Home » Blog » Dissertation » Topics » Corporate Governance » Corporate Governance Dissertation Topics (28 Examples) For Research

Corporate Governance Dissertation Topics (28 Examples) For Research

Mark Aug 21, 2021 Aug 12, 2021 Corporate Governance No Comments

Corporate governance refers to the code of conduct for global business corporations. It is important for businesses to act responsibly and contribute to the betterment of society and people. As the concept of corporate governance has emerged, the scope and area for research have increased. We provide you with a list of corporate governance dissertation […]

Corporate governance refers to the code of conduct for global business corporations. It is important for businesses to act responsibly and contribute to the betterment of society and people. As the concept of corporate governance has emerged, the scope and area for research have increased. We provide you with a list of corporate governance dissertation topics.

The research topics on corporate governance and project topic on corporate governance are listed to help students in selecting a topic for their research and thesis. We have sorted down some of the most interesting corporate governance dissertation topics and can provide you with a brief on the selected topic.

A list Of Corporate Governance Dissertation Topics

A comparison of corporate governance policies and practices in the years 2010 to 2020.

Studying the impact of corporate governance practices on the management and leadership styles.

Identifying the most effective corporate governance strategies and its impact on organizational reputation.

An integrated analysis of the corporate governance practices in developing countries.

To investigate the impact of corporate governance policies and their implementation on the monetary success of large businesses.

Analysing the competence of corporate governance in a state-owned enterprise in the UK.

Comparing the policies of corporate social responsibility and its causes and effects.

Can effective corporate governance contribute to dealing with the global recession?

Studying the role of audit practices in corporate governance.

Evaluation of corporate governance regulations in the US and the UK.

Studying the importance of ethics in corporate governance taking a real-life case example.

A literature review on the corporate governance in a family-based business.

To study the impact of corporate governance on earning management in SMEs.

How does corporate governance affect the financial performance and financial stability of a business?

Studying the board attributes and corporate social responsibility disclosure.

Investigating the relationship between corporate governance and operating cash flow.

How does effective corporate governance help in building and maintaining relationships with the strategic partners?

To study the impact of ownership structure and corporate governance on the success of a business.

Does effective internal audit help in developing corporate governance policies and regulations?

To investigate the effect of accounting conservatism and corporate governance on tax avoidance.

Studying the impact of corporate governance on voluntary risk disclosure in large businesses in the UK.

The relationship between corporate governance and enterprise risks in the banking industry.

The contribution of innovation in enhancing corporate governance in organisations.

The importance of developing a code of conduct to manage organisational behaviour.

A literature review on corporate governance and its growing importance.

Studying and comparing the laws and policies related to corporate governance in the UK and the United States.

What is the role of corporate governance in the case of blockchain technology?

The role of corporate governance in long-term competitiveness based on value-added measures.

Topic With Mini-Proposal (Paid Service)

Along with a topic, you will also get;

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology with identification of raw sample size, and data collection method

- View a sample of topic consultation service

Get expert dissertation writing help to achieve good grades

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Posts

Message Us On WhatsApp

Get Instant Help From 5000+ Experts For

101 trending corporate governance dissertation topics & research ideas.

- Dissertation

Writing a dissertation on corporate governance delves into the intricate mechanisms and structures that govern the relationships among stakeholders within a company. This academic pursuit involves a comprehensive exploration of rules, practices, and processes that ensure ethical decision-making, transparency, and accountability in corporate environments. A corporate governance dissertation is a scholarly endeavor that critically examines the governance frameworks companies employ to balance the interests of diverse stakeholders, including shareholders, executives, employees, and the broader community.

The landscape of corporate governance is multifaceted, encompassing aspects such as board structures, shareholder activism, executive compensation, ethical considerations, and the impact of regulatory frameworks. As an academic undertaking, a dissertation in corporate governance seeks to contribute new insights, address gaps in existing knowledge, and provide a nuanced understanding of the complexities inherent in governing modern corporations.

The research journey often begins with a thorough review of existing literature, which establishes the theoretical foundation and contextualizes the study within the broader field of corporate governance. Methodologically, researchers may employ various approaches, including case studies, surveys, interviews, or quantitative analyses, to investigate specific aspects of corporate governance practices.

101 Unique Corporate Governance Dissertation Topics

Here is a list of 101 potential corporate governance dissertation topics across various dimensions of the field. Please note that these topics are broad, and you may need to refine them based on your specific interests and the focus of your academic program:

- The Impact of Board Diversity on Corporate Performance

- Corporate Governance and Financial Reporting Quality

- Shareholder Activism and Corporate Governance

- The Role of Institutional Investors in Corporate Governance

- Executive Compensation and Firm Performance

- Corporate Governance in Family-Owned Businesses

- The Influence of Corporate Governance on Mergers and Acquisitions

- Board Independence and Firm Value

- Corporate Governance and Corporate Social Responsibility (CSR)

- The Effect of CEO Duality on Corporate Governance

- The Role of Auditors in Corporate Governance

- Governance Mechanisms in Emerging Markets

- Corporate Governance and Risk Management

- Regulatory Impact on Corporate Governance Practices

- Shareholder Rights and Corporate Governance

- The Relationship Between Corporate Governance and Corporate Fraud

- Impact of Corporate Governance on Innovation

- Governance Challenges in Multinational Corporations

- Board Effectiveness and Corporate Governance

- The Role of Board Committees in Corporate Governance

- Corporate Governance and Corporate Ethics

- The Impact of Corporate Governance on Firm Bankruptcy

- Stakeholder Theory and Corporate Governance

- The Role of Government in Corporate Governance

- Corporate Governance in Nonprofit Organizations

- Corporate Governance in the Banking Sector

- Comparative Analysis of Corporate Governance Models

- Corporate Governance in Technology Companies

- The Effect of Globalization on Corporate Governance

- Corporate Governance and Firm Resilience

- The Relationship Between Corporate Governance and Environmental Sustainability

- Governance Practices in Small and Medium-sized Enterprises (SMEs)

- Corporate Governance and Initial Public Offerings (IPOs)

- The Impact of Board Size on Corporate Governance

- Corporate Governance and Shareholder Value Creation

- The Role of Leadership in Corporate Governance

- Corporate Governance and Firm Reputation

- Board Turnover and Corporate Governance

- Corporate Governance and Corporate Culture

- The Effect of Ownership Structure on Corporate Governance

- The Role of Technology in Enhancing Corporate Governance

- Corporate Governance and Corporate Citizenship

- The Influence of Institutional Environment on Corporate Governance

- Board Tenure and Corporate Governance

- Corporate Governance and Dividend Policy

- The Relationship Between Corporate Governance and Corporate Tax Avoidance

- Governance Challenges in State-Owned Enterprises

- The Impact of Activist Investors on Corporate Governance

- The Role of Corporate Governance in Financial Crises

- Corporate Governance in the Healthcare Sector

- The Influence of Cultural Factors on Corporate Governance Practices

- Governance Challenges in Public-Private Partnerships (PPPs)

