Yelp offers advertising and business solutions, generating revenue through partnerships. |

| LinkedIn Talent Solutions | Recruitment and Subscription Model | LinkedIn’s recruitment tools and premium subscriptions | LinkedIn Talent Solutions provides tools for talent recruitment and generates revenue through premium subscriptions. |

| Square | Payment Processing and Financial Services | Square’s payment processing and financial services | Square offers payment processing and financial services, earning revenue through transaction fees and subscriptions. |

| Salesforce | CRM and Enterprise Software Model | Salesforce’s customer relationship management (CRM) | Salesforce generates revenue from its CRM software and cloud services for enterprises. |

| Udemy | Online Learning and Course Sales Model | Udemy’s marketplace for online courses | Udemy allows instructors to sell courses, with revenue shared between the platform and instructors. |

| GoFundMe | Crowdfunding and Platform Fees Model | GoFundMe’s crowdfunding platform and fees | GoFundMe facilitates fundraising campaigns and charges platform fees on donations. |

| Shutterfly | Photo Printing and Personalized Products | Shutterfly’s photo books, gifts, and printing services | Shutterfly generates revenue by selling personalized photo products. |

| Robinhood | Commission-Free Stock Trading Model | Robinhood’s commission-free stock and crypto trading | Robinhood offers commission-free trading and generates revenue through order flow payments. |

| Salesforce Marketing Cloud | Marketing Automation Model | Salesforce Marketing Cloud’s marketing automation | Salesforce’s marketing automation tools generate revenue through subscription and usage fees. |

| DoorDash | Food Delivery and Service Fees Model | DoorDash’s food delivery and service fees | DoorDash charges service fees to customers and restaurants for food delivery services. |