- Corporate Governance in the Energy Industry

- The Effect of Corporate Governance on Earnings Management

- Board Evaluation and Corporate Governance

- Corporate Governance in the Hospitality Industry

- The Role of Technology in Improving Corporate Governance Transparency

- The Impact of Corporate Governance on Firm Reputation

- Governance Practices in the Pharmaceutical Sector

- Corporate Governance and the Adoption of Sustainable Business Practices

- The Relationship Between Corporate Governance and Innovation Performance

- Governance Challenges in the Nonprofit Sector

- Corporate Governance and Intellectual Property Management

- The Role of Corporate Governance in Corporate Scandals

- The Influence of Ownership Concentration on Corporate Governance

- Governance Practices in the Retail Industry

- Corporate Governance and Cybersecurity Risk Management

- The Effect of Board Gender Diversity on Corporate Governance

- Governance Challenges in the Educational Sector

- Corporate Governance and Business Ethics

- The Impact of Corporate Governance on Employee Relations

- Governance Practices in the Real Estate Industry

- The Role of Corporate Governance in Digital Transformation

- The Relationship Between Corporate Governance and Supply Chain Management

- Governance Challenges in the Transportation Sector

- Corporate Governance and Financial Inclusion

- The Influence of Political Factors on Corporate Governance

- Governance Practices in the Agricultural Sector

- Corporate Governance and Customer Relations

- The Effect of Corporate Governance on Corporate Philanthropy

- Governance Challenges in the Entertainment Industry

- The Role of Corporate Governance in Crisis Management

- Corporate Governance and the Adoption of Emerging Technologies

- Governance Practices in the Fashion Industry

- The Impact of Corporate Governance on Entrepreneurial Firms

- The Relationship Between Corporate Governance and Corporate Branding

- Governance Challenges in the Aerospace Industry

- Corporate Governance and Supply Chain Sustainability

- The Role of Corporate Governance in Digital Marketing

- Governance Practices in the Renewable Energy Sector

- Corporate Governance and Franchise Management

- The Influence of Social Media on Corporate Governance

- Governance Challenges in the Telecommunications Industry

- The Effect of Corporate Governance on Customer Satisfaction

- Corporate Governance and Blockchain Technology

- The Relationship Between Corporate Governance and E-commerce

- Governance Practices in the Biotechnology Industry

- The Impact of Corporate Governance on Employee Motivation

- Corporate Governance and Product Innovation

- The Role of Corporate Governance in ESG (Environmental, Social, and Governance) Investing

- Governance Challenges in the Artificial Intelligence Industry

When choosing a dissertation topic, consider your interests, the relevance to your academic program, and the availability of resources for research. Additionally, consult with your advisor to ensure that the chosen topic aligns with the requirements and expectations of your doctoral program.

If you need assistance in writing your Corporate Governance Dissertation, please send your requirement to [email protected] and get instant Corporate Governance Dissertation Help .

Book Your Assignment

Recent Posts

How To Prepare An Excellent Thesis Defense?

How to restate a thesis – a detailed guide, explanatory thesis: examples and guide for clear writing, how to write 3 types of thesis statements, how to effectively prepare for your thesis defense, popular categories, get assignment help from subject matter experts.

4.7/5 rating | 10,000+ happy students | Great tutors 24/7

ONLINE TO HELP YOU 24X7

OR GET MONEY BACK!

OUT OF 38983 REVIEWS

Corporate Governance Research Paper Topics

This guide provides a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on choosing a relevant and feasible topic, and tips on how to write a successful corporate governance research paper. Corporate governance is a critical aspect of modern business that has a significant impact on the success of organizations. As a result, students who study corporate governance are often assigned to write research papers that explore various aspects of the topic. In addition, iResearchNet offers custom writing services that provide expert degree-holding writers, customized solutions, and timely delivery. By using this guide and iResearchNet’s writing services, students can ensure that their corporate governance research papers meet the highest academic standards.

Corporate Governance Research

Corporate governance is a critical aspect of modern business that encompasses the practices, processes, and systems by which organizations are directed, controlled, and managed. As a result, students who study corporate governance are often assigned to write research papers that explore various aspects of the topic, ranging from board structures and executive compensation to shareholder activism and stakeholder engagement.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code.

In this guide, we provide a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on how to choose a relevant and feasible topic, and tips on how to write a successful corporate governance research paper. In addition, we offer custom writing services through iResearchNet that provide expert degree-holding writers, customized solutions, and timely delivery.

By using this guide and iResearchNet’s writing services, students can ensure that their corporate governance research papers are well-researched, well-written, and meet the highest academic standards.

100 Corporate Governance Research Paper Topics

Corporate governance is a broad and complex topic that encompasses a wide range of issues and challenges facing modern organizations. To help students choose a relevant and feasible corporate governance research paper topic, we have divided our comprehensive list of topics into 10 categories, each with 10 topics.

Board of Directors

- Board independence and effectiveness

- Board diversity and gender equality

- CEO duality and separation of roles

- Board composition and characteristics

- Board oversight and accountability

- Board nominations and elections

- Board leadership and culture

- Board committees and responsibilities

- Board evaluation and performance

- Board compensation and incentives

Executive Compensation

- Executive pay and performance

- Executive pay and firm performance

- Pay-for-performance and pay-for-skill

- CEO pay ratios and pay equity

- Stock options and equity-based compensation

- Executive severance and golden parachutes

- Executive perquisites and benefits

- Executive retirement and pensions

- Say-on-pay and shareholder activism

- Institutional investors and executive pay

Shareholder Activism

- Shareholder rights and activism

- Shareholder proposals and proxy access

- Shareholder engagement and communication

- Shareholder activism and corporate social responsibility

- Institutional investors and shareholder activism

- Hedge funds and shareholder activism

- Shareholder activism and executive compensation

- Shareholder activism and board independence

- Shareholder activism and corporate governance reforms

- Shareholder activism and CEO turnover

Stakeholder Engagement

- Stakeholder identification and analysis

- Stakeholder mapping and prioritization

- Stakeholder communication and dialogue

- Stakeholder participation and empowerment

- Stakeholder consultation and feedback

- Stakeholder engagement and corporate social responsibility

- Stakeholder engagement and sustainability reporting

- Stakeholder engagement and risk management

- Stakeholder engagement and corporate reputation

- Stakeholder engagement and value creation

Corporate Culture and Ethics

- Corporate values and ethics

- Ethical leadership and decision-making

- Corporate social responsibility and sustainability

- Business ethics and compliance

- Corporate citizenship and philanthropy

- Corporate culture and values alignment

- Corporate culture and employee behavior

- Corporate culture and organizational performance

- Corporate culture and innovation

- Corporate culture and risk management

Board-Shareholder Relations

- Board-shareholder communication and engagement

- Board-shareholder conflict resolution

- Board-shareholder cooperation and collaboration

- Board-shareholder activism and response

- Board-shareholder rights and responsibilities

- Board-shareholder agreements and charters

- Board-shareholder engagement and corporate social responsibility

- Board-shareholder relations and institutional investors

- Board-shareholder relations and minority shareholders

- Board-shareholder relations and corporate governance reforms

Regulatory and Legal Environment

- Corporate governance regulations and compliance

- Corporate governance laws and policies

- Corporate governance codes and standards

- Corporate governance enforcement and penalties

- Corporate governance and public policy

- Corporate governance and the role of regulators

- Corporate governance and antitrust laws

- Corporate governance and securities laws

- Corporate governance and data privacy laws

- Corporate governance and intellectual property laws

Risk Management and Disclosure

- Enterprise risk management and oversight

- Risk management and strategic planning

- Risk management and financial reporting

- Risk management and sustainability reporting

- Risk management and cybersecurity

- Risk management and climate change

- Risk management and supply chain management

- Risk management and crisis management

- Risk management and stakeholder engagement

- Risk management and disclosure requirements

International Corporate Governance

- Cross-border mergers and acquisitions and corporate governance

- Corporate governance and foreign direct investment

- Corporate governance and multinational corporations

- Corporate governance and global supply chains

- Corporate governance and global financial markets

- Corporate governance and emerging markets

- Corporate governance and corruption

- Corporate governance and cultural diversity

- Corporate governance and the United Nations Sustainable Development Goals

- Corporate governance and global challenges

Corporate Governance Reform

- Corporate governance failures and scandals

- Corporate governance reforms and their impact

- Corporate governance and shareholder activism

- Corporate governance and executive compensation reform

- Corporate governance and board independence reform

- Corporate governance and stakeholder engagement reform

- Corporate governance and diversity and inclusion reform

- Corporate governance and sustainability reform

- Corporate governance and regulatory reform

- Corporate governance and future trends

By organizing the corporate governance research paper topics into categories, students can easily identify areas of interest and develop research questions that align with their academic goals and interests. The categories cover a wide range of issues and challenges facing modern organizations, from board structures and executive compensation to stakeholder engagement and international corporate governance.

Choosing a Topic in Corporate Governance

Choosing a relevant and feasible corporate governance research paper topic is critical for success in academia. The following are expert tips on how to choose a corporate governance research paper topic:

- Consider your interests : Choose a topic that you are interested in and passionate about. Your enthusiasm for the topic will help you stay motivated throughout the research and writing process.

- Identify a research gap : Choose a topic that fills a research gap or addresses a new research question. This will help you contribute new knowledge to the field and make a meaningful contribution to academic scholarship.

- Consult with your instructor : Discuss potential topics with your instructor and seek feedback on your ideas. Your instructor can help you refine your research question and suggest relevant literature and sources.

- Conduct a literature review : Conduct a literature review to identify gaps and areas of interest within the field. This will help you develop research questions and identify key concepts and themes.

- Consider feasibility : Choose a topic that is feasible given the time and resources available to you. Be realistic about your research scope and the data sources that are available to you.

- Stay current : Choose a topic that is current and relevant to the field. This will help you stay up-to-date on the latest trends and developments in corporate governance.

- Identify a manageable scope : Choose a topic that has a manageable scope. Narrow down your research question to a specific aspect of corporate governance that can be explored in-depth within the scope of a research paper.

- Brainstorm potential topics : Brainstorm a list of potential topics based on your interests, literature review, and discussions with your instructor. Evaluate each topic based on its relevance, feasibility, and potential impact.

By following these expert tips, students can choose a relevant and feasible corporate governance research paper topic that aligns with their academic interests and goals. In the next section, we provide tips on how to write a successful corporate governance research paper.

How to Write a Corporate Governance Research Paper

Writing a successful corporate governance research paper requires careful planning and attention to detail. The following are expert tips on how to write a corporate governance research paper:

- Develop a clear research question : Develop a clear and concise research question that addresses a gap or new research question within the field of corporate governance. The research question should be specific and focused to ensure a manageable scope for the research paper.

- Conduct a literature review : Conduct a comprehensive literature review to identify key concepts and themes within the field of corporate governance. This will help you develop a theoretical framework and provide a foundation for your research paper.

- Select appropriate research methods : Select appropriate research methods that align with your research question and objectives. This may include qualitative, quantitative, or mixed-methods research approaches.

- Collect and analyze data : Collect and analyze data using appropriate research methods. This may include conducting interviews, surveys, or analyzing financial data. Ensure that your data collection and analysis is rigorous and aligns with the research question and objectives.

- Develop a clear and structured outline : Develop a clear and structured outline for your research paper. This will help you organize your thoughts and ideas and ensure a logical flow of information.

- Write a clear and concise introduction : Write a clear and concise introduction that provides background information and context for the research question. The introduction should also clearly state the research question and objectives.

- Develop a comprehensive literature review : Develop a comprehensive literature review that provides a theoretical framework for the research question. The literature review should be organized thematically and include key concepts and themes within the field of corporate governance.

- Analyze and interpret findings : Analyze and interpret the findings of the research. Ensure that your analysis and interpretation aligns with the research question and objectives.

- Develop a clear and concise conclusion : Develop a clear and concise conclusion that summarizes the key findings of the research and provides implications for practice and future research.

- Ensure proper formatting and citation : Ensure that your research paper is properly formatted and cited. Follow the guidelines of the citation style required by your instructor, such as APA, MLA, or Chicago.

By following these expert tips, students can write a successful corporate governance research paper that contributes new knowledge to the field and makes a meaningful contribution to academic scholarship. In the next section, we provide information on how students can benefit from the iResearchNet writing services for corporate governance research papers.

iResearchNet Writing Services for Corporate Governance Research Papers

At iResearchNet, we understand the importance of producing high-quality corporate governance research papers that meet the academic standards of students. Our team of expert degree-holding writers can help students produce well-written and well-researched corporate governance research papers that meet the requirements of their instructors. Our writing services include the following features:

- Expert degree-holding writers : Our writers are experts in corporate governance with advanced degrees in the field. They have the knowledge and expertise to produce high-quality research papers that meet the academic standards of students.

- Custom written works : We provide custom written works that are tailored to the specific needs and requirements of each student. Our writers work closely with students to ensure that their research papers meet their expectations and academic standards.

- In-depth research : Our writers conduct in-depth research to ensure that the research papers are well-supported with relevant and reliable sources.

- Custom formatting : Our writers are well-versed in various citation styles, including APA, MLA, Chicago/Turabian, and Harvard. We ensure that the research papers are properly formatted and cited according to the required citation style.

- Top quality, customized solutions : We are committed to providing top-quality and customized solutions that meet the unique needs and requirements of each student.

- Flexible pricing : We offer flexible pricing options to ensure that our writing services are affordable for students.

- Short deadlines : We can accommodate short deadlines of up to 3 hours for urgent assignments.

- Timely delivery : We ensure timely delivery of research papers to ensure that students have enough time to review and submit their assignments.

- 24/7 support : We provide 24/7 support to answer any questions or concerns that students may have about their research papers.

- Absolute Privacy : We prioritize the privacy and confidentiality of our clients. We ensure that all client information is kept confidential and secure.

- Easy order tracking : We provide easy order tracking to enable students to track the progress of their research papers.

- Money-back guarantee : We offer a money-back guarantee to ensure that students are satisfied with the quality of their research papers.

By using iResearchNet writing services, students can benefit from the expertise of our writers and produce high-quality corporate governance research papers that meet the academic standards of their instructors.

Order Your Custom Research Paper Today!

Writing a successful corporate governance research paper requires careful planning and attention to detail. By choosing a relevant and feasible research paper topic, conducting a comprehensive literature review, and following the tips outlined in this article, students can produce high-quality research papers that make meaningful contributions to the field of corporate governance. Additionally, iResearchNet writing services offer students a valuable resource for producing high-quality research papers that meet the academic standards of their instructors. With expert degree-holding writers, customized solutions, and a range of support features, iResearchNet can help students achieve academic success and excel in their studies. Contact us today to learn more about our writing services and how we can assist you in your corporate governance research paper writing needs.

ORDER HIGH QUALITY CUSTOM PAPER

No notifications.

Dissertations on Corporate Governance

Corporate Governance is a term used to describe the way in which a corporation is governed and how operations are controlled. Corporate Governance covers the processes and procedures that employees must follow during business operations.

View All Dissertation Examples

Latest Corporate Governance Dissertations

Including full dissertations, proposals, individual dissertation chapters, and study guides for students working on their undergraduate or masters dissertation.

Relationship Between Corporate Governance and Corporate Social Responsibility

Dissertation Examples

This research presents the in-depth relationship between CG and CSR with focus on the two of the most-developed nations of the world, UK and the US....

Last modified: 22nd Nov 2023

Corporate Governance Practices of Indian Companies

This paper reports on the level of disclosure of a sample of Indian companies listed on the NSE by examining their annual reports....

Last modified: 25th Jan 2022

Corporate Governance in Theory and Practice: A Comparison between the UK and US

This paper will firstly talk about corporate governance broadly, outlining the trend of United Kingdom Corporate Governance. It will also deliberate the relative effects, comparing the United Kingdom and United States techniques....

Last modified: 21st Dec 2021

Quality of Corporate Governance in BHS and its Impact on Key Stakeholders

An assessment of the quality of corporate governance in BHS and its impact on key stakeholders and the downfall of BHS....

Last modified: 30th Nov 2021

Examining Family Business Corporate Governance

Dissertation Introductions

This dissertation sets out a study of the family business’s corporate governance, addressing the relationship between the owners and the management....

Last modified: 10th Nov 2021

Corporate Governance Literature Review

Example Literature Reviews

In a nutshell, Corporate Governance is the foundation by which a company regulates and directs. It is a set of guidelines, procedures, and disciplines that executives utilize to standardize a corporation....

Last modified: 29th Oct 2021

Analysis of Tesco's Corporate Governance and Responsibility

This project will place emphasis on the governance framework in the UK, namely the revised Combined Code, though I will make brief analyses of other reports and frameworks....

Last modified: 20th Oct 2021

Evolution of UK Corporate Governance and Effects of Corporate Scandal

The aim of this dissertation is to examine the evolution of Corporate Governance in the United Kingdom and the affects which corporate scandals had on it....

Last modified: 25th Aug 2021

Roles of Shareholders in UK Corporate Governance

Corporate governance links to the system in which firms and organisations are engaged and governed. Its existence is to facilitate efficient and judicious management that can bring the long-term success of the company to its shareholders....

Last modified: 9th Mar 2021

Corporate Governance Disclosures in Emerging Capital Markets

THE CASE OF GHANA CHAPTER 1 1.1 INTRODUCTION Corporate governance has dominated the policy agenda in developed market economies since the mid 1990s. The spate of corporate failures and massive governm...

Last modified: 12th Dec 2019

Effect of Corporate Governance on Attracting Investors

Corporate governance is the way of corporation being directed which is involves a relationship between the manager , the shareholders , and other stakeholders of the company. The use of corporate gov...

Analysis of the Combined Code of Corporate Governance

Corporate governance is the system or process by which companies are directed and controlled (Cadbury,1992,p.2) Good corporate governance should contribute to better company performance by helping a b...

Analysis of Corporate Governance Strategies in Banking

ABSTRACT The Corporate Governance concept has grown as a milestone for estimating corporate excellence in the context of domestic and foreign enterprise patterns. From support and suitable code of beh...

Corporate Governance Score and Firm Performance

Limited liability company structure is the most preferred structure for a large business. In this structure, a large number of investors provide the risk capital. They are called shareholders, the dee...

Efficiency of IT Audit in Corporate Governance

Critical Research Analysis On The Effectiveness Of IT Auditing For Corporate Governance Chapter 1: Introduction 1.1 Introduction Auditing is one of the essential elements for the successful functionin...

Corporate Governance and Value Creation Relationship

Department of Economics VALUE CREATION AND THE ROLE OF CORPORATE GOVERNANCE Abstract Corporate Governance is a subject of many professional and academic debates. Since there are many different researc...

A Study on Corporate Governance in Asia

The 1997 Asian Financial Crisis showed how mismanagement and poor governance could undo decades of prosperity within a short span of a ......

Last modified: 11th Dec 2019

Corporate Governance and Risk Management - AO World PLC

Table of Contents 1. Executive Summary 1.1. Purpose of Report: 1.2. Conclusions: 1.3. Key Recommendations: 2. Introduction 3. Section A – Corporate Governance 3.1. Background Information 3.2. Per...

Last modified: 10th Dec 2019

Corporate Governance Policies and Models

Literature Review: Corporate governance covers various different but related economic issues or variables in its definition. According to Shleifer and Vishny (1997) in The Journal of Finance, “C...

Last modified: 9th Dec 2019

Conflicts of Corporate Governance

Conflicts of Corporate Governance Affecting Firm Performance Corporate governance as a topic of interest in academic literature dates back to the work of Berle and Means (1932) and till recently, eff...

Popular Tags

- Browse All Tags

- Biomedical Science

- Business Analysis

- Business Strategy

- Computer Science

- Construction

- Consumer Decisions

- Criminology

- Cultural Studies

- Cyber Security

- Electronics

- Engineering

- Environmental Science

- Environmental Studies

- Food And Nutrition

- Health And Social Care

- Human Resources

- Information Systems

- Information Technology

- International Business

- International Relations

- International Studies

- Mental Health

- Pharmacology

- Social Policy

- Sustainability

- Young People

Dissertation Writing Service

Dissertation Proposal Service

Topic with Titles Service

Samples of our work

- Open access

- Published: 01 November 2021

The impact of corporate governance measures on firm performance: the influences of managerial overconfidence

- Tolossa Fufa Guluma ORCID: orcid.org/0000-0002-1608-5622 1

Future Business Journal volume 7 , Article number: 50 ( 2021 ) Cite this article

63k Accesses

40 Citations

Metrics details

The paper aims to investigate the impact of corporate governance (CG) measures on firm performance and the role of managerial behavior on the relationship of corporate governance mechanisms and firm performance using a Chinese listed firm. This study used CG mechanisms measures internal and external corporate governance, which is represented by independent board, dual board leadership, ownership concentration as measure of internal CG and debt financing and product market competition as an external CG measures. Managerial overconfidence was measured by the corporate earnings forecasts. Firm performance is measured by ROA and TQ. To address the study objective, the researcher used panel data of 11,634 samples of Chinese listed firms from 2010 to 2018. To analyze the proposed hypotheses, the study employed system Generalized Method of Moments estimation model. The study findings showed that ownership concentration and product market competition have a positive significant relationship with firm performance measured by ROA and TQ. Dual leadership has negative relationship with TQ, and debt financing also has a negative significant association’s with both measures of firm performance ROA and TQ. Moreover, the empirical results also showed managerial overconfidence negatively influences the relationship of board independence, dual leadership, and ownership concentration with firm performance. However, managerial overconfidence positively moderates the impact of debt financing on firm performance measured by Tobin’s Q and negative influence on debt financing and operational firm performance relationship. These findings have several contributions: first, the study extends the literature on the relationship between CG and a firm’s performance by using the Chinese CG structure. Second, this study provides evidence that how managerial behavioral bias interacts with CG mechanisms to affect firm performance, which has not been studied in previous literature. Therefore, the results of this study contribute to the theoretical perspective by providing an insight into the influencing role of managerial behavior in the relationship between CG practices and firm performance in an emerging markets economy. Hence, the empirical result of the study provides important managerial implications for the practice and is important for policy-makers seeking to improve corporate governance in the emerging market economy.

Introduction

Corporate governance and its relation with firm performance, keep on to be an essential area of empirical and theoretical study in corporate study. Corporate governance has got attention and developed as an important mechanism over the last decades. The fast growth of privatizations, the recent global financial crises, and financial institutions development have reinforced the improvement of corporate governance practices. Well-managed corporate governance mechanisms play an important role in improving corporate performance. Good corporate governance is fundamental for a firm in different ways; it improves company image, increases shareholders’ confidence, and reduces the risk of fraudulent activities [ 67 ]. It is put together on a number of consistent mechanisms; internal control systems and external environments that contribute to the business corporations’ increase successfully as a complete to bring about good corporate governance. The basic rationale of corporate governance is to increase the performance of firms by structuring and sustaining initiatives that motivate corporate insiders to maximize firm’s operational and market efficiency, and long-term firm growth through limiting insiders’ power that can abuse over corporate resources.

Several studies are contributed to the effect of CG on firm performance using different market developments. However, there is no consensus on the role CG on firm performance, due to different contextual factors. The role of CG mechanisms is affected by different factors. Prior studies provided different empirical evidence such as [ 14 ], suggested that the monitoring efficiency of the board of directors is affected by internal and external factors like government regulation and internal firm-specific factors; the role of board monitoring is determined by ownership structure and firm-specific characters Boone et al. [ 8 ], and Liu et al. [ 57 ] and Bozec [ 10 ] also reported that external market discipline affects the internal CG role on firm performance. Moreover, several studies studied the moderation role of different variables in between CG and firm value. Mcdonald et al. [ 63 ] studied CEO experience moderating the board monitoring effectiveness, and [ 60 ] studied the moderating role of product market competition in between internal CG and firm performance. Bozec [ 10 ] studied market disciple as a moderator between the board of directors and firm performance. As to the knowledge of the researcher, no study considered the influencing role of managerial overconfidence in between CG mechanisms and firm corporate performance. Thus, this study aims to investigate the influence of managerial overconfidence in the relationship between CG mechanisms and firm performance by using Chinese listed firms.

Managers (CEOs) were able to valuable contributions to the monitoring of strategic decision making [ 13 ]. Behavioral decision theory [ 94 ] suggests that overconfidence, as one type of cognitive bias, encourages decision-makers to overestimate their information and problem-solving capabilities and underestimates the uncertainties facing their firms and the potential losses from litigation associated with claims against them. Several prior studies reported different results of the manager's role in corporate governance in different ways. Previous studies claimed that overconfidence is a dysfunctional behavior of managers that deals with unfavorable consequences for the firm outcome, such as value distraction through unprofitable mergers and suboptimal investment behavior [ 61 ], and unlawful activities (Mishina et al. [ 64 ]). Oliver [ 68 ] argued the human character of individual managers affects the effectiveness of corporate governance. Top managers' behaviors and experience are primary determinants of directors' ability to effectively evaluate their managerial decision-making [ 45 ]. In another way, [ 47 , 58 ] noted managerial overconfidence can encourage some risk and make up for managerial risk aversion, which leads to suboptimal investment decisions. Jensen [ 41 ] suggested in the presence of free cash flow, the manager may overinvest and they can accept a negative net present value project. Therefore, the existence of CG mechanisms aims to eliminate or reduce the effect of agency and asymmetric information on the CEO’s decisions [ 62 ]. This means that the objectives of CG mechanisms are to counterbalance the effect of such problems in the corporate organization that may affect the value of the firms in the long run. Even with the absence of agency conflicts and asymmetric information problems, there is evidence documented for distortions such as the case of corporate investment. Managers will over- or under-invest regarding their optimism level and the availability of internal cash flow.

Agency theory by Jensen and Meckling [ 42 ] has a very clear vision of the problems that exist in the company to know the disagreement of interests between shareholders and managers. Irrational behavior of management resulting from behavioral biases of executive managers is a great challenge in corporate governance [ 44 ]. Overconfidence may create more agency conflict than normal managers. It may lead internal and external CG mechanisms to decisions which damage firm value. The role of CG mechanisms mitigating corporate governance results from agency costs, information asymmetry, and their impact on corporate decisions. This means the behavior of overconfident executives may affect controlling and monitoring role of internal/external CG mechanisms. According to Baccar et al. [ 5 ], suggestion is that one of the roles of corporate governance is controlling such managerial behavioral bias and limiting their potential effects on the company’s strategies. These discussions lead to the conclusion that CEO overconfidence will negatively or positively influence the relationships of CG on firm performance. The majority of studies in the corporate governance field deal with internal problems associated with managerial opportunism, misalignment of objectives of managers and stakeholders. To deal with these problems, the firm may organize internal governance mechanisms, and in this section, the study provides a review of research focused on this specific aspect of corporate governance.

Internal CG includes the controlling mechanism between various actors inside the firm: that is, the company management, its board, and shareholders. The shareholders delegate the controlling function to internal mechanisms such as the board or supervisory board. Effective internal CG is essential in accomplishing company strategic goals. Gillan [ 30 ] described internal mechanisms by dividing them into boards, managers, shareholders, debt holders, employees, suppliers, and customers. These internal mechanisms of CG work to check and balance the power of managers, shareholders, directors, and stakeholders. Accordingly, independent board, CEO duality, and ownership concentration are the main internal corporate governance controlling mechanisms suggested by various researchers in the literature. Thus, the study considered these three internal corporate structures in this study as internal control mechanisms that affect firm performance. Concurrently, external CG mechanisms are mechanisms that are not from the inside of the firm, which is from the outside of the firms and includes: market competition, take over provision, external audit, regulations, and debt finance. There are a lot of studies that examine and investigate the effect of external CG practices on the financial performance of a company, especially in developed nations. In this study, product market competition and debt financing have been taken as representatives of external CG mechanisms. Thus, the study used internal CG measures; independent board, dual leadership, ownership concentration, and product-market competition, and debt financing as a proxy of external CG measures.

Literature review and hypothesis building

Corporate governance and firm performance.

Corporate governance has got attention and developed as a significant mechanism more than in the last decades. The recent financial crises, the fast growth of privatizations, and financial institutions have reinforced the improvement of corporate governance practices in numerous institutions of different countries. As many studies revealed, well-managed corporate governance mechanisms play an important role in providing corporate performance. Good corporate governance is fundamental for a firm in several ways: OECD [ 67 ] indicates the good corporate governance increases the company image, reduces the risks, and boosts shareholders' confidence. Furthermore, good corporate governance develops a number of consistent mechanisms, internal control systems and external environments that contribute to the business corporations’ increase effectively as a whole to bring about good corporate governance.

The basic rationale of corporate governance is to increase the performance of companies by structuring and sustaining incentives that initiate corporate managers to maximize firm’s operational efficiency, return on assets, and long-term firm growth through limiting managers’ abuse of power over corporate resources.

Corporate governance mechanisms are divided into two broad categories: internal corporate governance and external corporate governance mechanisms. Supporting this concept, Keasey and Wright [ 43 ] indicated corporate governance as a framework for effective monitoring, regulation, and control of firms which permits alternative internal and external mechanisms for achieving the proposed company’s objectives. The achievement of corporate governance relies on the mechanism effectiveness of both internal and external governance structures. Gillan [ 30 ] suggested that corporate governance can be divided into two: the internal and external mechanisms. Gillan [ 30 ] described internal mechanisms by dividing into boards, managers, shareholders, debt holders, employees, suppliers, and customers, and also explain external corporate governance mechanisms by incorporating the community in which companies operate, the social and political environment, laws and regulations that corporations and governments involved in.

The internal mechanisms are derived from ownership structure, board structure, and audit committee, and the external mechanisms are derived from the capital market corporate control market, labor market, state status, and investors activate [ 26 ]. The balance and effectiveness of the internal and external corporate governance practices can enhance a better corporate operational performance [ 21 ]. Literature argued that integrated and complete governance mechanisms are better with multi-dimensional theoretical view [ 87 ]. Thus, the study includes both internal and external CG mechanisms to broadly show the connection of these components. Filatotchev and Nakajima [ 26 ] suggest that an integrated approach bringing external and internal mechanisms jointly enhances to build up a more general view on the effectiveness and efficiency of different corporate governance mechanisms. Thus, the study includes both internal and external CG mechanisms to broadly show the connection of these three components.

Board of directors and ownership concentration are the main internal corporate governance mechanisms and product market competition and debt finance also the main representative of external corporate governance suggested by many researchers in the literature that were used in this study. Therefore, the following sections provide a brief discussion of internal and external corporate governance from different angles.

Independent board and firm performance

Board of directors monitoring has been centrally important in corporate governance. Jensen [ 41 ] board of directors is described as the peak of the internal control system. The board represents a firm’s owners and is responsible for ensuring that the firm is managed effectively. Thus, the board is responsible for adopting control mechanisms to ensure that management’s behavior and actions are consistent with the interest of the owners. Mainly the responsibility of the board of directors is selection, evaluation, and removal of poorly performing CEO and top management, the determination of managerial incentives and monitoring, and assessment of firm performance [ 93 ]. The board of directors has the formal authority to endorse management initiatives, evaluate managerial performance, and allocate rewards and penalties to management on the basis of criteria that reflect shareholders’ interests.

According to the agency theory board of directors, the divergence of interests between shareholders and managers is addressed by adopting a controlling role over managers. The board of directors is one of the key governance mechanisms; the board plays a pivotal role in monitoring managers to reduce the problems associated with the separation of ownership and management in corporations [ 24 ]. According to Chen et al. [ 16 ], the strategic role of the board became increasingly important and going beyond the mere approval of strategic management decisions. The board of directors must serve to reconcile management decisions with the objectives of shareholders and stakeholders, which can at times influence strategic decisions (Uribe-Bohorquez [ 85 ]). Therefore, the board's responsibilities extend beyond controlling and monitoring management, ensuring that it takes decisions that are reliable with the corporations [ 29 ]. In the perspective of resource dependence theory, an independent director is often linked firm to outside environments, who are non-management members of the board. Independent boards of directors are more believed to be effective in protecting shareholders' interests resulting in high performance [ 26 ]. This focus on board independence is grounded in agency theory, which addresses inefficiencies that arise from the separation of ownership and control [ 24 ]. As agency theory perspective boards of directors, particularly independent boards are put in place to monitor managers on behalf of shareholders [ 59 ].

A large number of empirical studies are undertaken to verify whether independent directors perform their governance functions effectively or not, but their results are still inconclusive. Studies [ 2 , 50 , 52 , 56 , 85 ], reported the supportive arguments that independent board of directors and firm performance have a positive relationship; in other ways, a large number of studies [ 6 , 17 , 65 91 ], and findings indicated the independent director has a negative relation with firm performance. The positive relationship of independent board and firm performance argued that firms which empower outside directors may lead to their more effective monitoring and therefore higher firm performance. The negative relationship of independent board and firm performance results are based on the argument that external directors have no access to information about the internal business of the firms and their relation with internal management does not allow them to have a sufficient understanding of the firm’s day-to-day business activities or it may arise from the lack of knowledge of the business or the ability to monitor management actions [ 28 ].

Specifically in China, the corporate governance regulation code was approved in 2001 and required that the board of all Chinese listed domestic companies must include at least one-third of independent directors on their board by June 2003. Following this direction, many listed firms had appointed more independent directors, with a view to increase the independence of the board [ 54 ]. This proclamation is staying stable till now, and the number of independent directors in Chinese listed firms is increasing from time to time due to its importance. Thus, the following hypothesis is proposed.

Hypothesis 1

The proportion of independent directors in board members is positively related to firm performance.

Dual leadership and firm performance

CEO duality is one of the important board control mechanisms of internal CG mechanisms. It refers to a situation where the firm’s chief executive officer serves as chairman of the board of directors, which means a person who holds both the positions of CEO and the chair. Regarding leadership and firm performance relation, there are different arguments; there is not consistent conclusion among different researchers. There are two competitive views about dual leadership in corporate governance literature. Agency theory view proposed that duality could minimize the board’s effectiveness of its monitoring function, which leads to further agency problems and enhance poor performance [ 41 , 83 ]. As a result, dual leadership enhances CEO entrenchment and reduces board independence. In this condition, these two roles in one person made a concentration of power and responsibility, and this may result in busyness of CEO which affects the normal duties of a company. This means the CEO is responsible to execute a company’s strategies, monitoring and evaluating the managerial activities of a company. Thus, separating these two roles is better to avoid concentration of authority and power in one individual and separate leadership of board from the ruling of the business [ 72 ].

On the other hand, stewardship theory suggests that managers are good stewards of company resources, which could benefit a firm [ 9 ]. This theory advocates that there is no conflict of interest between shareholders and managers, if the role of CEO and chairman vests on one person, rather CEO duality would promote a clear sense of strategic direction by unifying and strengthening leadership.

In the Chinese firm context, there are different conflicting conclusions about the relationship between CEO duality and firm performance.

Hypothesis 2

CEO duality is negatively associated with firm performance.

Ownership concentration and firm performance

The ownership structure is which has a profound effect on business strategy and performance. Agency theory [ 81 ] argued that concentrated ownership can monitor corporate operating management effectively, alleviate information problems and agency costs, consequently, improve firm performance. The concentration of ownership as a large number of studies grounded in agency theory suggests that it has both the incentive and influence to assure that managers and directors operate in the interests of shareholders [ 19 ]. Concentrated ownership presence among the firm’s investors provides an important driver of good CG that should lead to efficiency gains and improvement in performance [ 81 ].

Due to shareholder concentrated economic risk, these shareholders have a strong encouragement to watch strictly over management, making sure that management does not engage in activities that are damaging the wealth of shareholders. Similarly, Shleifer and Vishny [ 80 ] argue that large share blocks reduce managerial opportunism, resulting in lower agency conflicts between management and shareholders.

In other ways, some researchers have indicated, block shareholders harmfully on the value of the firm, especially when majority shareholders can abuse their position of dominant control at the expense of minority shareholders [ 25 ]. As a result, at some level of ownership concentration the distinction between insiders and outsiders becomes unclear, and block-holders, no matter what their identity is, may have strong incentives to switch resources to the ways that make them better off at the cost of other shareholders. However, concentrated shareholding may create a new set of agency conflicts that may provide a negative impact on firm performance.

In the emerging market context, studies [ 77 , 90 ] find a positive association between ownership concentration and accounting profit for Chinese public companies. As Yu and Wen [ 92 ] argued, Chinese companies have a concentrated ownership structure, limited disclosure, poor investor protection, and reliance on the banking system. As this study argues, this concentration is more controlled by the state, institution, and private shareholders. Thus, ownership concentration in Chinese firms may be an alternative governance tool to reduce agency problems and enhance efficiency.

Hypothesis 3

The ownership concentration is positively related to firm performance.

Product market competition and firm performance

Theoretical models have argued that competition in product markets is a powerful force for overcoming the agency problem between shareholders and managers [ 78 ]. Competition in product markets plays the role of a takeover [ 3 ], and well-managed firms take over the market from poorly managed firms. According to this study finding, competition helps to build the best management team. Competition acts as a substitute for internal governance mechanisms, practically the market for corporate control [ 3 ]. Chou et al. [ 18 ] provided evidence that product market competition has a substantial impact on corporate governance and that it substitutes for corporate governance quality, and they provide evidence that the disciplinary force of competition on the management of the firm is from the fear of insolvency. For instance, Ibrahim [ 39 ] reported firms to operate in competitive industries record more returns of share compared with the concentrated industries. Hart [ 33 ] stated that competition inspires managers to work harder and, thus, reduces managerial slack. This study suggests that in high competition, the selling prices of products or services are more likely to fall because managers are concerned with their economic interest, which may tie up with firm performance. Managers are more focused on enhancing productivity that is more likely to reduce cost and increase firm performance. Thus, competition in product market can reduce agency problems between owners and managers and can enhance performance.

Hypothesis 4

Product market competition is positively associated with firm performance.

Debt financing and firm performance

Debt financing is one of the important governance mechanisms in aligning the incentives of corporate managers with those of shareholders. According to agency theory, debt financing can increase the level of monitoring over self-serving managers and that can be used as an alternative corporate governance mechanism [ 40 ]. This theory argues two ways through debt finance can minimize the agency cost: first the potential positive impact of debt comes from the discipline imposed by the obligation to continually earn sufficient cash to meet the principal and interest payment. It is a commitment device for executives. Second leverage reduces free cash flows available for managers’ discretionary expenses. Literature suggests that when leverage increases, managers may invest in high-risk projects in order to meet interest payments; this action leads lenders to monitor more closely the manager’s action and decision to reduce the agency cost. Koke and Renneboog [ 48 ] have found empirical support that a positive impact of bank debt on productivity growth in German firms. Also, studies like [ 77 , 86 ] examine empirically the effect of debt on firm investment decisions and firm value; reveal that debt finance is a negative effect on corporate investment and firm values [ 69 ] find that there is a significant and negative relationship between debt intensity and firm productivity in the case of Indian firms.

In the Chinese financial sectors, banks play a great role and use more commercial judgment and consideration in their leading decision, and even they monitor corporate activities [ 82 ]. In China listed company [ 77 , 82 ] found that an increase in bank loans increases the size of managerial perks and free cash flows and decreases corporate efficiency, especially in state control firms. The main source of debts is state-owned banks for Chinese listed companies [ 82 ]. This shows debt financing can act as a governance mechanism in limiting managers’ misuse of resources, thus reducing agency costs and enhance firm values. However, in China still government plays a great role in public listed company management, and most banks in China are also governed by the central government. However, the government is both a creditor and a debtor, especially in state-controlled firms. Meanwhile, the government as the owner has multiple objectives such as social welfare and some national (political) issues. Therefore, when such an issue is considerable, debt financing may not properly play its governance role in Chinese listed firms.

Hypothesis 5

Debt financing has a negative association with firm performance

Influence of managerial overconfidence on the relationship of corporate governance and firm performance

Corporate governance mechanisms are assumed to be an appropriate solution to solve agency problems that may derive from the potential conflict of interest between managers and officers, on the one hand, and shareholders, on the other hand [ 42 ].

Overconfidence is an overestimation of one’s own abilities and outcomes related to one’s own personal situation [ 74 ]. This study proposed from the behavioral finance view that overconfidence is typical irrational behavior and that a corporate manager tends to show it when they make business decisions. Overconfident CEOs tend to think they have more accurate knowledge about future events than they have and that they are more likely to experience favorable future outcomes than they are [ 35 ]. Behavioral finance theory incorporates managerial psychological biases and emotions into their decision-making process. This approach assumes that managers are not fully rational. Concurrently, several reasons in the literature show managerial irrationality. This means that the observed distortions in CG decisions are not only the result of traditional factors. Even with the absence of agency conflicts and asymmetric information problems, there is evidence documented for distortions such as the case of corporate investment. Managers will over- or under-invest regarding their optimism level and the availability of internal cash flow. Such a result push managers to make sub-optimal decisions and increase observed corporate distortions as a result. The view of behavioral decision theory [ 94 ] suggests that overconfidence, as one type of cognitive bias, encourages decision-makers to overestimate their own information and problem-solving capabilities and underestimates the uncertainties facing their firms and the potential losses from proceedings related with maintains against them.

Researchers [ 34 , 61 ] discussed the managerial behavioral bias has a great impact on firm corporate governance practices. These studies carefully analyzed and clarified that managerial overconfidence is a major source of corporate distortions and suggested good CG practices can mitigate such problems.

In line with the above argument and empirical evidence of several researchers, therefore, the current study tried to investigate how the managerial behavioral bias (overconfidence) positively or negatively influences the effect of CG on firm performance using Chinese listed firms.

The boards of directors as central internal CG mechanisms have the responsibility to monitor, control, and supervise the managerial activities of firms. Thus, the board of directors has the responsibility to monitor and initiate managers in the company to increase the wealth of ownership and firm value. The capability of the board composition and diversity may be important to control and monitor the internal managers' based on the nature of internal executives behaviors, managerial behavior bias that may hinder or smooth the progress of corporate decisions of the board of directors. Accordingly, several studies suggested different arguments; Delton et al. [ 20 ] argued managerial behavior is influencing the allocation of board attention to monitoring. According to this argument, board of directors or concentrated ownership is not activated all the time continuously, and board members do not keep up a constant level of attention to supervise CEOs. They execute their activities according to firm and CEO status. While the current performance of the firm desirable the success confers celebrity status on CEOs and board will be liable to trust the CEOs and became idle. In other ways, overconfidence managers are irrational behaviors that tend to consider themselves better than others on different attributes. They do not always form beliefs logically [ 73 ]. They blame the external advice and supervision, due to overestimating their skills and abilities, underestimate their risks [ 61 ]. Similarly, CEOs are the most decision-makers in the firm strategies. While managers are highly overconfident, board members (especially external) face information limitations on a day-to-day activities of internal managers. In other way, CEOs have a strong aspiration to increase the performance of their firm; however, if they achieve their goals, they may build their empire. This situation will pronounce where the market for corporate control is not matured enough like China [ 27 ]. So, this fact affects the effectiveness of board activities in strategic decision-making. In contrast, as the study [ 7 ] indicated, as the number of the internal board increases, the impact of managerial overconfidence in the firm became increasing and positively correlated with the leadership duality. In other ways, agency theory, many opponents suggest that CEO duality reduces the monitoring role of the board of directors over the executive manager, and this, in turn, may harm corporate performance. In line with this Khajavi and Dehghani, [ 44 ] found that as the number of internal board increases, the managerial overconfidence bias will increase in Tehran Stock Exchange during 2006–2012.

This shows us the controlling and supervising role of independent directors are less likely in the firms managed by overconfident managers than normal managers; conversely, the power of CEO duality is more salient in the case of overconfident managers than normal managers.

Hypothesis 2a

Managerial overconfidence negatively influences the relationship of independent board and firm performance.

Hypothesis 2b

Managerial overconfidence strengthens the negative relationships of CEO duality and firm performance.

An internal control mechanism ownership concentration believes in the existence of strong control against the managers’ decisions and choices. Ownership concentration can reduce managerial behaviors such as overconfidence and optimism since it contributes to the installation of a powerful control system [ 7 ]. They documented that managerial behavior affects the monitoring activities of ownership concentration on firm performance. Ownership can affect the managerial behavioral bias in different ways, for instance, when CEOs of the firm become overconfident for a certain time, the block ownership controlling attention is weakened [ 20 ], and owners trust the internal managers that may damage the performance of the firms in an emerging market where external market control is weak. Overconfidence CEOs have the quality that expresses their behavior up on their company [ 36 ]. In line with this fact, the researcher can predict that the impact of concentrated ownership on firm performance is affected by overconfident managers.

Hypothesis 2c

Managerial overconfidence negatively influences the impact of ownership concentration on firm performance.

Theoretical literature has argued that product market competition forces management to improve firm performance and to make the best decisions for the future. In high competition, managers try their best due to fear of takeover [ 3 ], well-managed firms take over the market from poorly managed firms, and thus, competition helps to build the best management team. In the case of firms operating in the competitive industry, overconfidence CEO has advantages, due to its too simple to motivate overconfident managerial behaviors due to being overconfident managers assume his/her selves better than others. Overconfident CEOs are better at investing for future investments like research and development, so it plays a strategic role in the competition. Englmaier [ 23 ] argues firms in a more competitive industry better hire a manager who strongly believes in better future market outcomes.

Therefore, the following hypothesis was proposed:

Hypothesis 2d

Managerial overconfidence moderates the effect of product market competition on firm performance.

Regarding debt financing, existing empirical evidence shows no specific pattern in the relation of managerial overconfidence and debt finance. Huang et al. [ 38 ] noted that overconfident managers normally overestimate the profitability of investment projects and underestimate the related risks. So, this study believes that firms with overconfident managers will have lower debt. Then, creditors refuse to provide debt finance when firms are facing high liquidity risks. Abdullah [ 1 ] also argues that debt financers may refuse to provide debt when a firm is having a low credit rating. Low credit rating occurs when bankers believe firms are overestimating the investment projects. Therefore, creditors may refuse to provide debt when managers are overconfident, due to under-estimating the related risk which provides a low credit rating.

However, in China, the main source of debt financers for companies is state banks [ 82 ], and most overconfidence CEOs in Chinese firms have political connections [ 96 ] with the state and have a better relationship with external financial institutions and public banks. Hence, overconfident managers have better in accessing debt rather than rational managers in the context of China that leads creditors to allow to follow and influence the firm investments through collecting information about the firm and supervise the firms directly or indirectly. Thus, managerial overconfidence could have a positive influence on relationships between debt finance and firm performance; thus, the following hypothesis is proposed:

Hypothesis 2e

Managerial overconfidence moderates the relationship between debt financing and firm performance.

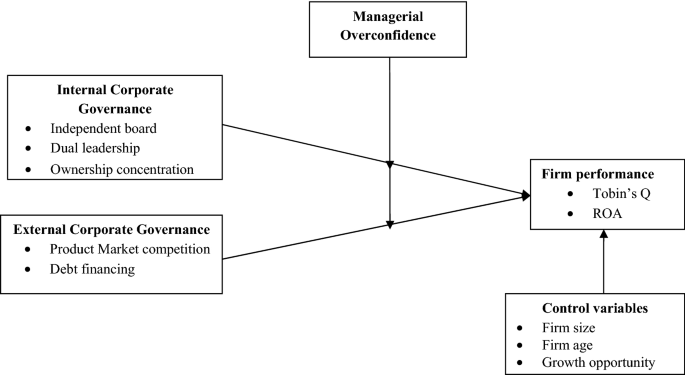

To explore the impact of CG on firm performance and whether managerial behavior (managerial overconfidence) influences the relationships of CG and firm performance, the following research model framework was developed based on theoretical suggestions and empirical evidence.

Data sources and sample selection

The data for this study required are accessible from different sources of secondary data, namely China Stock Market and Accounting Research (CSMAR) database and firm annual reports. The original data are obtained from the CSMAR, and the data are collected manually to supplement the missing value. CSMAR database is designed and developed by the China Accounting and Financial Research Center (CAFC) of Honk Kong Polytechnic University and by Shenzhen GTA Information Technology Limited company. All listed companies (Shanghai and Shenzhen stock Exchange) financial statements are included in this database from 1990 and 1991, respectively. All financial data, firm profile data, ownership structure, board structure, composition data of listed companies are included in the CSMAR database. The research employed nine consecutive years from 2010 to 2018 that met the condition that financial statements are available from the CSMAR database. This study sample was limited to only listed firms on the stock market, due to hard to access reliable financial and corporate governance data of unlisted firms. All data collected from Chinese listed firms only issued on A shares in domestic stoke market exchange of Shanghai and Shenzhen. The researcher also used only non-financial listed firms’ because financial firms have special regulations. The study sample data were unbalanced panel data for nine consecutive years from 2010 to 2018. To match firms with industries, we require firms with non-missing CSRC top-level industry codes in the CSMAR database. After applying all the above criteria, the study's final observations are 11,634 firm-year observations.

Measurement of variables

Dependent variable.

- Firm performance

To measure firm performance, prior studies have been used different proxies, by classifying them into two groups: accounting-based and market-based performance measures. Accordingly, this study measures firm performance in terms of accounting base (return on asset) and market-based measures (Tobin’s Q). The ROA is measured as the ratio of net income or operating benefit before depreciation and provisions to total assets, while Tobin’s Q is measured as the sum of the market value of equity and book value of debt, divided by book value of assets.

Independent Variables

Board independent (bind).

Independent is calculated as the ratio of the number of independent directors divided by the total number of directors on boards. In the case of the Chinese Security Regulatory Commission (2002), independent directors are defined as the “directors who hold no position in the company other than the position of director, and no maintain relation with the listed company and its major shareholders that might prevent them from making objective judgment independently.” In line with this definition, many previous studies used a proportion of independent directors to measure board independence [ 56 , 79 ].

CEO Duality

CEO duality refers to a position where the same person serves the role of chief executive officer of the form and as the chairperson of the board. CEO duality is a dummy variable, which equals 1 if the CEO is also the chairman of the board of directors, and 0 otherwise.

Ownership concentration (OWCON)